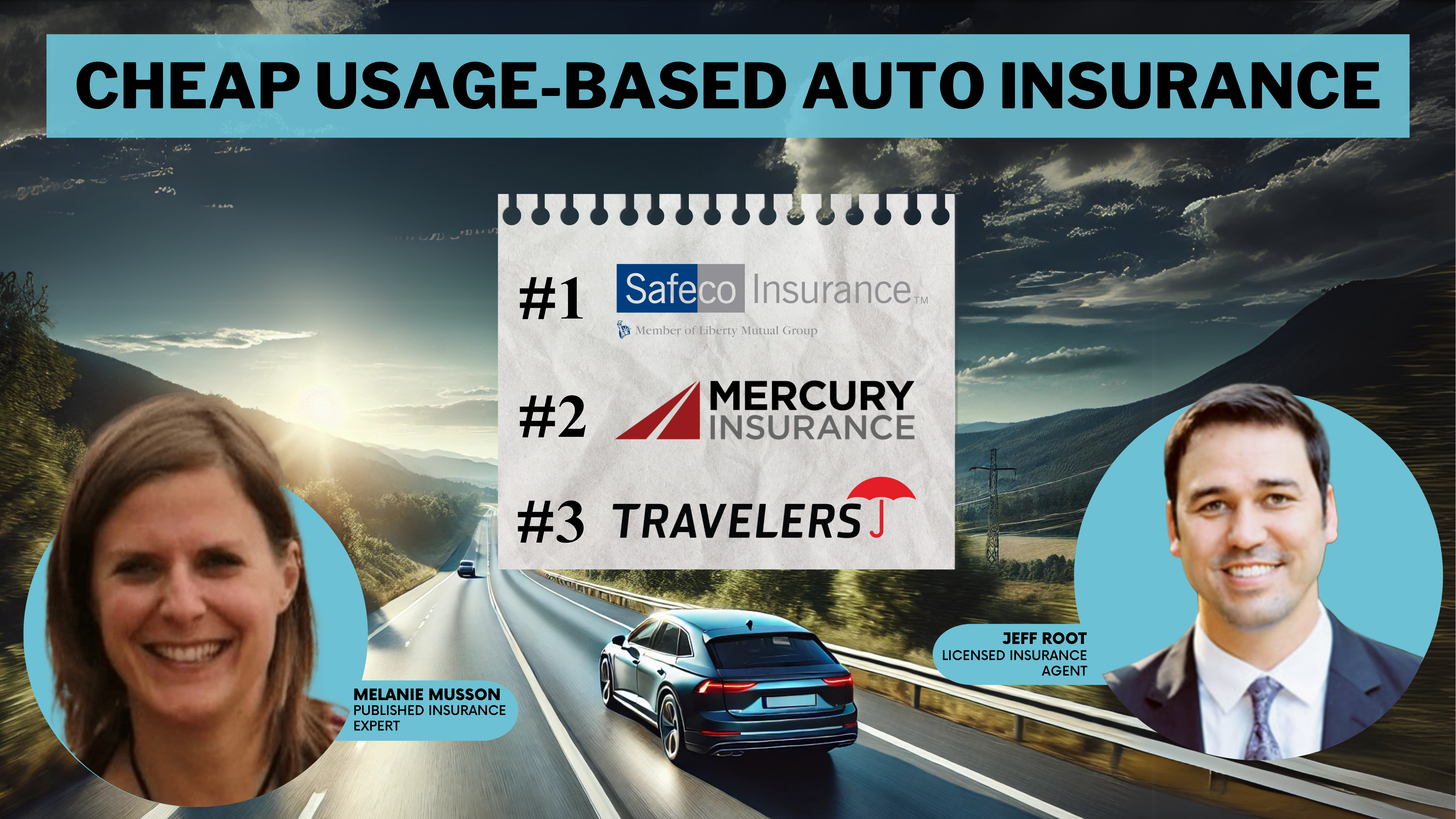

Cheap Usage-Based Auto Insurance in 2025

Safeco, Mercury, and Travelers are the top cheap usage-based auto insurance programs that help drivers save up to 30%. Usage-based car insurance programs track your driving behaviors, including speeding, hard braking, and what time you drive. Safe drivers can significantly reduce their rates by using UBI devices.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Jun 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,278 reviews

1,278 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 675 reviews

675 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best

Complaint Level

Pros & Cons

675 reviews

675 reviews 1,733 reviews

1,733 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsWhen it comes to cheap usage-based auto insurance, our top choices are Safeco, Mercury, and Travelers, which offer programs that track your driving habits to offer generous discounts to safe drivers.

Safeco is the top choice for telematics insurance companies because it provides personalized feedback to help you drive better. Although Safeco may not be one of the cheapest auto insurance companies on the market, enrolling in its UBI program makes it affordable for safe drivers.

Our Top 7 Picks: Cheap Usage-Based Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $38 | A | Rewarding Program | Safeco | |

| #2 | $42 | A | Affordable Rates | Mercury | |

| #3 | $53 | A++ | Intelligent Tracking | Travelers | |

| #4 | $56 | A+ | Snapshot Savings | Progressive | |

| #5 | $62 | A | Safe Driving | American Family | |

| #6 | $63 | A+ | SmartRide Discounts | Nationwide |

| #7 | $87 | A+ | Drivewise Benefits | Allstate |

Explore our telematics insurance comparison below to find the right auto insurance based on driving habits. Then, enter your ZIP code above into our free comparison tool to find the best UBI program today.

- Usage-based insurance programs track driving habits to offer discounts

- Most major insurance companies offer a UBI option

- Good drivers save an average of 22% by enrolling in a UBI program

#1 – Safeco: Top Overall Pick

Pros

- RightTrack: Safeco offers a telematics insurance discount of up to 30% with RightTrack, depending on how well you drive. According to Safeco RightTrack reviews, most users like the mobile app.

- Safe Driver Discounts: Among Safeco’s many discounts are savings for remaining accident and traffic-violation-free.

- Customized Feedback: One benefit of enrolling in the RightTrack program is that you’ll get personalized feedback on your driving behaviors. Learn more about Safeco’s insurance programs in our Safeco auto insurance review.

Cons

- Limited Availability: RightTrack is currently available in just 36 states.

- Rates Are High for Some Drivers: Safeco is often an affordable option for insurance, but some drivers will see higher rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Mercury: Best for Affordable Rates

Pros

- RealDrive: Save up to $513 per year by signing up for Mercury’s UBI car insurance program, RealDrive.

- User-Friendly App: Mercury’s mobile app receives excellent reviews for its user-friendly design.

- Affordable Rates: Drivers looking for cheap insurance will likely find it with Mercury. Learn how Mercury keeps its rates so low in our Mercury auto insurance review.

Cons

- Limited Availability: Although Mercury has expanded from its home state of California, it’s only made it into 11 states.

- Few Customization Options: As a smaller insurance company, Mercury offers fewer coverage options than some of its larger competitors.

#3 – Travelers: Best for Safe Driver Discounts

Pros

- IntelliDrive: Earn a 10% enrollment discount for signing up for IntelliDrive. After the monitoring period, you can save up to 30% on your policy.

- Short Observation Period: Unlike many usage-based insurance companies, Travelers only gathers data about your driving habits for 90 days.

- No Plug-in Device: IntelliDrive monitors your behavior through an app on your phone, meaning you won’t have to worry about plugging a device into your vehicle.

- Discount Options: Travelers offers 15 additional ways to save, including a 10% discount for safe drivers. Explore your discount options in our review of Travelers auto insurance.

Cons

- Expensive for Bad Drivers: Most usage-based insurance providers guarantee your rates won’t increase after signing up for their programs. Travelers does not make this promise – IntelliDrive can raise your rates after bad driving behavior.

- Mixed Android App Reviews: The IntelliDrive app gets much better reviews among Apple users than it does for Android users.

#4 – Progressive: Best Budgeting Tools

Pros

- Progressive Snapshot: Safe drivers can save up to 20% with Progressive’s usage-based auto insurance program, Snapshot.

- Short Review Period: Progressive is one of the telematics car insurance companies that monitor driving behaviors for a short period. Snapshot only needs to gather data for the first policy period.

- Budgeting Tools: Like many of its competitors, Progressive offers safe driver discounts to help you save. Progressive takes its dedication to help drivers save even further by offering the Name Your Price budgeting tool.

Cons

- Snapshot can increase rates. Progressive is one of the few companies where UBI insurance rates can actually increase if you don’t drive well enough. Read more about Progressive’s rate increase in our Progressive auto insurance review.

- Not the Best Discount: Snapshot can help you get cheap telematics insurance, but it doesn’t offer the best discount. You may find a better discount with another company.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Mobile Phone Users

Pros

- SmartRide: Nationwide advertises up to 40% savings for safe drivers who enroll in SmartRide. According to our Nationwide SmartRide review, however, only about 10% of all drivers earn the full discount.

- Rate Lock Guarantee: Nationwide guarantees that drivers who do not qualify for a SmartRide discount will not see their rates increase.

- UBI Phone Use Not Tracked: Most telematics insurance companies track phone use, but SmartRide does not.

- Vanishing Deductible Program: Save $100 on your deductible for every year you spend claims-free, up to $500. Explore the Vanishing Deductible program and other coverage options in our Nationwide auto insurance review.

Cons

- Not Ideal for Heavy Traffic: If you spend a lot of time in heavy traffic, you’ll likely find a better telematics car insurance discount with another company.

- Availability Varies: SmartRide is available in every state Nationwide sells insurance in, but the program varies. For example, California drivers can earn a maximum discount of only 15%, and the app is unavailable.

#6 – American Family: Best for Costco Members

Pros

- KnowYourDrive: Save up to 20% on your insurance with American Family’s UBI auto insurance program, KnowYourDrive.

- Excellent Mobile App Reviews: Both Apple and Android users give the KnowYourDrive app highly for its convenience. See what else you can do with the mobile app in our American Family auto insurance review.

- Underwrites for Costco: American Family writes auto insurance policies for Costco members through CONNECT.

Cons

- Limited Availability: American Family only sells insurance in 19 states.

- Constant Evaluation: KnowYourDrive requires continuous monitoring, and your discount will change every policy period.

#7 – Allstate: Best UBI Savings

Pros

- Allstate Drivewise: Allstate has one of the best UBI car insurance discounts. Our Allstate Drivewise review shows the safest drivers can save up to 40%.

- Trip Forgiveness: Allstate sets itself apart as one of the best telematics car insurance companies by letting you delete a trip from your monitoring log.

- Ample Coverage Options: Aside from car insurance based on usage, Allstate offers a variety of add-ons. Explore your coverage options in our Allstate auto insurance review.

Cons

- Higher Rates: Despite offering a solid telematics auto insurance discount, Allstate tends to be one of the highest-priced options on the market.

- Availability Varies: Drivers in Arkansas and New York can only get the car insurance plug-in Drivewise option.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Effect of Mileage on Your Auto Insurance Rates

How far, how often, and how you drive are all important factors to insurers. If you no longer work, rarely use your car, and drive relatively few miles each year, insurers will usually charge you less.

Not all insurers offer auto insurance discounts, though, and it’s important to know what to ask about when talking to insurers about usage-based discounts.

Although people are driving less for several reasons — car costs, gas prices, working from home, and environmental concerns — nearly one-third of auto insurance customers in the U.S. have reported a rate increase in the past year. So checking out usage-based auto insurance could be a great way to drive their premiums down by personalizing their auto insurance experience.Jeff Root Licensed Insurance Agent

To help you understand the impact of mileage and how it can save you money, we’re going to go through everything you need to know about your commute’s impact on rates.

How Mileage Impacts Your Auto Insurance Rates

It’s natural to wonder why you’d pay less if your commute were five miles instead of 20. The reason that your annual mileage affects your auto insurance is that people who drive more have a higher chance of getting into an accident. If you drive only five miles a day, you’ll encounter fewer irresponsible drivers than the average person who drives 29 miles daily.

If you didn’t fully understand how important it was to give accurate mileage ratings, your information on file could be hurting you. Overestimating mileage could potentially result in overcharging. Luckily, if you say you’re going to drive 15,000 miles for the whole year and that estimate is wrong, you can request that it be changed.

Data shows that you’re exposed to more potential accidents the more you drive, so overestimating your mileage could be costing you.

If you need to lower the mileage estimate for a car on your policy, you should call your agent. When the difference is minimal, the agent will process the change with no hesitation.

However, if you go from driving 15,000 miles per year to 5,000 miles, you may have to provide documentation showing your current odometer reading.

How Using Your Vehicle Impacts Your Insurance Rates

You don’t necessarily have to be a commuter or a business professional to drive 10,000–20,000 miles every year. Some retirees and home-based professionals still spend a lot of their time in their cars going on road trips or enjoying music as they take the scenic route down the coast. If you don’t limit your usage in a mileage sense, you might qualify for savings elsewhere.

In addition to offering low-mileage discounts to qualifying drivers, companies will offer discounts to drivers to limit their usage to only driving their personal cars for personal reasons. Every car will receive a different vehicle usage rating. While these aren’t always the terms used, companies will typically assign one of three ratings to the vehicle:

- Pleasure

- Business

- Commuter

Pleasure-use vs. commuter auto insurance rates have moderate variations. Pleasure-use comes with the lowest rate because it’s the class where the risk measures are the lowest. Why? People who use their cars for pleasure usually aren’t driving during traffic rush hours and aren’t stressed, worrying about whether they will get to work on time. This helps reduce their risk measure.

To find out how a car is rated, look at your declarations page and see if it says pleasure, commuter, or business next to the car.

How Commuting in Your Car Poses More Risk

If you have a short commute, you might wonder why you’re going to pay more than someone who drives a lot of pleasure mileage. Like just about everything related to car insurance, the answer is risk.

Here are a few reasons why people who commute by car are more likely than others to get into an accident:

Factors That Affect Usage-Based Auto Insurance Discounts

Factor Rate Impact

Accidents Near Home Most accidents occur close to home, potentially raising rates.

Cellphone Use While Driving Significantly increases accident risk, which affects rates.

Driving Behavior Rushed driving increases accident risk and potentially rates, while relaxed driving lowers risk.

Driving in High-Risk Areas Frequenting accident-prone or vandalism-prone areas raises rates.

Hard Braking Events Indicates risky driving, which can increase rates.

Job & Commuting Mode Lower rates for public transit users compared to daily car commuters.

Mileage Higher mileage increases rates; lower mileage decreases them.

Rush Hour Accidents Higher risk during rush hour may increase rates.

Time of Day (3–6 p.m.) Higher accident risk during peak commute times may affect rates.

Vehicle Usage Classification Pleasure" use lowers rates; "business" or "commuter" use increases them.

Your job affects auto insurance — if you take the bus to work each day and only use your car on the weekends, you should have a lower rate.

Basics of Usage-Based Auto Insurance

What is usage-based auto insurance? Now that we know how mileage affects drivers’ rates, we want to build on this information to discuss usage-based auto insurance.

Usage-based discounts are an excellent way to get the best auto insurance for good drivers. There are several different types of usage-based auto insurance, and you need to be aware of what each entails so you can choose the one that best suits your needs.

If you choose the wrong type of usage-based insurance, you might not get the full discount you’re entitled to.

So keep reading to learn about what types of mileage-based insurance programs are on the market.

How Telematics Devices Work

How does usage-based insurance telematics work? Telematics car insurance is basically car insurance based on driving habits.

Vehicle telematics generally consists of electronic devices that monitor a person’s driving habits whenever they hit the road. Basically, electronic devices collect data and send it through phone lines and cables to a computer that interprets the data.

Many drivers worry about a device tracking their location and driving behaviors all the time. While insurance companies take great effort to protect your data, you should make sure you're comfortable with the idea of sharing your information with an insurance company before signing up for a UBI program.Travis Thompson Licensed Insurance Agent

Because of the differences between the types of insurance, telematics devices vary in what they record. For example, our Allstate Milewise review explains that this Allstate device only tracks your mileage. One device may only record how far you drive, while another device will record what times of day you drive (some times are riskier than others), hard-braking events, distracted driving, and other safe driving details.

However, they all serve the basic function of recording data and sending it to your insurer. This means that you don’t have to record and send the data yourself, which makes things easier for all involved. Signing up for usage-based insurance is usually easy too — simply follow the instructions provided by your insurance company. Most providers have instructions for getting started listed on their websites.

Just make sure to research what types of data these devices record and what discounts you’ll be earning. You might not want to bank on the full discount from telematics car insurance quotes you may get. You won’t necessarily get the usage-based insurance telematics discount that the company offers if you have poor driving habits.

Types of Usage-Based Auto Insurance

Let’s explore the types of usage-based auto insurance so that you can decide which one is right for you. There are generally two options: pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD).

- PAYD calculates your premium based on the actual usage of your car. The theory behind it is that if you’re not driving, you’re not likely to get involved in an accident.

- PHYD monitors how you drive looking for patterns of risky behavior, such as the aforementioned hard-braking events. If you need high-risk auto insurance, PHYD is not right for you.

Let’s take a look at these two types in-depth.

Pay-As-You-Drive (PAYD) Insurance

You should look into PAYD insurance if you rarely drive. If you use your car frequently for work or pleasure, PAYD insurance will not save you much money.

PAYD is not only a good way to save on your insurance — it’s also a great way to help the environment.

As more companies introduce PAYD insurance, leisure driving may be reduced, and families may be more responsible about grouping trips together and making fewer unnecessary trips. It might also encourage people to own multiple vehicles because families wouldn’t be paying for cars they’re not actively driving. From a consumer perspective, the change makes a lot of sense.

It’s also an easy way to encourage greener driving habits. If you’re intereted in PAYD insurance that has the smallest environmental impact, you should consider comparing quotes from the best eco-friendly auto insurance companies.

Pay-How-You-Drive (PHYD) Insurance

You should only get PHYD insurance if you are a careful driver. If you are a poor driver, you won’t earn any discounts.

Some insurers will actually penalize you for driving poorly, which means PHYD could end up costing you money.

If you are a good driver, though, there is little to worry about choosing PHYD coverage from the best auto insurance companies for good drivers. Just make sure to ask if there is a penalty for poor driving before you get the insurer’s telematics device and sign up for a PHYD program.

These programs are useful, though, for helping drivers improve. The Insurance Research Council performed a survey in 2015 that found 56% of drivers tried to purposefully improve their driving due to a tracking device provided by their insurance company, and 88% said they found the information provided to be helpful.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Types of Telematics Devices

There are many different types of telematics devices, and they all differ in how they are installed. Some can simply be downloaded on your phone, while others are devices that plug into your car.

Insurers will help you with the installation of these devices and explain how they work, but we want to run through the basics of each type to give you some general knowledge. This way, you can learn how to get auto insurance with the best telematics option for your needs.

Embedded Devices

Technology is advancing faster than we can keep up with it. Some of today’s newer models of cars are already equipped with in-vehicle devices that monitor various situations, such as your mileage and tire pressure. Generally, these will be built into your GPS system.

The General Motors OnStar Smart Driver system uses the car’s own data connection to communicate with several insurance companies.

The OnStar is just one of the many systems available that monitor telematics to help drivers save money on the road. GM even uses OnStar’s telematics for its OnStar insurance (soon to be named General Motors Insurance). Read about it in our GM auto insurance review.

The telematics box should not affect the functioning of your car at all, as it is built and designed for your car model. If you notice any issues, talk to your vehicle’s manufacturer. However, we want to point out that this type of device will only work for PAYD insurance, as they usually can’t monitor data about the driver’s habits — just data about how far the vehicle is driven.

Plug-in Devices

In-vehicle devices, also known as dongles, are similar to embedded devices. While it is a separate device you plug into your car, it records the same data as an embedded device.

While many drivers prefer to get UBI from car insurance companies with the best mobile apps so they can skip plugging something in, others prefer the dongle.

Having a car insurance plug-in is a great choice for people who want to choose when they’re tracked because you can take it out whenever you’d like.

This means that you won’t get a discount for safe driving with in-vehicle devices, as they will only record data about how far you drive. If you’re looking for a telematics device that records more than just distance, you’ll need to look into mobile apps.

Mobile Apps

If you opt for an insurance company with a mobile driving app, you won’t have to install a device in your car. Most insurers offer mobile apps that record much more than distance. Many companies only offer a mobile app. For example, our American Family KnowYourDrive review shows you can only use a mobile app if you want to participate in the program.

A mobile app usually records information about the time of day, hard braking, speed, and distracted driving.

While these apps are great for safe drivers, insurers are still working on fixing a few kinks. For example, because the app is constantly running in the background, it tends to drain a smartphone’s battery pretty quickly.

Still, the apps are going to record more data than an in-vehicle or embedded device, and as technology advances, these issues should improve.

Driving Behaviors UBI Devices Track

Telematics can track a wide range of factors that affect your insurance rates, including:

- Cellphone use: This is usually recorded on usage-based apps, as distracted driving is a serious problem. If you stay off your phone in the car, the app will record this.

- Fuel consumption: How fuel-efficient is your car?

- Hard braking: Not only does hard braking cause more wear and tear on the car, but it also suggests that drivers are more likely to have an accident.

- Idling time: How long do you spend sitting in traffic? The more cars on the road, the more risk of getting into an accident.

- Location: Are you driving or parking in an area prone to accidents or vehicle vandalism?

- Speed: Are you driving the speed limit? Speeding is one of the most common causes of car accidents.

- Vehicle faults: A device may record any issues with your car that can make driving dangerous, such as not changing your oil regularly.

As we explained earlier, this data is sent via cellular or satellite networks and is then interpreted by a computer. Insurers then use this data to determine if a driver is eligible for a discount.

Because telematics devices can collect a great deal of sensitive information, such as where you park your car, you may be concerned about privacy. Always check that your company has a privacy statement saying that it doesn’t sell data to third parties. Most major, reputable companies would never do this, but it never hurts to be extra cautious and double-check. So instead of skipping over the fine print, read that privacy statement.

Telematics Devices Can Be Wrong

Technology is great, but there is room for error. Sometimes, a malfunctioning device may misrecord how far you drive or where you drive. If you notice issues, make sure to contact your insurer right away.

The last thing you want is for your discount to drop because the technology failed. Another issue that can arise with telematics involves the recording of hard braking events.

Usage-based apps can’t tell if you hit the brakes because you weren’t paying attention and almost rolled through a stop sign, or if a car swerved in front of you with no warning.

As a result, you could be penalized for an event you had no control over. Fortunately, some apps allow you to cite and even dismiss the incident. But not all apps can determine the reason for hard braking, so this may be a flaw you’ll have to learn to live with.

Paying attention to your surroundings, though, can help you keep alert to avoid sudden stops. Shopping at one of the best auto insurance companies without penalties for no-fault accidents can also help mitigate this risk.

Pay-Per-Mile Auto Insurance

Pay-per-mile is just another name for pay-as-you-drive insurance. Basically, an in-vehicle telematics device records how far a person drives each month. When you’re trying to learn how to lower your auto insurance rates, pay-as-you-go insurance is a good option if you’re a low-mileage driver.

Drivers will pay a base rate for this type of insurance, which is calculated from factors like age, gender, and driving record.

Insurers will then charge a predetermined per-mile fee on top of the base rate. Because of this, rates vary month to month depending on how much drivers travel. So, if you take an occasional long trip outside of your normal driving range, you may see a small spike in your rates that month. However, for the most part, your rates should stay about the same.

This is because some insurers will only record up to a certain number of miles. So if you drive past the daily range once or twice, insurers will only charge up to a daily maximum. This makes it very cost-effective for people who rarely drive but may take the occasional long trip for vacation or to visit family or friends.

Largest Auto Insurers With Pay-Per-Mile Coverage

So, what are the largest pay-as-you-go auto insurance companies? This coverage isn’t as common as usage-based programs, so it may be a little harder to find at major companies.

Below is a list of major companies that have pay-per-mile insurance.

Top Pay-Per-Mile Auto Insurance Programs

| Insurance Companies | Program Name | Availability |

|---|---|---|

| Allstate | Milewise | Available in 47 states |

| American Family | KnowYourDrive | Available in 19 states |

| Esurance | Esurance Pay Per Mile | Excluding: AL, AK, DC, FL, HI, ID, KS, ME, MA, MI, MN, NH, NJ, NY, NC, RI, SD, VT, WA, WY |

| Farmers | Signal® | Excluding: AK, HI, LA, MA, MI, NJ, NY |

| Geico | DriveEasy | Excluding: AK, CA, DC, DE, HI, KS, ME, MA, MO, MS, MT, ND, HD, NY, RI, SD, VT, WV, WY |

| Hartford | TrueLane | Excluding: FL |

| Liberty Mutual | ByMile | Excluding: AK, CA, DC |

| Nationwide | SmartMiles | Excluding: CA, HI, MA, MI, NY |

| Progressive | Snapshot | Available in 47 states |

| Root Insurance | Root Insurance Telematics | Excluding: AL, AK, DC, FL, HI, ID, KS, ME, MA, MI, MN, NH, NJ, NY, NC, RI, SD, VT, WA, WY |

| State Farm | Drive Safe & Save | Excluding: DC |

| Travelers | IntelliDrive | Excluding: CA, HI, NY |

| USAA | SafePilot | AZ, OH, TX, OK |

Unfortunately, companies don’t yet offer pay-per-mile in every state. This is because most insurers are still in the trial period of testing pay-per-mile in just one state before expanding the program.

In the future, this should be a much more readily available option.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Pick the Best Usage-Based Auto Insurance

We discussed each type’s functions, but how do you choose the best UBI program? How much data are you comfortable sharing with your insurer? Is the amount saved worth it?

Like any other type of auto insurance, you should research your options before you settle on an answer. In this section, we will guide you through these questions and more. Stick with us for help finding the best usage-based car insurance for your needs.

Choosing the Best UBI

So how do you know if pay-as-you-go or UBI is right for you? You should get pay-as-you-drive insurance if you don’t drive often. Some examples of drivers who might benefit from pay-as-you-drive include:

- Those who work from home

- Those who take public transit to work

- Retired people

- Stay-at-home parents

Basically, if you don’t pull your car out of the garage every day, you should consider pay-as-you-drive insurance. For example, the best auto insurance companies for telecommuters are excellent options for drivers who work from home.

If you do drive often, UBI is a convenient way to earn discounts. Sometimes, the apps will give discounts if you drive less.

You should only get UBI if you are a good driver. Some insurers penalize drivers for poor driving habits, raising their rates.

If an insurer doesn’t charge for poor driving, it’s worth trying UBI for a while. However, if you aren’t earning any discounts, keeping the app or in-vehicle device may be more trouble than it’s worth, especially with the apps.

Why? Because with an app, you may have to turn it on every time you are in the car, draining your battery.

If you forget to mark that you are a passenger when you get into a car, you will be penalized for distracted driving if you go on your phone.

These little design flaws can be more trouble than they’re worth if your driving isn’t earning you any discounts. So consider what form of usage-based car insurance sounds right for you, then give it a try and see if it saves you money.

Usage-Based Auto Insurance Savings

How much you save depends on the insurer. With so many companies offering UBI programs, it can be difficult to figure out your best option. For example, State Farm didn’t quite make our list of the best UBI companies, but our State Farm Drive Safe and Save review lists a maximum discount of 30%. Below is a complete list of savings.

Top Usage-Based Auto Insurance (UBI) Programs

| Company | Program Name | How It's Tracked | Sign-up Discount | Savings Potential |

|---|---|---|---|---|

| Drivewise | Mobile App | 10% | 40% | |

| KnowYourDrive | Mobile App or In-Vehicle Device | 10% | 20% |

| DriveEasy | Mobile App | 20% | 25% | |

| RightTrack | Mobile App or In-Vehicle Device | 5% | 30% |

| Mile Auto | Mileage-Based | 20% | 40% | |

| SmartRide | Mobile App or In-Vehicle Device | 10% | 40% | |

| Snapshot | Mobile App or In-Vehicle Device | $25 | 20% | |

| RightTrack (Liberty) | Mobile App | 5% | 30% | |

| Drive Safe & Save | Mobile App or In-Vehicle Device | 5% | 50% | |

| IntelliDrive | Mobile App | 10% | 30% |

Not all insurers list the average savings a driver makes on their sites, so ask your insurer. As you can see, though, usage-based programs often give you a discount just for signing up. If you drive safely, you can often save at least 15%.

This means that unless an insurer charges more for bad driving habits, usage-based auto insurance will always save you some money.

Pay-Per-Mile Auto Insurance Savings

Ultimately, the answer to this question depends on how much you drive every year and the company you choose. You will have to do a little math based on your annual mileage and the insurer’s flat rate and per-mile fee. You’ll also need to do a bit of research to find the best pay-per-mile company — our Metromile auto insurance review is a great place to start.

If an insurer charges a flat rate fee of $20 each month and 5 cents for every mile, your per-mile fee would be $360 per year if you drove 6,000 miles.

Add this to the flat rate fee of $240, and you are only paying $600 a year for car insurance. So do a little bit of math and compare it to the cost of a basic auto insurance policy to see if a pay-per-mile insurance plan will be worth it for you.

You can also get a quote for pay-per-mile insurance and a quote for regular insurance and compare the two. Remember, an insurer’s flat-rate fee and per-mile fee depend on your demographics and driving record. The average rate insurers post on their website may not apply to you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

When Usage-Based Auto Insurance Is Right For You

There are a few things you want to consider to make sure usage-based auto insurance is right for you. Think about the following questions before you commit to usage-based auto insurance.

- How much do you drive every year? If it’s under 10,000 miles, usage-based car insurance could work for you.

- Do you have a poor driving record? Drivers with bad records will likely not save with usage-based insurance. For example, you should look at how long speeding tickets affect auto insurance rates in your state before you sign up for UBI if you have speeding violations.

- What times of day do you drive? If you drive at riskier times, such as rush hour, usage-based car insurance may not be for you.

- Do you want to share data with your insurer? How comfortable are you with sharing information? While web developers have worked to create secure telematics apps, some people are still uncomfortable with the invasion of privacy.

One last thing we want to point out about usage-based auto insurance is that you have a guaranteed tracker on your car in case it’s stolen. So even if you aren’t entirely comfortable sending your location to your insurer for usage-based auto insurance, it could be invaluable in the event your car is stolen.

The Best Safe Driving Habits to Follow

If you have a usage-based app or an in-vehicle device that monitors more than the distance driven, you need to ensure your driving habits are up to par. In addition, you can follow the tips below to ensure you’re getting the best discount possible.

- Drive at the safest times of the day. This means avoiding idling in rush hour traffic or late-night driving (when there are more tired or drunk drivers who may crash into you).

- Don’t speed. Always follow the speed limits, as speeding will not affect your discount.

- Don’t brake or accelerate hard. Ease into braking and accelerating to keep your discount high.

- Don’t drive as much. The less you are on the road, the better your rate or discount will be. So take advantage of carpooling or public transit.

If you follow these habits, you should rack up some decent savings.

You can also pursue other options for keeping yourself safe on the road outside of UBI programs. For example, learning why you need to take a defensive driving class can refresh your driving skills and prepare you for dangerous situations on the road.

Pros and Cons of Usage-Based Auto Insurance

Now that we’re near the end of our guide to usage-based auto insurance, we want to break down the benefits and disadvantages for you. You’re already an expert on usage-based auto insurance now that you’ve read this far, but it can help to go back over the pros and cons before making a decision.

So stick with us as we jump into analyzing usage-based car insurance.

Advantages of Usage-Based Auto Insurance

So what are the advantages of usage-based auto insurance? Well, besides saving you money, usage-based auto insurance helps create more accurate driving profiles. For example, average car insurance rates by age show that a 25-year-old driver may have high rates. However, a usage-based app could reveal to an insurance company that this driver is actually very cautious and deserving of a discount.

Not to mention that many drivers actively try to improve their driving habits when using usage-based devices. This is a plus for both insurers and drivers. Watch this video to learn more about insurers trying to improve your driving habits.

The Insurance Information Insitute found that drivers are less likely to get into accidents, and insurers are less likely to have to pay a claim. This is also a reason parents should consider telematics devices for teenagers, as it can help younger drivers be aware of where they need to improve.

As a result, usage-based car insurance is becoming popular among both consumers and providers.

IHS Automotive predicts that by 2023, 142 million customers will sign up for usage-based policies worldwide, compared to the under 12 million customers in 2015.

As studies continue, you can expect to see more data on the benefits and disadvantages of usage-based car insurance.

Disadvantages of Usage-Based Auto Insurance

There are a few drawbacks to usage-based insurance. While any reputable insurer won’t sell your data to third parties, telematics devices could still be used to give information to law enforcement.

For example, if you’re parked near a store when it’s robbed, insurers may have to give your data to law enforcement to make sure you weren’t involved, as speeding off after the cashier handed over the cash is suspicious.

Also, as we mentioned before, some insurers may actually increase your rates for bad driving. For example, our Progressive Snapshot review says that only two out of every 10 drivers have increased rates after using the program. However, you don’t want to be part of the unlucky 20% with increased rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding Usage-Based Car Insurance and Telematics Systems

Usage-based auto insurance is a great way to save money on car insurance, but only if used correctly. Make sure to analyze your mileage and driving habits before you commit to a program or insurer. Otherwise, usage-based auto insurance could end up doing more harm to your rates than good.

If you feel knowledgeable about the program and your own needs and habits, though, usage-based car insurance is a great choice that can save you a significant sum of money over the year. When you’re ready to learn how to get multiple insurance quotes, you can always enter your ZIP into our free tool comparison tool below.

Frequently Asked Questions

Who offers usage-based insurance?

Many of the best auto insurance companies offer car insurance based on usage, including most major providers like Allstate, State Farm, and Progressive. However, UBI program availability varies by company. You’ll need to check what’s available in your state before you sign up.

What’s the difference between UBI and pay-as-you-go programs?

Usage-based insurance tracks driving behaviors like speeding, hard braking, and what time you drive to caluclate a discount on your regular policy.

Pay-as-you-go insurance plans track your mileage to determine how much you pay. Generally, you’ll get a set amount you pay per day no matter what. You’ll also get an amount per mile, usually just a few cents. Your insurance company tracks your daily mileage to calculate your rates.

How would insurance companies benefit from offering usage-based insurance?

There are several benefits for auto insurance companies. Usage-based devices encourage drivers to improve their driving habits, which reduces the chance of providers having to pay accident claims. Providers also have quicker access to more complete details regarding accidents, so they can process claims more quickly.

Offering a usage-based auto insurance program that personalizes insurance for their clients and can save them money casts providers in a more positive light, which they need: Rate increases to nearly a third of auto insurance customers in the U.S. in the past year have led to the largest decline in customer satisfaction in 20 years, according to J.D. Power.

What is the difference between usage discounts and usage-based rates?

A usage discount is a set amount you’ll save on your regular policy for meeting an eligibility requirement. For example, low-mileage discounts can be earned by staying under a specified number of miles each month. Once you qualify, you usually don’t have to worry about losing it.

Usage-based rates are determined by a tracking device – usually a plug-in device or a mobile app. Your driving behaviors determine how much of a discount you get on your insurance, and most companies reevaluate your driving from time to time.

Does Geico use telematics?

For the longest time, Geico car insurance was one of the few insurers who didn’t offer a telematics system. However, in 2019 Geico began testing its DriveEasy usage-based app.

Currently, the app is only available in Pennsylvania and Connecticut. Geico should roll the app out into more states if the testing stage goes well.

If you’re interested in enrolling in usage-based insurance as a Geico customer but don’t live in an eligible state, enter your ZIP code into our free comparison tool to see other options.

Does usage-based insurance save you money?

The amount you can save with a telematics car insurance discount depends on the company you sign up with and your driving habits. Most drivers can save at least a small amount by enrolling, while others can cut their costs almost in half.

If you don’t think UBI is a good fit for you, there are plenty of other ways to save. For example, you can purchase the bare minimum car insurance requirements in your state for the cheapest coverage possible.

Which company has the best telematics car insurance discount?

Nationwide and Allstate advertise the best usage-based car insurance discount at 40%. However, most drivers don’t receive the full discount, instead saving about 25% on their insurance. The amount you can save on your policy depends on your driving habits.

What is the difference between SmartMiles and SmartRide?

If you’ve heard of Nationwide’s telematics systems before, you might be wondering what the difference between the two is.

- SmartRide is a usage-based discount program.

- SmartMiles is a form of pay-as-you-drive coverage.

Nationwide SmartMiles is a good option to save money if you don’t drive much.

Does cell phone use affect UBI rates?

Cell phone use is often tracked by UBI programs, but not always. Since mobile use is considered a risky driving behavior, many companies penalize cellphone use without a hands-free device.

If you frequently use a phone while driving, make sure to check if phone use is tracked by a UBI program before signing up. You can easily check UBI programs while comparing quotes — enter your ZIP code into our free comparison tool to get started.

Which vehicles are eligible for SmartMiles?

With SmartMiles from Nationwide, generally, your car must be made after 1996. This is because older cars aren’t compatible with the devices. Make sure to ask Nationwide if your vehicle will work for the program. Read our expert Nationwide SmartMiles review to learn more.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.