Best Delaware Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

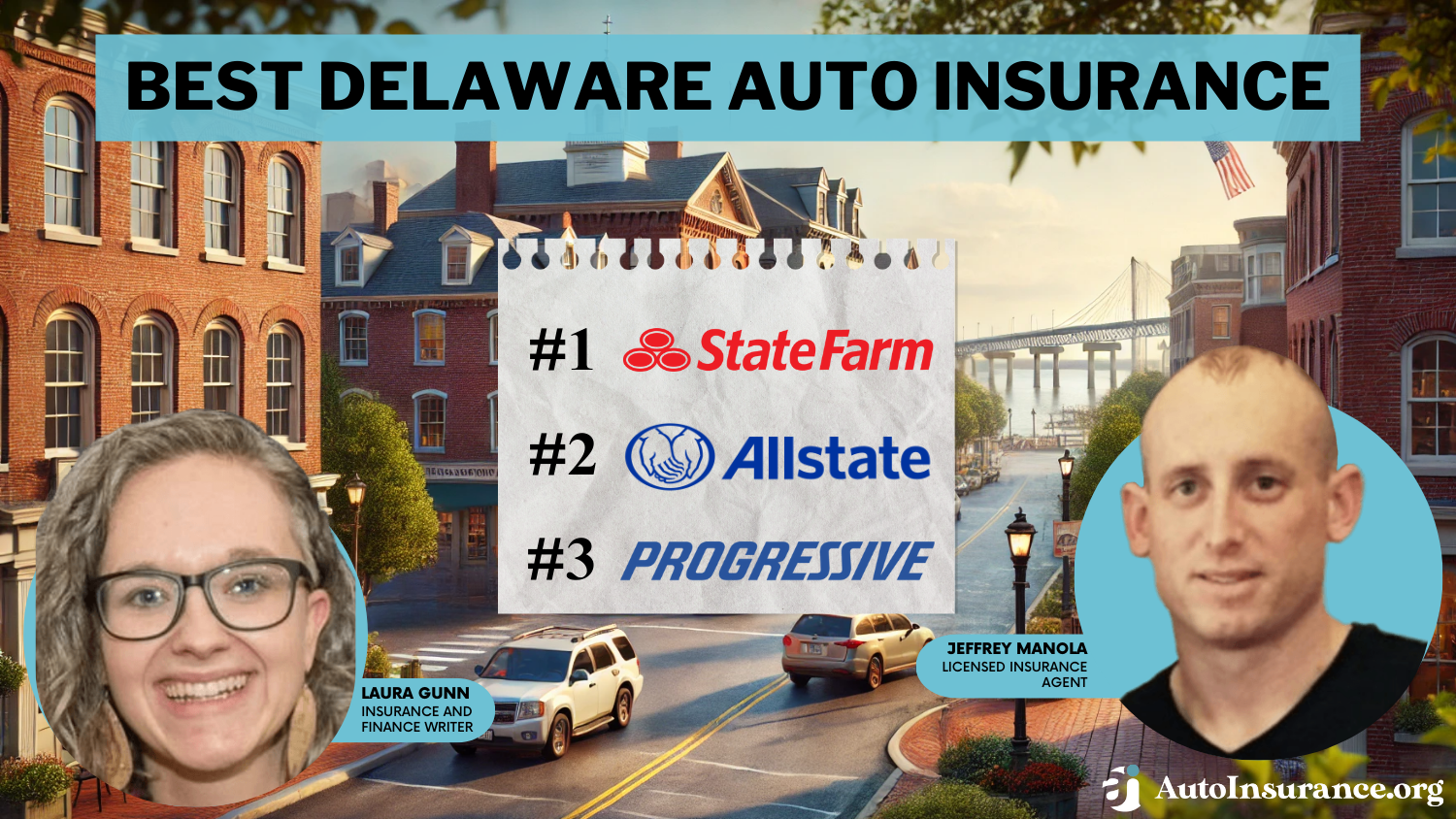

The best Delaware auto insurance can be found at State Farm, Allstate, and Progressive, with rates starting at $47 per month. These companies have the best car insurance in Delaware through discount opportunities, digital tools, and customization options. So, finding affordable auto insurance in Delaware is easy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Delaware

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Delaware

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Delaware

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Allstate, and Progressive have the best Delaware auto insurance rates, especially if you want to customize your policy.

State Farm is our top pick for coverage in the First State for several reasons.

Generous auto insurance discounts, policy customization options, a robust UBI program, and affordable rates are just a few of those reasons.

Our Top 10 Company Picks: Best Delaware Auto Insurance

| Company | Rank | Good Credit Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Customer Service | State Farm | |

| #2 | 8% | A+ | UBI Discount | Allstate | |

| #3 | 5% | A+ | Competitive Rates | Progressive | |

| #4 | 9% | A+ | Accident Forgiveness | Nationwide |

| #5 | 5% | A | Add-on Coverages | Liberty Mutual |

| #6 | 7% | A | Claims Service | American Family | |

| #7 | 10% | A+ | Exclusive Benefits | The Hartford |

| #8 | 5% | A | Group Discounts | Farmers | |

| #9 | 7% | A+ | Dividend Payments | Amica Mutual | |

| #10 | 6% | A++ | Specialized Coverage | Travelers |

Read on to learn more about the best Delaware auto insurance, including how to keep average car insurance costs in Delaware down and which companies have the best rates.

Then, enter your ZIP code into our free comparison tool to see rates in your area.

- Delaware drivers typically enjoy low rates, especially if their records are clean

- Most Delaware car insurance companies offer discounts to help you save

- State Farm and Allstate have the best auto insurance quotes in Delaware

#1 – State Farm: Top Pick Overall

Pros

- Extensive Network of Local Agents: State Farm maintains a strong network of local agents who offer personalized service and support.

- Discounts for Safe Drivers: There are several State Farm discounts to take advantage of, including several ways to save if you have safe driving habits and vehicle safety features.

- Comprehensive Coverage Options: State Farm has a wide range of coverage choices, including customized policies for Delaware residents. Explore your coverage options in our State Farm auto insurance review.

Cons

- Higher Premiums: State Farm often offers cheap car insurance in Delaware, but not all drivers will see low rates.

- Mixed Reviews: While some drivers agree that State Farm offers the best auto insurance in Delaware, others are less impressed with the service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Comprehensive Coverage

Pros

- Accident Forgiveness: Purchase Allstate’s accident forgiveness to get emergency help when you’re stranded. As a bonus, you can purchase roadside assistance in emergencies, even if you aren’t an Allstate customer.

- UBI Programs: Allstate offers a usage-based insurance (UBI) discount through Drivewise and pay-per-mile coverage from Milewise. See which will help you get the cheapest auto insurance in Delaware in our Allstate auto insurance review.

- Comprehensive Policies: Allstate offers a variety of add-ons so you can get the exact coverage you want. One of the most popular choices for additional coverage is Allstate’s accident forgiveness.

Cons

- Higher Premiums: Allstate is almost always one of the most expensive car insurance options on the market. If you need cheap car insurance in Delaware, you may need to look elsewhere.

- Discount Limitations: Although Allstate offers a variety of discounts, some drivers will struggle to qualify for savings.

#3 – Progressive: Best for Innovative Online Tools

Pros

- Snapshot Program: Progressive’s UBI program, Snapshot, helps drivers save up to 30%. However, you should be cautious before signing up — Snapshot is one of the few UBI programs that can increase rates for bad driving.

- Competitive Rates: Progressive often offers competitive car insurance quotes in Delaware. Explore innovative budgeting tools in our Progressive auto insurance review.

- Wide Range of Coverage Options: When you want the best car insurance in Delaware, you should shop Progressive’s add-on catalog. Check out all your insurance options in our Progressive auto insurance review.

Cons

- Mixed Reviews on Claims: Some customers report issues with the Progressive claims process, citing long wait times and unsatisfactory outcomes.

- Loyalty Struggles: Despite being one of the best Delaware car insurance companies, Progressive struggles with low loyalty ratings.

#4 – Nationwide: Best for UBI Savings

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible add-on reduces your add-on by $100 for every year you spend claims-free, up to $500. See how the vanishing deductible program works in our Nationwide auto insurance review.

- SmartRide: Save up to 40% on average Delaware car insurance costs by enrolling in the UBI program SmartRide.

- Excellent Add-ons: Most companies offer add-ons so you can customize your policy, and Nationwide is no different. There is a wide range of coverages available for Delaware drivers.

Cons

- Rates Can be High: Nationwide is rarely the cheapest option, especially if you need car insurance for high-risk drivers in Delaware.

- Limited Digital Experience: With a focus on a traditional insurance experience, many customers are disappointed by Nationwide’s online tools and app features.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Unique Coverage Opportunities

Pros

- Customizable Coverage: Pick and choose between Liberty Mutual’s wide range of options to tailor policies to specific needs. Check out a full list of options in our Liberty Mutual auto insurance review.

- Accident Forgiveness: Purchase Liberty Mutual’s accident forgiveness to avoid premium increases after an accident.

- RightTrack: Liberty Mutual offers its safest drivers a discount of up to 30% with its UBI program, RightTrack.

Cons

- More Complaints: Liberty Mutual receives more complaints than the national average for a company of its size.

- Claims Process Problems: Many drivers report being unsatisfied with how Liberty Mutual resolved their claims.

#6 – American Family: Best for Costco Members

Pros

- Local Agents: Finding face-to-face help is easy when you get your car insurance from American Family since the company has a vast network of local agents.

- Unique Discounts: Aside from standard savings like being a safe driver, American Familly offers unique discounts. Popular choices include discounts for young drivers and loyalty.

- Costco Policies: American Family underwrites auto insurance policies for Costco, helping warehouse members find affordable car insurance in Delaware.

Cons

- Less Competitive Rates: American Family can be more expensive, particularly for high-risk drivers. See how much you might pay for your coverage in our American Family auto insurance review.

- Lacking Digital Tools: The online and mobile tools American Family offers its drivers could be more user-friendly.

#7 – The Hartford: Best for Older Delaware Drivers

Pros

- AARP Program: The Hartford sells insurance exclusively to AARP members. It comes with options for specialized coverage and discounts for AARP members.

- Exceptional Customer Service: High ratings for customer satisfaction — particularly among older drivers — mean you’ll probably enjoy your policy from The Hartford.

- Lifetime Renewability: The Hartford guarantees that your policy renewal will be approved for as long as premiums are paid.

Cons

- Eligibility Restrictions: AARP membership is required to purchase a new auto insurance policy from The Hartford. Learn more about how to buy insurance in our auto insurance review of The Hartford.

- Higher Premiums: The Hartford accepts younger people as additional drivers for an existing policy, but you’ll pay much higher rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Auto Insurance Discount Options

Pros

- Car Insurance Discounts Selection: With 23 options, Famers has one of the longest lists of discounts on the market. See how these discounts can help you find cheap auto insurance in Delaware in our Farmers auto insurance review.

- Flexible Payment Plans: Farmers offer multiple payment options to accommodate different financial situations.

- Extensive Coverage Options: Farmers provides a wide range of coverage options tailored to the needs of Delaware drivers.

Cons

- Can be Expensive: Despite offering a massive number of discounts, Farmers is typically not one of the cheapest car insurance companies in Delaware.

- Mixed Customer Service Reviews: Some customers report inconsistent service experiences from Famers representatives.

#9 – Amica Mutual: Best for Dividend Payouts

Pros

- High Customer Satisfaction: Amica Mutual consistently receives high ratings for the customer service experience it provides to policyholders.

- Valuable Optional Coverages: Craft the perfect auto insurance in Delaware by taking advantage of Amica’s numerous coverage options.

- Dividend Policies: Since Amica is a mutual company, it pays eligible drivers dividends when the company does well. Learn how dividend payments work in our Amica Mutual auto insurance review.

Cons

- Higher Prices: While the average cost of car insurance in Delaware is typically low, many drivers will see higher prices.

- Fewer Discounts: Amica Mutual does not offer fewer discounts compared to some of its competitors.

#10 – Travelers: Best Customer Service Reviews

Pros

- Wide Range of Discounts: Travelers offers various discounts, including a hybrid or green vehicle discount, which can be hard to find elsewhere.

- Local Representatives: Travelers has a strong local agent presence in most areas, providing customized service to people who prefer interacting with a representative in person.

- High Customer Satisfaction: It may not be the cheapest car insurance in Delaware, but Travelers typically receives more positive reviews for customer service than negative. See what customers have to say in our Travelers auto insurance review.

Cons

- No SR-22 Insurance: Not only does Travelers have higher-than-average Delaware car insurance rates for high-risk drivers, but it also won’t file SR-22 forms on your behalf if you need it.

- Limited Online Tools: Travelers doesn’t have as many online tools for policy management, compared with other, larger insurance companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Delaware Auto Insurance Rates

Delaware auto insurance rates are usually higher than the national average. In fact, what drivers pay for Delaware state minimum auto insurance policies is what other states often pay for full coverage.

Although auto insurance rates are affected by a variety of reasons, the main culprit in Delaware’s higher rates is population density. A denser population leads to more traffic accidents and car thefts, which in turn increases car insurance rates.Michelle Robbins Licensed Insurance Agent

While it’s always an important step, comparing car insurance quotes in a state with higher average rates is vital. Check below to see how much you might pay for Delaware insurance from our top companies.

Delaware Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $108 | $207 |

| American Family | $68 | $130 |

| Amica Mutual | $46 | $153 |

| Farmers | $83 | $157 |

| Liberty Mutual | $256 | $494 |

| Nationwide | $75 | $144 |

| Progressive | $47 | $90 |

| State Farm | $61 | $116 |

| The Hartford | $44 | $115 |

| Travelers | $43 | $82 |

Although Delaware rates can be expensive, there are plenty of ways to save. If you already have a policy, consider selecting a higher deductible or lowering your coverage to a liability-only auto insurance plan. If you’re interested in a new policy, exploring a company’s discount options is a good start.

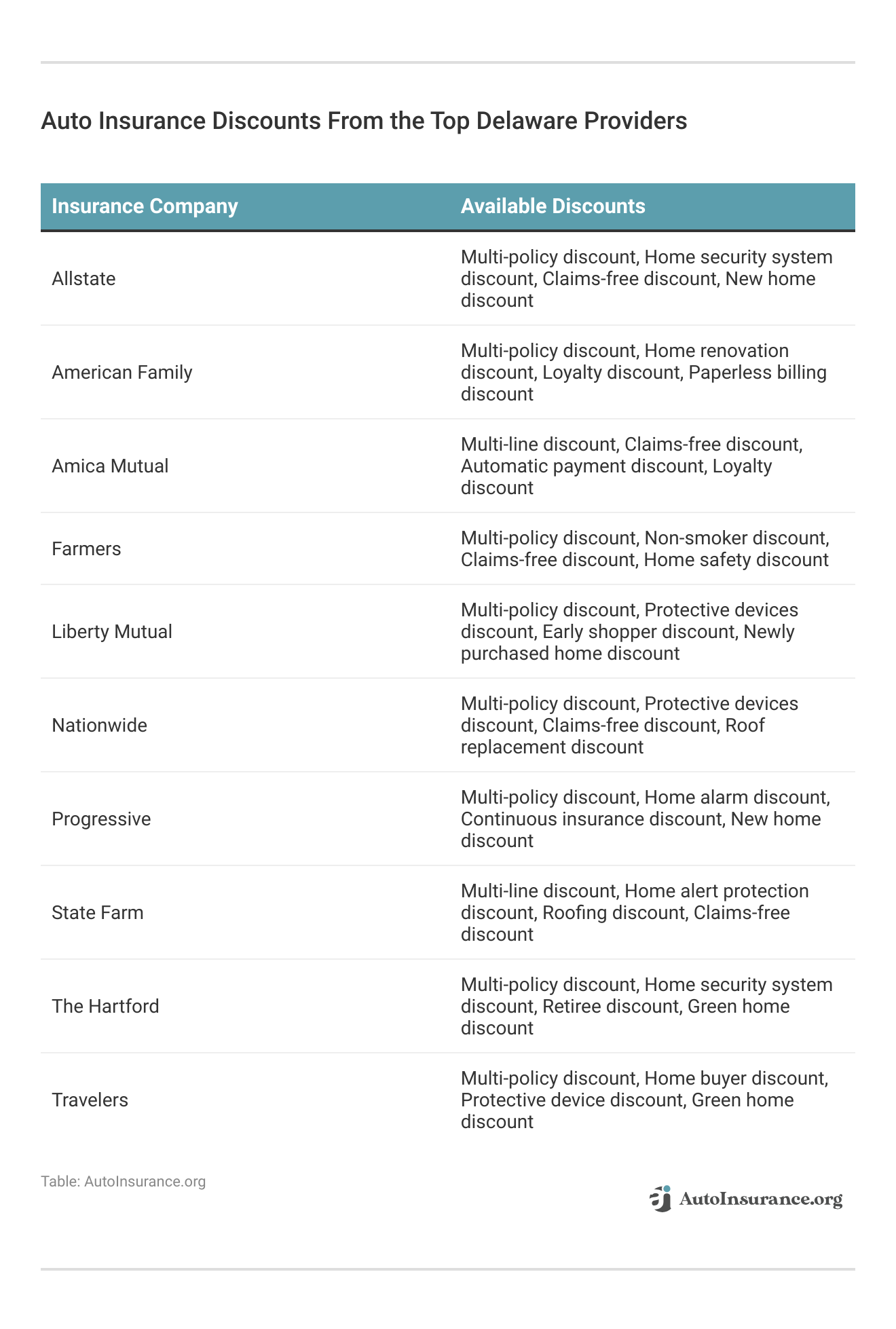

Our top Delaware car insurance companies offer a variety of discounts to help drivers save. Below, you’ll find a selection of discounts most popular among Delaware drivers.

Whether you want insurance that only meets Delaware car insurance laws or a policy with the most coverage possible, comparing quotes is the single most important step you can take to find affordable car insurance in Delaware.

Delaware Auto Insurance Rates by Credit Score

In Delaware, auto insurance companies can use credit scores as a factor when calculating a driver’s rates. Drivers with poor credit pay $316 monthly on average for full coverage auto insurance in Delaware.

Insurance companies charge more for drivers with poor credit because they’re considered higher risk. Drivers with poor credit scores are more likely to miss payments, leading to a greater risk of their insurance getting canceled and them driving without insurance. See the table below to compare the average cost of car insurance in Delaware by credit rating:

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $78 | $95 | $142 | |

| $65 | $79 | $118 |

| $70 | $85 | $127 | |

| $52 | $68 | $104 | |

| $88 | $105 | $156 |

| $66 | $80 | $122 | |

| $61 | $75 | $113 | |

| $59 | $72 | $109 | |

| $60 | $74 | $111 | |

| $48 | $58 | $87 |

The best auto insurance companies in Delaware for drivers with bad credit are Travelers and Progressive, offering average monthly rates of $152 and $163, respectively.

Delaware Auto Insurance Rates After a DUI

A DUI is one of the worst offenses a driver can have on their record and can raise a driver’s rates substantially. Finding cheap auto insurance after a DUI can be difficult and you should expect your rates to go up after a conviction, but the amount it increases depends on the insurance company. On average, Delaware car insurance with a DUI costs $340 monthly.

You’ll find the lowest average Delaware auto insurance quotes from Progressive if you have a DUI. Expect to pay $114 monthly for full coverage with Progressive with a DUI. On the other hand, Liberty Mutual auto insurance rates in Delaware skyrocket to $1,405 after a DUI.

Delaware Auto Insurance Rates After an At-Fault Accident

At-fault accidents are another factor that greatly impacts auto insurance rates, causing them to increase by hundreds of dollars annually. Expect to pay $218 monthly for Delaware auto insurance after an at-fault accident.

The table below will show you how much different insurance companies charge after an at-fault accident:

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

You’ll find the best deal on Delaware auto insurance after an at-fault accident with Travelers, costing $82 monthly for full coverage.

Delaware Auto Insurance Rates for Young Drivers

Young drivers often struggle to find cheap insurance rates, as insurance companies profile them as high-risk drivers due to inexperience. Usually, teenagers who purchase their own policies pay up to three times more than the average car insurance rate. The best auto insurance companies for teens in Delaware charge $908 monthly on average.

Below, you can see the cheapest auto insurance companies for young drivers:

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $868 | $910 | $640 | $740 | |

| $452 | $456 | $333 | $371 | |

| $1,156 | $1,103 | $853 | $897 | |

| $425 | $445 | $313 | $362 | |

| $1,031 | $1,121 | $745 | $893 |

| $586 | $679 | $432 | $552 |

| $1,144 | $1,161 | $843 | $944 | |

| $444 | $498 | $327 | $405 | |

| $1,026 | $1,298 | $757 | $1,056 |

Geico auto insurance offers the cheapest rates for teen drivers, averaging $253 monthly for a full coverage policy. The next best car insurance company in Delaware is State Farm, where teens can get a policy for $490 monthly. However, in most cases, a teen driver should join their parent’s policy, since it’s cheaper than buying a separate Delaware auto insurance policy.

Delaware Auto Insurance Rates by City

In addition to coverage choices and personal driving records, insurance companies also look at a driver’s location. If a driver lives in an area in Delaware prone to multiple crashes, poor weather, or crime, they’ll have higher insurance rates to offset the potential risk of them filing a claim. So, comparing auto insurance rates by ZIP code is vital to finding cheap rates in DE.

When you’re ready to compare auto insurance rates, most companies have a quote request form on their website. Completing the form usually takes no longer than 15 minutes and requires a minimal amount of information.

If that seems too time-consuming, you can always use a free comparison tool to look at multiple quotes at the same time.

One of the cheapest major cities for car insurance is Dover, whereas Wilmington has some of the most expensive rates for car insurance. Compare Wilmington, DE, auto insurance rates to find the lowest rates for your coverage needs.

Delaware Auto Insurance Laws

All drivers must follow Delaware’s auto insurance laws to avoid fines and penalties. Read on to learn about everything from the insurance coverages you must carry to SR-22 requirements for high-risk drivers in Delaware.

Delaware Auto Insurance Coverage Requirements

Every driver in Delaware must carry bodily injury liability insurance, property damage liability insurance, and personal injury protection auto insurance. Take a look at Delaware’s state minimum auto insurance requirements below:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

- Property Damage Liability: $10,000 per accident

- Personal Injury Protection: $15,000 per person and $30,000 per accident

You must carry these auto insurance coverage amounts in Delaware to drive legally.

However, the amount required in Delaware isn’t always enough to cover all the costs of an accident, so if you can afford higher premiums, you should increase your amounts.

Delaware Auto Insurance Optional Coverages

Property damage liability, bodily injury liability, and personal injury protection are the only coverages required by law in Delaware. However, if you have a loan or lease on your car, your lender may require you to carry collision and comprehensive insurance. Other than that, all the following coverages are optional in Delaware.

- Comprehensive Coverage: Comprehensive auto insurance helps if your car gets damaged in a non-accident-related event, like severe weather or vandalism.

- Collision Coverage: Collision auto insurance helps pay for repairs if your car gets damaged in an accident. Without collision coverage, you may have to pay for repairs to your vehicle out of pocket.

- Gap Coverage: Gap insurance helps pay the difference between what you owe on your car and what your car is worth after depreciation.

- Medical Payments: Medical payments coverage on auto insurance covers medical bills, doctor’s visits, and other medical costs associated with a covered event.

- Roadside Assistance: The best auto insurance companies for roadside assistance help if your car breaks down and you need certain assistance, like fuel services or flat tire repair.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist coverage reimburses you after an accident if the at-fault individual doesn’t carry proper Delaware-mandated liability coverage.

- Rental Car Reimbursement: If your car is in the shop due to a covered event, rental car reimbursement helps pay up to a certain amount for a rental vehicle.

While adding optional coverages raises your insurance rates, you’ll have financial protection after an accident. Read more about Delaware windshield replacement auto insurance.

When you rent a car🚘, do you automatically sign🖊️ for the insurance policy offered by the rental company? You might not need to. https://t.co/27f1xf131D has a guide📑 to rental insurance to help you decide. Check it out here👉: https://t.co/Q0kWn7XeTD pic.twitter.com/uCoEDidMx7

— AutoInsurance.org (@AutoInsurance) September 18, 2023

The required coverages in Delaware only protect you by paying for other parties’ costs if you cause an accident — they won’t pay for your car repairs.

Delaware DUI Laws

If you get convicted of a DUI in Delaware, there are more penalties than just increased insurance rates, making it hard to find cheap car insurance in Delaware. Some of the other consequences include fines, probation, jail time, or suspended licenses. Read more about the best auto insurance companies for drivers with a DUI.

The penalties for a first DUI offense won’t be as harsh as those for a third DUI offense, but even a first DUI conviction will result in hefty fines, potential jail time, and other penalties.

Delaware SR-22 Auto Insurance Requirements

Drivers with severe infractions on their records, such as driving without insurance or a DUI, must have an SR-22 certificate. An SR-22 certificate is a form filed by your insurance company that proves you meet Delaware auto insurance requirements.

If you’re currently insured, let your current insurance company know you need SR-22 certification. If you don’t have insurance, you’ll need your new insurance company to apply for SR-22 auto insurance.

Remember that an insurance company may refuse to insure high-risk drivers, so you may have to shop around at a few different companies.

You must purchase non-owner auto insurance if you don’t own a car. You must show proof of insurance to get an SR-22 certificate, so you must get car insurance before applying for an SR-22 in Delaware. Read more about non-owner SR-22 auto insurance requirements in Delaware.

Find the Best Delaware Auto Insurance Today

You’ll pay $169 monthly for full coverage auto insurance in Delaware, though rates vary by various factors like driving profile and demographics. However, you can find cheap car insurance in Delaware by shopping around and comparing rates.

Serious infractions, such as a DUI or an at-fault accident, may significantly raise the price of auto insurance in Delaware. To see how much you might pay for your Delaware auto insurance, enter your ZIP code into our free comparison tool today.

Frequently Asked Questions

What is the cheapest car insurance in Delaware?

USAA, Travelers, Progressive, Geico, and State Farm have some of the cheapest full coverage auto insurance rates in Delaware.

Why is car insurance so high in Delaware?

Delaware auto insurance costs $169 monthly, 42% higher than the national average. The high cost of Delaware car insurance is likely because the state has such a high population density despite being a small state.

Still, the cost of insurance depends on the driver’s record and their insurance company. Although all insurance companies check driving records before they issue a quote, they use different formulas. Find cheap car insurance in Delaware by comparing quotes from various companies.

What is the minimum auto insurance required in Delaware?

Drivers must carry bodily injury liability insurance, property damage liability insurance, and personal injury protection insurance.

What are the penalties for not carrying the minimum car insurance?

Driving without auto insurance is a serious infraction, and drivers will face fines, suspended licenses/registrations, SR-22 insurance, and more.

Is Delaware a no-fault auto insurance state?

No, Delaware isn’t a no-fault auto insurance state. Instead, it’s an “at-fault” state, meaning the at-fault driver is financially responsible for the medical bills and damages they cause in an accident. However, like many no-fault states, Delaware requires personal injury protection auto insurance, which covers your medical bills and lost wages.

Is car insurance cheaper in Delaware or Florida?

Delaware car insurance averages $169 monthly, while Florida auto insurance costs around $152 monthly. While Delaware has higher rates than Florida, finding cheap car insurance in Delaware is possible with discounts.

What happens if I drive without auto insurance in Delaware?

Driving without auto insurance in Delaware is illegal and can result in severe penalties, including fines, suspension of your driver’s license, and registration, as well as the requirement to file an SR-22 form (proof of insurance) with the Delaware Department of Insurance.

How can I find the best auto insurance rates in Delaware?

To find the best auto insurance rates in Delaware, we recommend you:

- Shop around and obtain quotes from multiple insurance companies.

- Consider factors such as coverage options, deductibles, and customer reviews.

- Maintain a good driving record and credit score, as they can affect your insurance premiums.

- Inquire about discounts for which you may be eligible, such as safe driver discounts or bundling policies with the same insurer.

Of course, the most important step is learning how to evaluate multiple auto insurance quotes online.

Can my auto insurance rates be increased if I’m involved in an accident in Delaware?

Yes, it’s possible for your auto insurance rates to increase if you’re involved in an accident in Delaware. Insurance companies consider factors such as fault, the severity of the accident, and your claims history when determining Delaware premiums.

What are the best auto insurance companies in Delaware?

The best auto insurance companies in Delaware are State Farm, Allstate, and Progressive. However, you may find a different company has the best personalized rates for you, which is why it’s important to compare quotes. Enter your ZIP code into our free comparison tool to see how much you’ll pay for Delaware auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.