Best Nebraska Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Progressive, USAA, and Geico have the best Nebraska auto insurance policies. Progressive's minimum coverage rates in Nebraska average $25/mo. All drivers must carry at least minimum auto insurance in Nebraska, as Nebraska insurance requirements and laws require 25/50/25 in liability insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jul 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Nebraska

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Nebraska

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Nebraska

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsProgressive, USAA, and Geico have the best Nebraska auto insurance.

Nebraska auto insurance costs are 4% higher than average, but finding cheap auto insurance in Nebraska isn’t usually difficult, especially if you shop at the best Nebraska car insurance companies.

Our Top 10 Company Picks: Best Nebraska Auto Insurance

| Company | Rank | Multi Vehicle-Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Competitive Rates | Progressive | |

| #2 | 25% | A++ | Military Focus | USAA | |

| #3 | 10% | A++ | Affordable Coverage | Geico | |

| #4 | 20% | A | Customer Service | Farmers | |

| #5 | 25% | A | Coverage Options | Liberty Mutual |

| #6 | 20% | B | Reliable Service | State Farm | |

| #7 | 20% | A+ | Comprehensive Policies | Nationwide |

| #8 | 8% | A++ | Flexible Plans | Travelers | |

| #9 | 25% | A+ | Nationwide Network | Allstate | |

| #10 | 20% | A | Personalized Service | American Family |

Read on to explore the types of auto insurance you need in Nebraska and see how much it might cost for car insurance in Omaha, NE, and other cities.

Then, enter your ZIP code into our free quote comparison tool above to compare Nebraska auto insurance costs with as many companies as possible to find the best policy for you.

- Progressive has the best Nebraska car insurance for drivers

- Nebraskan drivers usually pay about 4% more for car insurance

- Nebraska requires drivers to have liability and uninsured motorist insurance

#1 – Progressive: Top Pick Overall

Pros

- Competitive Rates: High-risk drivers will find competitive Nebraska rates at Progressive.

- Snapshot Discount: Safe Nebraska drivers who score high in the program get a discount.

- Coverage Options: Progressive has flexible coverage options for Nebraska customers.

Cons

- Customer Reviews: Just average ratings are given to Progressive. Learn in our review of Progressive.

- Snapshot Rates: Customers may see higher Nebraska rates for bad driving in Snapshot.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Focus

Pros

- Military Focus: USAA sells exclusively to Nebraska customers who are military or veterans.

- Customer Service: The company has good reviews. Learn more in our USAA review.

- Coverage Variety: Nebraska customers can choose extras like roadside assistance for their Nebraska policy.

Cons

- Eligibility Restrictions: USAA sells only to Nebraska veterans and military.

- Lack of Local Agents: Nebraska local agents are hard to find.

#3 – Geico: Best for Affordable Coverage

Pros

- Affordable Coverage: Nebraska policies are generally cheap at Geico. Learn more about rates in our review of Geico.

- Financial Rating: Geico’s financial management of policies and claims is rated highly.

- Online Convenience: Nebraska customers can easily access their information and make changes online.

Cons

- Lack of Local Agents: Geico’s services aren’t provided through local agents.

- Gap Coverage: Geico does not sell gap coverage.

#4 – Farmers: Best for Customer Service

Pros

- Customer Service: Customers can get assistance from Farmers’ representatives online or in person.

- Multi-Policy Discounts: Bundle Nebraska policies for a lower rate. Learn more in our review of Farmers.

- Coverage Variety: Purchase more coverage if needed from Farmers’ selection of add-ons.

Cons

- Claims Processing: Negative reviews left by Farmers’ customers mention slow processing times.

- High-Risk Rates: High-risk Nebraska drivers will have less competitive rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Coverage Options

Pros

- Coverage Options: Liberty Mutual offers great options like roadside assistance and gap insurance. Learn more in our review of Liberty Mutual.

- 24/7 Assistance: Nebraska drivers don’t need to wait until certain hours to call Liberty Mutual.

- Multi-Policy Discount: Purchasing multiple policies will lower Nebraska car insurance rates.

Cons

- Higher Rates: Higher-risk customers in Nebraska will find rates less competitive.

- Customer Reviews: Reviews about services provided give mostly average ratings.

#6 – State Farm: Best for Reliable Service

Pros

- Reliable Service: State Farm is considered a reliable company for claims and services.

- Discount Selection: Nebraska drivers can qualify for several discounts. Learn more in our State Farm review.

- Roadside Assistance: A useful coverage for Nebraska drivers with older vehicles.

Cons

- Financial Stability: The company has a lower than average rating from A.M. Best.

- Online Management: Local agents limit the need for online management tools, which could be a negative for some customers.

#7 – Nationwide: Best for Comprehensive Policies

Pros

- Comprehensive Policies: Nebraska customers can get great comprehensive coverage from Nationwide.

- Accident Forgiveness: Nationwide’s forgiveness policy benefits safe drivers in Nebraska.

- Multi-Policy Discount: Insurance is cheaper for Nebraska customers who bundle. Learn more by reading our Nationwide review.

Cons

- Customer Reviews: Most ratings are mixed about customer service.

- High-Risk Driver Rates: Quotes for bad Nebraska drivers will be less economical.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Flexible Plans

Pros

- Flexible Plans: Nebraska plans are flexible for customers. Find out more about plan options in our Travelers’ review.

- IntelliDrive Discount: Safe Nebraska drivers can lower rates by getting a good score in the program.

- Financial Rating: The company’s finances are very stable.

Cons

- IntelliDrive Rate Increases: Nebraska drivers risk higher rates if they score badly in the program.

- Customer Service: Services don’t always receive high ratings in customer reviews.

#9 – Allstate: Best for Nationwide Network

Pros

- Nationwide Network: Allstate sells auto insurance nationwide. Read more in our Allstate review.

- Claim Satisfaction: Allstate’s claim satisfaction guarantee may result in lower rates for unhappy Nebraska customers.

- Multiple-Policy Discount: Nebraska customers who are multiple-policy holders will have lower rates.

Cons

- Customer Reviews: Allstate’s services aren’t rated highly by most customers.

- Higher Rates: Allstate is one of the more expensive Nebraska companies.

#10 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family’s services are more personalized due to local agents.

- Discount Variety: Nebraska customers have plenty of opportunities at American Family to maximize savings.

- Coverage Variety: The company sells plenty of Nebraska add-ons. Learn more in our American Family insurance review.

Cons

- Online Services: Local agent availability means online tools may be lacking.

- Rates for New Customers: Loyalty discounts aren’t given to new customers, so rates may be higher initially.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Companies in Nebraska

Nebraska requires all drivers to carry a minimum amount of insurance before driving. As an at-fault state, having the right coverage is vital to avoid financial hardship after a car accident. The best companies offer both full and minimum coverage options to customers.

Nebraska Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $33 | $125 |

| American Family | $30 | $112 |

| Farmers | $35 | $130 |

| Geico | $25 | $92 |

| Liberty Mutual | $48 | $179 |

| Nationwide | $20 | $77 |

| Progressive | $25 | $95 |

| State Farm | $18 | $69 |

| Travelers | $27 | $102 |

| USAA | $15 | $56 |

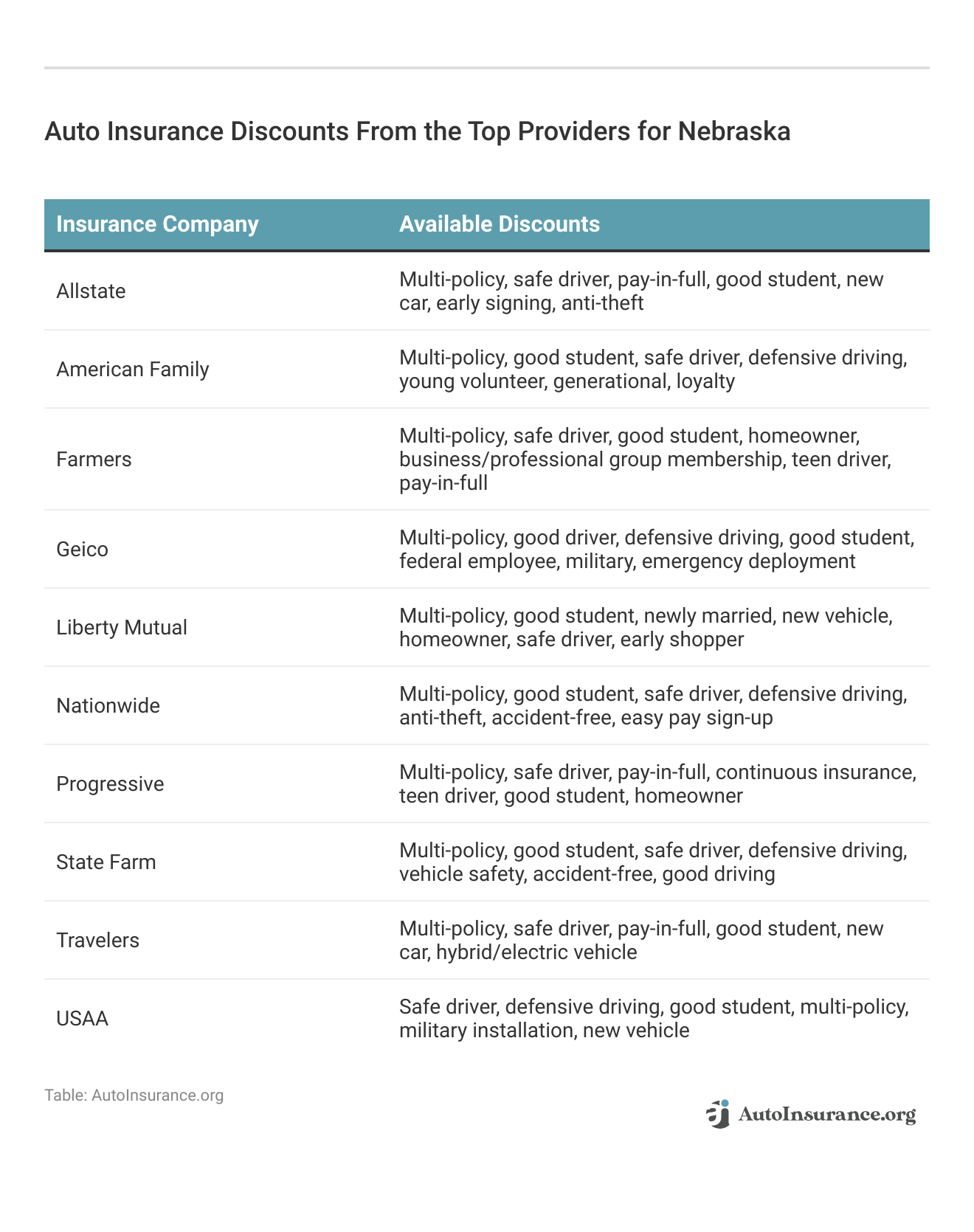

The best Nebraska auto insurance companies also have discounts to help customers save.

There are various factors that affect auto insurance rates, so comparing quotes is integral to finding the most affordable coverage. Companies like Progressive offer free quotes on their websites, or you can use a free tool to comparison shop.

However, you can see what insurance companies charge Nebraska drivers by reading more rate information in the sections below.

Minimum Auto Insurance Rates in Nebraska

States require car insurance to protect both you and other drivers. The most commonly required insurance type is liability auto insurance coverage, but some states include others. Nebraska requires the following insurance types:

- Bodily injury liability — $25,000 per person

- Bodily injury liability — $50,000 per accident

- Property damage liability — $25,000 per accident

- Bodily injury uninsured motorist — $25,000 per person

- Bodily injury uninsured motorist — $50,000 per accident

Liability insurance is an important part of your policy because it protects you from expensive bills if you cause an accident.

Uninsured/underinsured motorist insurance pays for repairs and medical expenses when someone with insufficient insurance or no insurance hits you.Dani Best Licensed Insurance Producer

According to the Insurance Information Institute, 9.3% of Nebraska drivers are uninsured, so having uninsured motorist (UM) coverage can save you thousands.

Buying minimum state insurance is the cheapest option for Nebraska car insurance. Below, you can get an idea of how much minimum insurance costs in the Cornhusker State.

Minimum Coverage Auto Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $87 | |

| $62 | |

| $53 | |

| $76 | |

| $43 | |

| $96 |

| $63 |

| $56 | |

| $47 | |

| $53 | |

| $32 | |

| U.S. Average | $61 |

Geico auto insurance offers the cheapest average rates in Nebraska, followed by USAA. USAA often has the lowest rates for drivers throughout the country but has strict membership requirements. Only military members and their families are eligible for USAA coverage. Check out our USAA auto insurance review for more information.

While liability-only insurance will keep your rates low, it comes with a financial risk. With the rising cost of car repairs and medical bills, Nebraska’s minimum insurance might not cover all the damage you cause in an accident. If you reach your liability limits, you’ll have to pay for anything left over.

Full Coverage Auto Insurance Rates in Nebraska

Full coverage auto insurance refers to a suite of insurance products offering nearly complete protection for your car. It includes liability, comprehensive, collision, uninsured motorist, and medical payments insurance.

Full coverage costs more than minimum insurance, but the extra coverage is usually worth it if it fits your budget. The exact amount you’ll pay depends on factors unique to you, but you can get an idea of what rates you might see below.

Minimum vs. Full Coverage Monthly Insurance Rates by Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $47 | $124 | |

| $53 | $138 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 | |

| U.S. Average | $65 | $170 |

Nationwide and USAA offer the cheapest average full coverage rates in Nebraska, each costing about $100 a month. These companies are much more affordable than competitors, with the next cheapest company being Geico at about $143 a month.

Still, various other factors, such as location, affect your Nebraska insurance rates. For example, rates are usually higher in big cities, so you’ll pay more expensive premiums if you need auto insurance in Omaha, Nebraska.

Nebraska Auto Insurance Rates by Age

Various factors affect insurance rates, but age is one of the most impactful. Statistically speaking, young, inexperienced drivers file more claims, get into more accidents, and engage in reckless behaviors more often than other age groups.

Due to this increased riskiness, young people pay some of the highest rates for car insurance. So while there are ways to find cheaper auto insurance for teens, young drivers should still expect higher rates.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $468 | $540 | $141 | $147 | $125 | $122 | $122 | $119 |

| $640 | $740 | $240 | $252 | $231 | $228 | $226 | $223 | |

| $435 | $591 | $165 | $195 | $164 | $166 | $161 | $163 |

| $520 | $600 | $200 | $210 | $190 | $185 | $180 | $175 | |

| $853 | $897 | $228 | $239 | $199 | $198 | $194 | $194 | |

| $313 | $362 | $128 | $124 | $114 | $114 | $112 | $112 | |

| $745 | $893 | $249 | $285 | $244 | $248 | $239 | $243 |

| $404 | $454 | $124 | $130 | $112 | $110 | $110 | $108 | |

| $432 | $552 | $177 | $194 | $161 | $164 | $158 | $160 |

| $843 | $944 | $187 | $194 | $159 | $150 | $156 | $147 | |

| $362 | $417 | $109 | $113 | $103 | $101 | $101 | $99 | |

| $327 | $405 | $133 | $147 | $123 | $123 | $120 | $120 | |

| $580 | $670 | $180 | $190 | $164 | $161 | $159 | $156 |

| $757 | $1,056 | $142 | $154 | $139 | $141 | $136 | $138 | |

| $257 | $289 | $106 | $113 | $84 | $84 | $82 | $82 | |

| U.S. Average | $560 | $656 | $182 | $191 | $166 | $165 | $163 | $161 |

Once again, Nebraska drivers will probably find the cheapest rates with USAA and Nationwide.

One of the highest-rated insurance providers in the U.S. limits its customer base to military 🪖and families. If eligible for a policy, you'll want to check out USAA auto insurance. https://t.co/27f1xf1ARb has researched and shared its review here👉: https://t.co/uR2RQsZKJP pic.twitter.com/bv69cDQk8O

— AutoInsurance.org (@AutoInsurance) July 31, 2023

The average teen driver pays more than $400 monthly for coverage, but you won’t be stuck with high rates forever. If you keep your driving record clean, your rates will drop in your mid-twenties.

Nebraska Auto Insurance Rates by Credit Score

You might wonder how credit scores affect auto insurance rates in Nebraska. In some states — including Nebraska — your credit score affects your car insurance rates because insurers view auto insurance policyholders with low credit as more likely to miss payments and file claims.

Drivers in Nebraska pay up to 170% more for car insurance when they have low credit scores. However, you can lower your rates by increasing your credit score.

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $78 | $95 | $142 | |

| $65 | $79 | $118 |

| $70 | $85 | $127 | |

| $52 | $68 | $104 | |

| $88 | $105 | $156 |

| $66 | $80 | $122 | |

| $61 | $75 | $113 | |

| $59 | $72 | $109 | |

| $60 | $74 | $111 | |

| $48 | $58 | $87 |

In Nebraska, Nationwide offers the cheapest average rates for drivers with poor credit scores by a large margin. Car insurance quotes in Omaha and other Nebraska cities average just $141 a month with Nationwide but can be nearly $1,000 with State Farm.

Nebraska Auto Insurance Rates After an Accident

Insurance companies look at many factors to determine your rates, but it all comes down to the risk level you represent. The higher the chance you’ll file a claim, the more you’ll pay for insurance.

One of the most telling risk factors for your chance of filing a claim is having previous incidents on your driving record. Having an at-fault accident on your record can increase your rates significantly, making it difficult to find affordable auto insurance for drivers with accidents.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

As you can see, some companies are more forgiving than others when you have an accident on your record. Nationwide and USAA are once again some of the cheapest insurance companies in Omaha and other Nebraska cities.

Although your rates will be higher after an at-fault accident, an incident will only affect your rates for about three years. If you keep your record clean, your rates will eventually return to normal.

Nebraska Auto Insurance Rates After a DUI

DUI convictions have one of the most significant impacts on your car insurance rates and can increase your rates drastically.

DUIs are a red flag to insurance companies, and some will drop drivers after a conviction. Drivers with multiple convictions will probably need to find high-risk auto insurance, but even a single DUI will increase your rates. Finding the best auto insurance for drivers with a DUI can be a challenge.

Auto Insurance Monthly Rate Increases: Clean Record vs. One DUI

| Insurance Company | Clean Record | One DUI | Rate Increase |

|---|---|---|---|

| $87 | $152 | 75% | |

| $62 | $104 | 68% |

| $76 | $105 | 38% | |

| $43 | $117 | 172% | |

| $96 | $178 | 85% |

| $63 | $129 | 105% | |

| $56 | $75 | 34% | |

| $47 | $65 | 38% | |

| $53 | $112 | 111% | |

| $32 | $58 | 81% |

Farmers offers the lowest rates after a DUI in Nebraska, with USAA and Nationwide close behind. However, higher insurance rates aren’t the only consequence of a DUI.

Nebraska state laws impose the following penalties after a DUI charge:

- First Offense: Up to 60 days in jail, a $500 fine, and a license suspension of six months.

- Second Offense: Up to 90 days in jail, a $500 fine, and a license suspension of one year.

- Third Offense: Up to one year in jail, a $1,000 fine, and a license revocation of 15 years.

- Fourth Offense: Up to five years in jail, a $10,000 fine, and a license revocation of 15 years.

- Fifth Offense: Up to 20 years in jail, a $25,000 fine, and a license revocation of 15 years.

Nebraska imposes steeper penalties if your blood alcohol content is over .15 or you get too many convictions within a short period. However, a DUI won’t affect your rates forever. If you don’t add more infractions to your record, your rates will drop after about seven years.

Unveiling the Cost of Auto Insurance in Your City

Explore auto insurance costs in select Nebraska cities such as Auburn, Cedar Rapids, Cozad, Omaha, and Scottsbluff.

Nebraska Auto Insurance Cost by City

Compare rates and premiums tailored to your location for a better understanding of insurance expenses in your area.

Nebraska Auto Insurance by City

Whether you’re looking for Omaha, NE auto insurance or Scottsbluff, NE auto insurance, auto insurance is only slightly more expensive than the national average.

Insurance companies carefully track claim numbers by location, meaning you can see different rates by moving even one ZIP code.

Cities with higher theft rates, heavier traffic, and more claims will have higher insurance rates. For example, car insurance in Lincoln, NE, is typically cheaper due to lower car theft rates and a smaller population. Insurance companies in Lincoln, NE, consider that drivers have a smaller chance of filing a claim.

On the other hand, even the most populated cities in Nebraska can have low rates. For example, auto insurance in Omaha, NE, is often cheaper than in other cities despite having the largest population.

Other Nebraska Auto Insurance Laws

Aside from the Nebraska auto insurance minimum requirements, there are a few other Nebraska car insurance laws you should know about in the Cornhusker State.

All drivers must keep proof of insurance with them whenever they drive. Nebraska accepts physical copies of your card and digital downloads.

Driving without car insurance in Nebraska is a class II misdemeanor. If you get caught without car insurance, your license will be suspended until you provide proof that you have the minimum coverage. Other penalties include:

- $50 license reinstatement fee

- $50 registration reinstatement fee

- SR-22 insurance for three years

You’ll also face increased insurance rates when you buy a new policy. Insurance companies consider it a red flag if you have gaps in your coverage policy.

However, not all vehicles require insurance. For example, you don’t need coverage for snowmobiles, dealer-plated cars, boats, and campers on the back of trucks in Nebraska.

Optional Auto Insurance Options in Nebraska

Nebraska doesn’t require more insurance beyond the minimum liability requirements. However, purchasing additional insurance is a great way to increase the protection of your car, especially if full coverage doesn’t cover everything.

Most insurance companies offer various add-ons, but the most popular in Nebraska include:

- Loan/lease payoff or gap insurance coverage

- Rental car reimbursement

- Roadside assistance

- Custom parts and equipment

- New car replacement

While adding more coverage to your policy increases your car’s protection, it also increases your rates. So only buy what you need to keep your rates as low as possible, and get plenty of Nebraska auto insurance quotes to find the cheapest rate.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Nebraska SR-22 Auto Insurance

Some states require drivers to prove financial responsibility with an SR-22 form after certain traffic violations. While you’ll see SR-22 auto insurance advertised, it’s not an actual coverage type. Instead, it’s a form you must submit to your state’s DMV saying you meet minimum insurance requirements.

Nebraska requires drivers to submit SR-22 forms if any of the following apply to you:

- 12 or more points on your license within two years

- Driving without car insurance

- Court-ordered driver’s license revocation

- Reckless driving

- DUI conviction

- Driving with a suspended license

While circumstances vary, most drivers must carry SR-22 insurance for three years. However, you won’t have to figure out how to file by yourself. Instead, an insurance company will file on your behalf.

How to Get SR-22 Auto Insurance in Nebraska

Getting SR-22 car insurance is especially easy if you already have an insurance policy — all you have to do is contact a representative. There is a risk that your insurance company will drop you as a customer if you need SR-22 insurance. However, most companies are willing to work with you.

If you need a new policy, getting a quote is a simple process, even when you need SR-22 insurance. Inform any company you shop at that you’ll need SR-22 insurance.

You’ll need to submit SR-22 insurance to reinstate your license when the state suspends it. It’s simple enough to get SR-22 insurance when you have a car, but what happens if you don’t own a vehicle?

In this situation, a non-owner auto insurance policy can help. Non-owner insurance covers you in any car you drive and allows you to meet Nebraska’s minimum requirements.

Read more: Non-Owner SR-22 Auto Insurance

Finding SR-22 insurance is relatively easy, but expect higher rates. Your insurance company will likely charge you a filing fee for submitting your SR-22 form, which will also increase your monthly expenses.

Find Cheap Auto Insurance in Nebraska Today

Nebraska drivers pay about 4% more than the national average for insurance, but you can find Nebraska cheap auto insurance by shopping with the right company. Overall, USAA and State Farm are your best bet for affordable coverage. While State Farm and USAA are often the most affordable companies in Nebraska, you might find better rates elsewhere.

The easiest way to ensure you find the best Nebraska auto insurance quotes is to compare rates with as many companies as possible (learn more: How to Evaluate Auto Insurance Quotes).

Enter your ZIP code into our free quote comparison tool below to get started on finding cheap car insurance in Nebraska.

Frequently Asked Questions

How much does insurance cost in Nebraska?

The average Nebraskan driver pays a little over $400 for minimum insurance and about $1,200 for full coverage. The Nebraska auto insurance rates you pay might differ depending on your unique circumstances.

Is it illegal to not have car insurance in Nebraska?

Yes, driving without insurance in Nebraska is illegal. You could face driver’s license suspension and fines for not carrying car insurance in Nebraska (learn more: Is not having auto insurance a criminal offense?).

What car insurance is required in Nebraska?

You need two auto insurance types to meet the Nebraska insurance requirements. The first liability insurance covers repairs and medical bills for other drivers after you cause an accident. The second uninsured motorist coverage pays for your damages and injuries if a driver without adequate coverage hits you.

What is the cheapest car insurance company in Nebraska?

While the cheapest car insurance company for you depends on various factors, Nationwide and USAA tend to have the lowest rates in Nebraska. However, young drivers might find better Nebraska auto insurance rates at other companies (learn more: Best Auto Insurance for Drivers Under 25).

What is Nebraska auto insurance?

Nebraska auto insurance refers to the insurance coverage required and available to drivers in the state of Nebraska. It provides financial protection in the event of accidents, damage to vehicles, or injuries to individuals involved in a car accident.

What are the minimum auto insurance requirements in Nebraska?

In Nebraska, the minimum auto insurance requirements include:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $25,000 property damage liability coverage per accident

Get Nebraska car insurance quotes for minimum coverage today by entering your ZIP in our free tool.

What does bodily injury liability coverage mean?

Bodily injury liability coverage is a type of insurance that covers medical expenses, lost wages, and other damages for injuries caused to others in an accident for which you are at fault. In Nebraska, the minimum bodily injury liability coverage ensures financial protection of up to $25,000 per person and up to $50,000 per accident.

It is recommended to carry a higher limit if you are able, as it will also help cover the cost of lawsuits if the cost is within your set limit (learn more: Does auto insurance pay over the limit of bodily injury to settle lawsuits?).

What is property damage liability coverage?

Property damage liability coverage provides insurance protection for damages caused to someone else’s property in an accident for which you are at fault. In Nebraska, the minimum property damage liability coverage requirement is $25,000 per accident.

Are the minimum auto insurance requirements in Nebraska sufficient?

The minimum auto insurance requirements in Nebraska meet the state’s legal standards. However, the Nebraska car coverage required by the state may not provide adequate protection in all situations. In the event of a severe accident or significant property damage, the minimum coverage might not be enough to cover all expenses.

It’s generally recommended to consider higher liability limits and additional coverages to ensure comprehensive protection (learn more: How much car insurance do I need?).

Is Nebraska a no-fault state?

No, Nebraska is an at-fault state for auto insurance.

Is it illegal to not carry auto insurance in Nebraska?

Yes, all drivers must carry Nebraska automobile insurance to drive.

Is car insurance cheaper in Nebraska?

Full coverage auto insurance in Nebraska costs an average of $146 per month, which is slightly more expensive than the U.S. average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.