Best Tennessee Auto Insurance in 2025 (Find the Top 10 Companies Here!)

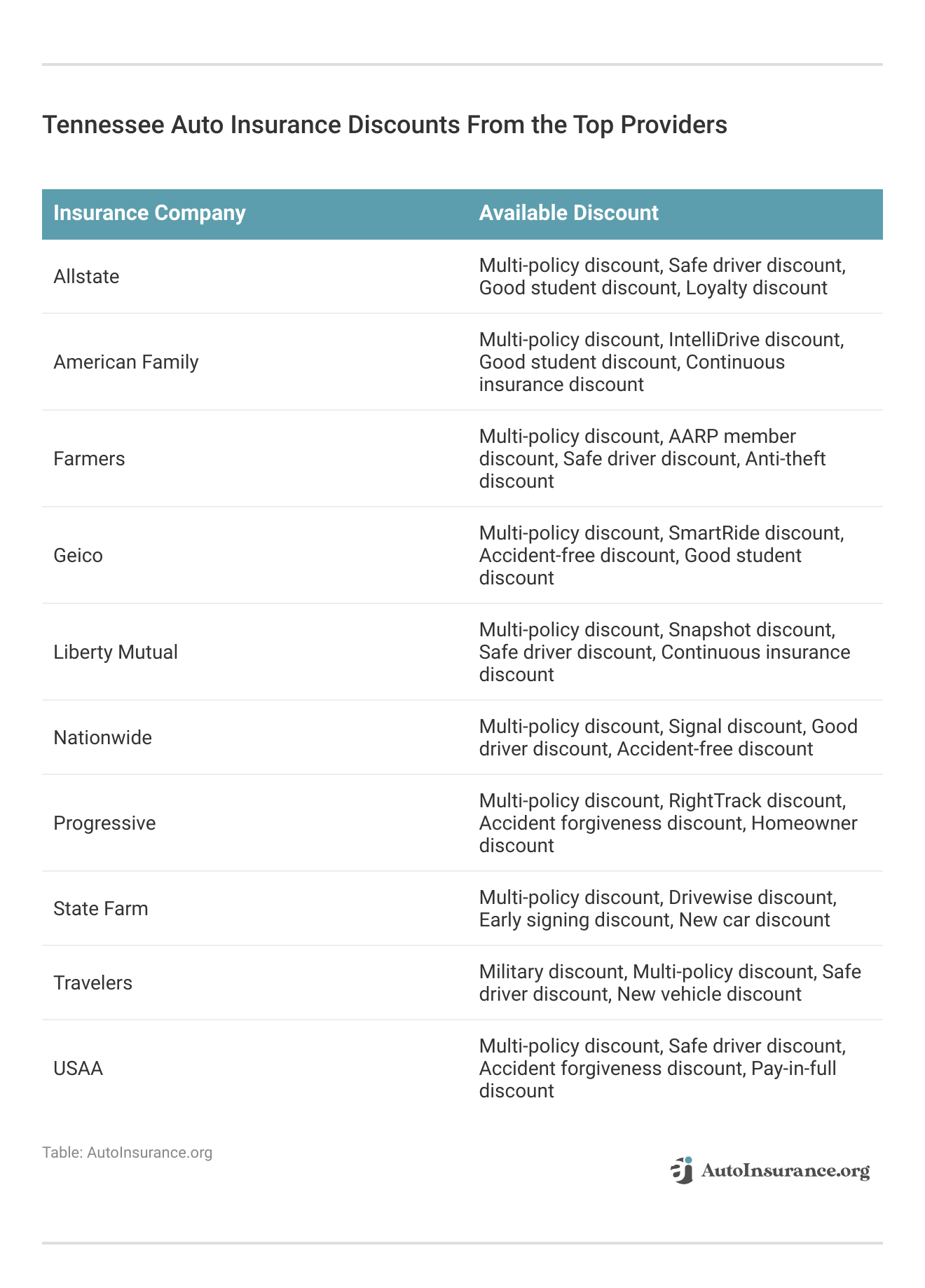

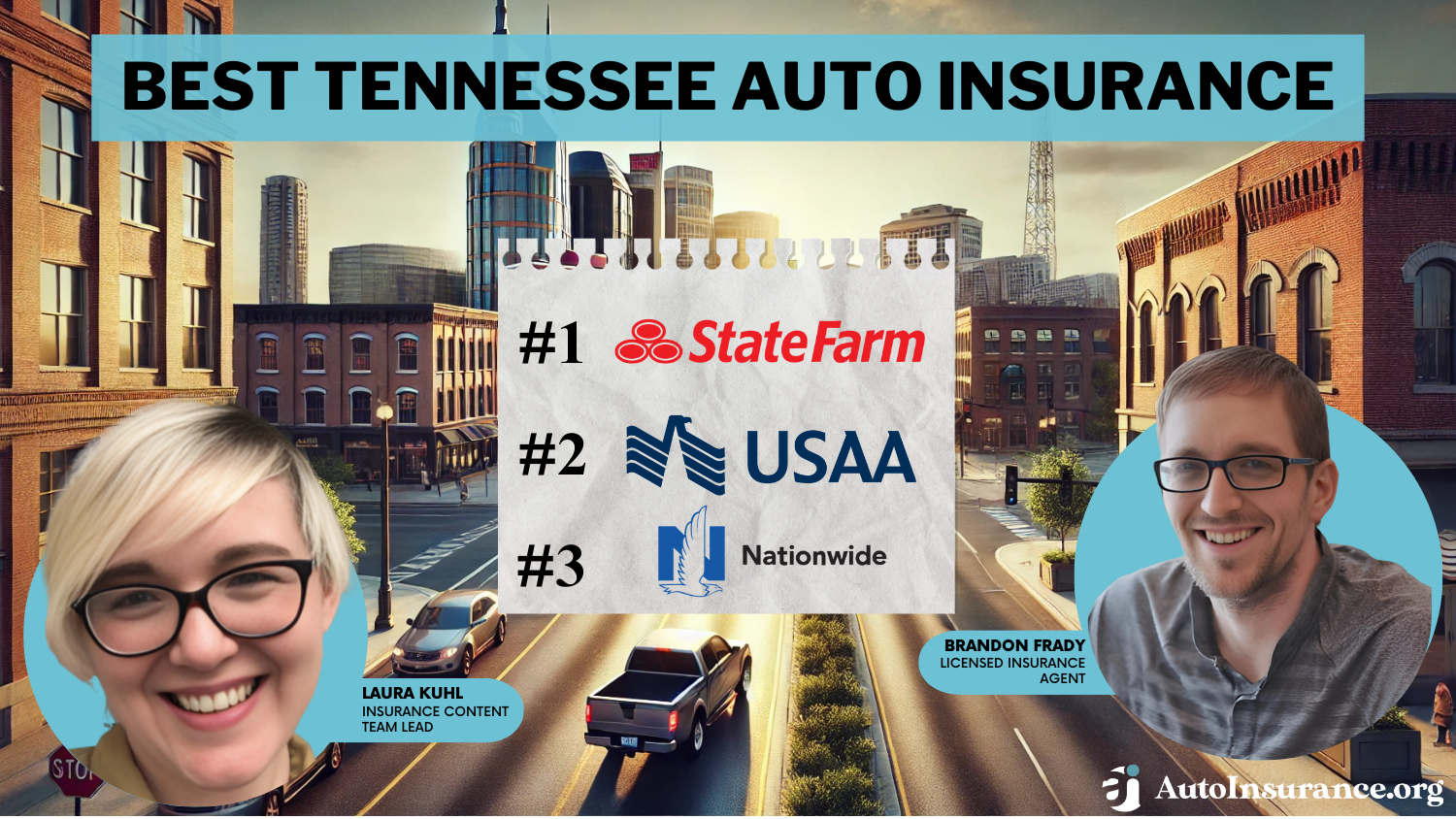

Best Tennessee auto insurance providers like State Farm, USAA, and Nationwide offer up to 27% discounts, standing out for competitive rates that cater to drivers seeking reliable coverage options with substantial savings potential. Compare quotes from these top companies to find the best deal for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Tennessee

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Tennessee

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Tennessee

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsState Farm, USAA, and Nationwide emerge as the top choices for best Tennessee auto insurance, offering up to 27% discounts. State Farm particularly stands out for its competitive rates and comprehensive coverage options, making it the preferred pick for drivers seeking both affordability and reliability in their insurance plans.

In Tennessee, comparing rates helps residents save. Expect about $45 monthly for minimum liability. Explore how the best auto insurance companies vary by city, driving record, and coverage for the cheapest options tailored to you.

Our Top 10 Company Picks: Best Tennessee Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | B | Local Presence | State Farm | |

| #2 | 23% | A++ | Military Focus | USAA | |

| #3 | 26% | A+ | Bundling Discount | Nationwide |

| #4 | 20% | A+ | Competitive Rates | Progressive | |

| #5 | 27% | A++ | Vanishing Deductible | Geico | |

| #6 | 21% | A | Flexible Policies | Liberty Mutual |

| #7 | 20% | A+ | Discount Variety | Allstate | |

| #8 | 18% | A | Customizable Coverage | Farmers | |

| #9 | 15% | A | Member Benefits | American Family | |

| #10 | 10% | A++ | Broad Coverage | Travelers |

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- State Farm offers the best rates and comprehensive coverage options in Tennessee

- Tailor your insurance to specific needs with customizable policies and discounts

- Find competitive rates and reliable service from top Tennessee auto insurers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Wide Network: State Farm has an extensive network of agents, making it easy for customers to find local, personalized service.

- Competitive Rates for Full Coverage: Offers some of the lowest rates for comprehensive and collision insurance in Tennessee.

- Discount Variety: Offers a variety of discounts, including for safe driving and bundling policies, which can help customers save significantly on their premiums. Check out our State Farm auto insurance review for more information.

Cons

- Higher Rates for Minimum Liability: Generally has higher premiums for minimum coverage compared to competitors.

- Limited Discounts: Fewer discount options available compared to some other major insurers.

Finding Affordable Tennessee Auto Insurance

A company that your friend recommends as being affordable for Tennessee car insurance may not actually be affordable for you, as rates vary drastically from driver to driver. While To help you get an idea of what companies may be a good fit for you price-wise, we’ve broken down company rates by different driver categories.

Tennessee Minimum and Full Coverage Auto Insurance Rates

Those looking to save on insurance for older cars that aren’t worth much may consider just carrying the minimum of insurance required in Tennessee. While Full coverage auto insurance costs more but offers better financial protection than just liability insurance. Rates generally range in price by a few hundred dollars between the cheapest and most expensive companies.

Tennessee Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$57 $183

$40 $130

$34.04 $110

$31 $100

$42 $235

$47 $151

$36 $118

$29 $92

$35 $112

$23 $74

State Farm is one of the cheapest companies on average for full coverage insurance in Tennessee, with Geico coming in a close second. If you want to lower your auto insurance, you may want to get car insurance quotes in TN from the cheaper companies on the list above.

How Accidents Affect Tennessee Auto Insurance Rates

At-fault accidents negatively affect your rates, even if you pick a cheaper company. However, you can try to lower the increased amount you have to pay by switching companies if you find your rates become too high.

Tennessee Auto Insurance Monthly Rates by Provider: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $183 | $244 | |

| $130 | $195 | |

| $135 | $187 | |

| $110 | $155 | |

| $100 | $181 | |

| $235 | $329 |

| $151 | $151 |

| $118 | $193 | |

| $92 | $109 | |

| $112 | $151 | |

| $74 | $105 | |

| U.S. Average | $130 | $155 |

State Farm and USAA once again remain some of the cheapest companies if you have an at-fault accident on your record, costing significantly less than other companies.

How DUIs Affect Tennessee Auto Insurance Rates

DUIs are another driving offense that drastically affects how much you pay for car insurance. However, how much you pay in rates after a DUI depends upon your choice of company.

Tennessee Full Coverage Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | One Accident | One DUI | One Ticket | Clean Record |

|---|---|---|---|---|

| $244 | $255 | $207 | $183 | |

| $195 | $215 | $151 | $130 | |

| $205 | $282 | $211 | $165 | |

| $155 | $159 | $140 | $110 | |

| $181 | $410 | $100 | $100 | |

| $329 | $385 | $14 | $235 |

| $151 | $285 | $180 | $151 |

| $193 | $131 | $158 | $118 | |

| $109 | $101 | $101 | $92 | |

| $151 | $165 | $145 | $112 | |

| $105 | $140 | $88 | $74 | |

| U.S. Average | $155 | $234 | $133 | $130 |

While Farmers is one of the more expensive companies for basic liability insurance, it is one of the cheapest providers of auto insurance for drivers with a DUI. In contrast, Geico and USAA are some of the more expensive companies after a DUI offense, even though they are generally cheaper for basic policies.

Insights Into the Cost of Auto Insurance in Your City

Credit Score and Tennessee Auto Insurance

Bad credit scores negatively affect drivers’ insurance rates if their insurance company uses credit scores as a rating factor. This is because drivers with bad credit scores are more likely to miss payments and end up driving illegally without insurance.

Tennessee Full Coverage Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $81 | $101 | $121 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 | |

| U.S. Average | $130 | $155 | $234 |

State Farm and Allstate are some of the worst companies to pick if you have a bad credit score, costing thousands of dollars more on average. On the other hand, companies like Geico and USAA are some of the best auto insurance companies for bad credit.

Tennessee Auto Insurance Rates for Young Drivers

Young drivers are often charged the highest insurance rates due to their inexperience on the road. This leads to many people asking how to find cheap car insurance for young drivers.

If you’re shopping🛒 for auto insurance for the first time, the options may seem overwhelming😮…and expensive. Before stressing, check out https://t.co/27f1xf131D, where you can find a simple explanation of coverages and companies. Here’s a guide👉: https://t.co/9zx25ZU4fU pic.twitter.com/BkD3lvaThA

— AutoInsurance.org (@AutoInsurance) August 11, 2023

While the cheapest option is to join a parent’s policy, young drivers shopping for their own insurance policy will notice huge discrepancies in rates between companies.

Tennessee Teen Full Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $857 | $673 | $640 | $547 | |

| $566 | $444 | $339 | $361 | |

| $626 | $683 | $492 | $364 | |

| $774 | $608 | $591 | $494 | |

| $618 | $485 | $492 | $394 | |

| $1,114 | $875 | $817 | $711 |

| $683 | $536 | $424 | $436 |

| $1,065 | $836 | $765 | $680 | |

| $394 | $309 | $256 | $251 | |

| $411 | $323 | $273 | $263 | |

| $338 | $265 | $240 | $216 | |

| U.S. Average | $720 | $565 | $484 | $501 |

Young drivers should avoid Progressive and Allstate, where average rates are well over $5,000 per year. Instead, they should shop at cheaper companies like USAA and Geico.

Tennessee Auto Insurance Rates by City

The area where your vehicle is parked every night has a huge impact on your rates. From crime to weather conditions, where you live affects your odds of filing a claim.

Memphis and Nashville have some of the most expensive insurance rates on average. If you live in one of Tennessee’s major cities, make sure to shop around to ensure you’re getting the best rates possible. For example, researching Memphis auto insurance from multiple local companies will let you see which one can save you the most money.

Tennessee Auto Insurance Laws

A state’s laws can affect how much you pay for auto insurance and make it harder to find the cheapest car insurance, as certain states may require you to carry more insurance coverage or have stricter financial penalties for DUIs. We’ve outlined some of the major laws that affect car insurance prices in Tennessee below.

Tennessee Auto Insurance Requirements

All Tennessee drivers must purchase bodily injury liability insurance and property damage liability insurance to drive legally in Tennessee. The minimum limits they must purchase for each coverage are as follows:

- Bodily Injury: $25,000 per person and $50,000 per accident

- Property Damage: $15,000 per accident

If you can afford to do so, we recommend carrying higher limits than what Tennessee requires. This is because if the damage costs exceed the limits, you will have to pay the rest, which can be financially impossible for some drivers.

Tennessee drivers should consider higher liability limits than the state minimum to avoid significant out-of-pocket costs in case of severe accidents.Jimmy McMillan LICENSED INSURANCE AGENT

For more on property damage liability insurance, check out the best property damage liability auto insurance companies.

Optional Tennessee Auto Insurance Coverage

Besides bodily injury and property damage liability insurance, Tennessee doesn’t legally require drivers to carry any other car insurance coverages. This means that the following coverages are optional for most drivers:

- Comprehensive auto insurance

- Collision auto insurance

- Gap insurance

- Modified car insurance

- Non-owner auto insurance

- Rental car reimbursement insurance

- Roadside assistance

- Uninsured motorist coverage

- Underinsured motorist coverage

- Umbrella insurance

If you have a lease or loan on your vehicle, your lender will likely require you to carry comprehensive and collision insurance on your vehicle in order to fully protect their asset.

DUI Penalties in Tennessee

No matter what state you live in, DUIs are a serious driving offense. DUIs in Tennessee can result in a number of penalties, such as:

- Fines

- Ignition Interlock Device (IID)

- Increased Insurance Rates

- Jail Time

- License Suspension

- Probation and Substance Abuse Treatment

- Sr-22 Certificate

Penalties will increase in severity for each subsequent DUI offense. For example, your vehicle might be seized after your second DUI, and you will have to pay multiple fines and fees to get it back.

Tennessee SR-22 Auto Insurance Certificates

SR-22 auto insurance is required in Tennessee. SR-22 certificates are a way to ensure that high-risk drivers are carrying the required insurance coverages in Tennessee. Your insurance company will submit the certificate to government authorities, so if you need an SR-22 certificate, let your insurance company know.

If your insurance company drops you for being a high-risk driver or you don’t have insurance, your new insurance company may charge a small fee for filing your SR-22 certificate.

Keep in mind that even if you don’t own a car, you will need to get an SR-22 certificate if requested. You can purchase non-owner car insurance in order to meet Tennessee’s insurance requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Find Cheap Tennessee Auto Insurance Coverage Today

Tennessee drivers can find cheaper rates for car insurance by looking carefully at how a company’s rates change based on a driver’s records. A driver with a DUI won’t find the same cheap rates at the same company that a driver with a clean record signed up with. Read more about auto insurance for drivers with a DUI.

If you’re ready to start shopping, enter your ZIP code into our free quote comparison tool below to find the best cheap car insurance in Tennessee based on your area and driving record.

Frequently Asked Questions

Does Tennessee have cheap auto insurance?

Your monthly Tennessee insurance rate will depend on your driving record, choice of an insurance company, and more. However, expect to pay around $107 monthly for Tennessee car insurance, about $12 cheaper than the national average.

How much is car insurance in Tennessee?

On average, drivers in Tennessee can expect to pay around $100 per month for car insurance. However, this can fluctuate based on individual circumstances.

What is the average cost of car insurance in Tennessee?

The average cost of car insurance in Tennessee tends to be about $100 per month for most drivers. However, this price will vary depending on how much coverage a driver chooses and their personal driving record.

Get fast and cheap auto insurance in Tennessee coverage today with our quote comparison tool below.

Which company has the cheapest car insurance in Tennessee?

Some of the companies that drivers should look into for cheap car insurance in Tennessee include State Farm, USAA, and Geico.

Read more: Cheapest Auto Insurance Companies

Is Tennessee a no fault insurance state?

No, Tennessee auto insurance laws follow a “tort” or fault-based model where drivers who cause the accident are responsible for covering medical costs and property damage.

Is it illegal to drive in Tennessee without insurance?

It is illegal to drive without car insurance in Tennessee. You face fines of $300 or more and license suspension.

Read more: Does a suspended license affect auto insurance rates?

What auto insurance is required in Tennessee?

Tennessee drivers must carry at least 25/50/25 in liability coverage to drive legally.

Does Tennessee require full coverage insurance?

While minimum coverage is required, drivers do not need to carry full coverage in Tennessee unless the terms of their loan or lease require it. However, it’s recommended to carry higher limits to avoid financial burden in case of an accident.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

How much is car registration in Tennessee?

Tennessee vehicle registration costs between $86 and $89, depending on if you also need a new license plate or just a decal.

Does my credit score affect my auto insurance rates in Tennessee?

Your credit score can indeed impact your auto insurance premiums in Tennessee. Insurers often use credit-based insurance scores to assess risk and determine rates. Drivers with lower credit scores may face higher premiums compared to those with better credit histories.

What are SR-22 certificates and when are they required in Tennessee?

An SR-22 certificate is a form filed by your insurance company to verify that you have the state-required minimum liability coverage. In Tennessee, drivers typically need an SR-22 if they have been convicted of certain offenses such as DUIs, driving without insurance, or causing accidents without adequate coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.