Best Hawaii Auto Insurance in 2025 (Top 10 Companies Ranked)

Secure the best Hawaii auto insurance with State Farm, Geico, and Progressive, offering competitive rates starting at $26 per month. These industry leaders are known for affordability and comprehensive coverage options tailored for Hawaii. Compare quotes to find the ideal choice for Hawaii drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Hawaii

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Hawaii

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Hawaii

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

Find the best Hawaii auto insurance with State Farm, Geico, and Progressive, offering rates as low as $26 per month. State Farm stands out for its excellent customer service. Compare quotes now to find the best auto insurance in Hawaii that suits your needs and saves you money.

Car insurance in Hawaii tends to be significantly lower than the national average. There are various factors that affect auto insurance rates, so you could find better prices from other companies.

Our Top 10 Company Picks: Best Hawaii Auto Insurance

Company Rank Multi-Policy

DiscountA.M. Best Best For Jump to Pros/Cons

#1 17% B Personalized Service State Farm

#2 15% A++ Extensive Discounts Geico

#3 14% A+ Competitive Rates Progressive

#4 13% A+ Comprehensive Coverage Allstate

#5 16% A++ Military Benefits USAA

#6 12% A Customizable Policies Liberty Mutual

#7 11% A+ Comprehensive Coverage Farmers

#8 10% A Tailored Policies Island

#9 9% A Personalized Service First

#10 8% A Customer Service DTRIC

Learn about car insurance in Hawaii and find the best rates. Compare quotes from multiple companies for the right policy. Use our free comparison tool above to see what Hawaii auto insurance quote look like.

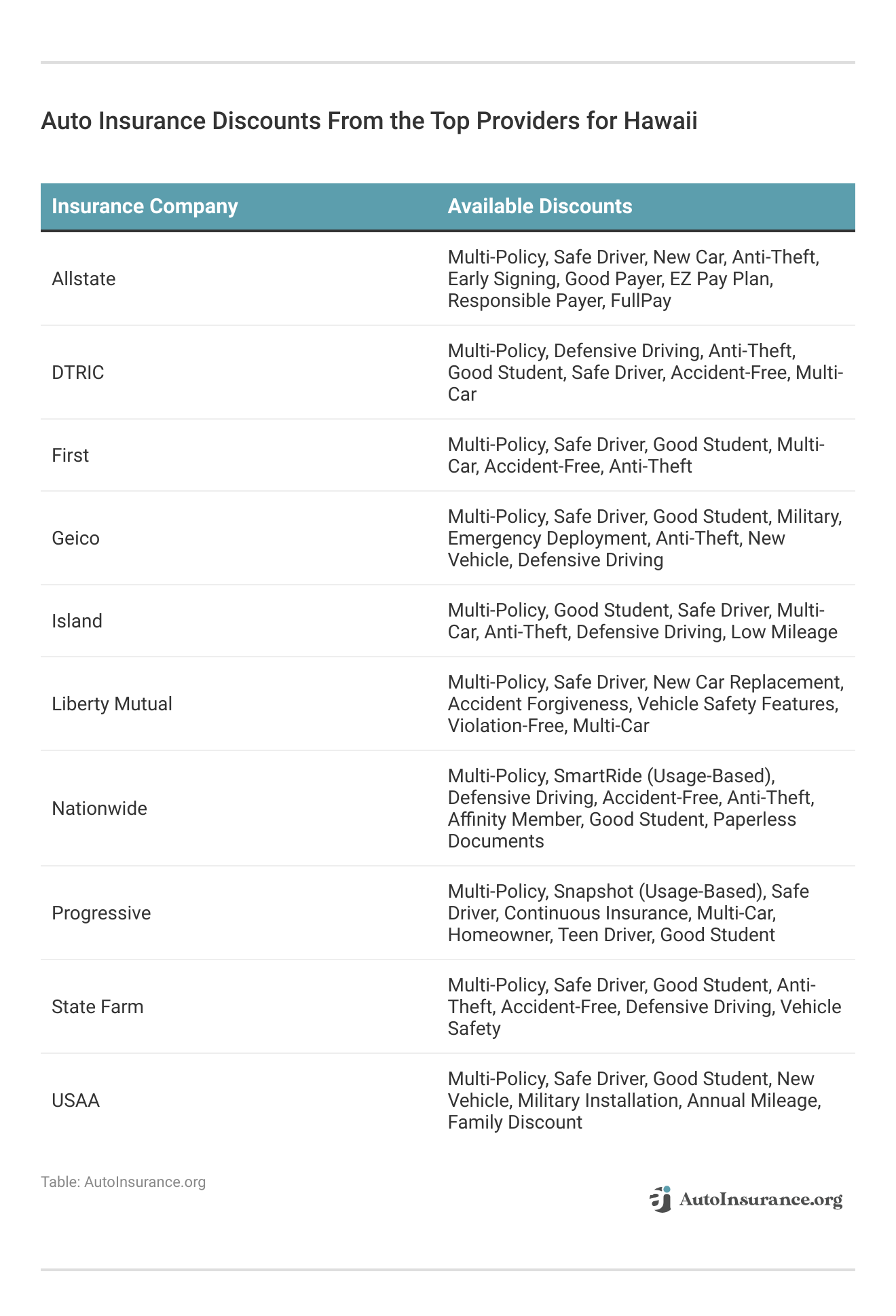

- Available discounts on Hawaii auto insurance

- Unique coverage for Hawaii includes volcanoes and driving

- State Farm offers competitive rates and great service

- Hawaii Auto Insurance

#1 – State Farm: Top Overall Pick

Pros

- Excellent Customer Service: State Farm is well-known for its high-quality customer service and support.

- Wide Range of Coverage Options: They offer comprehensive coverage options that can be tailored to individual needs.

- Discounts and Incentives: State Farm provides various discounts that can help reduce premiums. Discover insights in our guide titled State Farm auto insurance review.

Cons

- Higher Premiums: While competitive, State Farm’s premiums might be slightly higher compared to some other insurers.

- Limited Online Tools: The online platform and digital tools may not be as advanced as some competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Extensive Discounts

Pros

- Low Premiums: Geico often offers some of the lowest premiums in the industry.

- User-Friendly Online Experience: They have a robust online platform with easy-to-use tools and a mobile app.

- Good for Young Drivers: As mentioned in our Geico auto insurance review, Geico tends to have affordable rates for young and inexperienced drivers.

Cons

- Average Customer Service: While decent, customer service ratings can vary.

- Limited Local Agents: Geico primarily operates online, so in-person agent support may be limited.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive offers competitive rates, especially for drivers with a good record.

- Name Your Price Tool: Progressive auto insurance review showcases their unique feature that allows customers to customize their coverage to fit their budget.

- Wide Range of Discounts: Progressive offers various discounts that can help reduce premiums.

Cons

- Customer Service Reviews: Some customers have reported mixed reviews about their customer service experience.

- Rates May Increase After Claims: Progressive’s rates can increase significantly after filing a claim.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Strong Financial Stability: Allstate is a well-established company with strong financial stability.

- Extensive Coverage Options: They offer a wide range of coverage options and additional features.

- User-Friendly Mobile App: Our Allstate auto insurance review showcases their highly rated mobile app that provides easy access to policy information.

Cons

- Higher Premiums: Allstate tends to have higher premiums compared to other insurers.

- Mixed Customer Service Reviews: Customer service reviews are varied, with some complaints about responsiveness.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Benefits

Pros

- Lowest Premiums: USAA typically offers the lowest premiums, especially for military members and their families.

- Top-Rated Customer Service: They consistently receive top ratings for customer service and satisfaction.

- Exclusive Benefits: USAA offers exclusive benefits for military members and their families. See more details about this in our page titled USAA auto insurance review.

Cons

- Eligibility Requirements: USAA is only available to military members, veterans, and their families.

- Limited Branch Locations: They have fewer physical branch locations compared to other insurers.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers customizable policies to fit individual needs. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- Discounts and Savings: They provide various discounts that can help lower premiums.

- Online Tools: Liberty Mutual has a user-friendly online platform and mobile app.

Cons

- Higher Premiums: Liberty Mutual tends to have higher premiums compared to other insurers.

- Customer Service Reviews: Some customers have reported dissatisfaction with their customer service.

#7 – Farmers: Best for Comprehensive Coverage

Pros

- Personalized Service: Farmers offers personalized service through local agents.

- Coverage Options: They provide a wide range of coverage options to meet different needs.

- Discounts Available: Farmers offers various discounts that can help reduce premiums. (Read more: Farmers auto insurance discounts)

Cons

- Higher Premiums: Farmers’ premiums can be higher compared to other insurers.

- Claims Process: Some customers have reported issues with the claims process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Island: Best for Tailored Policies

Pros

- Local Knowledge: Island Insurance has a deep understanding of Hawaii’s unique insurance needs.

- Customer Service: They provide personalized customer service tailored to local residents.

- Established Reputation: Island Insurance has a long-standing reputation in Hawaii.

Cons

- Higher Premiums: Island Insurance tends to have higher premiums compared to national insurers.

- Limited Coverage Options: They may have fewer coverage options compared to larger national insurers.

#9 – First Insurance Company of Hawaii: Best for Personalized Service

Pros

- Comprehensive Coverage: First Insurance offers comprehensive coverage options.

- Local Presence: They have a strong local presence and understanding of Hawaii’s insurance market.

- Customer Service: First Insurance provides personalized customer service.

Cons

- Highest Premiums: First Insurance has the highest premiums among the listed insurers.

- Limited Online Tools: They may have limited online tools compared to larger national insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – DTRIC: Best for Customer Service

Pros

- Local Expertise: DTRIC has a deep understanding of Hawaii’s insurance market.

- Customer Service: They provide personalized customer service tailored to local residents.

- Reputation: DTRIC has a good reputation for reliability and customer satisfaction.

Cons

- Higher Premiums: DTRIC tends to have higher premiums compared to national insurers.

- Limited Availability: They may have limited availability compared to larger national insurers.

Cheapest Hawaii Auto Insurance Companies

Compared to the rest of the country, Hawaii drivers pay about 27% less for car insurance, with monthly full coverage rates of $77.

However, there are many factors that companies consider when crafting insurance quotes. Your age, driving record, and location can significantly impact your insurance rates.

An excellent way to start looking for car insurance is to compare how rates change for different factors. You can see how much Hawaii auto insurance might cost in the discussion below, but remember that the amount you’ll pay for insurance is unique to you.

Hawaii Minimum Auto Insurance Rates

Most states require drivers to buy a minimum amount of auto insurance, and Hawaii is one of them. You’ll need the following coverage before you can drive in the Aloha State:

- Bodily Injury Liability: $20,000 per person

- Bodily Injury Liability: $40,000 per accident

- Property Damage Liability: $10,000 per accident

- Personal Injury Protection: $10,000 per person

Liability auto insurance pays for damage and injuries you cause to other drivers in an accident. It also pays legal fees if someone sues you.

Personal injury protection auto insurance is required because Hawaii is a no-fault state. No-fault states limit how much you can sue another driver and require your insurance to cover your medical bills.

Minimum car insurance in Hawaii is your cheapest option for coverage. To know how much minimum auto insurance in Hawaii might cost, check out the rates below:

Hawaii Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$52 $142

$35 $94

$44 $119

$65 $175

$26 $72

$55 $145

$56 $154

$35 $94

$28 $77

$19 $53

USAA offers the lowest rates for minimum insurance but has strict eligibility Hawaii auto insurance requirements. Only active or retired military members and their families are eligible for coverage. Read more about the best auto insurance for veterans.

If that doesn’t apply to you, the Travelers and State Farm are good alternatives.

Before signing up for a Hawaii minimum insurance policy, know the financial risks. Hawaii requires a fairly low amount of auto insurance to where you could exceed your policy limits. If that happens, you must cover the remaining damages.

Hawaii Auto Insurance Rates by Age

Young, inexperienced drivers are the riskiest groups for car insurance companies to cover. The top Hawaii car insurance companies consider young drivers risky because they’re more likely to get into accidents, file claims, and engage in reckless behaviors.

Due to these risks, auto insurance for young adults is more expensive, about $452 monthly in Hawaii. However, your Hawaii car insurance rates will decrease around age 25 if you avoid traffic infractions.

Hawaii Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $567 | $471 | $150 | $157 | $144 | $142 | $133 | $137 | |

| $430 | $357 | $98 | $115 | $97 | $99 | $88 | $89 | |

| $664 | $551 | $137 | $144 | $119 | $119 | $103 | $110 | |

| $279 | $232 | $80 | $78 | $71 | $72 | $65 | $66 | |

| $696 | $577 | $154 | $177 | $152 | $154 | $131 | $141 |

| $422 | $350 | $112 | $123 | $100 | $102 | $88 | $93 |

| $730 | $606 | $117 | $122 | $100 | $94 | $83 | $85 | |

| $312 | $259 | $84 | $92 | $77 | $77 | $68 | $68 | |

| $803 | $666 | $88 | $95 | $86 | $87 | $78 | $80 | |

| $224 | $186 | $67 | $71 | $53 | $53 | $47 | $47 | |

| U.S. Average | $545 | $452 | $169 | $117 | $100 | $100 | $78 | $89 |

Geico auto insurance might be the best option for young drivers in Hawaii who don’t come from military families. Since car insurance is so expensive, young people should compare Hawaii auto insurance rates with as many companies as possible.

Hawaii Auto Insurance Rates After an Accident

Another important risk factor for Hawaii car insurance companies is past accidents. People with at-fault accidents in their driving record will see higher auto insurance rates in Hawaii. However, accidents only affect your insurance rates for about three years. If you avoid additional accidents, your Hawaii insurance premiums will eventually return to normal.

Hawaii Full Coverage Auto Insurance Monthly Rates & Provider: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $200 | $142 | |

| $149 | $99 | |

| $170 | $119 | |

| $118 | $72 | |

| $208 | $154 |

| $143 | $102 |

| $167 | $94 | |

| $91 | $77 | |

| $123 | $87 | |

| $70 | $53 | |

| U.S. Average | $152 | $100 |

As you can see, some Hawaii insurance companies are more forgiving than others for having an at-fault accident. USAA, State Farm, and Geico have the best auto insurance for drivers with accidents in Hawaii, with monthly full coverage rates of $58, $76, and $98, respectively.

Hawaii Auto Insurance Rates After a DUI

Many factors will increase how much you pay for car insurance in Hawaii, including speeding tickets, being young, or causing an accident. However, auto insurance for drivers with a DUI in Hawaii is expensive, increasing average monthly rates to $153.

DUI charges are so serious that some companies will drop you as a customer after a single charge. You might have to get high-risk auto insurance in Hawaii if you have multiple DUIs.

Still, some of the best car insurance in Hawaii will work with you if you only have one DUI. However, your rates will be much higher than drivers without a conviction.

Hawaii Full Coverage Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $142 | $200 | $240 | $167 | |

| $99 | $149 | $164 | $115 | |

| $119 | $170 | $165 | $148 | |

| $72 | $118 | $193 | $94 | |

| $154 | $208 | $277 | $187 |

| $102 | $143 | $210 | $122 |

| $94 | $167 | $126 | $125 | |

| $77 | $91 | $100 | $86 | |

| $87 | $123 | $182 | $119 | |

| $53 | $70 | $97 | $60 | |

| U.S. Average | $100 | $152 | $184 | $129 |

USAA offers the lowest average monthly Hawaii auto insurance rates with a DUI of $80. State Farm comes in next, averaging $83/mo, but you should always compare rates after a conviction. Even if your insurance company doesn’t drop you, you might find more affordable Hawaii auto insurance coverage elsewhere.

Higher insurance rates aren’t the only penalty after a DUI in Hawaii. You’ll also face the following consequences:

- First Offense: 48 hours to five days in jail, up to $1,000 fine, a year of license suspension, 72 hours of community service, and mandatory attendance in an alcohol education course

- Second Offense: five to 30 days in jail, up to $3,000 fine, 240 hours of community service, three years of license suspension, and alcohol education

You’ll have $500 and 48 hours of jail time added to your sentence if you have a minor in the car with you when you get a DUI. If you get a third DUI within 10 years, you might spend five years in jail and lose your vehicle.

Keeping your record clean of DUIs is integral for low Hawaii insurance rates. DUIs affect your Hawaii car insurance rates for a long time but generally fall off after seven years.

Hawaii Auto Insurance Rates by City

From beautiful beaches to lush jungles, Hawaii’s cities and towns offer a unique place to live. Your Hawaii auto insurance rates vary by location, so you’ll see different auto insurance rates by ZIP code.

For example, Hilo and Honolulu auto insurance rates are higher because they have more traffic. However, cheap car insurance in Hawaii is generally easy to find.

Cost of Auto Insurance in Hilo, Hawaii

| Hawaii Auto Insurance Cost by City |

| Hilo, HI |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Hawaii Auto Insurance Laws

You already know how much car insurance Hawaii requires all drivers to carry, but there are additional Hawaii auto insurance laws to know.

First, you must carry proof of insurance in your vehicle at all times as a physical or digital copy. You also have to present proof to law enforcement upon request.

The penalty for driving without auto insurance in Hawaii includes the following:

- $500 fine for the first offense, $1,500 for the second

- Potential up to thirty days in jail

- Possible license suspension

- SR-22 insurance

It might be tempting to drive without car insurance, but you should never take the risk. Getting affordable car insurance coverage in Hawaii is usually simple, but you’ll face complicated consequences if you get caught without coverage.

Hawaii is also one of the few states prohibiting auto insurance companies from using your credit score to determine your rates. Other factors still apply, but you won’t have to worry about higher Hawaii car insurance rates because of a low credit score.

Hawaii SR-22 Auto Insurance

Hawaii requires drivers to file SR-22 auto insurance after severe traffic violations, like a DUI or driving without insurance. Although you’ll often hear it labeled as insurance, SR-22s are a form. SR-22 forms prove that you carry Hawaii’s minimum insurance.

You might have to file SR-22 insurance for the following traffic violations:

- Driving without car insurance

- DUI conviction

- Driving with a suspended license

- Reckless driving

If you need SR-22 insurance in Hawaii, you’ll probably need to file it for three years. However, you don’t need to file your SR-22 insurance yourself. Your insurance company should handle the filing for you to ensure the state receives it.

Handling SR-22 insurance in Hawaii can be a challenge after a serious traffic violation, but it's essential for ensuring you meet the state's requirements.Travis Thompson LICENSED INSURANCE AGENT

There is a risk that you’ll be dropped as a customer if you need SR-22 insurance, but most Hawaii insurance companies will work with you. Your Hawaii auto insurance rates will increase, and you’ll have to pay a filing fee, but you won’t need to go elsewhere.

If you need a new car insurance policy, getting SR-22 insurance is relatively the same as applying for standard coverage. Make sure to inform the company you’re shopping with that you need SR-22 insurance to get what you need.

Hawaii will suspend your license for various traffic violations, and you’ll need SR-22 insurance to get it back. You can also buy non-owner SR-22 auto insurance in Hawaii if you don’t have a car but need to get your license back. Non-owner insurance will satisfy Hawaii’s car insurance requirements and covers you whenever you drive someone else’s car.

Find the Best Auto Insurance in Hawaii Today

Hawaiian drivers usually pay less for car insurance, but choosing the right company can help you save even more. USAA, State Farm, and Travelers in Hawaii are typically the most affordable options in the Aloha State, but you might see better car insurance quotes in Hawaii with another company.

Everyone likes a good neighbor🏘️, but does State Farm live up to its slogan, "Like a good neighbor, State Farm is there?" https://t.co/27f1xf1ARb can help you learn more about one of the leading companies in the U.S. Check out the review here👉: https://t.co/twfTgnzWWC pic.twitter.com/bqBwkOjZb0

— AutoInsurance.org (@AutoInsurance) July 28, 2023

Whether you need minimum insurance, full coverage, or SR-22 insurance, comparing Hawaii insurance quotes with multiple companies is essential to find the cheapest auto insurance companies.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

Is Hawaii a no-fault auto insurance state?

Hawaii is a no-fault car insurance state, meaning you’re responsible for paying your own medical insurance to handle injuries after an accident. To cover medical expenses, drivers must carry $10,000 worth of personal injury protection auto insurance coverage.

Read more: Cheap No-Fault Auto Insurance

How much is car insurance in Hawaii?

Hawaiians pay about $87 monthly for full coverage auto insurance, while minimum insurance costs about $32. However, rates vary based on factors such as driving profile, location, and demographics, so compare Hawaii car insurance quotes to find the best deal.

Can you buy car insurance without a license in Hawaii?

While there’s nothing saying you can’t buy a car without a license, it might be a difficult task. Insurance companies don’t often sell policies to people without a license, and you can’t register a car without coverage.

Use our free comparison tool below to see what auto insurance quotes look like in your area

Is new car theft insurance required in Hawaii?

There isn’t a specific type of insurance called theft coverage, but a comprehensive policy protects against theft. The state of Hawaii does not require comprehensive insurance, but you might need it if you have a car loan or lease.

What kind of car insurance do I need in Hawaii?

Drivers in Hawaii must carry minimum liability insurance coverage, which includes $20,000 bodily injury liability per person, $40,000 bodily injury liability per accident, and $10,000 property damage liability per accident. Drivers must also carry PIP coverage with minimum limits of $10,000 per person.

Where can I purchase auto insurance in Hawaii?

Auto insurance can be purchased from various sources in Hawaii. You can contact insurance agents or brokers, visit their offices, or utilize online platforms to obtain quotes and purchase coverage. Many insurance companies also offer the option to purchase insurance directly from their websites or over the phone.

Is auto insurance higher in Hawaii?

Hawaii auto insurance rates are 27% cheaper than the national average, with monthly rates of $87. To simply meet Hawaii’s auto insurance coverage requirements, you’ll pay about $32.

What factors make Hawaii auto insurance rates lower than the national average?

There are several factors that affect auto insurance rates. The state has fewer instances of severe weather conditions that can cause accidents or damage to vehicles, resulting in lower claim frequencies. Moreover, Hawaii has a robust no-fault insurance system, which helps in managing and reducing insurance costs by limiting legal disputes and payouts.

What are the advantages of choosing a local Hawaii auto insurance provider over a national company?

Opting for a local Hawaii auto insurance provider often comes with several advantages. These providers tend to have a deeper understanding of local driving conditions, which can lead to more personalized coverage options. They may also offer better customer service tailored to the needs of Hawaii residents, including faster response times and easier access to claims assistance.

What should I do if I’m involved in an accident in Hawaii?

If you’re involved in an accident in Hawaii, it’s essential to first ensure everyone involved is safe and seek medical attention if necessary. Then, exchange insurance information with the other parties involved and document the accident scene by taking photos and obtaining witness statements, if possible.

Finally, report the accident to your insurance company as soon as possible to initiate the claims process and receive assistance with any repairs or medical expenses covered by your policy. Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest auto insurance in Hawaii for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.