Best Brownsville, Texas Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Geico, USAA, and State Farm are top picks for the best Brownsville, Texas auto insurance, starting at $70/month. Geico offers cheaper rates, and USAA provides excellent discounts for military families. State Farm stands out with personalized local support. These companies deliver reliable coverage in Brownsville.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Brownsville Texas

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Brownsville Texas

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Brownsville Texas

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsGeico, USAA, and State Farm lead the way in providing the best Brownsville, Texas auto insurance, with rates starting as low as $70 per month. Geico offers affordable options, perfect for residents near Boca Chica Boulevard.

USAA provides military families with discounts, while State Farm’s local agents, like those near Alton Gloor Boulevard, offer personalized support.

Below you’ll find information on how to get cheap auto insurance in Brownsville, TX, for every age, credit history, and driving record.

Our Top 10 Company Picks: Best Brownsville, Texas Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Rates | Geico | |

| #2 | 30% | A++ | Military Discount | USAA | |

| #3 | 30% | B | Local Agents | State Farm | |

| #4 | 30% | A+ | Safe Driver | Progressive | |

| #5 | 40% | A+ | Custom Coverage | Allstate | |

| #6 | 40% | A+ | Reliable Service | Nationwide |

| #7 | 15% | A | Agent Network | Farmers | |

| #8 | 30% | A | Unique Coverage | Liberty Mutual |

| #9 | 20% | A++ | New Car | Travelers | |

| #10 | 20% | A | Bundling Discounts | American Family |

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Geico offers the most affordable rates, starting at $70/month for minimum coverage

- USAA offers exclusive discounts for military families

- Brownsville drivers can get personalized service from State Farm’s local agents

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Brownsville Driver-Friendly Rates: Geico’s $130/month full coverage in Brownsville beats the city average by $368, helping residents save for other local expenses like fresh seafood from Gamboas.

- Gulf Coast Protection: With Geico’s comprehensive coverage, Brownsville drivers are shielded from hurricane-related damages, crucial given the city’s 12 hurricane disasters in 2019.

- Local Business Auto Coverage: Geico offers commercial auto policies for Brownsville’s small businesses. View our Geico auto insurance review for a deeper look into their commercial coverage.

Cons

- Limited Local Office Hours: Geico’s Brownsville office closes earlier than some competitors, potentially inconveniencing residents who work late shifts at the port.

- Limited Coverage for Cross-Border Travel: Brownsville residents frequently traveling to Matamoros, Mexico, may find Geico’s international coverage options lacking.

#2 – USAA: Best for Military Discount

Pros

- Brownsville Veteran Focus: USAA’s military-centric policies cater to veterans in Brownsville, home to the Veterans War Memorial of Texas.

- Resaca Flood Protection: To understand how their comprehensive coverage can keep you safe, read our USAA auto insurance review as they include protection against flooding in Brownsville.

- Border Patrol Employee Perks: USAA provides exclusive discounts for Brownsville’s numerous U.S. Customs and Border Protection employees.

Cons

- No Local Cultural Events Sponsorship: Unlike some insurers, USAA doesn’t sponsor Brownsville’s cultural events like the Latin Jazz Festival.

- Absence of Spanish-Language Brownsville Agents: USAA lacks bilingual local agents, a drawback in predominantly Hispanic Brownsville.

#3 – State Farm: Best for Local Agents

Pros

- Brownsville Native Agents: State Farm’s local agents, born and raised in Brownsville, offer unparalleled insights into the city’s unique insurance needs.

- Brownsville Farmer’s Market Vendor Insurance: Local vendors at Brownsville Farmer’s Market can access tailored commercial auto policies from State Farm.

- Historic Brownsville Vehicle Coverage: State Farm offers specialized classic car insurance in Brownsville’s historic district. For more details, explore our State Farm auto insurance review.

Cons

- Limited Public Transit Discounts: State Farm doesn’t offer significant discounts for users of Brownsville’s B Metro public transportation system.

- No Coverage for Pedicab Drivers: Brownsville’s growing pedicab industry in the entertainment district isn’t covered under State Farm’s policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Safe Driver

Pros

- Brownsville Food Truck Coverage: Progressive offers specialized insurance for Brownsville’s thriving food truck scene, including those at Linear Park.

- Student Discounts: Students in Brownsville can access significant discounts with Progressive. Want to see how these discounts could work for you? Take a look at our Progressive auto insurance review.

- Palmito Ranch Battlefield Commuter Rates: Progressive offers competitive rates for Brownsville residents who commute to the Palmito Ranch Battlefield historic site.

Cons

- No Brownsville Sports Park Event Coverage: Progressive doesn’t offer special event coverage for vehicles used during events at Brownsville Sports Park.

- Limited Mitte Cultural District Parking Protection: Vehicles parked in the busy Mitte Cultural District may have limited coverage options with Progressive.

#5 – Allstate: Best for Custom Coverage

Pros

- Brownsville Port Worker Focus: Allstate offers tailored policies for port employees in Brownsville. Learn more about these customized options in our Allstate auto insurance review.

- Children’s Museum of Brownsville Family Discounts: Families with memberships to the Children’s Museum of Brownsville can access unique discounts with Allstate.

- Charity League Volunteer Benefits: Allstate provides special benefits for members of the Brownsville Charity League, supporting their community service.

Cons

- Higher Premiums in Flood-Prone Areas: Residents near Brownsville’s resacas may face higher premiums with Allstate due to flood risks.

- Limited Options for Seasonal Residents: Winter Texans in Brownsville may find Allstate’s policies less flexible for their part-time residency.

#6 – Nationwide: Best for Reliable Service

Pros

- Resaca-Front Property Adjustments: Policies are tailored for homes along Brownsville’s unique resaca system, considering flood risks and scenic premiums.

- UTRGV Campus Driver Discounts: Students and faculty commuting to the University of Texas Rio Grande Valley Brownsville campus enjoy reduced rates.

- Brownsville Metro Bus Driver Coverage: Nationwide provides specialized insurance for Brownsville’s public transit drivers, supporting the city’s transportation infrastructure.

Cons

- No SpaceX Launch Viewing Protection: Unlike some local insurers, Nationwide doesn’t offer special coverage for vehicles parked at SpaceX launch viewing sites.

- Park Area Rates: Brownsville residents may face high premiums due to event-related traffic risks. Check out how Nationwide tackles these risks in our Nationwide auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Agent Network

Pros

- Brownsville-Matamoros Sister City Coverage: Farmers offers unique cross-border insurance options for Brownsville residents frequently traveling to Matamoros.

- Parade Vehicle Insurance: Special event coverage is available in Brownsville. Learn how Farmers can assist with this type of coverage in our Farmers auto insurance review.

- Mitte Cultural District Art Transport Coverage: Farmers offers specialized insurance for vehicles transporting artwork to and from Brownsville’s Mitte Cultural District.

Cons

- Higher Premiums for Los Ebanos Neighborhood: Residents of Brownsville’s historic Los Ebanos neighborhood may face increased rates due to narrow streets and parking challenges.

- Limited Options for South Padre Island Commuters: Brownsville residents regularly commuting to South Padre Island may find Farmers’ coverage less tailored to their needs.

#8 – Liberty Mutual: Best for Unique Coverage

Pros

- Special Discounts: Brownsville residents can access special rate reductions. Learn more about how they offer these discounts in our Liberty Mutual auto insurance review.

- Brownsville Performing Arts Center Event Protection: Liberty Mutual provides specialized coverage for vehicles during events at this popular Brownsville venue.

- Jacob Brown Auditorium Conference Attendee Benefits: Visitors attending conferences at Brownsville’s Jacob Brown Auditorium can access short-term policy adjustments.

Cons

- Higher Rates for Southmost Neighborhood: Residents of Brownsville’s Southmost area may face increased premiums due to higher traffic density.

- Limited Options for Winter Texan Vehicles: Seasonal residents in Brownsville may find Liberty Mutual’s policies less flexible for their part-time vehicle use.

#9 – Travelers: Best for New Car

Pros

- Tour Vehicle Coverage: Offers specialized insurance for cars used in tours of Brownsville’s historical sites. Check our Travelers auto insurance review to learn how these policies work.

- UTRGV Brownsville Campus Rideshare Protection: Students using rideshare services around the University of Texas Rio Grande Valley campus receive tailored coverage.

- Brownsville Birding Festival Participant Benefits: Travelers provides unique auto insurance options for birdwatchers attending Brownsville’s annual Birding Festival.

Cons

- Higher Premiums for Olmito Area Residents: Brownsville residents in the Olmito area may face increased rates due to its semi-rural classification.

- No Special Rates for Brownsville Metro Bus Users: Unlike some insurers, Travelers doesn’t offer discounts for regular users of Brownsville’s public transportation system.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Bundling Discounts

Pros

- Independent School District Employee Benefits: American Family offers specialized auto insurance packages for employees of Brownsville’s largest school district.

- Beachgoer Protection: Brownsville residents frequently visiting beaches have customized auto policies, learn more in our American Family auto insurance review.

- Brownsville Latin Jazz Festival Participant Coverage: American Family provides specialized protection for vehicles involved in this annual Brownsville cultural event.

Cons

- Higher Rates for Downtown Brownsville Parking: Vehicles regularly parked in downtown Brownsville may face increased premiums due to higher risk assessments.

- Brownsville-Port Isabel Highway Commuters: Brownsville residents who frequently travel this busy corridor may find American Family’s policies less accommodating.

Main Factors Influencing Auto Insurance Rates in Brownsville, TX

Your car insurance provider considers factors like how much you drive and your city’s theft rates. Below’s the average rates for both minimum and full coverage from the top insurers in Brownsville.

Brownsville, Texas Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $95 | $145 | |

| $120 | $170 | |

| $105 | $155 | |

| $80 | $130 | |

| $110 | $160 |

| $100 | $150 |

| $85 | $135 | |

| $90 | $140 | |

| $115 | $165 | |

| $70 | $120 |

Brownsville, Texas has a commute time average of 18 minutes, which is less than the national average. Complete coverage rates may be lower given that 121 car thefts were reported in 2019. In addition, Brownsville experienced 12 hurricanes in 2019, making comprehensive coverage a wise decision.

Want to save some cash on auto insurance in Brownsville, Texas? If so, you’re in luck. There are several top-notch insurance providers in the area that offer a wide array of discounts designed to help you lower your premiums significantly.

Whether you're an experienced driver or a new car owner, discounts can greatly affect your overall insurance costs.Jeffrey Manola LICENSED INSURANCE AGENT

By exploring these options, you can find various ways to save money, whether it’s through safe driving records, bundled policies, or discounts for certain affiliations.

Auto Insurance Discounts From the Top Providers in Brownsville, Texas

| Insurance Company | Available Discounts |

|---|---|

| Multi-policy, Safe Driver, Anti-theft, Good Student, New Car, Early Signing, Full Payment, Responsible Payer | |

| Multi-policy, Multi-vehicle, Good Student, Safe Driver, Loyalty, Early Bird, Generational, Steer Into Savings, Low Mileage, Defensive Driving | |

| Multi-policy, Multi-vehicle, Safe Driver, Good Student, Senior Driver, Homeowner, Professional Group, Hybrid/Electric Vehicle | |

| Multi-policy, Multi-vehicle, Safe Driver, Good Student, Military, Anti-theft, Defensive Driving, Federal Employee, New Vehicle, Emergency Deployment | |

| Multi-policy, Multi-vehicle, Accident-free, Good Student, Newly Married, Newly Retired, Military, Early Shopper, Pay-in-full, Online Purchase |

| Multi-policy, SmartRide (usage-based), SmartMiles (pay-per-mile), Good Student, Defensive Driving, Accident-free, Affinity Member |

| Multi-policy, Multi-vehicle, Snapshot (usage-based), Safe Driver, Homeowner, Continuous Insurance, Good Student, Paperless Billing | |

| Multi-policy, Safe Driver, Good Student, Defensive Driving, Accident-free, Anti-theft, Multi-vehicle | |

| Multi-policy, Multi-vehicle, Hybrid/Electric Vehicle, Good Student, Safe Driver, New Car, Continuous Insurance, Early Quote, Homeowner | |

| Safe Driver, Multi-vehicle, Good Student, New Vehicle, Military, Loyalty, Defensive Driving, Annual Mileage |

Take advantage of these discounts to maximize your savings and secure the best coverage for your needs. Don’t miss out on potential savings with pay-in-full auto insurance discounts from your chosen provider.

Monthly Brownsville, TX Car Insurance Rates

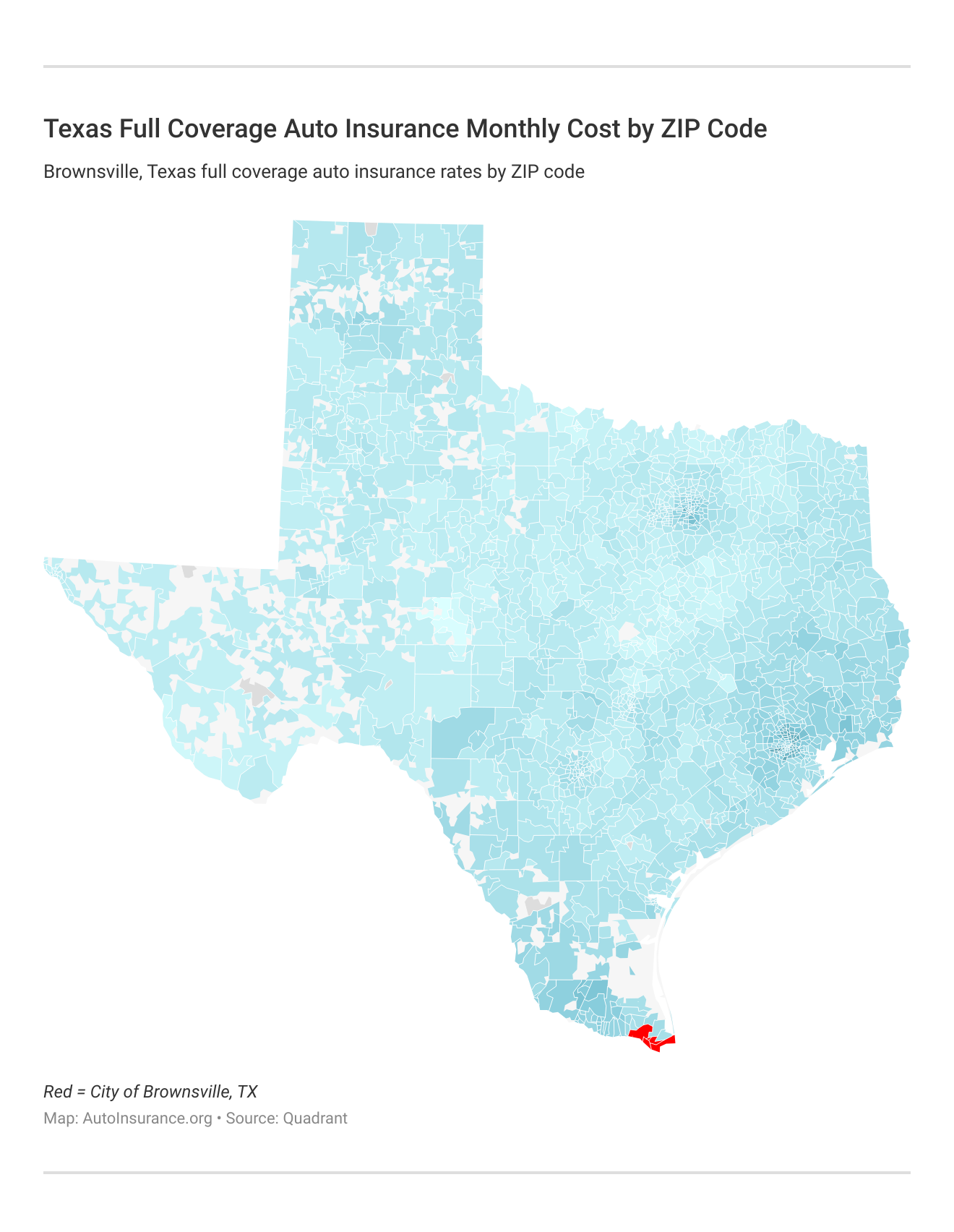

Check out the following list to see the monthly auto insurance rates for Brownsville, Texas, broken down by ZIP Code:

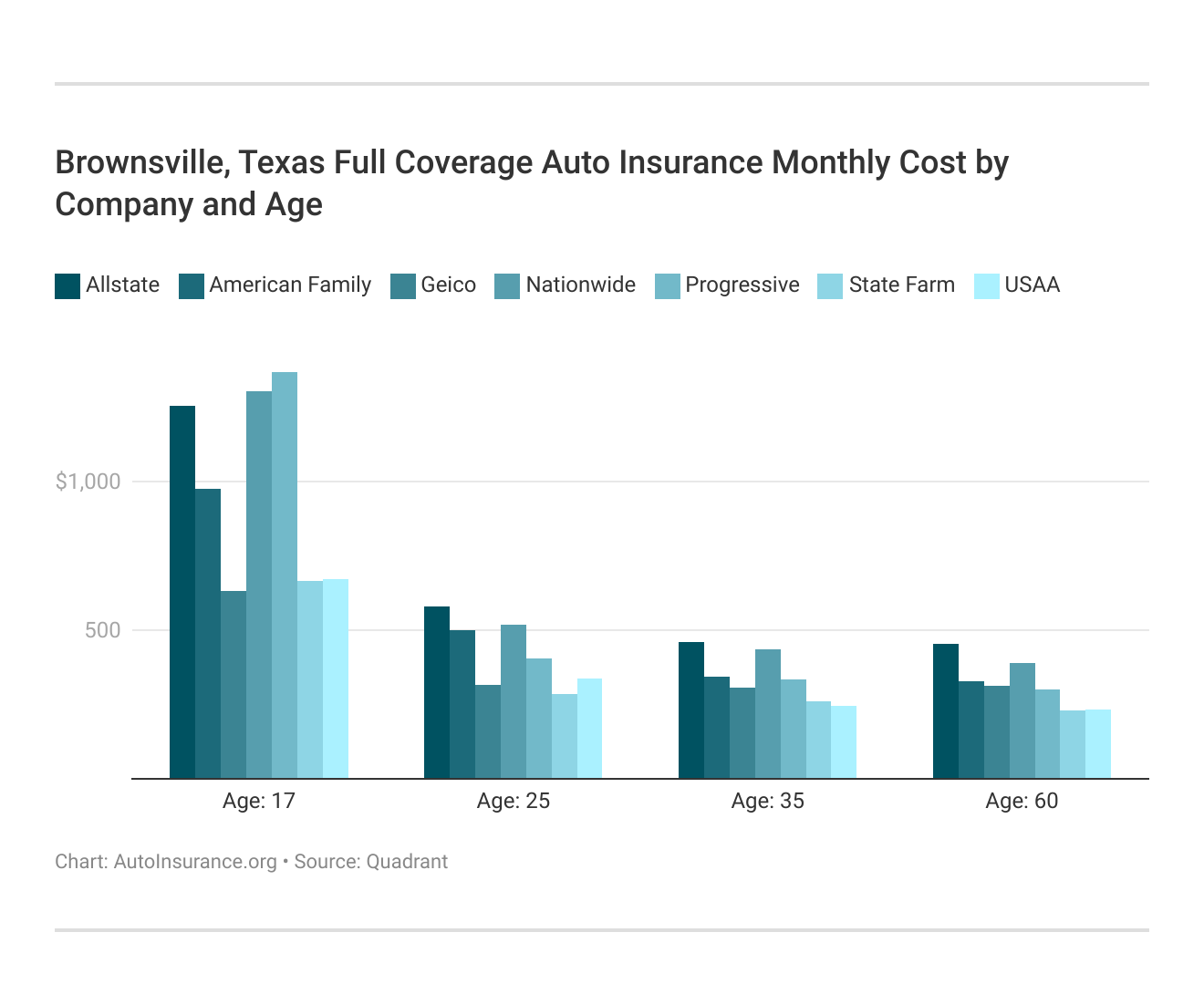

For more information, see auto insurance rates by ZIP code: what you need to know. Regarding pricing, there is a significant variation based on the age of the customer, as the top insurance provider for one age group might not be the best among others.

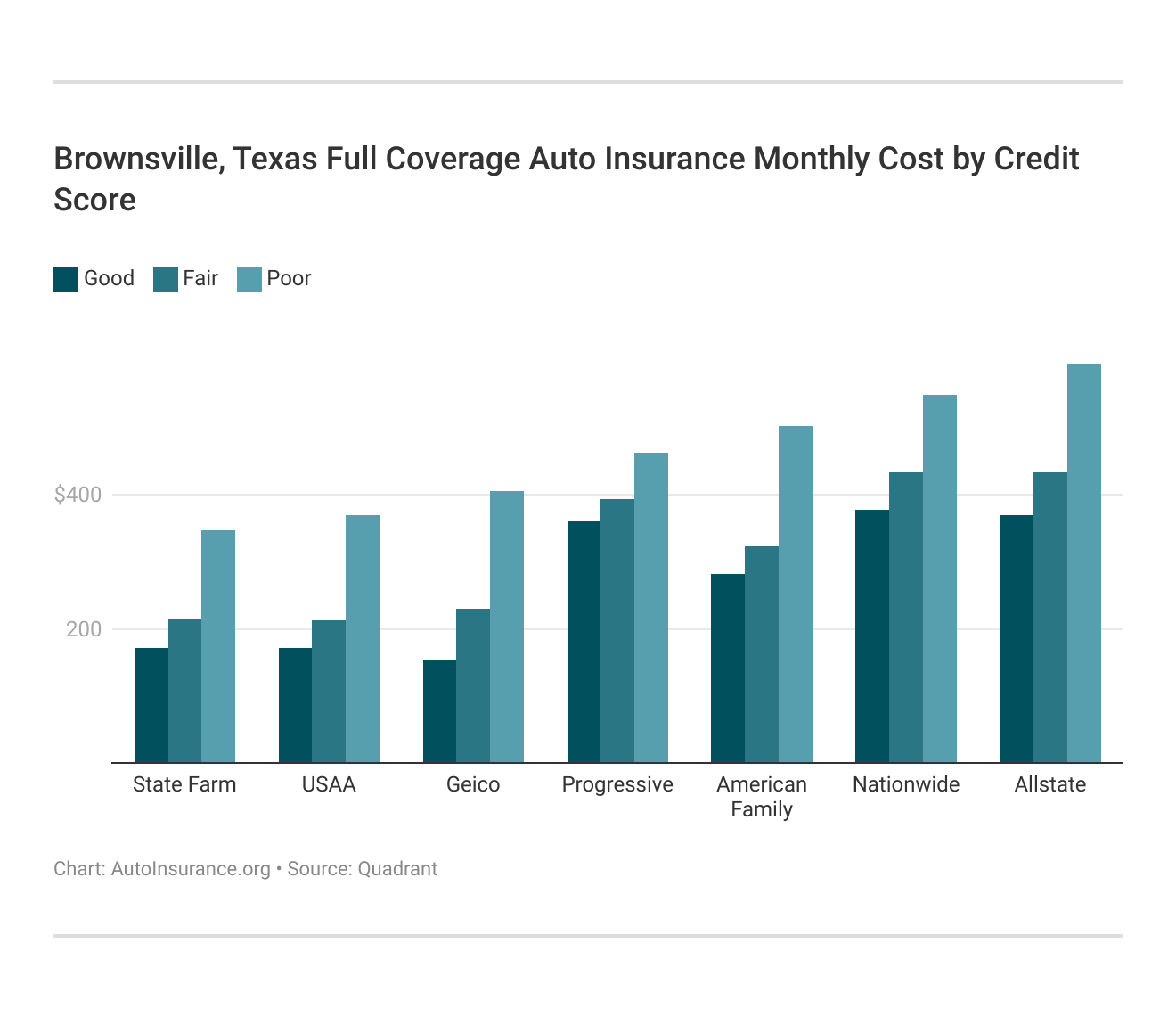

Unless you live in California, Hawaii, or Massachusetts, where credit discrimination is illegal, your Brownsville auto insurance rates will depend on your credit score. For more information on the impact of your credit score, see auto insurance and your credit score.

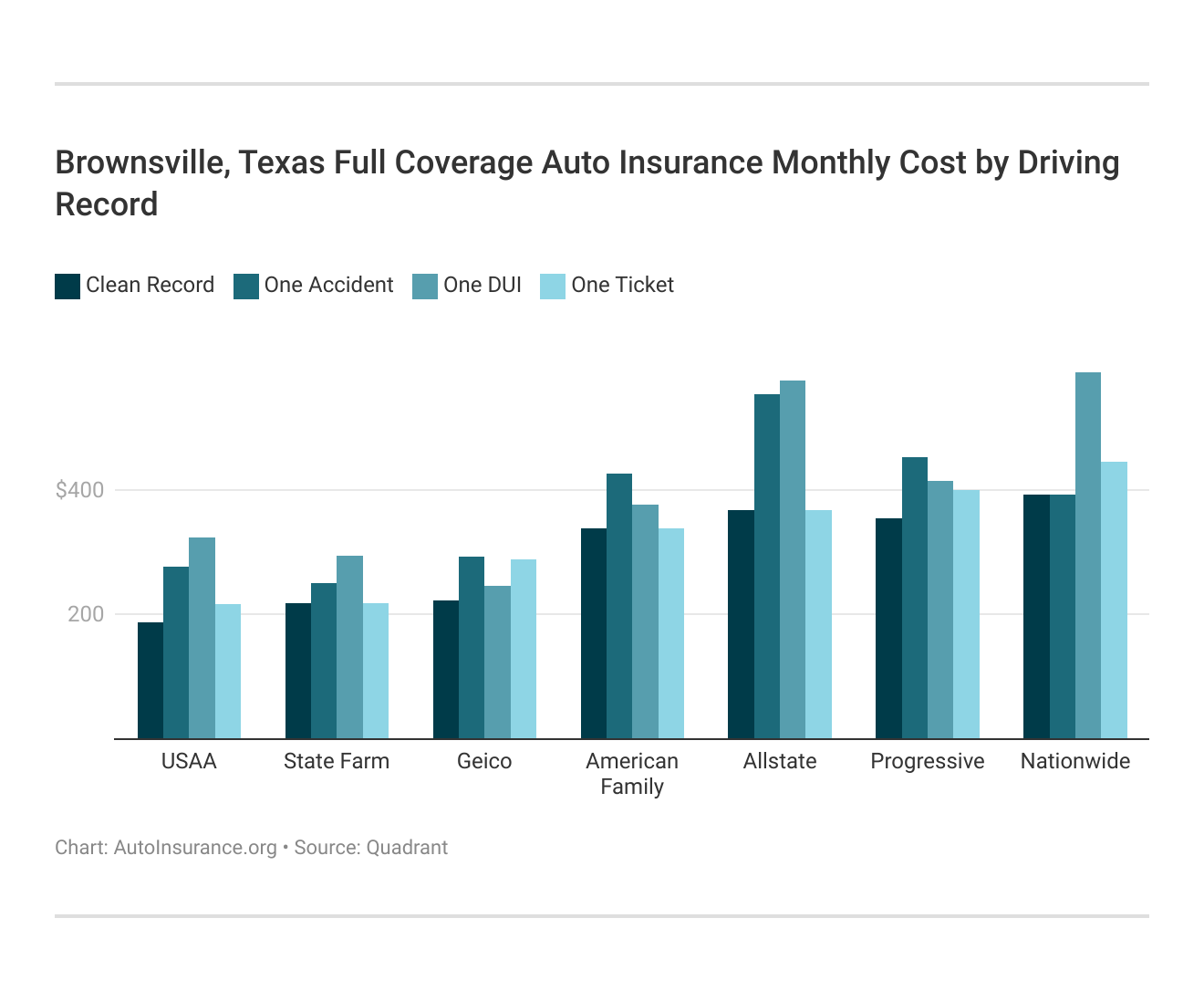

Driving record affects Brownsville auto insurance rates. Despite other factors, a Brownsville, Texas DUI may raise your auto insurance rates by 40–50%. See chart below:

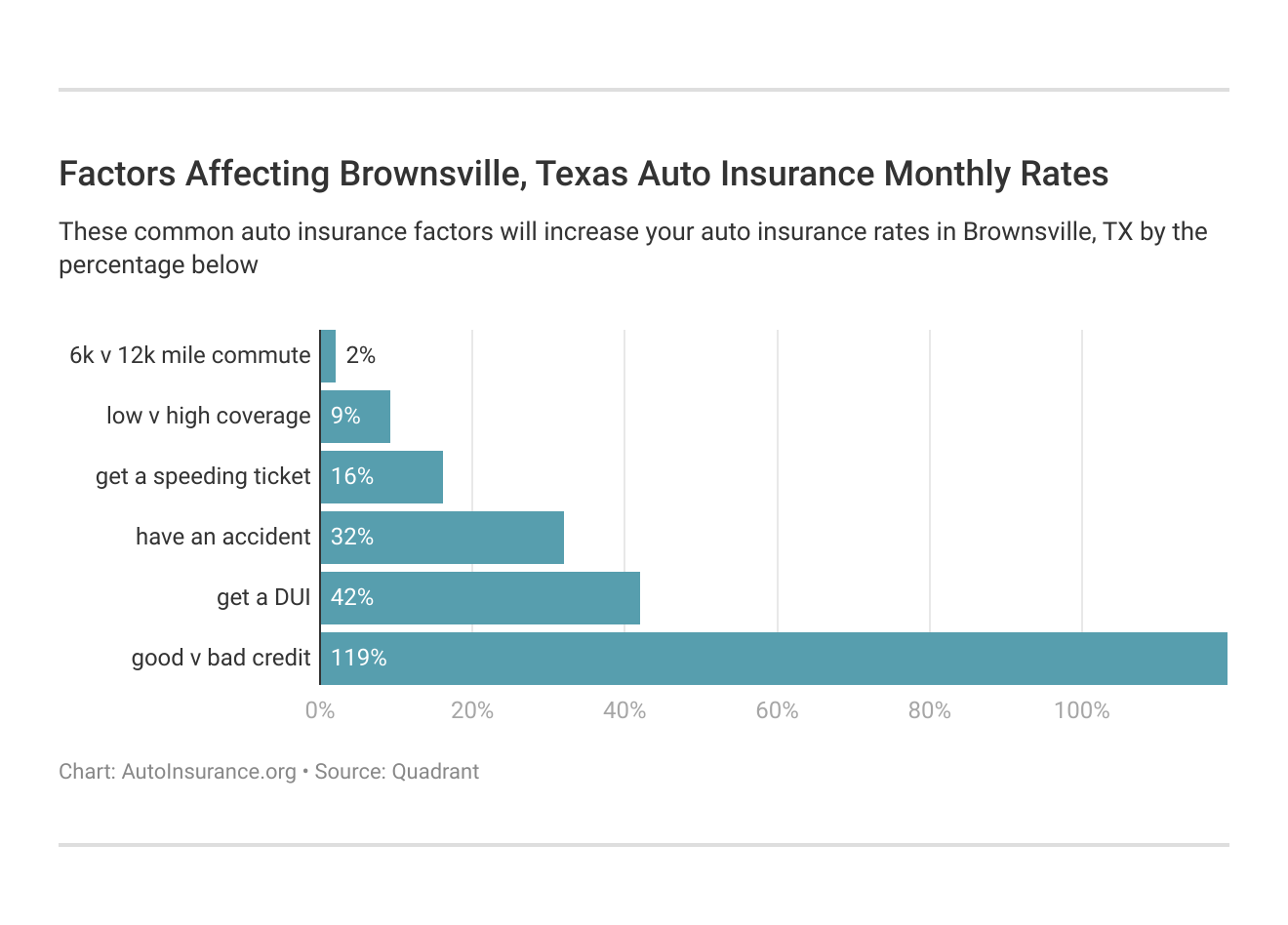

Factors affecting auto insurance rates in Brownsville, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Brownsville, Texas auto insurance.

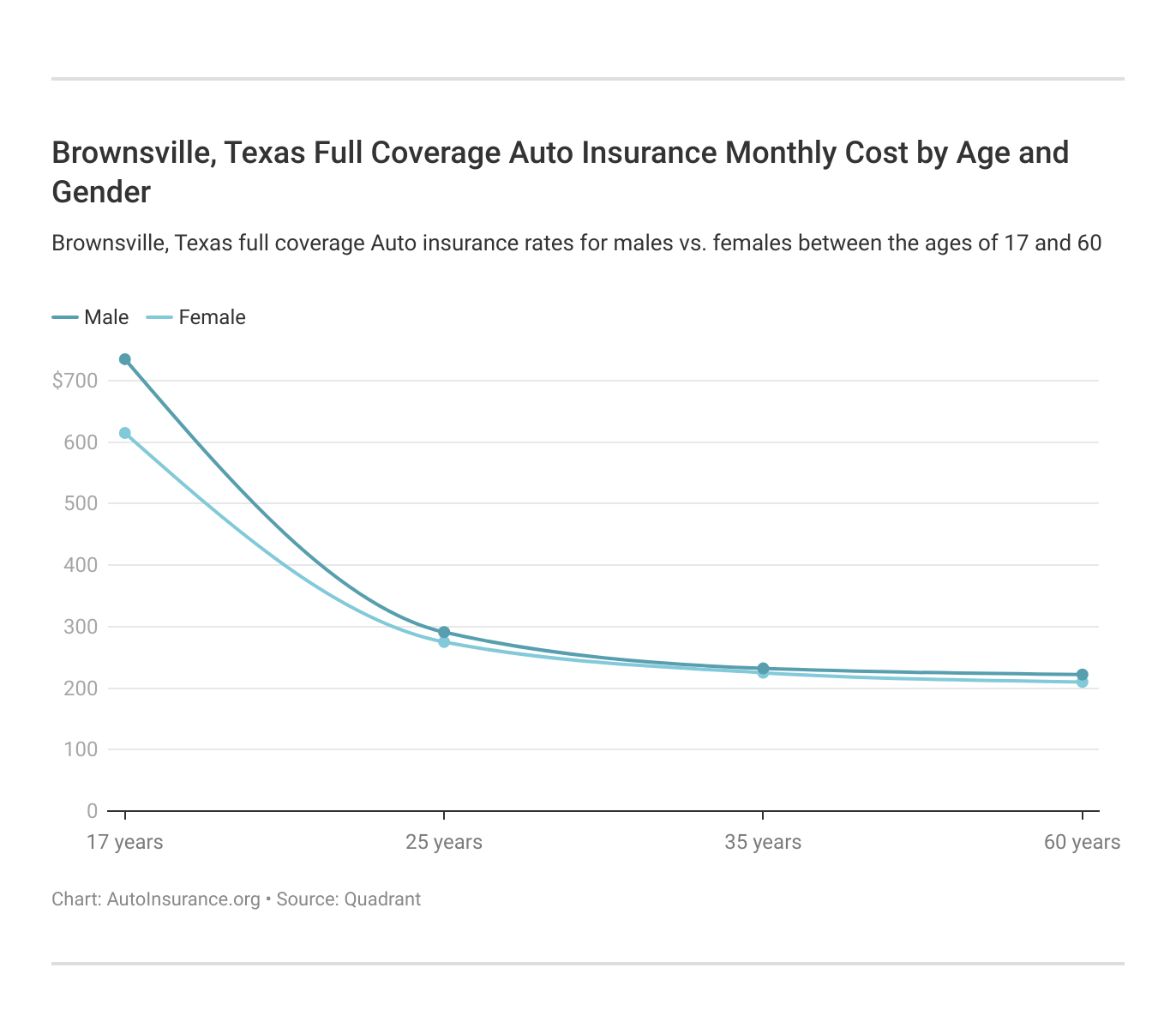

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk.

Texas does use gender, so check out the average monthly auto insurance rates by age and gender in Brownsville, TX. For more information, see male vs. female auto insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Legal Auto Insurance Requirements in Brownsville, TX

All Brownsville drivers have to meet the Texas state law minimum requirements for auto insurance. In Texas, you have to carry at least:

- $30,000 per person and $60,000 per incident for bodily injury liability (BIL) insurance

- $25,000 per incident for property damage

Texas is an at-fault state. How are at-fault accidents defined? At-fault means an at-fault driver must use their auto insurance policy to pay for the no-fault driver’s bodily injury and property damage from the collision.

Brownsville, TX auto insurance rates are higher than the national average. Numerous factors, such as traffic violations and accidents, as well as demographics, can affect this disparity and raise premiums. Auto insurance for young adults and teens can be much more expensive.

The easiest way to snag cheap auto insurance in Brownsville, TX is by finding discounts. If you don’t qualify for any, just keep looking until you find a policy that fits your budget. Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Frequently Asked Questions

Who has the cheapest car insurance in Texas?

In Texas, Geico is often recognized for offering some of the most affordable auto insurance rates, with policies starting as low as $90 per month in Brownsville. Comparing quotes from several insurance providers is important because location, driving history, and type of vehicle are factors that affect auto insurance rates.

What auto insurance coverage should I have in Texas?

In Texas, drivers are required to carry at least the state minimum liability coverage. This includes $30,000 per person for bodily injury, $60,000 per accident, and $25,000 for property damage. However, it’s recommended to consider additional coverage such as comprehensive, collision, and uninsured/underinsured motorist coverage for better protection.

What company has the best car insurance rate?

The best car insurance rate will depend on individual factors like your driving history, age, and location. However, Geico, USAA (for military families), and State Farm are consistently top providers offering competitive rates in Brownsville and across Texas.

How long does it take to get car insurance in Texas?

Getting car insurance in Texas can be a quick process. If you have all the necessary information ready, such as your driver’s license, vehicle details, and personal information. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Which car insurer is best?

The best car insurer for you will depend on your unique needs. Geico is generally recognized for its affordability, USAA for military members, and State Farm for local, personalized support. Each company has strengths in different areas, so it’s important to evaluate your specific requirements when choosing a provider.

How much is Texas car insurance?

In Brownsville, rates can start as low as $90 per month. However, the average cost for comprehensive auto insurance in Texas typically ranges between $120 to $150 per month, depending on your circumstances.

Why is car insurance so high in Texas?

Car insurance in Texas tends to be higher due to factors like severe weather conditions, high traffic accident rates, and a large number of uninsured drivers. Cities like Brownsville also face specific risks, such as hurricanes, which can drive up the cost of full coverage.

What city in Texas has the highest auto insurance rates?

Cities with higher accident rates, severe weather, and more uninsured drivers, such as Houston and Dallas, often have the highest auto insurance rates in Texas. Rates in these metropolitan areas tend to be significantly higher than the state average.

Read More:

What is the best insurance provider in Texas?

For Texas drivers, the best insurance providers often include Geico for low rates, USAA for military families, and State Farm for local agent support. These companies consistently rank high for customer satisfaction and coverage options across the state.

Can you go to jail for driving without insurance in Texas?

Yes, driving without insurance in Texas is illegal and can result in fines, license suspension, and even jail time for repeat offenders. Texas law requires all drivers to have at least the state minimum liability insurance to legally operate a vehicle.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.