Lemonade Auto Insurance Review for 2025 (Get Options & Costs Here!)

Lemonade auto insurance review covers its AI-driven claims process and rates starting at $40 a month. It offers free roadside assistance, emergency crash assistance, and fast claims handling. Pricing factors include driving behavior and mileage, with bundling options available for added savings.

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Lemonade Insurance

Monthly Rates:

$40A.M. Best Rating:

AComplaint Level:

LowPros

- AI-driven fast claims processing

- Affordable rates for low mileage

- Discounts for electric vehicles

- Free roadside assistance

Cons

- Limited state availability

- No rideshare coverage

- Higher rates for high-risk drivers

Lemonade auto insurance review looks at how the company uses AI to speed up claims and cut costs, with rates starting as low as $40 per month for minimum coverage.

Auto Insurance Rating Lemonade

| Rating Criteria | |

|---|---|

| Overall Score | 3.9 |

| Business Reviews | 4.0 |

| Claim Processing | 4.0 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.3 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 4.8 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 2.2 |

| Savings Potential | 4.2 |

Its mobile app makes it easy to file claims and manage your policy without calling an agent. Lemonade also offers discounts for low-mileage drivers, bundling, and safe driving.

We’ll break down the pricing, coverage options, and how it compares to larger providers.

- Lemonade auto insurance starts at $80 a month, and the AI claims process

- Offers free roadside assistance and emergency crash support through mobile app

- Pricing is based on driving habits and mileage, with discounts for bundled policies

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Lemonade Auto Insurance Monthly Rates by Age and Coverage Level

Insurance rates vary based on your age and gender. At 16, girls usually pay about $160 a month for the minimum, while boys pay closer to $200. If they want full coverage, those rates rise to $275 for girls and $320 for boys. By age 25, those prices drop—women pay around $110, and men about $120 for the same basic plan.

Lemonade Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $92 | $229 |

| 16-Year-Old Male | $100 | $245 |

| 18-Year-Old Female | $85 | $212 |

| 18-Year-Old Male | $92 | $225 |

| 25-Year-Old Female | $60 | $150 |

| 25-Year-Old Male | $65 | $160 |

| 30-Year-Old Female | $55 | $140 |

| 30-Year-Old Male | $58 | $145 |

| 45-Year-Old Female | $85 | $180 |

| 45-Year-Old Male | $85 | $180 |

| 60-Year-Old Female | $80 | $175 |

| 60-Year-Old Male | $82 | $178 |

| 65-Year-Old Female | $78 | $170 |

| 65-Year-Old Male | $80 | $172 |

The pattern keeps going as drivers get older. A 60-year-old woman typically pays $80 a month for minimum coverage, while a man of the same age pays about $85. Full coverage auto insurance costs drop as drivers age, with teens paying the most and seniors the least. Lemonade charges higher rates for younger drivers, similar to traditional insurers.

Based on lemonade car insurance reviews, pricing is competitive, but without more info on discounts, claims service, or policy options, it’s hard to compare its overall value to bigger insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

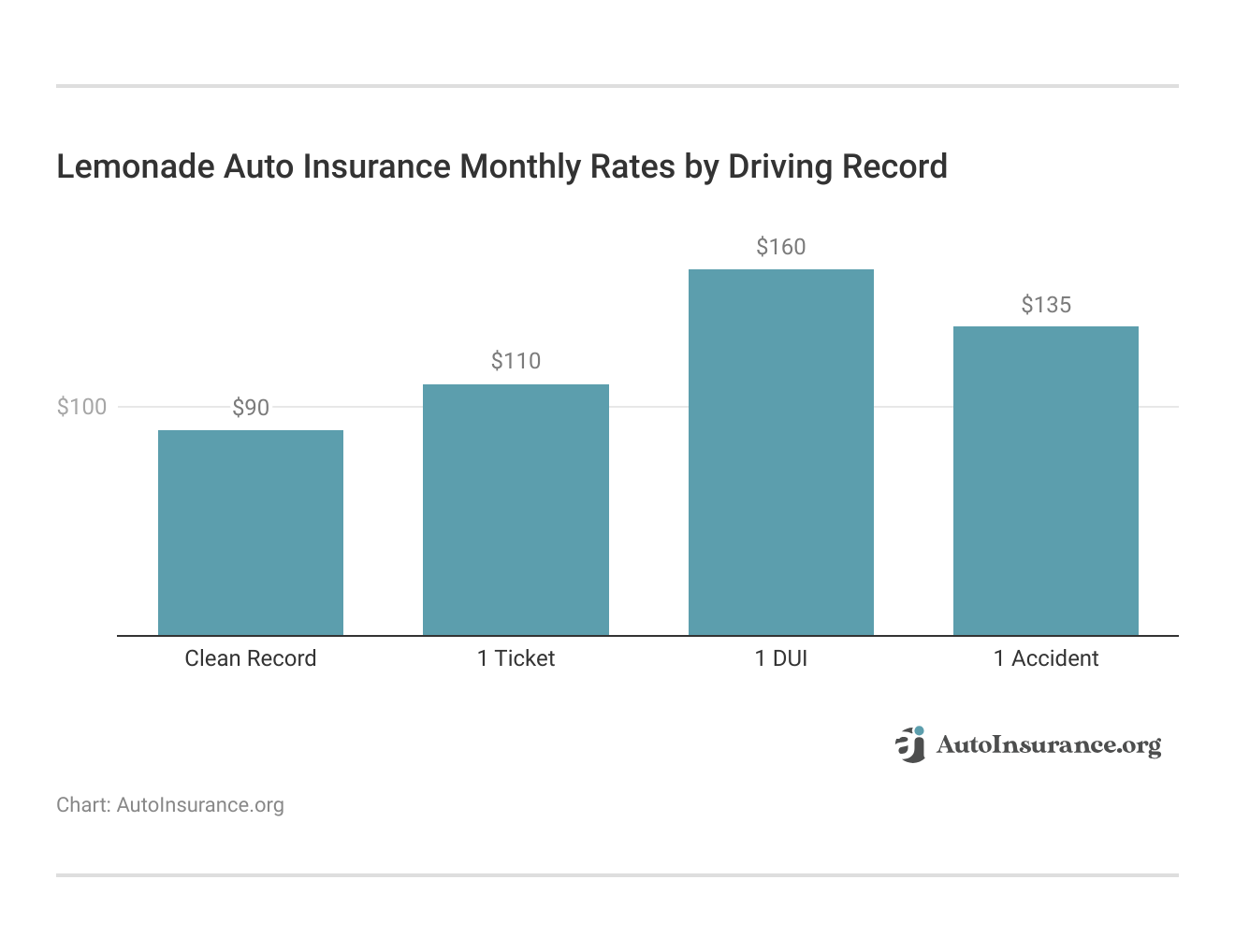

Lemonade Auto Insurance Monthly Rates by Driving Record

Lemonade’s rates are lower than most traditional insurers. For minimum coverage, the company charges just $40 per month, and for full coverage, $66 — less than most competitors.

Lemonade vs. Competitors: Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $85 | $180 | |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

For comparison, Allstate’s minimum coverage starts at $102, while full coverage is $252. Even Geico, known for its competitive pricing, charges $70 for minimum coverage and $123 for full coverage. Lemonade’s rates are lower than those of Nationwide, Progressive, and State Farm, making it one of the cheapest options.

Lemonade car pricing varies based on driving records. A clean record costs $90 per month for minimum coverage and $185 for full coverage. A single ticket raises rates to $110 for minimum and $225 for full coverage. Drivers with a DUI pay the highest, at $160 and $320, while an accident results in $135 and $260 for minimum and full coverage, respectively.

Lemonade’s AI speeds claims, but some need human review. Upload clear photos to avoid delays.Justin Wright Licensed Insurance Agent

These rates indicate that Lemonade Insurance Company follows industry trends, where high-risk drivers pay significantly more. This aligns with how auto insurance companies check driving records, using factors like traffic violations, accidents, and claims history to determine risk and set premiums accordingly.

Lemonade Auto Insurance Discounts: How Much You Can Save on Your Policy

Lemonade auto insurance offers several discounts, with the highest savings potential coming from the safe driver discount at 15%. Drivers with multiple vehicles can save up to 12% through a multi-car discount. Bundling auto insurance with home or renters insurance qualifies for a 10% discount, the same savings available for low-mileage drivers and those who complete a defensive driving course.

Auto Insurance Lemonade Discounts by Savings Potential

| Discount | |

|---|---|

| Anti-Theft Device | 5% |

| Bundling | 10% |

| Defensive Driving | 10% |

| Early Sign-Up | 3% |

| Low Mileage | 10% |

| Loyalty | 7% |

| Multi-Car | 12% |

| Pay-in-Full | 3% |

| Paperless Billing | 3% |

| Safe Driver | 15% |

Long-term customers can receive a 7% loyalty discount while installing an anti-theft device lowers costs by 5%. Smaller auto insurance discounts of 3% apply to paperless billing, early sign-up, and paying the policy in full. While LIC offers competitive discounts, actual savings vary based on eligibility and state availability.

Lemonade Auto Insurance Monthly Rates by Credit Score Compared to Competitors

Lemonade auto insurance provides competitive credit-based rates and often beats the prices of big-name competitors. And at $115 a month for good-credit drivers, it’s a better deal than Allstate’s $130, Farmer’s $140, and Progressive’s $132. Even with good credit, Lemonade is affordable at $135, eclipsing Farmers $160, Nationwide $148 and Travelers $155.

Auto Insurance Lemonade Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $130 | $150 | $180 | |

| $125 | $145 | $175 | |

| $140 | $160 | $190 | |

| $120 | $140 | $170 | |

| $115 | $135 | $165 | |

| $128 | $148 | $178 |

| $132 | $152 | $182 | |

| $118 | $138 | $168 | |

| $135 | $155 | $185 | |

| $110 | $130 | $160 |

For bad credit, Lemonade Insurance’s $165 rate is lower than Progressive’s $182 and Allstate’s $180, though USAA auto insurance offers the lowest rates across all credit levels. Compared to other providers, Lemonade positions itself as an affordable option, especially for drivers with good or fair credit, while still maintaining lower rates than several well-known competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Lemonade Auto Insurance Coverage: What’s Included & How It Works

Lemonade auto insurance covers modern drivers with solutions that are affordable, convenient, and sustainable. Here’s what their policies say:

- Liability Coverage: This includes medical bills and repair costs if you cause an accident. It includes bodily injury liability for any drivers or passengers injured and property damage liability for any vehicles or other property.

- Collision Coverage: Pays for repairs or replacement if your car is damaged in a crash, whether you hit another vehicle or a stationary object like a pole or guardrail.

- Comprehensive Coverage: Protects against theft, vandalism, fire, floods, and damage from falling objects or animals. If your car is totaled, Lemonade reimburses you based on its actual cash value.

- Uninsured/Underinsured Motorist Coverage: If you’re hit by a driver without enough insurance, this covers your medical expenses and car repairs. It also applies to hit-and-run accidents.

- Roadside Assistance: Provides help for dead batteries, flat tires, towing, fuel delivery, and lockouts, ensuring you’re not stranded if your car breaks down.

Lemonade’s pay-per-mile car insurance prices can be good for the low-mileage driver, but the premiums will add up if you take a lot of long trips.

Electric and hybrid vehicle owners benefit from exclusive discounts, including coverage for charging equipment, making it a solid option for eco-conscious drivers looking to cut costs.

Lemonade Auto Insurance Reviews: Ratings and Financial Stability

The consumer ratings for Lemonade auto insurance vary, as do the financial assessments. According to J.D. Power, Lemonade scored an 807 out of 1,000, which is below average for customer satisfaction. Lemonade has a B rating with the Better Business Bureau (BBB), which indicates average satisfaction, and a 70/100 rating on Consumer Reports, indicating average experience.

Business Ratings and Consumer Reviews Lemonade

| Agency | |

|---|---|

| Score: 807 / 1,000 Below Avg. Satisfaction |

|

| Score: B Fair Business Practices |

|

| Score: 70/100 Average Customer Satisfaction |

|

| Score: 2.50 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Lemonade has a complaint index score of 2.50 from the National Association of Insurance Commissioners (NAIC), which indicates that it gets more complaints than the average in the industry. Still, A.M. Best gives Lemonade an (A) financial strength rating, meaning it’s financially solid.

Comment

byu/hariiii22 from discussion

inInsurance

As a user on Reddit explains, Lemonade is dependent on venture capital funding, which means it can focus on acquiring customers now instead of making money immediately. The program for its synthetic agent helps mitigate early losses, allowing for expansion without a commensurate impact on its combined ratio.

Lemonade car insurance review data shows that while Lemonade’s loss ratios have improved to 73%, customer complaints and below-average satisfaction scores highlight ongoing issues with service and claims handling. If you evaluate auto insurance quotes, consider both pricing and Lemonade Insurance customer reviews before making a decision.

Pros & Cons of Lemonade Auto Insurance

Lemonade auto insurance stands out with AI-driven claims processing, competitive rates for low-mileage drivers, and unique perks for EV owners. But is it the right choice for you? Here’s a quick look at the pros and cons.

Pros

- AI-Powered Claims in Seconds: Lemonade auto insurance processes 40% of claims instantly through AI, with the fastest payout recorded at just 3 seconds.

- Significant Savings for Low-Mileage Drivers: Drivers who log fewer miles pay less, with usage-based pricing that can cut costs by up to 40% compared to standard policies.

- Exclusive Perks for EV & Hybrid Owners: Lemonade offers discounts for electric and hybrid vehicles, covers home chargers, and provides emergency roadside charging assistance.

Cons

- Only Available in Seven States: Lemonade auto insurance is currently limited to Arizona, Illinois, Ohio, Oregon, Tennessee, Texas, and Washington, restricting access for most drivers.

- No Rideshare Coverage: Drivers for Uber, Lyft, or delivery services cannot get coverage through Lemonade, making it unsuitable for those who use their car for work.

According to findings of our Lemonade Insurance review, Lemonade auto insurance is a good fit for tech-savvy, low-mileage and eco-conscious drivers. But it only has limited availability and no rideshare insurance coverage could be dealbreakers. Consider your driving habits before switching.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Lemonade Insurance Company Claims Process

The claims process with Lemonade is entirely digital, meaning no paperwork and no phone calls. Disbursements are also extremely prompt — the company highlights a record time of just three seconds for a claim to be cleared. Follow these steps to file a claim in detail:

- Open The Lemonade Mobile App: Tap the “Claim” button on the homepage. This starts the claims process immediately, as Lemonade does not have a phone-based claims service.

- Provide Claim Details: Answer a series of questions about the incident. You’ll need to describe what happened, the time and location, and any other relevant details.

- Upload Supporting Documents: Receipts, photos, or videos of the damage. In some cases, Lemonade requires a short recorded statement explaining the situation.

- Enter Your Banking Details: A direct deposit will be made once your claim is approved. Lemonade processes all payouts electronically—there are no paper checks.

- Wait For Claim Approval: The AI system verifies everything instantly. If further review is needed, a representative will manually assess the claim.

LIC’s AI-driven claims system speeds up approvals, but a comprehensive auto insurance claim involving high-cost repairs or missing details will go through manual review, which can delay payouts.

If your car is undrivable, securing a rental in advance can help since car insurance Lemonade only reimburses temporary transportation costs after claim approval.

Lemonade Auto Insurance Review: Fast Claims & Eco-Friendly Coverage

In this Lemonade auto insurance review, we’ve seen how their innovative approach stands out with fast claims, transparent pricing, and eco-friendly initiatives like tree planting. Lemonade’s use of AI and customer-driven Giveback programs sets it apart.

I filed a storm claim with Lemonade. The app was fast, but a human had to approve it. That caused a delay.Tonya Sisler Insurance Content Team Lead

However, while their low rates and rapid claims process are attractive, their coverage options may not be right for every driver — especially those looking for more traditional features of the best auto insurance companies. If you drive infrequently and prioritize social impact, Lemonade could be a good fit.

Start comparing total coverage auto insurance rates by entering your ZIP code here.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is Lemonade Insurance?

Lemonade is a digital-first insurance company offering car, home, renters, pet, and life insurance. It operates through an app, using AI-driven pricing and claims processing. Instead of a traditional model, Lemonade takes a flat fee and donates unclaimed money to nonprofits through its Giveback program.

Is Lemonade a good insurance company for car coverage?

Lemonade works well for low-mileage and app-focused drivers. Rates start at $30 to $40 for minimum coverage and about $66 for full coverage. Claims are handled quickly, sometimes in just 3 seconds. However, its NAIC complaint index is 2.50—higher than average—and its J.D. Power score is 807 out of 1,000, slightly below the norm.

Is Lemonade car insurance good for all drivers?

Lemonade car insurance is ideal for drivers who are low-mileage, own a hybrid or EV, and prefer to manage their policy through an app. It also provides low-mileage auto insurance discounts, which makes it gentler on the wallet for ad-hoc drivers. But it might not be right for drivers who have long daily commutes or those drivers who like talking to a representative by phone.

What is Lemonade’s Insurance customer service number?

Lemonade primarily offers chat-based customer support through its app and website. Unlike traditional insurers, Lemonade does not have a widely advertised phone number for customer service. You can reach them by email at [email protected] or use their app for assistance.

What makes Lemonade better than traditional car insurance companies?

Lemonade price coverage using driving data and mileage. It offers roadside assistance, EV discounts, and even plants trees to offset emissions. At $40 per month for minimum coverage, it’s cheaper than Allstate ($102) and Progressive ($88). Everything runs through the app—no calls, no paperwork.

What do Lemonade Insurance reviews say about pricing and claims?

Lemonade insurance reviews highlight affordable rates for some drivers and fast digital claims processing. However, some users report strict eligibility requirements and policy limitations. Those who file an auto insurance claim for complex situations may experience delays, especially if additional documentation or manual review is required.

What do Lemonade life insurance reviews say?

Lemonade life insurance reviews highlight affordable term life policies with no medical exams for eligible applicants. Some users appreciate the quick online application, while others mention limited policy options compared to traditional life insurance providers.

What do Lemonade home insurance reviews mention?

Lemonade home insurance reviews often praise low premiums and an easy claims process. However, some homeowners report slow response times for complex claims and higher rates in disaster-prone areas.

Why is Lemonade Insurance so cheap?

Lemonade offers auto insurance for different types of drivers, but its pricing model favors low-risk individuals. The company uses AI to assess risk, operates digitally to reduce overhead, and offers per-mile pricing, making it a cost-effective option for low-mileage drivers. Those who drive less typically pay lower rates, while high-mileage or high-risk drivers may see higher premiums.

What do Lemonade pet insurance reviews say?

Lemonade pet insurance reviews mention low starting prices, fast claims approval for routine care, and simple policy management. However, coverage for pre-existing conditions and some specialized treatments is limited, which some pet owners find restrictive.

What do Lemonade car insurance reviews highlight?

Most Lemonade car insurance reviews skim over its low-mileage discounts, eco-friendly incentives like tree planting, and its app-based claims process. The telematics-based pricing appeals to some drivers, but the lack of building the customer experience appeals to others.

How do you cancel a Lemonade policy?

If you’re wondering how to cancel auto insurance with Lemonade, log into the Lemonade app, go to your policy settings, and submit a cancellation request. If switching providers, make sure your new policy is active before canceling to avoid a coverage gap. Lemonade issues prorated refunds based on any unused premium.

What do Lemonade renters insurance reviews say?

Lemonade renters insurance reviews often mention quick signup, affordable coverage, and instant claims approvals for small losses. However, policyholders with high-value items may need to add extra coverage since Lemonade’s standard policy has payout limits.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Does Lemonade offer car insurance in Colorado?

No, Lemonade car insurance is not yet available in Colorado. Currently, it is offered in seven states, but expansion plans may include Colorado in the future. Check their website for the latest updates on state availability.

Which states offer Lemonade car insurance?

Lemonade car insurance is available in Arizona, Illinois, Ohio, Oregon, Tennessee, Texas, and Washington, with plans to expand. Auto insurance rates by state vary based on local regulations, risk factors, and Lemonade’s pricing model, so premiums may differ depending on where you live. The company does not yet operate in all 50 states.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Misha221tg

Super duper great experience!