Auto-Owners Auto Insurance Review in 2025 (See Plans & Prices Here!)

Our Auto-Owners auto insurance review shows lower rates starting at $31 monthly with many discounts and agent support. Evaluate Auto-Owner's auto insurance for personalized service and extensive protection options. Rates vary, but Auto-Owner's provides coverage in 26 states.

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Jun 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Auto-Owners Insurance

Monthly Rates

$31A.M. Best:

A++Complaint Level:

LowPros

- Usage-based savings program

- Strong financial stability rating

- Robust local agent support

Cons

- Higher rates for young drivers

- No direct online claims filing

Auto-Owners auto insurance review showcases the company’s commitment to providing tailored coverage through a network of local agents.

This insurer stands out with a range of policy options, including comprehensive, collision, and liability coverage, enhanced by discounts for safe driving and multiple policies.

Auto-Owners Auto Insurance Review Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.3 |

| Business Reviews | 4.5 |

| Claim Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 4.4 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 4.2 |

| Digital Experience | 5.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.5 |

| Policy Options | 3.8 |

| Savings Potential | 4.3 |

Additionally, Auto-Owners offers unique programs like TrueRide for usage-based savings and robust support for claims. Explore how their specific offerings can meet your unique insurance needs.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

- Auto-Owners auto insurance offers customizable coverage starting at $31/mo

- TrueRide enhances Auto-Owners auto insurance with usage-based savings

- Comprehensive policies cover roadside assistance and rental needs effectively

Auto-Owners Insurance Rates by Age and Gender

When reviewing Auto-Owners Auto Insurance, it’s safe to say that both age and gender impact monthly rates for insurance. For example, 16-year-old boys pay the highest premiums, with the highest range hitting $447 per month for some types of full coverage, while those aged 65 pay only $85 a month on average for the same coverage level.

Auto-Owners Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $166 | $427 |

| 16-Year-Old Male | $182 | $447 |

| 18-Year-Old Female | $135 | $315 |

| 18-Year-Old Male | $156 | $364 |

| 25-Year-Old Female | $40 | $105 |

| 25-Year-Old Male | $42 | $111 |

| 30-Year-Old Female | $37 | $98 |

| 30-Year-Old Male | $39 | $103 |

| 45-Year-Old Female | $34 | $89 |

| 45-Year-Old Male | $33 | $87 |

| 60-Year-Old Female | $31 | $79 |

| 60-Year-Old Male | $32 | $81 |

| 65-Year-Old Female | $33 | $87 |

| 65-Year-Old Male | $33 | $85 |

As drivers age, their rates tend to decline, as seen in their fall from $447 at 16 to $81 at 60. This holds true for both genders, with 60-year-old ladies paying a fraction less, with their average full cover bill coming in at $79 per month, among the lowest rates of any of their male equivalents.

When it comes to auto insurance rates by age, younger drivers often face higher premiums. This is because insurers see them as higher risk because of their inexperience behind the wheel. As these drivers age and rack up more driving experience, though, their rates tend to go down, making the transition to lower-risk age brackets.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Your Guide to Understanding Auto-Owners Competitive Insurance Rates

Auto-Owners offers competitive rates when it comes to credit score impacts, with its rates being particularly advantageous for those with good and fair credit scores. At $85 for good credit and up to $140 for poor credit, it positions itself as a more affordable option compared to companies like Liberty Mutual and The Hartford, which peak at $150 for poor credit scores.

Auto-Owners Auto Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $90 | $115 | $145 | |

| $85 | $110 | $140 | |

| $89 | $113 | $143 | |

| $88 | $112 | $142 | |

| $95 | $120 | $150 |

| $92 | $116 | $146 |

| $87 | $111 | $141 | |

| $86 | $108 | $138 | |

| $91 | $115 | $145 |

| $80 | $100 | $130 |

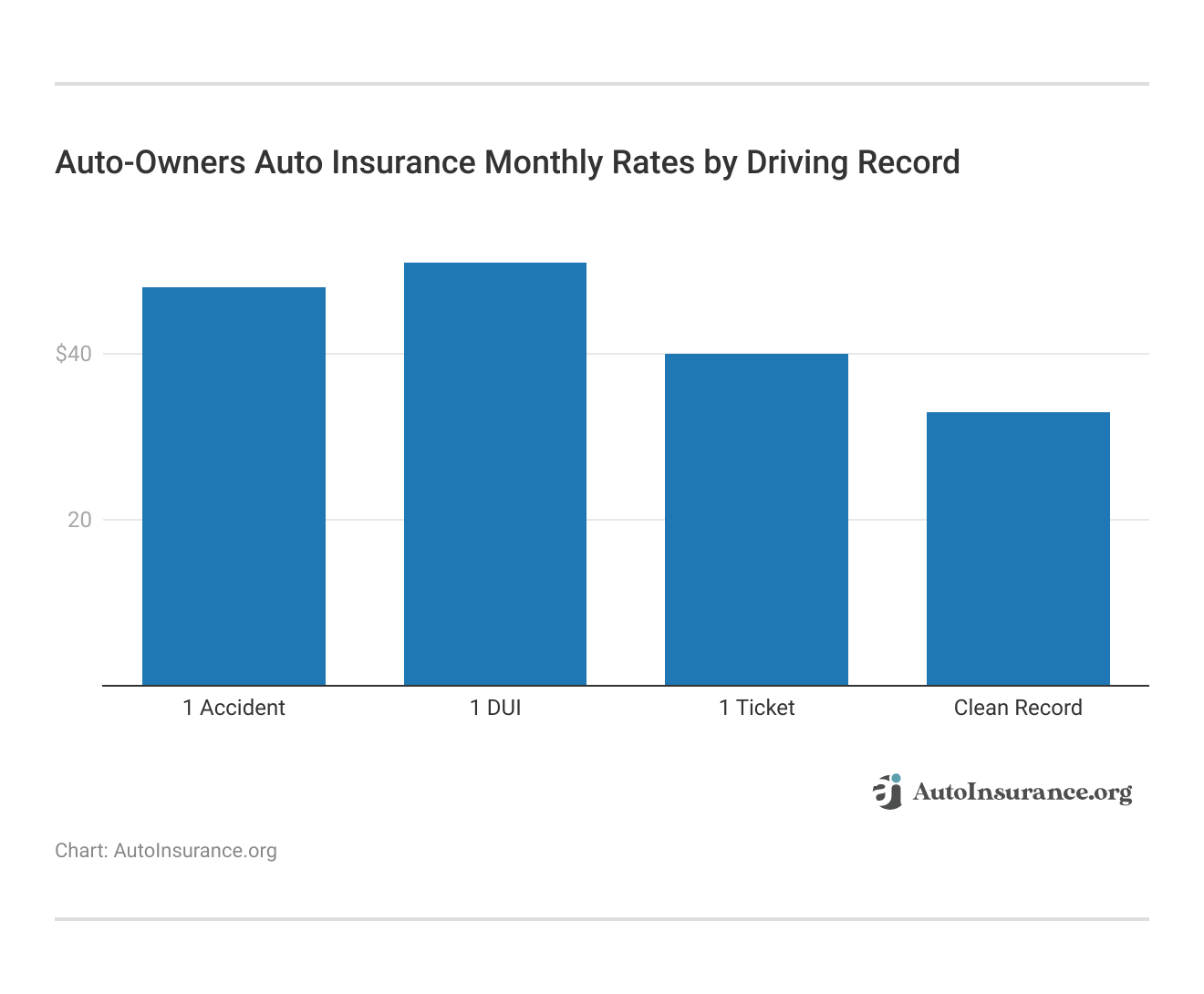

Auto-Owners show consistency in pricing for drivers with infractions such as accidents or DUIs, suggesting a more lenient pricing structure compared to the industry, which often significantly hikes rates for such driving records.

Auto-Owners offer competitive full coverage rates, even for those with driving infractions on their record. If you’ve seen your premiums rise after past driving errors, this strategy may be especially helpful. It’s a reminder of how factors like credit scores affect auto insurance rates, influencing what you pay based on your financial history as well as your driving record.

Auto-Owners Insurance: Affordable Quality Coverage

Auto-Owners offers affordable auto insurance rates compared to industry heavyweights. Auto-Owners sells both minimum and full coverage options as cheap auto insurance, with $60 and $120 auto insurance prices, respectively.

Auto-Owners Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $70 | $135 | |

| $60 | $120 | |

| $68 | $138 | |

| $65 | $130 | |

| $75 | $145 |

| $72 | $140 |

| $63 | $128 | |

| $64 | $125 | |

| $70 | $140 |

| $55 | $110 |

For instance, it undercuts Liberty Mutual and The Hartford, whose full coverage rates climb to $145 and remain cheaper than Nationwide and Farmers. With this pricing, Auto-Owners is a strong contender for consumers on a budget, and it demonstrates its intention of providing value while not skimping on how much is covered.

To file a claim with Auto-Owners, contact your local agent or call their 24/7 claims service, and for the best coverage, consider bundling policies and adding optional protections like roadside assistance or rental car reimbursement to fit your driving needs.Jeff Root Licensed Insurance Agent

This is the best balance of price and quality coverage if you’re looking to get solid insurance without needing to pay more than you need to. Particularly when you consider the average auto insurance cost per month, their offerings stand out in the market for delivering value.

Auto-Owners Insurance Discount Overview

Auto-Owners offers a variety of auto insurance discounts that make it affordable to a broader array of drivers. For instance, their Safe Driver discount is their highest discount at 15% off, which they offer to customers with a clean driving record. A 12% discount is offered to military personnel as a way to recognize their contribution and help mitigate expenses.

Auto-Owners Auto Insurance Discounts

| Discount Name | |

|---|---|

| Safe Driver | 15% |

| Military | 12% |

| Bundling | 11% |

| Multi-Policy | 10% |

| Pay-in-Full | 9% |

| Good Student | 8% |

| New Car | 8% |

| Low Mileage | 7% |

| Defensive Driving Course | 6% |

| Anti-Theft Device | 5% |

The company also encourages policy bundling with discounts of up to 11%, and additional savings are available through their multi-policy discount of 10%. Budget-conscious consumers will appreciate the 9% savings from paying their premium in full. Moreover, students and new car owners can enjoy 8% off their premiums, promoting both academic achievement and new vehicle purchases.

Drivers who maintain low mileage or take defensive driving classes qualify for discounts of 7% and 6%, respectively, and installing anti-theft devices also contributes a 5% discount. Auto-Owners discounts range from customer loyalty rewards to safe-driving incentives, making its premium rates competitive in the insurance market and its policies more cost-effective for a variety of needs and lifestyles.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto-Owners Auto Insurance Coverage Options

Auto-Owners policies offer all the typical car insurance coverages. Car insurance coverages offered by Auto-Owners include:

- Liability: Liability auto insurance pays for bodily injuries and property damage to others.

- Collision: Collision auto insurance covers damages to your vehicle from an accident.

- Comprehensive: Comprehensive auto insurance pays for damages to your car unrelated to an accident, like fire, theft, and acts of nature.

- Uninsured/Underinsured Motorist: Uninsured Motorist Coverage (UIM) auto insurance pays for damages if the at-fault driver has little or no insurance.

- Medical Payments: Medical payment coverage pays for medical costs, such as doctor bills and prescriptions, after an accident.

- Personal Injury Protection: Personal injury protection insurance pays for related expenses after an accident, such as lost wages and child care.

When you’re looking into types of auto insurance coverage, it’s clear that sticking with just the basic liability coverage your state requires might not be enough. For more comprehensive protection, consider adding options that cover more than just the other guy’s car.

This can give you, your passengers, and your vehicle better security on the road. Each added coverage can play a big role in how well you bounce back from an accident, financially and otherwise.

What You Should Know About Auto-Owners Insurance Group

Auto-Owners Insurance Company has affordable auto insurance rates for drivers in 26 states. The company also offers drivers multiple insurance options and numerous auto insurance discounts. As a result, many drivers may find the company meets all their insurance needs. However, Auto-Owners requires you to use a local agent for most needs.

After a minor accident, Auto-Owners’ accident forgiveness kept my rates from increasing, proving the value of optional coverage—if you drive often, adding accident forgiveness and rental car reimbursement can save you money and hassle in the long run.Aremu Adams Adebisi Feature Writer

While you can pay your bill online or through the app, your agent must give you quotes and help with any insurance needs, like a policy change or filing a claim. Our Auto-Owners insurance review finds that the insurer is a good fit for drivers who like face-to-face service and need multiple insurance products, such as auto and homeowners coverage. However, the company isn’t a good fit for drivers who want to do everything online.

Auto-Owners Insurance: Excellence in Customer Satisfaction and Financial Stability

Auto-Owners Insurance earns high marks for customer service and solid coverage options, clearly focusing on customer satisfaction and financial strength. Add in ratings from J.D. Power indicating above-average customer satisfaction and an A++ from AM Best highlighting superior financial health, and Auto-Owners emerges as the clear standout in the insurance field.

Auto-Owners Auto Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 692 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 80/100 Positive Customer Feedback |

|

| Score: 0.75 Fewer Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength |

Additionally, customer rating sites such as Consumer Says show positive testimonials, in contrast to a discussion on social media sites such as Reddit, where consumers say they are satisfied with the carrier’s claims process (high marked prices) and offer high marks on the process even as prices might be marked slightly higher.

Auto-Owners is known for its animation service and full coverage. Their user-friendly auto insurance apps and a simplified process for managing policies and submitting claims., enhance this reputation among their client.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Auto-Owners Auto Insurance

Auto-Owners auto insurance really stands out for its variety of coverage options and personalized service, catering to auto insurance for different types of drivers. Whether you’re a seasoned commuter or a weekend road tripper, they tailor policies to meet individual needs effectively.

- Strong independent agent network for in-person support

- Wide range of coverage, including classic and modified cars

- Multiple discounts, including bundling and safe driver savings

While Auto-Owners offers solid benefits, there are some downsides to consider.

- No online quotes or digital claims filing

- Only available in 26 states

Auto-Owners provides reliable coverage and strong customer service through its agent network, but the lack of online convenience and limited availability may not work for all drivers.

Auto-Owners Auto Insurance: Comprehensive and Specialized Coverage

Auto-Owners Auto Insurance provides an array of specialized coverages in addition to standard auto insurance. Auto-Owners roadside assistance covers emergencies like jump-starts, fuel delivery, and towing. Glass and windshield repair and replacement are fully covered under its glass coverage option. Gap insurance covers the difference between a vehicle’s depreciated value and the balance still owed.

Additional expense coverage reimburses Auto-Owners for rental car coverage, lodging, and fuel if their vehicle is damaged during a trip. Diminished value insurance compensates for the loss in car value post-accident. The Personal Automobile Plus package offers specific protections, including identity theft and lock rekeying, and accident forgiveness ensures that premiums do not increase after your first at-fault accident.

For car enthusiasts, there is tailored insurance for classic and modified vehicles, ensuring specialized needs are met. Beyond auto coverage, Auto-Owners also offers insurance for homeowners, renters, condos, and life, alongside policies for motorcycles, boats, RVs, and businesses. Its homeowner’s insurance provides extensive protection for property damage and personal liability.

Life insurance options include whole, universal, and term policies, with potential discounts for bundling multiple policies. Additionally, Auto-Owners offers annuities and disability income, serving as a comprehensive provider for both insurance and financial products.

Why Auto-Owners Insurance Deserves Your Attention

There are relatively few online transactions available at Auto-Owners, but this approach works well if you prefer in-person dealings. A name you can rely on financially, Auto-Owners also receives high ratings for its stability from A.M. Best and receives few complaints from customers, underscoring its reliable claims processing. For best value, quality, and personal service, Auto-Owners shine among auto insurance companies.

Despite its limited online transaction capabilities, this approach benefits those who value direct interaction. Auto-Owners also has financial strength, earning top-of-the-line ratings from A.M. Best and low complaint ratios, which can indicate good performance on claims. Auto-Owners Insurance is the right fit for anyone looking for quality, affordability, and personalization.

Use our free comparison tool to see what auto insurance quotes look like in your area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Who owns Auto-Owners insurance?

Auto-Owners Insurance is a mutual insurance company, which means it is owned by its policyholders rather than shareholders, emphasizing customer focus and service.

What is the 24-hour phone number for Auto-Owners Insurance?

The 24-hour phone number for Auto-Owners Insurance claims is 1-888-252-4626, and policyholders can report claims at any time of day.

How can I get an Auto-Owners auto insurance quote?

To get an Auto-Owners auto insurance quote, reach out to a local independent agent. Since Auto-Owners doesn’t offer online quotes, you can use the Agency Locator tool on their website to find an agent close to you. This is a practical step to evaluate auto insurance quotes effectively.

What do reviews say about Auto-Owners business insurance?

Auto-Owners business insurance reviews often highlight the company’s strong customer service and comprehensive coverage options, making it a preferred choice for business owners seeking reliable insurance solutions.

How does Auto-Owners compare to State Farm in terms of services and pricing?

Auto-Owners and State Farm each offer a large selection of insurance products alongside high levels of customer service. Auto-Owners tend to have a more personalized service approach through local agents, while State Farm may offer more digital tools and possibly better rates for some drivers. Comparison shopping is recommended.

What is the phone number for the Auto-Owners claims department?

You can file an auto insurance claim with Auto-Owners by calling their claims department at 1-888-252-4626, available 24 hours a day to report claims whenever you need.

How do I log in to my Auto-Owners Insurance account?

You can log in to your Auto-Owners Insurance account by visiting their website and accessing the Customer Center from the main menu, where you can manage your policy, make payments, and view your insurance card.

What is the overall Auto-Owners Insurance rating?

Auto-Owners Insurance has consistently received high ratings for financial stability and customer satisfaction, including an A++ (Superior) rating from A.M. Best.

Are Auto-Owners home insurance reviews positive?

Reviews often highlight Auto-Owners for its comprehensive coverage and outstanding customer service in home insurance, although they sometimes mention higher prices than other insurers. This makes Auto-Owners a notable choice among companies for bundling home and auto insurance.

What does the A.M. Best rating for Auto-Owners Insurance indicate?

The A.M. Best rating of A++ (Superior) for Auto-Owners Insurance indicates a superior ability to meet ongoing insurance obligations, reflecting the company’s strong financial stability.

How does Auto-Owners Insurance handle windshield replacement?

Auto-Owners Insurance covers windshield replacement under its comprehensive coverage. Policyholders with this coverage can have their windshield replaced with little to no out-of-pocket cost, depending on their deductible.

In which states is Auto-Owners Insurance available?

Auto-Owners Insurance meets the minimum auto insurance requirements by state in 26 states, such as Alabama, Arizona, Arkansas, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, North Carolina, North Dakota, Ohio, Pennsylvania, South Carolina, South Dakota, Tennessee, Utah, Virginia, and Wisconsin.

What are the features of an Auto-Owners policy?

An Auto-Owners policy can include a variety of coverages such as liability, collision, comprehensive, uninsured/underinsured motorist protection, personal injury protection, and additional options like roadside assistance and rental car coverage.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

How can I contact Auto-Owners Insurance customer service?

Auto-Owners Insurance customer service can be contacted by calling their main customer service number at 1-800-346-0346.

Does Auto-Owners Insurance offer towing services?

Yes, Auto-Owners Insurance offers towing services as part of their roadside assistance coverage, which helps drivers with emergencies such as breakdowns, flat tires, or dead batteries.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

helthscreen

Poor service

Vic_the_man

Good Enough

ellenamcd2

Well done Auto Owners Insurance

josechepe2001

Great policies and great road assistance

jessman1128

We love Auto Owners Insurance!

64061

Try auto owners.

VSchmitt

Good company from longtime customer

pallam

Great policy for all our family needs

Tricia987654

Easy to love

db404

Agent mistakenly did not put comp on my oldest vehicle.