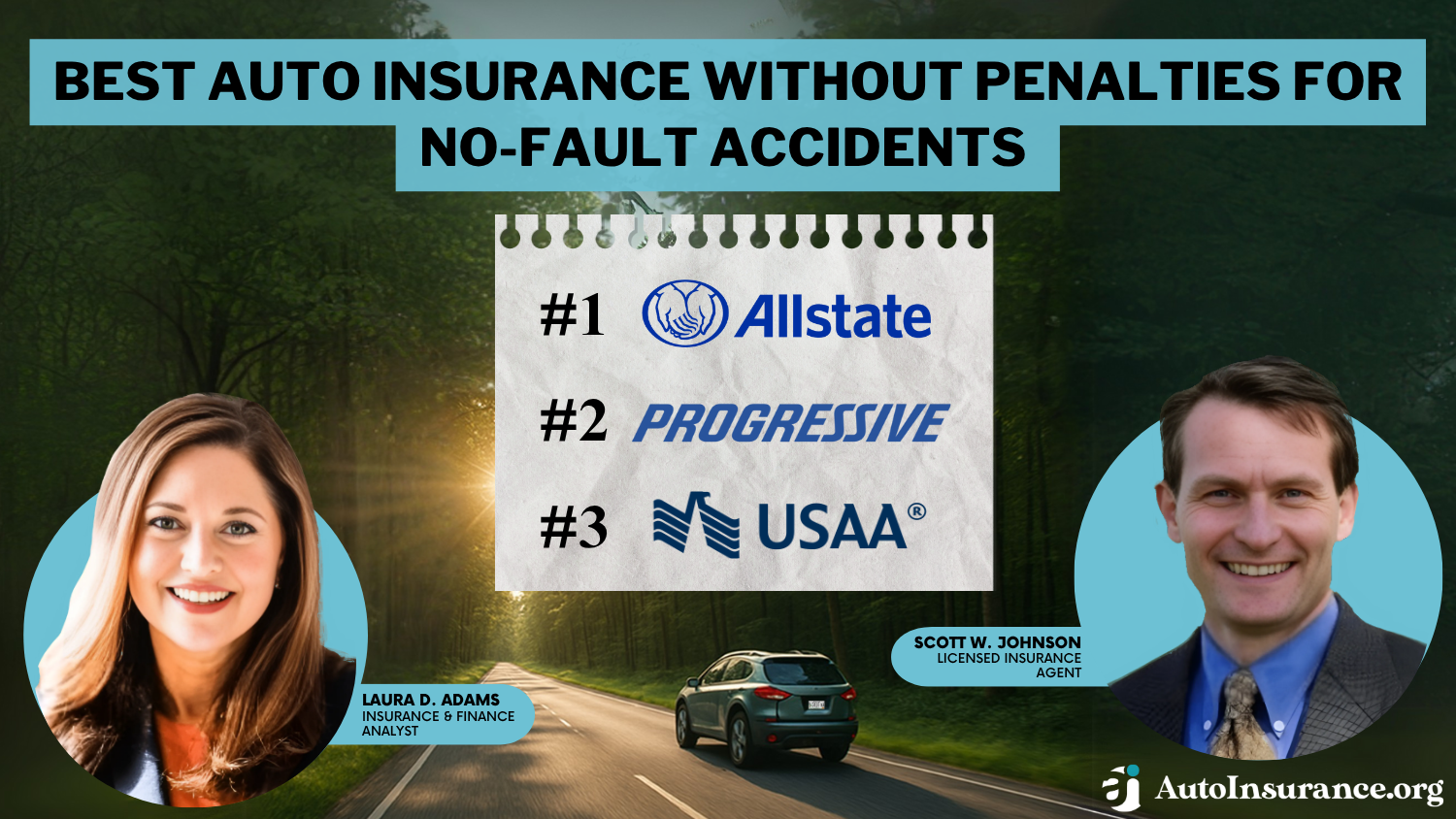

Best Auto Insurance Without Penalties for No-Fault Accidents in 2025 (Top 8 Companies Ranked)

Amica, USAA, and Geico offer the best auto insurance without penalties for no-fault accidents. These providers offer cheap no-fault insurance quotes from $150 per month and minimal to zero rate hikes after not-at-fault claims, especially for drivers with a clean driving record.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jun 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsAmica Mutual is the top pick overall, with USAA and Geico also ranking among the best auto insurance without penalties for no-fault accidents.

Our Top 8 Company Picks: Best Auto Insurance for No-Fault Accidents

| Company | Rank | Safe Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 40% | A+ | Claims Satisfaction | Allstate | |

| #2 | 34% | A+ | Budgeting Tools | Progressive | |

| #3 | 30% | A++ | Military Members | USAA | |

| #4 | 30% | A | Discount Options | Liberty Mutual |

| #5 | 25% | A+ | Dividend Payments | Amica | |

| #6 | 25% | A+ | Customer Service | Erie |

| #7 | 22% | A++ | Affordable Rates | Geico | |

| #8 | 15% | A++ | Personalized Policies | State Farm |

These providers offer affordable full coverage auto insurance, with rates starting as low as $150 per month, depending on your driving history and available discounts.

Amica stands out for its customer satisfaction, zero rate hikes after not-at-fault claims, and strong coverage options. Compare no-fault insurance quotes to find the best deal based on your location and needs.

- Compare top auto insurers with no penalties for no-fault accidents

- Avoid rate hikes after not-at-fault claims with top-rated providers

- Amica is the top pick for affordable, penalty-free, no-fault accident coverage

To find out if you can get cheap no-fault car insurance, simply enter your ZIP code into our free quote tool to quickly compare prices from various companies near you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Amica Mutual: Top Pick Overall

Pros

- Rate Stability: Amica auto insurance review shows it’s one of the best auto insurance companies without penalties for no-fault accidents, with 0% premium increases post-claim for eligible drivers.

- Financial Return: As a mutual insurer, Amica pays out dividends up to 20% of annual premiums and also offers Amica accident forgiveness, making it a standout among no-penalty providers.

- Customer Confidence: Ranked #1 in customer satisfaction by J.D. Power, this recognition aligns with positive no-fault insurance reviews, supporting its lead status for handling no-fault claims fairly.

Cons

- Higher Rates: An Amica policy comes with many perks, but it also comes at a higher price.

- Limited Availability: Most Americans are eligible for coverage from Amica, but you won’t be able to buy a policy if you live in Hawaii.

#2 – USAA: Best for Military Members

Pros

- Exclusive Forgiveness: USAA ranks among the best auto insurance companies without penalties for no-fault accidents, offering no rate hikes for first-time not-at-fault incidents.

- Military Support: Tailored for military families, USAA offers protections for deployment-related claims, making it one of the best insurance options for accidents, including those where you’re not at fault.

- Accident Forgiveness Program: The USAA auto insurance review shows it offers automatic forgiveness after five years of clean driving, even for no-fault claims.

Cons

- Eligibility Barrier: USAA isn’t available to civilians seeking the best auto insurance for people with accidents.

- Claim Restrictions: Some users report strict documentation requirements when proving not-at-fault status, which may delay resolution.

#3 – Geico: Best for Cheap Coverage

Pros

- Budget-Friendly Premiums: Geico offers affordable auto insurance for no-fault accidents, with average monthly full coverage rates starting around $150.

- Rate Stability After Incidents: Geico auto insurance review highlights that Geico often minimizes premium hikes after not-at-fault claims, preserving affordability for safe drivers.

- Nationwide Accessibility: Geico is one of the best auto insurance companies without penalties for no-fault accidents. It offers broad coverage options across all 50 states.

Cons

- Occasional Penalty Fluctuations: Despite being a top contender, Geico may still impose minor rate increases after multiple not-at-fault claims, averaging 2–4%.

- Basic Forgiveness Policy: Geico’s accident forgiveness is not automatic, making it less reliable among auto insurance companies without penalties for no-fault accidents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Personalized Service

Pros

- Zero Penalty Policy: State Farm leads among the best auto insurance companies without penalties for no-fault accidents, with a 0% premium increase.

- Policyholder Favoritism: According to our State Farm auto insurance review, drivers with clean records benefit from personalized attention and steady premiums, even after no-fault claims.

- Accident Forgiveness Advantage: State Farm’s built-in accident forgiveness makes it a top choice for those seeking no penalty for not-at-fault events.

Cons

- Not Available to All: Although it’s one of the best auto insurance companies for no-fault accidents, coverage and policies can vary significantly across no-fault insurance states and other regions.

- Slow Claims Processing: Some policyholders report claim delays, despite its no-penalty policy for no-fault claims.

#5 – Progressive: Best for Drivers on a Budget

Pros

- Snapshot Discount Advantage: Progressive rewards safe driving with usage-based savings of up to 30% with its Snapshot.

- Strong Online Tools: Recognized among the best auto insurance companies without penalties for no-fault accidents, their Name Your Price tool helps customize coverage to avoid overpaying post-claim.

- First-Claim Forgiveness: Our Progressive auto insurance review shows it’s one of the best auto insurance companies without penalties for no-fault accidents, thanks to first-incident accident forgiveness.

Cons

- Higher Rate Impact on Repeats: Despite being one of the best auto insurance companies without penalties for no-fault accidents, second claims can still cause rate hikes, even if not your fault.

- Average Penalty Presence: Progressive averages a 16% premium increase post-accident, making it less lenient among auto insurance companies without penalties for no-fault accidents.

#6 – Allstate: Best for Claims Satisfaction

Pros

- Accident Forgiveness Perk: Allstate stands out as one of the best auto insurance companies without penalties for no-fault accidents due to its accident forgiveness program, which can protect rates.

- Low Average Penalty: With just a 4% rate hike, Allstate auto insurance reviews rank it among the best auto insurance companies without penalties for no-fault accidents.

- Claim Reputation: Allstate’s smooth claims process makes it a solid pick for cheap no-fault auto insurance without penalty.

Cons

- Not Always Zero Penalty: Even though it’s one of the best auto insurance companies without penalties for no-fault accidents, minor rate increases may still apply depending on the state or claim details.

- Higher Base Rates: Allstate’s higher rates are offset by its reputation for having the best insurance for high-risk drivers with no-fault accident leniency.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Erie Insurance: Best for Customer Service

Pros

- No-Fault Premium Stability: Among the best auto insurance companies without penalties for no-fault accidents, Erie has a reputation for not increasing rates after non-fault claims.

- Customer-First Claims Handling: Known for exceptional claims satisfaction, Erie supports customers through no-fault incidents with a 90% retention rate post-claim.

- Transparent No-Fault Policies: An Erie auto insurance review highlights that the company’s policy terms clearly outline how no-fault claims are handled without penalizing drivers, helping build long-term trust.

Cons

- Limited Geographic Availability: Erie is among the top insurers with no penalties for no-fault accidents, but drivers in most states—especially those not having car insurance—can’t access its coverage.

- Fewer Digital Support Tools: While handling claims well, Erie lacks the modern digital claim-filing tools that some competitors offer for no-fault situations.

#8 – Liberty Mutual: Best for Discount Options

Pros

- Rate Forgiveness Advantage: Liberty Mutual is one of the best auto insurance companies without penalties for no-fault accidents. It offers optional accident forgiveness that prevents premium hikes.

- Bundled Savings Protection: Liberty Mutual auto insurance review shows that discount programs apply even after a no-fault accident, helping customers maintain affordability post-incident.

- Nationwide Reach: Liberty Mutual’s broad availability ensures more drivers can access no-penalty policies for no-fault accidents across the U.S.

Cons

- Forgiveness Not Standard: Despite being one of the best auto insurance companies without penalties for no-fault accidents, Liberty Mutual’s forgiveness policy requires additional purchase in many states.

- Inconsistent Rate Response: Premiums may rise after no-fault claims in states without forgiveness, making cheap car insurance for no-fault harder to maintain.

Auto Insurance Rates by Gender for No-Fault Accidents

Full coverage auto insurance monthly premiums for no-fault accidents vary by provider and gender, with Amica offering the most affordable auto insurance premiums at $150 for males and $145 for females.

Rates differ slightly by gender, but driving habits and discounts matter more. For example, using a telematics app can lower premiums for safe drivers.Jeff Root Licensed Insurance Agent

USAA follows closely, providing rates of $160 and $155, respectively, making both strong contenders among the best auto insurance companies without penalties for no-fault accidents. Geico remains competitive with rates of $170 for males and $165 for females, while State Farm offers a balance of service and affordability at $180 and $175.

Full Coverage Auto Insurance Monthly Rates for No-Fault Accidents

| Insurance Company | Male | Female |

|---|---|---|

| $200 | $195 | |

| $150 | $145 | |

| $210 | $205 |

| $170 | $165 | |

| $220 | $215 |

| $190 | $185 | |

| $180 | $175 | |

| $160 | $155 |

On the higher end, Liberty Mutual presents the most expensive rates at $220 for males and $215 for females, despite its discount programs. Erie also trends high with $210 and $205 rates, though it’s known for superior customer service.

Progressive and Allstate fall in the mid-range, with Progressive at $190/$185 and Allstate at $200/$195, though both have been noted for modest premium increases even after no-fault claims, as highlighted in many no-fault insurance explanations.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Rates by Driving Record for No-Fault Accidents

Auto insurance rates vary by provider and record, with USAA offering the lowest premiums, $84 clean, $111 post-accident, making it a top choice among the best auto insurance companies without penalties for no-fault accidents. Geico and State Farm stay affordable, while Liberty Mutual, Allstate, and Farmers see higher post-accident hikes.

Full Coverage Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 | |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 | |

| $84 | $96 | $111 | $154 |

A not-at-fault accident means you didn’t cause the crash. In no-fault states—such as those included in the list of no-fault car insurance states—like Florida and New York, you must file a claim with your own insurer. That’s why having coverage from the number one insurance company in the USA is crucial, as inadequate protection can leave you financially vulnerable.

In contrast, the 38 tort states hold the at-fault driver’s insurance responsible for damages. While drivers in no-fault states file claims with their own insurer, some tort state insurers may still raise rates or charge fees. Reviewing auto insurance for different types of drivers helps clarify how policies vary by situation.

Get Best Auto Insurance Rates With No Penalties for No-Fault Accidents

Based on rate data and policy leniency, USAA, Amica, and Geico offer the best auto insurance without penalties for no-fault accidents. USAA leads with the lowest rates, at $84 clean and $111 post-accident, followed by Amica, at $150 for males and $145 for females, and Geico, at $114 clean and $189 after an accident.

These providers offer top value with minimal rate hikes, making them ideal for drivers seeking affordable, no-penalty coverage across various types of auto insurance, including liability, collision, and comprehensive plans.

Enter your ZIP code into our free auto insurance quote comparison tool to compare rates from the top car insurance providers for no-fault accidents near you.

Frequently Asked Questions

Who pays the excess in a no-fault claim if the other driver is clearly at fault?

In most cases, even in a no-fault claim, you initially pay the excess (deductible) to your own insurer to process repairs. However, if the at-fault driver is clearly identified and their insurer accepts liability, you may be reimbursed for the excess amount after the claim is settled.

What do most no-fault plans not cover when it comes to vehicle damage?

Most no-fault insurance plans do not cover damage to your vehicle if you are at fault or even in no-fault scenarios. These policies primarily focus on personal injury protection (PIP), so you’ll need additional collision or comprehensive coverage to pay for vehicle repairs.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

If a car accident is not your fault, does your insurance go up even with accident forgiveness?

If you have accident forgiveness on your policy, your insurance typically won’t go up after a not-at-fault or even at-fault accident, at least for the first incident. However, not all companies include accident forgiveness by default, and eligibility requirements may apply.

What is the difference between fault liability and no-fault liability in auto insurance?

Fault liability means the driver who caused the accident is legally and financially responsible for damages, including medical expenses and property repair. In contrast, no fault liability allows each party to file claims with their own insurance provider, regardless of who caused the accident, typically covering personal injury through Personal Injury Protection (PIP).

How can I find Amica agents near me for personalized insurance assistance?

To compare service options like Amica auto insurance vs Geico, you can locate Amica agents near you by visiting the official Amica website and using their agent locator tool. Enter your ZIP code or city to view nearby representatives who can offer personalized support, explain policy details, and help manage claims efficiently.

What is the best insurance for someone with a bad driving record?

Top providers like State Farm, Progressive, and Geico offer cheap auto insurance for a bad driving record through competitive rates, accident forgiveness, and flexible high-risk policies, making coverage more affordable for drivers with past infractions.

Does Progressive offer accident forgiveness for a not-at-fault accident?

Progressive’s accident forgiveness program typically applies only to at-fault accidents, and generally after a qualifying period of safe driving. While the company may not penalize you as heavily for not-at-fault incidents, accident forgiveness does not automatically shield your premium from increases due to a no-fault claim unless stated in your policy.

What is the rule of no-fault liability in auto insurance?

The rule of no fault liability in auto insurance means that each driver involved in an accident must file a claim with their own insurance company, regardless of who caused the crash. This system is designed to speed up claims processing and reduce litigation by eliminating the need to prove fault in certain situations.

In a no-fault accident, who pays for vehicle repairs?

In a no-fault accident, your insurer typically covers vehicle repairs through collision auto insurance, regardless of fault. This is standard in no-fault states, where each driver’s policy handles their own damages up to the coverage limit.

What are some common no-fault accident examples?

A typical no-fault insurance example is being rear-ended at a red light or involved in a hit-and-run. In no-fault states, your own insurance covers the damages in these cases.

Can I file a claim using the Amica insurance toll-free number?

Yes, you can report a new claim or get updates on an existing one by calling Amica’s toll-free claims department at 1-800-242-6422. Claim representatives are trained to guide you through the process, including questions about accidents, property damage, or how to add no-fault insurance to your policy.

How does car insurance work when you are not at fault and the other driver is uninsured?

If the at-fault driver is uninsured, uninsured and underinsured motorist (UM/UIM) coverage can cover your damages. Without it, you may have to pay out of pocket or take legal action, which can be costly and time-consuming.

What is the best protection against uninsured drivers for vehicle repairs?

The best protection for car damage caused by an uninsured driver is a combination of uninsured motorist property damage (UMPD) and collision coverage. While UMPD covers property damage in some states, Collision Coverage applies regardless of fault and is accepted everywhere, offering broader protection.

What is the meaning of no-fault indemnity in auto insurance?

No fault indemnity in auto insurance refers to a policy where your own insurer compensates you for damages or injuries regardless of who caused the accident. This system aims to simplify claims processing, reduce legal disputes, and ensure faster payouts, especially in no-fault states that require personal injury protection (PIP) coverage.

If you are at fault in a car accident, does insurance cover the other driver’s damages?

Yes, if you have liability auto insurance coverage, it typically covers the other driver’s medical expenses and property damage up to your policy limits. However, it won’t cover your own vehicle or injuries unless you carry additional protection like collision or medical payments coverage.

Does Geico raise rates after no-fault accident claims?

Yes, Geico may raise your rates after a no-fault accident, depending on your driving history, claim frequency, and state regulations. While you’re not at fault, Geico still considers claim activity when determining risk, which can lead to modest premium increases.

Can I sue the other driver after a no-fault car accident settlement?

In most no-fault states, your ability to sue the at-fault driver is limited and depends on whether your injuries exceed a certain monetary threshold or severity threshold, such as permanent disability or significant disfigurement. If those thresholds are met, you may pursue a liability claim or lawsuit for damages not covered by your PIP, including pain and suffering.

What is the most important type of coverage in a no-fault state?

In no-fault states, personal injury protection (PIP) auto insurance is essential. It covers medical bills, lost wages, and basic services regardless of fault, providing fast financial support after an accident.

How can I retrieve my quote from Progressive if I didn’t save it?

If you started a quote with Progressive but didn’t save it, you can often retrieve it by visiting the Progressive website and selecting “Retrieve Your Quote” at the top of the homepage. You’ll need to provide identifying details such as your email address, ZIP code, or quote reference number if available.

What happens if you are not at fault in a car accident but still file a claim?

If you’re not at fault in an accident, your insurer may recover costs through subrogation. Still, the claim might appear on your record, unless you have auto insurance that doesn’t check your driving record, which helps keep your rates stable.

Does a no-fault accident affect insurance in the future, even if I wasn’t to blame?

Yes, a no-fault accident can still impact your future insurance rates, depending on your provider and state auto insurance laws. While you’re not considered at fault, some insurers may still raise your premiums due to an increased perceived risk or the cost of the claim.

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.