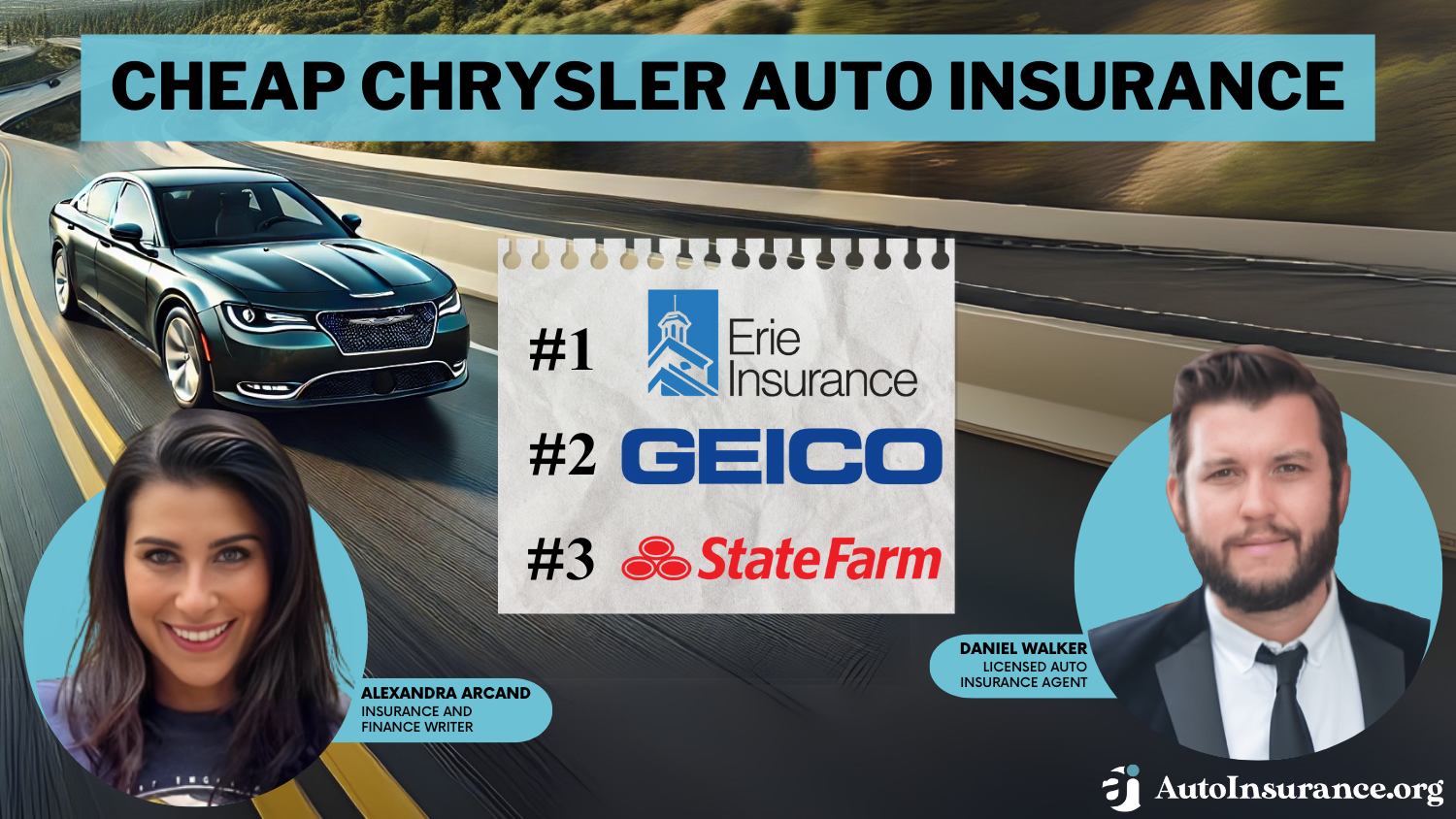

Cheap Chrysler Auto Insurance in 2025 (Save With These 10 Companies!)

Erie, Geico, and State Farm are the top providers of cheap Chrysler auto insurance. Minimum Chrysler insurance coverage at Erie averages only $22/mo. While model rates vary, as Chrysler 300 insurance costs are different than Chrysler 200 car insurance costs, these companies will have the cheapest rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Chrysler

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Chrysler

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Chrysler

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsErie, Geico, and State Farm are the top choices for cheap Chrysler auto insurance.

Other great options for cheap Chrysler car insurance include Travelers, Progressive, and several other companies.

Our Top 10 Company Picks: Cheap Chrysler Auto Insurance

| Company | Rank | Monthly Rates | AM Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | A+ | Customer Service | Erie |

| #2 | $30 | A++ | Online Convenience | Geico | |

| #3 | $33 | B | Coverage Options | State Farm | |

| #4 | $37 | A++ | Loyalty Discounts | Travelers | |

| #5 | $39 | A+ | Budgeting Tools | Progressive | |

| #6 | $43 | A | Accident Forgiveness | American Family | |

| #7 | $44 | A+ | Vanishing Deductible | Nationwide |

| #8 | $53 | A | Family Plans | Farmers | |

| #9 | $61 | A+ | Pay-Per-Mile Rates | Allstate | |

| #10 | $68 | A | 24/7 Support | Liberty Mutual |

As you can see, minimum coverage Chrysler rates start at just $22 monthly.

Regardless of the type of auto insurance you choose, it’s important to find and compare Chrysler auto insurance quotes from various companies to avoid overpaying for coverage.

Affordable Chrysler car insurance rates are just a click away. Enter your ZIP code into our free quote tool above to find the cheapest policy for you.

#1 – Erie: Top Overall Pick

Pros

- Customer Service: To learn about Erie’s great customer service reputation, check out our Erie review.

- Bundling Savings: Erie offers a generous discount to multi-policy holders.

- Roadside Assistance: Add roadside assistance to your policy for help if your Chrysler breaks down.

Cons

- Limited Availability: Only select states have Erie auto insurance.

- Claim Filing: You can’t file a claim online; you must contact an Erie agent.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Online Convenience

Pros

- Online Convenience: Whether you want to file a claim or add a driver, you can do so online through Geico’s website or app.

- Discount Variety: From safe driver to good student discounts, learn about Geico’s discount options in our Geico review.

- Coverage Variety: Geico’s coverage options help Chrysler owners create personalized policies.

Cons

- Discount Availability: A few of Geico’s discounts are unavailable or reduced in some states.

- In-Person Customer Service: Geico local agents aren’t as widely available.

#3 – State Farm: Best for Coverage Options

Pros

- Coverage Options: Read about State Farm’s list of full and minimum coverage options for drivers in our State Farm review.

- Agent Availability: Chrysler owners should be able to easily find a local agent near them.

- Financial Reputation: State Farm is one of the largest insurers with great financial standing.

Cons

- Policy Purchases: You can’t go online and quickly buy a policy.

- Rates High for High-Risk Drivers: State Farm is affordable for most drivers but can be a more expensive option for high-risk drivers.

#4 – Travelers: Best for Loyalty Discounts

Pros

- Loyalty Discounts: Travelers wants to keep customers, which is why it offers a loyalty discount.

- Customizable Deductibles: Tweak deductible amounts to meet your needs. Find out more in our review of Travelers.

- Gap Insurance: This coverage is great for owners of new Chrysler.

Cons

- Rates for High-Risk Drivers: Having a DUI or accident on your record may eliminate Travelers as an affordable provider.

- Rates After UBI Program: While Travelers’ UBI program offers a discount to safe drivers, it may also raise rates for unsafe drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Budgeting Tools

Pros

- Budgeting Tools: Progressive has a free tool to help customers purchase coverage on a budget.

- Online Convenience: Progressive’s app or website allows you to do anything, from filing a claim to removing a car.

- Coverage Options: Progressive has everything from basic to full coverage options. Learn more in our Progressive review.

Cons

- Rates After UBI Program: While Progressive’s UBI program offers safe driver discounts, unsafe drivers may have rate increases.

- In-Person Service: Progressive’s agents may not be available locally in some areas.

#6 – American Family: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Safe drivers may avoid rate increases at American Family after their first accident.

- Customer Service: Customers gave American Family’s customer service positive reviews. Read more in our American Family review.

- Discount Variety: There are discounts for every type of driver at American Family.

Cons

- Availability: Chrysler drivers may not have American Family insurance in their state.

- High-Risk Rates: Some drivers won’t find American Family’s rates as competitive as other companies.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Staying claims-free over time will reduce or eliminate your deductible at Nationwide.

- Agent Availability: Nationwide has agents available in most areas. Read about Nationwide’s customer service in our review of Nationwide.

- Bundling Discounts: Being a multi-policy customer at Nationwide can pay off with Nationwide’s bundling discount.

Cons

- Claims Handling: Some customers gave Nationwide less-than-positive reviews.

- High-Risk Rates: The affordability of Nationwide’s policies may not be the same for every driver.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Family Plans

Pros

- Family Plans: Families can benefit from Farmers’ multi-car and multi-policy discounts. Learn more in our review of Farmers’ auto insurance.

- Agent Availability: Farmers offers local agents in the majority of states.

- Driver Discounts: Teen and adult drivers can save with any of Farmers discounts.

Cons

- High-Risk Rates: Farmers can be more expensive for teens purchasing their own policy.

- Customer Satisfaction: Claims processing at Farmers has received some negative feedback.

#9 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: If you are an occasional driver, check out our Allstate Milewise review to learn how you can save.

- Claim Satisfaction Guarantee: Unhappy customers may receive credit towards their policy premiums.

- Add-On Coverages: Fully protect your Chrysler with add-ons from Allstate.

Cons

- Teen Rates: Teens purchasing their own Chrysler policy may wish to avoid Allstate.

- Complaint Index: Allstate has a slightly higher rate of complaints than the national average.

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Even if it’s the middle of the night, Liberty Mutual will offer assistance.

- Online Convenience: The company’s app and website are useful for quick policy changes or claims.

- Add-On Coverages: Our Liberty Mutual review discusses what coverages you can add to your car.

Cons

- High-Risk Rates: Other companies may offer more affordable policies.

- Discount Availability: Some states may be lacking some of Liberty Mutual’s discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chrysler Auto Insurance Rates

The average cost of Chrysler auto insurance is $139 each month. Still, there are many factors that affect auto insurance rates. For most car owners, the following factors can impact car insurance rates:

Chrysler Auto Insurance Rates by Age

If you’re a teen or young adult driver, you’ll pay more for Chrysler car insurance since most insurance companies consider you a risk and charge you higher rates.

Teen drivers can save money on car insurance if they’re on a parent’s policy. In addition, companies often offer teens and young adults cheaper rates on their guardian’s car insurance policy. Some companies also offer discounts to help drivers save money on auto insurance for teens.

Chrysler Auto Insurance Rates by Gender

Most insurance companies charge higher rates if you’re a male. So, males who own Chrysler vehicles often pay more monthly for coverage than females with the same car. Read more about auto insurance for men vs. women.

If you’re a male, you may find that certain companies don’t base their car insurance rates on your gender. Also, once you hit your late 20s, your rates won’t vary much based on gender.

Chrysler Auto Insurance Rates by Location

Believe it or not, where you live can significantly impact how much you’ll pay for car insurance coverage. So, comparing Chrysler auto insurance rates by ZIP code is essential.

If you own a Chrysler in a big city or highly trafficked area, you can expect to pay higher-than-average rates for car insurance coverage. However, if you live in a rural area with less traffic and less crime, your Chrysler auto insurance rates may be lower than average.

Chrysler Auto Insurance Rates by Marital Status

Chrysler auto insurance quotes may also vary based on whether you’re married or single. For example, married couples are statistically less likely to file a car insurance claim. As a result, you may save money on your car insurance if you’re married, but you could pay more for coverage if you’re single. Learn more about auto insurance rates for married vs. single drivers.

Chrysler Auto Insurance Rates by Driving Record

Your driving history also affects your insurance costs. Your monthly Chrysler car insurance rates will be low if you have a clean driving record. Still, if you have blemishes like an at-fault accident or traffic tickets on your record, you could pay higher rates for auto insurance for high-risk drivers.

Chrysler Auto Insurance Rates by Credit Score

Your credit score impacts your auto insurance rates. If you have a poor credit score, car insurance companies believe you’re more likely to file a claim. So, they’ll often charge you higher insurance premiums.

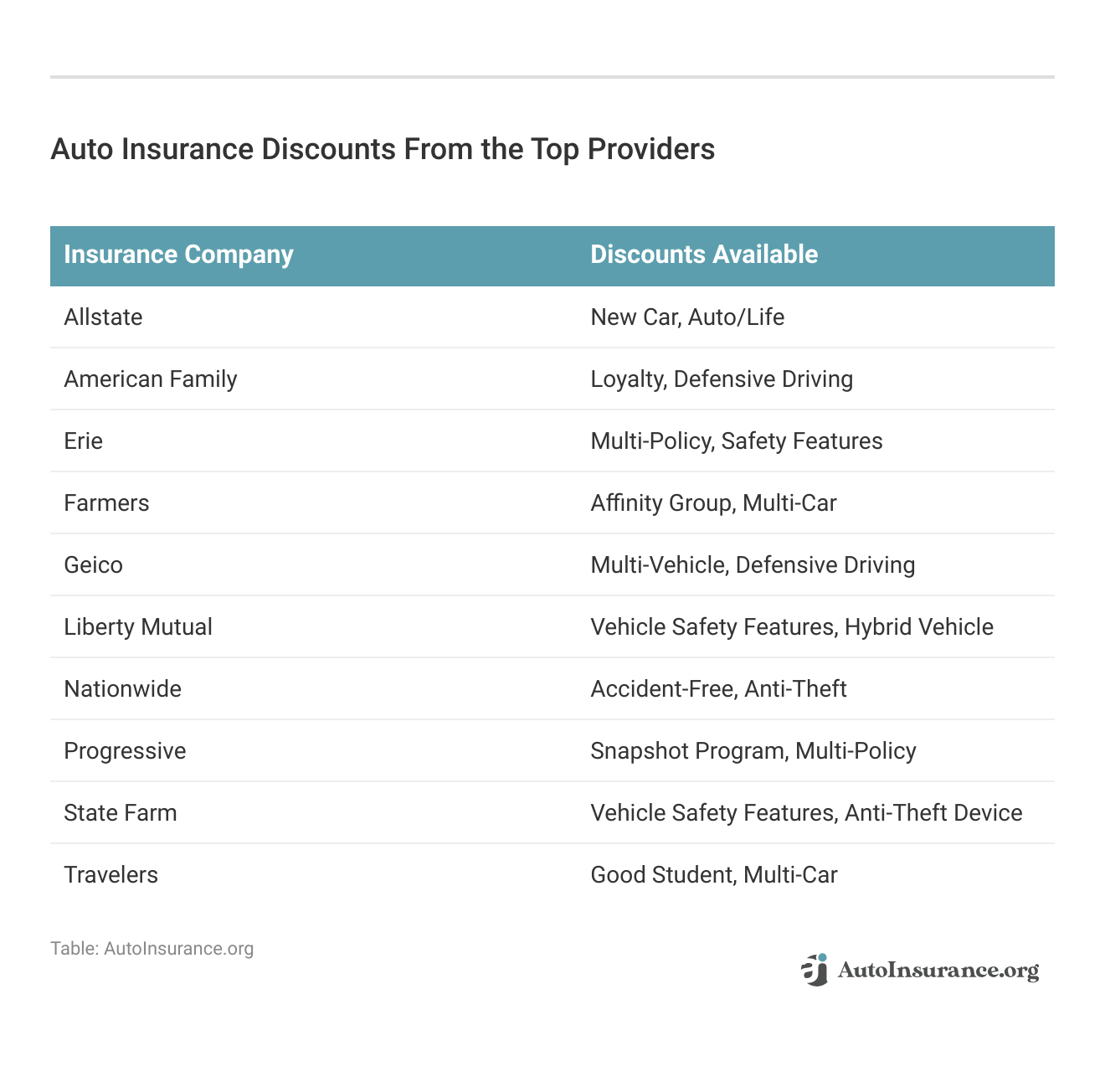

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $78 | $95 | $142 | |

| $65 | $79 | $118 |

| $70 | $85 | $127 | |

| $52 | $68 | $104 | |

| $88 | $105 | $156 |

| $66 | $80 | $122 | |

| $61 | $75 | $113 | |

| $59 | $72 | $109 | |

| $60 | $74 | $111 | |

| $48 | $58 | $87 |

As you can see, good credit may result in cheaper car insurance rates. However, some states don’t allow car insurance companies to consider a person’s credit score when determining rates.

Chrysler Auto Insurance Rates by Coverage Type

The type of car insurance coverage you choose significantly impacts your coverage rates.

Chrysler Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $43 | $117 |

| Erie | $22 | $58 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

If you choose lower levels of coverage — like a minimum coverage policy — you’ll pay cheaper rates. On the other hand, you’ll pay more for added protection if you choose a full coverage policy with add-on coverages.

Chrysler Auto Insurance Coverages

The type of car insurance coverage you purchase for your Chrysler depends on how old your vehicle is, whether you owe on a loan or lease, and how much your vehicle is worth based on its actual cash value (ACV). Standard coverage options you can purchase for your Chrysler include:

- Bodily injury liability auto insurance

- Property damage liability auto insurance

- Personal injury protection (PIP) auto insurance

- Medical payments (MedPay)

- Uninsured/underinsured motorist protection

- Collision auto insurance

- Comprehensive auto insurance

In addition to these standard options, many insurance companies offer add-on options like:

If you have a newer Chrysler, consider a full coverage policy that combines your state’s mandatory coverage with collision and comprehensive insurance. Gap insurance and new car replacement could also be helpful if you have a new car with a loan or lease.

How to Get Cheap Chrysler Auto Insurance

You may be able to find cheap car insurance coverage for your Chrysler, but it depends on the factors mentioned above and the model of Chrysler you drive.

There’s more to comparing📊 car insurance quotes than finding the cheapest🤑 premium. https://t.co/27f1xf131D has published an excellent guide to understand💡 the most important factors to compare between insurers. Check it out here👉: https://t.co/ax4M3DRVnp pic.twitter.com/JkvOOirl2A

— AutoInsurance.org (@AutoInsurance) August 4, 2023

The best way to get cheap Chrysler rates is to shop online and compare quotes from different companies. Many older models will cost less to cover because their ACV is lower. Still, you can find and compare quotes from different insurance companies to determine which offers the coverage you want at a price that works with your budget.

Comparison of Auto Insurance Costs for Chrysler Models

Comparing Chrysler models can help you make an informed decision about your next vehicle purchase, as Chrysler Crossfire insurance costs will be different than Chrysler 300 costs. Let’s dive into the details to determine which model best suits your needs.

| Cost of Auto Insurance for Chrysler's by Model |

|---|

| Chrysler 300 |

| Chrysler PT Cruiser |

If you have an expensive model, shop around for quotes to find savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Chrysler Auto Insurance

Some of the best ways to save money on car insurance for Chryslers include:

- Bundling insurance policies

- Increasing your auto insurance deductible

- Keeping a clean driving record

- Considering a usage-based auto insurance program

If you bundle insurance policies with the same company, you’ll probably qualify for a discount on coverage. Bundling policies like homeowners and auto insurance could help you save as much as 25% on your insurance rates.

Increasing your car insurance deductible is another great way to save on car insurance. If your deductible is $500, ask your insurance company how much you could save in monthly rates if you increase it to $1,000. Remember that you don’t want to increase your deductible to an amount you can’t afford to pay out of pocket if you get in an accident.

Your driving record plays a significant role in Chrysler car insurance rates. If you keep your driving record clean, most companies will offer you more competitive car insurance rates. Work to stay accident-free and avoid traffic tickets.Dani Best Licensed Insurance Producer

Your annual mileage may also be a large component of getting affordable Chrysler auto insurance policies. So, if you drive fewer miles annually, your insurance company may reward you with lower rates.

Understanding More About Chrysler Auto Insurance

Chrysler auto insurance rates vary for many reasons. If you drive a Chrysler, you can shop online and compare quotes from several insurance companies to determine which offers you the most affordable Chrysler car insurance.

If your rates are high, consider increasing your deductible or searching for auto insurance discounts like bundling insurance policies. Then, as your driving record improves over time, you should get more affordable Chrysler auto insurance rates with different insurance companies in your area. Compare rates now with our free quote tool to find cheap Chrysler insurance.

Frequently Asked Questions

Are Chryslers expensive to insure?

The average cost of Chrysler auto insurance is $139 each month. Shop online to compare Chrysler auto insurance rates from various companies.

Does Chrysler have roadside assistance?

Your Chrysler auto insurance includes five years or 100,000 miles (whichever comes first) worth of roadside assistance coverage with the factory warranty.

Is insurance on a Chrysler 300 high?

Are Chrysler 300 expensive to insure? It depends on your coverage and company. Chrysler 300 auto insurance averages $150 per month for full coverage. You can check with different insurance companies in your area to determine which offers the most affordable rates for your Chrysler 300.

How much is auto insurance for a Chrysler Sebring?

A Chrysler Sebring full coverage auto insurance policy costs $98 per month.

Is Dodge auto insurance expensive?

The average cost of Dodge car insurance is $158 monthly (learn more: Cheap Dodge Auto Insurance).

How much does Chrysler Crossfire insurance cost?

The Chrysler Crossfire costs $200 per month to insure on average. The year of your Chrysler Crossfire and its limited edition status impacts Chrysler auto insurance rates.

How much is auto insurance for a Chrysler Pacifica?

Auto insurance for a Chrysler Pacifica costs $133 on average for full coverage. However, you can find low-cost Chrysler car insurance by comparing quotes from various companies. Enter your ZIP code into our free tool to quickly find affordable Chrysler car insurance quotes.

What types of coverage are available for Chrysler auto insurance?

The types of coverage available for Chrysler auto insurance are similar to those available for other vehicles. Common coverage options include:

- Liability Coverage: This covers damages and injuries you may cause to others in an accident where you are at fault.

- Collision Coverage: This pays for repairs or replacement if your Chrysler is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: This covers non-collision-related damages to your Chrysler, such as theft, vandalism, or weather-related damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance or is uninsured.

Depending on the age of your Chrysler, you may want to purchase full coverage auto insurance for your vehicle rather than a minimum coverage or liability-only policy. Full coverage offers more protection behind the wheel. Still, if your Chrysler is several years old and paid off, you may get away with simply purchasing your state’s minimum coverage amount.

How are Chrysler auto insurance rates determined?

Chrysler auto insurance rates are determined by several factors, including:

- Vehicle Model: The specific Chrysler model you own can impact insurance rates, as factors like repair costs and safety features vary between models.

- Driver Profile: Your driving record, age, location, and other personal factors can influence your insurance rates.

- Coverage Options: The coverage options you select, such as liability limits and deductibles, can affect your premiums.

- Insurance Company: Different insurance companies have their own rating algorithms and underwriting criteria, which can lead to variations in rates.

Who has the absolute cheapest auto insurance for Chryslers?

Erie has the most affordable Chrysler insurance rates, whether you are shopping for Chrysler Pacifica car insurance or Chrysler Crossfire insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.