Best Willis, Texas Auto Insurance in 2025 (Compare the Top 10 Companies)

For the best Willis, Texas auto insurance, evaluate our best providers such as State Farm, Allstate, and Progressive, with premiums beginning at $48 a month. Take into account local conditions to select a policy that aligns with your budget while offering the coverage essential for driving in Willis, Texas.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Willis Texas

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Willis Texas

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Willis Texas

A.M. Best

Complaint Level

Pros & Cons

Top or known as the best Willis, Texas auto insurance, including State Farm, Allstate, and Progressive, offer starting rates as low as $48 per month.

Compare auto insurance premiums in Willis with those in Houston, Dallas, and Corpus Christi.

Our Top 10 Company Picks: Best Willis, Texas Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A+ Local Agents Allstate

#3 10% A+ Tight Budgets Progressive

#4 20% A Safe Drivers Farmers

#5 10% A++ Military Members USAA

#6 20% A+ Widespread Availability Nationwide

#7 25% A++ Cheap Rates Geico

#8 25% A Affinity Discounts Liberty Mutual

#9 13% A++ Bundling Policies Travelers

#10 5% A+ Exclusive Benefits The Hartford

Before buying auto insurance in Willis, check rates from various providers to get the best premium. Enter your ZIP code above for free quotes.

- State Farm offers the best auto insurance in Willis, Texas, starting at $48 per month

- Allstate provides top insurance for local agents

- Customizable coverage and competitive rates are crucial factors for auto insurance

#1 – State Farm: Top Overall Pick

Pros

- Local Agent Network: State Farm has a strong local agent network, making it one of the best Willis, Texas auto insurance providers for personalized service. This network is crucial for tailored advice specific to the Willis community. Find out in our State Farm company review.

- High Customer Satisfaction: Despite an A.M. Best rating of B, State Farm consistently delivers high customer satisfaction, cementing its position as the best Willis, Texas auto insurance provider for reliable claims service.

- Comprehensive Coverage Options: State Farm provides extensive coverage options, including rideshare insurance and rental car coverage, making it a top choice for best Willis, Texas auto insurance for comprehensive protection.

Cons

- Higher Premiums: State Farm’s premiums can be higher than those of budget competitors like Geico, which might not appeal to those looking for the most affordable best Willis, Texas auto insurance.

- Limited Usage-Based Insurance: The limited availability of usage-based insurance options may not attract drivers in Willis seeking the best Willis, Texas auto insurance for low-mileage discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Local Agents

Pros

- Strong Local Presence: Allstate is known for its strong local presence, making it the best Willis, Texas auto insurance provider for those who value face-to-face interactions with knowledgeable agents. Find more information about Allstate’s rates in our review of Allstate insurance.

- Multiple Bundling Options: With a 25% bundling discount, Allstate offers substantial savings, further solidifying its position as the best Willis, Texas auto insurance choice for those bundling multiple policies.

- Accident Forgiveness: Allstate’s accident forgiveness is a key feature that makes it one of the best Willis, Texas auto insurance providers, as it helps drivers avoid premium increases after an accident.

Cons

- Variable Customer Service: While Allstate is a top choice for best Willis, Texas auto insurance, customer service can vary depending on the local agent, potentially leading to inconsistent experiences.

- Higher Premiums: Allstate generally has higher premiums compared to other providers, which may make it less attractive for budget-conscious consumers seeking the best Willis, Texas auto insurance.

#3 – Progressive: Best for Tight Budgets

Pros

- Snapshot Program: The Snapshot program rewards safe driving with discounts, positioning Progressive as the best Willis, Texas auto insurance provider for drivers looking to lower their premiums through good habits.

- Budget-Friendly Tool: Progressive’s Name Your Price tool allows drivers to tailor coverage to their budget, further establishing it as the best Willis, Texas auto insurance option for financial flexibility.

- Strong Online Presence: With robust online tools, Progressive stands out as the best Willis, Texas auto insurance provider for tech-savvy customers who prefer managing policies digitally. Our complete Progressive review goes over this in more detail.

Cons

- Lower Satisfaction Ratings: Despite being a top pick for best Willis, Texas auto insurance, Progressive’s customer satisfaction can be lower due to mixed experiences with claims handling.

- Limited In-Person Agents: Progressive’s limited in-person agent availability may deter those who prefer face-to-face service, making it less ideal for customers seeking the best Willis, Texas auto insurance with personal interaction.

#4 – Farmers: Best for Safe Drivers

Pros

- Comprehensive Coverage: Farmers provides comprehensive coverage options, such as new car replacement and glass repair, reinforcing its status as the best Willis, Texas auto insurance provider for full protection.

- User-Friendly App: The Farmers mobile app makes managing policies easy, establishing Farmers as the best Willis, Texas auto insurance provider for tech-savvy users seeking convenience.

- Range of Products: With a 20% bundling discount and a wide range of additional insurance products, Farmers is a strong contender for the best Willis, Texas auto insurance provider for those looking to bundle and save.

Cons

- Higher Premiums: Farmers’ premiums may be higher than other providers, which could be a drawback for those seeking the most affordable best Willis, Texas auto insurance. Take a look at our Farmers insurance company review to learn more.

- Discount Flexibility: The discounts and coverage options might not be as flexible as other providers, making it less appealing for those who want customizable best Willis, Texas auto insurance solutions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Members

Pros

- Exclusive Services for Military: USAA is the best Willis, Texas auto insurance provider for military members, offering tailored services that cater specifically to their unique needs. Check out insurance savings for military members and their families in our complete USAA auto insurance review.

- Superior Customer Service: With an A.M. Best rating of A++, USAA is renowned for its customer service, making it the best Willis, Texas auto insurance choice for those seeking reliable and efficient support.

- Specialized Coverage Options: USAA provides specialized coverage such as military-specific discounts and overseas insurance, making it the best Willis, Texas auto insurance provider for military personnel.

Cons

- Limited Availability: USAA’s services are exclusive to military members, which limits its availability for the broader market seeking the best Willis, Texas auto insurance.

- App Usability: While robust, USAA’s online tools and mobile app may not be as user-friendly as those offered by other best Willis, Texas auto insurance providers, especially for older members.

#6 – Nationwide: Best for Widespread Availability

Pros

- Vanishing Deductible Program: Nationwide’s Vanishing Deductible program rewards safe driving, making it a strong contender for the best Willis, Texas auto insurance provider for those looking to reduce out-of-pocket costs.

- Comprehensive Coverage Options: Nationwide offers a range of coverage, including accident forgiveness and total loss deductible waiver, establishing it as one of the best Willis, Texas auto insurance providers.

- Strong Financial Stability: With an A.M. Best rating of A+, Nationwide provides confidence in claim payouts, further solidifying its place as the best Willis, Texas auto insurance provider. Learn more through our Nationwide auto insurance review.

Cons

- Higher Premiums: Nationwide’s premiums may be higher than budget-oriented providers, which could be a disadvantage for those seeking the cheapest best Willis, Texas auto insurance.

- Privacy Concerns: Some of Nationwide’s discounts, like the SmartRide program, require extensive data sharing, which might raise privacy concerns for those seeking the best Willis, Texas auto insurance with minimal data tracking.

#7 – Geico: Best for Cheap Rates

Pros

- Affordable Premiums: Geico is known for offering some of the lowest premiums, making it the best Willis, Texas auto insurance provider for those looking for cheap rates.

- Extensive Online Tools: Geico’s user-friendly mobile app and website make it easy to manage policies, establishing it as the best Willis, Texas auto insurance provider for tech-savvy customers. Learn more about Geico’s rates in our Geico auto insurance company review.

- High Bundling Discount: Geico offers a 25% bundling discount, making it an attractive option for those looking to combine policies with the best Willis, Texas auto insurance provider.

Cons

- Limited Coverage Options: While Geico offers affordable rates, its coverage options might not be as comprehensive, which could be a downside for those seeking the best Willis, Texas auto insurance with extensive protection.

- Variable Customer Service: Geico’s customer service can vary, which might affect its appeal as the best Willis, Texas auto insurance provider for those who prioritize consistent, high-quality service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Affinity Discounts

Pros

- Affinity Discounts: Liberty Mutual offers significant affinity discounts, making it the best Willis, Texas auto insurance provider for members of certain organizations or professions.

- High Bundling Discount: Offering a 25% bundling discount, Liberty Mutual is an excellent option for those looking to combine home and auto policies with the best Willis, Texas auto insurance provider.

- Exclusive Benefits: Liberty Mutual offers exclusive benefits such as better car replacement and accident forgiveness, positioning it as one of the best Willis, Texas auto insurance providers.

Cons

- Higher Premiums: Liberty Mutual’s premiums may be higher, which could be a drawback for budget-conscious consumers seeking the best Willis, Texas auto insurance. To see monthly premiums and honest rankings, read our Liberty Mutual review.

- Variable Claims Process: The claims process with Liberty Mutual can be inconsistent, which might affect its appeal as the best Willis, Texas auto insurance provider for those who prioritize a smooth claims experience.

#9 – Travelers: Best for Bundling Policies

Pros

- Strong Financial Stability: With an A.M. Best rating of A++, Travelers is financially sound, ensuring reliable claims processing, making it one of the best Willis, Texas auto insurance providers.

- Customizable Coverage: Travelers offers customizable coverage options, such as accident forgiveness and new car replacement, positioning it as a top choice for the best Willis, Texas auto insurance provider.

- Wide Coverage Network: Travelers provides coverage across a broad network, making it the best Willis, Texas auto insurance provider for those who may travel or relocate frequently.

Cons

- Higher Premiums: Travelers’ premiums can be on the higher side, which could be a disadvantage for those seeking the cheapest best Willis, Texas auto insurance. Read our full review of Travelers insurance for more information.

- Less Aggressive Discounts: Travelers’ discounts, including its 13% bundling discount, may not be as aggressive as those of other best Willis, Texas auto insurance providers, potentially limiting savings.

#10 – The Hartford: Best for Exclusive Benefits

Pros

- Specialized Coverage for AARP Members: The Hartford is the best Willis, Texas auto insurance provider for AARP members, offering exclusive benefits tailored to older drivers. Read more through our The Hartford auto insurance review.

- Exclusive Features: The Hartford offers unique features like RecoverCare, which provides assistance after an accident, making it the best Willis, Texas auto insurance provider for added peace of mind.

- Reliable Claims Service: The Hartford is known for its reliable claims service, further establishing it as the best Willis, Texas auto insurance provider for drivers who value a hassle-free claims process.

Cons

- Limited Availability: The Hartford’s services are primarily available to AARP members, limiting its appeal to a broader audience seeking the best Willis, Texas auto insurance.

- Lower Bundling Discount: With only a 5% bundling discount, The Hartford may not be the best Willis, Texas auto insurance provider for those looking to maximize savings through policy bundling.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

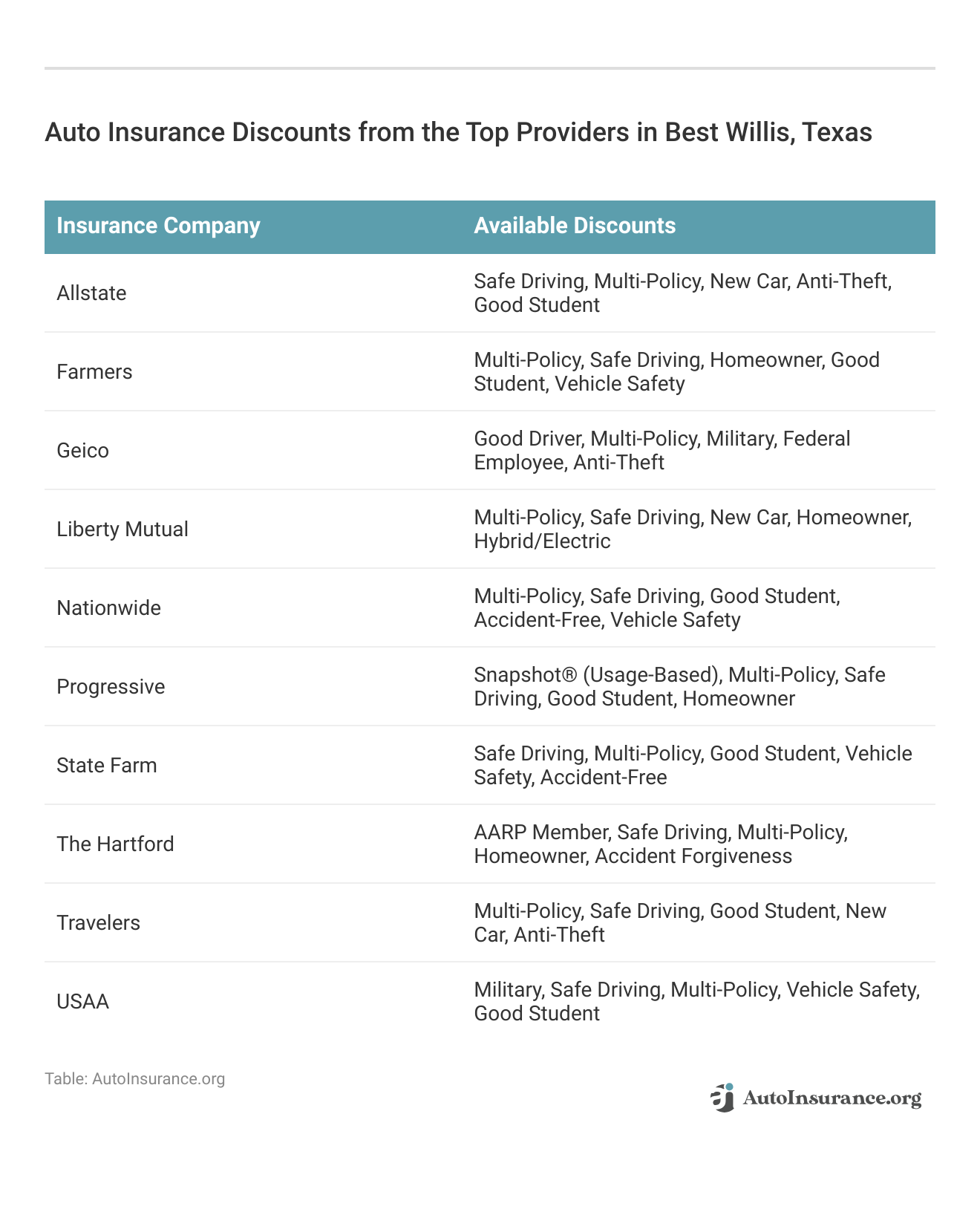

Most Affordable Auto Insurance in Willis, Texas by Category

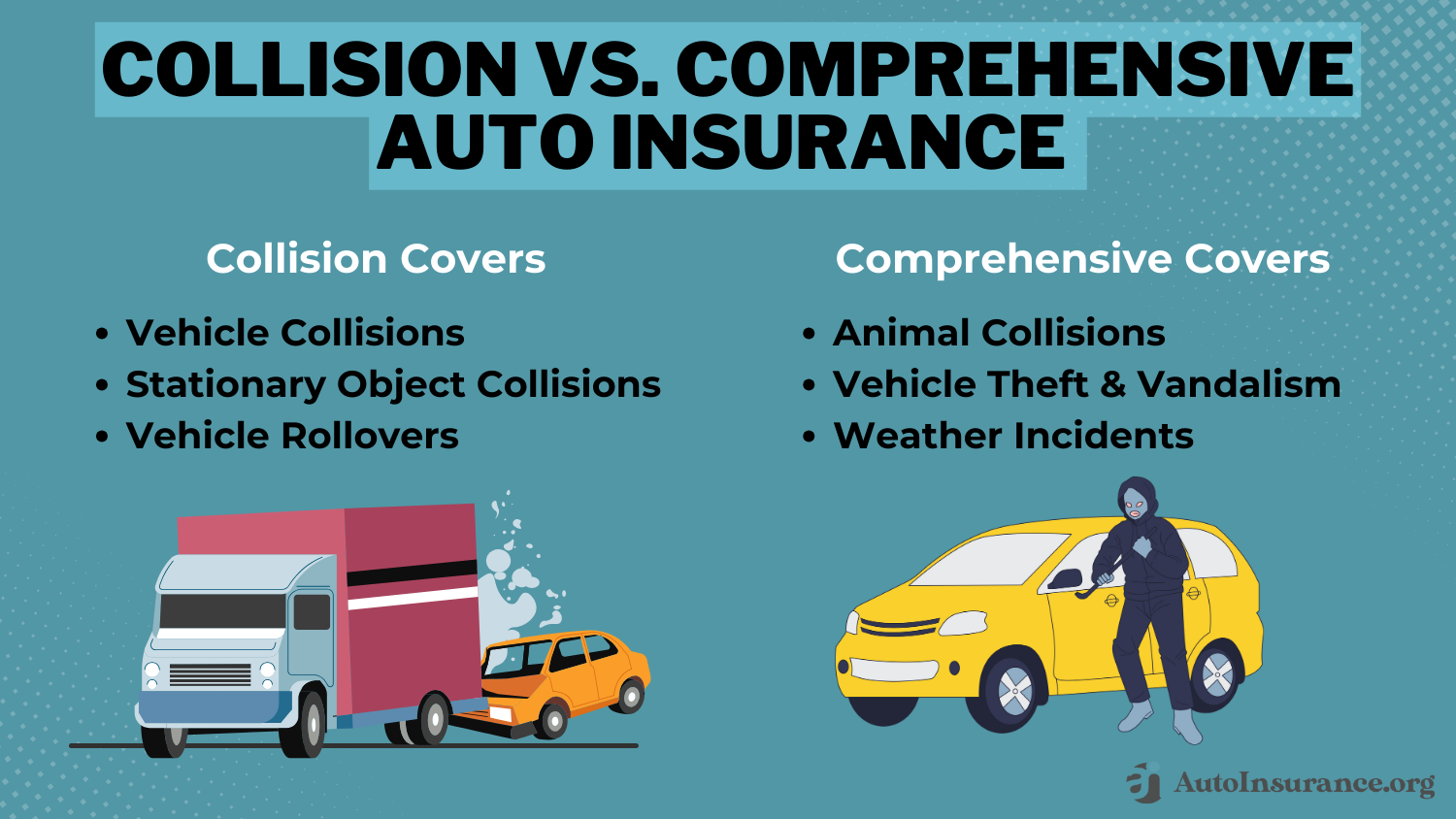

By analyzing these factors across categories—such as liability coverage, comprehensive and collision auto insurance coverage, and add-ons like roadside assistance—you can identify which insurer provides the most cost-effective solution for your specific situation.

This thorough comparison will help ensure that you find the best possible rates and coverage for your personal requirements, ultimately leading to more informed and financially savvy decisions regarding your auto insurance.

Most Affordable Auto Insurance Provider in Willis, Texas

In Willis, Texas, finding the most affordable auto insurance provider involves comparing quotes from several key companies known for their competitive pricing in the region.

Companies such as Geico, Progressive, and State Farm often emerge as some of the cheapest options due to their extensive networks and strong presence in the state.

Geico is renowned for its low rates and user-friendly online services, making it a popular choice for cost-conscious drivers. Progressive stands out with its usage-based insurance options, which can be advantageous for those with lower annual mileage.

State Farm, while slightly higher in cost compared to Geico and Progressive, offers comprehensive coverage options and excellent customer service, which may justify the higher premium for some.

Jeff Root

Licensed Insurance Agent

In Texas, drivers must have a minimum amount of liability coverage to legally operate a vehicle. This requirement helps protect both you and others on the road while influencing the overall cost of your auto insurance.

When selecting an insurance provider, it’s important to consider the minimum auto insurance requirement by state to ensure you meet the legal standards.

Additionally, local insurance providers might offer tailored discounts or promotions that can further impact affordability.

Comparing quotes and assessing the specific coverage options and discounts available, while ensuring you meet the minimum auto insurance requirement by state, can help determine the most cost-effective insurance solution for residents of Willis. Enter your ZIP code now.

Features Influencing Auto Insurance Rates in Willis, Texas

Auto insurance rates in Willis, Texas, can fluctuate based on several local factors that influence how insurance providers determine rates.

One significant factor is the rate of vehicle theft, as higher theft rates lead to increased insurance premiums due to more frequent and costly claims. The FBI’s monthly statistics report that Willis has experienced 2 auto thefts, which affects the overall cost of insurance.

Additionally, the average commute time in Willis is 27.7 minutes, according to City-Data, which also affects insurance rates. Longer commute times are generally associated with higher insurance costs because they increase the likelihood of accidents.

These local factors combined contribute to the variation in auto insurance rates in Willis, reflecting both the risk of theft and the increased potential for accidents due to longer driving times, as insurance providers assess these risks to determine rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comparison of Willis, Texas Auto Insurance Quotes

When considering auto insurance in Willis, Texas, it’s crucial to compare quotes from a variety of insurance providers to ensure you find the best coverage at the most competitive rates.

Auto insurance rates by age vary, as younger drivers often face higher costs compared to older, more experienced drivers. And this can significantly impact your premium.

Jeffrey Manola

LICENSED INSURANCE AGENT

This process not only allows you to explore different pricing options but also helps you understand how various insurers tailor their policies to the local market and different age groups, ultimately leading to better savings and more suitable coverage for your needs.

Utilize online tools to enter your ZIP code and receive free, personalized auto insurance quotes specific to Willis, Texas.

Frequently Asked Questions

What is auto insurance?

Auto insurance is a contract between an individual and an insurance company that provides financial protection in the event of an accident or damage to a vehicle.

It helps cover the costs associated with repairs, medical expenses, and liability claims resulting from a car accident.

Is auto insurance mandatory in Willis, TX?

Yes, auto insurance is mandatory in Willis, TX, as it is in most states. Texas law requires drivers to carry a minimum amount of liability insurance to cover potential damages caused to others in an accident.

The minimum liability coverage limits in Texas are currently $30,000 for bodily injury per person, $60,000 for bodily injury per accident involving multiple people, and $25,000 for property damage. Enter your ZIP code now to begin.

Which insurance provider is considered the top overall pick for auto insurance in Willis, Texas?

State Farm is the top overall pick for auto insurance in Willis, Texas, due to its strong customer service and solid reputation. It also offers a competitive bundling discount of 17%, adding extra value for customers.

Additionally, State Farm is recognized for offering some of the best rideshare auto insurance, making it an ideal choice for drivers participating in rideshare services who need comprehensive coverage tailored to their needs.

What makes Allstate the best choice for those who prefer working with local agents in Willis, Texas?

Allstate is ideal for those who prefer local agents in Willis, Texas, because of its extensive network of knowledgeable representatives.

The company also provides a substantial bundling discount of 25%, making it attractive for policyholders.

Why is Progressive recommended for drivers with tight budgets in Willis, Texas?

Progressive is recommended for drivers on tight budgets in Willis, Texas, due to its competitive rates and flexible coverage options.

With an A+ rating from A.M. Best, it also offers a bundling discount of 10% for added savings. Enter your ZIP code now to begin.

What feature does Farmers offer that benefits safe drivers in Willis, Texas?

Farmers benefits safe drivers in Willis, Texas, through its innovative telematics program that rewards good driving behavior.

The company also offers a 20% bundling discount, which can lead to significant savings.

Additionally, Farmers is recognized as one of the best auto insurance for military families and veterans, offering tailored discounts and benefits specifically for those who have served in the armed forces.

Who is USAA’s auto insurance primarily designed for in Willis, Texas?

USAA’s auto insurance is primarily designed for military members and their families in Willis, Texas, offering exclusive benefits tailored to their needs. It boasts an A++ rating from A.M. Best and a 10% bundling discount.

What program does Nationwide offer to reward safe driving in Willis, Texas?

Nationwide offers the SmartRide program, which rewards safe driving with potential discounts in Willis, Texas. The company also provides a 20% bundling discount, making it a cost-effective choice for comprehensive coverage. Enter your ZIP code now to begin.

How does Geico stand out as a budget-friendly auto insurance provider in Willis, Texas?

Geico stands out as a budget-friendly option in Willis, Texas, among the best auto insurance companies due to its consistently low rates and A++ rating from A.M. Best.

It also offers a generous 25% bundling discount, helping customers save even more.

What exclusive benefits does The Hartford offer to AARP members in Willis, Texas?

The Hartford offers exclusive benefits to AARP members in Willis, Texas, including tailored coverage options and enhanced customer service.

Despite a lower bundling discount of 5%, the company’s A+ rating ensures reliable service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.