Cheap Subaru Auto Insurance in 2025 (Save Money With These 10 Providers!)

Our top picks for cheap Subaru auto insurance is Geico, AAA, and State Farm. These companies offer plenty of Subaru insurance discounts and UBI programs to help keep rates low. With average minimum insurance rates starting at $30 per month, finding low Subaru car insurance rates is usually easy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jan 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Subaru

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Subaru

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Subaru

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top providers for cheap Subaru auto insurance are Geico, AAA, and State Farm, thanks to their usage-based insurance programs and generous discounts.

Geico has the cheapest Subaru insurance costs, especially for drivers with government jobs. In addition to affordable quotes, Geico offers excellent customer service and a variety of types of auto insurance to meet any need. Geico is ideal for Subaru drivers looking for digital options to manage their policies and start claims.

Our Top 10 Company Picks: Cheap Subaru Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $30 | A++ | Cheap Rates | Geico | |

| #2 | $32 | A | Roadside Assistance | AAA |

| #3 | $33 | B | Coverage Options | State Farm | |

| #4 | $37 | A+ | Budgeting Tools | Travelers | |

| #5 | $39 | A | Loyalty Discounts | Progressive | |

| #6 | $43 | A+ | Accident Forgiveness | American Family | |

| #7 | $44 | A | Customizable Policies | Nationwide |

| #8 | $53 | A | Customizable Policies | Farmers | |

| #9 | $61 | A+ | Customized Policies | Allstate | |

| #10 | $68 | A | 24/7 Support | Liberty Mutual |

Read on to explore your options for cheap Subaru auto insurance.

Then, compare quotes today by entering your ZIP code in our free comparison tool above.

- Subaru’s excellent safety and reliability ratings help keep insurance rates low

- The average Subaru driver pays $44 per month for minimum insurance

- Geico and AAA have the cheapest Subaru insurance quotes

#1 – Geico: Top Pick Overall

- Subaru Auto Insurance

Pros

- Competitive Rates: Geico offers affordable Subaru car insurance rates to most drivers. See how much you might pay in our Geico auto insurance review.

- Online Tools: It’s easy to manage your car insurance policy with Geico’s convenient online tools.

- Solid Customer Service: Although it doesn’t leave everyone satisfied, Geico policyholders usually leave positive customer service reviews.

Cons

- Average Claims Reviews: Geico does a little worse with its claims reviews, with many customers reporting long wait times.

- Fewer Coverage Options: Despite being one of the largest insurance companies in the country, Geico offers fewer add-on options than expected.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – AAA: Best for Roadside Assistance Plans

Pros

- Three Roadside Assistance Plans: AAA offers three cheap Subaru insurance roadside assistance plans, starting at an average of just $65 per year.

- Member Benefits: AAA membership comes with more than just roadside assistance. You’ll gain access to perks like hotel discounts and shopping deals. Explore more perks in our AAA auto insurance review.

- Good Local Presence: AAA maintains a large number of local agents in most major cities, meaning you probably won’t have trouble finding personalized help.

Cons

- Membership Fees: To purchase auto insurance from AAA, you need to be a member. Membership fees are affordable but add to the overall price of your insurance.

- Rates Sometimes High: Although AAA usually offers low prices, it can sometimes be expensive. For example, Subaru BRZ insurance costs can be high at AAA for drivers with bad credit scores.

#3 – State Farm: Best for Bundling Discounts

Pros

- Good Customer Satisfaction: Most customers report being satisfied with their State Farm policies. Read what more customers have to say in our State Farm auto insurance review.

- Multi-Policy Discounts: State Farm offers 13 discounts, which include an excellent bundling discount for buying home and auto insurance.

- Excellent Coverage Options: Aside from the basics, you can add coverage to your policy, such as roadside assistance and travel expense coverage.

Cons

- Limited Specialty Coverage: While State Farm offers a good variety of add-ons, you won’t find coverage for car modifications or Subaru gap insurance.

- Average Digital Tools: Despite being the largest insurance company in America, State Farm’s digital tools leave customers wanting.

#4 – Travelers: Best for Policy Customization

Pros

- Customizable Coverage: With options like rideshare insurance and accident forgiveness, Travelers is an excellent option for anyone who wants to customize their coverage.

- IntelliDrive: Save up to 30% on your policy by enrolling in IntelliDrive, Travelers’ UBI program. See if IntelliDrive is right for you in our Travelers auto insurance review.

- Strong Financial Ratings: A. M. Best gives Travelers an A++ for its financial stability, meaning any claims you need to make will be paid.

Cons

- Average Claims Handling: Travelers policyholders report that the claims resolution process can be slow.

- Mixed Customer Reviews: When it comes to customer reviews, drivers are split. Many say they love their Travelers policy, while others have been less impressed.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Drivers on a Budget

Pros

- Snapshot: Progressive’s UBI program Snapshot offers savings of up to 30%. However, bad drivers can see their rates increase under Snapshot.

- Friendly Digital Tools: Progressive has an excellent mobile app you can use to manage your policy and start claims. You can also use the Name Your Price tool to see how much coverage you can purchase based on your desired monthly budget.

- Low Rates: Drivers can usually find affordable rates with Progressive. For example, Progressive’s Subaru Outback insurance costs are typically lower than the national average.

Cons

- Limited Agents: Progressive focuses more on online policy management, so it can be hard to find help from an agent in some areas.

- Low Customer Loyalty: Despite low rates, Progressive struggles with customer loyalty. Explore what Progressive is doing to improve its service in our Progressive auto insurance review.

#6 – American Family: Best for Costco Members

Pros

- Writes Costco Policies: American Family writes and manages Costco policies, helping warehouse members save.

- Multiple Discounts: With an impressive selection of 18 options, American Family makes it easy to take advantage of discounts. See how many discounts you may qualify for in our American Family auto insurance review.

- Customizable Coverage: Get the best car insurance for Subarus by adding extra coverage to your policy. American Family offers choices like accidental death and dismemberment coverage and gap insurance.

Cons

- Limited Availability: You can only get Subaru insurance quotes from American Family in 19 states.

- Higher Rates for Some Models: American Family is not the cheapest option for all Subaru models. For example, Subaru Impreza insurance rates are some of the highest at American Family.

#7 – Nationwide: Best UBI Savings

Pros

- Subaru Friendly Coverage: Like most companies, Nationwide offers a variety of add-ons. See how you can customize car insurance for Subarus in our Nationwide auto insurance review.

- SmartRide: Nationwide has one of the best UBI discounts for safe Subaru drivers. You can save up to 40% for driving safely with SmartRide.

- On Your Side Review: Make sure your policy is still the best fit for your Subaru with Nationwide’s yearly On Your Side review.

Cons

- Higher Rates: Nationwide is not always the cheapest option for insurance. For example, Subaru Forester insurance costs when you have a DUI can be very high. However, Nationwide might be a good choice if your credit score is low.

- Claims Handling: A common complaint against Nationwide is that the company resolves claims too slowly.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best Selection of Discounts

Pros

- Ample Discounts: Farmers has one of the best selections of discounts on the market, with 23 opportunities to save. See how many you qualify for in our review of Farmers auto insurance.

- Strong Customer Service: Farmers has a reputation for excellent customer service, particularly regarding its claims resolution.

- Coverage Options: Get the best insurance for Subarus with Farmers’ add-on options. Some of the most popular include new car replacement and windshield coverage.

Cons

- Rates are often high. Farmers is not usually the cheapest option for car insurance, especially for sportier cars. Subaru WRX insurance costs can be particularly high at Farmers.

- Limited Local Agents: Farmers isn’t as large as some of its competitors, and the number of local agents it offers reflects that. If speaking with a local representative is important to you, you might want to consider another company

#9 – Allstate: Best for Full Coverage Service

Pros

- Full Coverage Options: Allstate offers a variety of add-ons to customize your policy, including new car replacement, sound system coverage, and roadside assistance.

- UBI Programs: There are two UBI programs Allstate offers — Milewise and Drivewise. See which is right for you in our Allstate auto insurance review.

- Financial Stability: Allstate’s A.M. Best rating of A+ means the company will be able to pay policyholder claims with ease.

Cons

- Higher Rates: Allstate has some of the best insurance for Subarus, but it comes at a price. Allstate is usually one of the most expensive options for car insurance.

- Claims Handling Issues: It may offer excellent customer service, but many Allstate policyholders report unsatisfactory claims experiences.

#10 – Liberty Mutual: Best for Insurance From the Dealership

Pros

- Partnership With Subaru: Liberty Mutual has partnered with Subaru to offer drivers special savings on their insurance. In most cases, you can sign up for a Liberty Mutual policy at the dealership when you buy a Subaru.

- Online Tools: If you prefer to manage your policy online, Liberty Mutual offers a convenient website and mobile app.

- Excellent Coverage Options: You can purchase a variety of add-ons for your Liberty Mutual policy, including better car replacement, gap insurance, and original parts replacement coverage.

Cons

- Average Rates: Finding the cheapest coverage is difficult with Liberty Mutual. For example, Subaru Crosstrek insurance costs with Liberty Mutual are usually a bit above the national average.

- Customer Service Problems: Many Liberty Mutual drivers report feeling less than satisfied with their customer service experience. Read what customers have to say in our Liberty Mutual auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Subaru Auto Insurance Costs

Finding the best Subaru insurance rates is usually a simple task. The type of car you drive is one of the many non-driving related factors that affect your insurance rates. Insurance companies typically consider Subaru a safe brand to insure, which is why Subarus are usually offered low rates.

Check below to see how much you might pay for your Subaru insurance from our top companies.

Subaru Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| American Family | $43 | $117 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

Despite having overall low rates, there are still significant variations between rates from even the cheapest Subaru companies. That’s why it’s important to compare quotes with multiple companies — you’ll likely overpay if you don’t.

Factors That Affect Subaru Auto Insurance Rates

There are a few universal factors that affect auto insurance rates that companies use to calculate premiums. Some of the factors you can control, and others are circumstantial. Thankfully, one guaranteed way to find lower auto premiums is by determining what car you drive.

Most Subaru models, with the exception of the sporty WRX, tend to have lower insurance costs than most other vehicles. Subaru usually ranks among the highest in safety and crash-test ratings.

All of these factors make a Subaru, in the eyes of many insurance companies, a safe vehicle, meaning lower coverage prices for Subaru owners.

Because of these specific features related to these cars, many insurance companies are beginning to offer discounts only for Subaru owners. That is fantastic news, considering some of the discounts are up to ten percent.

Even before you consider all of Subaru’s great qualities, including its usually cheap cost to insure, you may want to consider some other factors that are outside of your control. Sometimes, these factors can drastically affect the cost of insurance, even with owning a Subaru.

Subaru Auto Insurance Rates by Driving Record

For example, the Subaru Outback is one of the easiest models to find cheap auto insurance. Regardless, one factor that you may not be aware of that does impact the cost of insurance is your driving record. Check below to see how much you might pay for insurance based on your driving record.

Subaru Auto Insurance Monthly Rates by Driving Record & Coverage Level

| Driving Record | Minimum Coverage | Full Coverage |

|---|---|---|

| Clean Record | $213 | $425 |

| One Speeding Ticket | $245 | $488 |

| One Accident | $266 | $531 |

| One DUI | $319 | $638 |

No matter what type of car you drive, if you have multiple tickets and a few accidents on your record, you can bet that the insurance premium will be very high. Additionally, you won’t qualify for a good driver auto insurance discount, which further increases your rates.

If you are unsure what your driving record looks like, or if you want to see if there are any discrepancies on your record, contact your local Department of Motor Vehicles. Many departments will offer online services to obtain your record, usually for a small fee.

Subaru Auto Insurance Rates by Driver

Another factor that causes insurance prices to vary from person to person is basic information about you. For example, factors like your age and gender will greatly impact your insurance prices.

If you are a male and under the age of 25, it will not matter what you drive. Your insurance will probably cost quite a bit. To get an idea of how much you might pay for your insurance based on your age, check below.

Subaru Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age and Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 18-Year-Old Female | $325 | $650 |

| 18-Year-Old Male | $375 | $750 |

| 25-Year-Old Female | $275 | $550 |

| 25-Year-Old Male | $350 | $700 |

| 35-Year-Old Female | $225 | $450 |

| 35-Year-Old Male | $275 | $550 |

| 45-Year-Old Female | $200 | $400 |

| 45-Year-Old Male | $225 | $450 |

| 55-Year-Old Female | $175 | $350 |

| 55-Year-Old Male | $200 | $400 |

| 65-Year-Old Female | $175 | $350 |

| 65-Year-Old Male | $200 | $400 |

In addition, where you live can also influence the price of insurance. Most online resources for finding quotes ask for your zip code. Insurance companies want to know the relative neighborhood you live in and the city, which is why they ask for your ZIP code when you start a request form.

Big cities with a high crime rate and many accidents will always force insurance companies to raise prices. Likewise, if you live in a city with a high percentage of theft or vandalism, your rates will reflect that.

Finally, your credit history will also impact the cost of insurance. If your score isn’t as high as you’d like, you should find coverage from the best auto insurance companies for drivers with bad credit scores.

Whether you drive a brand new Outback or a used Impreza, if you have a bad credit score, your insurance rates for a Subaru Impreza or Outbackwill be higher.

Insurance companies view credit scores as a measurement of how likely you are to file a claim. The higher the likelihood, the higher your insurance costs.

Subaru Auto Insurance Cost Comparison

This table provides a comparative overview of auto insurance costs for different Subaru models, including the Forester, Impreza, Justy, and WRX. Compare the rates below to make informed decisions.

Subaru Auto Insurance Monthly Rates by Model & Coverage Level

| Subaru Model | Minimum Coverage | Full Coverage |

|---|---|---|

| 2024 Subaru Ascent | $80 | $180 |

| 2024 Subaru Crosstrek | $75 | $170 |

| 2024 Subaru Forester | $78 | $175 |

| 2024 Subaru Impreza | $72 | $160 |

| 2024 Subaru Legacy | $75 | $165 |

| 2024 Subaru Outback | $77 | $170 |

| 2024 Subaru Solterra | $85 | $190 |

| 2024 Subaru WRX | $82 | $180 |

As you can see, there are significant variations between Subaru models. For example, the best auto insurance for a Subaru Forester will likely cost much less than coverage for a sporty WRX.

Benefits of Subarus

Even though there are some factors you cannot control, there are others that you can. What car you drive is a great way to control the cost of insurance. A Subaru is among the cheapest cars to insure.

In the market for a new Subaru?🚘These cars might be considered cheap to insure, but a lot of things factor into your rates!🤔If you’re looking to find the cheapest coverage, check out https://t.co/27f1xf131D!💲Read our guide for Subaru insurance here👉: https://t.co/z4faPtSoRa pic.twitter.com/6xAf5F3UVj

— AutoInsurance.org (@AutoInsurance) May 8, 2023

However, sometimes premiums can fluctuate even between models based on their trim level. For example, a bigger engine than the stock engine will probably garner a higher premium. The bigger engine means you can go faster, and that is a risk to insurance companies. On the other hand, trims that come with certain safety features can help you qualify for an anti-theft auto insurance discount.

Trim levels have different insurance rates for a few different reasons, but an important one is safety features. For example, the Limited trim for the Subaru Ascent comes with DriverFocus distraction mitigation system, which helps keep you safe. In turn, it can help lower your insurance rates.Kristen Gryglik Licensed Insurance Agent

Regardless, the Subaru name has become synonymous with dependability and safety, which is great if you are looking for cost-effective coverage.

Another great resource for further information about the variety of models Subaru offers and why so many insurance companies are offering great rates is J.D. Power and Associates. The ratings that J.D. Power provides are consumer-based and are one of the reasons Subaru is becoming so popular.

Other Factors to Consider for Subaru Auto Insurance

In addition to all the information previously discussed, you may also want to consider the safety ratings of a Subaru. Being recognized for crash-test ratings has been a staple of the Subaru name for years. Considering safety ratings is important, especially when you’re evaluating auto insurance quotes.

An insurance company wants to predict how often you may file a claim. Accidents not only cost you money, but they also cost your insurance provider. If you are driving a vehicle that has a high safety rating, that tells your insurance provider that you will be less likely to file an expensive accident claim, which means cheaper premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Save on Subaru Auto Insurance

Again, even though Subarus tend to have cheaper insurance costs, there are more ways to help control the price of your premium. Another factor to consider is your coverage and deductibles.

It is wise, and likely required by your lender, to have comprehensive and collision on your new Subaru Forester car insurance policy. Just know that adding these coverages will increase your premium.

To offset those costs, out-of-pocket expenses, you probably should consider raising your deductibles. Of course, that is all dependent on if you can afford the repair costs.

You may also want to consider dropping add-ons to your policy, like roadside assistance. You can check with your insurance provider about their schedule for premium payments or pay the premium upfront.

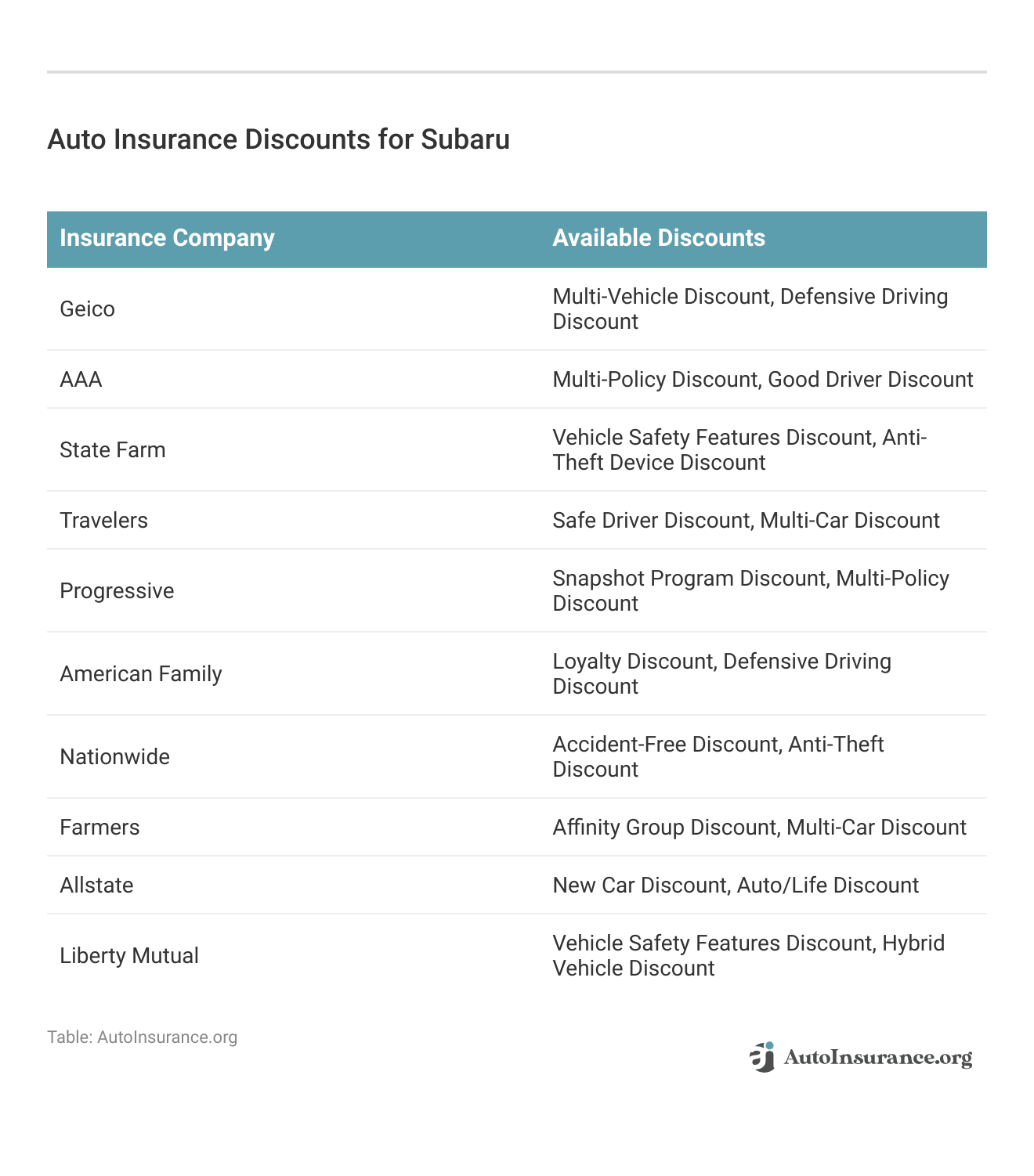

If you pay your premium outright, you will usually receive a discount of some kind. There are a variety of ways to reduce your premium and still find the perfect coverage for your beloved Subaru. Check below to see some of the most popular discounts for Subaru owners.

From getting electric vehicle auto insurance discounts for the Solterra or a good student auto insurance discount for maintaining academic excellence, there are plenty of ways to help you save on your Subaru insurance.

Find the Best Subaru Auto Insurance Today

Finding cheap Subaru auto insurance is usually simple because providers see the brand as safe and reliable. You can save even more on your insurance by taking advantage of Subaru-friendly auto insurance discounts or enrolling in a UBI program.

No matter how you decide to save, the most important step in finding affordable Subaru insurance is comparing quotes. Enter your ZIP code into our free comparison tool below to see how much you might pay today for Subaru cheap insurance.

Frequently Asked Questions

What factors affect the cost of Subaru auto insurance?

Several factors can influence the cost of Subaru auto insurance, including the model and year of the Subaru, the driver’s age and driving history, the location where the car is primarily driven or parked, the coverage options chosen, and the deductible amount.

Are there any specific insurance discounts available for Subaru owners?

Yes, some insurance companies offer specific discounts for Subaru owners. Subaru insurance discounts can vary, but they may include features such as discounts for safety features like EyeSight® Driver Assist Technology, good driver discounts, or multi-vehicle discounts if you insure multiple Subarus with the same insurance company.

Which Subaru is the most expensive to insure?

Most Subaru drivers see affordable rates, but Subaru’s sports cars come with the highest insurance quotes. For example, finding the best Subaru WRX auto insurance can be a little more difficult than if you were looking to insure an Outback.

Should I purchase additional coverage for my Subaru beyond the minimum requirements?

While minimum liability coverage is required by law, it is often recommended to consider additional coverage options to protect your Subaru adequately. Comprehensive and collision coverage can help pay for damages to your Subaru in the event of an accident, theft, or natural disaster, providing you with greater peace of mind.

If you have a new Subaru, you may also want to consider gap insurance. Compare rates with our free tool to find the best Subaru gap insurance costs.

Does Subaru offer any special insurance programs or partnerships?

Subaru has partnerships with certain insurance companies, which may offer exclusive benefits or discounts to Subaru owners. It’s advisable to inquire with your local Subaru dealership or visit the official Subaru website for more information about any available insurance programs.

Which Subaru has the cheapest insurance?

The cheapest Subaru to insure will also be the safest. The Crosstrek, Forester, and Ascent all have affordable rates compared to similar vehicles. You can also find the best Subaru Impreza auto insurance for an affordable price.

Can I use any insurance provider for my Subaru, or are there preferred insurance companies?

You have the freedom to choose any insurance provider for your Subaru. However, some insurance companies may have more experience with insuring Subaru vehicles or offer specialized coverage options tailored to Subaru owners. It’s recommended to research different insurance providers, compare quotes, and select a company that suits your specific needs.

How do you choose the best company for Subaru insurance?

There are many resources available to help you choose the best insurance. A great place to start is to look at the 10 best auto insurance companies, according to Reddit. These companies have excellent customer service and affordable rates.

You can also enter your ZIP code into our free comparison tool to see which companies have the Subaru cheapest insurance rates.

Are Subarus cheap to insure?

Generally speaking, Subaru is an affordable brand to insure. However, several factors affect rates. Drivers with bad credit scores, at-fault accidents, or limited driving experience might see much higher rates. You will also see different rates among models, as a Subaru Legacy car insurance policy will have different rates than a Subaru Outback car insurance policy.

Why are Subarus so cheap?

Suabarus are common cars that are mass-manufactured, helping keep purchase prices affordable for most drivers. The lower purchase price of Subarus also keeps car insurance costs low.

Is Subaru considered a safe brand?

Are Subarus the safest cars? Subaru receives excellent safety ratings on all of its models, especially its line of SUVs. You can compare safety ratings with other makes — such as Subaru vs. Honda SUV safety ratings — to find a car that best suits your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.