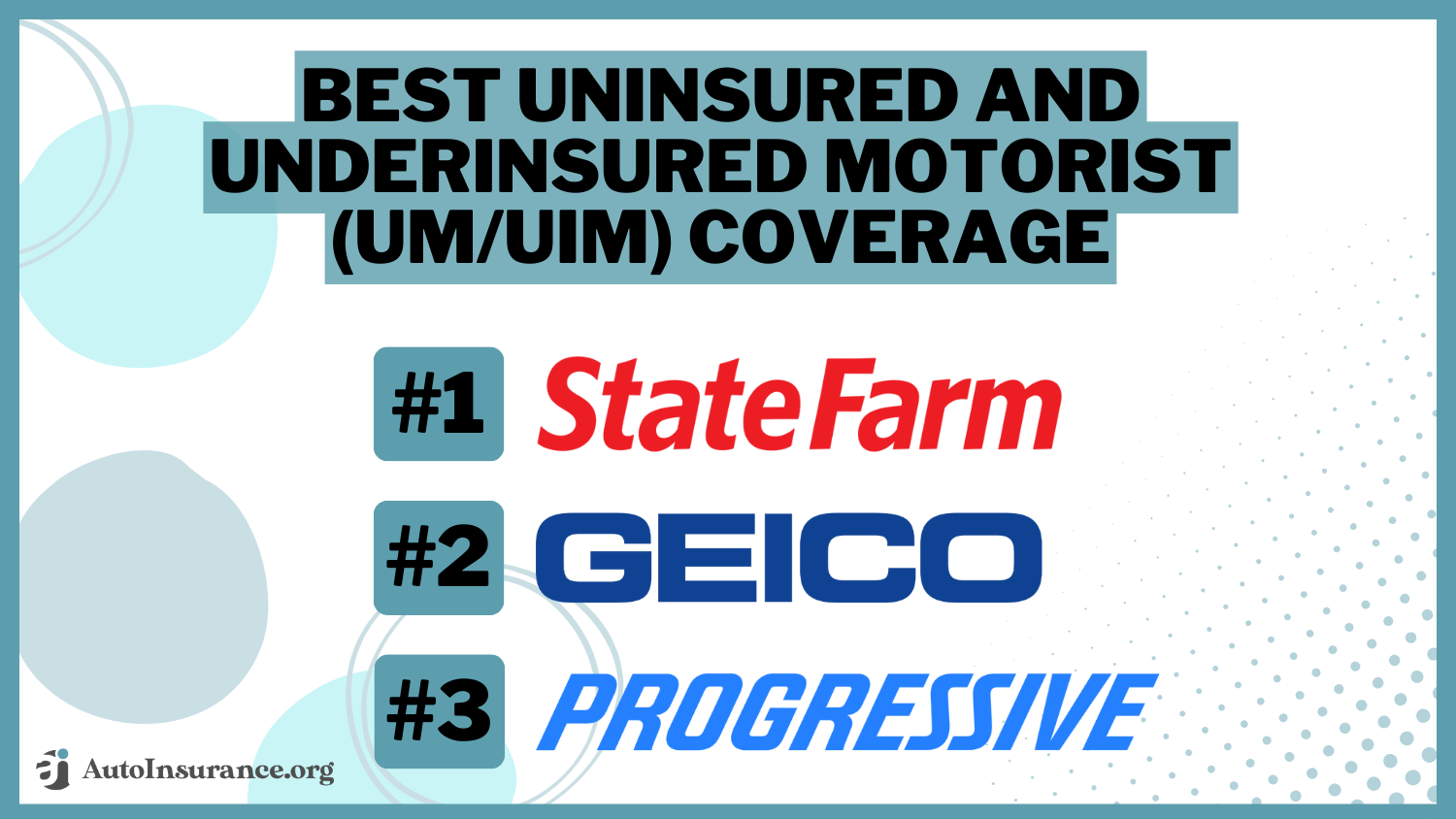

Best Uninsured and Underinsured Motorist (UM/UIM) Coverage in 2024 (Top 9 Companies)

The best uninsured and underinsured motorist coverage comes from State Farm, Geico, and Progressive. At an average price of $30 per month, uninsured motorist insurance costs are usually affordable. Find affordable UM/UIM coverage by shopping at the best companies, enrolling in UBI programs, and finding discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 14, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 14, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17,754 reviews

17,754 reviewsCompany Facts

Avg. Monthly Rate for UM/UIM

A.M. Best Rating

Complaint Level

Pros & Cons

17,754 reviews

17,754 reviews 19,116 reviews

19,116 reviewsCompany Facts

Avg. Monthly Rate for UM/UIM

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,126 reviews

13,126 reviewsCompany Facts

Avg. Monthly Rate for UM/UIM

A.M. Best Rating

Complaint Level

Pros & Cons

13,126 reviews

13,126 reviewsState Farm, Geico, and Progressive have the best uninsured and underinsured motorist coverage because they offer low rates and quick claims resolution.

UM/UIM insurance is required by law in some states, but there are plenty of reasons why to buy more auto insurance than the minimum requirements. UM/UIM insurance can save you thousands of dollars if you’re hit by a driver without enough coverage.

| Company | Rank | A.M. Best | UBI Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 30% | Personalized Policies | State Farm | |

| #2 | A++ | 25% | Low Rates | Geico | |

| #3 | A+ | 30% | Discount Options | Progressive | |

| #4 | A+ | 40% | UBI Savings | Allstate | |

| #5 | A++ | 30% | Military Families | USAA | |

| #6 | A+ | 40% | Vanishing Deductible | Nationwide |

| #7 | A | 30% | Add-on Coverages | Farmers | |

| #8 | A | 30% | Young Drivers | Liberty Mutual |

| #9 | A++ | 30% | Safe Drivers | Travelers |

Read on to learn more about uninsured motorist coverage and how to get the right plan for your car. Then, compare rates in our free tool to find the most affordable plan.

- State Farm, Geico, and Progressive offer the best UM/UIM coverage

- Uninsured/underinsured motorist coverage protects you from drivers without coverage

- Uninsured motorist insurance costs an average of $30 per month

#1 – State Farm: Top Pick Overall

Pros

- Extensive coverage options: State Farm offers a lot more than uninsured motorist insurance. You can also add things like rental car reimbursement and rideshare insurance to your policy.

- Local agents: It’s easy to get personalized, face-to-face help because State Farm has a huge network of local agents.

- Affordable rates: While it’s not always the cheapest option, State Farm usually offers affordable rates.

- Ample discounts: State Farm offers 13 discounts and a usage-based insurance program to help drivers save. Explore State Farm’s discount options in our State Farm auto insurance review.

Cons

- Limited online tools: With a focus on working with local agents, State Farm doesn’t always impress customers looking to purchase and manage policies online.

- Some drivers see higher rates: Although State Farm usually offers affordable insurance, you’ll likely find better prices elsewhere if your credit score is low.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Federal employee discounts: Geico offers an impressive 16 discounts to help drivers save, particularly if you work for the government. Geico has special savings for federal and other government employees.

- Competitive rates: Geico often tops the list of affordable insurance providers, no matter which state you live in. Compare Geico’s rates with other top providers in our Geico auto insurance review.

- Online tools: It’s easy to get a quote, sign up for a policy, and manage your plan with Geico’s convenient online tools.

Cons

- Mixed reviews: It might be one of the largest providers in the country, but that doesn’t mean Geico is without complaints. Many customers report being unsatisfied with Geico’s claims service.

- Higher rates for high-risk drivers: Geico’s rates are less competitive for drivers with speeding tickets, at-fault accidents, or DUIs on their record.

#3 – Progressive: Best for Discount Options

Pros

- Automatic discounts: Many of Progressive’s 13 discounts automatically apply to your account when you become eligible.

- Name Your Price tool: Progressive makes it easy to stick to a budget. Simply enter how much you want to spend on coverage per month into the Name Your Price tool, and Progressive will give you coverage options to match.

- Snapshot: Enroll in Progressive UBI program, Snapshot, to save on your insurance. See if Snapshot is right for you in our Progressive Snapshot review.

Cons

- Low customer loyalty: Despite being an affordable provider, Progressive struggles to retain customers. Learn more about Progressive’s customer ratings in our Progressive auto insurance review.

- Rates can increase: You’ll almost always see your rates increase after events like traffic violations and at-fault accidents, but many Progressive drivers report large increases for seemingly no reason.

#4 – Allstate: Best for UBI Savings

Pros

- Drivewise and Milewise: Allstate offers two UBI programs: Drivewise and Milewise. Read our Drivewise review to see how this traditional telematics program can help you save. If you’re a low-mileage driver, check out our Allstate Milewise review. Either of these UBI programs can help you save on Allstate underinsured motorist coverage.

- Extensive network of local agents: Allstate has one of the largest networks of local agents, meaning you’ll always be able to get personalized help.

- Full coverage options: Purchasing extra coverage like uninsured motorist insurance is easy at Allstate because it offers a variety of customization options. Explore Allstate’s add-on options in our Allstate auto insurance review.

Cons

- Higher rates: Allstate offers excellent uninsured motorist insurance coverage, but you’ll pay higher rates. Regardless of where you live, Allstate is almost always one of the pricier insurance options.

- More complaints: While it has plenty of satisfied customers, Allstate also receives a fair number of complaints. Most complaints revolve around Allstate’s claims resolution and customer service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Military discounts: As a company focused on providing service to military families, USAA has special savings for servicemembers. Learn more about USAA car insurance discounts in our USAA auto insurance review.

- Low rates: USAA consistently offers the cheapest car insurance rates, regardless of where you live and what type of driver you are.

- Financial services: USAA offers more than just auto insurance. Members can enjoy USAA’s financial services, including banking, loans, and retirement planning.

Cons

- No gap insurance: If you want to protect yourself from paying on an upside-down loan, you need gap insurance. Unfortunately, USAA does not sell this coverage.

- Eligibility requirements: Drivers need to be USAA members to purchase coverage. Only active and retired military members and their direct families are eligible for membership.

#6 – Nationwide: Best for Deductible Savings

Pros

- Vanishing Deductible: Earn $100 off your deductible for every year you spend claims-free with Nationwide’s Vanishing Deductible program, up to $500.

- Bundling discounts: Nationwide sells a variety of insurance products. Purchasing multiple policies like auto and homeowners insurance can earn you a bundling discount.

- Coverage options: Nationwide offers plenty of add-ons to customize your policy, including gap insurance and pet injury coverage. Learn more about your coverage options in our Nationwide auto insurance review.

Cons

- Limited availability: Despite being one of the largest insurance companies in the U.S., Nationwide sells coverage in 47 states.

- Rates can be high: Nationwide is rarely the cheapest option for insurance, but many customers feel the price is worth the quality.

#7 – Farmers: Best for Add-on Coverages

Pros

- Add-on availability: There are plenty of ways to customize your Farmers policy with add-on options like original equipment coverage and rideshare insurance.

- Discount options: Farmers has one of the best auto insurance discount selections. Explore all 23 ways to save in our Farmers auto insurance review.

- Highly-rated mobile app: Manage your policy and start claims with Farmers’ highly-rated mobile app.

Cons

- No new Florida policies: Residents of the Sunshine State will need to find coverage elsewhere as Farmers no longer sells new policies in Florida.

- Slow roadside assistance: Farmers offers an affordable roadside assistance plan, but many customers complain about how long it takes to get help.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Young Drivers

Pros

- Excellent coverage choices: While adding more coverage to your policy increases your rates, Liberty Mutual has excellent add-ons. Popular choices include better car replacement coverage and gap insurance.

- Young driver discounts: Although it’s not usually the cheapest option, Liberty Mutual can be affordable for young drivers, thanks to its discounts for youths. Learn more about these discounts in our Liberty Mutual auto insurance review.

- Online insurance options: Liberty Mutual makes it easy to get quotes, purchase policies, manage your plan, and start claims through its website or mobile app.

Cons

- Low claims satisfaction: Liberty Mutual struggles with its claims satisfaction ratings, with customers citing slow response times.

- Limited agents: Liberty Mutual’s network of local agents is smaller than many of its competitors, meaning drivers looking for face-to-face help will have a harder time finding it.

#9 – Travelers: Best for Safe Driving Discounts

Pros

- Unique coverage options: Travelers offers a great selection of add-ons, including new car replacement, rental coverage, and accident forgiveness.

- IntelliDrive: Save up to 30% on your insurance by signing up for Tavelers’ UBI program, IntelliDrive.

- Solid financial strength: With a superior A++ from A.M. Best, you don’t have to worry about your claims going unpaid with Travelers.

Cons

- Average rates: Travelers isn’t usually the most expensive option for insurance, but it’s also not the cheapest.

- Limited coverage availability: Travelers is only available in 42 states. To see if your state qualifies for Travelers coverage, read our Travelers auto insurance review.

Understanding Uninsured and Underinsured Motorist Coverage

Uninsured motorist coverage pays for medical bills and vehicle damage if you’re in an accident with a driver who doesn’t have liability auto insurance or if you’re involved in a hit-and-run and don’t know the person who hit you.

Uninsured/underinsured motorist insurance works similarly to comprehensive coverage, but it only covers you if someone else hits you. UM/UIM insurance is also typically cheaper than comprehensive.Travis Thompson Licensed Insurance Agent

Take a look at the table below to see the top states for uninsured motorists.

| State | Percent of Uninsured Motorists |

|---|---|

| Alabama | 18% |

| Alaska | 15% |

| Arizona | 12% |

| Arkansas | 17% |

| California | 15% |

| Colorado | 13% |

| Connecticut | 9% |

| Delaware | 11% |

| District of Columbia | 16% |

| Florida | 27% |

| Georgia | 12% |

| Hawaii | 11% |

| Idaho | 8% |

| Illinois | 14% |

| Indiana | 17% |

| Iowa | 9% |

| Kansas | 7% |

| Kentucky | 12% |

| Louisiana | 13% |

| Maine | 5% |

| Maryland | 12% |

| Massachusetts | 6% |

| Michigan | 20% |

| Minnesota | 12% |

| Mississippi | 24% |

| Missouri | 14% |

| Montana | 10% |

| Nebraska | 7% |

| Nevada | 11% |

| New Hampshire | 10% |

| New Jersey | 15% |

| New Mexico | 21% |

| New York | 6% |

| North Carolina | 7% |

| North Dakota | 7% |

| Ohio | 12% |

| Oklahoma | 11% |

| Oregon | 13% |

| Pennsylvania | 8% |

| Rhode Island | 15% |

| South Carolina | 9% |

| South Dakota | 8% |

| Tennessee | 20% |

| Texas | 14% |

| Utah | 8% |

| Vermont | 7% |

| Virginia | 10% |

| Washington | 17% |

| West Virginia | 10% |

| Wisconsin | 14% |

| Wyoming | 8% |

Uninsured motorist coverage pays for:

- Medical bills

- Lost wages

- Pain and suffering compensation

- Funeral expenses

- Car damage in certain states

Many states require all drivers to carry uninsured motorist coverage, which insurers often bundle with underinsured motorist insurance. Underinsured motorist insurance is similar to uninsured motorists. It will cover you in these situations when the driver has insurance but not enough to cover the damage they caused fully.

For example, suppose your medical bills total $30,000, and the driver who hit you has only $15,000 in bodily injury insurance coverage. In that case, an underinsured motorist policy will kick in and cover the remaining costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Uninsured and Underinsured Motorist Coverage Costs

Although some policy options can get pricy quickly, uninsured motorist coverage costs are usually affordable. Check below to see how much our best uninsured and underinsured motorist coverage companies charge.

| Insurance Company | Uninsured Motorist | Underinsured Motorist |

|---|---|---|

| State Farm | $35 | $40 |

| Geico | $30 | $35 |

| Progressive | $40 | $45 |

| Allstate | $45 | $50 |

| USAA | $25 | $30 |

| Nationwide | $35 | $40 |

| Farmers | $40 | $45 |

| Liberty Mutual | $45 | $50 |

| Travelers | $35 | $40 |

As you can see, the best uninsured/underinsured motorist coverage can be very affordable. You can also lower your rates by finding discounts and enrolling in a usage-based car insurance program.

Uninsured Motorist vs. Underinsured Motorist Coverage

Every insurance company has its own policies regarding uninsured motorist coverage.

Here are the four types of coverage often grouped together under uninsured motorist insurance:

- Uninsured motorist bodily injury (UM): UM covers you when you’re in an accident, and the driver at fault doesn’t have any car insurance.

- Uninsured motorist property damage (UMPD): UMPD covers damage to your vehicle if someone without insurance hits it. Many states require this insurance type.

- Underinsured motorist bodily injury (UIM): UIM covers you when another driver with inadequate insurance hits you and doesn’t carry enough liability insurance to cover your medical bills, lost wages, etc.

- Underinsured motorist property damage (UIMPD): UIMPD covers damage to your vehicle in the same situation.

By adding all of these coverages to your policy, you are better protected if a driver with inadequate auto insurance hits you.

Uninsured and Underinsured Motorist Coverage Requirements

The minimum auto insurance required in each state varies. If your state requires uninsured motorist coverage, you must purchase the minimum amount to drive legally. Usually, these amounts are the same as your liability coverage.

Every state has different requirements for how much coverage drivers need.

Uninsured Motorist Coverage Limits

Uninsured motorist coverage usually gets expressed as two numbers, such as 100/300.

This means that if you get into an accident, you are covered for the following amounts:

- $100,000 bodily injury coverage per person

- $300,000 bodily injury coverage per accident

If you have this 100/300 policy and two passengers are injured in an accident caused by someone else, your maximum payout is $300,000. If this still isn’t enough to cover expenses, your health insurance will usually kick in to help.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

State Laws for Uninsured and Uninsured Motorist Coverage

As mentioned above, many states require drivers to have uninsured motorist coverage in addition to liability insurance.

Check below to see if uninsured motorist coverage is required in your state.

If you live in a state that requires it, your insurance agent will help you to adjust your car insurance so you are properly covered.

Determining Whether Uninsured Motorist Coverage Is Necessary

If your state doesn’t require you to have uninsured motorist coverage, it is still a smart move to add it to your insurance policy. There are a few things to consider when deciding if it’s right for you.

Consider Whether Health Insurance Covers Bodily Injuries

Some health insurance plans will cover drivers and passengers who have sustained injuries from a car accident. You might not need bodily injury coverage if you have a good health insurance plan. However, it’s worth it most of the time.

Uninsured motorist covers more than just medical bills, such as lost wages and money for pain and suffering. Do you need medical payment coverage on auto insurance? Health insurance doesn’t usually cover these expenses. However, if you have a high-deductible health insurance policy, getting uninsured motorist coverage could be worth it.

Consider Whether My Current Auto Insurance Policy Covers Vehicle Damage

Collision insurance often covers damage to your car when another driver hits you. Collision insurance covers the majority of car accidents, not only those involving uninsured drivers.

So if you have collision insurance, you may not need to add uninsured motorists.

Check if Your State Has Many Uninsured Drivers

According to recent studies by the Insurance Research Council, approximately one in eight drivers is uninsured, though this varies a lot by state.

Mississippi has the highest rate of uninsured drivers at almost 30%, while New Jersey only has 3% of uninsured drivers on the road. Finding cheap car insurance in New Jersey can be hard, as the monthly minimum liability costs are higher.

Hit-And-Run Accidents May Not Be Covered by Uninsured Motorist Insurance

Depending on your state, uninsured motorist insurance may or may not cover damages if you’re the victim of a hit-and-run accident. A hit-and-run car accident is where the at-fault driver leaves the scene without exchanging contact information or insurance.

This can happen between two vehicles when a vehicle hits a piece of property and if a vehicle hits a pedestrian.

The following states don’t allow UMPD coverage for hit-and-run accidents:

- California

- Colorado

- Georgia

- Illinois

- Louisiana

- Ohio

In these states, you must add collision insurance to protect your vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding the Payout from an Uninsured Motorist Claim

Uninsured motorist claims work a little differently than collision insurance or a comprehensive claim for auto insurance. The UM amount you can claim gets reduced by the money you get from the other driver’s liability insurance.

Here is a step-by-step example:

- Let’s say you have $100,000 of UM coverage, and you only receive $50,000 from the at-fault driver’s liability insurance — but your medical bills are $300,000.

- Your UM coverage will likely pay $50,000 ($100,000 minus $50,000 from the at-fault driver), meaning you’re still responsible for $200,000 in medical bills.

- Most people won’t get the full UM payout of $100,000 plus the driver’s liability coverage of $50,000.

- In this situation, you might only receive $100,000 from insurance instead of the $150,000 you expected.

Some states, like Connecticut, don’t allow insurers to deduct the payout based on the at-fault driver’s insurance amount. So using the example above, you would get $150,000 in insurance instead of $100,000.

Other states, like Georgia, offer drivers a choice to add UM coverage to at-fault liability limits. There are many options for cheap car insurance in Georgia.

How to File an Uninsured Motorist Coverage Claim

You should immediately contact your insurance company to file a claim if you get hit by another driver who doesn’t have any or enough car insurance.

If you get rear-ended by a driver who doesn’t have adequate insurance, you’ll need to file an uninsured motorist claim with your own insurance company. Similarly, if you’re a pedestrian hit by a driver without proper insurance, you must also file a claim with your insurer — plus the driver’s insurance.

Here are the 10 safest states for pedestrians in the U.S. Living in one of these areas could decrease your risk of filing a claim as a pedestrian.

Another common situation where you would need to file a UMPB claim is if your vehicle is parked and you discover it has been hit or damaged but have no idea who caused it. You would file a claim under your UMPD coverage in this hit-and-run scenario. If you don’t have this coverage, you can also file a claim under your collision insurance.

Understanding Underinsured Motorist Coverage

Underinsured motorist coverage fills the gaps in the other driver’s liability insurance if you’re hit by someone who does not carry large enough insurance limits.

Suppose not all of your medical and property damage needs are covered by the at-fault driver’s insurance policy.

In that case, you can file a claim through your underinsured motorist coverage to avoid out-of-pocket expenses.

Technically, there are two types of underinsured motorist coverage, bodily injury, and property damage.

Bodily injury applies to your medical needs, while property damage applies to your vehicle.

UIM insurance claims cover hospital bills, medical care expenses, lost wages, and replacement services associated with an accident with an underinsured driver.

When does underinsured motorist coverage apply to you? Anytime you’re not at fault for causing an accident, and the other driver doesn’t carry enough liability coverage to pay for your damages.

So what is the difference between underinsured motorist coverage and uninsured motorist coverage?

The two policies are very similar, but uninsured motorist coverage costs a little more because it protects you against drivers with no insurance whatsoever.

According to the Insurance Information Institute (III), up to 13% of drivers do not carry insurance or one and eight people on the roads.

If you’re a victim of a hit-and-run, meaning the driver leaves the scene without exchanging information, some states allow you to use uninsured motorist coverage to pay for those damages.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to File an Uninsured/Underinsured Motorist Coverage Claim

How does underinsured motorist coverage work when you need to file a claim? Fortunately, the process is as simple as traditional insurance claims.

After an accident occurs with a driver carrying insubstantial insurance limits, report it to your own insurance provider in detail. Take photos of the scene if possible. Also, file a police report.

Afterward, wait for the adjuster to investigate your claim and present you with your underinsured motorist coverage settlement.

At this point, it’s crucial you understand the potential payout from an underinsured motorist claim.

In some states, the amount of liability insurance the other driver provides is subtracted from your UIM limits, so you might not get back as much as you assume. So check your local laws for more details.

Finally, accept the payment if you believe it’s fair. Usually, you’ll receive a reimbursement check in the mail from your provider. Filing an uninsured motorist claim works the same way.

Alternative Coverage Options to Uninsured and Underinsured Motorist Insurance

Other insurance options that offer similar safeguards to uninsured and underinsured motorist coverage include personal injury protection (PIP) and collision coverage.

PIP insurance is not available in every state but is usually required in no-fault states. It covers your medical costs after an accident regardless of fault. Medical payments coverage (MedPay) is similar to PIP but is not quite as broad.

In no-fault states with larger PIP limits, or if you carry MedPay, adding underinsured motorist coverage could be unnecessary.

Collision insurance protects your vehicle and property in your car if you’re involved in an accident while in motion. So if an underinsured driver hits you, you can rely on this coverage to replace your damaged property.

So for some drivers who invest in collision insurance, adding underinsured motorist property damage protection may be redundant.

There’s usually a deductible associated with both collision and underinsured motorist coverage that you must pay for out of pocket.

So if UIM insurance is not required in your state, you invest in MedPay or PIP insurance and purchase collision coverage, then you don’t need underinsured motorist coverage.

But underinsured motorist protection typically costs much less than MedPay, PIP, and collision policies.

Plus, if you invest in more than one coverage type, you can sometimes use them in tandem to avoid out-of-pocket expenses.

So the truth about uninsured motorist coverage and underinsured motorist coverage is that, for those who can afford it, it’s worth adding to your policy.

The Bottom Line: Best Uninsured and Underinsured Motorist Coverage

Even if uninsured motorist insurance isn’t a requirement in your state, it’s still worth considering. One in eight drivers takes to the road without adequate car insurance. If you get hit by one of these drivers, you may have serious out-of-pocket medical expenses.

Uninsured motorist coverage helps pay for these expenses caused by another driver. Generally, the cost of uninsured motorist coverage is low, and adding it could save you lots of money.

Talk to your insurance representative to ensure you have full protection against uninsured drivers. An insurance agent can also tell you if the law requires uninsured motorist coverage.

Underinsured motorist coverage is a wise investment and saves you from paying out of pocket after an accident with another driver who is not following the law.

The companies that offer the cheapest average underinsured motorist coverage rates are Geico, State Farm, and USAA.

But, fortunately, UIM policies are usually very affordable through most providers.

Now that you know how to buy uninsured and underinsured motorist coverage auto insurance, compare quotes and find the best coverage for you by entering your ZIP code into our free rate tool below.

Frequently Asked Questions

What does uninsured motorist insurance cover?

Uninsured motorist coverage kicks in if you are hit by someone who doesn’t have auto insurance. It pays for medical bills, lost wages, pain and suffering, funeral expenses, and car damage in certain states.

What is the difference between uninsured and underinsured motorist coverage?

Uninsured motorist coverage pays for expenses caused by someone who doesn’t have any auto insurance. Underinsured motorist coverage pays for expenses when someone else’s insurance isn’t enough to cover everything.

What if I’m hit by someone and I don’t have UM coverage?

If you’re hit by someone without insurance and you also don’t have UM coverage, you can take legal action and sue the at-fault driver. You would need to hire a lawyer and consider if the time and cost would be worth it.

Do I need uninsured motorist coverage if I have health insurance?

If your state requires it, you will have to have uninsured motorist insurance no matter what. However, if your state doesn’t, you might not need it if you have adequate health insurance. Keep in mind that uninsured motorist coverage won’t cover you for lost wages or pain and suffering.

Do I need uninsured motorist coverage if I have collision and comprehensive coverage?

If you don’t have uninsured motorist coverage, collision and comprehensive coverage will kick in to pay for repairs to your vehicle, but it won’t cover medical expenses or lost wages.

Should I buy uninsured motorist property damage coverage?

If your state doesn’t require uninsured motorist property damage (UMPD) coverage, you can protect your vehicle by having collision insurance. You don’t need both because collision coverage pays for damages to your vehicle no matter who is at fault.

However, UMPD only pays for certain situations. Speak with your insurance representative to compare the cost of UMPD with collision insurance.

Can I stack uninsured motorist coverage with my health insurance?

Generally, you can’t stack uninsured motorist coverage with your health insurance. However, choosing the right uninsured motorist coverage is still important.

Does uninsured motorist coverage have any limitations or exclusions?

Uninsured motorist coverage may have limitations or exclusions in certain states, so speak with your insurance company to learn more.

Is UM coverage required in Texas?

While Texas requires that auto insurance companies offer UM coverage, drivers can choose to refuse coverage in writing.

What does uninsured motorist coverage cover in Florida?

UM coverage in FL covers property damage, medical costs, lost wages, and wrongful death.

What is the difference between stacked and unstacked uninsured motorist coverage?

Stacked UM coverage combines coverage over multiple policies, while unstacked UM only covers the policy it’s on.

Do I need uninsured motorist coverage in Oklahoma?

Uninsured motorist coverage isn’t required in Oklahoma, but it’s still a good idea. Since around 13% of OK drivers don’t have auto insurance, add UM coverage to be better protected.

What is underinsured motorist (UIM) coverage?

Underinsured motorist (UIM) coverage is an optional add-on to auto insurance policies that protects if you’re involved in an accident with a driver who has inadequate insurance coverage to pay for your damages.

Why is underinsured motorist (UIM) coverage important?

UIM coverage is important because it helps protect you financially in case you’re involved in an accident with an underinsured driver. It can cover medical expenses, lost wages, and other damages that exceed the limits of the at-fault driver’s insurance.

What factors should I consider when selecting an auto insurance company for underinsured motorist (UIM) coverage?

When choosing an auto insurance company for UIM coverage, consider the following factors:

- Coverage limits: Ensure the company offers sufficient coverage limits to meet your needs.

- Reputation: Look for companies with a good reputation for customer service and claims handling.

- Cost: Compare premiums across different insurers to find the most affordable option for the coverage you need.

- Financial stability: Check the company’s financial strength ratings to ensure they can fulfill their obligations in case of a claim.

What are the advantages and disadvantages of underinsured motorist (UIM) coverage?

Pros:

- Financial protection: UIM coverage provides an additional layer of financial protection in case you’re involved in an accident with an underinsured driver.

- Peace of mind: Having UIM coverage gives you peace of mind knowing that you’re protected from potential financial burdens resulting from an accident.

- Broad coverage: UIM coverage can help cover medical expenses, lost wages, pain and suffering, and other damages beyond what the at-fault driver’s insurance may cover.

Cons:

- Additional cost: UIM coverage is an optional add-on to your auto insurance policy, so it will increase your premiums.

- Coverage limits: The amount of coverage available through UIM may vary depending on the insurer and the policy. Make sure to review the limits to ensure they meet your needs.

- Not required by law: UIM coverage is not mandatory in all states, so it’s up to you to decide if the added cost is worth the protection it provides.

Can I purchase underinsured motorist (UIM) coverage if I have a minimum coverage auto insurance policy?

In most cases, you can purchase underinsured motorist (UIM) coverage as an add-on to your minimum coverage auto insurance policy. However, availability and specific terms may vary depending on your insurance provider and state regulations. Consult with your insurance company to understand your options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.