Best Rhode Island Auto Insurance in 2025 (Top 10 Companies Ranked)

The top providers for the best Rhode Island auto insurance are Nationwide, Geico, and State Farm, offering competitive rates starting at $44 per month for minimum coverage. These companies stand out for their competitive rates and comprehensive coverage options tailored to Rhode Island auto insurance needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jul 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Rhode Island

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Rhode Island

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Rhode Island

A.M. Best

Complaint Level

Pros & Cons

The top pick overall for the best Rhode Island auto insurance is State Farm, with Nationwide and Geico also offering competitive rates starting at $44 per month for minimum coverage.

These companies stand out for their comprehensive coverage options tailored to Rhode Island’s unique insurance needs and their competitive pricing.

Our Top 10 Company Picks: Best Rhode Island Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A+ Broad Coverage Nationwide

#2 10% A++ Affordable Rates Geico

#3 20% B Reliable Service State Farm

#4 20% A Customer Satisfaction American Family

#5 25% A Comprehensive Policies Liberty Mutual

#6 8% A++ Financial Stability Travelers

#7 25% A++ Military Focus USAA

#8 12% A+ Online Tools Progressive

#9 25% A+ Local Agents Allstate

#10 20% A Personalized Plans Farmers

This guide delves into the coverage requirements, factors affecting premiums, and strategies for finding the best deals, ensuring you’re well-informed to make the right choice.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code above to find the most affordable quotes in your area.

- Nationwide stands out as the top pick for its competitive rates, starts at $44/mo

- Find the best Rhode Island auto insurance for full coverage auto insurance

- Tailored coverage options address Rhode Island’s unique auto insurance needs

#1 – Nationwide: Top Overall Pick

Pros

- Comprehensive Coverage: Nationwide offers a wide range of coverage options, including liability, collision, and comprehensive coverage, providing extensive protection for drivers.

- Customized Policies: Nationwide allows customers to customize their policies according to their specific needs, ensuring they get the coverage they require.

- Strong Financial Stability: Nationwide auto insurance review highlights the company’s solid financial strength, showcasing their ability to handle customer claims efficiently.

Cons

- Claims Processing Time: Some customers have reported longer-than-expected claims processing times, leading to delays in receiving payouts.

- Customer Service: While Nationwide offers 24/7 customer support, some customers have expressed dissatisfaction with the responsiveness and quality of customer service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Online Convenience: Geico’s user-friendly website and mobile app make it easy for customers to manage their policies, file claims, and access customer support.

- Discount Opportunities: Geico provides numerous discount opportunities, such as safe driver discounts, multi-vehicle discounts, and discounts for military members and federal employees, helping customers save on their premiums.

- Strong Financial Stability: Our Geico auto insurance review highlights the company’s strong financial strength rating, showcasing its ability to meet financial obligations to policyholders.

Cons

- Limited Agent Interaction: Geico primarily operates online and over the phone, which may be a disadvantage for customers who prefer face-to-face interactions with agents.

- Coverage Limitations: While Geico offers a wide range of coverage options, some customers may find that certain types of coverage or add-ons are limited compared to other insurers.

#3 – State Farm: Best for Reliable Service

Pros

- Personalized Service: State Farm auto insurance review highlights the company’s personalized service, which is delivered through a network of local agents, allowing for face-to-face interactions and tailored advice for customers.

- Comprehensive Coverage: State Farm offers a wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage, providing extensive protection for drivers.

- Discount Opportunities: State Farm offers various discount opportunities, such as multi-policy discounts, safe driver discounts, and discounts for good students, helping customers save on their premiums.

Cons

- Potentially Higher Rates: While State Farm offers competitive rates, some customers may find that rates are slightly higher compared to other insurers in certain cases.

- Availability: State Farm’s coverage may not be available in all areas of Rhode Island, limiting options for some customers, especially those in rural or remote areas.

#4 – American Family: Best for Customer Satisfaction

Pros

- Customizable Coverage: The American Family auto insurance review highlights the company’s diverse coverage options, enabling customers to customize their policies to fit their unique needs and budget.

- Personalized Customer Service: Customers praise American Family for its personalized customer service, with agents who take the time to understand their individual needs and provide tailored solutions.

- Innovative Technology: American Family offers innovative technology solutions such as mobile apps and online account management tools, making it convenient for customers to access their policies and manage their accounts.

Cons

- Limited Availability: American Family’s availability is limited to certain states, which may restrict potential customers in other regions from accessing their services.

- Higher Premiums: Some customers have reported higher premiums compared to other insurance providers, particularly for certain coverage types or demographics.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Comprehensive Policies

Pros

- Wide Range of Coverage Options: Liberty Mutual offers a comprehensive selection of coverage options, allowing customers to customize their policies to meet their individual needs.

- Discount Programs: The company provides various discount programs, including multi-policy discounts, safe driver discounts, and discounts for certain vehicle safety features.

- Strong Financial Stability: Liberty Mutual auto insurance review highlights the company’s strong financial stability rating, ensuring customers that their claims will be managed promptly and efficiently.

Cons

- Higher Premiums for Certain Demographics: Some customers have reported higher premiums with Liberty Mutual, particularly for younger drivers or individuals with less favorable driving records.

- Complex Claims Process: While the company aims to provide efficient claims processing, some customers have experienced delays and challenges in navigating the claims process, leading to frustration.

#6 – Travelers: Best for Financial Stability

Pros

- Extensive Coverage Options: Travelers offers a wide range of coverage options, including standard policies as well as specialized coverage for unique needs such as umbrella insurance and identity theft protection.

- Discount Opportunities: The company provides various discount opportunities, including multi-policy discounts, safe driver discounts, and discounts for certain safety features in vehicles.

- Claims Satisfaction: Travelers auto insurance review highlights the company’s consistent positive feedback for its claims handling process, with numerous customers praising its efficiency and responsiveness.

Cons

- Limited Availability: Travelers may have limited availability in certain regions, which could restrict potential customers from accessing their services.

- Complex Policy Options: The wide range of coverage options offered by Travelers may be overwhelming for some customers, leading to confusion and difficulty in selecting the most appropriate policies for their needs.

#7 – USAA: Best for Military Focus

Pros

- Excellent Customer Service: USAA auto insurance review highlights the company’s consistently high ratings for exceptional customer service, showcasing its prompt and helpful assistance to policyholders.

- Comprehensive Coverage Options: USAA offers a wide range of coverage options, including auto, home, life, and more, allowing customers to bundle policies for convenience and potential savings.

- Tech-Savvy Solutions: With innovative online tools and a user-friendly mobile app, USAA makes it easy for customers to manage their policies, file claims, and access resources on-the-go.

Cons

- Membership Limitations: USAA membership is limited to military personnel, veterans, and their families, excluding a significant portion of the general population from accessing its services.

- Limited Physical Presence: USAA primarily operates online and through phone support, which may be a drawback for customers who prefer face-to-face interactions or need assistance in person.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Progressive: Best for Online Tools

Pros

- Wide Range of Coverage Options: Progressive offers an extensive selection of coverage options, including standard policies, specialized coverage for unique needs, and customizable plans to suit individual preferences.

- Convenient Online Platform: Progressive auto insurance review highlights the user-friendly website and mobile app, which allow customers to conveniently manage policies, access resources, and file claims from any location.

- Strong Financial Standing: Progressive is a financially stable company with a solid reputation, instilling confidence in policyholders that their claims will be handled efficiently and effectively.

Cons

- Potential Rate Increases: Progressive’s pricing structure may lead to rate increases over time, especially for policyholders who make claims or experience changes in driving habits, potentially resulting in higher premiums.

- Limited Coverage for High-Risk Drivers: Progressive may not offer competitive rates or comprehensive coverage options for high-risk drivers, such as those with poor credit history or multiple accidents on their record.

#9 – Allstate: Best for Local Agents

Pros

- Wide Range of Coverage Options: Allstate auto insurance review showcases a variety of coverage options, enabling customers to customize their policies to fit their unique requirements.

- User-Friendly Digital Tools: Allstate provides user-friendly digital tools and resources, including mobile apps and online platforms, making it convenient for customers to manage their policies and file claims.

- Strong Financial Stability: Allstate has a solid financial reputation and stability, providing reassurance to customers that their claims will be paid promptly and reliably.

Cons

- Higher Premiums: Allstate tends to have higher premiums compared to some other insurance providers, which may make it less affordable for budget-conscious customers.

- Limited Coverage in Some Areas: Allstate may have limited coverage options in certain regions, which could be a drawback for customers seeking specific types of coverage or living in remote areas.

#10 – Farmers: Best for Personalized Plans

Pros

- Comprehensive Coverage Options: Farmers auto insurance discounts are available with various coverage options. These include standard policies such as liability, collision, and comprehensive, along with extra features like rental reimbursement, rideshare coverage, and new car replacement.

- Personalized Plans: Farmers provides personalized insurance plans tailored to individual needs. Policyholders can customize their coverage based on their unique requirements and budget, ensuring they only pay for what they need.

- Educational Resources: Farmers offers educational resources and tools to help customers understand their insurance options better and make informed decisions about their coverage.

Cons

- Potentially Higher Premiums: Farmers’ premiums may be higher than average, particularly for customers with certain risk factors or coverage needs.

- Limited Online Tools: While Farmers offers some digital tools and resources, its online platform may not be as robust or user-friendly as those of some other insurance providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding Auto Insurance Options in Rhode Island

Purchasing the minimum required auto insurance coverage in Rhode Island generally results in lower-than-average rates, making liability auto insurance a cost-effective choice. However, minimum coverage may not provide comprehensive protection.

State Farm offers the cheapest minimum coverage, followed by Amica Mutual, while Allstate charges the highest for minimum coverage. When considering a minimum coverage policy, it’s crucial to evaluate if it offers adequate protection, especially for newer or expensive vehicles, which might necessitate additional coverage.

Nationwide offers competitive rates and comprehensive coverage options tailored to Rhode Island's unique insurance needs, making it the top choice for auto insurance in the state.Jeff Root Licensed Insurance Agent

Full coverage policies, including collision and comprehensive insurance, provide extensive protection but come at higher rates. State Farm offers the most affordable full coverage in Rhode Island, while Amica Mutual follows, and Allstate remains the most expensive.

For individuals who are leasing a vehicle or those who prioritize comprehensive protection, opting for full coverage policies is strongly advised. These policies not only encompass the state minimum requirements but also include collision and comprehensive insurance.

Rhode Island Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $80 $189

American Family $64 $151

Farmers $78 $183

Geico $53 $125

Liberty Mutual $100 $235

Nationwide $81 $190

Progressive $49 $116

State Farm $32 $76

Travelers $44 $103

USAA $28 $65

Discover the monthly auto insurance rates for both minimum and full coverage in Rhode Island, offered by various leading providers. From State Farm’s budget-friendly rates at $32 for minimum coverage and $76 for full coverage to Liberty Mutual’s comprehensive protection at $100 for minimum coverage and $235 for full coverage, explore your options to find the right coverage level and provider to suit your needs and budget.

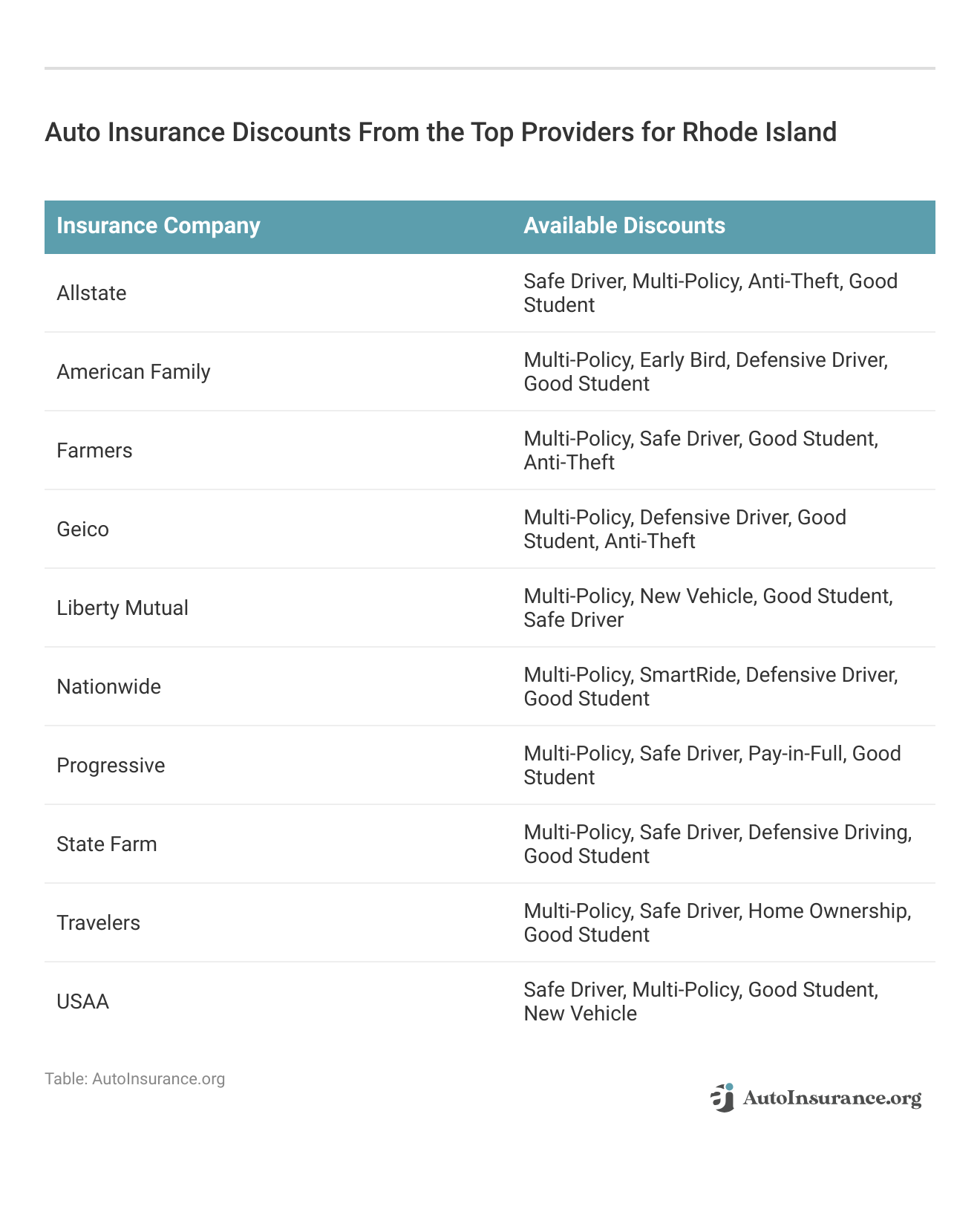

Discover exclusive auto insurance discounts tailored for Rhode Island residents from the top providers in the industry. This concise table showcases the available discounts from leading insurers, including Allstate, American Family, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA.

With incentives ranging from safe driving rewards to multi-policy savings and perks for good students, Rhode Island drivers can optimize their insurance coverage while enjoying significant cost savings.

Rhode Island Bad Credit Auto Insurance: Finding Coverage Solutions for All Drivers

Having poor credit could mean higher car insurance rates due to statistical correlations with increased claim likelihood. In Rhode Island, the average minimum monthly cost for drivers with bad credit is $140, but options exist for potentially cheaper rates. To gain further insights, consult our comprehensive guide titled “What is the average auto insurance cost per month?”

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $78 | $95 | $142 | |

| $65 | $79 | $118 |

| $70 | $85 | $127 | |

| $52 | $68 | $104 | |

| $88 | $105 | $156 |

| $66 | $80 | $122 | |

| $61 | $75 | $113 | |

| $59 | $72 | $109 | |

| $60 | $74 | $111 | |

| $48 | $58 | $87 |

State Farm offers the lowest premiums among well-known insurers, though still above the state average, at $181 monthly. Conversely, Progressive charges the highest premiums for drivers with poor credit, averaging $464 monthly.

Enhancing your credit score stands out as the paramount strategy for not only obtaining more favorable insurance rates but also fostering long-term financial stability. By diligently working to improve your creditworthiness, you demonstrate responsible financial behavior, which insurers often reward with lower premiums.

Affordable Auto Insurance Options in Rhode Island After an Accident

It’s common knowledge that finding auto insurance for drivers with accidents can be a challenge. For example, in Rhode Island, you could pay around $200 more each year for car insurance if you were in an accident.

State Farm has the lowest rates for someone with an at-fault accident on their record. Rates with the company are around $88 a month, whereas Amica Mutual charges $149 monthly. Progressive and Allstate charge the highest rates. Progressive charges $321 a month, and Allstate charges $329 each month.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

If you have an accident on your driving record, you could see your rates drop once the accident falls off your record. In Rhode Island, you can expect the accident to impact your rates for up to three years. Still, you should shop online and compare quotes at least once yearly to ensure you’re not overpaying for coverage.

Moreover, engaging in regular quote comparisons proves invaluable in identifying potential cost-saving opportunities. By staying informed about the evolving insurance market and exploring various coverage options, you empower yourself to make informed decisions that align with your budgetary and coverage needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Rhode Island Young Driver Auto Insurance

Almost every driver can find cheap car insurance in Rhode Island. However, if you’re looking for the best auto insurance for teens, you can expect to pay higher-than-average rates for coverage. Teen and young adult drivers can pay up to six times what drivers in their mid-30s pay for coverage. The average cost for car insurance for teen drivers in Rhode Island is $732 a month.

Rhode Island auto insurance companies often charge young drivers higher rates because they have less experience on the road and are more likely to get into an accident or file a claim. Still, some companies are cheaper than others regarding car insurance for teens and young adults.

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $868 | $910 | $640 | $740 | |

| $452 | $456 | $333 | $371 | |

| $1,156 | $1,103 | $853 | $897 | |

| $425 | $445 | $313 | $362 | |

| $1,031 | $1,121 | $745 | $893 |

| $586 | $679 | $432 | $552 |

| $1,144 | $1,161 | $843 | $944 | |

| $444 | $498 | $327 | $405 | |

| $1,026 | $1,298 | $757 | $1,056 |

Teens and young adults can save money on car insurance by jumping on a parent or guardian’s policy. However, if this is impossible for you, your best bet is to shop around and compare quotes from several providers. Certain providers may offer discounts based on good grades or defensive driving courses. These discounts could help you save anywhere from 5% to 15% on your car insurance.

Rhode Island Auto Insurance Rates Across Cities

In most states, you’ll likely find that where you live significantly impacts your car insurance rates. Car insurance companies set a person’s rates by considering several factors. One of the factors many companies consider is your ZIP code. You may enjoy lower rates if you live in a rural area that experiences less traffic and fewer crime incidents.

Similarly, your car insurance rates may be higher than average if you live in a crowded or highly trafficked area. In Rhode Island, the cheapest auto insurance rates are often in Middletown. Unfortunately, Providence carries the highest car insurance premiums. For additional details, explore our comprehensive resource titled “Auto Insurance Premium Defined.”

As you can see from the chart, rates can vary significantly from one city to another. So if you live in a city with a higher average for auto insurance, you should still shop around and compare rates to ensure you aren’t overpaying for coverage.

Navigating Rhode Island DUI Auto Insurance

A DUI conviction in Rhode Island can raise your car insurance rates by 87% or around $2,000 annually. Finding affordable coverage will be challenging if you have a DUI on your record. Still, some companies charge less than others for auto insurance after a DUI, so it’s important to shop around for auto insurance for drivers with a DUI.

Auto Insurance Monthly Rate Increases: Clean Record vs. One DUI

| Insurance Company | Clean Record | One DUI | Rate Increase |

|---|---|---|---|

| $87 | $152 | 75% | |

| $62 | $104 | 68% |

| $76 | $105 | 38% | |

| $43 | $117 | 172% | |

| $96 | $178 | 85% |

| $63 | $129 | 105% | |

| $56 | $75 | 34% | |

| $47 | $65 | 38% | |

| $53 | $112 | 111% | |

| $32 | $58 | 81% |

State Farm offers coverage for individuals with a DUI for $88 monthly. Remember that this cost is for a liability-only policy — full coverage will cost more. Progressive offers the second-cheapest option with roughly $322 a month. Nationwide charges $347 monthly, and Geico charges $382 a month.

Drivers with a DUI in Rhode Island face high insurance costs, with Allstate charging $404 monthly and Amica as the most expensive at $581; while a DUI remains on record for at least five years, exploring rate comparisons after its removal can potentially lower premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding Rhode Island’s Auto Insurance Requirements

To legally drive in Rhode Island, you need bodily injury and property damage liability insurance. The state requires coverage of $25,000 per person for bodily injury, $50,000 per accident, and $25,000 for property damage. These are represented as 25/50/25. To learn more, explore our comprehensive resource on insurance titled “Bodily Injury Liability (BIL) Auto Insurance.”

With competitive rates and tailored coverage, Nationwide stands out as the top choice for auto insurance in Rhode Island.Michelle Robbins Licensed Insurance Agent

While insurers typically assist in maintaining proper coverage, it’s your responsibility. Rhode Island’s minimums are relatively low, so consider higher coverage to avoid potential out-of-pocket expenses in accidents exceeding these limits. Speak with an insurance representative for more details on your options.

Exploring Additional Rhode Island Auto Insurance Coverage Options

Navigating auto insurance options can be a daunting task, especially when considering the diverse needs of drivers. In addition to Rhode Island state minimum requirements, you can purchase additional coverage options. Some of the most common car insurance coverage options include:

- Comprehensive Auto Insurance:This coverage helps pay for damage to your vehicle caused by something other than an accident, such as wind, hail, falling debris, or vandalism.

- Collision Auto Insurance: This coverage pays for damage to your vehicle from an accident. Collision coverage kicks in regardless of who is at fault in the accident.

- Gap Insurance: If you owe more on your car than it’s worth based on its actual cash value, GAP insurance pays the difference, so you don’t pay for your loan out of pocket if the vehicle gets totaled.

- Medical Payments (MedPay): MedPay covers medical bills related to an accident, such as visits to the doctor and hospital stays.

- Roadside Assistance: Roadside assistance offers help if you get stranded on the road and need towing services, flat tire repair, lockout services, or fuel delivery. Some companies may include roadside assistance in a full coverage policy, but many don’t.

- Rental Car Reimbursement Coverage: If your vehicle gets damaged and needs repair, this coverage helps reimburse you for rental car expenses during that time.

- Uninsured/Underinsured Motorist Coverage: This coverage helps to cover your injuries or property damage caused by another driver with no insurance, insufficient insurance, or a hit-and-run driver.

Whether it’s safeguarding your vehicle from non-collision damages with comprehensive insurance or ensuring medical expenses are covered with MedPay, each coverage choice plays a vital role in your overall insurance strategy.

By exploring and understanding these additional options, you can tailor your policy to suit your unique needs, providing confidence and security as you travel the roads of the Ocean State.

Understanding SR-22 Requirements

The Bottom Line: Cheap Auto Insurance in Rhode Island

Frequently Asked Questions

What is the Rhode Island Automobile Insurance Plan (RIAIP), and who is it for?

The RIAIP is designed to provide auto insurance coverage to individuals who have difficulty obtaining insurance through traditional channels due to factors such as poor driving records or high-risk profiles. It ensures that all drivers in Rhode Island have access to essential coverage.

How does the Rhode Island Auto Insurance Plan differ from regular auto insurance policies?

Unlike regular auto insurance policies, which are typically purchased directly from insurance companies, the RIAIP is a residual market mechanism. It serves as a last resort for individuals who cannot secure coverage from private insurers.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Is affordable insurance available in Rhode Island for drivers with less-than-perfect records?

Yes, through options like the Rhode Island Auto Insurance Plan, drivers with poor records or high-risk profiles can still access affordable insurance. While rates may be higher than average due to increased risk, the RIAIP helps ensure that coverage remains accessible.

To expand your knowledge, refer to our comprehensive handbook titled “Auto Insurance for Different Types of Drivers.”

What are the criteria for determining the best auto insurance in Rhode Island?

The best auto insurance in Rhode Island can vary depending on individual needs and preferences. Factors such as coverage options, customer service, rates, and financial stability of the insurer are crucial considerations when determining the best option.

How can I find the best rate for auto insurance in Rhode Island?

To find the best rate for auto insurance in Rhode Island, it’s essential to compare quotes from multiple insurers. Factors such as your driving history, coverage needs, and eligibility for discounts can all impact the rates you receive.

Where can I find the cheapest auto insurance in Rhode Island?

While rates may vary depending on individual circumstances, insurers like Progressive often offer competitive rates in Rhode Island. However, it’s essential to shop around and compare quotes from multiple providers to find the cheapest option for your specific situation.

To gain profound insights, consult our extensive guide titled “Where to Compare Auto Insurance Rates.”

What is SR-22 insurance, and how does it apply in Rhode Island?

SR-22 insurance is a form of proof of financial responsibility required for individuals who have been involved in certain traffic violations or offenses, such as DUIs or driving without insurance. In Rhode Island, drivers may need SR-22 insurance to reinstate their driving privileges.

Does Progressive offer auto insurance coverage in Rhode Island?

Yes, Progressive is one of the insurers that provide auto insurance coverage in Rhode Island. As mentioned in the article, they offer competitive rates and may be a good option for drivers looking for affordable coverage.

What factors contribute to finding the cheapest insurance in Rhode Island?

Several factors influence the cost of auto insurance in Rhode Island, including driving record, age, location, vehicle type, and coverage options. By maintaining a clean driving record, exploring discounts, and comparing quotes, drivers can increase their chances of finding affordable insurance.

For a comprehensive overview, explore our detailed resource titled “Auto Insurance Discounts.”

How can I obtain cheap auto insurance in Rhode Island?

To obtain cheap auto insurance in Rhode Island, consider options such as shopping around for quotes, bundling policies, maintaining a good driving record, and exploring discounts offered by insurers. Additionally, enrolling in programs like the Rhode Island Auto Insurance Plan can provide access to affordable coverage for high-risk drivers.

Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.