Best South Dakota Auto Insurance in 2025 (Top 10 Companies Ranked)

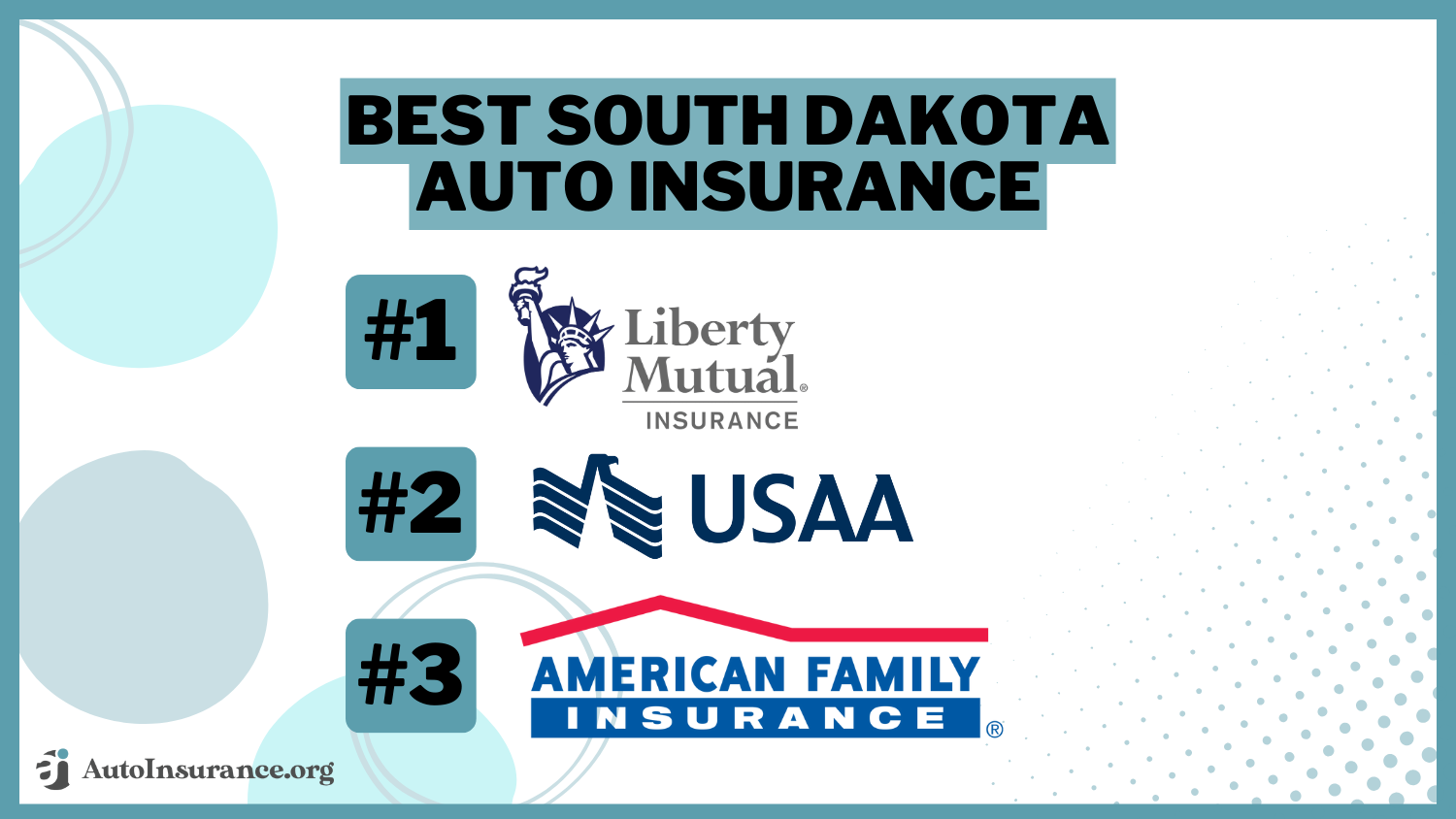

The best South Dakota auto insurance starts at just $9 per month with Liberty Mutual, USAA, and American Family topping the list. These companies offer affordable rates and excellent customer satisfaction, making them ideal choices for drivers in South Dakota looking for dependable coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for South Dakota

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for South Dakota

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

Company Facts

Full Coverage for South Dakota

A.M. Best

Complaint Level

Pros & Cons

The best South Dakota auto insurance company is Liberty Mutual emerging for its competitive rates and extensive coverage options. Alongside Liberty Mutual, USAA and American Family also shine as the best choices, offering affordable premiums and excellent customer satisfaction.

This article delves into detailed comparisons of these top providers, highlighting their strengths in providing reliable protection for South Dakota drivers. Whether you’re seeking minimum coverage or comprehensive policies, comparing quotes from these leading insurers ensures you find the best fit for your insurance needs.

Our Top 10 Company Picks: Best South Dakota Auto Insurance

Insurance Company Rank Multi Vehicle-Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A Customizable Coverage Liberty Mutual

#2 25% A++ Military Focus USAA

#3 20% A Customer Service American Family

#4 20% A Comprehensive Options Farmers

#5 10% A++ Competitive Rates Geico

#6 12% A+ Flexible Policies Progressive

#7 8% A++ Reliable Claims Travelers

#8 20% A+ Broad Coverage Nationwide

#9 20% B Local Agents State Farm

#10 25% A+ Extensive Discounts Allstate

- South Dakota Auto Insurance

Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Liberty Mutual is the best South Dakota auto insurance, rates start at $9/month

- Tailored coverage options for South Dakota drivers’ specific needs

- Compare quotes from Liberty Mutual and others to find best coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Liberty Mutual: Top Overall Pick

Pros

- Customizable Coverage: Liberty Mutual offers a wide range of coverage options that can be tailored to individual needs.

- A.M. Best Rating: The results of our Liberty Mutual auto insurance review suggests Liberty Mutual is rated A for financial stability by A.M. Best.

- Customer Satisfaction: Generally positive reviews for customer service.

Cons

- Customer Service Concerns: Some customers report issues with the responsiveness of customer service.

- Premiums: Rates may be higher compared to competitors for certain profiles.

#2 – USAA: Best for Military Focus

Pros

- Military Focus: Tailored products and exceptional service for military members and their families.

- A.M. Best Rating: Highest possible rating of A++ for financial strength and stability.

- Customer Service: Our USAA auto insurance review indicates USAA being highly rated for customer service satisfaction.

Cons

- Membership Restrictions: Only available to current and former military members and their families.

- Limited Branch Locations: Physical branches are not widely available in all areas.

#3 – American Family: Best for Customer Service

Pros

- Customer Service: Strong reputation for excellent customer service and claims handling.

- A.M. Best Rating: Our American Family auto insurance review reveals American Family is rated A for financial stability by A.M. Best.

- Coverage Options: Offers a variety of coverage options to meet customer needs.

Cons

- Coverage Limitations: Some customers find that coverage options may not be as customizable compared to other providers.

- Pricing: Premiums can be relatively higher in certain regions or for certain demographics.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Farmers: Best for Comprehensive Options

Pros

- Comprehensive Options: Provides a wide array of coverage options to suit various needs.

- A.M. Best Rating: Our Farmers auto insurance review reveals that Farmers is known for A rating exuding financial strength.

- Claims Handling: Generally good reviews for claims processing.

Cons

- Customer Satisfaction: Some customers report dissatisfaction with claims processing and customer service.

- Premium Costs: Rates may be higher compared to some competitors.

#5 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Known for offering some of the most competitive premiums in the industry. Geico offers competitive rates and Geico auto insurance discounts tailored for drivers with good records.

- A.M. Best Rating: Highest rating of A++ for financial stability.

- Accessibility: Easy online tools and customer service accessibility.

Cons

- Limited Coverage Options: Geico may not offer as many specialized coverage options compared to other insurers.

- Customer Service: Some customers report issues with customer service responsiveness.

#6 – Progressive: Best for Flexible Policies

Pros

- Flexible Policies: Offers customizable policies and a variety of coverage options.

- A.M. Best Rating: According to our Progressive auto insurance review, Progressive is rated A+ for financial strength.

- Innovative Tools: Provides tools like Snapshot for personalized rates.

Cons

- Pricing Structure: Progressive’s rates may not always be the lowest, depending on the driver profile.

- Claims Process: Some customers find the claims process to be more involved compared to other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Reliable Claims

Pros

- Reliable Claims: Known for efficient claims processing and customer satisfaction in this regard.

- A.M. Best Rating: Highest rating of A++ for financial stability.

- Coverage Options: Insights from our Travelers auto insurance reviews shows Travelers offers a broad range of coverage options.

Cons

- Premiums: Rates can be on the higher side for certain demographics or coverage levels.

- Availability: Not as widely available in all states compared to larger insurers.

#8 – Nationwide: Best for Broad Coverage

Pros

- Broad Coverage: Our assessment of Nationwide auto insurance review illustrates Nationwide offers extensive coverage options and add-ons to customize policies.

- A.M. Best Rating: Rated A+ for financial strength.

- Customer Support: Generally positive reviews for customer support.

Cons

- Pricing: Premiums may be higher compared to some regional insurers.

- Customer Service: Mixed reviews regarding customer service satisfaction.

#9 – State Farm: Best for Local Agents

Pros

- Local Agents: Extensive network of local agents for personalized service and support.

- Customer Service: Our examination of State Farm auto insurance review shows State Farm is highly rated for customer service and claims handling.

- Community Involvement: Actively involved in supporting local communities.

Cons

- Premiums: Rates may be relatively higher compared to some competitors.

- Discounts: Some customers find that discounts offered are not as extensive as with other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Extensive Discounts

Pros

- Extensive Discounts: Offers a wide range of discounts that can help lower premiums significantly.

- A.M. Best Rating: Our analysis of Allstate auto insurance review reveals Allstate’s A+ rating for financial strength.

- Technology: Provides innovative tools like DriveWise for safe driving rewards.

Cons

- Pricing: Premiums can still be relatively high despite discounts.

- Customer Satisfaction: Mixed reviews regarding customer service and claims processing efficiency.

South Dakota Auto Insurance by Coverage Level

How much is auto insurance in South Dakota? In South Dakota, rates vary widely based on the coverage level and provider chosen. For minimum coverage, which typically includes liability insurance to cover damages to others in an accident, the rates range from $9 per month with Geico to $37 per month with Liberty Mutual.

This basic coverage is the most affordable option but offers limited protection for the insured vehicle. For drivers opting for full coverage auto insurance, which includes comprehensive auto insurance and collision insurance in addition to liability, the monthly premiums increase significantly. Geico offers the lowest full coverage rate at $57 per month, while Liberty Mutual charges the highest at $230 per month.

South Dakota Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $22 $136

American Family $24 $151

Farmers $18 $113

Geico $9 $57

Liberty Mutual $37 $230

Nationwide $12 $76

Progressive $17 $105

State Farm $11 $67

Travelers $16 $97

USAA $9 $58

Other major insurers like Allstate, American Family, Farmers, Nationwide, Progressive, State Farm, Travelers, and USAA fall within these ranges, with their full coverage premiums varying based on their individual risk assessments and coverage offerings.

Factors influencing these rates include the driver’s age, driving history, the type of vehicle insured, and even the specific location within South Dakota. Urban areas may have higher rates due to increased traffic and risk of accidents, while rural areas generally see lower premiums. Insurers also consider local weather conditions and crime rates when determining premiums.

Liberty Mutual emerges as best auto insurance in South Dakota with rates starting at just $37 per month, offering competitive pricing and extensive coverage options.Chris Abrams Licensed Insurance Agent

To find the best car insurance in South Dakota, drivers are advised to obtain car insurance quotes in South Dakota from multiple providers and compare coverage levels, deductibles, and exclusions carefully.

This ensures they get the most suitable coverage for their needs at a competitive price, balancing affordability with comprehensive protection against potential financial losses due to accidents or theft. Understanding these rate dynamics helps drivers make informed decisions to safeguard themselves and their vehicles on South Dakota’s roads.

Cheap Auto Insurance in South Dakota With Bad Credit

Due to their risk profile, most drivers with poor credit pay up to 60% more for car insurance coverage. However, if you have bad credit, you may be able to find competitive coverage rates.

Auto Insurance Full Coverage Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $190 | $230 | $340 | |

| $145 | $180 | $280 |

| $165 | $200 | $310 | |

| $110 | $140 | $250 | |

| $220 | $260 | $390 |

| $140 | $170 | $300 | |

| $135 | $165 | $280 | |

| $120 | $140 | $220 | |

| $130 | $160 | $270 | |

| $95 | $110 | $180 |

Geico offers cheap full coverage auto insurance rates for someone with bad credit at $160 monthly.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Auto Insurance in South Dakota After an At-Fault Accident

If you’re in at-fault accident, expect it to impact your insurance rates. One at-fault accident could increase your monthly car insurance rates by more than $50.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

State Farm offers cheap auto insurance after an accident in South Dakota for drivers with accidents on their records, charging around $140 a month for coverage. Our State Farm auto insurance review compares rates across all demographics.

Cheap Auto Insurance in South Dakota for Young Drivers

Teen drivers present a higher risk for South Dakota car insurance companies as they’re more likely to get into an accident. Consequently, car insurance in South Dakota for teens comes with higher rates. Learn more information on “Companies With the Cheapest Teen Auto Insurance.”

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $868 | $910 | $640 | $740 | |

| $452 | $456 | $333 | $371 | |

| $1,156 | $1,103 | $853 | $897 | |

| $425 | $445 | $313 | $362 | |

| $1,031 | $1,121 | $745 | $893 |

| $586 | $679 | $432 | $552 |

| $1,144 | $1,161 | $843 | $944 | |

| $444 | $498 | $327 | $405 | |

| $1,026 | $1,298 | $757 | $1,056 |

Teen drivers pay over $350 on monthly auto insurance coverage. However, Nationwide offers teen drivers rates around $320 monthly. Read our Nationwide auto insurance review.

South Dakota Auto Insurance Rates by City

Car insurance is more expensive in some areas than in others. Rates vary from one city to the next. For example, you’ll pay higher rates for auto insurance coverage Sioux Falls SD since it’s a big city. Read more about Sioux Falls, SD auto insurance.

Cheap car insurance in South Dakota should be easy to find if you shop online to compare auto insurance quotes South Dakota. Depending on where you live, your ZIP code may help you get lower-than-average auto insurance costs in South Dakota. Use our comparison tool below to compare auto insurance quotes by ZIP code for free.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

South Dakota DUI Auto Insurance

A DUI can cause South Dakota drivers to pay up to $100 more for coverage monthly. So if you’re looking for cheap car insurance with a DUI on your record, you may find that rates are much higher than expected.

However, you can compare quotes from multiple companies in your area to see if some providers offer better rates. The best way to find car insurance after a DUI is to get quotes from multiple companies.

Auto Insurance Full Coverage Monthly Rate Increases: One DUI

| Insurance Company | Clean Record | One DUI | Percent Increase |

|---|---|---|---|

| $228 | $385 | 68.9% | |

| $166 | $276 | 66.3% |

| $198 | $275 | 38.9% | |

| $114 | $309 | 171.1% | |

| $248 | $447 | 80.2% |

| $164 | $338 | 106.1% | |

| $150 | $200 | 33.3% | |

| $123 | $160 | 30.1% | |

| $141 | $294 | 108.5% | |

| $84 | $154 | 83.3% |

State Farm offers the cheapest rates in South Dakota for people with a DUI, at $156. Comparatively, Geico’s rates are nearly $167 more monthly. Read our review to compare Geico vs. State Farm auto insurance. Once you find the companies that have the policies you need, shop online to compare quotes.

Progressive’s Comparison With Other Auto Insurance Providers

Explore a detailed comparison of Progressive, focusing on coverage, rates, and customer satisfaction. Make an informed decision by delving into the details.

Progressive vs. Other Top Auto Insurance Providers

Ultimately, choosing an insurance provider involves weighing coverage options, affordability, and customer service. Progressive’s comprehensive offerings and competitive pricing make it a compelling choice for many individuals and families seeking reliable insurance coverage.

Make an informed decision by exploring Progressive’s offerings in detail, ensuring you select the insurance that best fits your needs and budget. Be more guided by knowing “Where to Compare Auto Insurance Rates.”

South Dakota Auto Insurance Requirements

Drivers in South Dakota must carry car insurance in accordance with auto insurance South Dakota requirements. Individuals who purchase a liability-only insurance policy pay around $21 monthly for coverage.

What would you do if your car 🚘was damaged by a hit and run or uninsured driver? Maybe it’s time to consider🤔uninsured motorist property damage coverage. https://t.co/Jw0i5Eacvg has a guide to help you decide💡what’s right for you. Check it out here👉: https://t.co/lb0f61gA8i… pic.twitter.com/u4k8B4U2Qz

— AutoInsurance.org (@AutoInsurance) September 17, 2023

Mandatory coverage in South Dakota includes:

- $25,000 of bodily injury liability coverage per person

- $50,000 of bodily injury liability coverage per accident

- $25,000 of property damage liability per accident

- $25,000 of uninsured/underinsured coverage per person

- $50,000 of uninsured/underinsured coverage per accident

In addition to the state’s minimum coverage requirements, South Dakota residents can choose between the following additional coverages:

- Comprehensive auto insurance

- Collision auto insurance

- Gap insurance

- Medical payments

- Rental car reimbursement coverage

- Roadside assistance coverage

- Accidental death

- Total disability

The more coverage you purchase, the more your car insurance costs. However, full coverage and add-on protections will ensure you’re better protected on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

South Dakota SR-22 Auto Insurance

In South Dakota, SR-22 auto insurance is mandated for several specific reasons, primarily aimed at individuals deemed high-risk by the state. These reasons include DUI convictions, driving without auto insurance, multiple at-fault collisions, driving with a suspended license, and accumulating too many points on a license.

It may be challenging to find a policy if you don’t have insurance. Some companies will offer you a policy and file an SR-22, but you’ll likely have to pay a fee. In addition, some companies will probably deny coverage if you need to file SR-22 with a DUI on your record.

Discover more information on our “SR-22 Auto Insurance: What is it and who needs it?”

You may find it challenging to buy SR-22 coverage without a vehicle. However, the easiest thing you can do is buy non-owner auto insurance before filing an SR-22 request. Read more about non-owner SR-22 auto insurance policies.

If you find yourself in any of these situations, you’ll need to obtain SR-22 coverage to demonstrate financial responsibility. The process involves contacting your current insurance provider, who will then file the SR-22 on your behalf.

Liberty Mutual emerges as the top choice for South Dakota auto insurance with its competitive rates and extensive coverage options.Daniel Walker Licensed Auto Insurance Agent

While you can generally maintain your relationship with your existing insurer, be prepared for increased premiums due to the higher risk associated with needing SR-22 coverage. This requirement underscores the state’s commitment to ensuring that drivers who have exhibited risky behavior remain financially accountable on the road, thereby promoting safer driving practices overall.

Case Studies Illustrating Diverse Auto Insurance Solutions

In this section, we present several case studies highlighting real-world scenarios where individuals benefited from specific auto insurance solutions tailored to their needs.

- Case Study 1 – Post-Accident Savings With State Farm: John, from Rapid City, South Dakota, saved over $100 per month by switching to State Farm after an at-fault accident. This change provided comprehensive coverage while significantly reducing his financial burden.

- Case Study 2 – Geico’s Rideshare Insurance for Confidence on the Road: Sarah, a rideshare driver in Sioux Falls, South Dakota, found peace of mind with Geico’s rideshare auto insurance, offering competitive rates for comprehensive coverage during both personal and rideshare use.

- Case Study 3 – Nationwide’s Affordable Insurance for Teen Drivers: Mark and Lisa, parents in Aberdeen, South Dakota, opted for Nationwide for their teenage son’s insurance due to its affordability and comprehensive coverage tailored for young drivers.

- Case Study 4 – Progressive’s Solution for High-Risk Insurance Needs: Emily, a Pierre resident with a DUI conviction, turned to Progressive for specialized services. Progressive provided an SR-22 filing and manageable premiums, helping Emily meet legal requirements without financial strain.

These case studies illustrate how personalized auto insurance solutions can address specific needs and circumstances, ensuring individuals in South Dakota find the coverage that best suits them.

Whether recovering from an accident, needing specialized insurance for rideshare work, insuring young drivers, or managing high-risk situations, exploring options and comparing South Dakota auto insurance quotes can lead to significant savings and peace of mind.

The Bottom Line: Making an Informed Choice on South Dakota Auto Insurance

Choosing the right auto insurance out of the best auto insurance companies in South Dakota requires careful consideration of several factors such as coverage options, premiums, and customer satisfaction ratings. Whether opting for minimum liability coverage or comprehensive policies, comparing quotes remains crucial for finding the most suitable insurance plan.

Additionally, factors like driving history, credit score, and specific coverage needs can influence the final decision. By leveraging online tools and resources, South Dakota drivers can make informed choices to ensure adequate protection on the road without compromising on affordability or quality of service. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

How much is car insurance in South Dakota?

In South Dakota, rates vary widely based on the coverage level and provider chosen. For minimum coverage, which typically includes liability insurance to cover damages to others in an accident, the rates range from $9 per month with Geico to $37 per month with Liberty Mutual.

Can I suspend my auto insurance coverage if I’m not using my vehicle in South Dakota?

Auto insurance coverage suspension is not common in South Dakota, but you can explore options with your provider for cost reduction during periods of non-use. Discover more insights with our guide titled “Can I suspend auto insurance for a month?”

Are there any specific auto insurance requirements for rideshare drivers in South Dakota?

Rideshare drivers may need additional South Dakota auto insurance coverage and should contact their insurance provider to discuss rideshare insurance options. Enter your ZIP code below to find out if you can get a better deal.

Does South Dakota require proof of insurance to register a car?

Yes, you must have proof of South Dakota auto insurance to register a car.

What are the minimum South Dakota auto insurance requirements?

South Dakota requires drivers to carry at least liability insurance and uninsured/underinsured motorist coverage. These minimum requirements ensure financial responsibility in case of an accident.

What are the primary South Dakota auto insurance laws?

South Dakota auto insurance laws require drivers to maintain minimum liability coverage and uninsured/underinsured motorist coverage. Understanding these laws helps ensure compliance and adequate protection on the road.

How can I obtain South Dakota auto insurance quotes?

Getting South Dakota auto insurance quotes is easy. Simply enter your ZIP code above to compare rates from multiple insurers. This allows you to find the best coverage at competitive prices.

What factors influence South Dakota auto insurance rates?

South Dakota auto insurance rates are influenced by several factors, including your driving record, age, location, type of vehicle, and coverage limits. Understanding these factors helps drivers anticipate insurance costs. Obtain more knowledge and compare the best auto insurance by vehicle type.

Where can I find South Dakota cheap auto insurance options?

Finding South Dakota cheap auto insurance is possible by comparing quotes from various insurers. Use our tool to explore affordable coverage options tailored to your needs and budget. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Is temporary car insurance available in South Dakota?

Yes, temporary car insurance options are available in South Dakota for drivers needing short-term coverage. Contact insurers to discuss temporary insurance policies that suit your specific situation.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.