How to Get Multiple Auto Insurance Quotes in 2025 (8 Simple Steps)

Comparing quotes from multiple insurance companies is one of the easiest ways to save money. On average, drivers save about 15% by shopping around. Online quote comparison tools streamline the process of obtaining car insurance even further.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Jun 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The way you get multiple auto insurance quotes is by comparing options from various providers to find the best rate. By doing this, you can save up to 15% per month on your premiums. Finding out how to collect and evaluate these quotes will enable you to make well-informed choices about your coverage.

This article will help you navigate the process, outlining effective strategies and tools to get multiple insurance quotes at once. By taking the right steps, you can shop for multiple car insurance policies at once and secure competitive rates, ensuring you receive the coverage that best suits your needs.

Additionally, we’ll cover where to get an instant auto insurance estimate to further simplify your search. Discover your auto insurance choices by inputting your ZIP code into our free comparison tool above today to learn how to get multiple auto insurance quotes.

- Step #1: Research Insurers – Look for reputable auto insurance providers

- Step #2: Gather Information – Collect details about your vehicle and history

- Step #3: Use Comparison Tools – Utilize tools to streamline quote collection

- Step #4: Request Quotes – Contact multiple insurers for auto insurance quotes

- Step #5: Review Coverage – Examine the coverage options in each quote

- Step #6: Compare Rates – Analyze and compare premium costs from quotes

- Step #7: Ask Questions – Clarify any uncertainties with insurance agents

- Step #8: Make a Decision – Choose the best policy that fits your needs

Frequently Asked Questions

What is a car insurance quote?

Car insurance quotes estimate how much you will pay for auto insurance coverage. These quotes are determined based on your personal information and several factors providers use to assess your level of risk.

Can I get free car insurance quotes?

You should be able to get free quotes online. Comparing quotes can help you save money on your car insurance coverage.

What’s the best way of finding and comparing car insurance quotes?

Searching for and comparing quotes online is the best way to purchase car insurance. This will help you save money and avoid paying too much.

What information do I need to provide when requesting auto insurance quotes?

When you request quotes, you typically need to provide your name, address, contact details, vehicle specifics (like the year, make, and model), and your driving history. Understanding how auto insurance companies check driving records is crucial as this can influence your quotes.

How can I find a reliable insurance agent or broker?

To find a reliable insurance agent or broker, you can ask for recommendations from friends, family, or colleagues who have had positive experiences with insurance professionals. You can also research and read reviews online, or contact your state’s insurance department for a list of licensed agents or brokers.

What factors affect the cost of auto insurance quotes?

Several factors can influence the cost of auto insurance quotes. These factors may include your driving record, age, location, the type of vehicle you drive, the coverage limits you select, your credit history, and any discounts you may qualify for (such as good student discounts or multi-policy discounts).

Which company offers the cheapest auto insurance?

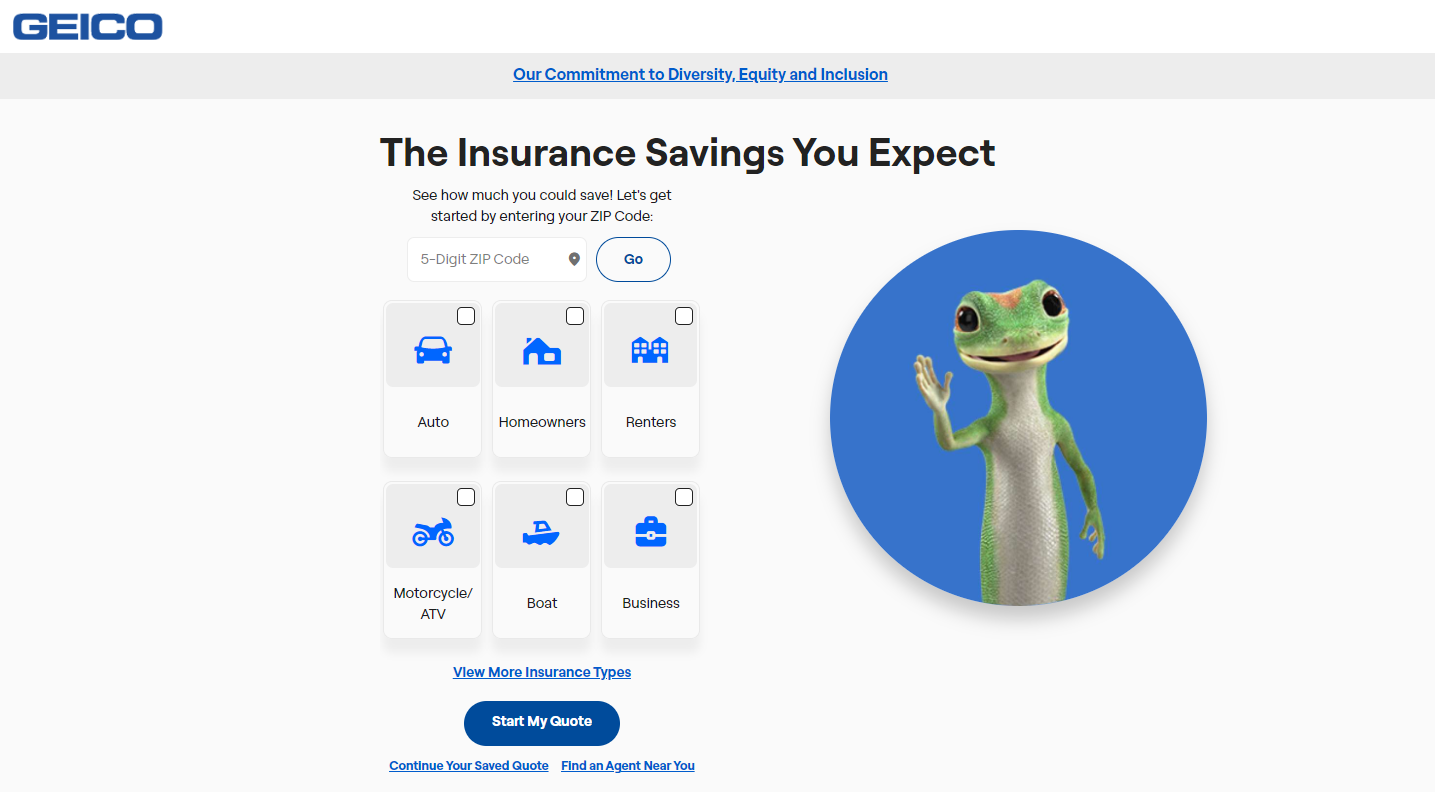

Certain companies, like USAA and Geico, offer cheaper rates for specific customers. Still, you won’t know which company will provide you with the most affordable rates until you find and compare quotes. Discover your auto insurance choices by inputting your ZIP code into our free comparison tool below today to learn how to get multiple auto insurance quotes.

Is there a way to get multiple auto insurance quotes at once?

Should I get multiple insurance quotes?

Yes, it’s highly recommended to compare quotes from multiple insurance companies. Prices and coverage options can vary significantly between insurers, so comparing quotes allows you to find the best coverage at the most competitive rate.

Do insurance quotes affect credit score?

Shopping around for auto insurance won’t affect your credit score because that’s not considered a “hard credit pull.” That happens when you apply for credit, such as for an auto loan or a credit card.

What is the cheapest way to insure multiple vehicles?

Reach out to car insurance providers with the lowest average policy rates and number discounts, including for insuring multiple vehicles. We recommend County Financial, Eric, Geico, Nationwide, and USAA.

How to get multiple auto insurance quotes?

To get multiple auto insurance quotes, follow these four steps:

- Gather Information: Prepare details about your vehicle and driving history.

- Use Comparison Tools: Utilize online quote comparison tools to enter your information once and receive multiple quotes.

- Contact Insurers: Reach out to various insurance companies directly for personalized quotes.

- Review and Compare: Analyze the coverage options and rates from different insurers to find the best fit for your needs.

To find competitive rates and ensure your vehicle is properly covered, make sure to read about how to save money by bundling insurance policies, as it can help you maximize your savings. Regularly check your quotes to stay informed about the best options available.

Can I get a new quote with the same insurance?

Yes, you can request a new quote from your current insurance provider. This may help you find better rates or coverage options based on changes in your situation.

Do car insurance quotes go up the more you search?

Generally, no. Shopping for car insurance typically involves “soft inquiries” that don’t affect your credit score or quotes. However, if you apply for new insurance and it leads to a hard inquiry, it could affect your rates.

How many insurance quotes should I get?

It’s advisable to get at least three to five quotes from different providers. This range allows for a good comparison of coverage options and prices.

How to get a car insurance quote before buying?

How to get an anonymous car insurance quote?

Some insurance companies allow you to get quotes without providing personal information by entering only vehicle details. Look for services specifically offering anonymous quotes.

How to get car insurance with multiple accidents?

To get car insurance with multiple accidents on your record, shop around and compare quotes, as some insurers specialize in high-risk policies. Additionally, consider taking a defensive driving course to potentially reduce rates.

Why can’t Liberty Mutual give me a quote?

Liberty Mutual may be unable to provide a quote due to missing information, issues with your driving record, or if you’re located in an area they don’t serve.

Why should you obtain several insurance quotes?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.