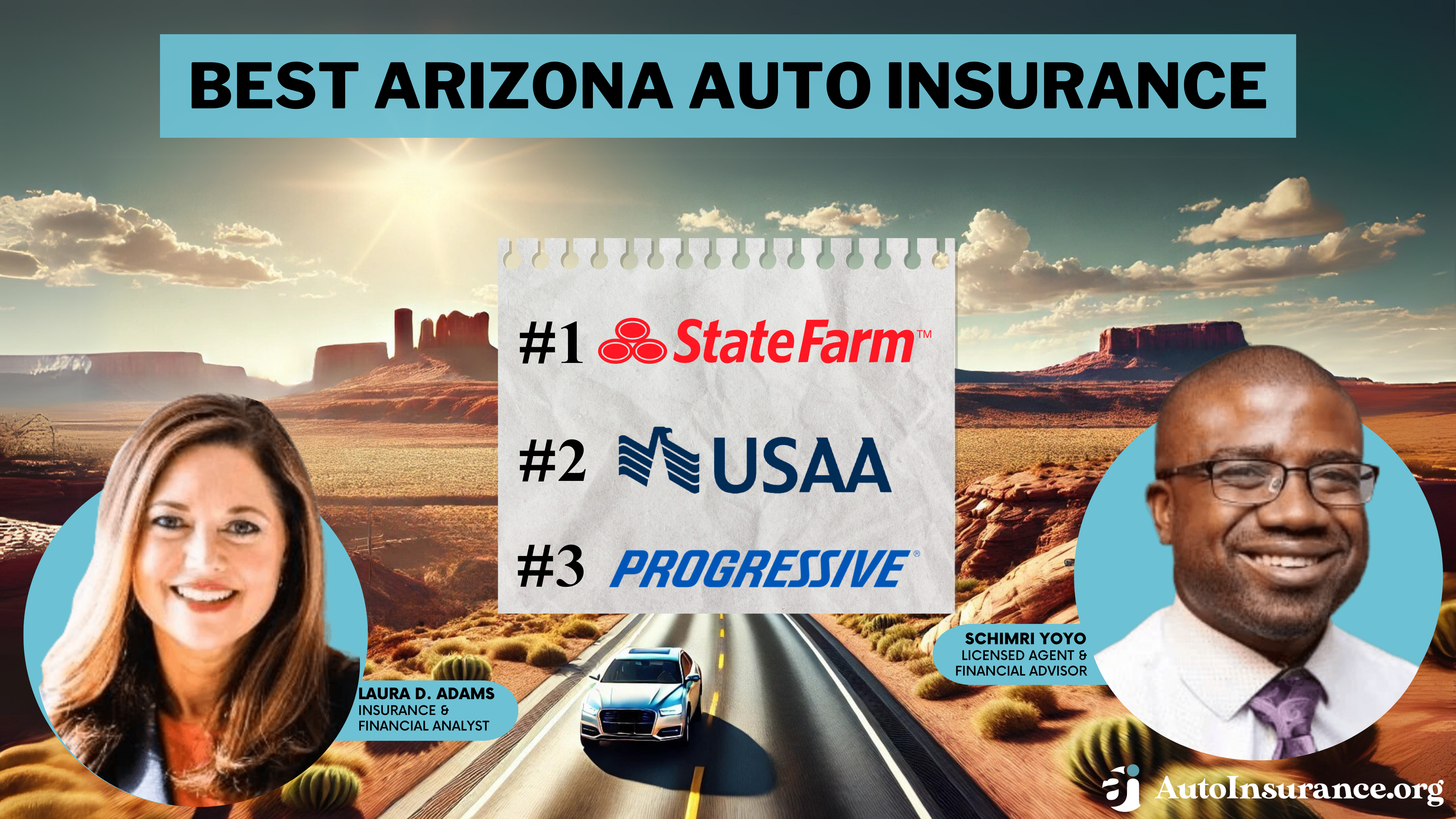

Best Arizona Auto Insurance in 2025 (Find the Top 10 Companies Here!)

State Farm, USAA, and Progressive have the best Arizona auto insurance. Arizona auto insurance rates are generally affordable, averaging $42/mo for minimum coverage at State Farm. Arizona drivers who want full coverage will pay more, but they will have better financial protection for accidents.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Arizona

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Arizona

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Arizona

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, USAA, and Progressive have the best Arizona auto insurance.

Arizona auto insurance rates are close to the national average at the best companies for Arizona car insurance.

Our Top 10 Company Picks: Best Arizona Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | B | Customer Service | State Farm | |

| #2 | 25% | A++ | Military Members | USAA | |

| #3 | 15% | A+ | Competitive Rates | Progressive | |

| #4 | 12% | A++ | Affordable Rates | Geico | |

| #5 | 10% | A+ | Usage-Based Discount | Allstate | |

| #6 | 12% | A | Safe Drivers | Farmers | |

| #7 | 11% | A | Claims Service | American Family | |

| #8 | 10% | A | Multi-Policy Discounts | Liberty Mutual |

| #9 | 23% | A+ | Accident Forgiveness | Nationwide |

| #10 | 15% | A+ | Exclusive Benefits | The Hartford |

There are plenty of ways to find cheap auto insurance in Arizona. Read on to learn where to find the best car insurance in Arizona. Then, enter your ZIP code into our free quote comparison tool above to compare AZ auto insurance rates with multiple companies for the best plan.

- State Farm has the best Arizona car insurance coverage

- Arizona auto insurance costs are 3% lower than U.S. average

- You can get cheap car insurance in AZ if you only meet the minimum requirements

- Arizona Auto Insurance

- Cheapest SR-22 Insurance in Arizona for 2025 (Top 10 Low-Cost Companies)

- Cheap Gap Insurance in Arizona (Big Savings With These 10 Companies in 2025)

- Best Auto Insurance for Seniors in Arizona (Top 10 Companies for 2025)

- Cheap Auto Insurance for High-Risk Drivers in Arizona (Top 10 Low-Cost Companies in 2025)

- Cheapest Teen Driver Auto Insurance in Arizona for 2025 (10 Most Affordable Companies)

- Best Wickenburg, Arizona Auto Insurance in 2025

- Best Waddell, Arizona Auto Insurance in 2025

- Best Tucson, Arizona Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Sun City West, Arizona Auto Insurance in 2025

- Best Prescott Valley, Arizona Auto Insurance in 2025 (Check Out These 10 Companies)

- Best Phoenix, Arizona Auto Insurance in 2025 (Compare the Top 10 Companies)

- Best Overgaard, Arizona Auto Insurance in 2025

- Best Nogales, Arizona Auto Insurance in 2025

- Best Mesa, Arizona Auto Insurance in 2025 (Find the Top 10 Companies Here)

- Best Maricopa, Arizona Auto Insurance in 2025

- Best Peoria, Arizona Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Glendale, Arizona Auto Insurance in 2025 (Find the Top 10 Companies Here!)

- Best Gilbert, Arizona Auto Insurance in 2025 (Find the Top 10 Companies Here)

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Customer Service: Local agents provide personalized service to Arizona customers.

- Discount Selection: State Farm has a large selection available for Arizona customers. Learn more in our State Farm review.

- Roadside Assistance: Arizona drivers can add this coverage for help with breakdowns on Arizona roads.

Cons

- Financial Stability: State Farm’s stability rating has been lowered to a B.

- Online Tools: State Farm focuses less on online convenience and more on in-person support.

#2 – USAA: Best for Military Members

Pros

- Military Members: USAA is the best Arizona company for military and veterans.

- Customer Service: USAA has a great reputation for its service, which we touch on in our USAA review.

- Coverage Variety: Arizona customers have plenty of options for their Arizona policies.

Cons

- Eligibility Restrictions: Arizona policies are exclusively sold to military or veterans.

- Lack of Local Agents: Arizona services are mainly virtual.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive has competitive rates for higher-risk drivers. Learn in our review of Progressive.

- Flexible Policies: Adjustments can be made to Progressive policies to suit Arizona drivers’ needs.

- Snapshot Discount: Offered to safe drivers in Arizona who successfully complete the program.

Cons

- Customer Reviews: Average ratings don’t make Progressive stand out for its customer service.

- Snapshot Rates: Arizona drivers who do poorly may have higher rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Arizona insurance rates are generally affordable at Geico.

- Online Convenience: Arizona policies can be managed online. Learn more in our review of Geico.

- Financial Rating: A.M. Best rated Geico’s financial stability highly.

Cons

- Lack of Local Agents: Geico’s customer service is virtual rather than in-person.

- Coverage Options: Geico offers most coverages but is missing options like gap.

#5 – Allstate: Best for Usage-Based Discount

Pros

- Usage-Based Discount: Allstate has a good driver program for Arizona customers.

- Claim Satisfaction: A claim satisfaction guarantee at Allstate offers discounted rates to unhappy customers.

- Multiple-Policy Discount: Arizona multiple-policy holders get a discount. Read more in our Allstate review.

Cons

- Customer Reviews: Poor customer service has been reported by some customers.

- Higher Rates: Arizona customers may find rates too high at Allstate.

#6 – Farmers: Best for Safe Drivers

Pros

- Safe Drivers: Farmers has affordable Arizona rates and discounts for safe drivers.

- Personalized Service: Farmers has Arizona online representatives and local agents.

- Multi-Policy Discounts: Arizona customers can bundle policies for cheaper rates. Learn more in our review of Farmers.

Cons

- Claims Processing: Slower processing has been noted in negative reviews.

- High-Risk Rates: Farmers’ rates are expensive for high-risk Arizona drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Claims Service

Pros

- Claims Service: American Family has decent reviews for its service representation.

- Student Savings: The company has a good student discount for Arizona students.

- Coverage Variety: Arizona drivers have a full selection for Arizona policies. Learn more in our American Family review.

Cons

- Online Services: Online tools are scarcer at American Family.

- New Customer Rates: New Arizona customers may have higher rates because they won’t get a loyalty discount.

#8 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discount: Arizona policies are cheaper if multiple policies are purchased. Learn more in our review of Liberty Mutual.

- 24/7 Assistance: Arizona drivers can reach out for assistance at Liberty Mutual 24/7.

- Custom Car Coverage: Custom and classic car owners in Arizona can get affordable coverage from Liberty Mutual.

Cons

- Higher Rates: Liberty Mutual Arizona rates can be higher for some customers.

- Customer Reviews: Liberty Mutual doesn’t always have glowing reviews.

#9 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Arizona drivers could avoid higher rates after their first accident.

- Coverage Options: Nationwide customers can get coverage for a variety of accident situations.

- Multi-Policy Discount: Arizona drivers can lower rates on auto insurance with this discount.

Cons

- Customer Reviews: Average ratings are given for the most part. Learn more in our Nationwide review.

- High-Risk Rates: Quotes for Arizona coverage are higher for poor drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits: The Hartford has benefits for AARP members, like discounts and lower rates.

- Financial Stability: Financial management is excellent at The Hartford. Learn more in our review of The Hartford.

- Coverage Options: The Hartford has plenty of coverages for Arizona drivers.

Cons

- Young Driver Rates: The Hartford isn’t the best choice for Arizona drivers.

- Customer Reviews: Customer service reviews are mixed for the most part.

Arizona Auto Insurance Rates

The amount you pay for auto insurance in AZ depends on various factors. Some of the most common factors that affect auto insurance rates include age, marital status, gender, credit score, driving history, and car type. One of the most important factors impacting AZ insurance rates is where you live.

Arizona car insurance quotes are generally slightly below average, though quotes for young drivers tend to be much higher. Young drivers should look at the best auto insurance companies for teens and get quotes from cheaper companies like State Farm.

Arizona residents looking for cheap insurance will see different rates depending on their unique situations, although looking at the average rates at the best Arizona auto insurance companies will give good drivers an idea of what to expect.

Arizona Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $94 | $250 | |

| $60 | $158 | |

| $70 | $187 | |

| $34 | $91 | |

| $93 | $247 |

| $61 | $161 |

| $44 | $117 | |

| $42 | $112 | |

| $77 | $249 |

| $33 | $88 |

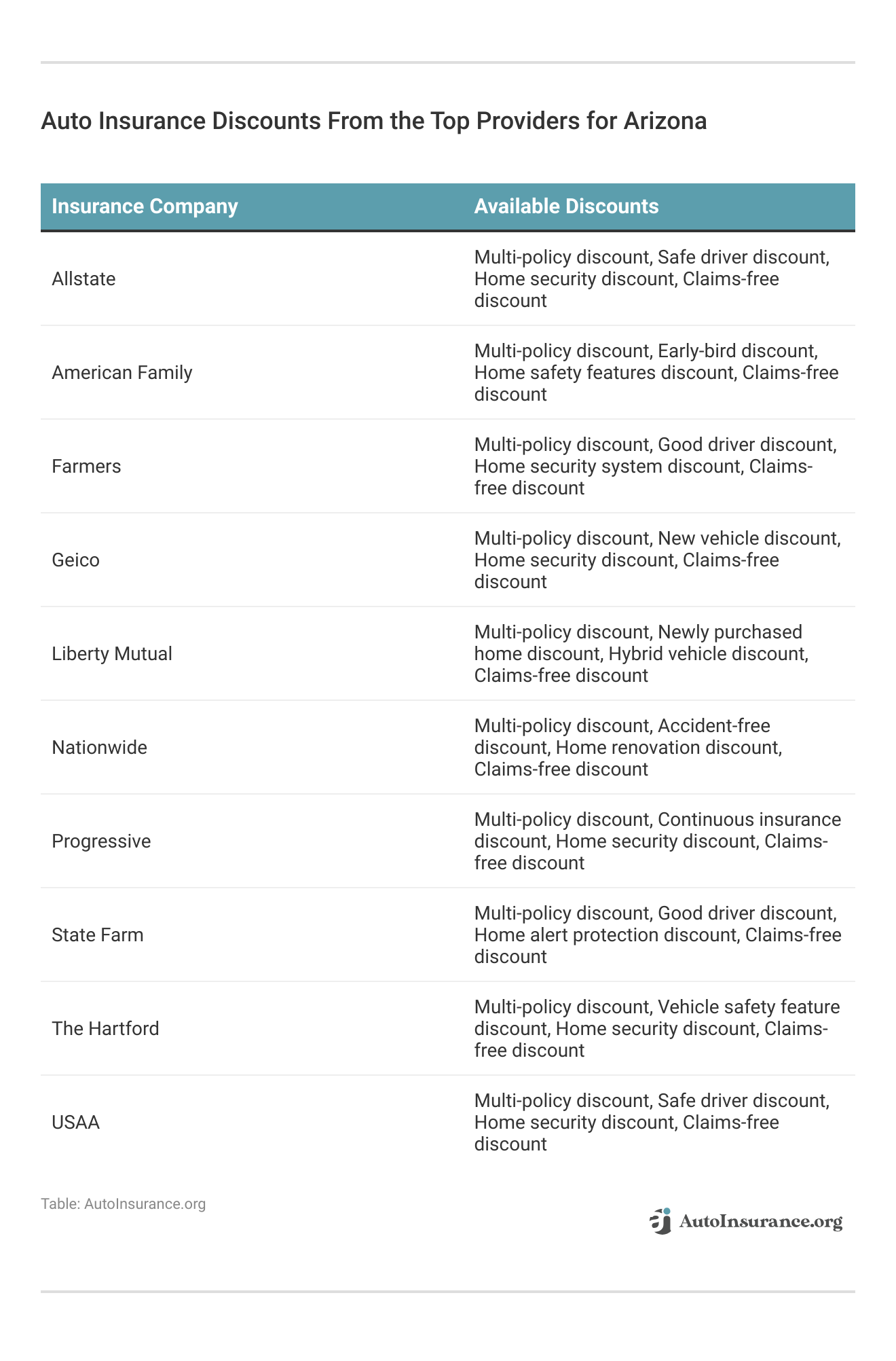

Shopping for Arizona auto insurance discounts can help drivers save, too.

Get an idea of where to start by looking at Arizona auto insurance companies offering the cheapest policy.

Arizona Liability Auto Insurance Rates

Like most states, Arizona auto insurance laws requires drivers to carry insurance before they can legally drive. Required insurance minimums include the following:

- Bodily Injury: $25,000 per person

- Bodily Injury: $50,000 per accident

- Property Damage: $15,000 per accident

Meeting the minimum requirement is your cheapest option for insurance in Arizona. While your specific rates will vary, you can get an idea of how much the minimum insurance is in Arizona below.

Cheapest Arizona Auto Insurance Companies for Minimum Liability

Geico, USAA, and Travelers offer some of the cheapest liability insurance in Arizona and are some of the best insurance companies in Arizona.

Arizona Minimum Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $94 | |

| $60 | |

| $31 | |

| $70 | |

| $34 | |

| $93 |

| $61 |

| $44 | |

| $42 | |

| $41 |

| $33 | |

| U.S. Average | $61 |

Although minimum coverage is your cheapest option, you should keep in mind that you’ll have more out-of-pocket expenses if your car is ever damaged. It’s also risky to get the state minimum coverage because Arizona’s limits are low, and you could easily do more damage than your policy covers.

Arizona Full Coverage Auto Insurance Rates

The only coverage listed in Arizona’s car insurance requirements is liability. Everything else is optional, including comprehensive, collision, uninsured motorist, medical payments, rental car reimbursement, and roadside assistance. Full coverage car insurance in AZ refers to a policy that includes all these optional insurances plus liability.

Full coverage auto insurance gives your car much more substantial protection on the road. You’ll pay more than you would for minimum insurance, but Arizona generally has affordable rates.

Cheapest Arizona Auto Insurance Companies for Full Coverage

As with minimum insurance, Travelers, Geico, and USAA are the three cheapest auto insurance companies in Arizona. However, most Arizonans will benefit from only Travelers or Geico — USAA has strict requirements for membership.

Arizona Full Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $250 | |

| $158 | |

| $128 | |

| $187 | |

| $91 | |

| $247 |

| $161 |

| $117 | |

| $112 | |

| $124 |

| $88 | |

| U.S. Average | $151 |

While full coverage will protect your car, you can add additional coverages to increase the value of your policy. These are some of the most common add-ons in Arizona:

- Rental car reimbursement

- Auto insurance for custom vehicles

- Mechanical breakdown insurance

- Roadside assistance coverage

- Gap insurance or loan-lease payoff

While these add-ons offer valuable coverage, they’ll also increase the amount you pay for your insurance.

Arizona Auto Insurance Rates by Credit Score

It might come as a surprise, but your credit score plays a crucial role in determining how much you’ll pay for your insurance.

In Arizona, drivers with poor credit can pay nearly 60% more for insurance than those with excellent scores. Take a look below to see what the average Arizonan pays based on their credit score.

Full Coverage Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

Geico and Travelers are once again solid options for Arizona drivers, but Progressive and Nationwide also offer low rates. If your credit score is low, you should compare rates with at least these four companies.

While you’ll pay more for insurance when you have a low credit score, the good news is that you’re not stuck with those rates forever. Raising your credit score will lower your rates, but you can also check out the best auto insurance companies that don’t check credit in the meantime.

Arizona Auto Insurance Rates After At-Fault Accidents

Car accidents can ruin your day, whether it’s a minor fender bender or something more serious. To add to the headache, an at-fault accident can raise your insurance rates by as much as 50%.

The table below will provide you with an idea of how much your insurance might increase after an at-fault accident in Arizona.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

Although Arizonans aren’t punished quite as hard as people in other states, you’ll still pay much more. For example, there’s more than a $400 difference between full coverage rates for drivers with and without an at-fault accident with Travelers.

Like low credit scores, an at-fault accident won’t affect your insurance rates forever. If you keep your driving record clean, your rates will start to lower after three years. However, if you continue to cause accidents, you might have to find high-risk auto insurance.

Arizona Auto Insurance Rates After a DUI

Arizona is proud of its reputation for being the toughest state on DUIs. Arizona splits DUI offenses into three categories:

- DUI: First-time DUI offenders will receive at least 10 days in jail, a fine of at least $1,250, mandatory alcohol education, a certified ignition lock in their car, and community service.

- Extreme DUI: For cases of a blood alcohol concentration of 0.15 or higher, first-time offenders get at least 30 days in jail, a fine of at least $2,500, mandatory alcohol education, an ignition lock, and community service.

- Aggravated DUI: Drivers get an aggravated DUI if they are driving on a suspended license, there is a minor under 15 in the car, or it’s their third DUI in 84 months. Aggravated DUIs come with a maximum sentence of two years in prison and license suspension for one year.

If you’re convicted of a DUI, it’s vital that you compare insurance rates. For example, Geico is usually one of the cheapest insurers in the state, but Geico’s rates after a DUI are more than 200% above the state average.

DUI Full Coverage Auto Insurance Monthly Rates vs. Clean Record by Provider

| Insurance Company | Clean Record | One DUI |

|---|---|---|

| $122 | $211 |

| $228 | $385 | |

| $166 | $276 | |

| $138 | $237 | |

| $198 | $275 | |

| $114 | $309 | |

| $248 | $447 |

| $142 | $338 |

| $150 | $200 | |

| $123 | $160 | |

| $161 | $239 |

| $141 | $294 | |

| U.S. Average | $165 | $295 |

Progressive and Travelers are probably your best bet for insurance after a DUI. You can also check out these other best auto insurance companies for drivers with a DUI. Unfortunately, DUIs in Arizona will affect your insurance for much longer than an at-fault accident. Most DUIs stay on your record for about seven years.

Arizona Auto Insurance Rates by Age and Gender

One of the most critical aspects of the cost of your Arizona insurance is your age. Insurance companies are wary of young drivers under 25 because they are statistically more likely to drive recklessly and get in accidents.

Although Arizona auto insurance is typically slightly below the national average, companies aren’t as kind to Arizonan youths. Another factor to consider is your gender. Auto insurance rates are typically higher for males. See the table below for how much you might pay based on age.

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $868 | $910 | $640 | $740 | |

| $452 | $456 | $333 | $371 | |

| $1,156 | $1,103 | $853 | $897 | |

| $425 | $445 | $313 | $362 | |

| $1,031 | $1,121 | $745 | $893 |

| $586 | $679 | $432 | $552 |

| $1,144 | $1,161 | $843 | $944 | |

| $444 | $498 | $327 | $405 | |

| $1,026 | $1,298 | $757 | $1,056 |

It may be difficult to find cheap rates for teens buying auto insurance in Arizona, but rates drop the older you get.

Read More: Cheapest Teen Driver Auto Insurance in Arizona

High school and college students should look for car insurance discounts to maximize their savings and get their prices as low as possible.

Arizona Auto Insurance Rates by City

The amount you pay for your Arizona auto insurance greatly depends on where you live. Car insurance companies keep careful track of claims numbers by ZIP codes, meaning you’ll pay more or less depending on your city.

Recently moved 🏡and found that car insurance rates are way higher💰? Considering telling your insurer your address is the same? https://t.co/27f1xf1ARb shares the risks of failing to update your address. Find the info you need here👉: https://t.co/2qUouyQ8tq pic.twitter.com/JkGBUubPef

— AutoInsurance.org (@AutoInsurance) September 8, 2023

It’s no surprise that Phoenix, AZ auto insurance and the surrounding cities of Glendale and Laveen have some of the highest rates. With heavy traffic on the I-10 and South Mountain Freeway, more traffic-related deaths than the national average, and above-average car theft, Phoenix drivers have plenty to be wary of.

However, other popular cities like Chandler, Gilbert, Tucson, and Maricopa have reasonable rates. Despite dangerous winter driving situations, Flagstaff offers some of the cheapest insurance in Arizona.

Read More: Best Flagstaff, Arizona Auto Insurance

Arizona City Comparison for Auto Insurance Rates

This table provides a quick overview of insurance rates across various cities in Arizona, facilitating a straightforward comparison for informed decision-making.

Arizona Auto Insurance Cost by City

Some cities will have lower rates for drivers because there are fewer accidents and safer driving conditions.

Arizona Proof of Auto Insurance Requirements

You already know how much liability insurance Arizona requires drivers to carry, but what about other insurance laws?

Do you need proof of insurance to buy a car? Arizona requires drivers to have proof of insurance before they can register a car.

You must provide proof of insurance to law enforcement as requested, and Arizona has some of the strictest laws about driving without coverage.Dani Best Licensed Insurance Producer

If you can’t show proof of insurance to law enforcement, you’ll receive a citation. For drivers who have insurance but couldn’t prove it at the time, you simply need to submit proof that you have coverage, and the charge will be dropped. Driving without insurance in Arizona comes with the following consequences:

- First Offense: You’ll likely receive a fine of $500, plus you might lose your license for three months and have to carry SR-22 insurance for two years.

- Second Offense: Your fine will be $750, you’ll face a six-month suspension, and you’ll need SR-22 insurance for two years.

- Third and Subsequent Offenses: Every time you’re caught without insurance after the second offense, you’ll get a fine of $1,000, a potential 12-month suspension, and an SR-22 insurance requirement for two years.

Despite these hefty consequences, the Insurance Information Institute (III) ranks Arizona as number 24 for uninsured drivers.

While it can be tempting to drive without coverage, you should try to find cheap insurance first. Getting the minimum amount of insurance you need in Arizona can save you from hefty fines, the loss of your license, and having to file SR-22 insurance.

Arizona SR-22 Auto Insurance Requirements

The Arizona MVD requires SR-22 auto insurance after DUI convictions, driving without insurance, driving with a suspended license, or when you’ve accumulated too many points on your license. SR-22 isn’t technically insurance — instead, it’s a form your insurance company files with the MVD.

An SR-22 form is proof from your insurance company that you carry at least the minimum requirement for insurance. The fee for filing an SR-22 form is usually low, but your insurance rates will be much higher.

Getting SR-22 Auto Insurance in Arizona

Drivers who already have insurance will have the easiest time getting an SR-22 form filed. All you need to do is contact an insurance representative and request that they file one for you. You’ll have to pay a small fee, and your rates will likely go up, but it will make sure you’re legal to drive again.

If your insurance company won’t file an SR-22 or you don’t have insurance, you’ll need to include a request when you get a quote. Some companies will outright refuse you, but finding help with SR-22 insurance is usually easy.

Getting SR-22 insurance when you don’t have a car makes things slightly more complicated. If you need your license back, you can purchase nonowner insurance before you file an SR-22 request. Nonowner insurance is usually cheaper than a standard policy, and it allows you to occasionally drive someone else’s car.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Auto Insurance Quotes in Arizona

While an area like Phoenix has much higher rates, most Arizonans don’t pay much higher than the national average. Glendale, AZ auto insurance is also slightly higher than in other areas in the state.

Finding cheap auto insurance in Arizona isn’t usually a struggle, especially when you know which car insurance companies in AZ offer the best prices. While Geico, Travelers, and USAA offer affordable Arizona car insurance quotes, enter your ZIP code into our free quote comparison tool below to compare cheap car insurance quotes in Arizona from the best companies.

Frequently Asked Questions

What are the cheapest insurance companies in Arizona?

Finding cheap car insurance in Arizona depends on what you need and what your unique circumstances are. Geico and USAA have the cheapest rates for minimum insurance, while Travelers has the lowest full coverage prices. Travelers also offer affordable rates for people with poor credit scores, while Progressive has the lowest DUI prices.

What is the average cost of car insurance in Arizona?

Average Arizona auto insurance rates are $513 a year for minimum insurance, or $42 a month. For full coverage, which we usually recommend for most Arizona drivers, the average annual price is $972, or $81 a month (learn more: What are the recommended auto insurance coverage levels?).

Why is Arizona car insurance so expensive?

Arizona auto insurance is actually about 3% less than the national average for insurance. Factors like an increasing population, uninsured drivers, and a higher number of traffic fatalities add to Arizona’s overall auto insurance rates.

How can I verify if an insurance company is licensed in Arizona?

The Arizona Department of Insurance (ADOI) is responsible for licensing and regulating Arizona auto insurance companies in the state. You can visit the ADOI website or contact their office to verify if an insurance company is licensed to operate in Arizona.

Can my insurance company cancel my policy in Arizona?

Insurance companies in Arizona can cancel your policy under certain circumstances, such as non-payment of premiums, providing false information, filing multiple claims, or a suspended driver’s license (learn more: Can your auto insurance company drop you after a claim?). However, they must follow proper notification procedures as required by state law.

What factors can affect my auto insurance rates in Arizona?

Several factors can influence your auto insurance quotes in Arizona, including your driving record, age, gender, type of vehicle, location, credit history, and the coverage options you choose. Insurance companies assess these factors to determine your level of risk and calculate your premiums accordingly.

How can I find affordable auto insurance in Arizona?

To find affordable auto insurance in Arizona, consider the following tips:

- Shop around and compare quotes from multiple insurance companies.

- Maintain a good driving record to qualify for lower rates.

- Increase your deductible, if financially feasible, to lower your premiums.

- Ask about available discounts, such as safe driver discounts or multi-policy discounts.

- Consider bundling your auto insurance with other policies, like home or renters insurance, for potential savings.

To find the cheapest Arizona auto insurance rates today, enter your ZIP in our free tool.

What happens if I drive without insurance in Arizona?

Driving without auto insurance in Arizona is illegal and can result in severe penalties. If caught driving without insurance, you may face fines, suspension of your driver’s license, and the possibility of having your vehicle impounded. It’s important to maintain continuous auto insurance coverage to comply with Arizona laws.

Who needs sr-22 insurance in Arizona?

High-risk drivers will be ordered to file for SR-22 insurance. Generally, drivers who need to carry SR-22 insurance will be drivers who drove without insurance, were charged with a DUI, or had other serious traffic infractions.

Are there any additional auto insurance requirements in Arizona?

Apart from the mandatory liability insurance, Arizona does not have any additional auto insurance requirements. However, it is recommended to consider additional coverage options at the top insurance companies in Arizona to protect yourself and your vehicle adequately.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.