Infinity Auto Insurance Review for 2025 (Rates & Discounts Listed Here)

Our Infinity auto insurance review found that Infinity is best for high-risk California drivers looking for auto insurance coverage. Infinity's average insurance rates for minimum coverage start at $36/mo, but Infinity's rates will be higher for high-risk drivers with DUIs, tickets, or accidents.

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Infinity

Average Monthly Rate For Good Drivers

$36A.M. Best Rating:

A-Complaint Level:

HighPros

- There is an Infinity Auto website available in Spanish

- The best Infinity Insurance quotes are for drivers who are considered high-risk

- Infinity Standard Auto Insurance Company includes a good roadside assistance program

Cons

- Infinity Auto Insurance policies are only available in California

- Few options for standard drivers with good driving histories

- Infinity sells auto insurance to high-risk drivers and offers multiple discount opportunities

- Infinity offers reasonably priced auto insurance rates, though there are cheaper alternatives

- There have been customer complaints about Infinity’s claims handling

Our Infinity auto insurance review found that Infinity car insurance may be an excellent option for high-risk drivers. However, the company could provide too few opportunities for people seeking robust full coverage auto insurance options.

We reviewed multiple aspects of Infinity, from customer service to financial stability, to help you decide if the company is the right choice for you.

Infinity Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.7 |

| Business Reviews | 4.0 |

| Claim Processing | 2.5 |

| Company Reputation | 3.5 |

| Coverage Availability | 4.3 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 2.0 |

| Digital Experience | 4.0 |

| Discounts Available | 4.3 |

| Insurance Cost | 3.9 |

| Plan Personalization | 4.0 |

| Policy Options | 3.8 |

| Savings Potential | 4.0 |

The main downside of Inifinity is that anyone living outside California cannot purchase a policy with Infinity.

Read on to learn more about Infinity auto insurance. If you want to find auto insurance quotes in your area, enter your ZIP in our free quote tool.

- Infinity has lower customer service satisfaction ratings

- Infinity only sells auto insurance in California

- The company received an A- financial rating with A.M. Best

Infinity Auto Insurance: Average Monthly Rates

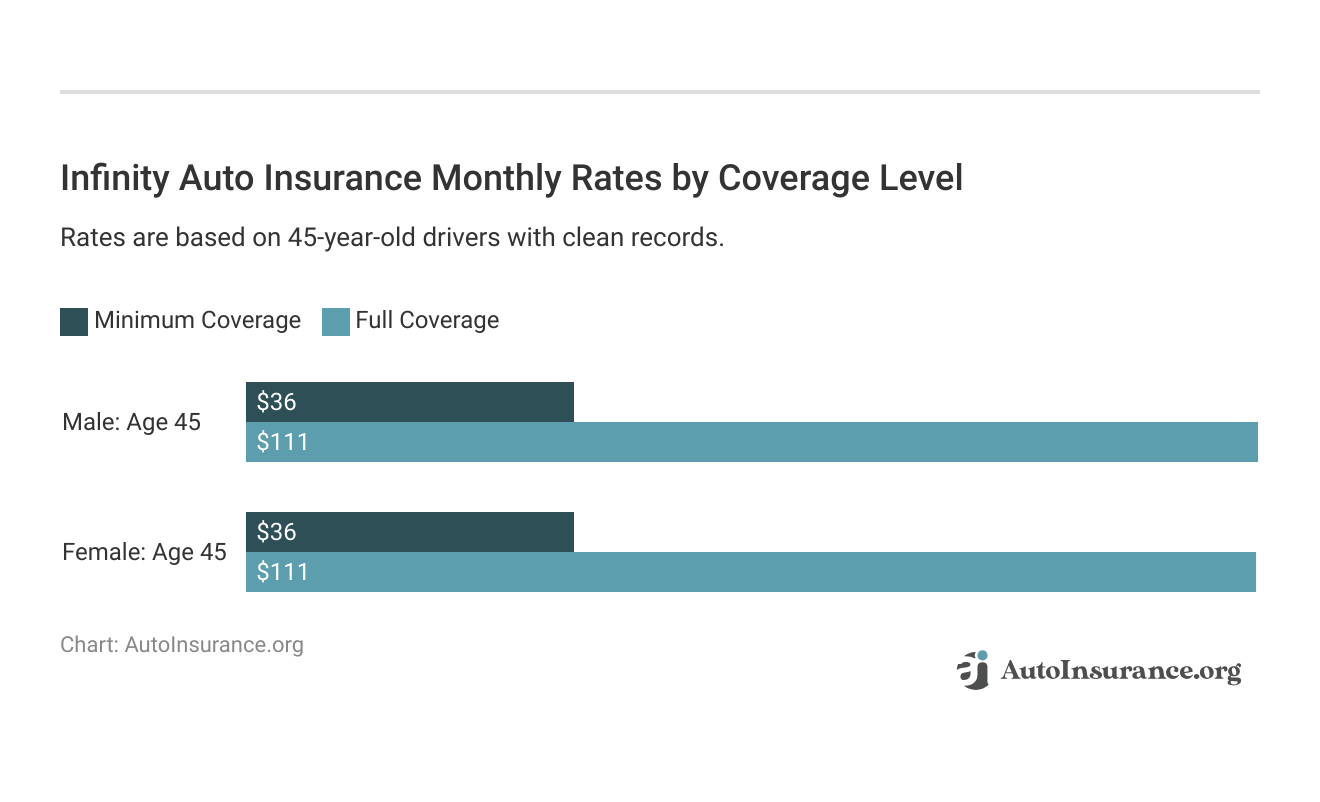

It isn’t easy to know how much you would pay for coverage with Infinity before getting a quote. Many factors affect car insurance rates, including age, location, and coverage type. To start, take a look at how rates vary by coverage, age, and gender at Infinity.

Infinity Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $242 | $721 |

| 16-Year-Old Male | $255 | $726 |

| 18-Year-Old Female | $197 | $532 |

| 18-Year-Old Male | $218 | $590 |

| 25-Year-Old Female | $63 | $192 |

| 25-Year-Old Male | $63 | $193 |

| 30-Year-Old Female | $58 | $179 |

| 30-Year-Old Male | $58 | $179 |

| 45-Year-Old Female | $52 | $158 |

| 45-Year-Old Male | $52 | $158 |

| 60-Year-Old Female | $48 | $141 |

| 60-Year-Old Male | $49 | $146 |

| 65-Year-Old Female | $51 | $155 |

| 65-Year-Old Male | $51 | $154 |

The graphic below shows how Infinity’s average annual rates for full vs. minimum auto insurance coverage compare for 45-year-old drivers.

Still, it’s safe to assume that rates with Infinity would be higher than rates with other companies since Infinity primarily insures risky drivers.

While rates with Infinity are higher than those from other companies, they are often less expensive than those with Farmers and National General. Before you commit to a policy with Infinity, shop around and compare auto insurance quotes from multiple providers online.

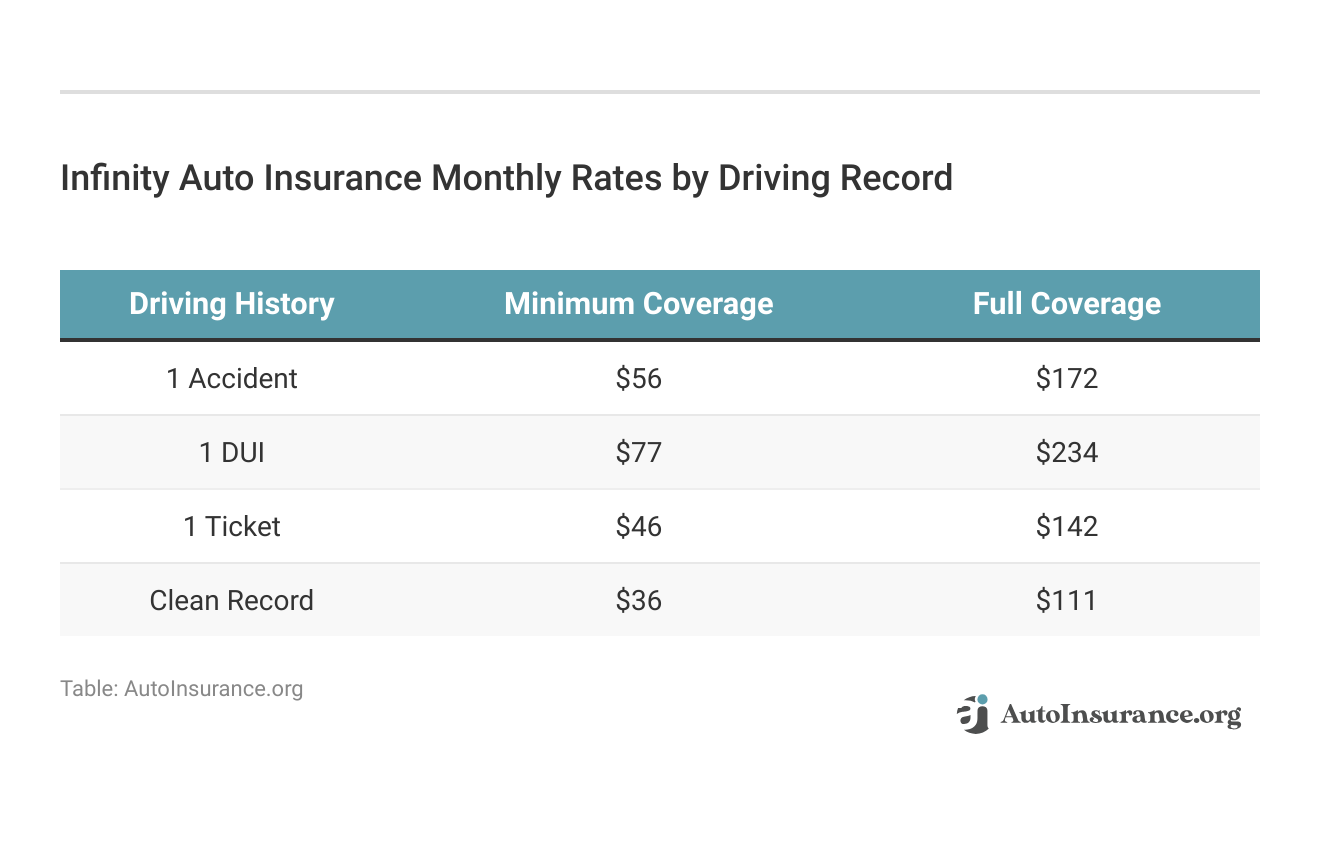

Infinity Auto Insurance for High-Risk Drivers

If you’re a high-risk driver, auto insurance rates are likely to be at least slightly higher than average for a few years.

Having infractions of any sort on your driving record will make your insurance more expensive. So, picking the right company for your situation can truly help keep costs down.Jeffrey Manola Licensed Insurance Agent

For teens and people with a driving infraction, auto insurance rates with Infinity are anywhere from 3% to 44% higher than the national average. Whether you have a DUI or a history of accidents, it can certainly affect your rates negatively.

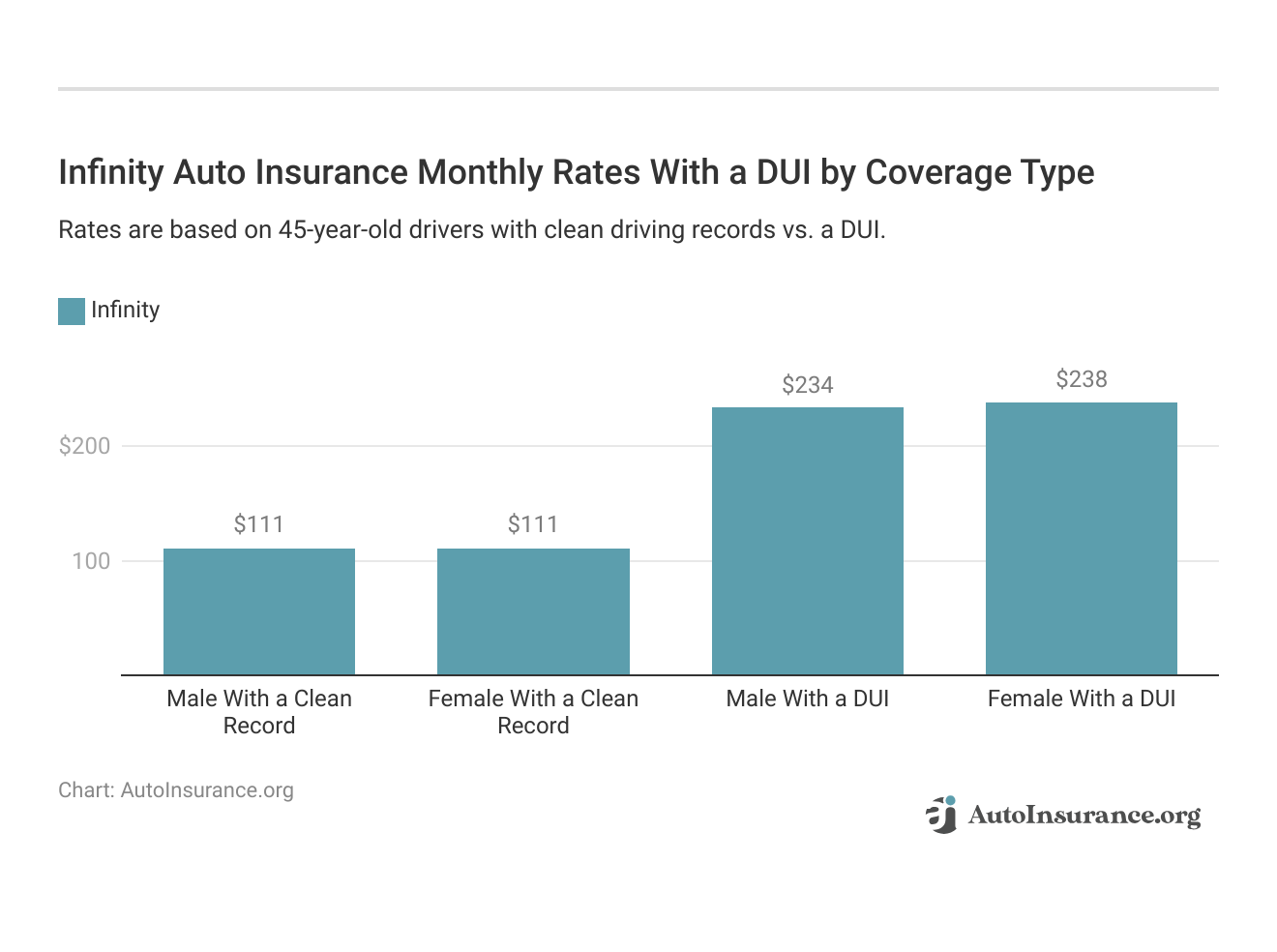

Compared to rates for a clean driving record, a DUI will cost drivers an average of $123 more per month for full coverage at Infinity. Here is another look at the Infinity average rates for drivers with a DUI on their driving record.

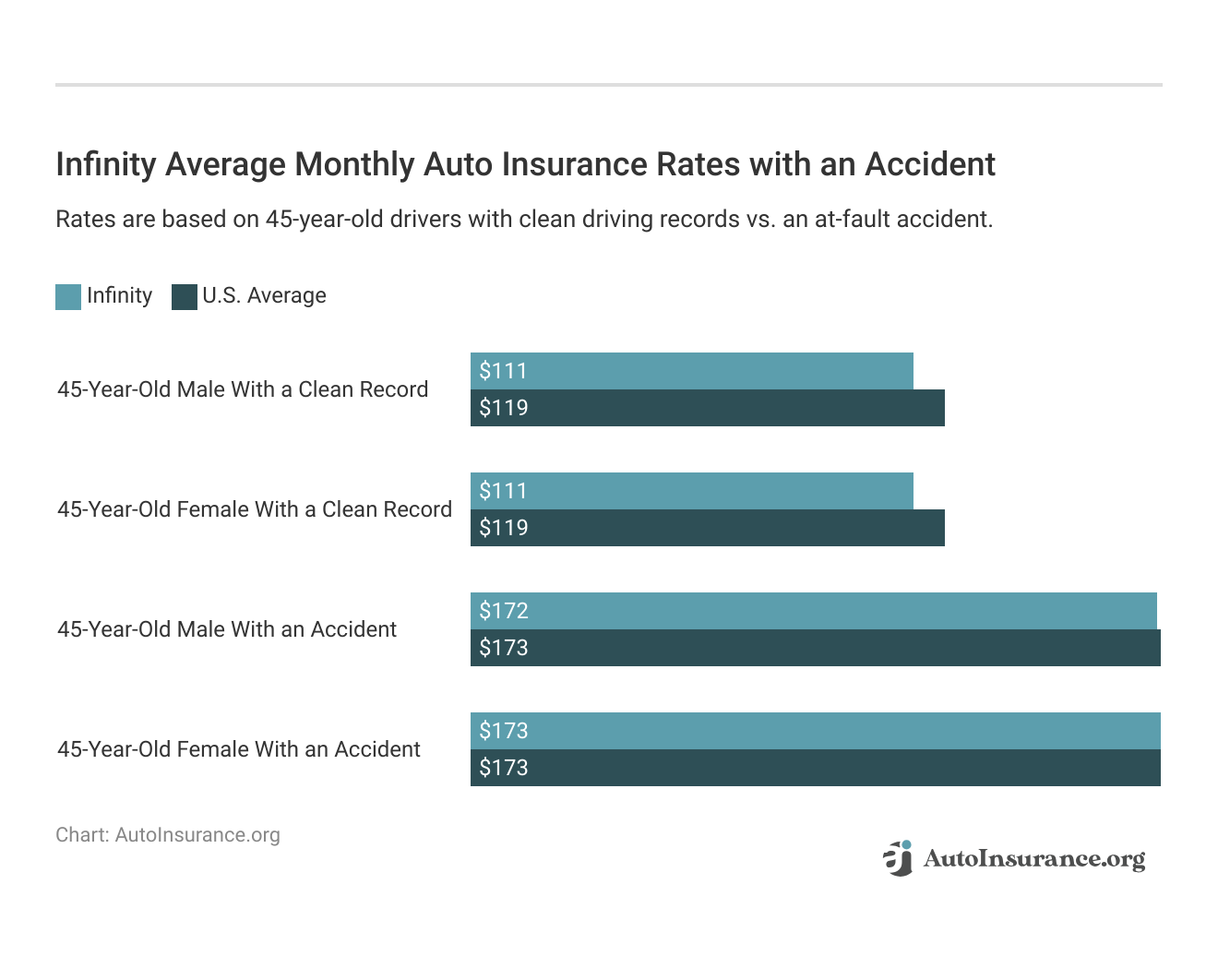

Rates will vary from one insurance company to the next as each company weighs factors like your driving record differently. So, those with accidents on your record won’t pay a set price. Here is a look at what you may be paying depending on what car insurance company you are with.

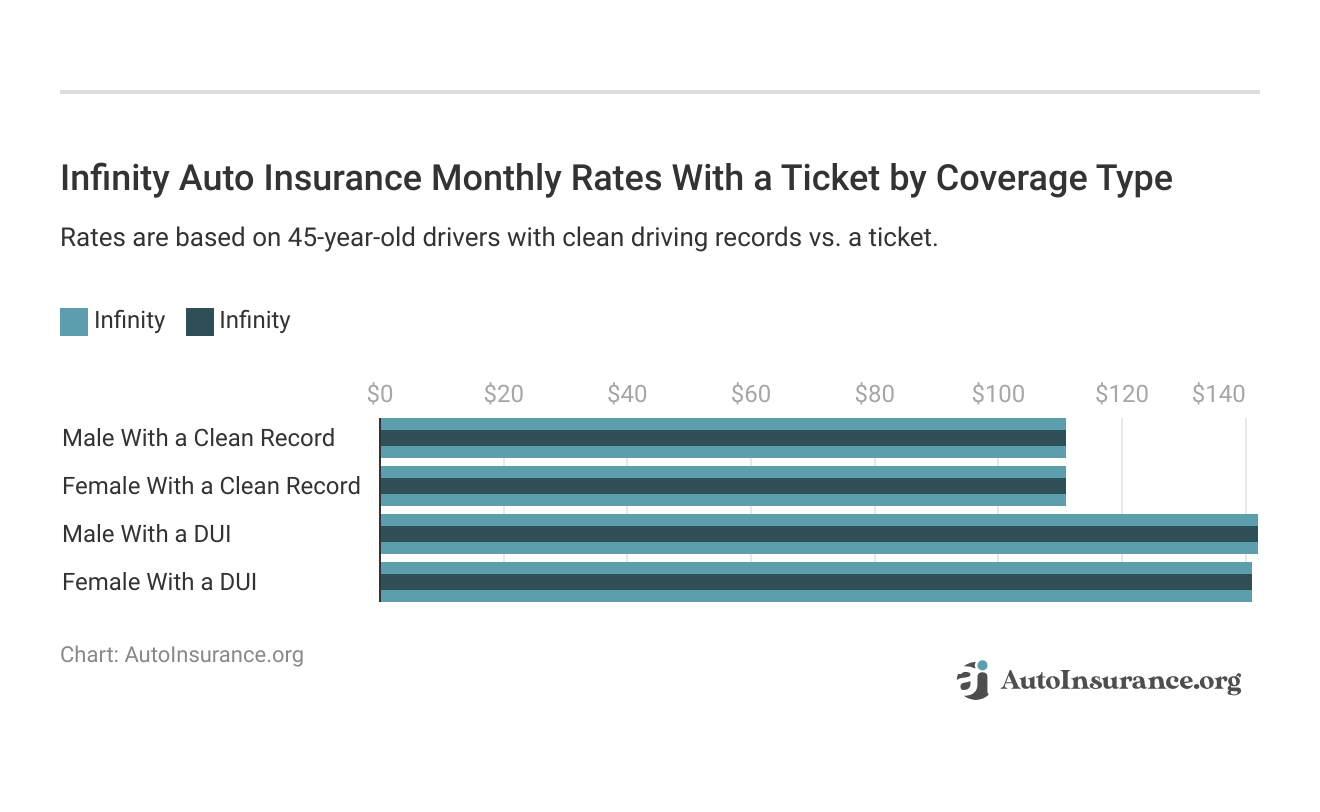

If you are pulled over and given a ticket for speeding, you may also see an increase in your auto insurance rates. Here’s how much, on average, Infinity rates may go up.

Overall, having infractions of any sort on your driving record will make your insurance more expensive. So, picking the right company for your situation can help keep costs down.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Infinity Auto Insurance Rates vs. the Competition

Infinity Auto Insurance is considered expensive because it primarily caters to high-risk drivers, especially in California. This is one of the biggest complaints about Infinity Insurance from drivers who do not live in this state.

Take a look at Infinity’s average auto insurance rates by age and gender compared to those of its competitors below.

Infinity Auto Insurance Monthly Rates vs. Competitors by Age & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|

| $868 | $910 | $231 | $228 | $214 | $220 | |

| $1,156 | $1,103 | $199 | $198 | $171 | $183 | |

| $425 | $445 | $114 | $114 | $104 | $106 | |

| $721 | $726 | $158 | $158 | $141 | $146 | |

| $1,031 | $1,121 | $244 | $248 | $211 | $227 |

| $586 | $679 | $161 | $164 | $141 | $149 |

| $1,144 | $1,161 | 159.34 | $150 | $131 | $136 | |

| $444 | $498 | $123 | $123 | $108 | $108 |

As you can see, Infinity is one of the more expensive options for most ages of drivers. Infinity is also pricier for DUI drivers, as you can see in the table below.

Infinity Full Coverage Auto Insurance Rates vs. Competitors by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $122 | $189 | $211 | $154 |

| $228 | $321 | $385 | $268 | |

| $198 | $282 | $275 | $247 | |

| $114 | $189 | $309 | $151 | |

| $158 | $245 | $335 | $202 | |

| $248 | $335 | $447 | $302 |

| $164 | $230 | $338 | $196 |

| $150 | $265 | $200 | $199 | |

| $123 | $146 | $160 | $137 | |

| $141 | $199 | $294 | $192 |

Good drivers will find cheaper rates at companies other than Infinity, but Infinity is cheaper than Progressive for drivers with an accident on their record.

Infinity Auto Insurance Coverage Options

Infinity Insurance, which is owned by Kemper, offers multiple options for auto insurance coverage. The company website states that policyholders have the option to purchase liability auto insurance coverage that meets California’s requirements (Learn More: Minimum Auto Insurance Requirements by State), but they can also purchase a full coverage policy that provides the best protection possible.

Drivers shopping at Infinity have multiple car insurance options that allow them to personalize their auto insurance policies. See what Infinity offers below.

Infinity Auto Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage you cause to others in an accident. |

| Collision Coverage | Pays for damage to your vehicle from a collision, regardless of fault. |

| Comprehensive Coverage | Covers non-collision-related damage, such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you're hit by a driver with insufficient or no insurance. |

| Medical Payments Coverage (MedPay) | Covers medical expenses for you and your passengers after an accident, regardless of fault. |

| Personal Injury Protection (PIP) | Provides broader medical coverage, including lost wages and rehabilitation, depending on your state. |

| Rental Car Reimbursement | Covers the cost of a rental car while your vehicle is being repaired after a covered accident. |

| Roadside Assistance | Provides services such as towing, battery jump-starts, and flat tire changes. |

| Custom Equipment Coverage | Covers aftermarket parts and customizations added to your vehicle. |

| SR-22 Insurance | Provides proof of financial responsibility for high-risk drivers as required by the state. |

If you’re looking for Infinity online insurance, you can easily get a free car insurance quote online or by calling 1-800-INFINITY. Their Infinity Insurance company reviews highlight their commitment to customer satisfaction. For any claims-related inquiries, you can reach out to their dedicated Infinity Insurance claims department by calling their claims phone number.

While you can always purchase more than the limit, Infinity insurance policy limits are set to the California requirements for the following:

- Liability Coverage

- Collision and Comprehensive Coverage

- MedPay and PIP

Understanding your policy limits ensures you’re adequately protected and aware of what your insurance will cover. If you have any specific questions about the information on your Infinity Insurance Policy or specifically about Infinity Insurance Liability Coverage, reach out to their customer service team.

Infinity Roadside Assistance

Along with these policies, Infinity offers DriverClub, the company’s 24/7 roadside assistance program. If you ever need assistance on the road, Infinity Insurance’s 24-hour roadside assistance is available. With Infinity DriverClub, policyholders can receive assistance if they run out of gas, get locked out, have a dead battery, and much more.

Infinity Insurance offers a convenient roadside assistance program to keep you protected when unexpected incidents occur on the road. Don’t forget to report an accident to Infinity Insurance as soon as it’s safe to do so.

The Infinity Insurance roadside assistance phone number is 1-800-353-6737. For non-urgent matters, you can contact Infinity Roadside Assistance at [email protected]. Membership for DriverClub is included in your Infinity auto insurance rates, though you will have to pay for roadside assistance services as needed.

Other Insurance Policies Sold by Infinity

Infinity Specialty Insurance Company offers a range of insurance solutions tailored to meet the needs of both personal and commercial customers. As part of the Infinity-Kemper Company, they provide coverage options that can be customized to fit individual budgetary and coverage requirements.

Their commitment to customer service supports a team of Spanish-bilingual insurance agents who are well-equipped to answer questions and find the best policies for clients.

Infinity, previously Kemper Insurance, also offers Infinity Life Insurance. Let’s explore more about Infinity’s low-cost insurance offerings:

- Infinity Life policies are underwritten through undisclosed, non-affiliated companies.

- Unit-Linked Policy (UAE), also known as Union Insurance, offers a policy called Infinity Life, which is a flexible, variable, and universal life insurance policy. This policy serves as a traditional life insurance protection and an investment opportunity for financial growth.

- Infinity Life Insurance also provides term life coverage. You can choose from various terms, including 10-year, 15-year, 20-year, and 30-year policies.

Whether you’re seeking personal auto insurance or commercial auto insurance for your business, Infinity Select Insurance can assist you in finding the right fit for your insurance needs.

Infinity Auto Insurance Discounts

Infinity does offer its policyholders specific auto insurance discounts on coverage, including the following:

Infinity Auto Insurance Discounts and Maximum Savings

| Discount Type | Savings Potential |

|---|---|

| Multi-Policy Discount | 20% |

| Pay-in-Full Discount | 10% |

| Good Student Discount | 15% |

| Safe Driver Discount | 10% |

| Multi-Vehicle Discount | 15% |

| Paperless Billing Discount | 5% |

| Early Signing Discount | 7% |

If you live in California and believe you may qualify for coverage, you can call Infinity to speak with a representative. Some discounts could help you save as much as 20% on your insurance premium.

If you are purchasing a family policy, you may want to find out which auto insurance companies have the biggest multi-car discounts. You can get Infinity auto insurance quotes and quotes from other companies to see which offers the best deal on multiple cars or multiple policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Infinity Auto Insurance Customer Reviews

Reading customer reviews is an important part of analyzing a company. Infinity doesn’t have the best customer satisfaction ratings, but some customers have left positive feedback on rating sites regarding claims and customer service.

For example, Infinity customers have left positive Infinity reviews on Trustpilot, a review platform where customers can rate the company.

However, while some positive reviews have been left on sites like Trustpilot, the overall ratings for Infinity are low. Trustpilot’s overall rating for Infinity from customer reviews is only 1.2 out of five stars.

For the most part, customers’ Infinity insurance ratings don’t make the company stand out from the competition for customer service (Read More: Auto Insurance Companies With the Best Customer Service).

Infinity Auto Insurance Business Ratings

Infinity’s business ratings give insight into a company’s credibility, such as its financial stability, claims handling, and more. Take a look at Infinity’s main business ratings below.

Infinity Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 790 / 1,000 Avg. Satisfaction |

|

| Score: A- Financial Strength |

|

| Score: 70/100 Mixed Customer Feedback |

|

| Score: 1.25 More Complaints |

|

| Score: A- Good Financial Strength |

Infinity has a higher-than-average number of complaints lodged at the NAIC. Infinity also had low customer satisfaction ratings, as recorded in J.D. Power’s latest study (Learn More: Best Auto Insurance Companies for Paying Claims).

However, Infinity did have good ratings from Consumer Reports, and its financial stability is strong.

Infinity Auto Insurance Pros and Cons

Not sure if Infinity is the right auto insurance company for you? Take a quick look at Infinity’s main pros below.

- High-Risk Coverage: Infinity insures high-risk drivers who may have trouble finding high-risk auto insurance elsewhere.

- Coverage Options: Infinity has great add-on coverages, especially its roadside assistance program.

- Spanish Website: Infinity offers an alternate website for auto insurance that is fully in Spanish.

While Infinity’s pros are great, the company also has some issues that drivers should be aware of before signing up for an auto insurance policy.

- Higher Rates: Because Infinity specializes in higher-risk auto insurance, it charges more than other companies for good drivers.

- Customer Satisfaction: Infinity has lower customer satisfaction ratings and multiple complaints.

When reading our Infinity insurance review, be sure to fully consider the pros and cons of Infinity so you can make the decision that’s right for your coverage needs and wallet.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Infinity Auto Insurance Contact Details

Below is a full list of Infinity contact details for auto insurance. You can also find Infinity insurance phone numbers listed on their website.

- Infinity Insurance Company Address: 900 E. Laurel Avenue McAllen, TX 78501

- Infinity Insurance Customer Service Phone Number: (800)-690-3818

- Infinity Insurance Claims Phone Number: (800)-4763-4648

- Infinity Commercial Auto Insurance Phone Number: (800)-722-3391

- Infinity Insurance 24 Hour Roadside Assistance Phone Number: (877)-512-6964

You can also get an Infinity Insurance quote by calling (800-463)-4648. Infinity customer service hours are 8:00 am to 6:00 pm Monday through Friday and 8:30 am to 3:00 pm on Saturday.

How To Pay Your Infinity Auto Insurance Policy

As an Infinity Insurance Agency, Inc. customer, managing your auto insurance payments is straightforward and hassle-free. To pay your bill online, go to InfinityAuto.com. If you have any questions about your policy or need assistance with processing your payment, you can connect with their friendly and knowledgeable customer service team by dialing 1-855-478-3705.

Read More: How do auto insurance payments work?

Don’t let payment confusion stand in the way of protecting what matters most. Additionally, if you prefer to make a one-time payment online, log in to your Infinity Auto account, click on “Payments” in the top menu bar, and choose from the available payment options. The Infinity Auto Insurance App also provides convenient features, including payment history, policy viewing, and more.

What You Should Know About Infinity Auto Insurance

If you’re a high-risk driver searching for proper car insurance coverage, you may want to consider full coverage Infinity Insurance. Infinity auto insurance offers nonstandard coverage to drivers who may have difficulty finding policies with other companies.

Infinity has an A- (Excellent) financial strength rating with A.M. Best and a stable outlook for the future.

The company also has an A+ rating with the Better Business Bureau (BBB). The Infinity auto insurance company offers the typical car insurance options, but it allows high-risk drivers to purchase liability-only policies. Unfortunately, Infinity car insurance is only available in California, so drivers outside of California will have to look elsewhere for cheap auto insurance for a bad driving record.

Since finding cheap auto insurance options may be difficult if you shop at Infinity, we recommend getting quotes from a few different companies to find the best deal. Compare rates now with our free quote comparison tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Infinity a good auto insurance company?

Infinity has a decent financial rating of A- from A.M. Best, but Infinity insurance reviews and ratings aren’t as strong as other major companies. It also has a high number of customer complaints, so you may want to compare quotes elsewhere before you buy high-risk car insurance from Infinity.

Where is Infinity auto insurance offered?

Infinity car insurance is only available in California.

What other types of insurance does Infinity offer?

Aside from insuring vehicles, Infinity offers the following insurance options: home, renters, flood, condo, business, and life insurance. If you buy more than one type of policy with Infinity, you may be eligible for a bundling discount (Learn More: How to Save Money by Bundling Insurance Policies).

How much does Infinity auto insurance cost a month?

Infinity auto insurance rates vary depending on your age, gender, and driving record. Older drivers with clean records pay $111/mo, while those with DUIs pay closer to $240.

Why is Infinity auto insurance so expensive?

Infinity specializes in nonstandard auto insurance for high-risk drivers, so auto insurance rates are higher to cover the increased risk of insuring drivers with a history of claims.

A review of Infinity insurance showcases that while some pros to the insurance are specialization, SR-22 filings, and coverage options, some of the cons include higher premiums, customer service, and availability in California only.

Does Infinity offer rideshare insurance?

Infinity does not offer rideshare auto insurance coverage in California. If you are looking for rideshare insurance, find the best deal by entering your ZIP in our free quote tool.

Is Infinity auto insurance the same as Kemper?

Yes, Kemper and Infinity Insurance are the same. In 2018, Kemper acquired Infinity insurance, making them part of the same company. Kemper Insurance owns Infinity insurance but sells insurance policies under its own name.

However, it’s important to note that Kemper is no longer writing new policies or renewing high-risk insurance policies in California. Instead, they are referring customers to their Infinity brand. To find an Infinity insurance office near you, head to their website to find all of those details, or you can call the Infinity insurance number.

Is Infinity good at paying auto insurance claims?

Many Infinity auto insurance reviews by customers complain about slow processing times when it comes to Infinity claims.

How do I file an auto insurance claim with Infinity?

If you need to file a claim with Infinity auto insurance, you should contact the Infinity auto claims department as soon as possible.

The Infinity claims department will guide you through the claims process, provide the necessary forms, and assist you in documenting the incident. It’s important to report the accident or incident promptly and provide accurate information to ensure a smooth claims process (Learn More: How to File an Auto Insurance Claim).

Can I manage my Infinity auto insurance policy online?

Infinity offers online policy management options for their customers. Through their website or mobile app, you can access your Infinity car policy details, make premium payments, view and update your coverage, and manage other aspects of your policy.

Does Infinity charge a cancellation fee?

If you choose to cancel car insurance before your policy term ends, Infinity might charge a cancellation fee.

How do I cancel Infinity auto insurance?

Policyholders can cancel Infinity car insurance online or by calling 1-800-INFINITY. You can find your Infinity Insurance Policy number on your insurance card, on your policy documents or you can log into your online account (Learn More: How to Cancel Auto Insurance).

What is Infinity DriverClub?

Infinity DriverClub is the company’s 24/7 roadside assistance program. Membership for DriverClub is included in your Infinity auto insurance rates, though you will have to pay for roadside assistance services as needed.

What is the Better Business Bureau review for Infinity auto insurance?

The Infinity auto insurance company has a B rating from the Better Business Bureau (BBB). The Infinity insurance rating on the BBB website paints a less favorable picture with a 1.04-star rating out of 5. This is based on over 100 customer reviews.

How do I pay my Infinity auto insurance bill?

Infinity auto insurance offers several ways to make an Infinity insurance payment.

- You can pay over the phone by calling the Infinity insurance Customer Service number.

- You can visit infinityauto.com to log into your account and pay on your policy (Learn More: Can I pay my auto insurance online?).

These are the two different ways that you can pay your Infinity auto insurance.

Who owns Infinity auto insurance?

Infinity auto insurance is now a subsidiary of Kemper Corporation, except in California, where it still operates independently. Infinity auto insurance is a good option if you are a California resident or plan to become one. You can get Infinity car insurance quotes before purchasing a Infinity policy to see how much you’ll pay for coverage.

How long has Infinity auto insurance been in business?

Infinity auto insurance has a rich history dating back to 1955. From their first client in eastern Alabama to today, they have served clients in 43 different states.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Gmrtnz13

Do not buy!!!

npm_97

NEVER AGAIN.

bakkanorzi

Terrible customer service.

PELKEY

Deceptive company

Lindaa

Becareful look for insurance somehwere else

Uknow21

Thumbs down

Eva_Moreno_

Review of customer services

Jordan_linel

WORST

ahmedaldafaae

Very bad company

Junk_Hauling_Express

Infinity Insurance is a great company! I highly recommend.