Best Indiana Auto Insurance in 2025 (Our Top 10 Picks)

The best Indiana auto insurance providers includes Farmers, Nationwide, and Travelers with rates as low as $37 monthly. These providers are known as the top rated insurance companies in Indiana. Compare quotes today to find affordable rates and coverage options that suit your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Indiana

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Indiana

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Indiana

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsThe best Indiana auto insurance provider includes Farmers, Nationwide, and Travelers, with rates as low as $37 per month. These companies offers competitive pricing and excellent customer service.

If you live in Indiana, you likely enjoy Indiana auto insurance rates that are below the national average.

Our Top 10 Company Picks: Best Indiana Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A Comprehensive Options Farmers

#2 20% A+ Broad Coverage Nationwide

#3 8% A++ Reliable Service Travelers

#4 25% A+ Strong Reputation Allstate

#5 20% B Local Agents State Farm

#6 25% A++ Affordable Rates Geico

#7 12% A+ Innovative Tools Progressive

#8 20% A Personalized Service American Family

#9 25% A Flexible Plans The General

#10 25% A Customer Focus Liberty Mutual

Learn more about Indiana auto insurance requirements, including liability coverage for bodily injury and property damage, and compare auto insurance quotes to find the best coverage for you.

However, your rates will vary based on factors like age, driving history, and credit score.

Comparing auto insurance quotes is essential to find the best coverage for you. Use our free comparison tool above to see what auto insurance quotes look like in your area.

- Indiana Auto Insurance

- Cheapest SR-22 Insurance in Indiana for 2025 (Save Money With These 10 Companies)

- Cheap Gap Insurance in Indiana (10 Most Affordable Companies for 2025)

- Best Auto Insurance After a DUI in Indiana (10 Most Affordable Companies for 2025)

- Best Auto Insurance for Seniors in Indiana (See the Top 10 Companies for 2025)

- Cheap Auto Insurance for High-Risk Drivers in Indiana (10 Most Affordable Companies in 2025)

- Cheapest Teen Driver Auto Insurance in Indiana (10 Best Companies for Savings in 2025)

- Best South Bend, Indiana Auto Insurance in 2025

- Best Seymour, Indiana Auto Insurance in 2025

- Best North Terre Haute, Indiana Auto Insurance in 2025

- Best Munster, Indiana Auto Insurance in 2025 (Find the Top 10 Companies Here)

- Best Jasper, Indiana Auto Insurance in 2025

- Best Griffith, Indiana Auto Insurance in 2025

- Best Payette, Idaho Auto Insurance in 2025

- Best Kooskia, Idaho Auto Insurance in 2025

- Best Indianapolis, Indiana Auto Insurance in 2025 (Compare the Top 10 Companies)

- Best Evansville, Indiana Auto Insurance in 2025

- Compare quotes for the best Indiana auto insurance rates

- Farmers Insurance offers competitive pricing and comprehensive coverage

- Indiana residents have auto insurance rates below the national average

Indiana Minimum and Full Coverage Auto Insurance

Full coverage in Indiana costs much more than a minimum coverage policy. The cheapest option in most cases are with Farmers at $79 per month for full coverage and Travelers at $24 for minimum. The table below compares Indiana’s monthly rates from industry leaders for both minimum and full coverage:

Indiana Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$75 $217

$57 $167

$42 $123

$34 $99

$98 $285

$52 $151

$37 $107

$38 $110

$81 $190

$37 $108

Full coverage car insurance in Indiana includes liability coverage along with collision and comprehensive car insurance. Collision insurance covers you if you’re at fault in an accident and your vehicle is damaged and in need of repair. Without collision coverage, you would be required to pay for repairs to your car out of pocket.

Comprehensive auto insurance covers your vehicle if it is damaged in a non-accident-related incident, like inclement weather or vandalism. Comprehensive coverage is especially helpful if you park your car outdoors most of the time.

Full coverage rates in Indiana are the most expensive with Allstate. The company charges $210 monthly for car insurance. Before purchasing a full coverage car insurance policy, you should shop online and compare Indiana auto insurance quotes from multiple providers to see your best option.

Indiana Liability-Only Auto Insurance

There are plenty of options for car insurance companies in Indiana, but they are not all the same. If you’re looking for cheap Indiana car insurance, you will have to do a bit of research to learn which companies work best for you.

You can find liability insurance extremely cheap in Indiana. Indiana’s average cost of a liability-only policy is around $35 per month, or $414 each year. Of course, your actual rate for liability coverage will depend on several factors.

Still, this coverage is by far the cheapest option in the state.

Minimum Coverage Auto Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $87 | |

| $62 | |

| $53 | |

| $76 | |

| $43 | |

| $96 |

| $63 |

| $56 | |

| $47 | |

| $53 | |

| $32 | |

| U.S. Average | $61 |

As you can see from our Auto-Owners auto insurance review, Auto-Owners offers the cheapest coverage overall when it comes to a liability policy. Coverage with Auto-Owners costs around $236 annually, or $20 per month, and Geico offers coverage for around $25 a month. Read our Geico auto insurance review for more information.

Compared to the cheapest companies in Indiana, Allstate’s rates are by far the highest, at $705 annually or $59 per month.

Just because a liability policy is cheap does not mean it’s always the best idea. Choosing liability-only means you go without certain coverage options that could protect you. On the other hand, if you drive a newer car, lease or finance your car, or have made expensive modifications to your vehicle, you may want to choose a full coverage policy to ensure you’re covered.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Indiana Auto Insurance for Bad Credit

You can find cheap auto insurance in Indiana if you have bad credit. Still, the cheapest Indiana car insurance premiums are reserved for individuals without blemishes on their credit histories. This is because insurance companies assess risk associated with prospective policyholders, and credit scores are an important factor for most insurers.

Statistics suggest a correlation between poor credit scores and the likelihood of someone filing a car insurance claim. Because of this, people with bad credit are often automatically charged more to offset the risk.

Drivers with poor credit in Indiana pay around $1,228 more for coverage each year. This makes it difficult to find cheap insurance in Indiana with bad credit. Still, there are some companies that offer competitive rates if your credit score isn’t where you want it to be. Read more on the best auto insurance companies for bad credit if you want to get affordable coverage.

Auto Insurance Full Coverage Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $190 | $230 | $340 | |

| $145 | $180 | $280 |

| $165 | $200 | $310 | |

| $110 | $140 | $250 | |

| $220 | $260 | $390 |

| $140 | $170 | $300 | |

| $135 | $165 | $280 | |

| $120 | $140 | $220 | |

| $130 | $160 | $270 | |

| $95 | $110 | $180 |

Geico offers the cheapest rates in Indiana for people with bad credit. The company charges $1,374 annually or $115 monthly. Auto-Owners is the second cheapest, charging $1,686 per year or $141 each month.

In contrast, Allstate charges $3,171 annually, or $264 monthly, for people with bad credit. The difference in rates is a good example of why people should compare car insurance quotes in Indiana from multiple companies before making a final decision.

Indiana Auto Insurance for At-Fault Accidents

If you have an accident on your driving record and are at fault, you can expect your car insurance rates to go up. Most companies will charge policyholders more after they file a claim, but this is especially true if you were the cause of an accident.

In Indiana, an at-fault accident could raise your rates as much as $700 per year. Other factors, like the car’s make and model and your coverage levels, will also impact your car insurance rates after an accident.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

Auto-Owners offers the cheapest car insurance to Indiana residents with an at-fault accident on their driving records. The company charges around $1,174 annually, or $98 each month, for coverage. Next is State Farm, which charges Indiana residents around $123 monthly for car insurance coverage if they have recently been in an accident.

Unfortunately, some insurance companies charge much more for coverage. Allstate, for example, charges over $300 each month for coverage if you’ve recently been in an accident in which you were at fault.

Indiana Auto Insurance for Teen Drivers

Teen drivers pay more for car insurance in every state. In Indiana, the rate increase for teen car insurance is significant, even at the companies with the best car insurance for teens and young drivers.

Teen drivers in Indiana pay around $3,307 annually for car insurance coverage or $276 monthly. This is nearly $1,800 more per year than the national average. Additionally, a 30-year-old driver in Indiana pays around half that for coverage.

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $868 | $910 | $640 | $740 | |

| $452 | $456 | $333 | $371 | |

| $1,156 | $1,103 | $853 | $897 | |

| $425 | $445 | $313 | $362 | |

| $1,031 | $1,121 | $745 | $893 |

| $586 | $679 | $432 | $552 |

| $1,144 | $1,161 | $843 | $944 | |

| $444 | $498 | $327 | $405 | |

| $1,026 | $1,298 | $757 | $1,056 |

Geico charges around $218 per month, and Auto-Owners is the next-cheapest option, charging $222 monthly. Finally, Farmers charges teen drivers nearly $5,550 annually, or $463 every month.

If you’re a teen driver, there are some ways you can save money on your Indiana car insurance coverage. The easiest way to save on auto insurance is to get on an adult’s plan. See if your parents or guardian will add you to their policy. If that’s not a possibility, you may be able to pursue certain discounts, like discounts for good students or driver training.

You should always compare rates from multiple companies to avoid paying too much for your coverage. And remember to find and compare quotes at least once a year to see if your rates improve as you get older.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Indiana Auto Insurance by City

You may find that your rates differ based on where you live in Indiana. Car insurance rates calculate their customers’ rates from several different factors. One factor for many companies is a person’s ZIP code.

If you ever wonder “why does my auto insurance go up when I move?” it might be due to a lot of traffic or a higher crime rate. You may also notice that your car insurance rates are higher than in other, less populated areas. For example, the cheapest car insurance in Indiana is found in Shadeland, and the most expensive rates are in Gary.

Car insurance in Indianapolis, for example, costs around $1,400 annually or $117 per month. In comparison, Carmel rates are around $98 a month. In addition, your ZIP code can significantly impact your auto insurance rates.

If you ever move within the state of Indiana, it’s a good idea to shop online for car insurance quotes to see what your new rates might be. Your insurance company should always have your updated address, and you may be able to find cheaper coverage in your new city.

Indiana Auto Insurance for DUIs

You can expect your car insurance rates to increase after a DUI conviction, but the overall cost will also depend on other factors. Take a look at the table to get a better idea of what different companies charge after a DUI conviction.

Auto Insurance Full Coverage Monthly Rate Increases: One DUI

| Insurance Company | Clean Record | One DUI | Percent Increase |

|---|---|---|---|

| $228 | $385 | 68.9% | |

| $166 | $276 | 66.3% |

| $198 | $275 | 38.9% | |

| $114 | $309 | 171.1% | |

| $248 | $447 | 80.2% |

| $164 | $338 | 106.1% | |

| $150 | $200 | 33.3% | |

| $123 | $160 | 30.1% | |

| $141 | $294 | 108.5% | |

| $84 | $154 | 83.3% |

After a DUI in Indiana, insurance rates vary significantly among companies like Farmers, Auto-Owners, and Allstate. While Auto-Owners generally offers competitive rates, they may not be the best option post-DUI.

If denied coverage, continue searching for high-risk insurance options to find suitable coverage that meets your needs. It’s essential to compare quotes and consider specialized insurers who cater to non-standard drivers in Indiana.

Finding Cheap DUI Auto Insurance

Is cheap auto insurance with a DUI possible? If you’ve been convicted of a DUI, you will not be able to find cheap car insurance in Indiana. A DUI may make it difficult to purchase car insurance in Indiana at all.

Auto insurance companies see DUI convictions as a very serious issue. Indiana has strict laws about what you must do to prove you’re financially responsible for your vehicle if you have a DUI on your driving record. And if you get a second DUI conviction, you will lose your right to drive altogether.

In Indiana, a DUI on your driving record can increase your car insurance rates by up to 90%. Because of this, it’s important to find and compare many different car insurance quotes from the companies with the best auto insurance for drivers with a DUI in Indiana.

Auto Insurance Rates Across Indiana Cities

This table provides a comparative overview of auto insurance costs in various cities across Indiana. Explore and compare rates to make informed decisions about your insurance coverage.

Indiana Auto Insurance Cost by City

The diverse auto insurance rates across Indiana cities underscore the importance of tailored coverage choices based on regional cost variations and individual needs.

Indiana Auto Insurance Laws

If you live in Indiana, you must carry car insurance on any car you own and drive. Purchasing the minimum coverage in Indiana can help you save hundreds or even thousands of dollars annually. Still, you may find that a full coverage policy offers more safety and peace of mind when you’re behind the wheel.

Indiana residents pay around $414 annually, or $35 each month, for minimum car insurance coverage. This price is around 73% lower than the national average in the U.S.

Indiana’s Minimum Auto Insurance Coverage Requirements

Indiana drivers are required to carry certain levels of coverage to drive legally. Most states in the U.S. require some sort of proof of insurance or financial responsibility.

According to Indiana’s Insurance Department, the minimum car insurance requirements in Indiana include:

- $25,000 per Person in Bodily Injury Coverage

- $50,000 per Accident in Bodily Injury Coverage

- $25,000 per Accident in Property Damage

- $50,000 per Accident in Uninsured/underinsured Motorist Coverage

Bodily injury insurance covers costs if someone is injured or killed in an accident you caused. If expenses exceed your coverage limits, you’ll be responsible for the remainder. Property damage insurance covers damage to another person’s car or property in an accident you’re at fault for, preventing you from having to pay repair costs yourself.

Having the best uninsured and underinsured motorist (UM/UIM) coverage is a way to protect yourself if you’re in an accident with someone who does not carry proper car insurance. If that individual is found at fault in an accident, your uninsured/underinsured motorist coverage will help pay for injuries or repairs.

Indiana Certificate of Compliance

If you have certain traffic violations on your driving record, you may need to file a certificate of compliance. A certificate of compliance is a form you need an insurance company to fill out on your behalf. The form states that you have financial responsibility and are able to carry proper coverage on your vehicle.

Some Indiana residents try to submit the certificate of compliance form on their own, but the form is only viable when submitted by a registered insurer. For more details on Indiana car insurance laws and obtaining a certificate of compliance, you can contact your local Department of Motor Vehicles.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Types of Indiana Auto Insurance Coverages

Car insurance coverages are not specific to location. Instead, they are specific to the company. While some add-on coverages may be difficult to come by, most standard options are easy to procure and offered by several different insurance companies.

Some of the most common insurance coverage types include:

- Comprehensive Auto Insurance: Comprehensive auto insurance coverage helps if your car is damaged in a non-accident-related event, like severe weather or vandalism.

- Collision Auto Insurance: Collision coverage helps pay for repairs if your car is damaged in an accident. Without collision auto insurance coverage, you may have to pay for repairs to your vehicle out of pocket.

- Guaranteed Auto Protection (gap) Insurance: Guaranteed Auto Protection (gap) insurance helps pay the difference between what you owe on your car and what your car is actually worth after depreciation.

- Medical Payments (MedPay): MedPay pays for medical bills, doctor’s visits, and other medical costs associated with a covered event (Read More: Do you need medical payment coverage on auto insurance?).

- Roadside Assistance: Roadside assistance coverage helps if your car breaks down and you’re in need of certain assistance, like fuel services or flat tire repair.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist coverage allows you to be reimbursed after an accident by your own insurance company if the at-fault individual does not carry proper Indiana-mandated liability coverage.

- Rental Car Reimbursement: If your car is in the shop due to a covered event, your insurance company will reimburse you for the cost of a rental vehicle up to a certain amount.

A full coverage policy with comprehensive and collision coverage is extremely helpful and allows drivers to have better peace of mind on the road. You can also purchase additional coverages to protect yourself and your vehicle.

Remember that any coverage you add will also add to your overall insurance costs.

For example, a full coverage policy in Indiana costs around 228% more than a liability-only policy. If this is not something you can afford, ask about discounts or see if you can choose a higher deductible.

Auto Insurance Cancellation Restrictions in Indiana

Indiana insurance companies can cancel a person’s policy within the first 60 days. If you have a policy for more than 60 days with an insurance company, that insurer cannot cancel your policy aside from very specific reasons.

If you fail to pay your premiums or lose your license after a violation, your insurance company has the right to terminate your policy. When this happens, the insurer is required to notify you of the cancellation.

Read more: What to Do if You Can’t Pay Your Auto Insurance

Similarly, if your company chooses not to renew your policy, it must inform you a minimum of 20 days before the policy ends. Most insurance companies terminate policies based on a person’s driving record. So, if you do not have any new accidents on your policy and continue paying your insurance premiums, you should not worry about it.

Indiana SR-22 Auto Insurance

SR-22 auto insurance is similar to a certificate of compliance. The SR-22 is a form proving that you have financial responsibility for your vehicle.

Insurance companies file SR-22s, and most individuals are required to submit one after specific major traffic violations, such as:

- A DUI or DWI conviction

- Multiple traffic violations

- Multiple accidents

- One or more at-fault accidents

- Driving without a license

- Driving with a suspended license

- Driving without insurance

If you are required to file an SR-22, finding a company willing to insure you may be difficult. You will need to follow specific steps to ensure you do everything properly.

How to Get an SR-22 in Indiana

If you have insurance, you may be able to request an SR-22 form via your current insurance company. In some cases, your company may choose not to cover you anymore. But many companies will file your SR-22 with the state of Indiana.

You can shop for coverage with another company if your current insurer refuses to file an SR-22 or if your rates are subject to increase.

If you do not have insurance with a specific company, you will likely have to pay a fee to have your SR-22 filed with a new provider. Unfortunately, it can be difficult to find a company that is willing to cover you, especially if you have a gap on your insurance record.

Securing an SR-22 in Indiana can be challenging after major traffic violations, but it's crucial to find a willing insurer to file this form, as it proves your financial responsibility and ensures compliance with state requirements.Justin Wright LICENSED INSURANCE AGENT

Needing an SR-22 will make you a high-risk driver with virtually every insurer. Still, there are plenty of companies that will likely offer you coverage. However, remember that car insurance will cost more once you are labeled a high-risk driver.

If you need an SR-22 but don’t own a car, you should purchase non-owner SR-22 car insurance with a company in your area. This coverage will help you prove you have financial responsibility and will also ensure that you have an insurance provider willing to file the form on your behalf.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What to do if Indiana Insurance Companies Refuse Coverage

You may find that not many insurance companies are willing to cover you in Indiana. This will likely be because of multiple traffic violations or a DUI/ DWI. If this is the case, you can apply for the Indiana Auto Insurance Plan through any insurance agent in the state.

Read more: How Auto Insurance Companies Check Driving Records

Indiana insurance companies are legally required to accept individuals enrolled in this program, so you can find proper coverage. Unfortunately, you will have to pay higher rates, and you may not qualify for a full coverage policy because of your level of risk.

The Bottom Line on Cheap Auto Insurance in Indiana

If you live in Indiana, you already pay less for auto insurance coverage than the national average. Still, you could be able to find cheaper Indiana auto insurance rates by shopping online and comparing quotes from multiple companies. Farmers is the best option in most scenarios for Indiana residents. But companies like Nationwide and Travelers also offer competitive rates in the state.

If you are looking for cheap insurance in Indiana, you should find and compare auto insurance rates by vehicle make and model from several companies in your area. Don’t assume that the first Indiana auto insurance quote you received is the best. Instead, research which companies offer the coverage you need at a price that works with your budget.

If you are a high-risk driver, comparing quotes is essential. And if you find that no company wants to offer you coverage, speak with an Indiana insurance agent about the possibility of enrolling in the Indiana Auto Insurance Plan. If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

How do I find the best auto insurance rates in Indiana?

To find the best auto insurance rates in Indiana, it’s crucial to compare quotes from multiple insurance providers. Companies like Farmers, Nationwide, and Travelers often offer competitive rates and discounts up to 25%. Use online comparison tools to compare coverage options and find the best auto insurance companies offers the best rates that suit your needs.

What’s the average cost of car insurance per month in Indiana?

Indiana car insurance costs an average of $1,261 annually or $106 per month. If you purchase a policy with a higher level of coverage, you will likely pay more. Still, if you purchase a minimum coverage policy, you may be able to pay even less for your Indiana car insurance coverage.

What is the minimum auto insurance in Indiana?

You must carry car insurance if you own and drive a car in Indiana. Indiana requires certain amounts of bodily injury, property damage, and uninsured/underinsured motorist insurance. The minimum amount required is 25/50/25. Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

How are auto insurance rates determined in Indiana?

Auto insurance rates in Indiana are determined by various factors, including your driving record, age, gender, location, the type of vehicle you drive, your credit history, and the coverage limits you choose. Insurance companies also consider statistical data on accident rates and claims in your area.

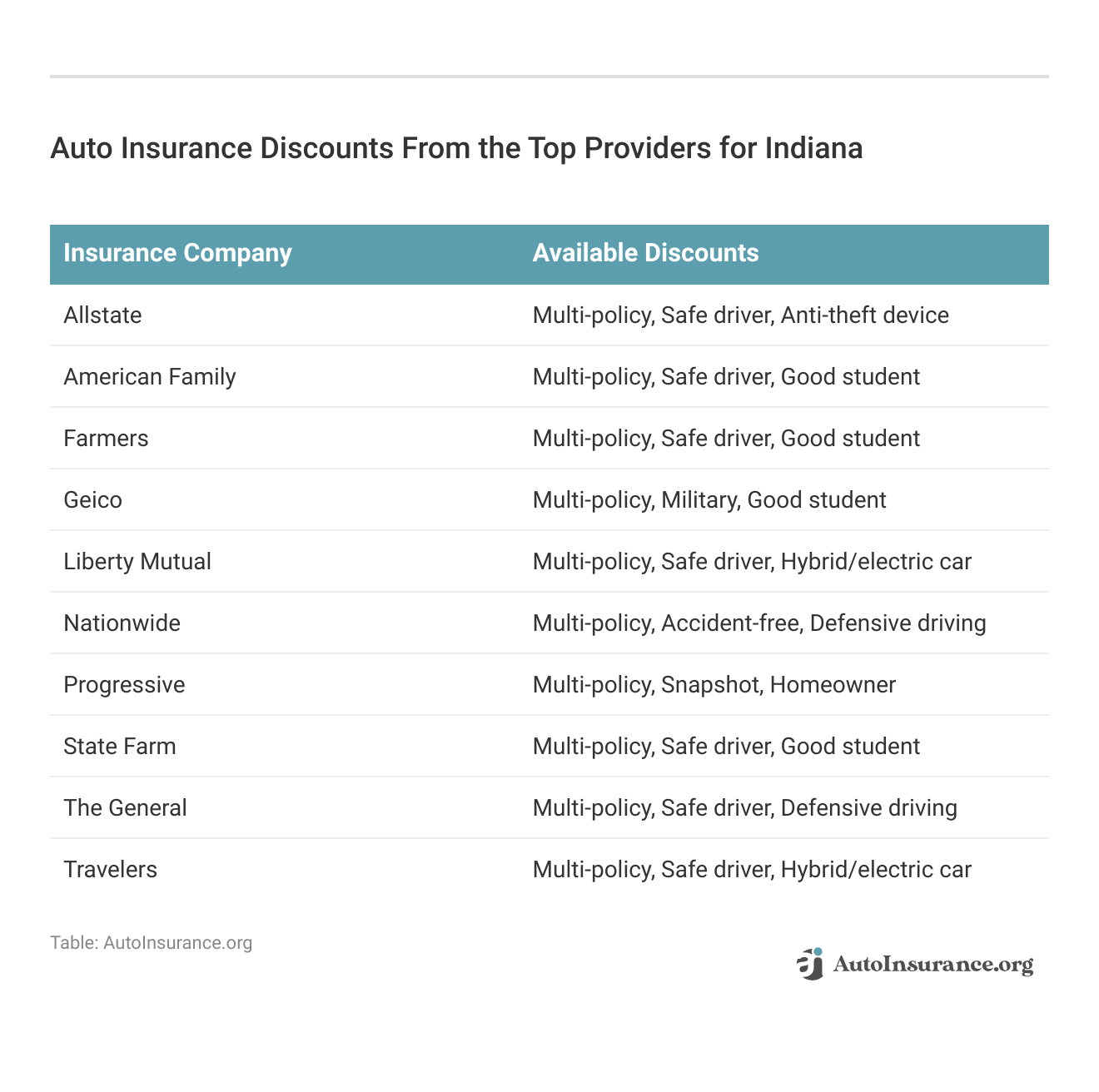

Are there any discounts available for auto insurance in Indiana?

Yes, insurance companies in Indiana offer various discounts that can help reduce your auto insurance premiums. Common discounts include good driver discounts, multi-vehicle discounts, safe driver courses, anti-theft device discounts, and bundling your auto insurance with other policies, such as homeowners insurance.

Can I add additional coverage to my auto insurance policy in Indiana?

Yes, you can add additional coverage to your auto insurance policy in Indiana. Some common optional coverages include collision coverage, comprehensive coverage, medical payments coverage, and rental reimbursement coverage. These coverages provide extra protection and can be tailored to your specific needs.

Is Indiana a no-fault auto insurance state?

No, Indiana is an at-fault state for auto insurance.

What factors affect the cost of auto insurance in Indiana?

Several factors can affect the cost of auto insurance in Indiana, including your age, driving record, credit score, the type of vehicle you drive, and the coverage limits you choose. Additionally, where you live in Indiana can impact your premiums, as rates can vary by ZIP code based on local traffic patterns, crime rates, and weather risks.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Are there specific coverage requirements for auto insurance in Indiana?

Yes, Indiana has minimum auto insurance coverage requirements that drivers must adhere to. The state requires drivers to carry liability insurance with minimum coverage limits of 25/50/25. This means $25,000 bodily injury coverage per person, $50,000 bodily injury coverage per accident, and $25,000 property damage coverage per accident.

While these are the minimum requirements, many drivers opt for higher coverage limits or additional types of coverage for better protection.

What are some tips for saving money on Indiana auto insurance?

There are several ways to save money on auto insurance in Indiana. Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, to qualify for multi-policy discounts. Additionally, maintain a clean driving record, as insurers often offer discounts for safe drivers.

You can also explore options like paying your premium in full upfront, raising your deductible, or taking advantage of available discounts for things like anti-theft devices or defensive driving courses. Read more: How to Save Money by Bundling Insurance Policies

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.