Allstate Auto Insurance Review (2024)

Allstate auto insurance costs about $160 monthly for full coverage. However, you may qualify for Allstate insurance discounts to lower your rates. This Allstate auto insurance review will detail Allstate auto insurance coverage types and how to find affordable Allstate car insurance rates.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jul 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Allstate

Average monthly rate for good drivers:

$160A.M. Best rating:

A+Complaint level:

LowPros

- Multiple coverage options

- Various discounts

- Additional savings programs

Cons

- Lower than average customer service ratings

- Higher than average auto insurance rates

Allstate auto insurance averages $160 monthly for full coverage auto insurance and offers reliable customer service. While the company has various types of auto insurance and high financial ratings, its rates are about 34% higher than the national average.

Allstate auto insurance coverage could also be a good fit for you if you need speciality insurance, such as rideshare insurance, or want to bundle multiple insurance types. When comparing Allstate auto insurance quotes, consider various auto insurance discounts and other savings programs, like Allstate Drivewise and accident forgiveness. These features could help you obtain affordable Allstate auto insurance rates.

What You Should Know About Allstate

Allstate auto insurance has a long history of offering insurance to fit many needs. You can also get many hard-to-find insurance options, such as rideshare and custom parts coverage. However, expect to pay around $160 a month for full coverage auto insurance with Allstate.

Allstate makes it easy for its policyholders to access services and their policies. For example, you can complete your Allstate bill pay online or by phone.

According to J.D. Power, Allstate auto insurance ranks below average but ranks well in other areas. For example, A.M. Best — which ranks companies based on financial stability — gave Allstate an A+ rating. It also received an A+ from the Better Business Bureau.

Keep reading this Allstate auto insurance review to learn more about Allstate auto insurance coverage options, how to get an Allstate auto insurance quote, and how to file an auto insurance claim.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to File an Allstate Auto Insurance Claim

If you’re in an accident, filing Allstate claims is easy. You can actually file an Allstate auto insurance claim from your Allstate app or online.

If you’d rather speak with someone, call the Allstate auto insurance claims phone number at 1-800-669-2214 or the Allstate auto insurance phone number at 1-800-669-1552. An Allstate auto insurance customer service representative will help you complete your claim quickly.

If you don’t have your Allstate insurance card on you, don’t worry — you can also access your insurance information through the app.

Although Allstate’s claim satisfaction is below average, the Allstate Claim Satisfaction Guarantee means you’ll get your money back.

If you think your settlement is too low, Allstate will credit you a portion of the difference — no questions asked. No other insurance company offers this perk, and it’s included for free with standard Allstate policies.

The term was coined “Allstate hands” to signify their strong grip and reliable protection when it comes to insurance coverage.

Allstate Insurance Coverage Options

Allstate offers various coverages to fit your needs. In addition to car insurance, Allstate provides coverage for other aspects of life.

Allstate car insurance coverages include:

- Liability auto insurance

- Collision auto insurance

- Comprehensive auto insurance

- Medical payments

- Personal injury protection

- Uninsured/underinsured motorist

- Gap insurance

- Rental car insurance

- Rideshare auto insurance

Allstate also provides other insurance products, including boat, RV, homeowners, renters, and life insurance, but remember that not all coverages are available in all states. Since Allstate offers many coverage options, it’s convenient to use them for all your insurance needs. You should also learn how to save money by bundling insurance policies with Allstate.

Allstate Insurance Rates Breakdown

Allstate offers various insurance coverages, but rates are typically higher than other top insurers. However, many factors affect auto insurance rates, which vary by driver.

One factor affecting your rates is what coverages you choose. More coverage means higher rates, but you’ll have fewer out-of-pocket costs in the long run. Consider coverage options and driving profile when shopping around to find the best Allstate auto insurance rates.

While you only need to carry your state’s minimum auto insurance requirements, experts recommend full coverage to protect your vehicle. Full coverage includes liability, collision, comprehensive, and other coverages required by your state.

The table below shows how Allstate compares to other top insurance companies based on coverage type:

Allstate rates are some of the highest out there. However, coverage isn’t the only thing affecting your auto insurance rates. Keep reading to see how other factors affect Allstate rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Age Affects Allstate Auto Insurance Rates

There are many reasons why auto insurance costs more for young drivers, such as their lack of experience and higher risk for accidents. On the other hand, older drivers are much less likely to be in an accident which costs the insurance company money.

This table shows average auto insurance rates by age and gender:

| Insurance Company | Male (Age 16) | Female (Age 16) | Male (Age 25) | Female (Age 25) | Male (Age 45) | Female (Age 45) | Male (Age 60) | Female (Age 60) |

|---|---|---|---|---|---|---|---|---|

| Allstate | $638 | $608 | $190 | $181 | $160 | $162 | $154 | $150 |

| American Family | $509 | $414 | $147 | $124 | $117 | $115 | $105 | $104 |

| Farmers | $773 | $810 | $180 | $172 | $139 | $139 | $128 | $120 |

| Geico | $312 | $298 | $93 | $97 | $80 | $80 | $74 | $73 |

| Liberty Mutual | $785 | $723 | $215 | $187 | $174 | $171 | $159 | $148 |

| Nationwide | $476 | $411 | $150 | $136 | $115 | $113 | $104 | $99 |

| Progressive | $814 | $801 | $146 | $141 | $105 | $112 | $95 | $92 |

| State Farm | $349 | $311 | $111 | $101 | $86 | $86 | $76 | $76 |

| Travelers | $910 | $719 | $116 | $107 | $99 | $98 | $90 | $89 |

| U.S. Average | $618 | $566 | $150 | $138 | $119 | $119 | $110 | $106 |

Allstate charges much higher rates for teens. In fact, a 17-year-old male driver pays more than double their female counterpart. However, rates for other age groups are very similar. Compare average insurance costs by age below to see if Allstate offers the cheapest rates.

Allstate Auto Insurance Rates for Teen Drivers

Teens historically pay the most for coverage, but rates start to drop after they turn 18. For example, Allstate auto insurance for teens is $1,000 to $2,000 more for 16-year-old drivers vs. 18-year-old drivers:

If you’re a teen driver or a parent adding a teen to a policy, you won’t find affordable coverage with Allstate. Allstate teen insurance rates are on par with the national average, but Geico, State Farm auto insurance, Nationwide auto insurance, and American Family auto insurance all charge thousands less per year.

Allstate Auto Insurance Rates for Senior Drivers

Drivers aged 55 and up pay the lowest rates, but Allstate charges $40 more per month than the national average:

Allstate auto insurance for seniors is cheaper with Geico auto insurance and State Farm than at Allstate. Another way to save for senior drivers is to be well-informed when they’re shopping for auto insurance.

How Driving Record Affects Allstate Auto Insurance Rates

Your driving record is the most significant factor determining your car insurance rates. Drivers with a bad driving record will see higher auto insurance rates.

This table shows average Allstate rates based on driving records compared to other companies:

You’ll likely pay too much with Allstate if you need high-risk auto insurance. Each company charges more after a traffic violation, but USAA auto insurance and State Farm are less likely to increase your rates as much. Keep reading how Allstate compares to other companies after accidents or a DUI to see if it’s the most affordable option for you.

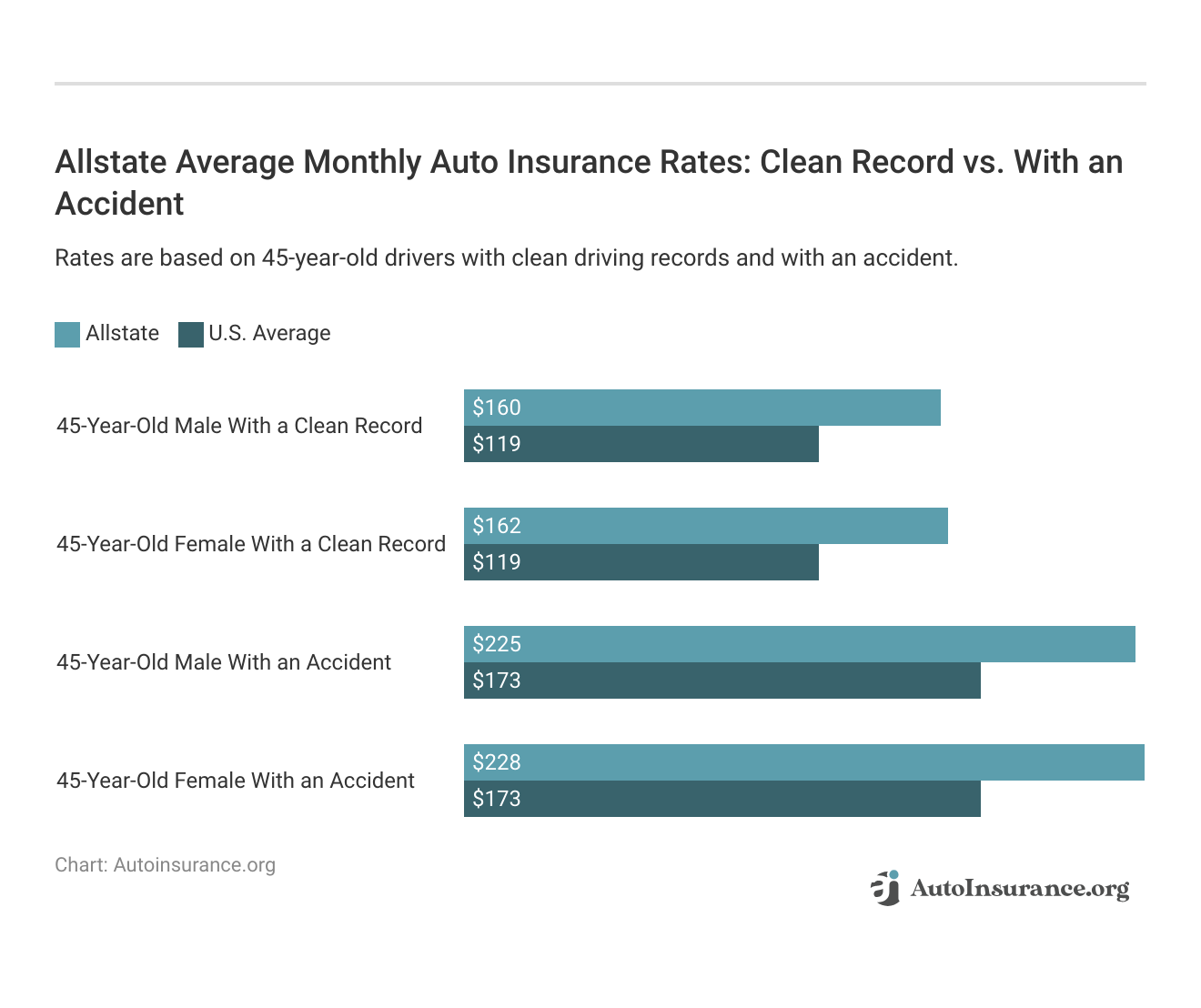

Allstate Auto Insurance Rates After an Accident

An at-fault accident will increase your insurance rates. The average Allstate rates after an accident are around $75 more per month, which is more expensive than other major insurers:

USAA and State Farm only charge around $16 more per month after an accident, so shop around and compare quotes before you buy from Allstate.

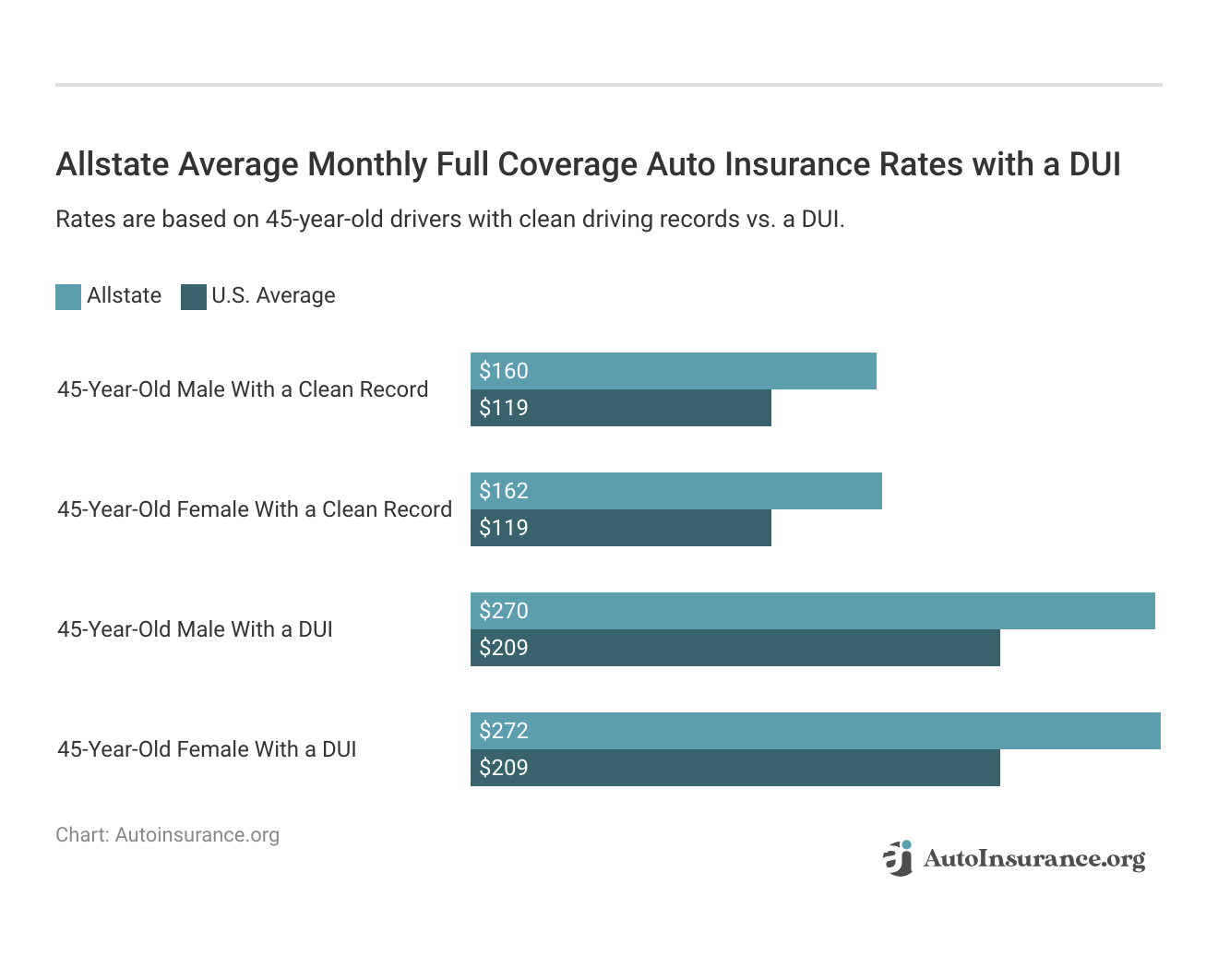

Allstate Insurance Rates After a DUI

Although rates increase with Allstate if you have a ticket or accident on your record, they almost double with a DUI. See how DUI auto insurance rates compare with the average Allstate rates below:

You can expect much more expensive Allstate auto insurance quotes if you have multiple DUIs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Credit Score Affects Allstate Auto Insurance Rates

You may not know that your credit score affects Allstate car insurance quotes in most states. While some states don’t allow insurance companies to consider your credit when determining your rates, most states allow it.

Insurance companies believe drivers with lower credit are more likely to file a claim. On the other hand, drivers with a higher credit score are more likely to pay for damages out of pocket and avoid filing a claim.

This table shows how your credit score affects Allstate car insurance rates.

Drivers with poor credit pay almost double for Allstate coverage. Improve your credit score to keep your Allstate rates low. You can also shop around for the best auto insurance companies that don’t check credit.

Allstate Discounts Available

While Allstate has higher-than-average rates, there are ways to save money with the lowest rates possible.

First, always take advantage of auto insurance discounts. Allstate offers various discounts based on the driver, policy, and vehicle. Bundle all your eligible Allstate auto insurance discounts to get the most significant savings.

This table shows Allstate auto insurance discounts. If the savings amount is known, it’s listed:

| Vehicle-Based Discounts | Driver-Based Discounts | Policy-Based Discounts |

|---|---|---|

| Anti-Lock Brakes - up to 10% | Defensive Driver Course - up to 10% | Claim-Free - up to 35% |

| Anti-Theft Devices - up to 10$ | Distant Student/Student Away at School - up to 35% | Continuous Coverage Discount - up to 25% |

| Daytime Running Lights - up to 2% | Driver's Education Course - up to 10% | Full Payment - up to 10% |

| Electronic Stability Control - 2% | Early Signing - up to 10% | Multi-Policy - up to 25% |

| Farm Vehicle - up to 10% | Good Student - up to 20% | AutoPay Discount - up to 5% |

| Green Vehicle - up to 10% | Military Discount - varies by location | Paperless Billing/Paperless Documents - 5% |

| New Vehicle - up to 30% | Safe Driver - earn up to $500 off your collision deductible | |

| Passive Restraint Discount - up to 30% | Senior Driver - up to 10% | |

| Utility Vehicle - up to 15% | ||

| Vehicle Recovery Tracking Systems - up to 10% |

Allstate is known for offering more discounts than other companies, but not all Allstate auto insurance discounts will be available where you live. Other restrictions may also apply, including age and mileage limits.

Allstate Auto Insurance Reward Programs

If you don’t qualify for as many discounts as you’d like, Allstate other rewards and programs can help you save. You may be eligible for multiple ways to save money.

Ways to save with Allstate include:

- Accident forgiveness: Accident forgiveness allows you to skip a rate increase after an accident. Read more about the best accident forgiveness auto insurance companies.

- Safe driving bonus: Drivers receive a check every six months with no accidents.

- New car replacement: Allstate offers your vehicle’s replacement value if it gets totaled and is less than two years old.

- Deductible rewards: Drivers receive lower auto insurance deductibles each year they keep a clean driving record.

Remember that some programs, such as accident forgiveness, require you to enroll and pay in advance.

Drivers may also consider participating in Allstate Drivewise, a telematics program offering a discount based on how you drive. Drivewise monitors certain driving habits — such as speed and the time of day you drive — and offers a discount for safe driving.

Mayhem is always lurking🆘Will Allstate help you deal with mayhem as they advertise? 🛟https://t.co/27f1xf1ARb can help you find an answer through unbiased auto insurance company reviews. Find out more about the pros and cons of Allstate here 👉: https://t.co/gPdNQGkn09 pic.twitter.com/sD4EIcLdw1

— AutoInsurance.org (@AutoInsurance) June 3, 2023

Finally, low-mileage drivers may consider switching to Milewise from Allstate. Milewise offers usage-based insurance allowing drivers to pay per mile. Typically, rates are much lower than traditional coverage.

Frequently Asked Questions

How do you file an Allstate auto insurance claim?

If you’re wondering how to file an Allstate auto insurance claim, the company offers various ways to begin the process.

File your claim through the Allstate app, website, or by calling the Allstate insurance company phone number at 1-800-255-7828. The easiest way to start your claim is through the Allstate app. Not only can you file a claim, but you can also upload pictures of the damage.

How fast does Allstate auto insurance pay claims?

We suggest you read Allstate claim reviews before signing with Allstate as your provider. It’s essential you feel confident that you are getting the best provider in your area who will give you excellent customer service and make filing a claim a breeze.

Some good news: Allstate offers a claims satisfaction guarantee (for free) with all policies. So, if you’re unhappy with your settlement, Allstate credits a portion back to you.

However, do keep in mind that Allstate claims satisfaction is below average, according to J.D. Power, which rates companies in the industry on customer satisfaction.

Is Allstate a good auto insurance company?

Yes, Allstate is a good company – one of the industry leaders.

Here’s a quick summary: Allstate offers various auto insurance coverages, but rates are slightly higher than average. When it comes to customer service and claims handling, the Allstate insurance company scores at or just below average.

But, remember this will vary by location. We suggest you read the Allstate company reviews. Just one Allstate Insurance review in your area can provide valuable insights into the quality of service and coverage options offered by this insurance provider where you live.

Who should consider Allstate auto insurance?

Allstate auto insurance is one of the best auto insurance companies that bundle home, auto, boat, and personal liability. It’s a great fit for drivers who need several policies.

However, drivers looking for excellent customer service and low rates probably won’t find what they want with Allstate.

How do you get an Allstate auto insurance quote?

Get Allstate auto insurance quotes online or through a local agent. You’ll need your personal and vehicle information. Knowing what Allstate auto insurance coverage you need is also a good idea.

And remember Allstate doesn’t just offer auto insurance coverage. You can save money by bundling your lines of coverage.

To receive an accurate and personalized Allstate Insurance quote, simply fill out the necessary information on their website to discover the best coverage options for your car, home, and life insurance needs.

How do you contact Allstate auto insurance?

There are multiple ways to contact Allstate auto insurance customer service to meet your needs, listed below:

- Website: www.allstate.com

- Allstate auto insurance phone number: 1-800-255-7828

- Mail: 2775 Sanders Rd., Northbrook, IL 60062

- Twitter: @Allstate

- Local agent

Is Allstate auto insurance expensive?

You’ll pay $160 monthly for full coverage Allstate auto insurance. On average, full coverage auto insurance costs $119.

Does Allstate auto insurance offer roadside assistance?

Yes, Allstate auto insurance sells roadside assistance as an add-on coverage. Learn more about the best roadside assistance coverage auto insurance companies.

What types of coverage does Allstate offer in addition to auto insurance?

Allstate offers homeowners, renters, life, boat, and RV insurance in addition to auto insurance.

Does Allstate provide insurance coverage in Las Vegas?

Interestingly enough we get this question a lot. It seems many Las Vegas residents (or visitors) are wondering if Allstate is available.

Well, you’re in luck because Allstate offers coverage in 81 Las Vegas zip codes from 89044 to 89199.

If you’re in need of reliable insurance coverage in Las Vegas, look no further than Allstate Insurance Las Vegas for a comprehensive and trustworthy option to protect yourself and your assets.

Can I manage my Allstate policy online?

Use your Allstate auto insurance login to manage your policy through the company’s website or mobile app.

How do I find Allstate car insurance near me?

If you are looking for reliable insurance coverage for your vehicle, search for “Allstate car insurance near me” to find a nearby office that can help meet your needs.

But, if you aren’t sure which provider offers the best rates in your area, you should first try out our free quote tool below.

Just enter your ZIP code and in minutes, you will get several customized car insurance quotes from the best providers based on your vehicle and where you live.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

EveC

Always lose arbitrations

Valencia Harris

ALLSTATE INSURANCE

Keith_G__

As Discriminatory As You Can Possibly Get

brenda_trammell

RUDE CUSTOMER SERVICE AND SCAMMERS!!!

Akiraw1_

The worst insurance ever

pirish101

Way overpriced! Will scam you if you cancel!

Carolyn0022

Untrained and Ignorant CS Team and Managers

Allstate_Sucks_in_CA

Allstate SUCKS

Shaytys50_

Unprofessional Agent

rickcf

Need to watch them and Drivewise is a scam.