Progressive Snapshot Review (2025)

Progressive Snapshot monitors driving habits like speed, phone usage, and time of day with its mobile app or plug-in device. Drivers can earn a Progressive Snapshot discount of up to 20% if they drive well. Read on to learn how the Snapshot program works and how it can lead to cheaper rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jun 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

How does Snapshot work? Progressive Snapshot is a usage-based auto insurance program that monitors driving behaviors with a device or mobile app and offers a discount of up to 20%, depending on how well you drive.

Does Progressive Snapshot raise your rates? Yes, if the Progressive Snapshot device detects poor driving, the company may increase your auto insurance rates. So, the Progressive Snapshot program may not be for everyone.

Read our review to compare the Progressive Snapshot insurance discount vs. other usage-based insurance programs, learn how the Progressive Snapshot program works, and determine if you can get cheap auto insurance with the program.

- Drivers get a 5% enrollment discount and up to 15% more with Snapshot

- Progressive Snapshot monitors hard braking, nighttime driving, and phone usage

- Your rates could go up if you score badly in the Progressive Snapshot program

Understanding the Progressive Snapshot Program

While many factors affect auto insurance rates, your driving record is one of the most significant. Typically, car insurance companies look at your driving record to determine whether you’re a safe or risky driver and calculate rates accordingly.

However, telematics programs like Snapshot from Progressive allow insurers to use real-time driving to determine if you’re likely to cost them money. So, even if you have infractions on your driving record, you can still earn an auto insurance discount if your driving has improved.

Snapshot allows drivers to save money on Progressive auto insurance. Safe drivers earn a discount, but the discount amount depends on your driving.

So, does Snapshot increase rates? Yes, Progressive Snapshot can increase rate for a driver who scores poorly. The company reports it raises rates on about 20% of participants.

Drivers earn a 5% Progressive Snapshot discount for enrolling in the program and can earn up to a 15% discount for safe driving. The length of the discount depends on your state. Some drivers may receive a discount for their policy’s life, but others may have to monitor driving repeatedly.

Progressive allows drivers to choose either app-based monitoring or a plug-in device. However, the Snapshot app records additional information and uses your phone’s battery and data.

Snapshot isn’t available everywhere. For example, the program isn’t available in California, and other states don’t allow drivers to receive a participation discount. For example, New York doesn’t allow sign-up discounts, and drivers must repeat monitoring every three years if they opt for the device.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How the Progressive Snapshot Program Works

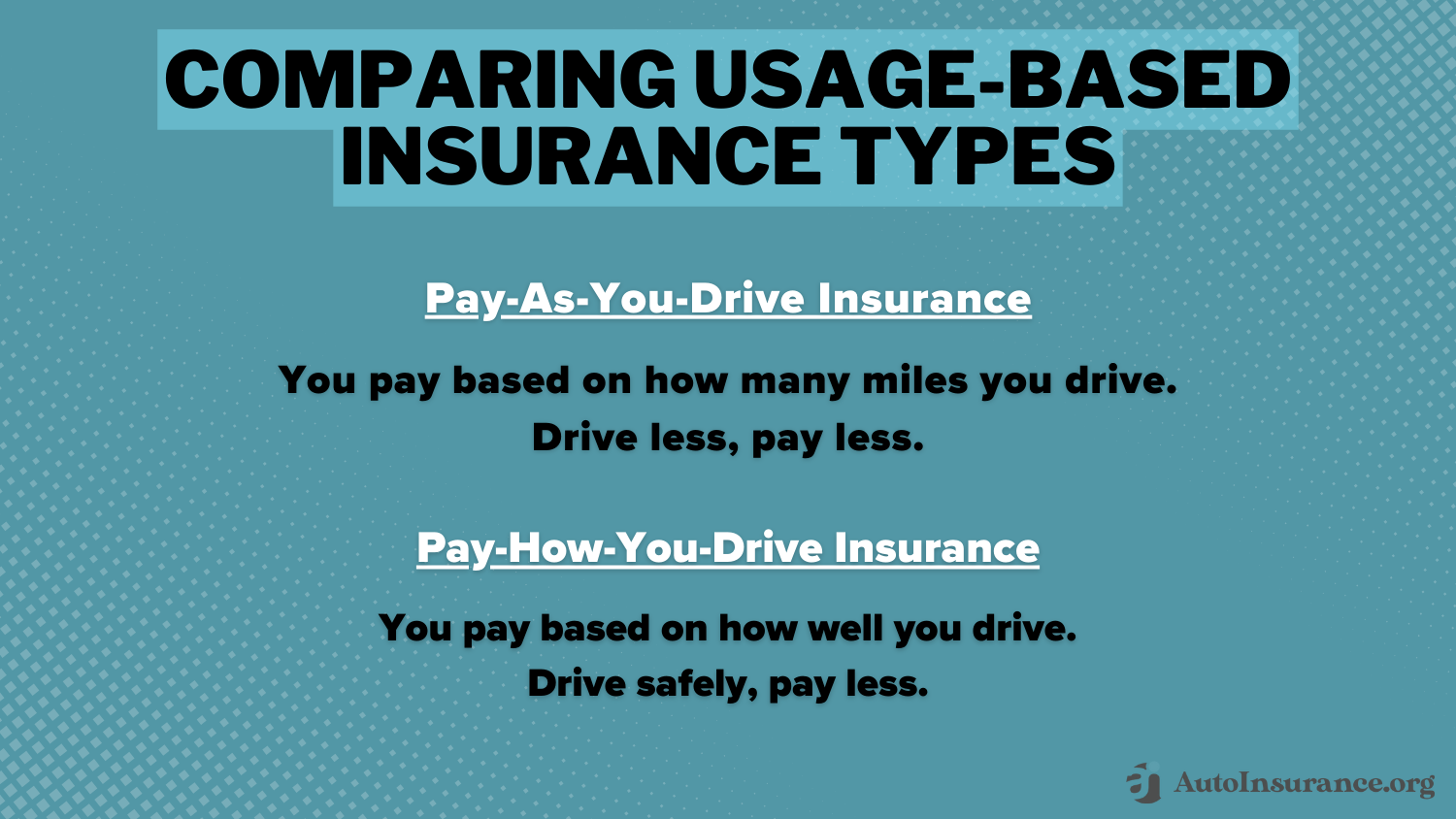

How does Snapshot with Progressive work? Snapshot from Progressive is a usage-based auto insurance program that uses telematics to monitor your driving, also known as pay-how-you-drive insurance.

Drivers can use the Snapshot app or a plug-in device to monitor driving, though some states only allow new customers to use the Snapshot app. However, drivers in those states may use the Progressive Snapshot plug-in device if they’re an existing customer with Snapshot. Regardless of how you’ll use Snapshot, contact Progressive to let them know you want to participate.

If you choose the Snapshot app, download it from your app store and create an account. All drivers on your account must participate in Snapshot. Once you’ve signed in, there’s no need to start the app when you drive, as the app runs in the background on your phone. You can see your trips and score in the Snapshot app.

If you’re using the Progressive Snapshot device to participate in the program, you’ll receive the device in the mail once you enroll. There’s no requirement for all drivers or vehicles to participate in Snapshot using the device.

Where does the Progressive Snapshot device plug in? Your Progressive plug-in device goes into your OBD port. The plug-in device for Snapshot beeps when it detects hard braking, and drivers can see their progress online or with the Progressive app. Mail your device back to Progressive when the monitoring period end.

In most cases, your Snapshot discount gets calculated, added to your policy renewal, and applied to the rest of your policy. However, some states require monitored driving again to continue the Progressive Snapshot discount.

Drivers may opt for the Progressive Snapshot plug-in device for various reasons. For example, if one household member works nights, they’ll receive a low score if all drivers must enroll in the Snapshot app. With the device, not all vehicles need to participate in Snapshot.

Driving Behaviors Progressive Snapshot Monitors

Insurers have found that specific behaviors lead to more accidents and claims. So, Progressive monitors those behaviors, including:

- Mileage: Low-mileage drivers are less likely to be in an accident since they don’t spend much time on the road. Read more about how to get a low-mileage auto insurance discount.

- Time of Day: Driving between midnight and 4 a.m. is the most dangerous since most serious crashes occur between these times.

- Hard Braking and Acceleration: Hard braking and acceleration indicate a lack of attention or aggressive driving. Both lead to more accidents.

- Speed: Does Snapshot track speed? Snapshot records driving above the posted speed limit.

- Phone Usage: Does phone usage affect Snapshot? Progressive Snapshot phone use, such as calls and texts, can impact your driving score.

If you’re wondering how to get an A on Progressive Snapshot, simply follow the speed limit, avoid phone usage, and avoid hard braking to get a good score. Unfortunately, Snapshot doesn’t know when you brake to avoid another driver, which can affect your score and lower your Progressive Snapshot discount.

So, how does Progressive Snapshot know I’m a passenger? You may be wondering, “With Progressive Snapshot, what if I’m a passenger?” If you’re a Progressive Snapshot passenger, the app can use your phone’s senors to determine if you’re driving or a passenger.

Drivers save the most if they limit mileage and hard braking, don’t drive at night, and don’t use their phones while driving. However, your rates will likely increase if you have risky driving habits.

Snapshot also records other data, such as your location and handheld phone usage. Progressive can use this information for underwriting and sell it to third parties for marketing and research purposes after removing personal information. However, users can restrict some third-party marketing usage of their data.

When your Snapshot monitoring period is over, you can delete it from your phone, which wipes stored data and analytics. However, the Progressive Snapshot mobile app keeps any data transmitted indefinitely.

The plug-in device records less data but still records locations and other information that Progressive or third parties can use.

How Progressive Snapshot Knows You’re Driving

How does Progressive Snapshot know if I’m driving? How the program knows you’re driving depends on your state and whether you use the app or Progressive Snapshot plug-in device.

In some states, you pick the vehicle you drive when enrolling in the program. Then, the app records you as the driver in that vehicle. Progressive averages the Snapshot scores together in other states to determine your discount.

However, if you use the plug-in device, the Snapshot score goes with the vehicle, not the driver. If Snapshot records the drive incorrectly, you can correct the trip.

You may be wondering how to pause Progressive Snapshot. Simply unplug your device or disable location services on your Progressive Snapshot app if you’re not driving for a while or using public transportation.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Reviews on Progressive Snapshot Mobile App

For drivers without a plug-in device, you’ll need to download the Progressive Snapshot app to monitor your driving, either on the Google Play Store or Apple App Store.

The Apple App Store has good Progressive Snapshot app reviews, with 4.5 stars out of 5 and over 4,900 reviews. On the other hand, the Google Play Store has over 12,100 reviews and 3.7 stars out of 5, featuring many Progressive Snapshot complaints regarding the app. Most customers who rated poorly complain that Progressive Snapshot is draining battery life quickly for many drivers.

Most customers who rated poorly complained of the app draining phone battery or logging events that never happened.

Progressive Snapshot vs. Other Usage-Based Insurance Programs

Progressive Snapshot doesn’t come out on top compared to telematics programs offered by the best auto insurance companies. While you could see a Progressive Snapshot rate increase for poor driving, most competitors offer higher discounts and don’t raise rates if you score poorly.

Check out the table below to see how the Progressive Snapshot discount stacks up against other companies:

Top Usage-Based Auto Insurance (UBI) Programs

| Company | Program Name | How It's Tracked | Sign-up Discount | Savings Potential |

|---|---|---|---|---|

| Drivewise | Mobile App | 10% | 40% | |

| KnowYourDrive | Mobile App or In-Vehicle Device | 10% | 20% |

| DriveEasy | Mobile App | 20% | 25% | |

| RightTrack | Mobile App or In-Vehicle Device | 5% | 30% |

| Mile Auto | Mileage-Based | 20% | 40% | |

| SmartRide | Mobile App or In-Vehicle Device | 10% | 40% | |

| Snapshot | Mobile App or In-Vehicle Device | $25 | 20% | |

| RightTrack (Liberty) | Mobile App | 5% | 30% | |

| Drive Safe & Save | Mobile App or In-Vehicle Device | 5% | 50% | |

| IntelliDrive | Mobile App | 10% | 30% |

Liberty Mutual, Nationwide, and Allstate auto insurance don’t raise rates for using their telematics programs, and you can save up to 40% with Nationwide SmartRide. Read more in our Nationwide SmartRide review.

However, while some companies offer higher usage-based discounts, Progressive rates are typically lower before discounts.

Drivers Who Would Benefit From Progressive Snapshot

The Progressive Snapshot program is free to enroll, and there’s no charge for the app or plug-in device. However, that doesn’t mean it’s right for everyone. Snapshot is a good option for low-mileage drivers, people who work from home, and safe drivers. Learn more about auto insurance for telecommuters.

In addition, the Progressive Snapshot program may benefit young drivers, since auto insurance for teens is higher than average.

Drivers who work nights, speed, brake or accelerate hard, and use their phones should skip Snapshot. These drivers may see a significant increase after participating in the program. Think carefully about your driving habits before enrolling in Snapshot.

If you’re not a Progressive customer, you can try Snapshot Road Test, allowing you to try the program for 30 days. Then, Progressive gives you a quote with your discount. You can then determine if switching to Progressive is right for you. Learn more about how to switch auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Deciding if Progressive Snapshot Is Worth it

Some drivers might be wondering whether Progressive Snapshot is worth it. Policyholders can save with Snapshot if they drive the speed limit and don’t use their phones while driving. However, other behaviors, such as hard braking and night driving, may increase Progressive rates. If Snapshot isn’t suitable for you, there are other ways to save on Progressive insurance.

Drivers can take advantage of other Progressive auto insurance discounts, such as a safe driving and multi-vehicle auto insurance discount. For example, the Progressive safe driver discount saves you around 30% on your policy.

Remember that Progressive isn’t the only insurer offering usage-based discounts. Most other top insurance companies offer similar programs, typically with higher discounts and without the chance of your rates increasing. If you’re shopping for car insurance, compare telematics programs and rates to find your best deal.

How Progressive Snapshot Can Lower Your Rates

Snapshot allows Progressive drivers to earn a discount for safe driving. However, what you consider safe driving may differ from what Snapshot recommends.

Do you know Flo? Progressive doesn't just have a memorable ad campaign history. They've also led the way in telematic car 🚘insurance with their Snapshot 🖼️program. https://t.co/27f1xf1ARb has reviewed Progressive, and you'll want to check it out here👉: https://t.co/yL6FtEW4OA pic.twitter.com/xZeejN5Qde

— AutoInsurance.org (@AutoInsurance) July 23, 2023

Snapshot monitors specific driving habits such as nighttime driving, speeding, hard braking, and Snapshot phone usage. Drivers with good Progressive Snapshot grades can earn up to a 20% discount. However, drivers who exhibit risky driving behaviors may see a rate increase.

Drivers confident in their driving abilities who don’t spend much time on the road may find Snapshot worth it. However, drivers who work nights or use their phones while driving may see higher rates.

Other car insurance companies offer similar programs with higher discounts and don’t have the risk of increased rates. So, drivers should compare Progressive Snapshot vs. other usage-based insurance programs to see which company offers the best deal.

Frequently Asked Questions

How does Progressive Snapshot work?

You may be wondering, “How does the Progressive Snapshot program work?” Progressive Snapshot uses a telematics device or mobile app to monitor driving habits like hard braking, nighttime driving, and speeding. You’ll receive a 5% Progressive Snapshot participation discount for simply enrolling, and you can earn up to 15% more based on your driving.

Does hard braking affect your Progressive Snapshot score?

Yes, Snapshot monitors hard braking and can lower your score. If you’re using the Snapshot device, it beeps when it detects hard braking. Unfortunately, Snapshot doesn’t differentiate between braking for an emergency and braking due to poor driving.

Additionally, some Snapshot reviews say Progressive Snapshot is too sensitive and counts regular braking as hard braking.

With Progressive Snapshot, how many hard brakes is bad? While there isn’t a specific number of hard brakes considered “bad,” frequent hard braking indicates to your Progressive car monitor that you’re a risky driver.

How does Snapshot know if I’m driving or a passenger?

How does Snapshot know if I’m a passenger or driver? The Progressive Snapshot app can automatically tell when you’re the driver rather than a passenger. However, if the app thinks you’re a driver, you can open it and correct trip information.

What are the disadvantages of Progressive Snapshot?

Your auto insurance rates could increase if you drive poorly with Progressive Snapshot. However, other usage-based programs, like State Farm Drive Safe and Save, won’t cause your rates to go up.

What do you do if you’re having problems with Progressive Snapshot?

If you have problems with Progressive Snapshot, whether it’s the app or device, call 1-877-329-7283.

Is Progressive Snapshot worth it?

Progressive policyholders may wonder, “Is Snapshot worth it?” Progressive Snapshot is worth it if you maintain safe driving habits. However, if you drive poorly, the Progressive Snapshot program may not be right for you, since poor driving can raise rates.

How much of a discount do you get with Progressive Snapshot?

By practicing safe driving habits, you can earn up to a 20% discount with Progressive Snapshot, which includes the 5% enrollment discount.

How does Progressive Snapshot compare to other usage-based insurance programs?

Compared to other usage-based insurance programs offered by different companies, Progressive Snapshot may not offer the highest discounts and has the potential for rate increases if your driving score is poor.

Does Progressive Snapshot track speed?

Can Snapshot tell if you’re speeding? Yes, the Progressive Snapshot app vs. plugin device monitors behaviors such as speeding, hard braking, phone usage, and time of day you drive.

How do I get an A on Progressive Snapshot?

You may be wondering how to get an A+ on Progressive Snapshot. You can get an A by following Progressive Snapshot rules, such as driving the speed limit, avoiding late night driving, and reducing hard brakes and accelerations. With Progressive Snapshot, 5 stars is the equivalent of an “A”.

Can Progressive Snapshot raise your rates?

A top question readers ask is, “Can Snapshot raise your rates?” Yes, while Snapshot with Progressive rewards safe driving, participants who driver poorly could see a Snapshot rate increase.

Check out Progressive Snapshot reviews to see if the program is right for your driving habits.

Does Snapshot track phone usage?

You may be wondering, “Does phone use affect Snapshot?” Yes, the Progressive driving app will detect any phone use while the car is moving.

How long is Progressive Snapshot?

Generally, the Progressive Snapshot program lasts six months, which lines up with the standard length of a car insurance policy term.

How does Snapshot know when I’m a passenger in my spouse’s car?

The Snapshot program relies on GPS and motion sensors to determine whether you’re a passenger. In addition, the app often prompts you to classify whether you were the drivr after trips.

What’s the difference between the Progressive Snapshot device vs. app?

The Snapshot device plugs into your vehicle’s OBD port, while the Progressive Snapshot mobile app uses your smartphone’s GPS.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.