Best New York Auto Insurance in 2025 (Top 10 Companies Ranked)

The top picks for the best New York auto insurance providers are State Farm, Geico, and Allstate, offers the cheapest rates starting at $51 per month. These companies stand out for their competitive pricing and comprehensive coverage options, making them top choices for New York drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in New York

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in New York

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in New York

A.M. Best

Complaint Level

Pros & Cons

The top picks for the best New York auto insurance providers, considering affordability and comprehensive coverage options, are State Farm, Geico, and Allstate, offering rates as low as $51 per month.

In this comprehensive guide, we delve into New York’s auto insurance requirements, coverage options, and ways to save on premiums.

Our Top 10 Company Picks: Best New York Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Local Agents State Farm

#2 15% A++ Competitive Rates Geico

#3 13% A+ Comprehensive Coverage Allstate

#4 14% A+ Snapshot Discounts Progressive

#5 12% A Customizable Policies Liberty Mutual

#6 11% A+ Customer Service Nationwide

#7 9% A++ Affordable Premiums Travelers

#8 10% A Personalized Service American Family

#9 8% A+ Excellent Coverage The Hartford

#10 12% A+ Online Platform Farmers

With a focus on providing the best coverage choices and savings, these companies offer a range of policies to suit different needs and budgets.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code above to find the most affordable quotes in your area.

- New York Auto Insurance

- Cheapest SR-22 Insurance in New York for 2025 (Save With These 10 Providers)

- Cheap Gap Insurance in New York (See the Top 10 Companies for 2025)

- Cheap Auto Insurance for High-Risk Drivers in New York (Save With These 10 Companies for 2025)

- Best Syracuse, New York Auto Insurance in 2025 (Find the Top 10 Companies Here)

- Best Staten Island, New York Auto Insurance in 2025

- Best Saratoga Springs, New York Auto Insurance in 2025

- Best Queens Village, New York Auto Insurance in 2025 (Compare the Top 10 Companies)

- Best Port Jervis, New York Auto Insurance in 2025

- Best Nassau, New York Auto Insurance in 2025 (Compare the Top 10 Companies)

- Best Ithaca, New York Auto Insurance in 2025

- Best Goshen, New York Auto Insurance in 2025

- Best Corona, New York Auto Insurance in 2025 (Find the Top 10 Companies Here)

- Best Coram, New York Auto Insurance in 2025 (Find the Top 10 Companies Here)

- Best Buffalo, New York Auto Insurance in 2025 (Compare the Top 10 Companies Here)

- Best Brooklyn, New York Auto Insurance in 2025

- Best Bayside, New York Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Albany, New York Auto Insurance in 2025 (Compare the Top 10 Companies)

- Best Rochester, New York Auto Insurance in 2025

- Best Yonkers, New York Auto Insurance in 2025

- Best Amherst, New York Auto Insurance in 2025 (Top 10 Companies Ranked)

- State Farm, top pick for best NY auto insurance, starting at $172/month

- Explore coverage options tailored to suit New York drivers

- Learn to save on insurance by comparing quotes & leveraging discounts

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options to fit different needs, including liability, collision, comprehensive, and more.

- Extensive Agent Network: State Farm auto insurance review showcases a broad array of local agents, emphasizing personalized assistance and dedicated support.

- Mobile App: State Farm’s mobile app is highly rated and offers convenient features like bill payment, claims filing, and policy management.

Cons

- Higher Rates: State Farm’s premiums can be higher compared to some other providers, especially for minimum coverage policies.

- Limited Availability: While State Farm is available nationwide, certain discounts and coverage options might not be available in all states.

#2 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: Geico is known for offering some of the most competitive rates in the industry, making it a popular choice for budget-conscious drivers.

- Online Convenience: Geico auto insurance review highlights the convenience of its comprehensive online platform, which facilitates seamless policy management, comparison of quotes, and filing of claims.

- Mobile App: The Geico mobile app is user-friendly and provides features such as digital ID cards, roadside assistance, and easy claims management.

Cons

- Limited Local Agent Support: Geico primarily operates online and over the phone, which might not suit customers who prefer face-to-face interactions.

- Coverage Limitations: Some coverage options might be limited compared to other insurers, potentially requiring additional policies for complete coverage.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options, including liability, collision, comprehensive, and various add-ons like roadside assistance and rental car reimbursement.

- Discounts: Allstate auto insurance review showcases various discounts, including those for safe drivers, multiple policies, and new vehicles, which can effectively reduce insurance premiums.

- Good Customer Service: Allstate is known for its responsive customer service and support, available through multiple channels including phone, email, and in-person agents.

Cons

- Mixed Claims Experience: Some customers have reported mixed experiences with the claims process, citing delays and difficulties.

- Limited Availability of Discounts: While Allstate offers many discounts, they may not be available in all states or to all customers, limiting potential savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Snapshot Discounts

Pros

- Competitive Pricing: Progressive auto insurance review showcases its reputation for offering competitive rates, particularly for basic coverage plans, positioning it as a budget-friendly choice for numerous motorists.

- Wide Range of Coverage Options: Progressive provides extensive coverage options, including liability, comprehensive, collision, and various add-ons like gap insurance and custom parts coverage.

- Strong Online Presence: Progressive’s website and mobile app are highly rated for ease of use, allowing customers to manage their policies, file claims, and get quotes conveniently.

Cons

- Average Customer Service: Progressive’s customer service is generally considered average, with some customers reporting issues with responsiveness and support.

- Rate Increases: Some customers have experienced significant rate increases upon policy renewal, which can be unexpected and burdensome.

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Discount Opportunities: Customers can benefit from various discounts, such as multi-policy, safe driver, new car, and accident-free discounts.

- Customizable Policies: Liberty Mutual auto insurance review highlights the flexibility for policyholders to customize their coverage according to individual requirements and financial constraints, showcasing options such as adjustable deductibles and coverage limits.

- 24/7 Customer Service: The company provides round-the-clock customer service and claims assistance, making it convenient for policyholders to get help when needed.

Cons

- Higher Premiums: Liberty Mutual’s premiums can be higher than those of some competitors, especially for high-risk drivers.

- Rate Increases: Policyholders have noted unexpected rate increases upon policy renewal, which can be frustrating for budget-conscious customers.

#6 – Nationwide: Best for Customer Service

Pros

- Discounts and Savings: The company provides various discounts such as multi-policy, safe driver, and accident-free discounts, helping customers save on premiums.

- Strong Financial Stability: Nationwide auto insurance review showcases a robust financial rating, demonstrating reliability and the capability to fulfill claims effectively.

- User-Friendly Digital Tools: Nationwide’s website and mobile app are user-friendly, making it easy for customers to manage policies, file claims, and make payments.

Cons

- Higher Premiums for High-Risk Drivers: Nationwide tends to charge higher premiums for drivers with poor credit or those with a history of accidents and violations.

- Limited Availability in Some Areas: Nationwide’s coverage options and discounts may not be available in all states or regions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Affordable Premiums

Pros

- Extensive Coverage Options: Travelers offers a comprehensive range of coverage options, including liability, collision, comprehensive, rental reimbursement, and roadside assistance.

- Discount Opportunities: The company provides numerous discounts, such as multi-policy, hybrid/electric vehicle, and good student discounts, which can significantly lower premiums.

- Customizable Policies: Travelers auto insurance review showcases the ability for customers to personalize their policies extensively, highlighting the flexibility to adjust coverage according to individual requirements.

Cons

- Limited Online Tools: Compared to some competitors, Travelers’ digital tools and online account management features are less advanced.

- Customer Service Variability: Customer service experiences can be inconsistent, with some customers reporting difficulties in resolving issues quickly.

#8 – American Family: Best for Personalized Service

Pros

- Comprehensive Coverage Options: American Family offers a wide range of insurance products, including auto, home, renters, life, and business insurance, allowing for convenient bundling and potentially lower rates.

- Discount Opportunities: American Family auto insurance review highlights a variety of discounts, including those for multi-policy, good student, safe driver, and loyalty, effectively showcasing how premiums can be significantly lowered.

- Strong Customer Service: American Family is known for its customer-centric approach, providing reliable support through various channels, including agents, online, and mobile app services.

Cons

- Higher Premiums: Some customers may find American Family’s premiums higher compared to other insurers, especially for standalone policies without bundled discounts.

- Mixed Customer Reviews: While many customers praise the company, there are some complaints about claim processing times and customer service experiences.

#9 – The Hartford: Best for Excellent Coverage

Pros

- Exceptional Claims Experience: The Hartford auto insurance review showcases the company’s reputation for an effective and customer-centric claims procedure, guaranteeing timely and equitable settlements for policyholders.

- Specialized Coverage Options: The company provides unique coverage options like “RecoverCare,” which helps with daily tasks if you’re injured in an accident, and “New Car Replacement” coverage.

- Strong Financial Ratings: The Hartford boasts high financial strength ratings, reflecting its ability to pay out claims and meet its financial commitments.

Cons

- Higher Costs for Young Drivers: The Hartford’s policies tend to be more expensive for younger, non-AARP drivers, potentially making it less competitive for this demographic.

- Coverage Area Limitations: While The Hartford is widely available, certain specialized products and services may not be offered in all states, restricting some customers’ options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Online Platform

Pros

- Wide Range of Coverage Options: Farmers offers a variety of insurance products, including auto, home, and life insurance, allowing customers to bundle and save.

- Excellent Customer Service: Farmers auto insurance review highlights the round-the-clock claims support alongside their reputation for responsive and supportive customer service.

- Discount Opportunities: Farmers offers numerous discounts, such as multi-policy, safe driver, and good student discounts, helping customers save on premiums.

Cons

- Higher Premiums: Farmers’ insurance policies can be more expensive compared to other providers, which may be a deterrent for cost-conscious customers.

- Mixed Reviews on Claims Handling: While customer service is generally praised, there are some mixed reviews regarding the efficiency and satisfaction of the claims process.

Essential Guide to Minimum Auto Insurance in New York

In New York, auto insurance is mandatory for all drivers, ensuring financial protection in case of an accident. The state requires specific minimum coverage levels, including bodily injury liability of $25,000 per person and $50,000 per accident, property damage liability of $10,000 per accident, and personal injury protection of $50,000 per person.

Additionally, uninsured motorist coverage must be $25,000 per person and $50,000 per accident. While not mandatory, supplementary uninsured/underinsured motorist coverage is recommended for extra protection.

State Farm offers the best overall value for New York auto insurance, with competitive rates and comprehensive coverage options.Jeff Root Licensed Insurance Agent

Optional but advisable coverages include collision and comprehensive, which cover damages from collisions and non-collision incidents like theft or natural disasters. Premiums vary based on factors such as age, driving history, and vehicle type, with potential discounts available for safe driving and multiple policies.

Non-compliance with insurance requirements can lead to severe penalties, including fines, license and registration suspension, and vehicle impoundment. Understanding and adhering to these requirements is essential for legal and financial safety on the road.

New York Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$96 $185

$89 $172

$108 $208

$51 $98

$130 $252

$107 $206

$63 $121

$89 $172

$60 $130

$114 $220

The monthly rates for auto insurance in New York vary by coverage level and provider. For minimum coverage, rates range from $40 with Geico to $104 with Liberty Mutual. For full coverage, prices span from $78 with Geico to $200 with Liberty Mutual.

Other providers such as Allstate, American Family, Farmers, Nationwide, Progressive, State Farm, The Hartford, and Travelers offer a range of rates, reflecting differences in coverage options and pricing strategies.

New York Liability-Only Auto Insurance Policy

While minimum coverage policies can help you save on coverage, buying liability-only auto insurance may not be the best idea. If you have a new car or drive a relatively expensive car, consider purchasing more than a minimum coverage policy for added protection. Minimum coverage only pays for other peoples’ vehicle damages and medical bills up to a certain limit.

Without additional coverage, you and your vehicle have no protection after an at-fault accident. Instead, you’d have to pay for medical bills, doctor visits, and car repairs out of pocket. If you have a vehicle loan or lease, your lender may require you to carry more than a liability-only policy — you’ll most likely need to purchase a full coverage policy in New York.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Deciding if You Need New York Full Coverage Auto Insurance

As stated earlier, you may have to buy a full coverage policy if you have a loan or lease on your vehicle. Still, even if you don’t, spending the extra money and being better protected behind the wheel could be beneficial.

With a full coverage auto insurance policy, you’ll have collision auto insurance and comprehensive auto insurance in New York. With collision coverage, your car insurance pays for vehicle repairs if it gets damaged in an accident. Collision coverage covers auto repairs after a covered event, regardless of fault.

State Farm emerges as the top choice for New York auto insurance, combining affordability and comprehensive coverage for drivers.Michelle Robbins Licensed Insurance Agent

A comprehensive insurance policy pays for vehicle repairs if it gets damaged by something other than an accident. For example, some of the most common comprehensive car insurance claims occur when a vehicle gets damaged by inclement weather, vandalism, or wild animals.

You may find full coverage car insurance in New York is too expensive. If that’s the case, but you still want or need a full coverage policy, your best bet is to shop online and compare coverage rates. Doing so can help you find the full coverage you need and avoid overpaying.

New York Auto Insurance After Traffic Violations

Having traffic violations on your driving record in New York will likely increase your auto insurance costs, as insurance companies consider driving records when determining rates.

Common violations such as speeding, distracted driving, DUI convictions, at-fault accidents, driving in the wrong direction, failure to yield or signal, failure to stop for a school bus, and following too closely indicate a higher risk, leading to higher premiums.

These infractions can remain on your record for three to five years, with severe violations like DUIs lasting longer. To find more affordable rates, it’s advisable to compare quotes from different insurers annually.

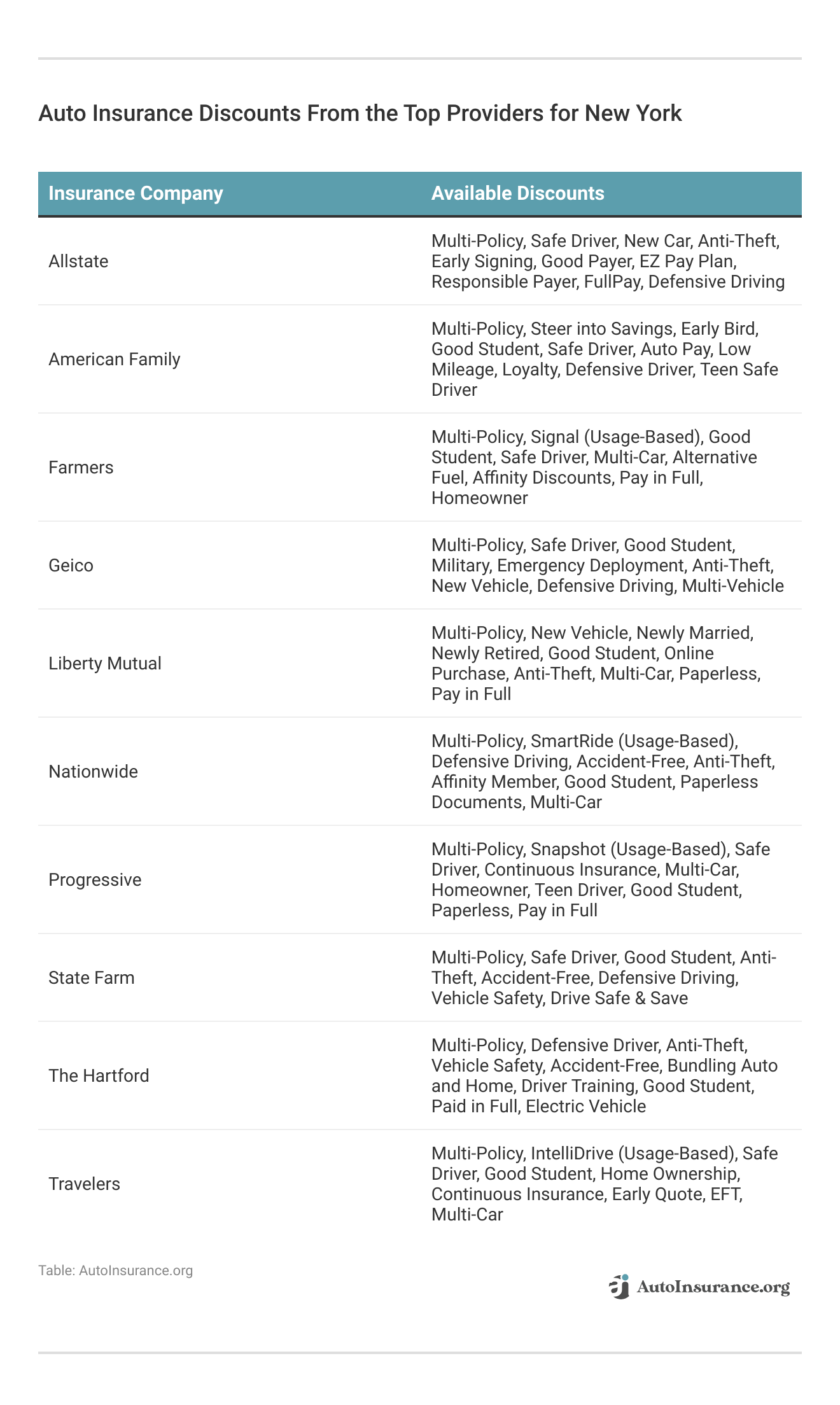

New York drivers can save on auto insurance through various discounts offered by top providers. Allstate, American Family, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, The Hartford, and Travelers offer savings for multi-policy, safe driving, good students, and anti-theft features.

Specific discounts include usage-based programs, new vehicle, military, early signing, pay in full, paperless, and more, helping drivers reduce their insurance costs.

New York Auto Insurance for Speeding Tickets

Speeding tickets affect your auto insurance rates. If you have a speeding ticket on your driving record, you’ll pay around 15% more for auto insurance on average. Still, shopping and comparing quotes from multiple companies should help you find more affordable rates.

Geico offers the cheapest car insurance in New York. The company charges $125 per month for car insurance if you have one or more speeding tickets on your driving record. To gain further insights, consult our comprehensive guide titled “How long does a speeding ticket affect your auto insurance rates?”

New York Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $226 | $185 | |

| $201 | $172 | |

| $260 | $208 | |

| $98 | $98 | |

| $252 | $252 |

| $215 | $206 |

| $122 | $121 | |

| $190 | $172 | |

| $253 | $220 | |

| $111 | $107 | |

| U.S. Average | $203 | $165 |

American Family auto insurance offers coverage at $131 per month, making it one of the cheaper options. State Farm follows closely at $138 per month. The most expensive option in New York for those with a speeding ticket is Liberty Mutual at $217 per month, with Hartford slightly lower at $215 per month.

Improving your driving record or taking a defensive driving course can help lower your rates. Learn more about the best auto insurance companies for drivers with speeding tickets.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

New York Auto Insurance After an Accident

If you were in a car accident in New York that was someone else’s fault, your car insurance rates shouldn’t go up. On the other hand, your rates could increase significantly if you need auto insurance after an at-fault accident.

On average, one at-fault accident on your driving record will raise your rates by nearly $600 annually. However, finding and comparing quotes from multiple insurance companies can help you save money on your coverage. For additional details, explore our comprehensive resource titled “What is full coverage auto insurance?”

New York Full Coverage Auto Insurance Monthly Rates by Provider: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $185 | $185 | |

| $260 | $172 | |

| $297 | $208 | |

| $103 | $98 | |

| $252 | $252 |

| $206 | $206 |

| $121 | $121 | |

| $172 | $172 | |

| $272 | $220 | |

| $111 | $107 | |

| U.S. Average | $244 | $165 |

Geico offers the cheapest auto insurance rates, costing $132 per month with an at-fault accident. State Farm follows at $150 per month, while Erie costs around $206. Allstate charges $225 monthly, and Liberty Mutual is the most expensive at $234 per month. After an at-fault accident drops off your record, you can find more affordable rates.

New York Auto Insurance for DUIs

If you receive a DUI conviction, you may have to pay a fine, attend specific courses, or serve jail time. Insurance companies see a DUI as a serious conviction, and anyone with a DUI on their driving record poses a significant risk to an insurance company. For example, if you need auto insurance with a DUI on your record in New York, you could pay 88% more for your auto insurance coverage.

New York Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $185 | $185 | $258 | $226 | |

| $172 | $260 | $286 | $201 | |

| $208 | $297 | $289 | $260 | |

| $98 | $103 | $241 | $98 | |

| $252 | $252 | $649 | $252 |

| $206 | $206 | $575 | $215 |

| $121 | $121 | $145 | $122 | |

| $172 | $172 | $190 | $190 | |

| $220 | $272 | $275 | $253 | |

| $107 | $111 | $175 | $111 | |

| U.S. Average | $165 | $244 | $295 | $203 |

With a DUI on your record, auto insurance rates can increase significantly. Progressive charges around $186 per month, Travelers $139, Erie $226, Allstate $225, Geico $132, and State Farm $102 for minimum coverage policies. To learn more, explore our comprehensive resource on insurance titled “Where to Compare Auto Insurance Rates”

In New York, a DUI can stay on your record for up to 15 years, affecting your rates for over a decade. It’s advisable to compare rates annually as they may decrease over time. Some insurers also offer discounts for completing safe or defensive driving courses.

New York Auto Insurance Rates for Bad Credit

Cheap car insurance in New York is an option for some people, but you probably won’t get cheap insurance in New York if you have bad credit. Unfortunately, your credit score impacts your car insurance costs. Studies show that people with low credit scores are more likely to file car insurance claims.

So, many insurance companies automatically charge higher rates when people have bad credit. Still, you may be able to find cheap insurance with one of the best auto insurance companies for drivers with bad credit.

New York Full Coverage Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 | |

| U.S. Average | $170 | $190 | $220 |

Geico offers the most affordable car insurance for people with bad credit, averaging $148 per month. Nationwide follows at $166 monthly. Allstate’s rates are higher at $296 per month, while Travelers charges around $194. Liberty Mutual is the most expensive at $355 per month.

If you have bad credit, your insurance rates will be higher. Improving your credit score over time can help lower these rates. To find the best deals, shop online and compare rates annually.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

New York Auto Insurance for Teens

If you’re a teen driver, you could pay up to four times as much for coverage as someone in their mid-30s with a clean driving record. Teens pose a risk to insurance companies due to their lack of experience, so the best auto insurance for teens is usually expensive.

For example, if you’re a teen driver, you’ll pay around $609 each month for car insurance, much more than a standard policy for older drivers.

New York Full Coverage Auto Insurance Monthly Rates for Teens by Gender & Provider

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $642 | $511 | $490 | $522 | |

| $753 | $598 | $451 | $612 | |

| $1,161 | $923 | $897 | $944 | |

| $442 | $351 | $216 | $359 | |

| $1,104 | $878 | $549 | $898 |

| $762 | $606 | $382 | $620 |

| $558 | $444 | $405 | $454 | |

| $739 | $588 | $478 | $601 | |

| $614 | $488 | $430 | $499 | |

| $627 | $499 | $429 | $510 | |

| U.S. Average | $761 | $808 | $560 | $656 |

As you age, your auto insurance rates tend to improve if you maintain a clean driving record. Younger drivers, in particular, can benefit from being added to a parent’s insurance policy, which often results in more competitive rates due to the parent’s longer driving history and established relationship with the insurance company.

This approach can provide substantial savings and make coverage more affordable for young drivers. Additionally, as you gain more driving experience and avoid traffic violations, your individual rates will likely decrease over time.

New York Auto Insurance Rate by Location

Believe it or not, your location significantly impacts your car insurance rates. For example, rural areas in New York often see more affordable auto insurance rates, whereas larger cities, like Manhattan, offer extremely expensive auto insurance coverage. To delve deeper, refer to our in-depth report titled “What are the recommended auto insurance coverage levels?”

The cheapest car insurance in New York is in Horseheads North, while Brooklyn, NY, auto insurance is the most expensive. The average rate for Rochester, NY, auto insurance is much lower than the average rate of NYC, NY auto insurance. So while you’ll pay just $131 per month for auto insurance in Rochester, you’ll pay $379 monthly in New York City.

Enhanced Auto Insurance Options for New York Drivers

From comprehensive protection against non-collision incidents to specialized assistance in times of need, New York drivers have a plethora of add-on coverages at their disposal. In addition to the mandatory coverages listed above, there are multiple add-on coverages New York drivers can purchase for more protection, including:

- Comprehensive Auto Insurance: Comprehensive coverage pays if your car is damaged by something other than an accident.

- Collision Auto Insurance: Collision insurance covers you if you’re in an accident and your vehicle is damaged.

- Loan/Lease Payoff: This coverage could pay the difference between your car’s worth and how much you owe on your loan or lease if the vehicle is totaled in a covered event.

- Medical Payments Coverage: MedPay coverage helps with medical bills like doctor’s visits and hospital bills.

- Rental Auto Reimbursement Coverage: If you have to rent a car because yours is in the shop after a covered event, your insurance company will pay you back for the money you spent on a rental car.

- Roadside Assistance Coverage: This coverage helps if you’re stranded and in need of help with a flat tire, fuel services, lockout services, or a tow.

- Uninsured/Underinsured Motorist Coverage: This helps if you’re in an accident with someone who doesn’t have proper insurance.

- Personal Injury Protection: You can increase your limits of PIP to avoid any issues if you’re in an accident.

Whether it’s safeguarding against unforeseen damages or ensuring peace of mind amidst bustling traffic, these add-on coverages offer a layer of protection tailored to your needs.

Consider augmenting your policy with comprehensive and collision coverage for added reassurance, knowing that you’re prepared for the unpredictable nature of urban driving. With a fortified insurance plan, you can embrace the city’s energy with confidence, knowing that you’re safeguarded against whatever the road may bring.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

New York SR-22 Auto Insurance

If you have certain infractions, you may be required to file an SR-22 with the state. An SR-22 is a formal document proving you have financial responsibility in the event of an accident. For example, the state may require SR-22 auto insurance if you get a DUI, cause multiple car accidents, have multiple traffic violations on your record, or neglect to pay child support.

Anyone currently insured should check with their existing auto insurance company to see if the company will file an SR-22 form on their behalf. If you have to shop for SR-22 coverage, expect to pay higher-than-average rates, as you’ll pose a significant risk to most companies.

Case Studies: Navigating New York Auto Insurance

Navigating the complex landscape of auto insurance in New York requires savvy decision-making and strategic planning. From understanding coverage options to managing risk factors, drivers face a myriad of challenges and opportunities in securing affordable and comprehensive protection.

- Case Study #1 – Saving With Safe Driving: John, a 30-year-old professional in Buffalo, discovered he saved $50 monthly on auto insurance by maintaining a clean record and comparing rates online despite a prior speeding ticket.

- Case Study #2 – Protecting New Investments: Sarah, a recent college graduate from Albany, New York, secured her financial stability with comprehensive auto insurance for her brand-new sedan, ensuring protection against accidents and non-collision incidents.

- Case Study #3 – Navigating Post-Accident Challenges: After an at-fault accident, Queens resident Michael navigated rising auto insurance rates by diligently comparing quotes. Despite setbacks, he found affordable coverage by exploring options and leveraging discounts, easing the financial impact.

- Case Study #4 – Rebuilding Credit and Reducing Rates: Lisa, a single mother from Brooklyn, improved her credit score through proactive financial management, leading to lower auto insurance rates and more resources for her family.

- Case Study #5 – Navigating High-Risk Status: David, a 25-year-old driver from Manhattan, overcame high auto insurance rates by finding specialized coverage for high-risk drivers, securing his future with strategic decisions. For a thorough understanding, refer to our detailed analysis titled “How to Lower Your Auto Insurance Rates.”

Whether through safe driving habits, comprehensive coverage, or proactive credit management, each individual demonstrates resilience and resourcefulness in navigating the complexities of the insurance market.

State Farm stands out as the premier choice for New York auto insurance, offering a blend of affordability and extensive coverage options.Daniel Walker Licensed Auto Insurance Agent

By learning from their experiences and exploring available options, drivers can make informed decisions to secure optimal coverage and financial protection on the road.

The Bottom Line: Cheap Auto Insurance in New York

Finding the cheapest car insurance in New York will take some work, but it’s possible to find coverage costing much less than the statewide average. You’ll never know which company will offer you the cheapest insurance in New York until you compare quotes from multiple companies at once.

While Progressive offers the cheapest average rates in the state, it may not be the best car insurance in New York for a person with bad credit. So as you shop online and compare New York auto insurance quotes, take your time and avoid rushing into a decision. To expand your knowledge, refer to our comprehensive handbook titled “Cheap Full Coverage Auto Insurance.”

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

What are the New York auto insurance requirements?

In New York, drivers are required to have minimum auto insurance coverage, including bodily injury liability of $25,000 per person and $50,000 per accident, property damage liability of $10,000 per accident, and personal injury protection of $50,000 per person. Additionally, uninsured motorist coverage must be $25,000 per person and $50,000 per accident.

What are some of the top auto insurance companies in New York?

Some of the top auto insurance companies in New York include State Farm, Geico, Allstate, Progressive, Liberty Mutual, Nationwide, Travelers, American Family, The Hartford, and Farmers.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

How can I find cheap auto insurance in NY?

To find cheap auto insurance in NY, it’s essential to compare quotes from multiple providers, consider higher deductibles, maintain a good driving record, and take advantage of discounts such as multi-policy, safe driver, and good student discounts.

Check out our ranking of the top providers: Best Auto Insurance for Good Drivers

What factors affect NY auto insurance rates?

NY auto insurance rates are affected by various factors including age, driving history, location, vehicle type, coverage levels, and credit score. Urban areas like New York City typically have higher rates compared to rural areas.

What are the different NYS auto insurance tiers?

NYS auto insurance tiers categorize drivers based on their risk levels. Standard tiers include preferred, standard, and non-standard. Preferred drivers have the lowest risk and typically enjoy the lowest rates, while non-standard drivers, often with poor driving records or credit, pay higher premiums.

Is it a requirement to have auto insurance in New York?

Yes, it is a requirement to have auto insurance in New York. All drivers must carry at least the state’s minimum required coverages to legally operate a vehicle on public roads.

To gain profound insights, consult our extensive guide titled “Types of Auto Insurance.”

How much does State Farm gap insurance cost per month in New York?

The cost of State Farm gap insurance can vary, but on average, it costs around $5 to $10 per month. For exact pricing, it’s best to get a personalized quote from State Farm.

What should I consider when choosing the best auto insurance in NY?

When choosing the best auto insurance in NY, consider factors like coverage options, customer service, financial strength of the insurer, discounts offered, and overall cost. It’s also helpful to read customer reviews and check ratings from independent agencies like A.M. Best.

Are there specific discounts available for auto insurance in New York?

Yes, many auto insurance companies in New York offer specific discounts such as safe driver discounts, multi-policy discounts, good student discounts, discounts for having anti-theft devices, and for taking defensive driving courses. Always ask your insurance provider about available discounts.

For a comprehensive overview, explore our detailed resource titled “Does auto insurance cover theft?”

How do I ensure compliance with New York state auto insurance laws?

To ensure compliance with New York state auto insurance laws, carry at least the minimum required coverages, maintain valid insurance at all times, and promptly update your insurance information if you change providers. Regularly review your policy to ensure it meets state requirements.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.