Cheap Audi Auto Insurance in 2025 (Save With These 10 Companies)

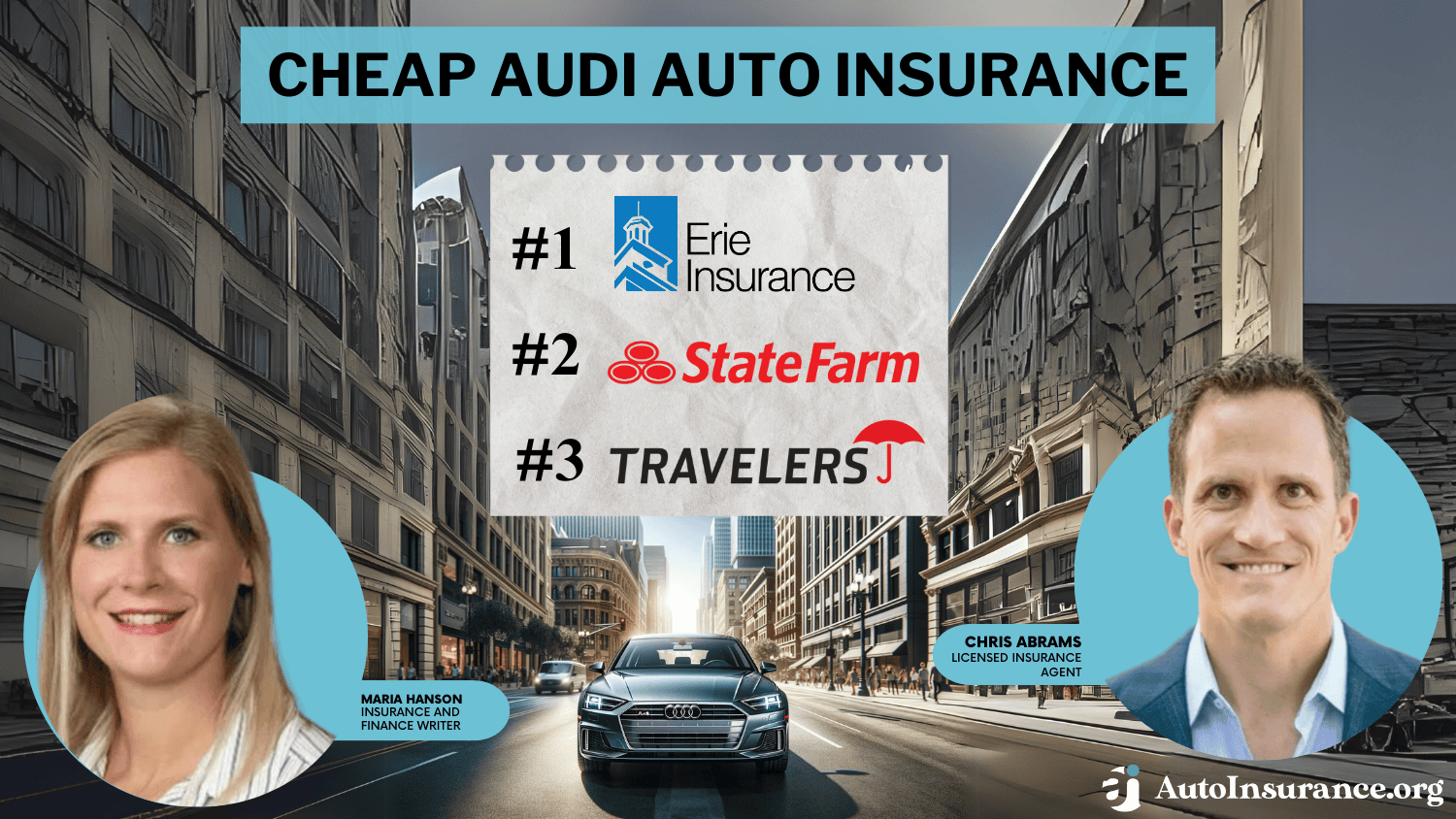

Erie, State Farm, and Travelers are the top three companies to look at for cheap Audi auto insurance, with minimum coverage beginning at $32 per month. Discover the key factors affecting your Audi auto insurance costs and learn how to compare quotes to protect your luxury car with the right coverage affordably.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Audi

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Audi

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Audi

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsIf you want cheap Audi auto insurance Erie, State Farm, and Travelers are the top three companies, with Erie policies starting at $32 per month.

Factors that affect auto insurance rates include the model, age, and safety features of the vehicle, all of which significantly influence Audi auto insurance prices.

Our Top 10 Company Picks: Cheap Audi Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A+ | Youth Discounts | Erie |

| #2 | $47 | A++ | Customer Service | State Farm | |

| #3 | $53 | A++ | Bundling Policies | Travelers | |

| #4 | $56 | A+ | Qualifying Coverage | Progressive | |

| #5 | $62 | A | Loyalty Rewards | American Family | |

| #6 | $63 | A+ | Usage-Based Coverage | Nationwide |

| #7 | $65 | A | Roadside Assistance | AAA |

| #8 | $76 | A | Safe-Driving Discounts | Farmers | |

| #9 | $87 | A+ | Infrequent Drivers | Allstate | |

| #10 | $96 | A | Add-on Coverages | Liberty Mutual |

Driving habits, credit score, and location will also all be taken into consideration by companies when providing a quote on insurance policies.

Explore your auto insurance options by entering your ZIP code into our free comparison tool above today.

- Explore affordable Audi auto insurance options starting at $32 per month

- Safe driving, credit score, and Audi model impact cheap insurance rates

- Compare multiple providers to ensure the most cost-effective policy

#1 – Erie: Top Pick Overall

Pros

- Coverage Options: Rare coverage opportunities, including pet injury protection.

- High BBB Rating: Erie has an A+ with the BBB. Learn more with our Erie auto insurance review.

- Rideshare: You’ll have coverage if you drive for Uber or Lyft.

Cons

- Coverage Area: Erie insurance is not offered in all 50 states.

- Add-Ons Cost More: The more you want on your policy the more expensive it will be.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Cheapest for Drivers With Infractions

Pros

- Claim Process: State Farm keeps you up to date via app or online. Read more with our State Farm auto insurance review.

- Financial Rating: Superior A++ rating with A.M. Best.

- Medical Payments Coverage: Helps pay for healthcare.

Cons

- Total Loss Protection: Gap insurance not available for policies.

- Poor Credit, High Rates: Drivers with low credit scores will pay more.

#3 – Travelers: Cheapest for Safe Drivers

Pros

- Plan Options: Gap and new car replacement insurance available.

- Affordable Rates: Insurance costs are below the national average. Read more in our Travelers auto insurance review.

- Superior Financial Rating: Has an A++ with A.M. Best.

Cons

- IntelliDrive Program: Drivers could see an increase in rates.

- High Rates for Teens: Young drivers will see high rates despite new and clean driving history.

#4 – Progressive: Cheapest for High-Risk Drivers

Pros

- Affordable for High-Risk Drivers: Rates are less than the average for high-risk drivers.

- Discount Opportunities: Over a dozen available including bundling and good student discounts. Learn more with our Progressive auto insurance review.

- Progressive App: Drivers can make payments and access insurance card.

Cons

- Customer Service: An array of complaints against rates being changed.

- Snapshot Program: Unsafe driving habits could lead to higher rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Cheapest for Older Drivers

Pros

- Adult Drivers Pay Less: Older drivers will pay around $200 less per year than the average.

- SR-22 Insurance: This isn’t offered by every company. Read more in our American Family auto insurance review.

- Bundling Prices: You can save money by bundling insurance prices.

Cons

- Claim Handling: Drivers report low satisfaction rates with claim process.

- Availability: Auto insurance isn’t offered in certain states.

#6 – Nationwide: Cheapest for Minimum Coverage

Pros

- Protection Choices: Medical payments, gap coverage, and accident forgiveness all offered.

- Additional Add-Ons: Drivers can also choose roadside assistance and rental reimbursement.

- SmartMiles: Usage-based program that provides discounts to drivers. Read more in our Nationwide auto insurance review.

Cons

- High Rates for DUIs: One infraction can raise your rates.

- Rideshare Not Available: If you drive for Lyft or Uber, you won’t have the option for coverage.

#7 – AAA: Cheapest for Members of AAA

Pros

- Membership Benefits: Towing, vehicle lockout, and rental cars included.

- Rewards Offered: Discounts provided for local attractions, going to movies, and out to eat.

- Vacation Options: With AAA, travel guides and discounted tickets are offered. Learn more with our AAA auto insurance review.

Cons

- Higher Costs: Almost 60% higher than the national average.

- Low Credit Score: Drivers with a low credit score will pay more.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Cheapest With Discounts

Pros

- Positive Customer Service: Drivers report high levels of customer satisfaction. Learn more with our Farmers auto insurance review.

- Signal: Usage-based program that offers discounts to safe drivers, signing up gets you %5 immediately.

- Discount Options: Easily get discounts for being paperless and a good driver.

Cons

- Policy Accessibility: Auto insurance not offered in all 50 states.

- No Gap Coverage: Gap auto insurance coverage pays the difference between a totaled car’s worth and what you still owe.

#9 – Allstate: Cheapest for Modified Vehicles

Pros

- Drivewise: Provides a discount based on driving habits. Learn more with our Allstate auto insurance review.

- Custom Parts Coverage: Helps cover the cost to repair or replace modifications such as a stereo.

- Claim Satisfaction Guarantee: If you think a claim settlement was too low, Allstate will pay a portion of the difference.

Cons

- Teens Pay More: Additionally male teen drivers will pay around double what female teens pay.

- Expensive Policies: Full coverage is going to be higher than the national average.

#10 – Liberty Mutual: Cheapest With Good Credit

Pros

- Medical Costs Coverage: Drivers can purchase medical payments coverage which pays for medical bills after an accident.

- Lifetime Replacement Guarantee: Any repairs done at an approved location are guaranteed for life. Read more with our Liberty Mutual auto insurance review.

- Bundling Options: Drivers can also bundle boat, homeowners, or small business insurance with their auto coverage.

Cons

- Increased Insurance Costs: Drivers with low credit scores will pay more than double for auto insurance.

- Claims Handling: Drivers report less than satisfactory results with claims handling.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pricing for Audi Auto Insurance

How much is an Audi to insure? There are some truly low car insurance prices advertised online, and many companies that promise significant savings.

Audi Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $62 | $166 | |

| $32 | $83 |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

While you can certainly find savings, you need to draw the line between affordable coverage that is adequate and cheap coverage that isn’t worth anything.

Many times low prices are used as a gimmick to draw people in; no one is actually paying $123 a month for full coverage car insurance.

However, there are many scams and fraudulent companies that will be more than happy to take your money and run. There are also companies that are only slightly better than fraud, but they don’t really intend to pay out on any of your legitimate claims.

Basically, if it sounds too good to be true, then it is. No doubt about it; no insurance company can afford to pay out thousands of dollars in claims when every customer is only paying $32 a month.

If you encounter extremely low insurance prices for your Audi, like that dream $32 rate you have to understand that it is either fraud or a company that will use every trick in the book not have to pay your claims.

You can certainly find adequate coverage at a great price; it just takes a bit of work. The truth is that you can’t expect such cheap prices to really offer you protection.

Ways to Find Cheap Audi Auto Insurance

The main way to find the lowest auto insurance premiums for adequate coverage is by doing your homework and perhaps changing some of your driving habits.

There is a myriad of ways for you to lower car insurance rates, no matter what type of vehicle you drive. The first factor that you can control that has a direct impact on your car insurance costs is how you drive.

Auto insurance underwriters are going to look at your last three years of driving. If those years are dotted with speeding tickets and accidents, then they have no reason to think that their future driving will be any different. To offset your risk of being in an accident, insurance providers are going to charge you higher rates, and high-risk auto insurance can be expensive.

Signing up for a defensive driving course can provide a variety of benefits, including a discount on your auto insurance.Daniel Walker Licensed Auto Insurance Agent

The National Highway Traffic Safety Administration maintained in a 1997 policy and implementation strategy for combating speeding that the behavior was a factor in as many as one-third of all fatal crashes.

While the rate of fatal crashes has been slowly dropping since then, speeding is still a major contributor in many car accidents.

Other factors that contribute to accidents include distracted driving, aggressive driving, and driving under the influence of drugs or alcohol. Changing those bad driving behaviors will lead to a decreased chance of injury or death, as well as lower car insurance costs.

Common Penalties for a First-Time DUI Offense

| Penalty for First DUI | Penalty |

|---|---|

| Community service | Determined in court |

| DUI program | Alcohol Diversion Program possible |

| Fine | Up to $1,000 |

| Jail time | BAC over .20: 10 days BAC over .25: 15 days BAC over .30: 20 days up to 180 days |

| License mandatory reinstatement | $98 min, SR22 insurance, and retake driver test |

| License revoked | 6 months |

| Probation | Determined in court |

| Required interlock device | Yes |

| Vehicle impounded | No law |

Another factor that you have control over that affects your car insurance rates is your credit history. It is a topic that is under hot debate at the moment, but insurance companies maintain that those people who are responsible with their finances are statistically more likely to be responsible drivers.

If you live in a state where insurance underwriters are allowed to use your credit history as a means for setting your car insurance rates, then you should improve your credit as much as possible.

Just as you need to drive safely to have a clean driving record, you also need to pay your financial obligations to have a good credit history. While it will take some time, there are also the benefits of having good credit to go along with lower coverage rates.

Factors Affecting Audi Auto Insurance Prices

Is owning an Audi really that expensive? The answer will always depend on various factors. One factor that has a fair impact on your auto insurance prices is the safety of the vehicle that you drive. As an Audi driver, you know that they are built with safety as well as performance in mind.

The IIHS is a nonprofit organization that performs crash test ratings on a slew of vehicles each year. Each year, they publish the list of top performers. Audi can tout the safety of the midsize Audi A3, the luxury A4 midsize and large A6 sedans, and the midsize luxury Audi Q5 SUV.

Vehicles with high safety ratings equate to lower claims in the eyes of car insurance underwriters. First, they likely have additional safety features for avoiding an accident altogether, such as traction control. In addition, safer vehicles also have interior safety features that minimize injuries to passengers when there is an accident, such as seatbelts and airbags.

A safer vehicle means lower car insurance prices, but it also means that your family or other passengers will likely suffer fewer serious injuries in the event of a crash. Safer vehicles are a win-win situation, though this doesn’t mean that you should go without collision auto insurance, which can help financially in the event of an accident.

Additional Factors for Audi Auto Insurance

Factors that are beyond your control include your location, your age, and your gender. These are all taken into consideration when you’re looking for Audi insurance. Whether or not you’re married will also affect your rates.

Young male drivers get the short end of the stick with higher car insurance rates, as they are the single group that has the highest rate of vehicle accidents.

Many factors beyond your immediate control, like marital status, impact insurance rates; for example, best auto insurance discounts for married couples can offer significant savings as single drivers get married and switch from sports cars to more family-friendly sedans and minivans.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance for Audi Models

While there are certain factors you can control, it’s also a good idea to think about the things you won’t have control over while on the road. Other drivers, accidents, theft, or animal encounters being some examples.

No one wants to think about having an accident or other loss in the future, but it is inevitable that most people will be in a car accident, will be the victim of car theft, or will hit a deer or a fence post at some point in time.

Oh deer! 🦌 I love when Progressive brings me back to record announcer lines for fun commercials like this one – just found this out in the “wild” (ok I’ll stop). 😆 pic.twitter.com/SRHYXBuuaD

— MELISSA MEDÍNA (@melissamedinavo) April 15, 2024

Drivers buy car insurance to be ready for those mishaps of the future, but few take steps to make sure that their insurance companies will be there as well. Finding cheap Audi insurance doesn’t always mean going with the cheapest company.

Unfortunately, car insurance companies go out of business all of the time. You certainly don’t want to find out that your insurer is filing bankruptcy while you are trying to file a claim.

You should check the financial ratings of every car insurance provider that you are considering. The U.S. Securities and Exchange Commission has designated 10 current rating agencies to keep tabs on important businesses such as the auto insurance industry.

Checking the ratings with any of the ten rating agencies will help you to understand the bigger financial picture behind your insurance provider. Strong ratings indicate that your insurer is fiscally robust and has the assets to take on many challenges.

A.M. Best Financial Ratings for the Top Auto Insurance Companies

| Insurance Company | Financial Rating |

|---|---|

| A++ | |

| A++ | |

| A+ | |

| A+ |

| A+ |

| A+ | |

| A | |

| A | |

| A |

| A |

Poor ratings might mean that an insurance company has taken on too much risk, and they are not bringing in as much money as they are paying out. This is why it’s important to obtain multiple auto insurance quotes. It makes it easier to check customer satisfaction ratings and the financial status of each company.

While nothing is certain or guaranteed, you can be as sure as possible that an insurance provider will be solvent in the future to help cover your car damages or losses.

Compare Rates to Find Cheap Audi Auto Insurance

The last factor that can determine how much you pay for your Audi coverage is how you shop for car insurance. If you buy a policy from the first insurance company you try, then you can bet that you are likely overpaying.

All car insurance experts recommend that you compare prices for the same coverage from many different providers.

For example, the Maine Department of Insurance publishes a consumer’s guide that accurately states that the only true way to know how much any car insurance company will charge you for coverage is to get many quotes from different providers to compare.

When you are in the process of evaluating auto insurance quotes, make sure you get quotes for the same amount of coverage from each provider so that your weigh your options accurately.

As an insurance writer, I've found that regularly comparing Audi insurance quotes can lead to significant savings, especially with new providers.Aremu Adams Adebisi Feature Writer

You can obtain Audi insurance quotes through agents, call centers, or websites, but the quickest method is using comparison websites like this one. Just submit one application, and you’ll receive multiple quotes from car insurance providers for easy comparison.

Overall Cost of Audi Auto Insurance

The amount of coverage you’ll need and what you will pay is going to depend on the model of Audi you own. For example, Audi A3 insurance costs will be lower than the A4 since the A4 is a newer and more luxurious model.

Navigate through the intricacies of auto insurance costs for Audi vehicles with this comparative analysis against BMW and Mercedes, providing essential guidance for potential buyers.

| Audi Vehicle Comparison |

|---|

| Audi vs. BMW Auto Insurance (#current_year) |

| Audi vs. Mercedes Auto Insurance (#current_year) |

Use the compare auto insurance rates by vehicle make and model tool to evaluate your current or desired Audi model against others, keeping in mind that factors like vehicle age and condition also affect insurance rates.

Compare Auto Insurance Costs Across Audi Models

Discover the extensive table provided below to easily compare Audi auto insurance premiums based on different models, helping you swiftly identify the optimal coverage for your vehicle.

The cheapest Audi to insure will all depend on many outlying factors, including the driver.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Maximizing Savings on Audi Auto Insurance

Audi drivers looking for affordable coverage will want to compare prices, especially given that Erie, AAA, and State Farm have the cheapest rates.

By comparing quotes, drivers can easily ensure money is being saved in the long term. If you already have coverage, you can always manage your existing auto insurance policy and check the market to see if there are any cheaper offers.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

Are there any specific insurance considerations for electric or hybrid Audi models?

Electric and hybrid Audi models may have specific insurance considerations, such as coverage for battery damage or unique repair requirements. It’s advisable to discuss these factors with your insurance provider to ensure you have appropriate coverage for your specific Audi model.

Who is known for cheapest car insurance?

Erie, State Farm, and AAA all have the cheapest Audi auto insurance. Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Can I suspend my Audi auto insurance if I’m not using my vehicle for an extended period?

Some insurance providers may offer options to suspend coverage temporarily if your Audi will not be in use for an extended period, such as during storage or when you’re traveling. Contact your insurance provider to look into finding garaging and storing auto insurance discounts.

Are Audis expensive to insure?

What you pay for coverage will depend on many things, including your driving record, personal details, and the condition of your vehicle.

Will my Audi auto insurance cover windshield damage?

Windshield damage is typically covered under comprehensive coverage. If you have comprehensive coverage, your insurance policy may cover the repair or replacement of a damaged windshield, subject to your deductible.

Can I transfer my existing insurance to a new Audi?

Yes, you can typically transfer auto insurance to a new vehicle. However, it’s important to inform your insurance provider about the change in vehicle as soon as possible to ensure continuous coverage.

Is the Audi A3 or A1 better?

The A3 is a larger model, with varying engine types. The A1 is a reliable vehicle that will maintain its value.

What factors influence the insurance costs for an Audi A3?

Insurance costs for an Audi A3 are affected by the vehicle’s safety ratings, theft rates, repair costs, and factors like the driver’s age, driving history, and credit score. The specific trim and features of the A3 also play a role. To get competitive rates, maintain a good driving record and seek eligible discounts.

Are Audis reliable?

Owning an Audi and making sure it’s a reliable vehicle lies in the upkeep. Making sure you have sufficient auto insurance will help protect your car on the road. This sometimes means having more than just the minimum auto insurance required by your state.

How does owning an Audi A3 Sportback e-tron affect car insurance rates?

Insuring an Audi A3 Sportback e-tron may cost more due to its hybrid technology, but its safety and efficiency could qualify for insurance discounts. Check with your insurer for specific hybrid vehicle coverage options and discounts.

What is the average cost of auto insurance for an Audi S3?

The cost of auto insurance for an Audi S3 varies based on the driver’s location, driving record, and coverage level. As a performance vehicle, the S3 generally has higher rates than standard models. For the most accurate rates, it’s best to compare quotes from multiple insurers.

What should I do if my Audi is totaled in an accident?

If your Audi is deemed a total loss, your insurer will reimburse you for its actual cash value minus the deductible. For guidance on how to file an auto insurance claim, contact your provider and follow their instructions.

Do Audis maintain value?

How much your Audi is worth will depend on upkeep, how it’s driven, and what auto insurance you purchase, especially if it’s a model that isn’t on the road every day.

Are Audi’s expensive to insure compared to other car brands?

Generally, Audis are considered more expensive to insure due to their high repair costs, advanced technology, and the higher purchase price associated with luxury vehicles. However, factors like model, safety features, and individual driver history can significantly influence the final insurance rates.

Will modifications to my Audi affect my insurance rates?

Modifications to your Audi, such as aftermarket parts or performance enhancements, may affect your insurance rates. It’s important to notify your insurance provider about any modifications made to ensure proper coverage. It might also be smart to look into auto insurance companies for modified cars.

Does having your car paid off make insurance cheaper?

Not always, since some drivers prefer to maintain full coverage even after their car has been completely paid off. You can switch to collision-only coverage in order to lower your rates, but this isn’t always recommended.

Can you still purchase Audi a3 insurance?

You can still purchase Audi A3 auto insurance, but given the age of the model, it’s going to be much more expensive to insure.

Which insurance company is usually the cheapest?

Several factors will determine which insurance company offers the lowest price, including whether or not you want to pay for full auto insurance coverage or just your state’s minimum requirement.

What factors influence the cost of cheap auto insurance for an Audi A3?

Insurance costs for an Audi A3 are influenced by the driver’s age, driving record, location, the level of coverage selected, and the car’s safety features. Premiums can be lower for models equipped with advanced safety technologies and for drivers with clean driving records.

What should I expect to pay for auto insurance for an Audi S6?

Auto insurance for the Audi S6 is generally higher than for less powerful models due to its luxury status and high performance. Insurers consider these factors as increasing the likelihood of costly claims, resulting in higher premiums.

Finding cheaper Audi insurance rates is as easy as entering your ZIP code into our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.