Best Kentucky Auto Insurance in 2025 (Find the 10 Companies Here!)

Find the best Kentucky auto insurance options with rates as low as $29 monthly from State Farm, Geico, and Progressive, as leading the pack. Learn how much is car insurance in Kentucky cost, and choose from reliable providers to find tailored coverage that fits your needs. Compare quotes today.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Feb 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Kentucky

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Kentucky

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Kentucky

A.M. Best

Complaint Level

Pros & Cons

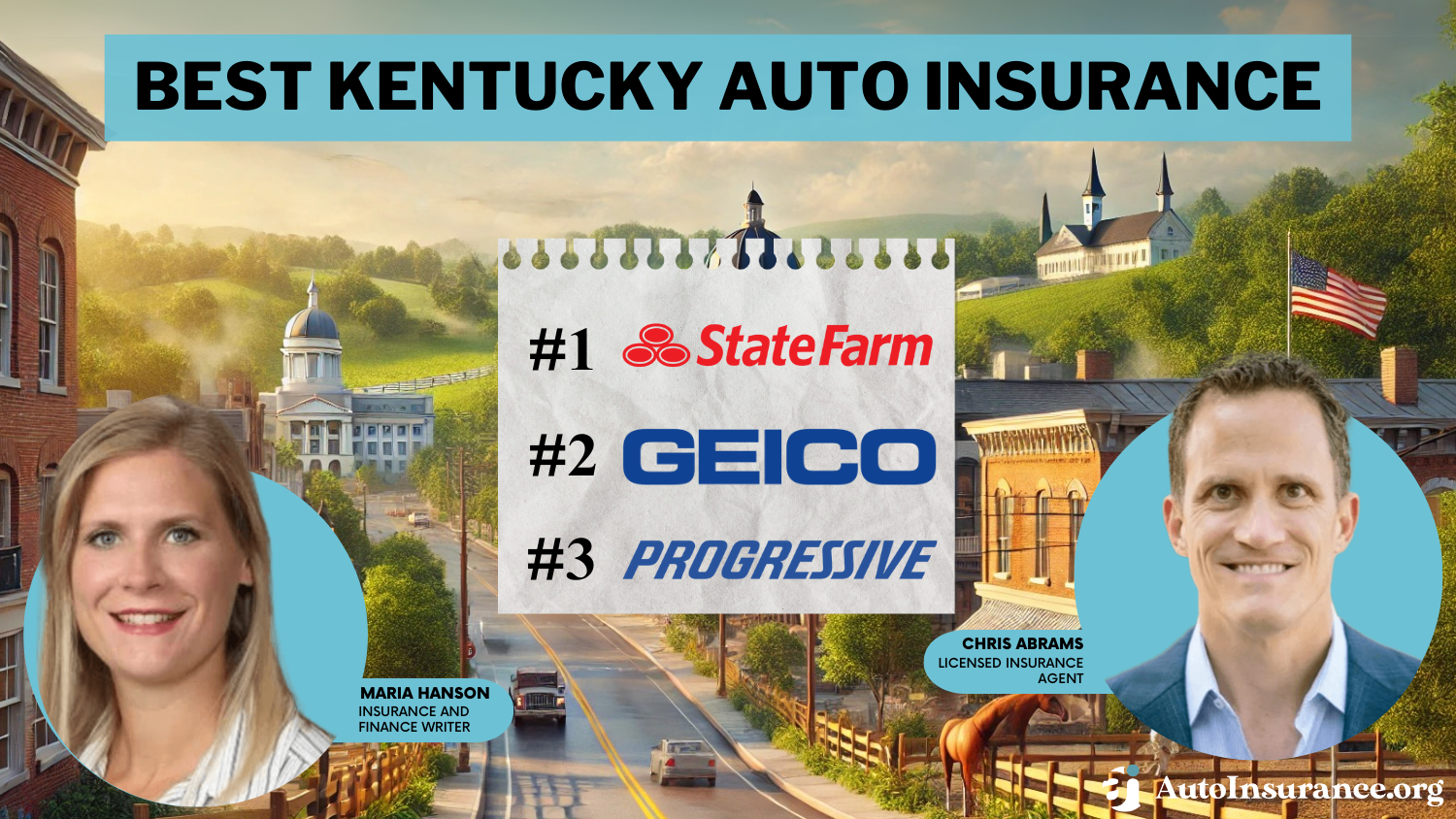

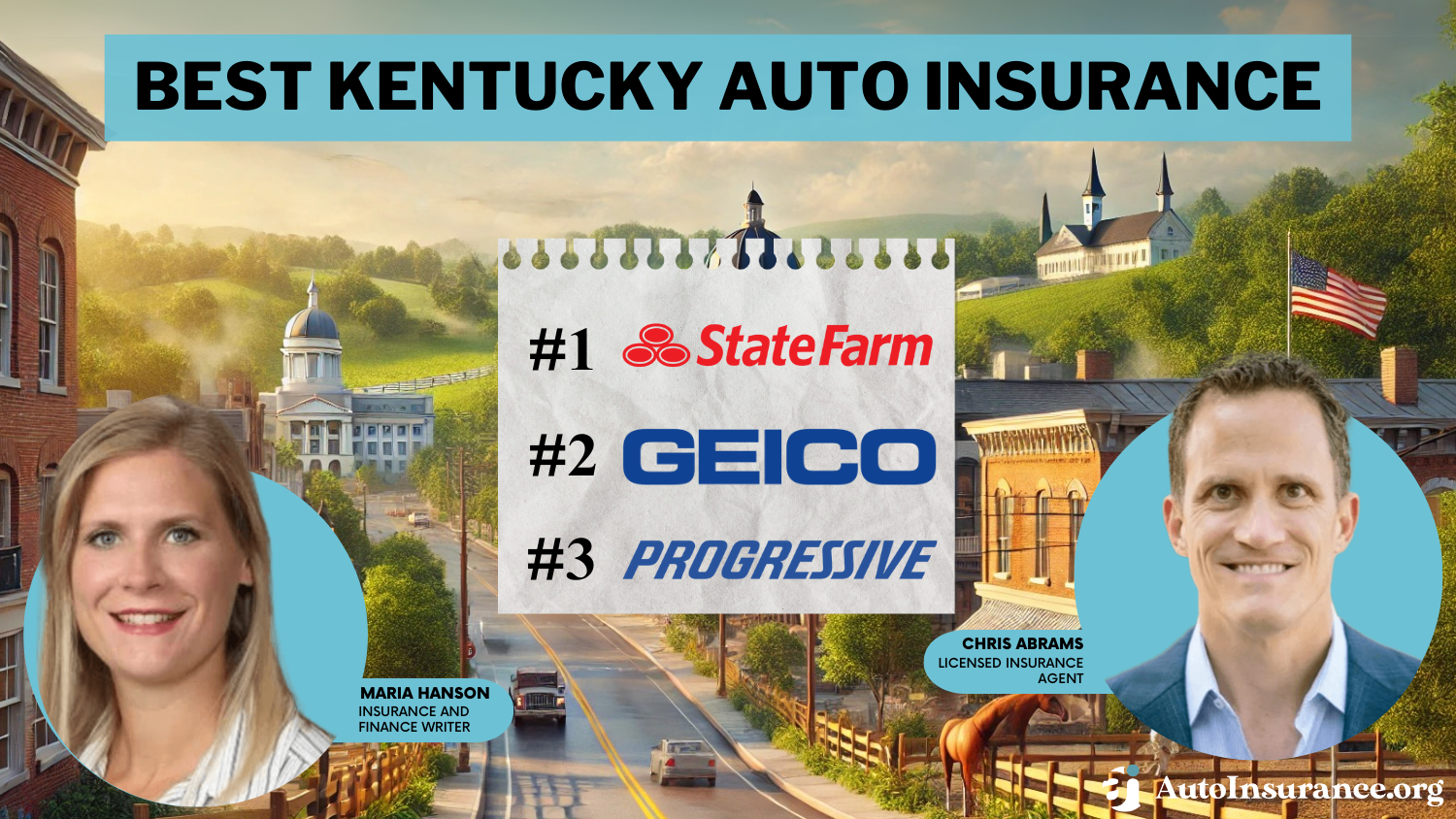

When looking for the best Kentucky auto insurance, look no further than State Farm, Geico, and Progressive as they stand out with their competitive rates as low as $29 per month.

Comparing quotes and understanding Kentucky auto insurance requirements is essential for legal compliance and financial efficiency.

Our Top 10 Company Picks: Best Kentucky Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Online Convenience State Farm

#2 15% A++ Customizable Polices Geico

#3 14% A+ Cheap Rates Progressive

#4 10% A+ Many Discounts Nationwide

#5 10% A+ Usage Discount Allstate

#6 12% A Add-on Coverages Liberty Mutual

#7 10% A Military Savings American Family

#8 10% A++ Student Savings USAA

#9 15% A Accident Forgiveness Farmers

#10 10% A++ Local Agents Travelers

Get an instant auto insurance quote to find affordable and comprehensive coverage that meets your needs. You can ensure you’re getting the best rate and the right amount of coverage for your vehicle and circumstances.

- Kentucky Auto Insurance

- Cheapest SR-22 Insurance in Kentucky for 2025 (Save With These 10 Providers)

- Cheap Gap Insurance in Kentucky (Top 9 Low-Cost Companies for 2025)

- Cheap Auto Insurance for High-Risk Drivers in Kentucky (10 Most Affordable Companies for 2025)

- Best Salyersville, Kentucky Auto Insurance in 2025

- Best Prestonsburg, Kentucky Auto Insurance in 2025 (Top 10 Companies Ranked)

- Best Louisville, Kentucky Auto Insurance in 2025

- Best Liberty, Kentucky Auto Insurance in 2025

- Best Inez, Kentucky Auto Insurance in 2025

- Best Greenville, Kentucky Auto Insurance in 2025

- Best Corbin, Kentucky Auto Insurance in 2025

- Compare quotes to save up to 17% on premiums

- State Farm is the top pick for exceptional customer satisfaction and reliability

- Kentucky’s insurance requirements and coverage options to decide wisely

#1 – State Farm: Top Overall Pick

Pro

- Personalized Service: Extensive network of local agents ensures tailored advice and personalized customer support.

- Wide Range of Products: Offers comprehensive coverage options including auto, home, and life insurance.

- Discount Programs: Multiple discounts such as multi-policy and safe driver incentives help lower costs.

Cons

- Higher Rates: While competitive, premiums may be slightly higher compared to some competitors. For discounts, read our State Farm auto insurance discounts page.

- Limited Online Options: Online quote and policy management tools are less extensive compared to fully digital insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Customizable Polices

Pros

- Competitive Rates: Known for consistently offering some of the most competitive premiums in the industry.

- Online Convenience: User-friendly online tools facilitate easy policy management and efficient claims processing.

- Customer Service: As mentioned in our Geico auto insurance review, the company is know for it’s excellent customer service and satisfaction ratings.

Cons

- Limited Personalized Service: Being predominantly online reduces opportunities for face-to-face interaction with agents.

- Rate Increases: Initial competitive rates can increase after the policy period, affecting long-term affordability.

#3 – Progressive: Best for Cheap Rates

Pros

- Innovative Tools: Unique tools like Name Your Price® and Snapshot® tailor policies to individual needs.

- Competitive Rates: Progressive auto insurance review emphasizes affordability with discounts like safe driver and multi-policy savings.

- Customer Service: Positive customer service ratings supported by a user-friendly mobile app for seamless interaction.

Cons

- Rate Increases: Premiums may rise following accidents or traffic violations.

- Limited Agent Availability: Fewer local agents may limit access to in-person customer support.

#4 – Nationwide: Best for Many Discounts

Pros

- Diverse Products: Offers a comprehensive suite of insurance products beyond auto coverage.

- Discounts: Generous discounts, especially for bundling policies, contribute to overall savings.

- Financial Stability: Strong financial stability and customer service ratings. For more information, read our Nationwide auto insurance review.

Cons

- Higher Rates: Premiums might be higher compared to direct competitors in certain regions.

- Limited Agent Availability: Inconsistent availability of local agents could impact personalized service delivery.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Usage Discount

Pros

- Extensive Coverage: Comprehensive options including accident forgiveness and various customizable features.

- Customer Service: Excellent reputation for responsive customer service and efficient claims handling.

- Discounts: Numerous discount opportunities enhance affordability for policyholders.

Cons

- Higher Premiums: Generally higher premium rates relative to other major insurers. Learn more about their premiums in our Allstate auto insurance review.

- Complex Claims Process: Some customers find navigating the claims process more involved compared to competitors.

#6 – Liberty Mutual: Best for Add-on Coverages

Pros

- Customizable Coverage: Offers flexibility with customizable coverage options tailored to individual needs.

- Discounts: Provides significant savings through multi-policy and safe driver discounts.

- Digital Tools: As mentioned in our Liberty Mutual auto insurance review, the company has a user-friendly website and mobile app for managing policies and claims.

Cons

- Higher Premiums: Premium rates may be higher than average in some market segments.

- Mixed Customer Service: Customer feedback varies, with some reporting less satisfactory experiences.

#7 – American Family: Best for Military Savings

Pros

- Local Agents: Personalized service from local agents who understand regional needs and provide tailored advice.

- Bundle Discounts: Savings for bundling home and auto insurance under one policy.

- Strong Financial Stability: Strong financial ratings provide assurance of reliable coverage. (Read More: American Family Auto Insurance Review).

Cons

- Limited Availability: Restricted availability in certain states limits accessibility for potential customers.

- Claims Process: Some customers experience delays or complications during the claims filing process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – USAA: Best for Student Savings

Pros

- Low Premiums: As outlined in USAA auto insurance review, the company offers some of the lowest premium rates due to its focus on military members and families.

- Top-rated Customer Service: Consistently high customer service ratings reflect dedication to member satisfaction.

- Exclusive Membership: Tailored insurance solutions specifically designed for military personnel and their families.

Cons

- Membership Restrictions: Limited to military personnel, veterans, and their families.

- Limited Coverage Options: Some specialized coverage options may not be as comprehensive as those offered by larger insurers.

#9 – Farmers: Best for Accident Forgiveness

Pros

- Coverage Options: Extensive range of coverage options including specialized policies to meet diverse customer needs.

- Local Agents: Personalized service from local agents ensures tailored advice and support. Check out this page Farmers auto insurance review to know more details.

- Claims Satisfaction: High customer satisfaction ratings for efficient and responsive claims processing.

Cons

- Higher Premiums: Premium rates may be higher compared to some competitors due to comprehensive coverage options.

- Complex Policies: Policies can be intricate, potentially requiring more effort to understand and manage effectively.

#10 – Travelers: Best for Local Agents

Pros

- Financial Strength: As outlined in our Travelers auto insurance review, Travelers has a strong financial stability and high customer service ratings.

- Customizable Policies: Offers customizable policies to fit individual needs.

- Online Tools: Convenient online tools for managing policies and claims.

Cons

- Higher Premiums: Premiums may be higher compared to some competitors.

- Limited Availability: Limited availability of local agents for in-person service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Cost of Auto Insurance in Kentucky

Kentucky Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $86 $236

American Family $60 $164

Farmers $72 $197

Geico $29 $80

Liberty Mutual $61 $168

Nationwide $67 $184

Progressive $41 $111

State Farm $36 $98

Travelers $51 $139

USAA $26 $72

To understand how insurance rates get calculated, you need to know what factors impact rates.

For some, purchasing Kentucky auto insurance is intimidating, especially if they’re unfamiliar with Kentucky’s insurance requirements, coverage types, or how insurance works. This lack of information could result in people purchasing coverage they don’t need on their Kentucky auto insurance policy, making it harder to find cheap auto insurance.

Kentucky Statistics Summary

| Statistics | Details |

|---|---|

| Miles of Roadway | Vehicle Miles: 48,675 million Miles in State: 79,857 |

| Vehicles | Registered: 4,040,964 Thefts: 7,782 |

| State Population | 4.512 Million |

| Most Popular Vehicle | Ford F-150 |

| Percent of Uninsured Drivers | 11.50% |

| Driving Fatalities | Speeding Fatalities: 138 DUI Fatalities: 181 |

| Average Monthly Premiums | Liability: $44 Collision: $22 Comprehensive: $12 |

Whether you’re looking to get the best Kentucky auto insurance coverage on a new vehicle, switch car insurance companies, or confirm you’re getting the best deal out there, look at our Kentucky auto insurance guide to help you find cheap car insurance in KY.

Required Kentucky Car Insurance Coverage

All Kentucky drivers must carry liability auto insurance, including the following three components:

Kentucky Auto Insurance Coverage

| Coverage | Description |

|---|---|

| Bodily Injury Liability | This coverage pays for injuries to other people caused by the policyholder in an accident. It covers medical expenses, lost wages, and legal fees of the injured parties. |

| Property Damage Liability | Covers the costs of damages to someone else's property resulting from an accident for which you are at fault. This includes repairs to vehicles, buildings, and other structures. |

| Personal Injury Protection (PIP) | Also known as "no-fault" coverage, PIP helps pay for your medical expenses, lost wages, and other related expenses regardless of who is at fault in an accident, up to a specified limit. |

The minimum required liability insurance coverage amounts in Kentucky are as follows:

- $25,000 Bodily Injury per Person per Accident

- $50,000 Bodily Injury per Accident

- $25,000 in Property Damage Liability

- $10,000 in Personal Injury Protection

Drivers can purchase higher coverage than the required state minimum. Although it may cost more to increase your coverage limits, it could be worth it if you’re involved in an accident, and the expenses total more than the state minimum.

For example, say you cause an accident resulting in bodily injury totaling $15,000 and property damage totaling $30,000. The $25,000 in bodily injury coverage would be enough, but extensive property damage totaling $30,000 means you’ll pay the $5,000 difference out of pocket.

Kentucky offers an alternative type of insurance policy known as combined single-limit coverage. Rather than purchase split-limit coverage that assigns an individual dollar amount to bodily injury and property damage claims, combined single-limit coverage assigns one dollar amount that applies to bodily injury, property damage, and personal injury protection.

Additional Options for Car Insurance in Kentucky

Liability coverage is the only insurance Kentucky requires, but auto insurers offer additional coverage options. Any coverage beyond the minimum state-required insurance could be considered full coverage depending on the type of auto insurance coverage added to the policy.

Additional types of auto insurance coverage available in Kentucky include:

Kentucky Auto Insurance Additional Coverage

| Coverage | Description |

|---|---|

| Collision | Pays for damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault. |

| Comprehensive | Covers damage to your vehicle from non-collision events such as theft, vandalism, natural disasters, and encounters with animals. |

| Guaranteed Auto Protection (GAP) | Covers the difference between the actual cash value of your vehicle and the remaining balance on your loan or lease if your car is totaled or stolen. |

| Medical Payments | Provides payment for medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. |

| Rental Car Reimbursement | Covers the cost of a rental vehicle while your car is being repaired after a covered insurance claim. |

| Roadside Assistance | Offers services such as towing, flat tire change, battery jump-start, lockout service, and fuel delivery when your car breaks down. |

| Uninsured/Underinsured Motorist | Protects you in case you are in an accident with a driver who either does not have insurance or does not have enough insurance to cover your damages and injuries. |

Although additional coverage is optional, some drivers can benefit from further protection.

Factors Impacting Kentucky Car Insurance Rates

When you shop around for cheap auto insurance in Kentucky, insurance companies use various factors to determine your monthly premium.

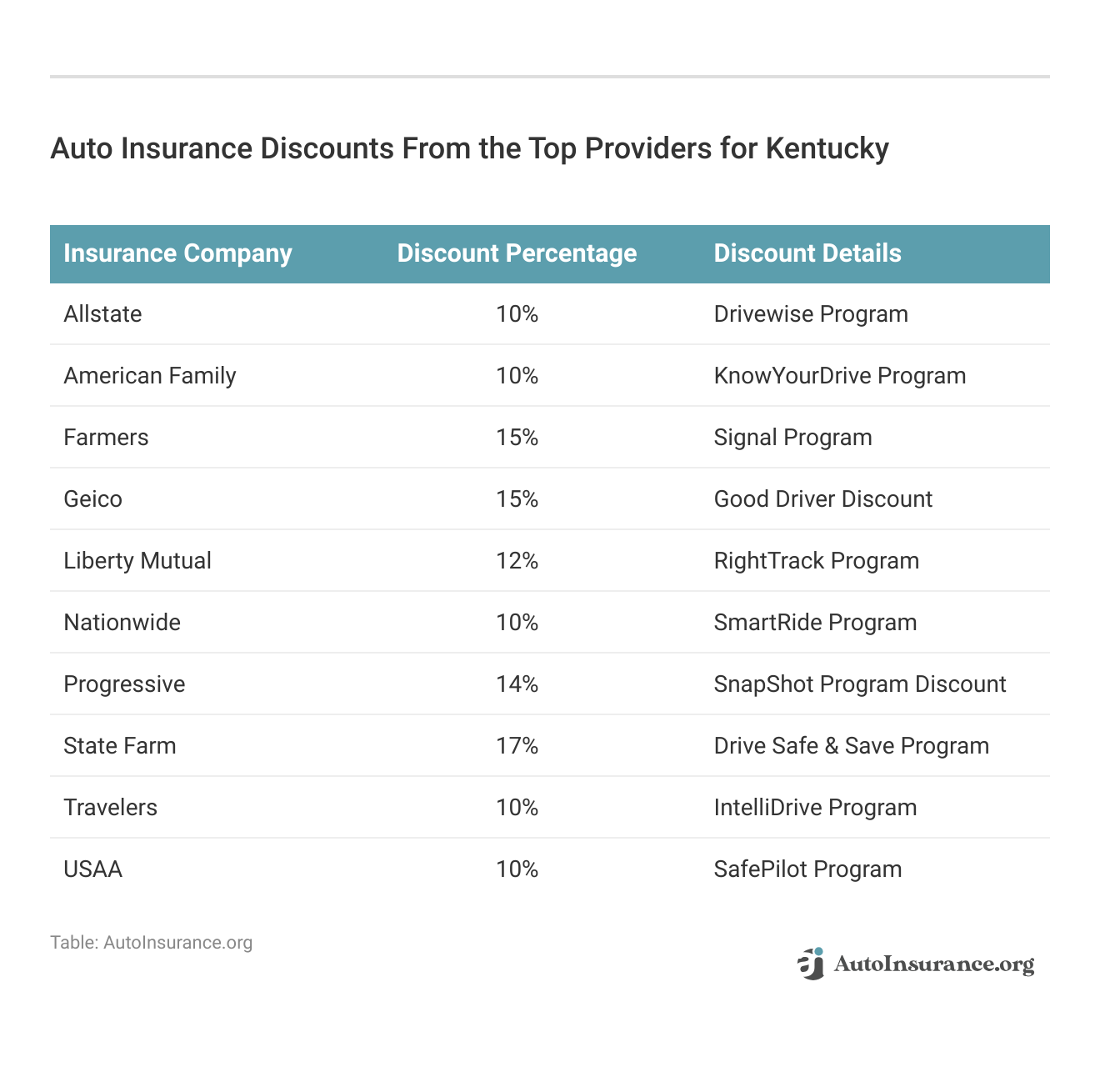

These discounts below can significantly impact rates by offering savings based on factors helping to lower monthly premiums.

These include your age, claims history, credit score (except in California, Hawaii, Massachusetts, and Michigan), driving history, gender (except in specified states), marital status, homeownership, education level, vehicle model, ZIP code (except in California and Michigan), and commute distance.

Each of these factors helps insurers assess your risk profile and calculate the appropriate insurance rates based on statistical likelihoods of accidents and claims. Each company’s rating system is different, but those mentioned above are the main factors that affect auto insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What to Consider When Choosing a KY Auto Insurance Company

As you shop around, you’ll see there are many insurance companies to choose from, which could make the purchasing process hard for you.

Below are a few considerations when looking for a Kentucky auto insurance company:

- Coverage Options: You must purchase the state minimum liability coverage, but if you’re interested in additional coverage options, choosing a company that offers what you need is important.

- Coverage Amounts: Purchasing the state minimum coverage amount is a good start, but it wouldn’t hurt to have the option to select a higher limit for added protection.

- Cost of Policy: Cost is important for many drivers, so once you determine what coverage you want, you can review quotes from different companies to find the most affordable.

- Deductible: A deductible is attached to certain additional coverages, such as collision and comprehensive. You want to select a deductible you can afford because you must make this payment before your insurance covers any vehicle damage after an accident.

- Discounts: Auto insurance discounts help lower the cost of insurance, and the more a company offers, the more money you could potentially save.

Ideally, the above criteria can guide you through purchasing auto insurance and help you choose the best insurance company for you. However, when reviewing coverage options and amounts, you must figure out how much coverage you need.

Determining how Much Auto Insurance Coverage you Need

Affordability is key when selecting an insurance company, and there are various coverage options available to drivers from all insurers. When deciding on your coverage needs, consider factors such as the value of your vehicle—opting for full coverage might not be cost-effective for a cheaper vehicle.

Additionally, increasing your coverage limits will also increase your premium costs. Assess your financial situation to determine if you could handle out-of-pocket expenses in the event of an accident; insurance can be an essential financial safeguard in such scenarios.

Purchasing more than the required coverages will cost more. However, higher annual auto insurance rates will likely be more affordable than the out-of-pocket costs you’ll be stuck paying if you have insufficient coverage.

How to Find Cheap Car Insurance in Kentucky

It’s no secret that auto insurance can be costly, especially if you opt for full coverage. Since insurers consider various factors to calculate rates, it’s common for rates to differ based on the company. However, with all auto insurance companies, drivers have the opportunity to lower their rates.

Here’s how you can get the cheapest car insurance in KY:

- Shop Around: Get car insurance quotes in KY from multiple auto insurance companies and compare the cost for the coverage you need.

- Bundle Insurance Policies: Many auto insurance companies offer a discount to customers who bundle policies, so if you’re in the market for auto insurance and homeowners or renter’s insurance, you can get a deal.

- Remove Coverage: Review your policy to confirm which coverage you need and remove what you don’t need to lower the price.

- Increase Your Deductible: The higher your deductible, the less you’ll pay for that coverage, but you don’t want to choose a deductible that’s too high because this is an out-of-pocket expense you must pay before your insurance covers vehicle replacement or repair.

- Improve Your Credit Score: Since insurers often use credit scores to calculate your insurance premium, improving your score can get you a better rate.

- Review Available Discounts: Review the discounts offered by your insurance company to confirm if they applied to your policy and see if there are discounts you may qualify for that haven’t applied to your premium yet.

Read More:

Whether you’re a new Kentucky resident needing auto insurance coverage or want to ensure you’re getting the best rate, the above methods are great ways to get cheap insurance in KY. You’ll also want to review your policy annually or semi-annually to confirm you’re getting the best possible rates through your auto insurer.

Companies Offering Auto Insurance in Kentucky

Here are some insurance companies offering car insurance in Kentucky:

- Geico

- Nationwide

- Liberty Mutual

- Progressive

- State Farm

- Allstate

- USAA

Use our online tool to compare Kentucky auto insurance rates from different insurance companies in your area. You can get started by entering your ZIP code. For example, you can compare Geico vs. State Farm auto insurance by shopping online.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kentucky Auto Insurance Laws

Owners of seasonal vehicles, such as RVs and sports cars, must surrender their plates before removing insurance from the vehicle. If you remove the vehicle from your insurance policy after surrendering your plates, you could be penalized for having an uninsured registered vehicle. When you’re ready to get your seasonal vehicle back on the road, you can register and insure it for the driving season.

Drivers with historic license plates must also surrender them if the vehicle is no longer insured. If you wish to drive the vehicle with or without historic license plates, you must register and insure it before driving it.

Confirm how insurance works in Kentucky if you drive for or use rideshare transportation, such as Uber or Lyft. Many insurance companies don’t provide rideshare insurance, but there are a few that offer this specific type of coverage.

Providing Proof of an Insurance Policy in Kentucky

Drivers must report electronically when purchasing, renewing, or transferring car insurance to a new vehicle. Even though this information is on file, drivers should still carry proof of insurance when operating their vehicles. Drivers can face penalties for failing to provide proof of insurance, whether or not they’re insured.

Penalties for Driving Without Auto Insurance in Kentucky

As mentioned, if authorities pull you over, they will request proof of insurance. While insured drivers may not face harsh penalties for failure to present proof of insurance, uninsured drivers aren’t so lucky.

Uninsured drivers face the following penalties for driving without auto insurance in Kentucky:

- Fine of $500 to $1,000

- Up to 90 days in jail

- Registration cancellation

Since a list of insured drivers is provided to the commonwealth by Kentucky auto insurers, the state is aware of which drivers are uninsured. Drivers not on this list get sent requests to provide proof of insurance via mail, and they then have 30 days to provide this proof. If proof isn’t received, their registration gets canceled until they submit the requested documentation.

Kentucky No-Fault Coverage

Kentucky is a choice no-fault state, meaning it doesn’t matter which driver is at fault when an accident occurs. All drivers in Kentucky must carry no-fault car insurance, so after an accident, they must file a claim with their own insurance company to compensate up to $10,000 for medical expenses, lost wages, or replacement services, regardless of fault.

Due to the state’s no-fault limits, an individual’s right to sue the at-fault driver is restricted.

Drivers have the right to opt-out of no-fault coverage, allowing them to sue for damages in the event of an accident. However, opting out also means an individual can sue them for damages if they’re at fault for an accident.

Kentucky drivers to carefully consider the benefits and limitations of no-fault coverage, as it impacts their ability to sue for damages and how claims are handled after an accident.Eric Stauffer LICENSED INSURANCE AGENT

If you wish to reject no-fault coverage, you can speak to your insurance company or the Kentucky Office of Insurance.

Whether drivers have no-fault coverage or not, people can still file claims against the at-fault driver if an injured party’s medical expenses total $1,000. They can also file claims if the injuries resulted in permanent disfigurement, deprivation of a bodily function, or fracture of a weight-bearing bone or other bones.

Additionally, since no-fault insurance only applies to bodily injury, drivers and passengers can file a property damage claim against the at-fault driver. Since Kentucky drivers must carry liability insurance, the at-fault party’s liability insurance covers property damage costs up to the coverage limit. However, they will have to pay out-of-pocket costs if the limit is too low.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kentucky Vehicle Title, Registration, and Car Insurance Requirements

To title a vehicle in Kentucky, drivers must provide the following:

- Photo Identification

- Original proof of Kentucky insurance, issued within 45 days of the titling date

- Completed TC96-182

- Signed and notarized Kentucky title

If the title and ID list different names, drivers must provide an affidavit proving the person listed on the title and ID are the same. Drivers can also use a marriage license or divorce decree.

Read More: Do you need proof of insurance to transfer a car title?

To register a vehicle in Kentucky, drivers must provide the following:

- Photo Identification

- Original Proof of Kentucky Insurance

- Registration Fee

A sheriff’s inspection is also required to register the vehicle if the owner bought it in Kentucky. Additionally, drivers have 15 days to register the vehicle after relocating to Kentucky.

Kentucky Vehicle Registration and Car Insurance Exceptions and Exemptions

Although all Kentucky drivers are required to register their vehicles and carry a minimum amount of car liability insurance coverage, there are some exceptions and exemptions to the state’s insurance and vehicle registration laws.

Students attending college in Kentucky or out of state can keep their car registered and insured in their home state if they have a student identification card from a Kentucky higher education institution while driving in the state. However, policyholders should confirm their state’s insurance requirements with their insurance company.

Active duty service members can use their out-of-state insurance to title and register a vehicle in Kentucky. However, when registering the vehicle, the insurance policy must be recorded as a military personal policy instead of a standard policy. Our USAA auto insurance review is helpful for military members looking for coverage.

If entered as a standard policy, the vehicle may be flagged as uninsured, and an uninsured notice may be issued. You’ll then need to provide proof of active military service to the county clerk’s office.

The Final Word on Cheap Kentucky Auto Insurance

Because Kentucky auto insurance is so expensive, it’s important to take the time to analyze rates and coverages. Otherwise, you could be stuck paying a high rate for coverages you don’t need.

To find the best auto insurance companies in KY, use our free quote comparison tool. It will help you compare personalized quotes from local Kentucky auto insurance companies.

Use our free comparison tool below to see what car insurance quotes in KY look like.

Frequently Asked Questions

What type of car insurance does Kentucky require?

All Kentucky drivers must carry minimum liability auto insurance, including:

- $25,000 bodily injury per person per accident

- $50,000 bodily injury per accident

- $25,000 in property damage liability

What is full coverage auto insurance in Kentucky?

A policy providing more coverage than the required state minimum liability insurance is considered full coverage insurance in Kentucky. For example, full coverage includes state minimum liability coverage alongside comprehensive, collision, and uninsured/underinsured motorist insurance.

Is Kentucky a no-fault state?

Yes, Kentucky is a choice no-fault state. Drivers can opt out of no-fault coverage, allowing them to sue and be sued for damages in the event of an accident. If you wish to opt out of no-fault coverage, speak to your insurance company or the Kentucky Office of Insurance.

Does no-fault coverage include property damage?

No-fault coverage doesn’t include property damage, so drivers and passengers can file a property damage claim against the at-fault driver. In Kentucky, drivers must carry liability insurance, so if a property damage claim gets filed, the at-fault party’s liability insurance will cover property damage costs up to the coverage limit.

How long do I have to get insurance after moving to Kentucky?

Drivers new to Kentucky have 15 days to register their vehicles after relocating to the state.

Do I need uninsured motorist coverage in Kentucky?

You are not legally required to have uninsured motorist coverage in Kentucky, but it can be a useful coverage to add onto your Kentucky auto insurance policy.

What are the penalties for not having car insurance in Kentucky?

In Kentucky, drivers face the following penalties for driving without auto insurance:

- Fine of $500 to $1,000

- Up to 90 days in jail

- Registration cancellation

How can I save money on car insurance in Kentucky?

Which insurance companies offer car insurance in Kentucky?

How much is Kentucky auto insurance?

Minimum auto insurance in Kentucky is an average of $55 per month, and full coverage auto insurance in Kentucky is an average of $168 per month. (Read More: Kentucky Minimum Auto Insurance Requirements)

Why is Kentucky auto insurance expensive?

Why is car insurance so expensive in Kentucky? Is a common question for those who’s moving to Kentucky, auto insurance rates are expensive because of location factors like crashes and weather. Getting Kentucky auto insurance quotes from multiple different companies will help most drivers find savings.

Is it illegal to not have auto insurance in Kentucky?

Yes, it is illegal to not carry Kentucky auto insurance if you are a Kentucky resident. To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.