Comprehensive Auto Insurance Claims in 2025 (Detailed Overview)

Comprehensive auto insurance claims cover a range of incidents, including hitting a deer, theft, and weather damage. Do comprehensive claims raise your insurance costs? You can expect rates to increase by 41% after filing a claim, but State Farm and Allstate won't raise rates nearly as high as other companies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jul 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Comprehensive auto insurance claims protect drivers against various non-collision damages, like natural disasters. But unlike liability insurance, comprehensive car insurance includes deductibles that drivers must pay when filing a claim before the insurance company covers any damage.

- Comprehensive coverage protects a vehicle from non-collision events

- Comprehensive insurance is optional, but may be required by some lenders

- A comprehensive claim raises rates for high-risk drivers with multiple claims

Does a comprehensive claim increase premiums? Some companies raise rates by 40% or more after a claim, so choosing the right type of auto insurance coverage for your vehicle is key. This article is intended to help answer important questions about your auto insurance coverage.

Learn the difference between collision insurance and comprehensive coverage, what counts as a comprehensive claim, and how to file comprehensive insurance claims. Enter your ZIP code into our free quote tool for the best comprehensive policy for you.

Comprehensive Claim Meaning Explained

When it comes to your auto insurance, comprehensive coverage is a type of policy that protects your vehicle from non-collision-related incidents. You file comprehensive auto insurance claims for losses due to theft, vandalism, natural disasters (such as floods and hurricanes), fire, falling objects, and hitting an animal.

What does fully comprehensive insurance cover? A comprehensive claim for auto insurance will cover hitting a deer or any loss or damage occurring when you are not behind the wheel, not resulting from a collision, or involving events beyond your ability to control as a driver.

Does a comprehensive claim increase insurance rates? Typically, no. Since you cannot reasonably anticipate a wild animal’s movements or behaviors, these collisions are deemed beyond your control. For this reason, comprehensive claims on auto insurance will not raise your rates as high as other claims.

The Requirements of Comprehensive Coverage

Comprehensive coverage helps pay for repairs or replacement of your vehicle, minus the deductible, and is typically not required as part of standard auto insurance coverage. It’s an optional coverage you can add to your existing policy to cover vehicle damage that is not crash-related.

State law does not require drivers to have comprehensive coverage. However, if you are leasing a vehicle, it’s common for the leaseholder to require comprehensive coverage as part of your lease agreement. Once you own your vehicle outright and aren’t required to have comprehensive coverage by a lender or lessor, it will be up to you to maintain any optional coverage in your policy.

Does a comprehensive claim raise insurance rates? It can, so before you buy comprehensive auto insurance, there are some things to consider, generally related to your vehicle’s actual cash value. For instance, it may not be a good investment if comprehensive coverage costs more than 10% of what your car is worth.

If you have financed your car, your lender may require that you include comprehensive coverage in your insurance policy until your debt is paid.Jeff Root Licensed Insurance Agent

However, a comprehensive policy will better protect your vehicle if you live in an area prone to intense weather or with a high incidence of property crime, vandalism, and theft, and could be worth the price. You should also consider whether you could afford to replace your car if it is a total loss due to a comprehensive claim, like theft.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to File a Comprehensive Auto Insurance Claim

Does auto insurance cover vandalism? Yes, comprehensive car insurance claims cover specific types of damage, including vandalism and theft. Some other common examples of comprehensive claims are:

- Damage caused by floods, fires, hurricanes, tornadoes, or hailstorms

- Damage from tree branches or debris falling on your car, including windows and the windshield

- Damage caused by animals or by hitting an animal, including deer

- Damage resulting from riots or civil unrest, such as looting or vandalism

Does a comprehensive claim raise rates? Yes, slightly, but don’t let that deter you if your vehicle is stolen or sustains significant damage that exceeds your deductible. If your car is stolen or damaged, take the following steps to file a claim.

Step #1: Contact the Police

Can I file an insurance claim without a police report? Contacting the police is only necessary to report theft, vandalism, or if you hit an animal that is blocking traffic. The police report will support your insurance claim. Gather any information about your car, such as the make, model, color, license plate number, and distinguishing features.

Step #2: Take Pictures of the Incident

Taking photos of the collision and damage will also support your claim and ensure you get the proper repairs. Find out where to get pictures of vehicles taken for auto insurance. If your car was stolen, include the most recent photographs you have of the vehicle.

Step #3: Consider Your Insurance Deductible

You must pay your auto insurance deductible before your provider covers any comprehensive insurance claims. Comprehensive deductibles range between $250 and $2,500, and if repairs cost less than your deductible, or you can do the repairs yourself, you may not want to file and avoid the rate increase.

Step #4: Notify Your Insurance Company

If repairs cost more than your deductible, notify your insurance company immediately and provide the police report number, incident details, and photos. Follow the instructions provided by your insurance adjuster regarding any additional documentation or steps required for filing a comprehensive claim for the stolen vehicle (Learn More: How do insurance adjusters determine the value of a car?).

Will a comprehensive claim raise my insurance? Your rates may increase slightly if you’ve filed car insurance claims in the past, but don’t expect your rates to get as high as they would after an accident or DUI. Scroll down to learn how a comprehensive claim does make your insurance go up.

How Comprehensive Claims Affect Premiums

How does filing a comprehensive claim affect rates? This table shows how comprehensive claims increase premiums with top providers. State Farm is one of the best comprehensive auto insurance companies for filing claims.

Comprehensive Auto Insurance Monthly Rate Increases: Before & After Claims

| Insurance Company | Before Claims | After Claims | Percent Increase |

|---|---|---|---|

| $91 | $118 | 30% | |

| $84 | $118 | 41% |

| $89 | $126 | 42% | |

| $82 | $120 | 46% | |

| $93 | $136 | 46% |

| $87 | $114 | 31% | |

| $88 | $142 | 61% | |

| $85 | $108 | 27% | |

| $86 | $117 | 36% | |

| $76 | $110 | 45% |

Will filing a comprehensive claim affect rates? Comprehensive claims generally have less impact on rates than collision claims, but your rates could increase if you file multiple claims within a short period, live in a high-risk area, or the claim payout is significant.

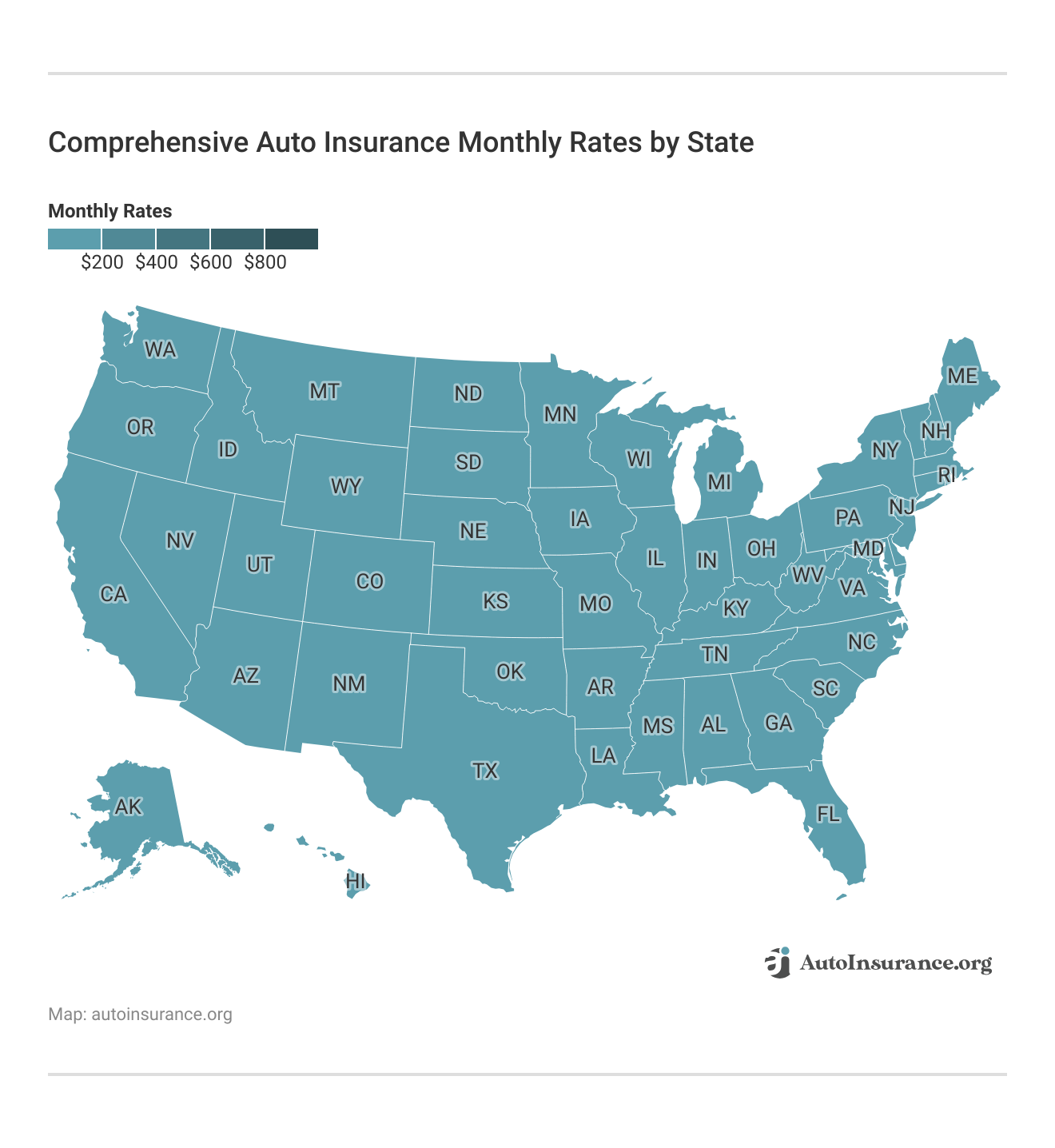

Comparing Comprehensive Auto Insurance Rates

Does a comprehensive claim raise your insurance? It can, so some key points to remember when considering the price of comprehensive coverage are premium factors, deductibles, coverage limits, discounts, and average costs of comprehensive insurance around the United States.

The make and model of your vehicle will be a determining factor. High-end cars will cost more to cover than others, as the insurance company takes a greater financial risk when considering the potential cost of a comprehensive loss on such a vehicle (Read More: Auto Insurance Rates by Vehicle Make and Model). Your rates will also be determined based on how you store your vehicle.

It is logical that areas with a higher likelihood of theft and vandalism will have higher comprehensive rates if you don’t have a garage.Dani Best Licensed Insurance Producer

Will a comprehensive claim increase insurance costs? The cost of comprehensive auto insurance will vary based on several factors. The level of deductible you choose will affect your comprehensive rates the most — a higher deductible will result in lower rates, and the lowest deductible will cause rates to rise.

The Difference Between Collision vs. Comprehensive Claims

There are many types of auto insurance, but most states only require drivers to carry a minimum level of liability insurance that only covers property damage and injuries in an auto accident for which you are at fault. It covers losses that the other driver incurs, but it does not cover your vehicle or treatment for any injuries you may sustain.

On top of minimum requirements, many drivers also carry the most common additional coverage types are collision and comprehensive. Like comprehensive coverage, collision insurance is optional coverage by state law, but lenders and lessors will require that you have it.

Is it better to file a comprehensive or collision claim? Collision auto insurance will pay the cost of repairing or replacing your vehicle when you are in a car accident, while comprehensive covers incidents unrelated to your driving skills. For example, if a tree branch falls on your car, the resulting damage is a comprehensive loss.

On the other hand, collision coverage applies to multi-vehicle crashes and collisions with objects or property. It also covers single-vehicle collisions that might occur if you swerve to avoid an animal and run into a tree or if a pothole causes your car to flip.

Collision vs. Comprehensive Auto Insurance Rates

Does a comprehensive claim raise rates more than collision claims? Collision insurance claims often raise rates more since they are caused by the fault of the driver, unlike comprehensive car insurance claims. This is why comprehensive insurance is often cheaper on its own than collision coverage.

Comprehensive Auto Insurance Monthly Rates vs. Collision Insurance

| Insurance Company | Comprehensive | Collision |

|---|---|---|

| $91 | $122 | |

| $84 | $111 |

| $89 | $120 | |

| $82 | $110 | |

| $93 | $125 |

| $87 | $113 | |

| $88 | $117 | |

| $85 | $115 | |

| $86 | $114 | |

| $76 | $108 |

Is comprehensive collision worth it? Buying both together with your minimum liability requirements is known as full coverage auto insurance. This comprehensive plan covers at-fault damages, collision damage to your vehicle, and circumstances beyond your control.

Some benefits include protection against various risks, peace of mind having both types of coverage, and coverage to help mitigate potential financial loss if you have a new car. Some considerations are the cost versus the value if you have an older car, evaluating your budget, and the risk factors in the area you live in.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Protect Yourself With Comprehensive Auto Coverage

Comprehensive auto insurance claims cover various non-collision incidents that may damage your vehicle. Comprehensive claims on auto insurance will help defray the cost of vehicle repairs or replacement for any loss or damage caused by theft, vandalism, fire, natural disasters, falling objects, hitting an animal, glass breakage, riots, and other civil disturbances.

Does a comprehensive auto claim increase premiums? When assessing how comprehensive claims affect insurance rates, it’s important to note that filing such claims can lead to increased premiums, depending on your insurer and claim history.

Your insurance company should provide comprehensive claims services to assist policyholders throughout the process. The best providers offer claims filing online or through mobile apps. State Farm is one of the most affordable options after a comprehensive claim at $108 per month (Read More: State Farm Auto Insurance Review).

Although this coverage is optional, you may be required by a lender or leaseholder to include it in your policy.Ted Patestos Licensed Insurance Adjuster

You may also want to consider maintaining comprehensive coverage if you own an expensive vehicle or live in a high-crime area where you are more likely to experience a comprehensive loss. Shopping around for multiple quotes can help you save. Enter your ZIP code into our free comparison tool to get started.

Frequently Asked Questions

How do I file a comprehensive auto insurance claim?

You must typically contact your insurance company to file a comprehensive claim. They will guide you through the process and provide the necessary forms and instructions. Be prepared to provide details about the incident, such as the date, time, location, and description of the damage. It’s also important to take photos or gather relevant documentation to support your claim.

What is a comprehensive claim on auto insurance?

Comprehensive auto insurance claims refer to a type of claim filed with your insurance company to cover damages to your vehicle that are not caused by a collision with another vehicle. Comprehensive coverage typically covers damages caused by theft, vandalism, natural disasters, falling objects, fire, or damage caused by animals.

How much will my insurance go up if I file a comprehensive claim?

How does making a comprehensive claim increase insurance? Insurance companies consider several factors that affect auto insurance rates, and claim history is one of them. While comprehensive claims are generally less likely to impact rates than at-fault collision claims, it’s advisable to check with your insurance provider to understand their specific policy regarding rate increases after filing a claim.

What counts as a comprehensive insurance claim?

A comprehensive auto insurance claim covers damage to your vehicle from non-collision-related events, such as theft, vandalism, natural disasters, fire damage, falling objects, animal collisions, and acts of nature. Any damage not caused by a collision normally falls under comprehensive coverage.

What does an unreported comprehensive claim mean?

An unreported comprehensive claim refers to damage or loss to a vehicle that occurs but is not formally reported to the insurance company.

What is the deductible for comprehensive auto insurance claims?

Auto insurance deductibles for a comprehensive claim are the amount you agree to pay out of pocket before your insurance coverage kicks in. The deductible amount is set when you purchase your auto insurance policy. For example, if your comprehensive deductible is $500 and the repair cost for a covered claim is $1,500, you would pay the $500 deductible, and your insurance company would cover the remaining $1,000.

What is a good comprehensive deductible?

Is it better to have a $500 deductible or $1,000? For a lower deductible ($250-$500) you’ll pay less out-of-pocket if you file a claim, but your premiums may be higher. Paying a higher deductible ($1,000 or more) means you’ll have lower premiums but will pay more out-of-pocket if you need to file a claim. Enter your ZIP code to shop for auto insurance by deductible.

What does comprehensive coverage include?

What type of damage would be covered under comprehensive? It provides coverage for damages to your vehicle that are not a result of a collision. This includes damages caused by theft, vandalism, fire, natural disasters, falling objects, civil disturbances, and animal-related incidents such as hitting a deer or a bird and damaging your vehicle.

Learn More: What is needed for adequate auto insurance coverage?

How do I know if I have comprehensive coverage?

Comprehensive coverage is typically an optional coverage that you can choose to add to your auto insurance policy. You can review your insurance policy documents or contact your insurance provider to determine if you have comprehensive coverage. If you have comprehensive coverage, it will be listed as a separate coverage type along with any deductible associated with it.

Is it better to have collision or comprehensive auto insurance?

This depends on your needs and the type of vehicle you have or plan to purchase. Collision coverage protects your vehicle if it’s damaged in an accident. Comprehensive coverage covers non-collision damage. If your car is newer, both coverages are worth having. Learn the differences between collision and comprehensive auto insurance.

What is it called when you have both comprehensive and collision insurance?

When you have both comprehensive and collision insurance, this is called full coverage auto insurance.

What is the difference between liability and comprehensive coverage?

Liability coverage is designed to protect you financially if you are at fault in an accident that causes injury to others or damages their property. Comprehensive coverage protects your vehicle from non-collision-related incidents, such as theft, vandalism, natural disasters, fire, and hitting an animal.

What should I do if my vehicle is stolen?

If your vehicle is stolen, you must contact the police and your insurance agent to file a comprehensive car insurance claim.

Does vandalism increase insurance with Geico?

Filing a vandalism claim with Geico or any auto insurance provider can increase your insurance rates. If you have a history of multiple claims, this may lead to a high premium after a vandalism claim. Read our Geico auto insurance review for more information.

What is a comprehensive loss in insurance?

A comprehensive auto claim loss in insurance refers to damage or loss to a vehicle caused by events other than a collision. Comprehensive coverage is optional in auto insurance that protects against these non-collision-related risks.

How much does insurance increase after a claim?

Does a comprehensive claim affect insurance rates? On average, filing a claim can increase premiums by 20-50% depending on the type of claim, claim amount, insurance provider, your driving history, and state regulations.

Learn More: Why do my auto insurance rates go up every year?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.