Best Texas Auto Insurance in 2025 (Top 10 Companies)

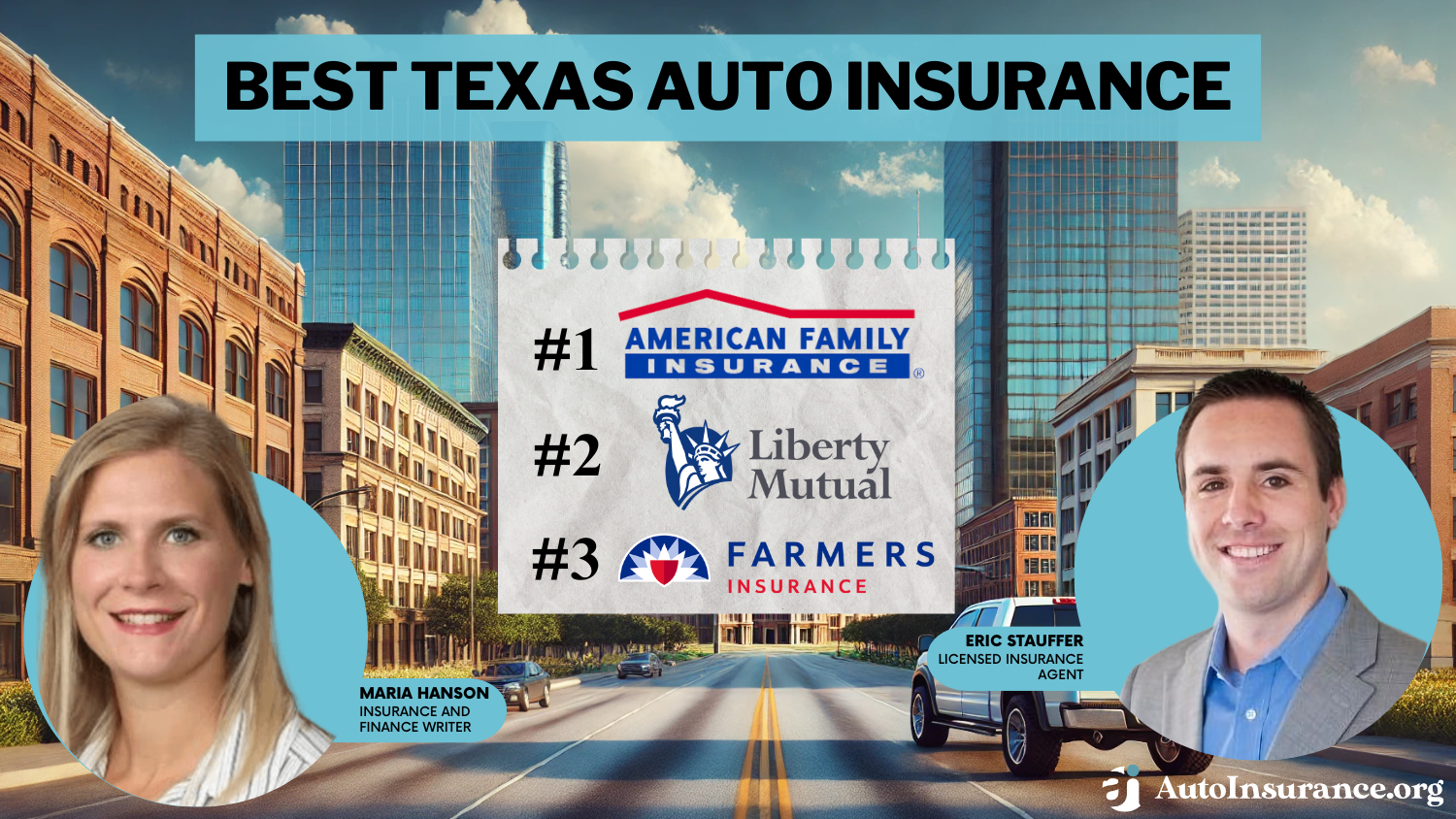

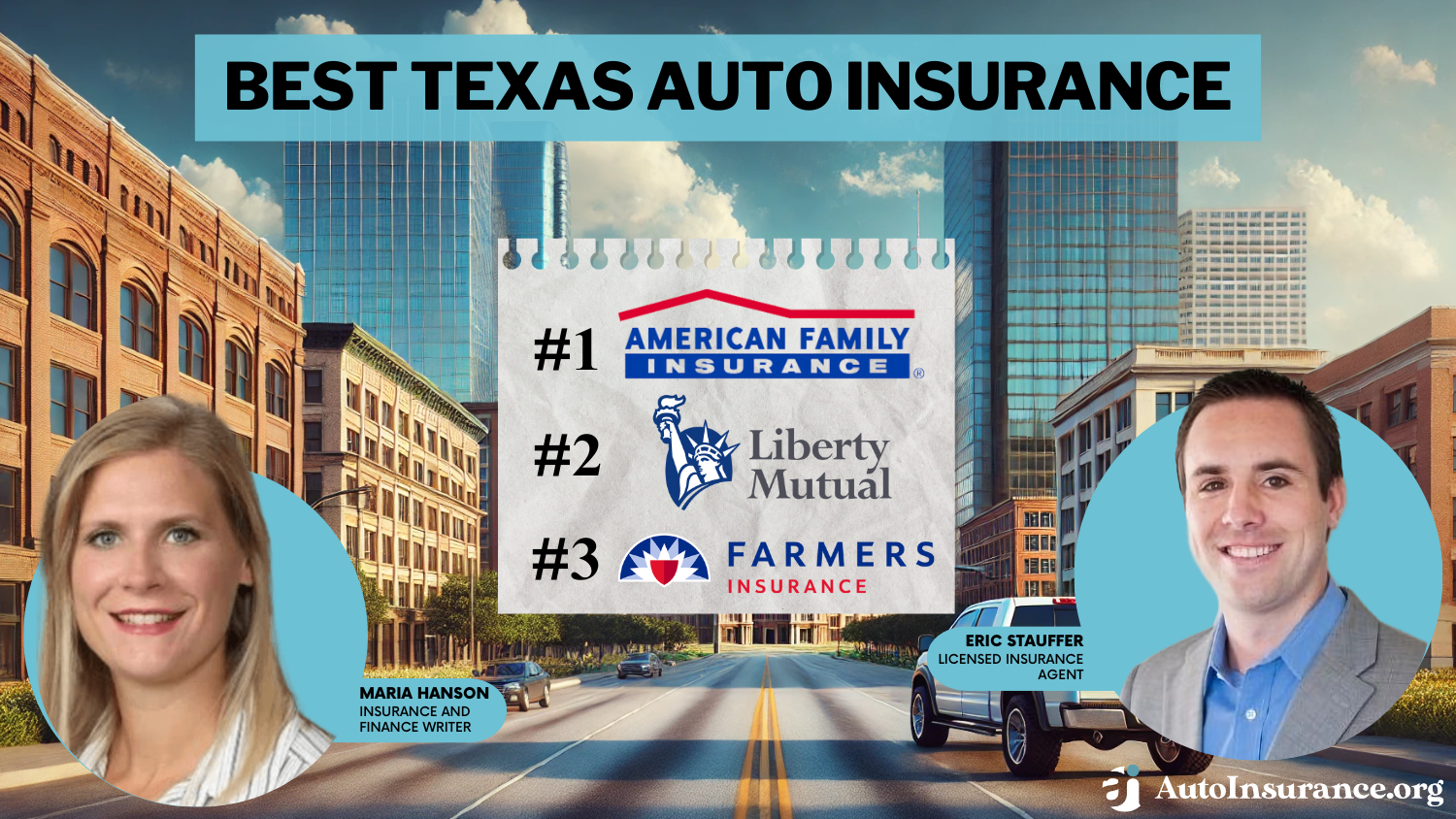

Obtain the best Texas auto insurance rates starting at $79 per month, with American Family, Liberty Mutual, and Farmers leading the pack for competitive pricing and comprehensive coverage options. Compare quotes from these top providers for you to find the best auto insurance in Texas.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

2,235 reviews

2,235 reviewsCompany Facts

Full Coverage for Texas

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Texas

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Texas

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsExplore the best Texas auto insurance from American Family, Liberty Mutual, and Farmers with rates as low as $79 per month. These companies are known for providing significant discounts and excellent service. Use our online tool for Texas auto insurance quotes comparison and find the best insurance solution.

The cheapest auto insurance in Texas varies by city and driver type. State Farm and Geico offer the most affordable rates for the average driver. Full coverage in Texas costs more due to mandatory minimum personal injury protection (PIP) coverage.

Our Top 10 Company Picks: Best Texas Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 27% A Discount Variety American Family

#2 23% A Flexible Policies Liberty Mutual

#3 25% A Customizable Coverage Farmers

#4 20% A++ Customer Service Travelers

#5 23% A++ Coverage Limits Geico

#6 20% A+ Competitive Rates Nationwide

#7 19% A+ No Fees Progressive

#8 18% A++ High-Risk Drivers USAA

#9 15% B Bundling Discounts State Farm

#10 10% A++ Digital Tools Travelers

Compare quotes by city to find the best rates and coverage. Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- Top companies are American Family, Liberty Mutual, and Farmers

- Mandatory minimum PIP coverage in Texas

- American Family is the top pick for competitive rates and service

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – American Family: Top Overall Pick

Pros

- Wide Range of Coverage Options: As mentioned in our American Family Auto Insurance Review, American Family offers a comprehensive selection of coverage options, including unique add-ons like emergency roadside assistance.

- Various Discounts: They provide discounts such as multi-policy, good student, and safe driving discounts, making it easier for customers to save money.

- Excellent Customer Service: American Family has high customer satisfaction ratings, indicating strong support and service for their policyholders.

Cons

- Higher Rates for Some Drivers: Rates can be higher compared to some competitors, especially for drivers with less than perfect driving records.

- Limited Availability: American Family primarily operates in the Midwest and some western states, limiting options for customers in other regions.

#2 – Liberty Mutual: Best for Flexible Policies

Pros

- Comprehensive Coverage Options: As outlined in our Liberty Mutual auto insurance review, Liberty Mutual offers a wide range of coverage options, including add-ons like new car replacement and better car replacement.

- Discounts Available: They provide discounts for bundling policies, safe driving, and alternative energy vehicles, helping customers save on premiums.

- User-Friendly Online Tools: Liberty Mutual offers a user-friendly online platform and mobile app for easy policy management and claims handling.

Cons

- Higher Premiums: Rates tend to be on the higher side, particularly for young drivers and those with recent accidents.

- Mixed Customer Service Reviews: Some customers have reported issues with claims handling and communication, affecting overall satisfaction.

#3 – Farmers: Best for Customizable Coverage

Pros

- Wide Variety of Insurance Products: Farmers offers a variety of insurance products beyond auto, including home, life, and business insurance, allowing customers to bundle policies and save.

- Several Discounts Available: They provide discounts such as multi-policy, good student, and affinity discounts, making coverage more affordable for many customers. Check out this page Farmers auto insurance review to know more details about the discounts available.

- Strong Financial Stability: Farmers has strong financial stability and good claims satisfaction ratings, offering peace of mind to policyholders.

Cons

- Higher Rates for Some Customers: Rates can be higher compared to some competitors, especially for new drivers and those with previous claims.

- Limited Availability: Farmers has limited availability in certain states, which can restrict options for customers seeking coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Customer Service

Pros

- Extensive Coverage Options: Allstate offers comprehensive coverage options and additional features like accident forgiveness and new car replacement, providing enhanced protection.

- Discounts Available: They offer discounts for safe driving, anti-theft devices, and bundling policies, helping customers lower their premiums.

- High Customer Satisfaction: Allstate is highly rated for customer service and claims handling, ensuring a positive experience for policyholders.

Cons

- Higher Premiums: Premiums can be higher compared to some competitors, particularly for younger drivers and high-risk drivers. Learn more about their premiums in our Allstate auto insurance review.

- Rate Increases After Incidents: Some customers report premium increases after accidents or traffic violations, which can be a downside for maintaining affordable coverage.

#5 – Geico: Best for Coverage Limits

Pros

- Competitive Pricing: Geico offers some of the lowest rates available, especially for drivers with clean records, making it a budget-friendly option.

- User-Friendly Platform: They have a user-friendly website and mobile app for easy policy management and claims filing, enhancing customer convenience.

- Wide Availability and Good Service: Geico is widely available across the U.S. and is known for good customer service, making it accessible and reliable for policyholders.

Cons

- Limited Coverage Options: As mentioned in our Geico auto insurance review, Geico may not offer as many coverage add-ons or specialized options compared to other insurers.

- Rate Increases for Incidents: Rates may increase significantly for drivers with recent accidents or traffic violations, affecting overall affordability.

#6 – Nationwide: Best for Competitive Rates

Pros

- Range of Coverage Options: Nationwide offers a range of coverage options and discounts, including vanishing deductible and accident forgiveness, providing flexible solutions.

- Strong Financial Stability: They have strong financial stability and good customer service ratings, ensuring reliable coverage and support for policyholders.

- National Availability: Nationwide is available in all 50 states, offering broad coverage options and flexibility for customers across the country.

Cons

- Higher Rates for Some Drivers: Rates can be higher compared to some competitors, especially for drivers with less-than-perfect driving records.

- Claims Processing Issues: Some customers report issues with claims processing and delays, which can affect satisfaction and service. For more information, read our Nationwide auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for No Fees

Pros

- Competitive Pricing and Discounts: Progressive offers competitive pricing and a variety of discounts, including multi-policy and safe driver discounts, helping customers save money.

- Innovative Tools: Progressive auto insurance review highlights the unique tools like the Name Your Price® tool and Snapshot® program for personalized rates, enhancing customer customization.

- User-Friendly Platform: Progressive has a user-friendly website and mobile app with robust customer support, making policy management and claims filing convenient.

Cons

- Claims Handling Issues: Some customers report difficulty with claims handling and long wait times for customer service, impacting overall satisfaction.

- Rate Increases After Incidents: Rates can increase after accidents or traffic violations, affecting the affordability of coverage.

#8 – USAA: Best for High-Risk Drivers

Pros

- Excellent Customer Service: USAA is highly rated for customer service and claims satisfaction, offering top-notch support to military members and their families.

- Competitive Pricing: As outlined in USAA auto insurance review, they offer competitive pricing and a range of discounts, including safe driver and military discounts, helping military families save on premiums.

Cons

- Limited Availability: USAA is exclusive to military members, veterans, and their families, so it’s not available to the general public.

- Rates for Non-Military Customers: Rates may not be as competitive for non-military-affiliated customers, limiting options for some drivers.

#9 – State Farm: Best for Bundling Discounts

Pros

- Extensive Agent Network: State Farm has an extensive network of agents and offices, providing personalized service and local expertise to customers.

- Comprehensive Coverage Options: They offer a wide range of coverage options, including unique add-ons like rideshare insurance, meeting diverse customer needs.

- Good Customer Service: State Farm is known for its good customer service reputation and strong financial stability, ensuring reliable coverage and support. For more details read our State Farm auto insurance review.

Cons

- Higher Rates for Some Drivers: Rates can be higher compared to some competitors, especially for new drivers and those with recent claims.

- Limited Availability: State Farm may have limited availability in some states and regions, which can restrict options for customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Digital Tools

Pros

- Variety of Coverage Options: Travelers offers a variety of coverage options, including specialized coverages like gap insurance and umbrella policies, meeting diverse customer needs.

- Discounts Available: They provide discounts for safe driving, multi-policy, and hybrid/electric vehicles, helping customers save on premiums.

- Strong Financial Stability: As outlined in our Travelers auto insurance review, Travelers has strong financial stability and good claims satisfaction ratings, offering peace of mind to policyholders.

Cons

- Higher Rates for Some Customers: Rates can be higher compared to some competitors, particularly for younger drivers and those with previous claims.

- Limited Availability: Travelers has limited availability in certain states and regions, which can restrict options for customers seeking coverage.

The Best Texas Auto Insurance Companies

Finding the best auto insurance companies in Texas will take some time to research. Luckily, we’ve gathered the top companies in the nation and compared them to local Texas insurance companies to help you find the best coverage at the most affordable rates.

According to J.D. Power, Texas Farm Bureau is the best auto insurance company in Texas based on customer satisfaction, but American Family and Farmers rank higher in terms of rates and coverage options.

Texas Auto Insurance Rates by Coverage

What are the state minimums for auto insurance in Texas? Texas law requires drivers to carry a minimum liability policy and personal injury protection (PIP) coverage. Use the table below to see how much coverage costs in Texas.

Texas Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$116 $313

$101 $274

$79 $214

$61 $164

$103 $277

$89 $240

$70 $188

$52 $140

$58 $157

$36 $97

Full coverage costs more than cheap Texas liability insurance, but it’ll save you from paying out of pocket for personal damages after an accident. Likewise, adding optional coverage like gap insurance and roadside assistance will raise your rates.

Carrying only the state minimums for auto insurance in Texas will give you the lowest rates, but you’re responsible for any personal costs after an accident.

Texas Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Female (Age 45) | Male (Age 45) |

|---|---|---|

| $309 | $313 | |

| $246 | $274 | |

| $215 | $214 | |

| $154 | $164 | |

| $273 | $277 |

| $236 | $240 |

| $197 | $188 | |

| $140 | $140 | |

| $155 | $157 | |

| $97 | $97 | |

| U.S. Average | $202 | $207 |

Below you’ll find reviews of the top Texas auto insurance companies for liability coverage, full coverage, drivers with poor credit, and young and high-risk drivers.

Cheapest Texas Liability Auto Insurance Company: Geico

Geico auto insurance offers the best rates for any level of coverage to the average driver with a good record. Geico is available throughout the state of Texas and consistently offers competitive quotes in the biggest cities, including San Antonio, Houston, and Dallas.

Read More: Geico Auto Insurance Review

Cheapest Texas Auto Insurance Company for Young Drivers: Texas Farm Bureau

Drivers between 16 and 19 years old pay the most for car insurance in every state. However, young Texans can save money with Texas Farm Bureau auto insurance. This local insurer offers lower rates than any other Texas insurance company to teen drivers with accidents, poor credit, or DUIs.

Cheapest Texas Auto Insurance Company for Drivers with Poor Credit: Nationwide

Each insurance company considers credit scores differently, and Nationwide auto insurance won’t raise your rates nearly as high as other insurers in Texas. Nationwide may not offer the cheapest car insurance in Texas to the average driver, but rates for those with bad or no credit are very affordable.

Read More: Nationwide Auto Insurance Review

Cheapest Texas Auto Insurance Company for High-Risk Drivers: State Farm

State Farm auto insurance accepts SR-22s and offers the cheapest Texas auto insurance rates after an accident, speeding ticket, or DUI. High-risk drivers generally pay around $190 per month for coverage in Texas, but you could get much lower Texas auto insurance quotes with State Farm.

Read More: State Farm Auto Insurance Review

Texas Auto Insurance Rates

The average car insurance cost in Texas is around $140 per month for full coverage auto insurance and $52 for minimum liability auto insurance. Your rates may be higher or lower depending on which city you live in and how much coverage you carry.

Texas Auto Insurance Rates by City

Bigger cities in Texas have more traffic and an increased risk of auto accidents and insurance claims. Insurance companies also charge more for driving in urban areas than on rural roads. That’s why even the best car insurance rates in Houston are still more expensive than rates in Lubbock or Plano.

Houston, San Antonio, and Dallas are the largest cities in Texas, with populations over one million. Compared to other Texas drivers, drivers in Houston pay about 18% more for insurance, while Dallas and San Antonio drivers pay 5%-15% more. For even more specifics check out auto insurance rates by ZIP code.

Cost of Auto Insurance in Various Texas Cities

Comparing auto insurance costs across cities is crucial for residents to choose the right coverage. In Texas, rates vary due to factors like location, driving history, and vehicle type. This table offers a comparative overview of insurance costs, helping individuals evaluate tailored rates and find cost-effective coverage.

Texas Auto Insurance Cost by City

Understanding the varying costs of auto insurance across different Texas cities helps residents select the most suitable and affordable coverage options available.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Texas Auto Insurance Requirements

By law, drivers must carry minimum levels of bodily injury and personal property coverage to drive on Texas roads.

Below are the Texas auto insurance requirements:

- Liability: Texas auto insurance requirements includes minimum liability auto insurance of $30,000 for bodily injury per person, $60,000 for injury per accident, and $25,000 for property damage.

- Personal Injury Protection: Drivers must carry at least $2,500 in personal injury protection (PIP) auto insurance or turn down this coverage by submitting a request in writing.

If you choose to not buy Texas auto insurance requirements, you could lose your license and registration. You’ will’ll be fined up to $350, which increases to $1,000 after subsequent offenses. In addition, the law can impound your vehicle, and you may have to carry SR-22 auto insurance to reinstate your Texas car insurance coverage.

Texas Optional Auto Insurance Coverage Types

Texas insurance requirements don’t include full coverage car insurance, but you can add these optional auto insurance types to better protect you and your passengers:

- Collision: Collision auto insurance pays for your and your passengers’ injuries and property damage after an accident or collision.

- Comprehensive: Comprehensive auto insurance pays for damages caused by unforeseen circumstances, including theft, vandalism, fire, and natural disasters.

- Uninsured Motorist Coverage: Uninsured/underinsured motorist coverage pays for property damage and medical costs if you’re in an accident with an uninsured, underinsured, or hit-and-run driver.

- Gap Insurance: Gap insurance covers your auto loan should you total your vehicle in an accident before paying it off.

- Roadside Assistance: Roadside assistance covers the cost of a tow, locksmith, tire replacement, or battery jump-start if your car cannot be driven. Options vary by city and company.

- Rental Car Reimbursement: Rental car reimbursement pays for a rental car when your vehicle is in the shop for repairs after a claim. Limitations apply, and options vary by city and company.

Keep in mind that the terms of your auto loan or lease agreement will dictate how much Texas auto insurance coverage you need.

Texas auto insurance requires liability coverage, but adding collision, comprehensive, and uninsured motorist coverages is crucial for full protection.Kristen Gryglik LICENSED INSURANCE AGENT

For example, most auto loans require drivers to carry additional collision and comprehensive insurance, which will raise your Texas auto insurance rates.

Cheapest Auto Insurance Rates in Texas

Finding cheap auto insurance in Texas comes down to how old you are, how much coverage you need, and what your driving history looks like. Auto insurance for teens and those with accidents or DUIs are often higher becuase they are considered high-risk. Compare that to drivers in their 30s and 40s with clean records who have the cheapest car insurance in Texas.

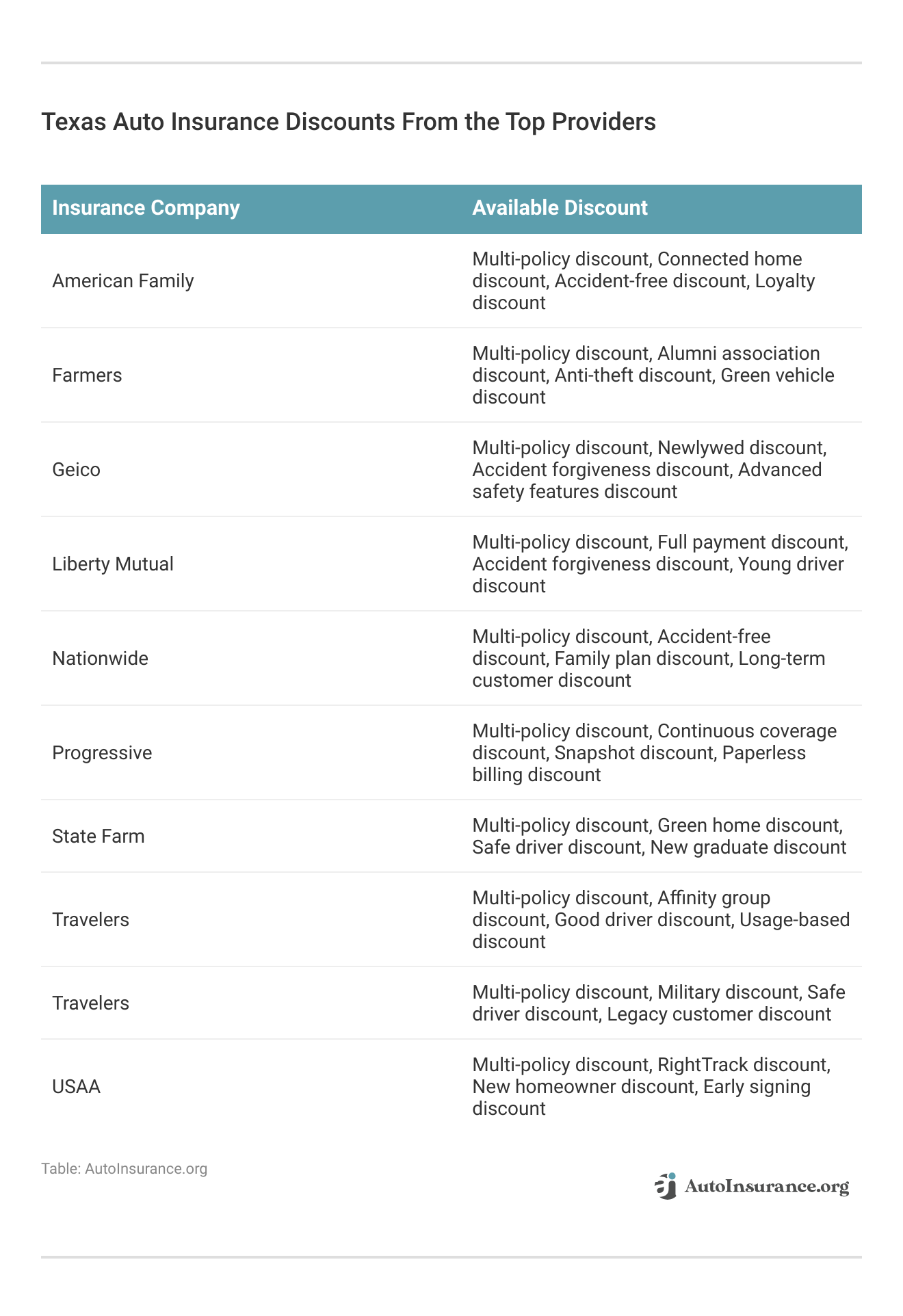

Here are various auto insurance discounts available from top Texas providers that help lower insurance costs:

The cheapest auto insurance companies in Texas are State Farm, Geico, and Texas Farm Bureau. USAA auto insurance also offers affordable auto insurance in Texas, but coverage is only available to active and retired military members and their families.

Below we compare Texas auto insurance quotes by company to help drivers like you find the most affordable coverage. Scroll down to compare Texas auto insurance rates by coverage level for drivers with poor credit scores, young drivers, and high-risk drivers.

Cheapest Texas Liability Auto Insurance Rates

Liability-only car insurance in Texas costs around $52 per month. Use the table below to compare these average rates to quotes from the top insurers in Texas:

Texas Minimum Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $116 | |

| $101 | |

| $79 | |

| $61 | |

| $103 |

| $89 |

| $70 | |

| $52 | |

| $58 | |

| $36 | |

| U.S. Average | $77 |

Geico offers cheap liability car insurance in Texas, followed by State Farm and Texas Farm Bureau. USAA’s rates are also competitive, but coverage isn’t available to every driver.

Cheapest Texas Full Coverage Auto Insurance Rates

The average cost of full coverage auto insurance in Texas is $140 per month.

This table shows how your rates can vary based on the company you shop with.

Texas Full Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $313 | |

| $274 | |

| $214 | |

| $164 | |

| $277 |

| $240 |

| $188 | |

| $140 | |

| $157 | |

| $97 | |

| U.S. Average | $207 |

You can lower your rates by dropping unnecessary coverages or raising your auto insurance deductibles, but you face higher personal costs after a claim.

Cheapest Texas Auto Insurance Rates for Bad Credit

Using credit scores for insurance rates is illegal in some states, but Texas law allows companies to check your score when you apply for a policy.

See how poor credit impacts your Texas car insurance rates with the major companies listed below:

Texas Full Coverage Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

Fortunately, some insurance companies don’t check credit scores or use a different risk-assessment strategy to determine driver rates. See this list for the best auto insurance companies that don’t check credit.

For example, insurers that use usage-based auto insurance rely on driving habits and mileage to determine rates. Signing up for usage-based insurance in Texas with State Farm, Progressive auto insurance, Farmers, or Allstate could help you obtain cheap Texas auto insurance.

Read More: Best Pay-As-You-Go Auto Insurance in Texas

Cheapest Texas Auto Insurance Rates for Young Drivers

Young drivers under 25 pay the most for car insurance in Texas, but there are plenty of tips for finding auto insurance for young drivers. Teens with good driving records can see their rates drop after they turn 21, but the cheapest auto insurance in Texas is for drivers between the ages of 30 and 50.

Texas Teen Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Female (Age 16) | Male (Age 16) | Female (Age 18) | Male (Age 18) |

|---|---|---|---|---|

| 1,105.84 | $710 | $742 | $899 | |

| 915.02 | $587 | $568 | $744 | |

| 1,195.22 | $767 | $924 | $972 | |

| 371.35 | $238 | $288 | $302 | |

| 1,252.61 | $804 | $850 | $1,018 |

| 1,100.98 | $706 | $683 | $895 |

| 1,583.37 | $1,016 | $1,141 | $1,287 | |

| 491.14 | $315 | $310 | $399 | |

| 1,445.82 | $928 | $843 | $1,176 | |

| 305.19 | $196 | $227 | $248 | |

| U.S. Average | 1,051.26 | $674 | $658 | $794 |

Texas Farm Bureau provides the cheapest auto insurance for teens in Texas.

Cheapest Texas High-Risk Auto Insurance Rates

Traffic violations, DUIs, accidents, and insurance claim all increase your risk as a driver. On average, high-risk drivers pay around $189 a month for coverage.

However, each insurance company ranks these violations differently. If your insurance company increased your rates after an accident or DUI, start shopping for new quotes as soon as possible. The table below compares high-risk auto insurance rates from the top Texas insurance companies:

Texas Full Coverage Auto Insurance Monthly Rates: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $313 | $313 | |

| $274 | $274 | |

| $267 | $214 | |

| $211 | $164 | |

| $338 | $277 |

| $287 | $240 |

| $235 | $188 | |

| $140 | $140 | |

| $214 | $157 | |

| $111 | $97 | |

| U.S. Average | $253 | $207 |

Comparing Texas auto insurance rates by violation is the easiest way to find more affordable high-risk Texas car insurance quotes.

Cheapest Texas Auto Insurance Rates After a DUI

As most people know, a DUI is definitely going to increase the cost of your auto insurance. Regardless, of where you live, this will be the case. Here is a look at the average rates for a driver with a DUI on their driving record.

Texas Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $313 | $483 | $504 | $313 | |

| $274 | $345 | $303 | $274 | |

| $214 | $305 | $298 | $267 | |

| $164 | $214 | $188 | $211 | |

| $277 | $374 | $500 | $338 |

| $240 | $240 | $439 | $287 |

| $188 | $300 | $248 | $235 | |

| $140 | $168 | $232 | $140 | |

| $157 | $221 | $328 | $214 | |

| $97 | $142 | $143 | $111 | |

| U.S. Average | $207 | $295 | $338 | $253 |

These rates are substantially higher than the rates for those without a DUI. With time and excellent driving, your rates will go down after a DUI. If you need more information, check out auto insurance for drivers with DUIs.

Cheapest Texas Auto Insurance Rates After an At-Fault Accident

Like a DUI, an at-fault accident will more than likely increase your car insurance rates. The impact on costs will vary based on how much your insurance company had to pay out. Here is an idea of what you may end up paying if you have at-fault accidents on your driving record in the state of Texas.

Texas Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $483 | $313 | |

| $345 | $274 | |

| $305 | $214 | |

| $214 | $164 | |

| $374 | $277 |

| $240 | $240 |

| $300 | $188 | |

| $168 | $140 | |

| $221 | $157 | |

| $142 | $97 | |

| U.S. Average | $295 | $207 |

With great driving and no accidents, you can take solace in the fact that Texas insurance rates will go down eventually. However, you’ll find the cheapest Texas auto insurance for drivers with accidents if you buy State Farm coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Texas Auto Insurance Quotes

Is Texas expensive for car insurance? Yes, Texas drivers pay about 18% more than the average driver due to the increased traffic risks and fast interstate highway speeds. Fortunately, drivers throughout Texas can save money by knowing how to get multiple auto insurance quotes and comparing Texas insurance rates from multiple companies.

The top auto insurance companies in Texas are State Farm, Geico, and Texas Farm Bureau. Military members get the best rates with USAA, and drivers with poor credit will find affordable coverage with Nationwide.

However, the Texas city you live in will significantly impact how much you pay for coverage. Even the best Texas car insurance companies will still offer more affordable rates to drivers in smaller cities. For example, auto insurance in Austin, Texas, the state capital, is cheaper than rates in Dallas, San Antonio, or Houston.

If you’re looking for the best car insurance in Texas, enter your ZIP code below. You can compare Texas auto insurance quotes from companies in your area to find you the most affordable coverage.

Frequently Asked Questions

Who has the best auto insurance rates in Texas?

Texas Farm Bureau, State Farm, and Geico sell the cheapest car insurance in Texas. You’ll find the most affordable Texas car insurance rates by comparing quotes from these and other Texas auto insurance companies in your city.

Read more: Texas Farm Bureau Auto Insurance Review

How much is car insurance in Texas?

Auto insurance in Texas is about $52 per month for liability-only and about $140 for full coverage. If you have accidents or other insurance claims on your record, your rates will average $189 per month.

Why is car insurance so expensive in Texas?

Drivers in Texas pay about 18% more for car insurance than the national average. Traffic rates in the state’s largest cities and higher average speeds on state highways lead to more expensive insurance rates.

Texas state insurance laws also require drivers to carry at least $2,500 in PIP, which makes minimum auto insurance more expensive than in other states.

The good news is you can keep your insurance costs low by comparing quotes and coverage from multiple companies. Use our free comparison tool below to see what auto insurance quotes look like in your area.

Is auto insurance mandatory in Texas?

Yes, auto insurance is mandatory in Texas. All drivers are required to carry liability insurance that meets the minimum coverage limits set by the state. Failure to maintain proper insurance coverage can result in penalties and fines.

What are the minimum auto insurance requirements in Texas?

The minimum auto insurance requirements by state of Texas, are commonly referred to as 30/60/25 coverage. This means you must have at least $30,000 in bodily injury liability coverage per person, $60,000 in bodily injury liability coverage per accident, and $25,000 in property damage liability coverage per accident

Are there any additional coverage options available in Texas?

Yes, in addition to the mandatory Texas liability insurance coverage, you can purchase additional coverage options to enhance your auto insurance policy. Some common options include collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection (PIP).

How are auto insurance rates determined in Texas?

Auto insurance rates in Texas are determined by various factors, including your age, driving record, the type of vehicle you drive, your credit history, where you live, and the coverage limits you choose. Insurance companies use these factors to assess the risk associated with insuring you and calculate your premium accordingly.

What should I do if I’m involved in a car accident in Texas?

If you’re in a Texas car accident, ensure everyone’s safety, call the police to report the accident, exchange information with the other driver(s) involved, document the scene, and notify your insurance company promptly with accurate details.

What does Texas liability insurance cover?

Texas liability auto insurance covers the costs associated with injuries or property damage you may cause to others in an accident. It helps pay for medical expenses, lost wages, pain and suffering, and property repairs or replacements. It doesn’t cover your own vehicle or injuries.

Can my auto insurance policy cover rental cars in Texas?

Some auto insurance policies in Texas may provide coverage for rental cars, but it depends on the specific terms and conditions of your policy. Review your policy or contact your insurance company to understand if rental car coverage is included or if you can add it as an optional coverage.

How can I find the best auto insurance rates in Texas?

To find the best auto insurance rates in Texas, consider the following tips:

- Shop around and compare Texas auto insurance quotes from multiple insurance companies.

- Maintain a good driving record and credit history.

- Bundle your Texas auto insurance with other policies, such as homeowners or renters insurance.

- Inquire about available Texas car insurance discounts, such as multi-car discounts and safe driver discounts.

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.