Best Phoenix, Arizona Auto Insurance in 2025 (Compare the Top 10 Companies)

State Farm, Farmers, and Erie offer the best Phoenix, Arizona auto insurance, with rates at $50 per month. Farmers mainly highlight its budget-friendly option. By comparing rates from these companies, you can secure the most affordable and comprehensive coverage for your specific needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Oct 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Phoenix AZ

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Phoenix AZ

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Phoenix AZ

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsExplore the best Phoenix, Arizona auto insurance providers like State Farm, Farmers, and Erie, with a competitive rate of $50 per month.

Finding the cheapest auto insurance companies in Phoenix can seem like a difficult task, but all of the information you need is right here.

Our Top 10 Company Picks: Best Phoenix, Arizona Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 14% | B | Many Discounts | State Farm | |

| #2 | 17% | A | Local Agents | Farmers | |

| #3 | 13% | A+ | 24/7 Support | Erie |

| #4 | 16% | A++ | Accident Forgiveness | Travelers | |

| #5 | 12% | A | Online App | AAA |

| #6 | 19% | A+ | Innovative Programs | Progressive | |

| #7 | 15% | A++ | Military Savings | USAA | |

| #8 | 18% | A+ | Add-on Coverages | Allstate | |

| #9 | 11% | A++ | Custom Plan | Geico | |

| #10 | 10% | A+ | Usage Discount | Nationwide |

Remember to inquire about available discounts. Many companies offer savings for safe driving, bundling policies, or having specific safety features in your vehicle.

Before purchasing auto insurance in Phoenix, Arizona, compare rates from various companies. You can enter your ZIP code above to receive free auto insurance quotes.

- Compare top providers for the best Phoenix, Arizona auto insurance

- Get full coverage or minimum liability options tailored to Phoenix drivers

- State Farm stands out with competitive rates and top customer satisfaction

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm offers a variety of discounts, including a 14% bundling discount, making it a strong contender for auto insurance.

- Extensive Agent Network: With a large number of local agents, State Farm provides personalized service and support. Check out “State Farm Auto Insurance Review” to know more.

- Customizable Coverage Options: Offers various coverage options and additional features tailored to individual needs.

Cons

- Higher Premiums for High-Risk Drivers: Rates may be higher for drivers with specific risk factors, which could affect its suitability.

- Inconsistent Customer Service: Service quality can vary depending on the local agent, potentially impacting overall satisfaction.

#2 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers have a strong network of local agents, which is beneficial for those seeking the best auto insurance with personalized service. Their A A.M. Best rating reflects financial strength.

- Custom Coverage Options: Provides various specialized policies, such as classic car insurance, tailored to diverse needs. Discover more at “Farmers Auto Insurance Review.”

- Multiple Discounts: Offers several discounts for bundling and maintaining a good driving record, contributing to its appeal.

Cons

- Potentially Higher Premiums: Insurance rates can be higher than those of some competitors, impacting its status as the best option for cost-conscious drivers.

- Mixed Reviews on Claims Handling: Some customers report delays or issues with claims processing, which could affect its reputation as the best Phoenix, Arizona auto insurance.

#3 – Erie: Best for 24/7 Support

Pros

- 24/7 Support: Erie offers around-the-clock customer support, making it a reliable option for the best auto insurance. Their A+ A.M. Best rating ensures financial stability.

- Affordable Rates: Known for competitive pricing and up to 13% off for bundling policies, Erie is a strong contender for the best auto insurance in Phoenix, Arizona.

- High Customer Satisfaction: High ratings for customer service and claims handling enhance its appeal. Learn more about high customer satisfaction at “Erie Auto Insurance Review.”

Cons

- Limited Availability: Erie’s coverage may not be available in all states, which could limit its effectiveness as the best Phoenix, Arizona auto insurance for some drivers.

- Fewer Discount Options: Compared to some competitors, Erie may offer fewer discount opportunities, which could potentially affect its appeal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness, which can be a significant benefit if you have a clean driving record. Discover more at “Travelers Auto Insurance Review.”

- Substantial Discounts: Up to 16% off for bundling multiple policies makes Travelers a competitive option, especially for those who need various types of coverage.

- High Financial Stability: The A++ A.M. Best rating signifies Travelers’ financial solid stability, assuring that they can handle claims effectively, making them a top pick.

Cons

- Limited Coverage for High-Risk Drivers: Travelers may not offer as many options for high-risk drivers, potentially affecting its suitability.

- Higher Rates for Certain Drivers: Premiums may be higher for drivers with specific risk factors, which could make Travelers less ideal.

#5 – AAA: Best for Online App

Pros

- Member Benefits: AAA offers exclusive perks for members, including roadside assistance and travel discounts, making it a top option. Their A A.M. Best rating supports financial reliability.

- Online App: Features a convenient online app for managing policies and accessing benefits, enhancing its appeal.

- Robust Customer Support: Known for dependable customer service, particularly in emergency situations, which contributes to its reputation.

Cons

- Higher Rates for Some Drivers: The company’s insurance rates may be higher than those of some competitors, which could impact its status as the best Phoenix, Arizona auto insurance for all drivers.

- Limited Coverage: AAA’s insurance may not be available in all regions, potentially affecting its effectiveness. Read more about limited coverage at “AAA Auto Insurance Review.”

#6 – Progressive: Best for Innovative Programs

Pros

- Innovative Programs: Progressive’s Snapshot program rewards safe driving with discounts, making it a top choice for low-risk drivers. Their A+ A.M. Best rating supports their financial reliability.

- Wide Range of Discounts: Offers up to 19% off for bundling policies and participating in innovative programs, enhancing its appeal. Discover more discounts at “Progressive Auto Insurance Review.”

- User-Friendly Online Tools: Provides a convenient website and mobile app for managing policies and claims, making it an accessible choice for the best auto insurance in Phoenix, Arizona.

Cons

- Variable Customer Service: Customer service experiences can differ, with some users reporting issues that might affect the company’s reputation.

- Higher Rates for Some Drivers: Premiums may be higher for drivers with specific risk factors, potentially limiting its effectiveness.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers special discounts and benefits for military members and their families, making it a top choice. The A++ A.M. Best rating supports their financial stability.

- Comprehensive Coverage Options: This plan includes features like roadside assistance and rental car reimbursement, which contribute to its reputation for military families.

- Competitive Multi-Policy Discounts: Offers up to 15% off for bundling policies, making it a valuable option for those seeking the best Phoenix, Arizona auto insurance and significant savings.

Cons

- Eligibility Restrictions: USAA insurance is only available to military families, which limits its accessibility and could affect its status. Read “USAA Auto Insurance Review” to know more.

- Limited Local Agents: Fewer physical locations may be inconvenient for those who prefer face-to-face interactions, potentially impacting its effectiveness.

#8 – Allstate: Best for Add-on Coverages

Pros

- Add-On Coverages: Allstate offers various add-on coverages, such as accident forgiveness and new car replacements. Learn more by reading our article “Allstate Auto Insurance Review.”

- Generous Multi-Policy Discounts: With up to 18% off for bundling policies, Allstate provides significant savings, positioning itself as one of the best auto insurance providers.

- High Financial Stability: An A+ A.M. Best rating highlights Allstate’s financial health, which is crucial for ensuring reliable claims handling.

Cons

- Higher Premiums: Compared to some competitors, Allstate’s premiums can be higher, which may affect its status as the best auto insurance option for budget-conscious drivers.

- Mixed Customer Service Reviews: Some users report inconsistent customer service experiences, which could impact overall satisfaction.

#9 – Geico: Best for Custom Plan

Pros

- Custom Plan: Geico offers customizable insurance plans to fit individual needs. Their A++ A.M. Best rating supports financial stability.

- Low Rates: Geico is an affordable choice for auto insurance. It is known for competitive pricing and offers up to 11% off when bundling policies.

- Wide Range of Discounts: Provides various discounts for safe driving, military members, and bundling, enhancing its appeal. To know more about discounts, check out “Geico Auto Insurance Review.”

Cons

- Customer Service Variability: Experiences with customer service can vary, with some users reporting issues, which may affect its reputation as the best Phoenix, Arizona auto insurance.

- Limited Coverage Options: Geico’s range of coverage options may be less comprehensive than some other providers’, potentially limiting its effectiveness.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide offers discounts based on mileage, making it a great option. Their A+ A.M. Best rating supports their financial stability.

- Customizable Policies: Provides various policy options, including unique add-ons, to suit individual needs. Know more about customizable policies at “Nationwide Auto Insurance Review.”

- Competitive Discounts: Offers up to 10% off for bundling policies, which is beneficial for those looking for the best Phoenix, Arizona auto insurance with multiple coverage options.

Cons

- Higher Premiums for Some Drivers: Depending on your driving history, Nationwide’s premiums can be higher, which may impact its status.

- Limited Coverage in Some Areas: Nationwide’s coverage options might not be as comprehensive in all regions, potentially affecting its effectiveness.

Cheap Phoenix, Arizona Auto Insurance by Age and Gender

Phoenix, Arizona, auto insurance laws mandate that you maintain at least the Arizona minimum auto insurance to meet your financial responsibilities in the event of an accident. Understanding car insurance requirements is crucial for ensuring you comply with legal standards and avoid penalties.

Phoenix, Arizona Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $59 | $125 |

| $61 | $113 | |

| $62 | $117 |

| $50 | $119 | |

| $61 | $118 | |

| $56 | $120 |

| $53 | $123 | |

| $56 | $114 | |

| $54 | $111 | |

| $58 | $116 |

Auto insurance rates in Phoenix, Arizona, are affected by age and gender. See how demographics impact the monthly cost of insurance. Additionally, factors such as driving history and vehicle type also play a significant role in determining your premium.

This coverage ensures that you are protected against potential liabilities and damages resulting from accidents. Make sure you review the required auto insurance limits in Phoenix, Arizona, to ensure compliance and avoid any legal issues.

Phoenix, Arizona Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $789 | $1,016 | $410 | $445 | $368 | $368 | $359 | $359 | |

| $721 | $943 | $272 | $318 | $272 | $272 | $250 | $250 | |

| $1,286 | $1,337 | $329 | $339 | $291 | $291 | $258 | $275 | |

| $469 | $491 | $147 | $144 | $162 | $181 | $138 | $178 | |

| $642 | $824 | $295 | $320 | $255 | $259 | $227 | $241 |

| $844 | $940 | $218 | $215 | $204 | $177 | $183 | $174 |

| $990 | $1,245 | $338 | $428 | $314 | $314 | $278 | $278 | |

| $597 | $754 | $212 | $223 | $200 | $211 | $186 | $198 | |

| $592 | $678 | $205 | $219 | $155 | $155 | $144 | $146 |

Consider reviewing additional coverage options to enhance your protection and ensure you’re adequately covered beyond the minimum requirements.

Cheap Phoenix, Arizona Auto Insurance for Teen Drivers

Finding cheap teen auto insurance in Phoenix, Arizona, can be particularly challenging due to higher risk factors associated with younger drivers.

Phoenix, Arizona Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| $789 | $1,016 | |

| $721 | $943 | |

| $1,286 | $1,337 | |

| $469 | $491 | |

| $642 | $824 |

| $844 | $940 |

| $990 | $1,245 | |

| $597 | $754 | |

| $592 | $678 |

The monthly teen auto insurance rates in Phoenix, Arizona, often reflect these risks, making it essential to compare options and look for potential discounts. Exploring various insurance providers and their offerings can help you find the most affordable rates for teen drivers.

Cheap Phoenix, Arizona Auto Insurance by Driving Record

Your driving record is a crucial factor in determining your auto insurance rates. A poor driving record can lead to substantially higher premiums while maintaining a clean driving history generally results in lower rates.

Phoenix, Arizona Auto Insurance Discounts by Provider

| Insurance Company | Discount Percentage | Discount Program |

|---|---|---|

| 12% | Anti-Theft Discount |

| 9% | Early Signing Discount | |

| 15% | Multi-Policy Discount |

| 10% | Good Student Discount | |

| 16% | Defensive Driving Discount | |

| 14% | Accident-Free Discount |

| 17% | Pay-in-Full Discount | |

| 13% | Safe Driver Discount | |

| 11% | Homeowners Discount | |

| 18% | Military Service Discount |

To better understand how your driving record affects your premiums, compare the monthly auto insurance rates for those with a bad record versus those with a clean record in Phoenix, Arizona.

Phoenix, Arizona Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $412 | $522 | $590 | $533 | |

| $294 | $449 | $566 | $341 | |

| $465 | $601 | $587 | $550 | |

| $184 | $250 | $337 | $184 | |

| $323 | $340 | $507 | $362 |

| $325 | $430 | $344 | $379 | |

| $475 | $571 | $523 | $523 | |

| $257 | $336 | $376 | $321 | |

| $208 | $299 | $394 | $245 |

This comparison will highlight how crucial it is to keep a clean driving record to potentially lower your insurance costs. To get started, enter your ZIP code below to compare full coverage auto insurance rates.

Phoenix, Arizona Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 45,000 |

| Total Claims Per Year | 35,000 |

| Average Claim Size | $5,800 |

| Percentage of Uninsured Drivers | 12% |

| Vehicle Theft Rate | 8,500 thefts/year |

| Traffic Density | High |

| Weather-Related Incidents | Low |

A history free from accidents and violations signals to insurers that you are a lower risk, which can lead to more favorable rates. Additionally, maintaining a clean record not only helps with current premiums but can also position you for better rates in the future.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Phoenix, Arizona Auto Insurance by Credit History

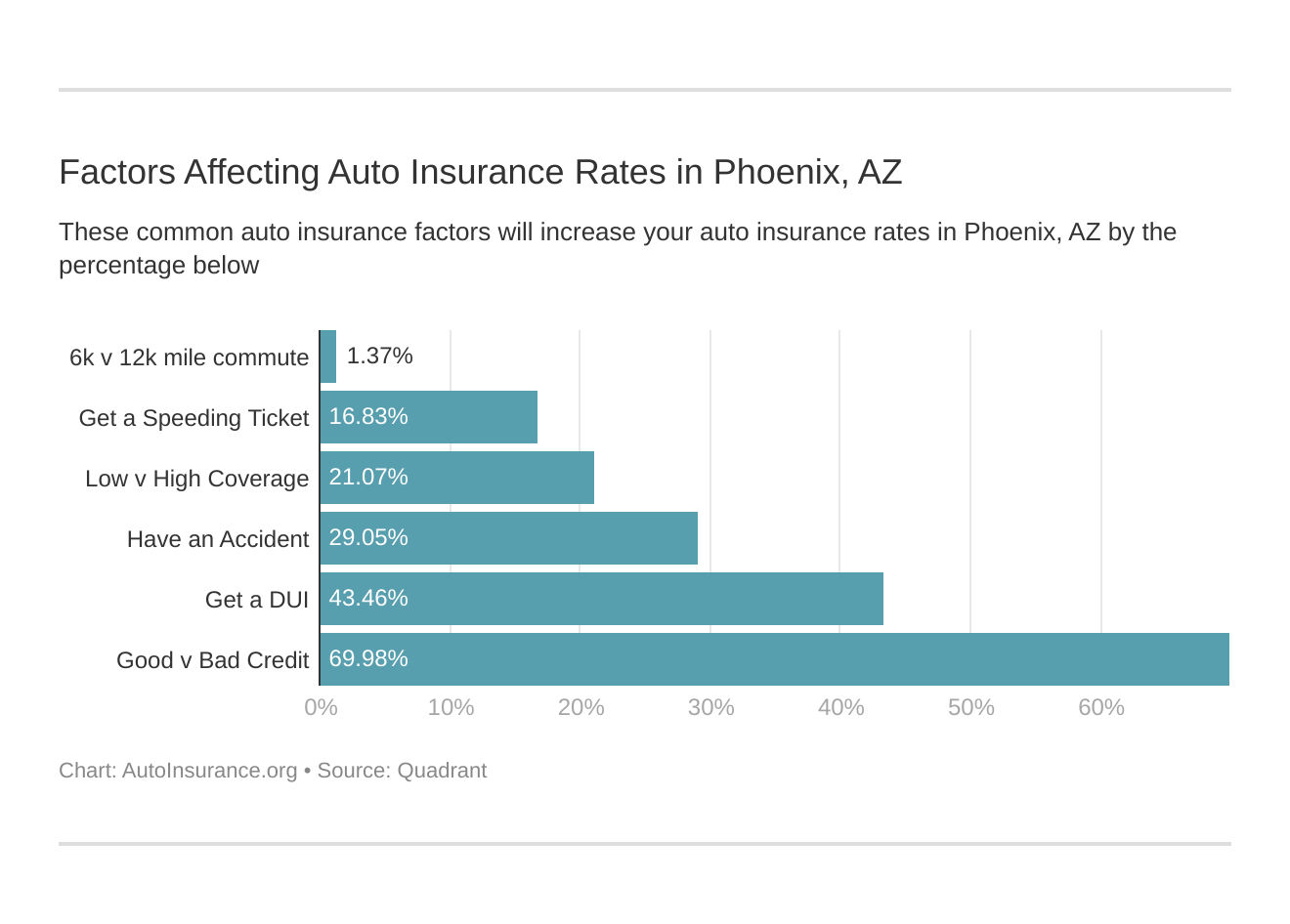

Credit history is a significant determinant of the cost of auto insurance, particularly for high-risk auto insurance. Insurance companies often use credit scores to assess risk, and poor credit history can potentially lead to higher premiums.

This can be especially important for high-risk drivers, who may face steeper rates due to their credit profiles. To understand how your credit history influences your rates, compare the monthly auto insurance rates in Phoenix, Arizona, by credit history.

Phoenix, Arizona Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| $656 | $468 | $419 | |

| $518 | $386 | $333 | |

| $626 | $526 | $500 | |

| $329 | $215 | $172 | |

| $462 | $367 | $320 |

| $413 | $360 | $336 | |

| $964 | $373 | $233 | |

| $393 | $320 | $255 | |

| $377 | $264 | $220 |

This comparison will illuminate how varying credit scores can affect high-risk auto insurance premiums and help you make informed decisions about managing your credit to potentially lower your insurance costs.

Cheap Phoenix, Arizona Auto Insurance Rates by ZIP Code

Quoting auto insurance rates by ZIP code in Phoenix, Arizona, can fluctuate based on ZIP code due to differences in risk factors, such as crime rates, traffic patterns, and accident frequencies.

Comparing the monthly cost of auto insurance by ZIP code in Phoenix will help you understand how these geographical variables impact your premiums.

Phoenix, Arizona Auto Insurance Monthly Rates by ZIP Code

| ZIP Code | Rates |

|---|---|

| 85003 | $413 |

| 85004 | $416 |

| 85006 | $421 |

| 85007 | $415 |

| 85008 | $399 |

| 85009 | $453 |

| 85012 | $416 |

| 85013 | $418 |

| 85014 | $401 |

| 85015 | $430 |

| 85016 | $393 |

| 85017 | $450 |

| 85018 | $385 |

| 85019 | $444 |

| 85020 | $402 |

| 85021 | $423 |

| 85022 | $379 |

| 85023 | $396 |

| 85024 | $374 |

| 85025 | $413 |

| 85026 | $395 |

| 85027 | $367 |

| 85028 | $373 |

| 85029 | $413 |

| 85031 | $442 |

| 85032 | $380 |

| 85033 | $432 |

| 85034 | $420 |

| 85035 | $432 |

| 85037 | $396 |

| 85039 | $375 |

| 85040 | $424 |

| 85041 | $423 |

| 85042 | $404 |

| 85043 | $417 |

| 85044 | $348 |

| 85045 | $350 |

| 85048 | $345 |

| 85050 | $362 |

| 85051 | $426 |

| 85053 | $391 |

| 85054 | $367 |

| 85065 | $390 |

| 85073 | $399 |

| 85083 | $357 |

| 85085 | $344 |

| 85086 | $338 |

| 85087 | $341 |

| 85097 | $372 |

By examining this data, you can find the most affordable insurance options available in your specific area and make informed decisions to potentially reduce your overall insurance costs.

Phoenix, Arizona Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A- | Low weather impact |

| Average Claim Size | B+ | Above-average claims |

| Vehicle Theft Rate | B | High theft rate |

| Traffic Density | C+ | Moderate congestion |

| Uninsured Drivers Rate | C | High uninsured rate |

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Cheap Phoenix, Arizona Auto Insurance Rates by Commute

Data collected from the Federal Highway Administration reveals that licensed Arizona residents racked up an average of 12,829 miles on the road in 2014 alone. Even with this number, drivers in the Valley of the Sun actually spend less time in traffic than some of the other major cities across the United States.

Take a look at the tables below to see how your commute in Phoenix might be impacting the price you are paying for car insurance. Whether your daily drive is short or long, insurance companies factor in the time you spend on the road when determining your premium.

Phoenix, Arizona Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $514 | $514 | |

| $408 | $416 | |

| $551 | $551 | |

| $235 | $243 | |

| $383 | $383 |

| $370 | $370 | |

| $510 | $537 | |

| $323 | $323 | |

| $284 | $290 |

The differences in prices between commute rates may not seem like much in the Valley of the Sun, but stretching your dollar certainly does, no matter where you live.

Even a slight reduction in rates can add up over time, so it’s worth reviewing how your driving patterns affect your insurance costs. Consider adjusting your commute or exploring other options to help save on your monthly premium.

If you’re wondering, “Where can I compare auto insurance rates?.” Online comparison tools are an excellent resource for finding the best deals and determining how different factors, like driving habits, impact your rates.

Increased traffic incidents from more cars on the road can lead to higher rates, so comparing coverage and rates across various car insurance providers could help you save money.Ty Stewart Licensed Insurance Agent

Additionally, inquire about discounts for low-mileage drivers or carpooling, as these can further lower your costs and help you get the most value for your money.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Frequently Asked Questions

Are there any specific insurance requirements for drivers in Phoenix, AZ?

Yes, drivers in Phoenix, AZ, are required to carry proof of insurance with them while driving in addition to carrying the minimum liability insurance coverage. Failure to provide proof of insurance when requested by law enforcement can result in penalties.

Can I use my out-of-state auto insurance in Phoenix, AZ?

If you have recently moved to Phoenix, AZ, you will generally need to obtain auto insurance coverage that meets the state’s requirements.

While some out-of-state policies may offer temporary coverage in Arizona, it is advisable to contact your insurance provider and update your policy to comply with Arizona regulations.

Enter your ZIP code into our free auto insurance quote comparison tool below to protect your vehicle at the best prices.

Does my credit score affect my auto insurance rates in Phoenix, AZ?

Yes, in Phoenix, AZ, like many other states, your credit score can influence your auto insurance rates. Insurance companies often use credit-based insurance scores as one factor in determining premiums.

Maintaining a good credit score may help you secure more favorable rates. Additionally, if you have traffic violations, you might wonder, “How long does a speeding ticket affect auto insurance rates?.”

In most cases, a speeding ticket can impact your rates for 3-5 years, so it’s essential to maintain both a good credit score and a clean driving record for the best rates.

What happens if my auto insurance lapses in Phoenix, AZ?

Allowing your auto insurance to lapse in Phoenix, AZ, can lead to various consequences. If caught driving without insurance, you may face penalties such as fines, license suspension, and vehicle impoundment.

Additionally, a lapse in coverage can result in higher insurance rates when you reinstate or obtain new coverage.

Can I exclude a household member from my auto insurance policy in Phoenix, AZ?

Yes, you may be able to exclude a household member from your auto insurance policy in Phoenix, AZ. However, it’s important to note that if the excluded person drives your insured vehicle and gets into an accident, your insurance may not provide coverage for the damages.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Are there any discounts available for auto insurance in Phoenix, AZ?

Yes, insurance companies often offer various discounts to policyholders in Phoenix, AZ. These discounts can include safe driver discounts, multi-policy discounts (bundling auto and home insurance, for example), good student discounts, and discounts for certain safety features installed in your vehicle.

It’s recommended to inquire about available discounts when obtaining quotes from insurance providers. Many of the cheapest auto insurance companies offer discounts for safe driving, bundling policies, or having anti-theft devices, which can significantly lower your overall premium.

What factors affect my auto insurance premium?

Several factors influence your auto insurance premium, including your driving history, the type of vehicle you drive, your location, your age, and the level of coverage you choose.

Insurance companies also consider your credit score and any discounts you may qualify for, such as bundling multiple policies or having a clean driving record.

How can I find the best auto insurance provider for my needs?

To find the best auto insurance provider, compare coverage options, rates, and customer service reviews across multiple companies. Consider factors such as financial stability (A.M. Best ratings), available discounts, and specific needs like accident forgiveness or roadside assistance.

Using online tools and speaking with insurance agents can also help you make an informed decision. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

What is the difference between liability, collision, and comprehensive coverage?

When choosing auto insurance, it’s essential to understand the critical types of coverage available to protect yourself and your vehicle. Here are the main coverage options:

- Liability Coverage: Covers damages and injuries to others if you are at fault in an accident. It does not cover your own vehicle or injuries.

- Collision Coverage: Pays for repairs to your vehicle after an accident, regardless of who is at fault.

- Comprehensive Coverage: This covers damages to your vehicle from non-collision incidents, such as theft, vandalism, natural disasters, or hitting an animal.

When selecting the right coverage, it’s essential to balance protection with affordability based on your needs.

Additionally, understanding average auto insurance rates by age can help you anticipate how much you’ll pay, as rates often vary significantly depending on your age group and driving experience.

Are there discounts available for auto insurance, and how can I qualify?

Yes, many auto insurance providers offer various discounts. Standard discounts include multi-policy discounts (for bundling auto with home or other insurance), safe driver discounts, low mileage discounts, and discounts for having certain safety features in your vehicle.

Check with your insurance provider to see what discounts are available and how you can qualify for them.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.