How Annual Mileage Affects Your Auto Insurance Rates: What You Should Know (2025)

Annual mileage affects your auto insurance rates since more time on the road equals a higher chance of getting in an accident. While an annual mileage of 7,500 miles averages $100/mo for car insurance, you'll pay around $140/mo if it's 15,000 miles. Below, we'll explain how insurance companies verify mileage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

How much does annual mileage affect car insurance? Annual mileage affects your auto insurance rates since more time driving means you’re more likely to get in an accident. For example, while a driver with 7,500 miles per year pays around $100/mo for full coverage auto insurance, you’ll average $140/mo with 15,000 miles annually.

However, you can always find cheaper auto insurance by driving less and finding an insurer with a low-mileage discount. Enter your ZIP code above to start comparing rates by annual mileage for car insurance from highly-rated insurers in your area.

- Insurers have their own auto insurance mileage tiers to determine risk and rates

- Estimate your driving needs for the upcoming year when you apply for coverage

- You may qualify for low mileage discounts or pay-as-you-go insurance

How Much Mileage Affects Insurance Rates

How does annual mileage affect car insurance? Some insurance companies want to know how many miles you will drive in the first year before extending coverage. This information is one of the factors that they use to help set insurance rates. Insurance companies extend protection, but they must calculate your potential risk.

Read More: Factors That Affect Auto Insurance Rates

What is annual mileage for car insurance? To insurers, your annual mileage is the amount you’ve driven in a certain year, which impacts your rates. As insurance is all about risk, these companies conclude that the more miles you drive in a year, the higher the potential for an accident and accompanying claim.

So, how much does mileage affect insurance? Check out the table below to see how much you could pay for coverage based on annual mileage:

Auto Insurance Monthly Rates by Mileage & Coverage Level

| Annual Mileage | Minimum Coverage | Full Coverage |

|---|---|---|

| 7,500 miles | $50 | $100 |

| 8,000 miles | $55 | $110 |

| 10,000 miles | $60 | $120 |

| 12,000 miles | $65 | $130 |

| 15,000 miles | $70 | $140 |

You may consider yourself a very safe driver, but accidents can still happen, and you can’t always account for other motorists.

Annual mileage is the number of miles you're likely to cover over 12 months, including commuting and leisure trips. Insurance companies understand that you can't predict the actual number of miles you will drive in 12 months, so they're willing to accept an estimate.Licensed Auto Insurance Agents Daniel Walker

How do insurance companies know how many miles you drive a year? Your insurance company uses various methos to determine your mileage, such as requesting an odometer reading from time to time, or through it’s telematics programs.

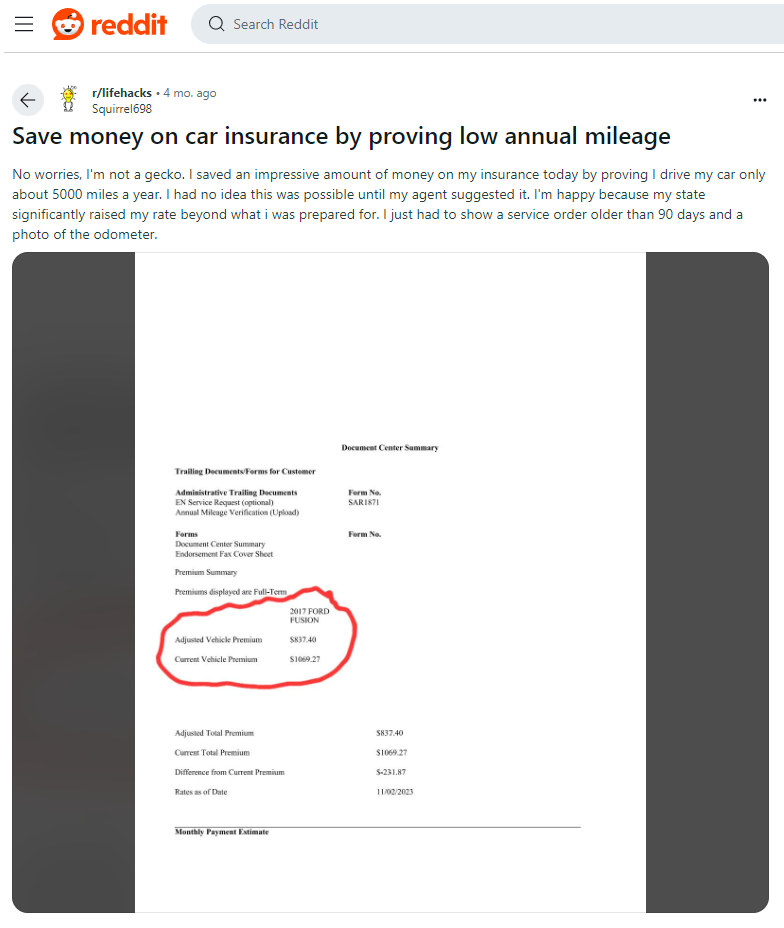

If you’re wondering how to change mileage on car insurance because you’re driving more or less than you originally though, speak with your insurance company to change the number. When researching car insurance annual mileage on Reddit, one user said they simply reported a change of mileage to their insurer and receive lower rates.

The Reddit user said they just needed to show proof of their odometer reading to get the rate adjustment.

Now that you know the answer to, “Does miles driven affect insurance?” we’ll help you estimate annual mileage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Calculate a Car Insurance Mileage Estimate

Before applying for any types of auto insurance coverage, it’s important to calculate how many miles you’ll likely drive in the next 12 months. You can base your information on the previous 12-month period and make any adjustments if you think it will change.

If you’re looking for a quick annual mileage calculator, simply multiply the amount of miles you typically drive in a week by 52 to get your estimated annual mileage.

If your driving pattern is quite consistent, you can reset your vehicle’s odometer/trip meter to zero and record your actual mileage for the next week or month to use as a guide. You can also refer to your vehicle’s service history, where the service coordinator typically records your mileage when you visit the shop.

Why You Should Never Knowingly Underestimate Mileage

What happens if you underestimate mileage for car insurance? Always be as accurate as possible when supplying estimated mileage to an insurance company. Some auto insurance policyholders may purposely underestimate their mileage to get a lower premium, but this could backfire. After all, the company could check your actual odometer reading following an accident.

They may also refer to records kept during an annual safety inspection. If insurance companies have access to a state database, they can estimate the average number of miles you drive. Should they find any anomalies, this could lead to higher premiums.

More About How Annual Mileage Affects Auto Insurance Rates

Does annual mileage affect car insurance? The number of miles you drive each year will affect the amount of money you pay for insurance coverage. Your auto insurance company may determine that the more you are on the road, the greater the risk you pose and then adjust your rate accordingly.

Consider pay-per-mile coverage if you want cheap annual mileage car insurance.

Below, you can see which companies offer a low annual mileage insurance discount:

Low Mileage Auto Insurance Discounts by Provider

| Insurance Company | Discount Percentage |

|---|---|

| 21st Century | 30% |

| AAA | 20% |

| Allstate | 30% |

| American Family | 25% |

| Ameriprise | 10% |

| Amica | 5% |

| Country Financial | 20% |

| Esurance | 25% |

| Farmers | 10% |

| Geico | 15% |

| Liberty Mutual | 10% |

| MetLife | 20% |

| Nationwide | 10% |

| Progressive | 31% |

| Safe Auto | 15% |

| Safeco | 20% |

| State Farm | 30% |

| The General | 25% |

| The Hanover | 10% |

| The Hartford | 10% |

| Travelers | 20% |

| USAA | 20% |

Read More: Cheap Auto Insurance for Infrequent Drivers

Paying for car🚗 insurance all the time when you only drive some of the time doesn't always make sense. https://t.co/27f1xf131D has a possible solution💡 for you: Pay-as-you-go coverage. Find out more here👉: https://t.co/Giu8rLtTaE pic.twitter.com/peyu2RtyJB

— AutoInsurance.org (@AutoInsurance) October 4, 2023

Now that you know the answer to, “Does a higher or lower odometer have more insurance costs?” you should do your best to estimate your car insurance annual mileage as accurately as possible. Enter your ZIP code to instantly compare rates for car insurance based on mileage if you don’t drive often.

Frequently Asked Questions

Does annual mileage impact car insurance?

A top question readers ask is, “Does mileage impact car insurance?” Yes, the number of miles you drive in a year can affect your auto insurance rates. Insurance companies often consider annual mileage as one of the factors when determining the cost of your car insurance policy.

What does annual mileage mean on car insurance? Annual mileage is the amount you’ve driven in a particular year, which companies use to set your rates.

How does mileage affect car insurance?

You might be wondering how mileage affects car insurance. The impact of annual mileage on auto insurance rates varies among insurance providers. Generally, the more miles you drive in a year, the higher the risk of being involved in accidents or experiencing damages, which can result in higher insurance premiums. However, companies may have different thresholds for high mileage car insurance or pricing tiers that can affect the rate increase.

What is the best annual mileage for insurance?

The specific mileage threshold that providers prefer varies by company. Some providers have predefined car insurance mileage brackets that influence premiums, such as 0-7,500 miles, 7,501-10,000 miles, or 10,001-15,000 miles per year. These thresholds may differ, so it’s best to check with your insurance company for their specific guidelines on how car insurance by mileage works.

Do insurers check mileage?

You may be wondering, “How do insurance companies check mileage?” Insurance companies typically rely on several methods to determine your annual mileage. These methods may include self-reporting, where you estimate your mileage when obtaining a quote or renewing your policy. Some insurers may also use telematics devices or smartphone apps to track your driving habits and calculate your mileage accurately.

What if my annual mileage changes during the policy term?

If your annual mileage changes significantly during your policy term, it’s important to notify your insurance company. Adjusting your mileage estimate can help ensure your policy accurately reflects your driving habits. Failing to update your mileage could result in potential issues, such as claim disputes or policy cancellation.

Are there any insurance discounts available for low mileage drivers?

Yes, many insurance companies offer discounts for low mileage drivers. These discounts are often known as “low mileage discounts” or “usage-based insurance.” If you drive fewer miles than the average driver, you may qualify for a reduced premium. The eligibility criteria and discount amounts may vary, so it’s advisable to inquire with your insurance provider about any available discounts.

Can you pay for insurance based on usage?

Some companies may offer a policy based on payment per mile. In other words, your premiums will be based on usage with a smaller base rate every month and an adjustment for the number of miles that you drive. Compare your options to see if this type of policy would work for you.

Enter your ZIP code into our free quote comparison tool below to find cheap low-mileage car insurance from the top providers near you.

What happens if you do more miles than you say on insurance?

Will my insurance go up if I drive more miles? Some insurance companies may increase rates if your annual mileage increases. You could also face policy cancellation from providers with strict mileage limits.

What is considered low-mileage for car insurance?

Many readers are asking, “How many miles a year for cheaper insurance?” Usually, insurers consider low mileage to be anywhere between 7,500 and 10,000 miles per year. Learn more about how to get a low mileage auto insurance discount from the top providers of low-mileage insurance.

Does low annual milieage affect car insurance rates? Yes, you’ll generally pay lower rates if you have low annual mileage.

How do I calculate annual mileage for insurance?

To calculate your annual mileage, write down your odometer reading at the beginning and the end of your policy term. Then, subtract your first reading from the second one to get an estimate for annual mileage on a car.

How do I change mileage for car insurance?

Contact your insurance provider to see how you should report any mileage changes.

What is annual mileage?

You might be wondering, “What does annual mileage mean?” The annual mileage meaning is the total distance a car traveled within a given year.

Do you need current car mileage for car insurance?

You might ask, “Do you need mileage to get car insurance?” Generally, your insurer won’t need your car’s current mileage, but they’ll likely ask you to estimate your annual mileage.

Is my insurance void if I go over mileage?

Generally, your car insurance policy won’t be void if you exceed your estimated mileage. However, you could see higher rates when your policy renews.

Is car insurance more expensive with more miles?

Does annual mileage affect insurance premiums if I drive a lot? Yes, you’ll pay higher auto insurance rates the more miles you drive annually.

Does how much you drive impact car insurance with Progressive?

Yes, Progressive considers how often you drive when setting rates. Progressive car insurance mileage brackets show that drivers with lower than 7,500 annual miles can save 23% on their rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.