Best Alaska Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, USAA, and Allstate have the best Alaska auto insurance. Minimum Alaska auto insurance requirements include 50/100/25 of liability coverage. At State Farm, minimum liability insurance averages $32/mo. However, Alaska drivers should consider full coverage to protect against weather incidents.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: May 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Alaska

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Alaska

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Alaska

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm, USAA, and Allstate have the best Alaska auto insurance.

Alaska auto insurance is cheaper than the national average, and you can find even lower rates if you only need the state minimum auto insurance requirements.

Our Top 10 Company Picks: Best Alaska Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Coverage | State Farm | |

| #2 | 10% | A++ | Military Benefits | USAA | |

| #3 | 25% | A+ | Claim Satisfaction | Allstate | |

| #4 | 25% | A++ | Low Rates | Geico | |

| #5 | 12% | A+ | Flexible Policies | Progressive | |

| #6 | 12% | A | Custom Coverage | Liberty Mutual |

| #7 | 20% | A | Personalized Service | Farmers | |

| #8 | 29% | A | Local Agents | American Family |

| #9 | 20% | A+ | Broad Coverage | Nationwide |

| #10 | 20% | A+ | Senior Focus | The Hartford |

However, you should consider full coverage auto insurance in Alaska to protect yourself and your vehicle.

Continue reading to learn about Alaska auto insurance companies and the factors affecting your rates at the best auto insurance companies. In addition, we’ll discuss other pertinent information about auto insurance in Alaska and help you find cheap auto insurance in Alaska. Compare rates with our free tool to shop for cheap Alaska auto insurance today.

- State Farm has the best Alaska car insurance coverage

- Alaska auto insurance requirements include 50/100/25 in liability coverage

- Alaska drivers should consider full coverage for better protection

#1 – State Farm: Top Pick Overall

Pros

- Reliable Coverage: State Farm is a reliable company for auto insurance coverage. Learn more in our State Farm review.

- Discount Selection: Alaska drivers have plenty of saving opportunities.

- Personalized Service: Local agents can be found for more personalized service.

Cons

- Financial Stability: A.M. Best lowered the company’s rating.

- Online Tools: Focusing on personalized assistance means State Farm has fewer online services.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA members get additional benefits, like shopping discounts.

- Customer Service: Customer reviews and ratings for service are high. Find out more in our USAA review.

- Coverage Variety: Alaskan drivers can get a basic policy or add extras like roadside assistance.

Cons

- Eligibility Restrictions: Alaska coverage is only sold to military or veterans.

- Lack of Local Agents: Alaska customer service is provided virtually.

#3 – Allstate: Best for Claim Satisfaction

Pros

- Claim Satisfaction: Allstate has a claim satisfaction guarantee. Read more in our Allstate review.

- Multiple-Policy Discount: Multiple-policy holders in Alaska will have discounted rates.

- Online Convenience: Allstate’s app is convenient for online management.

Cons

- Customer Reviews: Some negative reviews mention poor customer service.

- Higher Rates: Allstate’s rates can be higher than expected for some customers.

#4 – Geico: Best for Low Rates

Pros

- Low Rates: Geico generally has competitive rates for most Alaska drivers. Learn more about rates in our review of Geico.

- Online Convenience: Geico is user-friendly due to its free app.

- Financial Rating: The company got the highest rating from A.M. Best for financial stability.

Cons

- Lack of Local Agents: Alaska drivers will have to get support virtually.

- Coverage Options: Gap coverage is missing from Geico’s lineup.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Flexible Policies

Pros

- Flexible Policies: Alaska drivers can adjust their Progressive policy as needed.

- Snapshot Discount: Alaska customers can join Snapshot at Progressive.

- Coverage Options: Choose from extras like roadside assistance or carry a basic policy. Learn more by reading our review of Progressive.

Cons

- Customer Reviews: While Progressive has mostly average ratings, some reviews are negative.

- Snapshot Rates: Alaska drivers could have increased rates if they do poorly in the program.

#6 – Liberty Mutual: Best for Custom Coverage

Pros

- Custom Coverage: Liberty Mutual has good coverage for custom and classic cars in Alaska.

- 24/7 Claims: Alaska customers can file a claim or get support 24/7.

- Multi-Policy Discount: Lower rates by bundling policies. Learn more in our review of Liberty Mutual.

Cons

- Higher Rates: Alaska rates from Liberty Mutual may be slightly higher than average.

- Customer Reviews: Inconsistent customer service has been remarked upon in some reviews.

#7 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers provides personalized service through online representatives or local agents.

- Multi-Policy Discounts: Bundle at Farmers for lower Alaska car insurance rates.

- Coverage Variety: Alaska policies can be customized with add-ons. Learn more in our review of Farmers.

Cons

- Claims Processing: Some customers have left reviews about slow processing.

- Higher Rates: Farmers’ rates may be higher for some drivers in Alaska.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Local Agents

Pros

- Local Agents: American Family has local agents to support Alaska drivers.

- Student Savings: Alaska students can save with the company’s good student discount.

- Customer Satisfaction: Learn about the company’s good ratings in our American Family review.

Cons

- Online Services: They may not be as convenient at American Family.

- New Customer Rates: Alaska drivers who are new customers won’t get a loyalty discount, so rates may be slightly higher.

#9 – Nationwide: Best for Broad Coverage

Pros

- Broad Coverage: Nationwide full coverage protects Alaska drivers in a broad range of accidents.

- Multi-Policy Discount: Alaska drivers can lower rates by bundling at Nationwide.

- Accident Forgiveness: Alaskan customers may qualify for forgiveness for their first accident.

Cons

- Customer Reviews: Most reviews rate services as average. Learn more in our Nationwide review.

- High-Risk Rates: Alaska drivers will have expensive quotes if their driving records aren’t great.

#10 – The Hartford: Best for Senior Focus

Pros

- Senior Focus: The Hartford specializes in senior drivers and provides discounts to AARP members.

- Financial Stability: The Hartford has a good rating for its financial management.

- Coverage Options: Alaska drivers have a wide variety of choices. Learn more in our review of The Hartford.

Cons

- Young Driver Rates: The Hartford isn’t as economical for young Alaskan drivers.

- Customer Reviews: The Hartford doesn’t stand out for customer service, due to mixed reviews and ratings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance in Alaska

Some of the top companies for Alaska auto insurance aren’t necessarily the cheapest ones. However, most are cheap, and they offer great coverage and discounts to help make coverage more affordable.

Alaska Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $66 | $192 | |

| $51 | $150 | |

| $62 | $181 | |

| $37 | $109 | |

| $80 | $234 |

| $53 | $155 |

| $47 | $138 | |

| $32 | $93 | |

| $121 | $162 |

| $29 | $85 |

When searching for cheap car insurance, it’s important to note that just because a company says it’s affordable doesn’t mean it’s the cheapest for you. For example, some of the cheapest companies for drivers with clean records are some of the most expensive after an at-fault accident or DUI. People with a DUI on their record should search specifically for the best auto insurance for drivers with a DUI.

So, we’ve broken down the cheapest Alaska auto insurance companies for various coverage needs and driving infractions. From State Farm auto insurance to Progressive, you can find the most affordable auto insurance in Alaska for you based on your driving profile.

Cheapest Alaska Auto Insurance For Minimum Liability

Minimum liability auto insurance is the bare minimum you must carry to drive legally in Alaska. It covers other parties’ property damage and bodily injury bills if you cause an accident.

In Alaska, the average cost of minimum liability insurance is $32 monthly. Below, you can see what different Alaska auto insurance companies charge monthly for a minimum liability insurance policy:

Alaska Minimum Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $66 | |

| $51 | |

| $62 | |

| $37 | |

| $80 |

| $53 |

| $47 | |

| $32 | |

| $121 |

| $29 | |

| U.S. Average | $61 |

State Farm and Geico auto insurance offer some of the cheapest car insurance in Alaska for minimum liability insurance. Getting quotes from a few of the cheapest companies on the above list will help you see the cheapest one for you.

It’s best to avoid the more expensive companies on the list — like Allstate auto insurance — if you’re looking for a basic minimum liability insurance policy. Otherwise, you may pay much more for minimum Alaska insurance than if you picked a different auto insurance company.

To find out who has the best auto insurance for other types of coverage besides just minimum liability, you can read about Geico vs. Progressive auto insurance.

Cheapest Alaska Auto Insurance For Full Coverage

Full coverage auto insurance costs more than minimum liability insurance, but full coverage also protects drivers’ assets more than just carrying a liability policy. Since full coverage consists of comprehensive and collision coverages alongside minimum liability coverage, it pays for your own car repair costs if you cause a crash or your car gets damaged by animal collisions or weather.

In Alaska, full coverage insurance policies cost an average of $117 monthly. However, this average changes from company to company, as you can see in the table below:

Alaska Full Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $192 | |

| $150 | |

| $181 | |

| $109 | |

| $234 |

| $155 |

| $138 | |

| $93 | |

| $162 |

| $85 | |

| U.S. Average | $165 |

State Farm has some of the cheapest rates on average for full-coverage auto insurance in Alaska. Comparing Geico vs. State Farm auto insurance is a good way to start getting quotes when searching for cheap Alaska car insurance if you have a clean driving record. You can also get quotes directly from these companies’ websites or use a quote comparison tool.

If you have any infractions on your driving record, such as a DUI, then you should compare companies more in-depth to ensure these companies are still the cheapest for full coverage.

Cheapest Auto Insurance in Alaska For Young Drivers

Since young drivers lack experience, they’re more likely to get into crashes and file claims. Insurance companies charge young drivers more to offset the higher risk of paying out a claim.

If you’re a young driver, look at the average rates for younger drivers in Alaska below:

Alaska Full Coverage Auto Insurance Monthly Rates for Teen Drivers by Provider

| Insurance Company | 16-Year-Old Female | 16-Year-Old Male | 18-Year-Old Female | 18-Year-Old Male |

|---|---|---|---|---|

| $676 | $474 | $418 | $550 | |

| $654 | $459 | $392 | $532 | |

| $1,009 | $707 | $780 | $821 | |

| $424 | $297 | $299 | $345 | |

| $1,058 | $741 | $717 | $860 |

| $642 | $450 | $408 | $522 |

| $1,008 | $706 | $726 | $820 | |

| $425 | $298 | $268 | $346 | |

| $1,221 | $856 | $711 | $993 |

| $405 | $284 | $296 | $329 | |

| U.S. Average | $761 | $808 | $560 | $656 |

Geico and State Farm have some of the cheaper average rates for young drivers. Choosing one of these companies can save young drivers thousands of dollars than going with a more expensive company like Allstate.

It’s important to note that these average auto insurance rates are for young drivers purchasing their own insurance policies. Auto insurance for teens is much cheaper when added to an existing policy, such as their parent’s car insurance policy. If the young driver still lives at home, it’s perfectly acceptable for them to join their parents’ auto insurance policy.

Cheapest Auto Insurance in Alaska For Bad Credit

You might wonder how credit scores affect auto insurance rates in Alaska and why. Bad credit scores suggest that a driver is more likely to miss monthly payments, leading to a coverage lapse and a higher likelihood of driving without auto insurance.

Bad credit scores will raise your insurance rates at insurance companies in Alaska. Below, you can see how much the monthly rates are at different Alaska auto insurance companies for drivers with bad credit scores.

Alaska Full Coverage Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $108 | $128 | $148 | |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

Geico and State Farm are some of the best auto insurance companies for bad credit in Alaska. Travelers is also a good choice for cheaper auto insurance with bad credit. Read our Travelers auto insurance review to learn more about the company.

If you find your Alaska car insurance rates have increased due to bad credit, improving your credit score and picking a cheaper company can help you reduce your insurance rates. After all, getting your credit back on track is hard if you have to pay hundreds of dollars more in car insurance payments.

Cheapest Alaska Auto Insurance for At-Fault Accidents

Like bad credit scores, causing a car accident will increase your auto insurance rates in Alaska. How much more you pay for coverage depends on your insurance company. Below, you can see how insurance companies’ rates vary after an at-fault accident in Alaska.

Alaska Full Coverage Auto Insurance Monthly Rates & Provider: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $270 | $192 | |

| $226 | $150 | |

| $258 | $181 | |

| $180 | $109 | |

| $316 | $234 |

| $218 | $155 |

| $232 | $138 | |

| $110 | $93 | |

| $187 | $162 |

| $119 | $85 | |

| U.S. Average | $244 | $165 |

State Farm and Geico have some of the cheapest rates after an at-fault accident, whereas Progressive and Allstate have some of the most expensive average rates. However, Geico will increase your rates more after the first accident than other companies.

Keep in mind that the average rate increases you see in the table above are just for one at-fault accident on a driver’s record. More than one at-fault accident within the last few years will raise higher rates.

If your auto insurance company offers accident forgiveness, it’s usually worth signing up for. Since at-fault accidents increase rates by at least a few hundred dollars, having accident forgiveness means you won’t have to pay increased rates after your first at-fault accident claim.

Some accident forgiveness programs are free for qualifying drivers, while others may require you to pay a small fee to join. Regardless, accident forgiveness can save you a lot of money in the long run, as insurance companies will forgive your first at-fault accident with them.

Cheapest Alaska Auto Insurance for Traffic Tickets

Any traffic ticket that adds points to your driving record, such as speeding or reckless driving tickets, will also increase your auto insurance rates. Violations like these indicate to an insurance company that you are a higher risk to insure due to poor driving habits.

Below, you can see how traffic tickets change average rates at Alaska companies.

Alaska Full Coverage Auto Insurance Monthly Rates & Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $228 | $192 | |

| $175 | $150 | |

| $226 | $181 | |

| $144 | $109 | |

| $285 | $234 |

| $185 | $155 |

| $186 | $138 | |

| $102 | $93 | |

| $180 | $162 |

| $100 | $85 | |

| U.S. Average | $203 | $165 |

State Farm and Geico have some of the cheapest rates in Alaska for drivers with a traffic ticket. Drivers with tickets on their records should avoid Allstate, as this company has some of the highest average rates for drivers with tickets on their records. It’s important to know how long a speeding ticket affects your auto insurance when shopping for a policy.

Cheapest Alaska Auto Insurance for a DUI

A DUI conviction raises rates significantly at all insurance companies in Alaska, making it much more difficult to find cheap auto insurance. Below, we’ve outlined some of the average rates for drivers with a DUI on their driving record.

Alaska Full Coverage Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $192 | $270 | $270 | $228 | |

| $150 | $226 | $249 | $175 | |

| $181 | $258 | $252 | $226 | |

| $109 | $180 | $294 | $144 | |

| $234 | $316 | $422 | $285 |

| $155 | $218 | $319 | $185 |

| $138 | $232 | $169 | $186 | |

| $93 | $110 | $102 | $102 | |

| $162 | $187 | $277 | $180 |

| $85 | $119 | $152 | $100 | |

| U.S. Average | $165 | $244 | $295 | $203 |

State Farm has some of the lowest rates for drivers with a DUI on their record, making it a good choice to try and find savings. Meanwhile, while Geico is usually one of the cheapest companies, it will be one of the more expensive insurers if you have a DUI.

So, comparing companies’ average rates based on your driving record is essential. A cheap company may become more expensive than other insurers for certain demographics. If you have a DUI on your driving record, get quotes from multiple companies in Alaska to see which companies are actually the cheapest for you.

Cheapest Alaskan Cities for Auto Insurance Coverage

Just like car insurance rates change from state to state, drivers in different cities in Alaska will pay different rates, even with the same auto insurance company, due to different location risks in each city. For example, one city may have higher rates of vehicle theft or fatal crashes, making it riskier to insure cars in that city.

Take a look at the table below to get an idea of how average rates can change in Alaska’s major cities, including Anchorage auto insurance.

Alaska Auto Insurance Monthly Rates by ZIP Code

| Most Expensive | Rates | Least Expensive | Rates |

|---|---|---|---|

| Anchorage 99504 | $261 | Meyers Chuck 99903 | $206 |

| Chugiak 99567 | $260 | Wrangell 99929 | $206 |

| Eagle River 99577 | $259 | Hyder 99923 | $206 |

| Anchorage 99508 | $258 | Hydaburgh 99922 | $205 |

| Palmer 99645 | $258 | Thorne Bay 99919 | $205 |

| Anchorage 99502 | $257 | Point Baker 99927 | $205 |

| Anchorage 99507 | $257 | Ketchikan 99901 | $203 |

| Anchorage 99518 | $257 | Coffman Cove 99918 | $203 |

| Anchorage 99503 | $256 | Ward Cove 99928 | $203 |

| Anchorage 99599 | $256 | Juneau 99801 | $199 |

| Anchorage 99501 | $256 | Juneau 99811 | $199 |

| Anchorage 99513 | $256 | Auke Bay 99821 | $199 |

| Anchorage 99529 | $256 | Sitka 99835 | $198 |

| Big Lake 99652 | $256 | Port Alexander 99836 | $198 |

| Wasilla 99654 | $256 | Elfin Cove 99825 | $198 |

| Anchorage 99515 | $256 | Skagway 99840 | $198 |

| Anchorage 99517 | $256 | Haines 99827 | $197 |

| Anchorage 99530 | $256 | Gustavas 99826 | $196 |

| Sutton 99674 | $255 | Douglas 99824 | $196 |

| Anchorage 99516 | $255 | Petersburg 99833 | $196 |

| Indian 99540 | $252 | Kake 99830 | $196 |

| Jber 99505 | $251 | Pelican 99832 | $196 |

| Jber 99506 | $249 | Tenakee Springs 99841 | $196 |

| Willow 99688 | $246 | Hoonah 99829 | $196 |

| Houston 99694 | $246 | Angoon 99820 | $195 |

One of the most expensive cities for car insurance is Anchorage, Alaska. Still, it’s possible to find cheap auto insurance in Anchorage. If you move to Anchorage, you may see a slight increase in your insurance rates, even if you stick with the same insurance company.

Therefore, if you are moving to a new area in Alaska, we recommend getting a few insurance quotes to check how your rates will change and which company offers the most affordable auto insurance in Alaska.

Auto Insurance Costs Across Alaskan Cities

This table provides a comparative overview of auto insurance rates between Anchorage and Fairbanks, Alaska, enabling quick and informed decision-making for prospective policyholders.

Alaska Auto Insurance Cost by City

Living in a city with cheaper rates on average may mean your monthly insurance bill is lower.

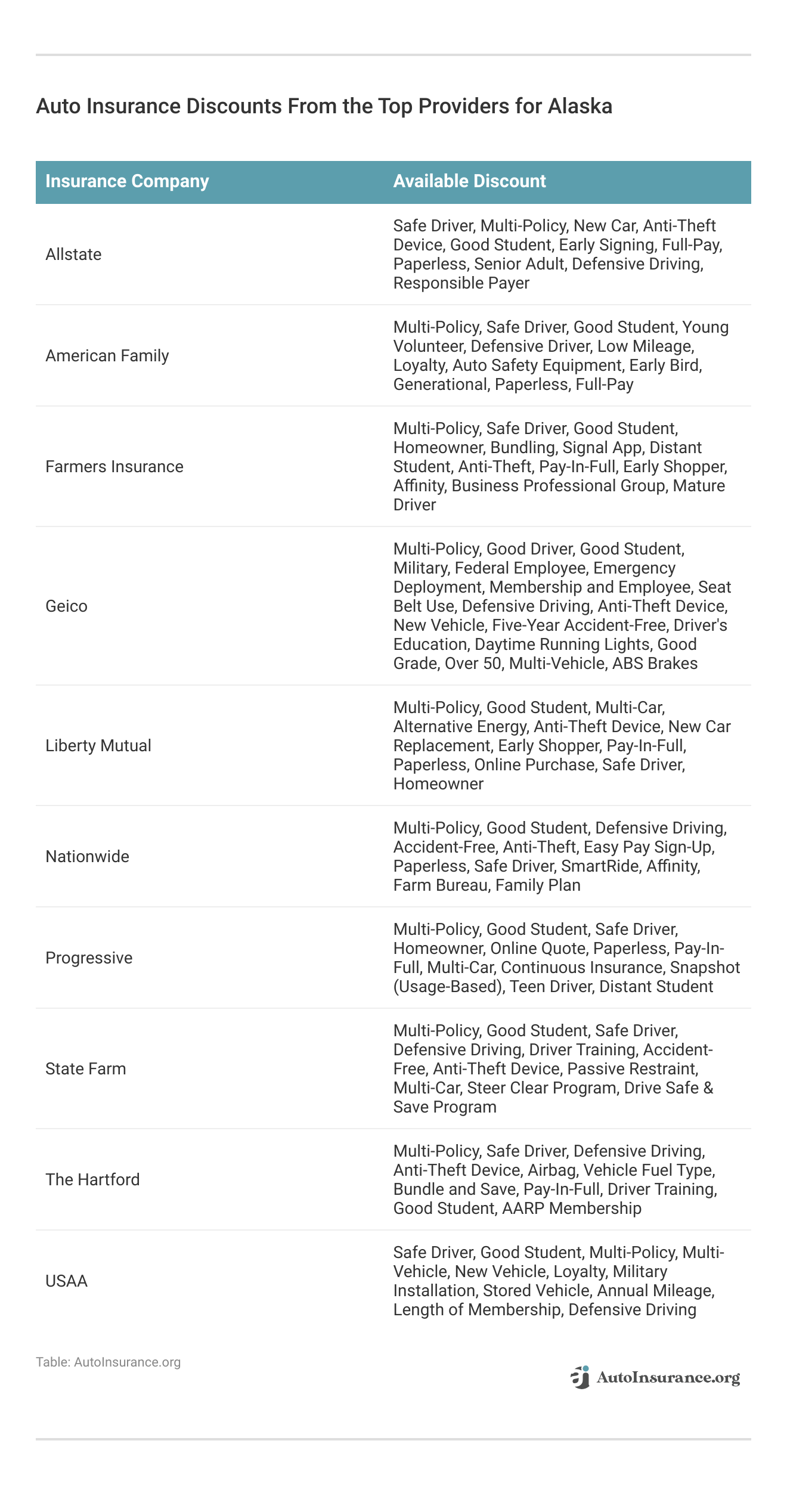

Additional Tips For Saving on Alaska Auto Insurance

Getting insurance quotes and comparing companies’ average rates based on your driving record is one of the best ways to find cheap insurance in Alaska. However, there are a few other tips and tricks to reduce your insurance costs.

For example, some auto insurance discounts don’t automatically apply to your insurance policy unless you ask for them, such as a defensive driver auto insurance discount or a good student discount. The best discounts you’ll find at the top companies are below.

Some of the things you can do to cut back on insurance costs include the following:

- Buy a Safe Car: Cars that are cheaper to repair and have good safety ratings are cheaper to insure. You can get quotes for the vehicle you want to see which are the best cars for Alaska insurance.

- Drop Unnecessary Coverages: You may want to get rid of extra coverages like roadside assistance or carry just bare minimum liability insurance if your car is old and greatly depreciated in value.

- Raise Deductibles: Increasing your auto insurance deductible will lower your rates, though you should never raise your deductible beyond an amount you can’t afford to pay out of pocket.

Check out your Alaska auto insurance company’s full list of discounts. There are many you may qualify for that haven’t been applied to your policy yet or programs you participate in for a discount.

For example, some insurance companies offer usage-based auto insurance discounts, where the company tracks your driving data for a few months and then offers a discount based on your score. Even if you don’t score well, most usage-based discounts often offer a small five to ten percent discount just for signing up.

Alaska Auto Insurance Coverage and DUI Laws

Knowing what coverages you must carry can help you plan your car insurance costs accordingly. States that require drivers to maintain higher levels of coverage will naturally have higher average insurance costs. Read on to find out what types of auto insurance you must carry in Alaska, and learn important DUI penalties and SR-22 insurance requirements.

Alaska Auto Insurance Requirements

If you live in Alaska, you must carry liability insurance to drive legally in the state. Alaska requires drivers to carry both bodily injury liability insurance and property damage liability insurance. The amounts drivers must carry for both of these liability coverages are as follows:

- Bodily Injury Liability Insurance: $50,000 per person and $100,000 per accident

- Property Damage Liability Insurance: $25,000 per accident

Alaska has fairly high limits for bodily injury liability insurance but only requires $25,000 worth of property damage liability insurance. If you cause a major accident resulting in more than $25,000 worth of damages, such as totaling another driver’s car, you may be stuck with out-of-pocket bills. So, purchasing a slightly higher liability limit is wise if you can afford it.

Alaska Auto Insurance Optional Coverages

Since Alaska only requires drivers to carry liability insurance, all other insurance coverages are optional, and you can drive legally without them without breaking Alaska car insurance laws. However, your lender may require you to carry comprehensive and collision insurance if you have a lease or loan on your car. In this case, you must purchase those coverages.

In all other cases, you can choose whether to carry the following car insurance coverages:

- Comprehensive

- Collision

- Gap insurance

- Modified car insurance

- Non-owner auto insurance

- Rental car reimbursement coverage

- Roadside assistance

- Uninsured/underinsured motorist coverage

- Umbrella insurance

These optional insurance coverages can be well worth the additional cost. For example, comprehensive auto insurance pays for your car repairs if it gets damaged by an animal collision, vandalism, theft, extreme weather, and more. With multiple large animal collisions in Alaska every year, purchasing comprehensive insurance can be well worth the slightly higher insurance costs.

Likewise, collision auto insurance pays for damages to your car if you hit another vehicle or object, such as a telephone pole. Without collision insurance, you’ll pay for your own car repairs in an accident you cause. So, while you’ll see an increase in Alaska car insurance rates when adding these coverages, they can save you from a financial headache later.

DUI Penalties in Alaska

DUIs in Alaska can cost you much time and money beyond just huge increases in insurance rates. Some of the penalties you may face in Alaska for a DUI conviction include the following consequences:

- Alcohol/drug evaluation

- Alcohol/drug treatment program

- Driving record points

- Fines and court fees

- Ignition interlock device (IID)

- Jail time

- License revocation

- Probation

- Restricted driver’s license

- SR-22 certificate

- Vehicle impoundment

The severity of the penalties in Alaska depends on the number of offenses and the severity of the offense. For instance, drivers may not receive jail time for their first DUI and have lighter fines. On the other hand, a driver with a third DUI charge will face mandatory jail time and have much higher fines and fees.

If you're convicted of a DUI 🚔, you might pay 74% more for car insurance 💰, according to https://t.co/27f1xf1ARb. Even with a DUI on your record, you can take control of your insurance options and search for better rates. Find out more here 👉: https://t.co/BN5jVydqXx pic.twitter.com/FKhuGNzHa0

— AutoInsurance.org (@AutoInsurance) June 13, 2023

While a DUI increases a driver’s Alaska auto insurance rates, other costs associated with the charge make getting a DUI very expensive. Auto insurance costs will also stay high for a few years. So, even after the court fees and fines get paid, DUI drivers will face financial repercussions long after the conviction, making obtaining cheap auto insurance with a DUI in Alaska difficult even when getting Alaska SR22 insurance quotes.

SR-22 Certificates for Alaska Auto Insurance

High-risk drivers in Alaska may have to apply for SR-22 certificates. SR-22 certificates in Alaska prove that a driver carries the state’s required insurance. You may need to file one to get back a revoked driver’s license and similar documentation.

Some Alaska drivers who might need an SR-22 certificate include the following:

- Drivers with a DUI or two on their driving record

- Drivers with multiple traffic violations and points on their driving record

- Drivers caught driving without insurance coverage

- Drivers caught driving with an expired or suspended driver’s license

If you currently have an Alaska auto insurance company and need an SR-22 certificate, contact your insurer and let them know to file it. Your insurance company may charge a small fee to file SR-22 or drop your coverage entirely if it can’t insure high-risk drivers with an SR-22 certificate.

While the company must give you notice so you have enough time to find new coverage, you may have trouble getting another policy if you got dropped.

If you can’t find an insurance company to insure you as a high-risk driver and provide an SR-22 certificate, you can apply to the Alaska Automobile Insurance Plan. The Alaska Automobile Insurance Plan will assign high-risk drivers to insurance companies in Alaska, so you're guaranteed insurance coverage.Brandon Frady Licensed Insurance Agent

Insurance through the Alaska Automobile Insurance Plan is often more expensive, so it’s best to see if you can find Alaska car insurance on your own first.

Finally, if you need an SR-22 certificate but don’t own a vehicle, purchase non-owner car insurance first. This insurance coverage provides liability insurance when driving other cars and meets the requirements for an SR-22 certificate and cheap SR-22 auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Auto Insurance in Alaska

Alaska’s car insurance rates can be cheap if drivers take the time to compare auto insurance quotes based on their driving records (learn more: How to Evaluate Auto Insurance Quotes). Drivers can also save on average Alaska car insurance costs by applying for discounts, dropping non-vital coverages, and raising their deductibles.

To find the best Alaska car insurance coverage today, enter your ZIP into our free quote tool.

Frequently Asked Questions

How much is Alaska auto insurance?

The average cost of car insurance in Alaska for full coverage is $117 monthly, but it depends on the individual driver. Get an Alaska car insurance quote to know exactly what you’ll pay.

Is auto insurance cheaper in Alaska?

Alaska auto insurance is slightly cheaper than the national average. While coverage in Alaska averages $117/mo, the national average is $119. However, expect rates for auto insurance in Fairbanks, Alaska, to be more expensive since it’s a larger city.

So, it’s easy to find the best car insurance in Alaska — all you need to do is compare quotes, coverage options, and discounts. Get Alaska car insurance quotes now by entering your ZIP in our free tool.

What are the cheapest auto insurance companies in Alaska?

When looking at Alaska car insurance companies, drivers should consider more than just the cost of a policy. In addition to insurance rates, it’s important to consider a company’s reputation and financial strength.

With that said, some of the best auto insurance companies in Alaska that offer cheap rates and decent ratings are State Farm and Geico. If you’re a military member or veteran, another great choice for cheap car insurance in Alaska that considers both cost and reputation is USAA auto insurance.

Is Alaska a no-fault state for car insurance?

No, Alaska requires the at-fault driver to cover the other driver’s injuries and property damages after an accident.

What is the average monthly cost of Alaska auto insurance?

Minimum liability insurance in Alaska costs an average of $34 monthly, whereas full coverage insurance in Alaska averages $110 per month.

However, your Alaska car insurance rates will vary by driving record, location, vehicle, and other important insurance rate factors.

How much car insurance do I need in Alaska?

Alaska car insurance requirements state that all drivers must have the following liability limits:

- Bodily Injury Liability Insurance: $50,000 per person and $100,000 per accident

- Property Damage Liability Insurance: $25,000 per accident

Drivers who don’t meet Alaska auto insurance requirements face multiple fines, revoked licenses, increased rates, and other penalties. If you find yourself struggling to pay for car insurance in Alaska, compare quotes and take advantage of discounts at your company.

What other types of auto insurance coverage should I consider in Alaska?

You should also consider other Alaska car insurance policies for full protection, such as collision coverage, uninsured/underinsured motorist coverage, medical payments coverage, and comprehensive coverage.

Are there any specific factors that can affect my auto insurance rates in Alaska?

There are several factors that affect auto insurance rates in Alaska, including your driving record, age, gender, vehicle type, location, credit history, and coverage type. Insurance companies also consider local factors, such as frequency of accidents, thefts, and severe weather conditions.

Can I get discounts on my auto insurance in Alaska?

Yes, many insurance companies offer discounts to help reduce your auto insurance premiums in Alaska.

Common discounts include safe driver discounts, multi-policy discounts, safety feature discounts, and defensive driver discounts. It’s best to inquire about available discounts with your insurer.

How can I find affordable auto insurance in Alaska?

Compare quotes from multiple insurance companies to find affordable auto insurance in Alaska. Maintaining a good driving record, choosing a vehicle with good safety ratings, and opting for higher deductibles can also help lower your Alaska insurance premiums.

Can I get coverage for rental cars in Alaska?

Yes, you can add rental car reimbursement coverage, which helps pay for a rental car while your car is in the shop for repairs after a covered claim.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.