How to Choose an Auto Insurance Company in 2024

Looking for the best rated auto insurance company? Did you know that in 2019, Esurance and Allstate were ranked as top companies by JD Power in an annual study?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Apr 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Before you choose a car insurance company, you need to figure out what kind of coverage you need

- Comparing car insurance companies can help you narrow thousands of potential insurers to the top three or four

- You can buy your insurance through different channels, such as captive agents, independent agents, or brokers

- It’s important to research your potential car insurance providers to make sure you choose a reliable auto insurance company

Choosing the right auto insurance company can be overwhelming when there are so many options to choose from.

Finding the quality car insurance company that’s right for you doesn’t have to be as hard as you think. In fact, it can be quite simple.

We’ll take you step-by-step through the process and show you how to confidently choose the right car insurance company for your situation.

You can compare car insurance quotes right here using our free quote tool!

Here’s what we cover:

Step #1 – Figure Out Your Insurance Needs

Knowing what you’re looking for is the place to start. Each state requires car insurance coverage at a different level, but what the mandatory coverage has in common between states is that it covers your liability and not your own vehicle damage costs.

The minimum you’re required to carry is known as “basic coverage” or “state minimum.”

Considering that most states require significantly less coverage than necessary to pay for the total loss of a new vehicle, you should consider purchasing higher limits even if you decide to only purchase liability coverage.

Without increased liability limits, you’ll have to make up the difference out of pocket between your coverage limit and the cost of the damage you cause.

If your car is financed, you’ll probably be required to carry full coverage insurance. Full coverage includes comprehensive and collision which will offer financial protection for a wide variety of damage to your own vehicle.

If you own your vehicle you can decide if you want to purchase full coverage. If your vehicle is valuable and you wouldn’t be able to recover from its loss out of pocket, you should probably carry full coverage.

There are several coverage types some of which are required depending on where you live, and some of which are optional.

| Type of Coverage | Required or Optional |

|---|---|

| Liability | Required |

| Collision | Owned Vehicle: Optional Leased or Financed Vehicle: Required |

| Comprehensive | Owned Vehicle: Optional Leased or Financed Vehicle: Required |

| Personal Injury Protection (PIP) | Required in some states with "no-fault" laws |

| Medical Payments (MedPay) | Required in some states with "no-fault" laws |

| Uninsured/Underinsured Motorist Coverage | Required in many states |

| Guaranteed Auto Protection (GAP) | Optional |

| Personal Umbrella Policy (PUP) | Optional |

| Rental Reimbursement | Optional |

| Emergency Roadside Assistance | Optional |

| Mechanical Breakdown Insurance | Optional |

| Non-owner Car Insurance | Optional |

| Modified Car Insurance Coverage | Optional |

| Windshield Coverage | Optional |

Related Article: How do I find an affordable auto insurance company?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Step #2 – Compare Car Insurance Companies to Save the Most

After you know what you’re looking for, you’re ready to try to find it for less money. Keep reading for tips on how to save as much money as possible!

Ask About Discounts

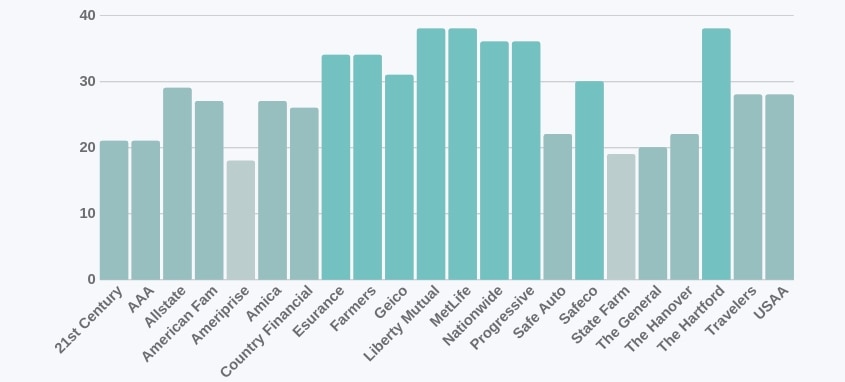

Car insurance discounts can make a significant difference in your car insurance premiums. Below we’ve charted which providers offer the most discounts as well as the which discounts you may want to ask about when applicable:

| Vehicle Discounts | Driver/Customer Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

Ask About Special Programs

Many insurance providers have special programs. The programs offer perks for their customers.

Some insurance companies offer accident forgiveness as an option. If you choose this option, you can have an accident and not experience rate hikes.

Some companies offer new car replacement if your current vehicle is totaled.

Consider a Low-income Program

Low-income car insurance programs are offered in some states:

- California’s Low-cost Auto Insurance Program (CLCA)

- New Jersey’s Special Automobile Insurance Policy (SAIP)

- Hawaii’s Low-cost Disability Auto Insurance Program

Plus there are a few non-government run programs like Citizens United Reciprocal Exchange (CURE).

Compare Car Insurance Quotes

Every six months to a year, you should do a car insurance review. Make sure your current levels of protection are what you still want, and if they’re not, make the changes in your search. Review the following aspects of your coverage:

- Deductible level – if you think you could afford a higher deductible amount out of pocket, you could raise your deductible and pay lower monthly premiums.

- Coverage level – If your car is paid in full and is not valuable, consider just purchasing liability coverage as opposed to full coverage.

You could get individual quotes from companies one at a time, but it will save you time to do a search with a comparison tool. We have one here that will give you multiple quotes after you enter your information just one time.

You could save a significant amount of money by finding a company that offers lower rates and switching to them.

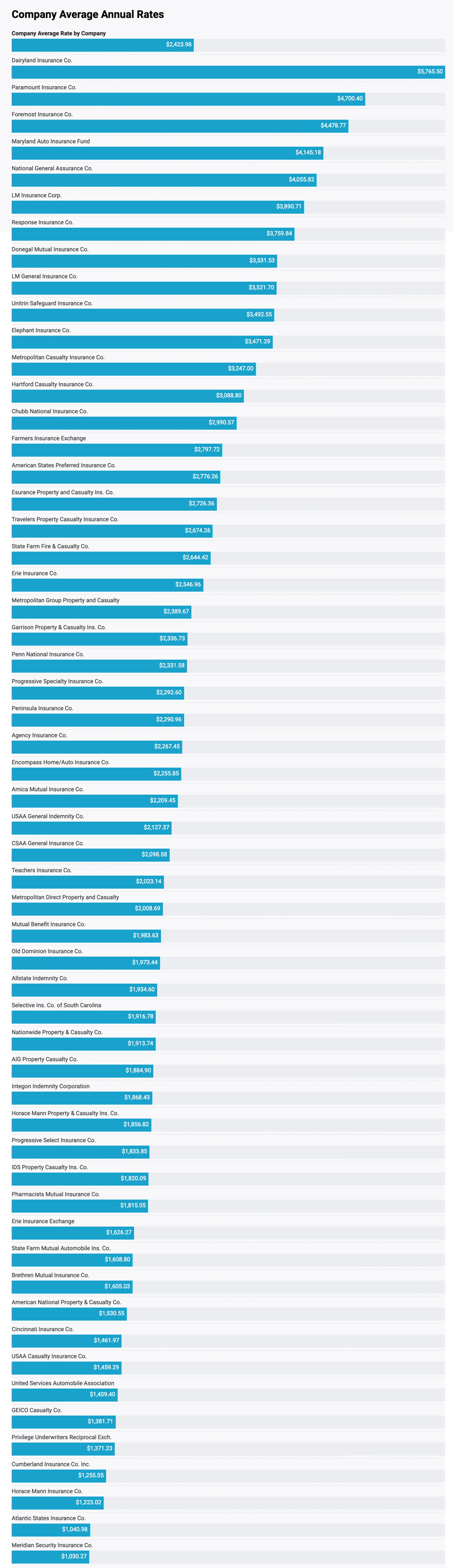

The importance of comparing rates can be understood by reviewing the data we collected from Maryland’s Insurance Department site (see below). Look at the wide span of rates — over a $4,000 difference from most to least expensive.

If you go with the first company you get a quote from you may be costing yourself a lot of money. Check out the car insurance company rates (average annual):

Step #3 – Decide Which Type of Service Provider You Want

You might be overwhelmed by the different choices of providers. We’ll break down some of the common options so you have an understanding of what you’d prefer.

- Captive Agents – Individuals who offer insurance from one company. If you go to a State Farm or Progressive office, for example, you’re going to interact with a captive agent. You can’t go into a State Farm office and purchase a Liberty Mutual policy. The majority of consumers go through captive agents.

- Independent Agents – An independent agent works for a variety of providers and can work with you to find an auto insurance company that offers what you’re looking for at a good price.

- Brokers – These are similar to independent agents, but while independent agents represent several insurance companies, brokers represent the customer and help find coverage from many providers.

- Direct Providers – As the name sounds, direct providers offer insurance directly to the customer. What a direct provider offers is what a captive agent offers.

- Online Only – Some companies are online only and don’t have brick and mortar offices throughout the country. If you use an online-only company, you won’t have a specific agent you work with and call with questions or to make a claim. Instead, you will correspond electronically and through phone calls.

- National Providers – These are the larger car insurance companies that offer policies to all or most states throughout the country.

- Local Providers – These companies may offer policies just in one state or one region.

Now that you understand some of the different types of agents and providers you can choose from, and you’ve compared quotes and found the companies that look best to you, take the next step and do car insurance company research.

We’ll show you where to look below.

Step #4 – Research the Provider

When you narrow down the vast list of potential car insurance providers to the top three or four, you’ll need to make sure they’re reputable. Researching to ensure a company’s reputation could save you a headache down the road when you make a claim.

A company that’s not financially stable may be unable to pay your claim. And if a company has poor customer satisfaction results, you may have a negative experience when you have to deal with them over a claim.

#1 – Make Sure They’re Licensed in Your State

If they’re not licensed in your state, it’s an automatic “no” for going with them. If a company isn’t licensed in your state, their coverage won’t be valid.

Check the National Association of Insurance Commissioners (NAIC) search page to see if the companies you’re considering are licensed in your state.

Below, we have listed the websites and phone numbers for each state. You can find accurate information and answers to your questions by contacting your state insurance regulating division.

| States | Website | Phone Number |

|---|---|---|

| Alabama | www.aldoi.gov | (334) 269-3550 |

| Alaska | www.commerce.alaska.gov | 1-800-INSURAK (in-state outside Anchorage) (907) 269-7900 (Anchorage office) (907) 465-2515 (Juneau office) |

| Arizona | https://insurance.az.gov | (602) 364-2499 (800) 325-2548 (In Arizona but outside the Phoenix area) |

| Arkansas | insurance.arkansas.gov | (800) 282-9134 or (501) 371-2600 |

| California | www.insurance.ca.gov | (800) 927-4357 (HELP) (800) 482-4833 (TTY) |

| Colorado | www.colorado.gov/pacific | (303) 894-7855 or (800) 886-7675 |

| Connecticut | www.ct.gov/cid | (860) 297-3800 or (800) 203-3447 |

| Delaware | insurance.delaware.gov | (302) 674-7300 |

| Florida | www.floir.com | (850) 413-3140 |

| Georgia | www.oci.ga.gov | (404) 656-2070 or (800) 656-2298 |

| Hawaii | cca.hawaii.gov/ins | (808) 586-2790 or (808) 586-2799 |

| Idaho | doi.idaho.gov | (208) 334-4250 |

| Illinois | insurance.illinois.gov | (312) 814-2420 (Chicago office) or (217) 782-4515 (Springfield office) |

| Indiana | www.in.gov/idoi | (800) 622-4461 |

| Iowa | iid.iowa.gov | (515) 281-5705 or (877) 955-1212 |

| Kansas | www.ksinsurance.org | (785) 296-3071 or (800) 432-2484 |

| Kentucky | insurance.ky.gov | (800) 595-6053 or (502) 564-3630 |

| Louisiana | www.ldi.la.gov | (800) 259-5300 |

| Maine | www.maine.gov/pfr/insurance | (207) 624-8475 |

| Maryland | https://www.mdinsurance.state.md.us | (410) 468-2090 |

| Massachusetts | www.mass.gov/orgs/division-of-insurance | (617) 521-7794 or (877) 563-4467 |

| Michigan | www.michigan.gov/difs | (517) 284-8800 or (877) 999-6442 |

| Minnesota | mn.gov/commerce | (651) 539-1500 or (800) 657-3602 |

| Mississippi | www.mid.ms.gov | (601) 359-3569 or (800) 562-2957 |

| Missouri | insurance.mo.gov | (573) 751-4126 |

| Montana | https://csimt.gov | (800) 332-6148 or (406) 444-2040 |

| Nebraska | doi.nebraska.gov | (402) 471-2201 |

| Nevada | doi.nv.gov | (888) 872-3234 |

| New Hampshire | www.nh.gov/insurance | (603) 271-2261 or (800) 852-3416 |

| New Jersey | www.state.nj.us/dobi | (609) 292-7272 or (800) 446-7467 |

| New Mexico | www.osi.state.nm.us | (855) 4ASK-OSI (855-427-5674) |

| New York | www.dfs.ny.gov | (800) 342-3736 |

| North Carolina | www.ncdoi.com | (855) 408-1212 |

| North Dakota | www.nd.gov/ndins | (701) 328-2440 or (800) 247-0560 |

| Ohio | www.insurance.ohio.gov | (800) 686-1526 |

| Oklahoma | www.ok.gov/oid | (800) 522-0071 or (405) 5210-2828 |

| Oregon | dfr.oregon.gov | (888) 877-4894 |

| Pennsylvania | www.insurance.pa.gov | (877) 881-6388 |

| Rhode Island | www.dbr.state.ri.us/divisions/insurance | (401) 462-9520 |

| South Carolina | doi.sc.gov | (803) 737-6160 |

| South Dakota | dlr.sd.gov/insurance | (605) 773-3563 |

| Tennessee | www.tn.gov/commerce | (615) 741-2241 |

| Texas | www.tdi.texas.gov | (512) 676-6000 or (800) 578-4677 |

| Utah | insurance.utah.gov | (801) 538-3800 |

| Vermont | www.dfr.vermont.gov | (802) 828-3301 |

| Virginia | www.scc.virginia.gov/boi | (804) 371-9741 or (800) 552-7945 |

| Washington | www.insurance.wa.gov | (800) 562-6900 |

| Washington D.C. | disb.dc.gov | (202) 727-8000 |

| West Virginia | www.wvinsurance.gov | (304) 558-3386 |

| Wisconsin | oci.wi.gov | (608) 266-3585 (Madison) or (800) 236-8517 (statewide) |

| Wyoming | doi.wyo.gov | (307) 777-7401 or (800) 438-5768 |

#2 – Check Their Complaint Ratio

Some states’ insurance websites make this information readily accessible, such as California’s which displays all the complaint ratio information for the past three years for the top 50 insurance companies. Their ratios are based on the number of justified complaints to 100,000 earned exposures.

Other states’ insurance websites don’t offer the information so easily. The table below lists each state and whether its insurance website offers complaint data (see websites above to access information).

| State | Complaint Info? | State | Complaint Info? | State | Complaint Info? |

|---|---|---|---|---|---|

| Alabama | no | Kentucky | yes | North Dakota | no |

| Alaska | no | Louisiana | no | Ohio | yes |

| Arizona | yes | Maine | yes | Oklahoma | no |

| Arkansas | yes | Maryland | yes | Oregon | yes |

| California | yes | Massachusetts | yes | Pennsylvania | yes |

| Colorado | yes | Michigan | yes | Rhode Island | no |

| Connecticut | yes | Minnesota | no | South Carolina | yes |

| Delaware | no | Mississippi | no | South Dakota | no |

| District of Columbia | no | Missouri | yes | Tennessee | no |

| Florida | yes | Montana | no | Texas | yes |

| Georgia | no | Nebraska | no | Utah | yes |

| Hawaii | yes | Nevada | no | Vermont | no |

| Idaho | yes | New Hampshire | no | Virginia | no |

| Illinois | yes | New Jersey | yes | Washington | yes |

| Indiana | yes | New Mexico | no | West Virginia | yes |

| Iowa | no | New York | yes | Wisconsin | no |

| Kansas | yes | North Carolina | no | Wyoming | yes |

If your state insurance website doesn’t offer complaint information, you can still go to the NAIC’s complaint search and enter the company of your choice to find the number of complaints.

#3 – Check Financial Ratings

This step is easy. A.M. Best is an independent rating agency. Once you set up your free profile at AMBest.com, you simply enter the company name you’re researching into the search bar to view its grade and outlook.

But, we’ve streamlined the search even more. We’ve compiled the data from A.M. Best for the companies with the best and worst ratings:

| Rating | Outlook | Best Rated Companies | Rating | Outlook | Worst Rated Companies |

|---|---|---|---|---|---|

| A++ | Stable | ACE American Insurance Company | C- | Stable | American Heartland Insurance Company |

| A++ | Stable | Agri General Insurance Company | C | Negative | American Service Insurance Company, Inc. |

| A++ | Stable | Auto-Owners Insurance Company | C+ | Stable | Country-Wide Insurance Company |

| A++ | Stable | Automobile Ins Co of Hartford, CT | C++ | Negative | First Acceptance Insurance Company |

| A++ | Stable | Chubb Insurance Company | C++ | Positive | First Chicago Insurance Company |

| A++ | Stable | Columbia Insurance Company | E | Union Mutual Insurance Company | |

| A++ | Stable | Continental Divide Insurance Company | |||

| A++ | Stable | Geico | |||

| A++ | Stable | Great Northern Insurance Company | |||

| A++ | Stable | Owners Insurance Company | |||

| A++ | Stable | Select Insurance Company | |||

| A++ | Stable | State Farm Mutual Automobile Ins Co | |||

| A++ | Stable | TravCo Insurance Company | |||

| A++ | Stable | The Travelers Companies | |||

| A++ | Stable | United Services Automobile Association |

Like the grades, you got in school, “A’s” are good and “+’s” are even better. You want a company with a good rating and a stable outlook. Find out more about AM Best’s rating here.

#4 – Check Car Insurance Company Ratings

The following independent companies compile mountains of data a year to provide consumers with ratings and recommendations:

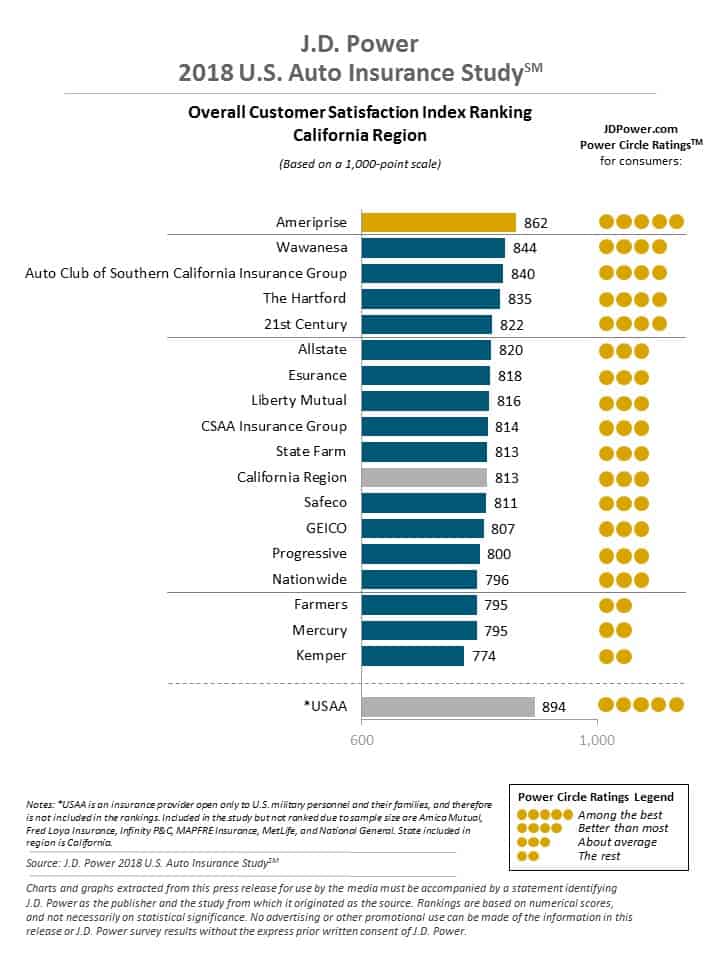

J.D. Power

This is a valuable resource. Every year they publish an insurance study and rank the insurance companies in various regions. You can search by region and see the highest and best-rated companies where you live.

They list the top-rated car insurance companies as follows:

Consumer Reports

You may be familiar with the Consumer Reports magazine and website already. One area they address often is car insurance. See what they have to say about the companies you’re interested in.

Here are Consumer Reports’ ratings for car insurance companies (subscription required to view results on their page):

| Car Insurance Company | Reader Score | Excellentase of Reaching an Agent | Simplicity of the Process | Promptness of Response | Damage Amount | Agent Courtesy | Timely Payment | Freedom to Select Repair Shop | Being Kept Informed of Claim Status |

|---|---|---|---|---|---|---|---|---|---|

| Allstate Insurance Goodroup | 88 | Excellent | Very Good | Very Good | Very Good | Excellent | Excellent | Very Good | Very Good |

| American Family Insurance Goodroup | 89 | Excellent | Very Good | Very Good | Very Good | Excellent | Very Good | Very Good | Excellent |

| Ameriprise P&C Companies | 89 | Very Good | Very Good | Very Good | Very Good | Very Good | Very Good | Very Good | Good |

| Amica Mutual Insurance Company | 96 | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent |

| Auto Club Excellentnterprises Insurance Goodroup | 92 | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Very Good |

| Auto Club Goodroup | 94 | Excellent | Excellent | Excellent | Very Good | Excellent | Excellent | Very Good | Very Good |

| Auto-Owners Insurance Goodroup | 93 | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Very Good |

| Berkshire Hathaway Insurance Goodroup | 89 | Excellent | Very Good | Excellent | Very Good | Excellent | Excellent | Very Good | Very Good |

| California State Auto Goodroup (CSAA) | 90 | Very Good | Very Good | Very Good | Very Good | Excellent | Excellent | Excellent | Very Good |

| Excellentrie Insurance Goodroup | 94 | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Very Good |

| Farm Bureau Property & Casualty Insurance Company | 90 | Very Good | Very Good | Very Good | Very Good | Excellent | Very Good | Excellent | Very Good |

| Farmers Insurance Goodroup | 89 | Excellent | Very Good | Very Good | Very Good | Very Good | Very Good | Very Good | Very Good |

| Hanover Insurance Goodroup Property & Casualty Companies | 90 | Excellent | Very Good | Excellent | Very Good | Excellent | Excellent | Excellent | Very Good |

| Hartford Insurance Goodroup | 90 | Excellent | Very Good | Excellent | Very Good | Excellent | Excellent | Excellent | Very Good |

| Liberty Mutual Insurance Companies | 88 | Very Good | Very Good | Very Good | Very Good | Very Good | Very Good | Very Good | Very Good |

| MAPFRE North America Group | 86 | Very Good | Very Good | Very Good | Good | Very Good | Very Good | Very Good | Good |

| Mercury Goodeneral Goodroup | 86 | Very Good | Very Good | Very Good | Very Good | Very Good | Very Good | Very Good | Good |

| MetLife Auto & Home Goodroup | 86 | Very Good | Very Good | Very Good | Good | Very Good | Very Good | Very Good | Good |

| Nationwide Goodroup | 88 | Very Good | Very Good | Very Good | Very Good | Excellent | Very Good | Very Good | Very Good |

| NJM Insurance Goodroup | 95 | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Very Good |

| PExcellentMCO Mutual Insurance Company | 93 | Excellent | Excellent | Excellent | - | Excellent | - | - | - |

| Progressive Insurance Goodroup | 87 | Very Good | Very Good | Very Good | Very Good | Very Good | Excellent | Very Good | Very Good |

| State Auto Insurance Companies | 89 | Very Good | Very Good | Very Good | Very Good | Very Good | Excellent | Very Good | Very Good |

| State Farm Goodroup | 89 | Excellent | Very Good | Very Good | Very Good | Excellent | Very Good | Very Good | Excellent |

| The Cincinnati Insurance Company | 93 | Excellent | Excellent | Excellent | - | Excellent | - | - | - |

| Travelers Goodroup | 90 | Excellent | Very Good | Excellent | Very Good | Excellent | Excellent | Excellent | Very Good |

| USAA Goodroup | 95 | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent | Excellent |

The Better Business Bureau (BBB)

While J.D. Power and Consumer Reports will give you general information about car insurance companies as a whole, the BBB grades individual offices. You’ll get the most specific rating for the local office you’re considering from the BBB as opposed to the other rating companies.

Making sure you choose the right car insurance company is well worth the effort. If you need to file a claim, you’ll be glad you chose a company that is financially stable and consumer-friendly.

Now that you know how to choose a car insurance company, you can purchase your coverage from the right car insurance company. Now, it’s time to let them help you understand your policy.

Read on for suggestions of questions to ask:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Step #5 – Questions to Ask Car Insurance Companies

The NAIC suggests asking these questions of your insurer:

- Will minimum liability limits be high enough to cover me if I am at fault in an accident?

- How much more would it cost to buy more than the minimum amount of liability insurance coverage?

- Will this policy cover me if I let someone else drive my car?

- Will this policy cover me if I have an accident in a rental car?

- Will this policy cover me if I have an accident while traveling for work?

- If my car is disabled, will this policy pay for a rental car while it is being repaired?

- Is there any cap or limit?

- If my car is disabled due to an accident, will the parts to repair the car be new or aftermarket?

- How much can I save with a higher deductible?

- What discounts are available?

- What other types of property do you insure? Can I qualify for a discount if I buy both policies from your company?

- What are my payment options? Can I pay monthly or quarterly? If I do, is there an extra charge or discount?

Frequently Asked Questions

How do I file a complaint against a car insurance company?

Find your state on the NAIC consumer complaint map to be directed to your state’s website with directions for making a complaint.

How much coverage do I have to have?

Each state makes its own requirements for car insurance. Find your state insurance website on the NAIC map to find out the requirements where you live.

If your vehicle is leased or financed, your lender will likely require full coverage.

How often can I switch insurance companies?

As often as you want. But be careful you don’t allow your policy to lapse.

Can I buy home insurance from the same company as car insurance?

Yes, if the company offers both types. Often you’ll be eligible for a significant discount when you combine your auto policy with a home or rental policy. You could also combine car insurance with a motorcycle or RV policy.

Even insuring a second vehicle with the same insurer could get you a discount.

How do I know if I am paying a fair price?

By doing a car insurance quote comparison. Make sure to review your policy and coverage at least once a year.

Also, we’ve collected the average annual premiums for full coverage in each state (that includes liability, comprehensive, and collision):

| States | 2015 Average Annual Rates | 2014 Average Annual Rates | 2013 Average Annual Rates | 2012 Average Annual Rates | 2011 Average Annual Rates |

|---|---|---|---|---|---|

| Idaho | $679.89 | $673.13 | $650.57 | $639.19 | $641.96 |

| Iowa | $702.46 | $683.67 | $668.09 | $656.84 | $648.99 |

| Maine | $703.82 | $689.12 | $674.94 | $667.66 | $662.28 |

| Wisconsin | $737.18 | $716.83 | $689.77 | $666.79 | $669.99 |

| Indiana | $755.03 | $728.93 | $704.50 | $724.44 | $710.36 |

| Vermont | $764.02 | $746.79 | $734.82 | $726.57 | $716.14 |

| South Dakota | $766.91 | $744.28 | $717.30 | $690.95 | $669.20 |

| North Dakota | $773.30 | $768.09 | $743.27 | $714.75 | $688.74 |

| Ohio | $788.56 | $766.66 | $738.68 | $714.05 | $697.61 |

| North Carolina | $789.09 | $768.28 | $739.91 | $720.47 | $708.10 |

| New Hampshire | $818.75 | $795.50 | $773.30 | $755.76 | $746.57 |

| Nebraska | $831.02 | $805.99 | $773.64 | $751.18 | $732.21 |

| Virginia | $842.67 | $836.14 | $809.40 | $781.38 | $768.95 |

| Wyoming | $847.44 | $844.33 | $804.52 | $796.14 | $791.14 |

| Kansas | $862.93 | $850.79 | $815.82 | $785.72 | $780.43 |

| Montana | $863.52 | $868.55 | $842.74 | $821.68 | $816.21 |

| Alabama | $868.48 | $837.09 | $811.75 | $788.07 | $784.38 |

| Tennessee | $871.43 | $855.56 | $829.38 | $794.53 | $767.82 |

| Missouri | $872.43 | $845.39 | $819.79 | $799.14 | $790.27 |

| Utah | $872.93 | $852.66 | $820.92 | $805.32 | $809.35 |

| Hawaii | $873.28 | $858.16 | $844.16 | $844.12 | $861.95 |

| Minnesota | $875.49 | $856.62 | $823.70 | $800.24 | $777.17 |

| Illinois | $884.56 | $854.10 | $819.27 | $806.21 | $803.04 |

| Oregon | $904.83 | $894.10 | $856.26 | $818.07 | $804.59 |

| Arkansas | $906.34 | $900.18 | $868.13 | $843.07 | $829.13 |

| New Mexico | $937.59 | $920.42 | $888.83 | $866.19 | $869.85 |

| Kentucky | $938.51 | $917.49 | $904.99 | $888.46 | $872.48 |

| Washington | $968.80 | $952.10 | $914.04 | $891.04 | $889.82 |

| Pennsylvania | $970.51 | $950.42 | $930.48 | $915.83 | $904.47 |

| Arizona | $972.85 | $961.88 | $926.52 | $899.91 | $899.33 |

| South Carolina | $973.10 | $936.69 | $904.22 | $880.82 | $857.70 |

| Colorado | $981.64 | $939.52 | $887.57 | $849.74 | $835.50 |

| California | $986.75 | $951.75 | $922.69 | $891.68 | $881.07 |

| Mississippi | $994.05 | $957.59 | $925.13 | $902.95 | $895.69 |

| Oklahoma | z$1,005.32 | $985.58 | $931.41 | $902.90 | $881.50 |

| West Virginia | $1,025.78 | $1,032.45 | $1,021.37 | $1,005.68 | $992.57 |

| Alaska | $1,027.75 | $1,050.09 | $1,058.15 | $1,053.54 | $1,053.48 |

| Georgia | $1,048.40 | $991.25 | $949.33 | $922.05 | $912.49 |

| Nevada | $1,103.05 | $1,083.42 | $1,047.74 | $1,024.09 | $1,029.87 |

| Texas | $1,109.66 | $1,066.20 | $1,017.81 | $974.68 | $959.87 |

| Maryland | $1,116.45 | $1,096.37 | $1,071.35 | $1,056.82 | $1,048.86 |

| Massachusetts | $1,129.29 | $1,107.76 | $1,080.48 | $1,048.06 | $1,011.14 |

| Connecticut | $1,151.07 | $1,132.78 | $1,109.03 | $1,082.28 | $1,068.18 |

| Delaware | $1,240.57 | $1,215.69 | $1,187.18 | $1,153.59 | $1,134.60 |

| Florida | $1,257.13 | $1,208.77 | $1,209.70 | $1,196.57 | $1,160.13 |

| Rhode Island | $1,303.50 | $1,257.40 | $1,210.55 | $1,176.05 | $1,148.97 |

| District of Columbia | $1,330.73 | $1,324.39 | $1,316.48 | $1,289.49 | $1,276.99 |

| New York | $1,360.66 | $1,327.82 | $1,301.49 | $1,273.70 | $1,236.77 |

| Michigan | $1,364.00 | $1,350.58 | $1,264.20 | $1,171.94 | $1,110.64 |

| New Jersey | $1,382.79 | $1,379.20 | $1,369.70 | $1,334.59 | $1,303.52 |

| Louisiana | $1,405.36 | $1,364.17 | $1,307.72 | $1,275.10 | $1,281.55 |

| U.S. Average | $1,009.38 | $981.77 | $950.92 | $924.45 | $908.43 |

Choosing the right car insurance company is worth the effort.

Get started comparing quotes from multiple providers at once using our free rate tool. Enter your zip code below to get started!

Related Articles

- How can I find a low-cost auto insurance company?

- Cheap Car Insurance Quotes (All You Need to Know)

- Can I find a cheap safe auto insurance company online?

Frequently Asked Questions

Why is it important to choose the right auto insurance company?

Choosing the right auto insurance company is crucial because it can significantly impact your financial protection, claims experience, customer service, and overall satisfaction. A reliable and reputable insurance provider ensures that you receive the coverage you need and the support you deserve in case of accidents, damage, or theft involving your vehicle.

What factors should I consider when selecting an auto insurance company?

Here are six points to consider when selecting an auto insurance company:

- Coverage options

- Financial stability

- Customer service

- Premiums and deductibles

- Discounts and rewards

- Ease of communication and technology

How can I research an auto insurance company’s reputation?

To research an auto insurance company’s reputation, you can consider this five tips:

- Check online reviews and ratings from reputable sources, such as consumer advocacy organizations or independent rating agencies.

- Visit the company’s website to learn about their history, mission, and values.

- Look for any news articles or press releases related to the company’s performance, awards, or recognition.

- Seek recommendations from family, friends, or colleagues who have had positive experiences with a particular insurer.

- Check with your state’s insurance department to verify the company’s licensing and see if there are any complaints filed against them.

How can I determine an auto insurance company’s financial stability?

Assessing an auto insurance company’s financial stability is crucial to ensure they can fulfill their obligations to policyholders. Here are four ways to determine financial stability:

- Review the company’s financial strength ratings from independent rating agencies like A.M. Best, Standard & Poor’s, or Moody’s. These ratings reflect the insurer’s ability to meet its financial commitments.

- Research the company’s financial statements and annual reports, which can often be found on their website or requested directly from the insurer.

- Check if the company is a member of industry organizations like the National Association of Insurance Commissioners (NAIC) or participates in state guarantee funds. These affiliations indicate a commitment to industry standards and regulatory compliance.

- Consider the company’s longevity in the insurance market. Established insurers with a long history generally indicate greater stability

Are there any resources that can help me compare auto insurance companies?

Yes, there are various services available to assist you compare auto insurance companies. Here are the three most common:

- Independent rating agencies: Websites like A.M. Best, J.D. Power, or Consumer Reports provide ratings and rankings of insurance companies based on factors such as customer satisfaction, financial strength, and claims handling.

- Online comparison tools: There are various websites that allow you to compare quotes and coverage options from multiple insurers, helping you find the best fit for your needs.

- State insurance department websites

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.