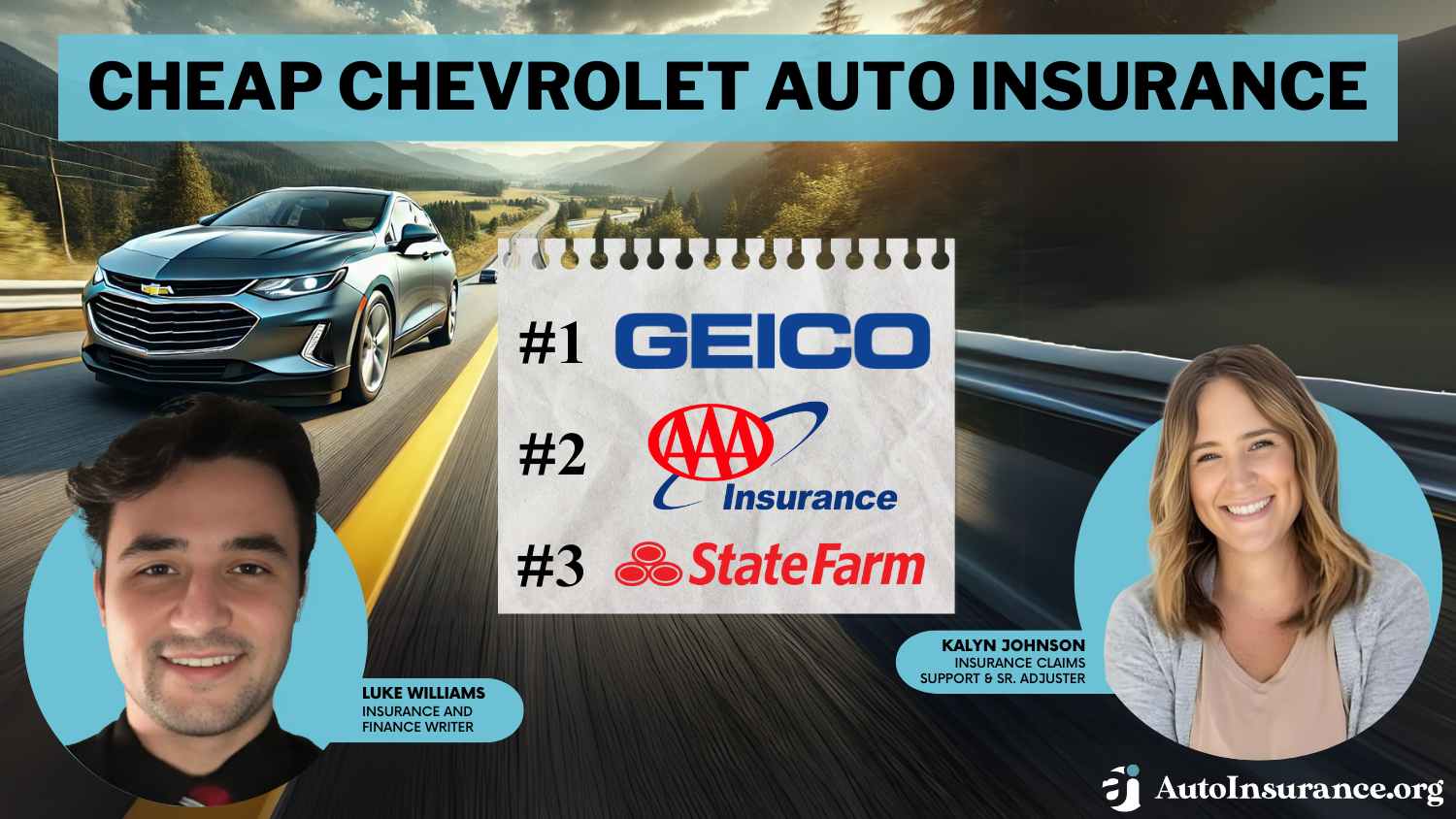

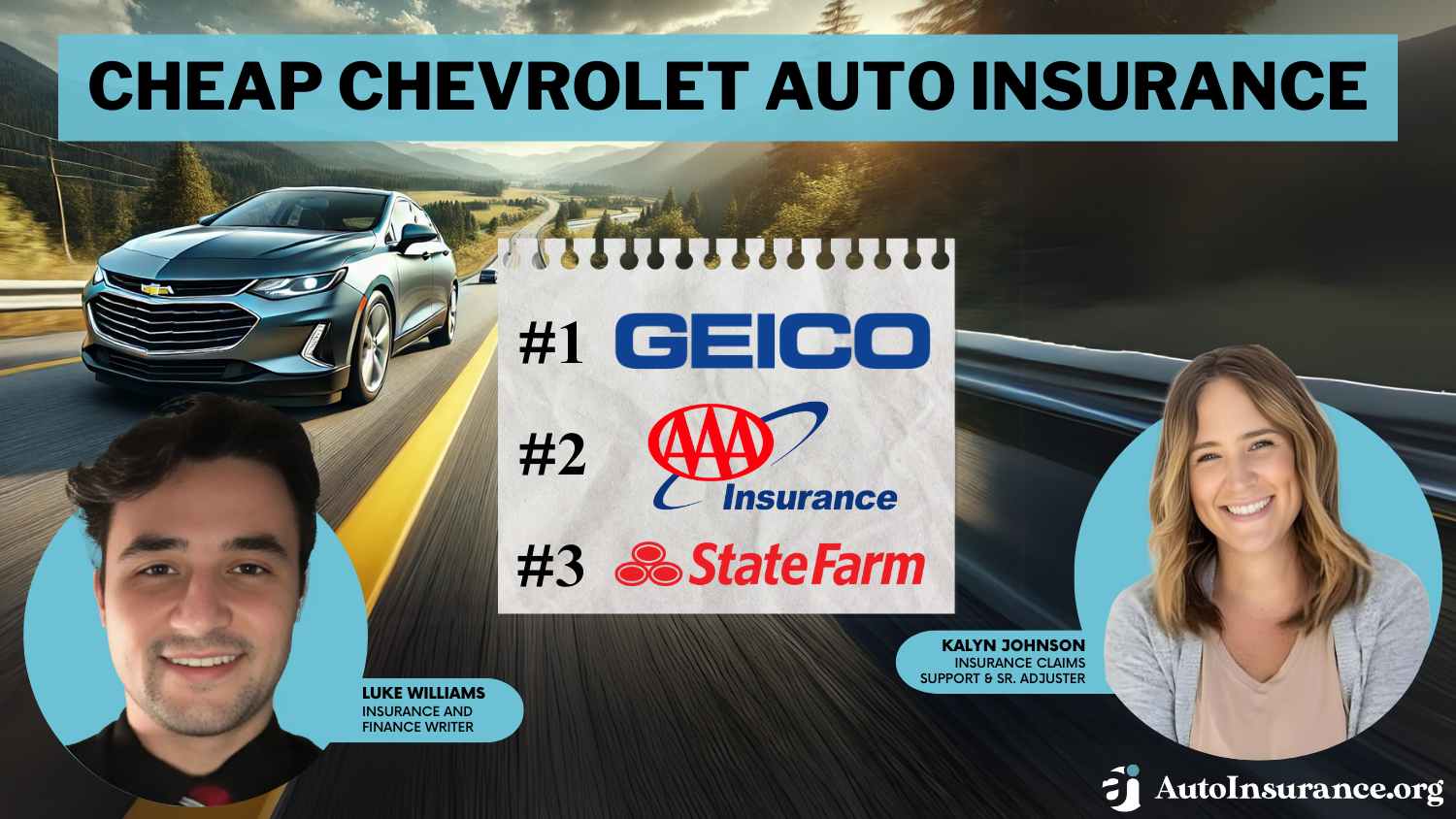

Cheap Chevrolet Auto Insurance in 2025 (Find Savings With These 10 Companies!)

Geico, AAA, and State Farm are the top picks for cheap Chevrolet auto insurance. Geico has the cheapest Chevrolet insurance rates, as minimum coverage is an average of $30/mo. Rates do vary by model, however. For example, Chevrolet Colorado car insurance will be cheaper than Chevrolet Volt car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: May 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Chevrolet

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Chevrolet

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Chevrolet

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top choices for cheap Chevrolet auto insurance are Geico, AAA, and State Farm.

You must carry Chevrolet auto insurance to drive legally, according to most state minimum auto insurance requirements.

Our Top 10 Company Picks: Cheap Chevrolet Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $30 | A++ | Online Convenience | Geico | |

| #2 | $32 | A | Roadside Assistance | AAA |

| #3 | $33 | A++ | Personalized Service | State Farm | |

| #4 | $37 | A+ | Business-Use Coverage | Travelers | |

| #5 | $39 | A | Loyalty Discounts | Progressive | |

| #6 | $43 | A+ | Accident Forgiveness | American Family | |

| #7 | $44 | A | Vanishing Deductible | Nationwide |

| #8 | $53 | A | Safety Discounts | Farmers | |

| #9 | $61 | A+ | Pay-Per-Mile Rates | Allstate | |

| #10 | $68 | A | 24/7 Support | Liberty Mutual |

On average, you’ll pay $144 monthly for full coverage on a Chevrolet, but rates vary based on the model, driving characteristics, insurance company, and more.

Read on to learn more about Chevrolet auto insurance coverage and find the best Chevrolet car insurance company for you. You can also compare Chevrolet insurance quotes now using our free tool.

- Geico has the cheapest Chevrolet car insurance rates

- The most expensive models are the Chevrolet Silverado and Chevrolet Corvette

- Drivers with clean driving records have more affordable Chevrolet insurance rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Online Convenience: Make quick policy changes with Geico’s app or website.

- Affordable Rates: Whether you are shopping for Chevrolet Avalanche car insurance or Chevrolet Captiva sport car insurance, Gieco will likely have the cheapest rates.

- Discount Options: Chevrolet owners can apply for good driver discounts and more at Geico. Read more about discounts in our Geico review.

Cons

- In-Person Service: Most customer service is conducted virtually.

- Discount Availability: A few discounts are limited based on location.

#2 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: If you have a Chevrolet that frequently breaks down, AAA is a great choice.

- Multi-Policy Discounts: Buying home or renters insurance in addition to auto insurance can reduce rates.

- Customizable Coverage: Learn about AAA’s customizable coverages in our AAA auto insurance review.

Cons

- Membership Fee: AAA requires an annual membership fee.

- Location Variations: Regional clubs sell AAA insurance, which means coverage, discounts, and customer service can vary.

#3 – State Farm: Best for Personalized Service

Pros

- Personalized Service: Learn about State Farm’s personalized service from local agents in our State Farm review.

- Bundling Discount: Customers can save on their Chevrolet insurance by bundling policies.

- Roadside Assistance: Get help from State Farm if your Chevrolet breaks down.

Cons

- Discount Availability: Chevrolet owners may not have access to all State Farm discounts in their state.

- Policy Purchases: You can’t finish a purchase online without contacting an agent.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Business-Use Coverage

Pros

- Business-Use Coverage: If you use your Chevrolet for business, you’ll want to check out Traveler’s commercial use policies.

- Flexible Deductibles: If you’re on a budget, you can raise your deductible to reduce your monthly rates.

- Coverage Options: Get add-ons like gap insurance or rental coverage for your Chevrolet. Learn about coverages in our Travelers review.

Cons

- Young Driver Rates: Rates at Travelers aren’t cheap for young drivers.

- Possible Rate Increases for UBI Participation: Participating in Traveler’s usage-based discount program could result in rate increases.

#5 – Progressive: Best for Loyalty Discounts

Pros

- Loyalty Discounts: Chevrolet owners can get a discount for staying loyal customers.

- Coverage Options: Get add-ons like rideshare insurance. Read our Progressive review for a full list of coverage choices.

- Budgeting Tool: Chevrolet owners on a budget should take advantage of Progressive’s Name Your Price tool.

Cons

- Higher Rates for Some: Chevrolet owners looking for affordable high-risk insurance will find Progressive’s rates expensive.

- Possible UBI Rate Increases: Participating in Progressive’s usage-based discount program may result in a rate increase.

#6 – American Family: Best for Accident Forgiveness

Pros

- Accident Forgiveness: American Fmaioy offers a great accident forgiveness policy for safe drivers.

- Service Reputation: American Family’s service has a good reputation, according to customer ratings.

- Multiple Discounts: Discounts range from good driver discounts to bundling discounts.

Cons

- Limited Availability: American Family is sold only in select states. Find out more in our review of American Family.

- High-Risk Rates: Drivers looking for affordable high-risk insurance may find rates expensive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: See your deductibles on your Chevrolet decrease for each policy period you go claim-free.

- On Your Side Review: A Nationwide representative will work with you each year to ensure you’re happy with your coverage and rates.

- Customizable Policies: Customize your Nationwide policy for your Chevrolet. Learn more in our Nationwide review.

Cons

- High DUI Rates: Nationwide is not the best for affordable DUI auto insurance.

- Not Sold in Some States: 47 states sell insurance.

#8 – Farmers: Best for Safety Discounts

Pros

- Safety Discounts: Get a discount if your Chevrolet has certain safety features.

- Coverage Options: Our Farmers review covers what insurance you can purchase from Farmers, such as roadside assistance.

- Personalized Service: Faremsr offers some local agents for personalized assistance.

Cons

- Discount Options: Farmers doesn’t offer discounts like vanishing deductibles.

- High-Risk Rates: Average rates for high-risk drivers are high.

#9 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: If you only drive your Chevrolet a few times a week, Allstate’s pay-per-mile insurance offers cheap rates.

- Deductible Reductions: Allstate offers up to $500 in deductible reductions for safe drivers.

- Availability: Chevrolet owners will find coverage in any state.

Cons

- Customer Reviews: Claims processing could use some improvement at Allstate.

- Young Driver Rates: Some find Allstate’s rates less affordable. Learn more about rates in our Allstate review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Need help with filing a claim or policy issues? Liberty Mutual can be reached around the clock.

- Discount Opportunities: Earn small discounts like a payment-in-full discount or large discounts like a good driver discount.

- Coverage Options: Our Liberty Mutal review covers what coverages you can add to your Chevrolet.

Cons

- High Complaints: Liberty Mutual’s number of complaints for customer service and claims is higher than the average.

- High-Risk Rates: You may pay more than average if you’re deemed a high-risk driver.

Chevrolet Auto Insurance Coverages

There isn’t a specific type of auto insurance you must carry if you own a Chevrolet unless you have a lease or loan on the car. In that case, you’ll need to carry collision and comprehensive insurance alongside your state-mandated auto insurance coverage. Take a look at some common Chevrolet auto insurance coverages below:

- Bodily injury liability auto insurance

- Collision auto insurance

- Comprehensive auto insurance

- Medical payments insurance

- Modified auto insurance

- Personal injury protection auto insurance

- Property damage liability auto insurance

- Rental auto insurance

- Roadside assistance

- Rental car reimbursement

- Uninsured/underinsured motorist insurance

Even if you aren’t required to carry collision or comprehensive auto insurance, we recommend carrying these coverages on your Chevrolet.

Collision and comprehensive coverages pay for your Chevy's repairs if it gets damaged by a collision, animal damage, weather, vandalism, or theft.Dani Best Licensed Insurance Producer

Chevy Protection Plan Auto Insurance

Alongside the above coverages, you can get the Chevrolet Protection plan backed by General Motors. The Chevy Protection plan covers repair costs for your vehicle’s engine, steering, transmission, fuel pump, and more. The Chevy plan has three levels, offering basic to comprehensive coverage: powertrain, silver, and platinum.

The Chevy Protection Plan also includes roadside assistance auto insurance for towing, battery service, flat tire assistance, fuel delivery, and lock-out assistance. However, not all states offer roadside assistance, so call the Chevy Protection Plan phone number at 833-959-0105 to learn more.

OnStar Insurance for Your Chevrolet

Tesla isn’t the only car manufacturer that offers insurance. General Motors has exclusive discounts and programs through its OnStar Insurance. It offers usage-based insurance for Chevrolet models 2016 or newer, and traditional auto insurance for models before 2016. Read more in our GM auto insurance review.

How to Find the Best Rates for Chevy Auto Insurance

How much does it cost to insure a Chevrolet? To give you an idea of how much Chevrolet auto insurance costs, we’ll look at auto insurance rates by company for all car types and average rates for different Chevrolet models.

Learn more: Where to Compare Auto Insurance Rates

Chevrolet Auto Insurance Rates by Company

One of the biggest factors influencing your Chevrolet auto insurance cost is which company you pick. If you pick a cheap auto insurance company, you’ll likely have cheaper average rates no matter what car you own. Check out the table below to see average monthly rates from the top Chevrolet car insurance companies:

Chevrolet Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| American Family | $43 | $117 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

If you’re a military member or veteran and qualify for USAA auto insurance, USAA is likely the cheapest company on the market. However, if you don’t qualify for USAA, get quotes from other affordable choices like Geico or AAA.

Chevrolet Auto Insurance Cost by Model

More expensive Chevrolet models will have higher auto insurance rates, as repairs or replacements will cost insurance companies more if you file an auto insurance claim. For example, insurance for a Chevrolet Silverado 3500HD is $18 more monthly than for a standard Chevrolet Silverado. However, Chevrolet auto insurance costs $144 monthly on average.

Look at the table below to see the average auto insurance rates for different Chevrolet models:

Chevrolet Full Coverage Auto Insurance Monthly Rates by Model

| Model | Rates |

|---|---|

| 2024 Chevrolet Camaro | $150 |

| 2024 Chevrolet Colorado | $124 |

| 2024 Chevrolet Corvette | $179 |

| 2024 Chevrolet Cruze | $145 |

| 2024 Chevrolet Equinox | $139 |

| 2024 Chevrolet Impala | $136 |

| 2024 Chevrolet Malibu | $140 |

| 2024 Chevrolet Silverado | $150 |

| 2024 Chevrolet Silverado 2500HD | $167 |

| 2024 Chevrolet Silverado 3500HD | $168 |

| 2024 Chevrolet Sonic | $138 |

| 2024 Chevrolet Spark | $133 |

| 2024 Chevrolet Suburban | $142 |

| 2024 Chevrolet Tahoe | $142 |

| 2024 Chevrolet Traverse | $128 |

| 2024 Chevrolet Trax | $130 |

| 2024 Chevrolet Volt | $171 |

Some of the more expensive Chevrolet models to insure on average include the Chevrolet Corvette, Chevrolet Volt, and Chevrolet Silverado models. Cheaper models will be the Chevrolet Colorado and Chevrolet Traverse. So, always compare auto insurance rates by vehicle make and model to find the most affordable Chevrolet car insurance.

Chevrolet Auto Insurance Cost Comparison by Model

Understanding the insurance costs for different Chevrolet models can help you make an informed decision when purchasing auto insurance. Let’s explore the insurance rates for various Chevrolet models to guide your decision-making process.

| Cost of Auto Insurance for Chevrolet's by Model | |

|---|---|

| Chevrolet Avalanche | Chevrolet Corvette Stingray |

| Chevrolet Camaro | Chevrolet Impala |

| Chevrolet Captiva Sport | Chevrolet Impala |

| Chevrolet Colorado | Chevrolet Spark |

| Chevrolet Corvette | Chevrolet Traverse |

Chevrolet Auto Insurance Rates by Age and Driving Record

Average auto insurance rates by age and driving record vary. Look at the table below to see how Chevrolet auto insurance rates change based on these factors:

Full Coverage Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 | |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 | |

| $84 | $96 | $111 | $154 |

Auto insurance for teens is significantly more expensive for older drivers with more experience. In addition, high-risk drivers, like those with at-fault accidents or tickets on their record, pay higher Chevrolet auto insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

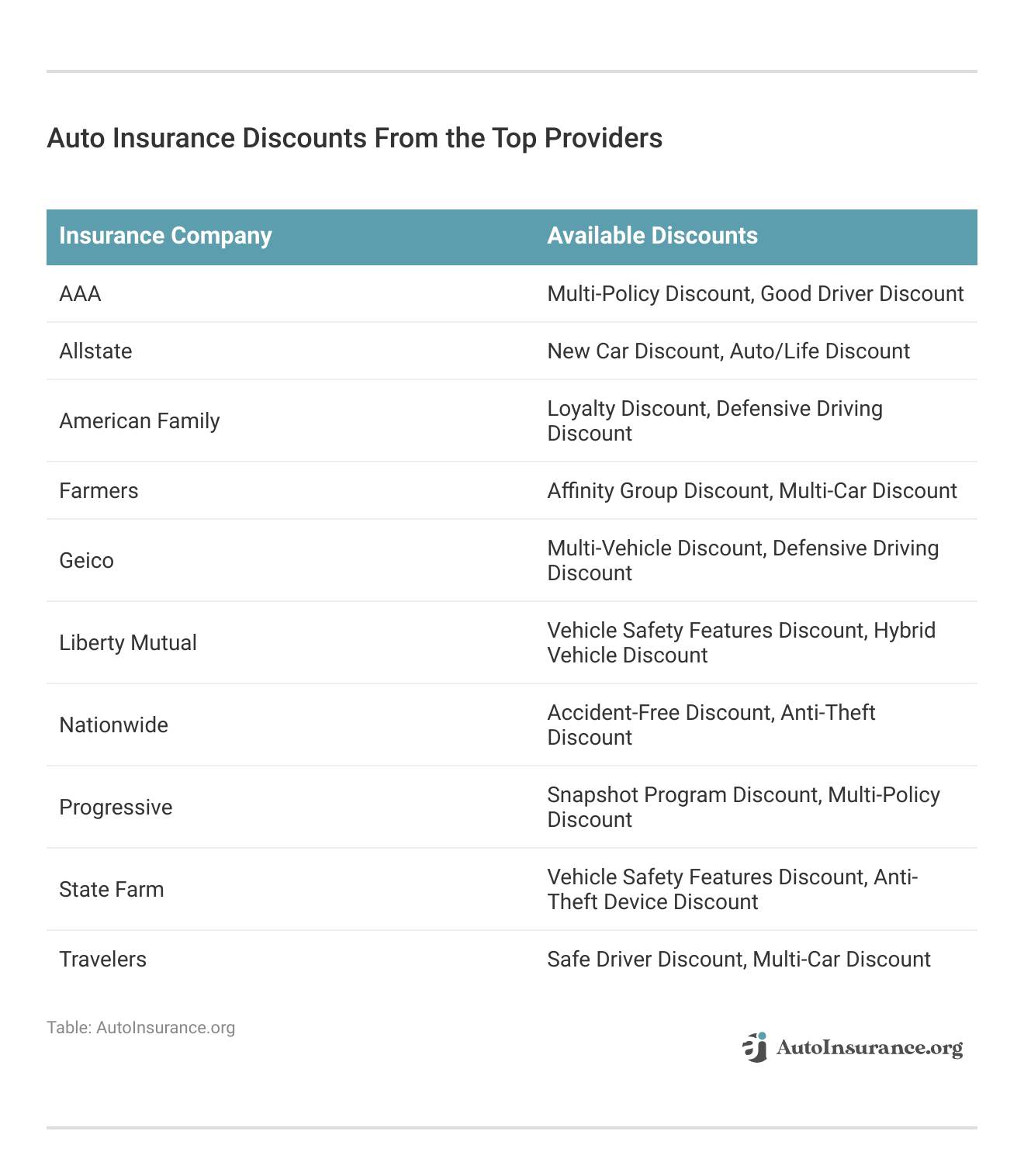

Ways to Save on Chevrolet Auto Insurance

In addition to shopping around for auto insurance rates and choosing a cheaper Chevrolet model to insure, there are other ways you save on Chevrolet auto insurance as well. For example, check for any discounts that may not automatically apply, such as a safe driver discount.

You can also bundle your Chevrolet auto insurance coverage with home insurance for a large discount (learn more: How to Save Money by Bundling Insurance Policies).

Take a look at our other top money-saving tips below:

- Be a safe driver and keep a clean driving record. One of the best ways to keep your auto insurance rates low is to keep a clean driving record, since at-fault accidents, DUIs, and traffic tickets will raise your rates.

- Raise your auto insurance deductible. You can raise your auto insurance deductible to reduce your rates, but don’t raise it beyond an amount you can’t pay out of pocket after an accident.

- Remove unnecessary coverages. If your Chevrolet is older and no longer worth much, you could remove collision and comprehensive insurance and carry just a minimum liability auto insurance policy.

Following the tips above can help you save on your Chevrolet auto insurance policy. While there are many factors that affect auto insurance rates you can’t control, you can control the factors above to get cheap Chevrolet car insurance coverage.

You definitely don't want to overspend 💰on auto insurance, and you probably wish you didn't have to buy it at all. At https://t.co/27f1xf131D, we crunched the numbers to help you save🤑. Check this out if you want to find the cheapest coverage 👉: https://t.co/933zXMWCxl pic.twitter.com/qBnsPMVoC0

— AutoInsurance.org (@AutoInsurance) June 5, 2023

You’ll also see your Chevrolet car insurance rates decrease as you age if you keep a clean driving record since teenagers and young adults get charged more than adult and senior drivers.

Finding Affordable Chevrolet Auto Insurance Coverage

The average auto insurance rates for Chevrolet models aren’t over $200, even for the most expensive models. While auto insurance rates vary based on a driver’s age and driving record, most Chevrolet owners will find that Chevrolet auto insurance rates are affordable and can earn auto insurance discounts to reduce rates.

Find the best Chevrolet auto insurance by comparing rates and coverage types from various companies. Use our free quote comparison tool to start comparing rates.

Frequently Asked Questions

Are Chevys expensive to insure?

No, Chevrolet auto insurance isn’t expensive compared to other car brands. However, if your rates are too expensive, take advantage of discounts, keep a clean driving record, and shop around for Chevrolet auto insurance quotes (learn more: How to Evaluate Auto Insurance Quotes).

How much does auto insurance cost for a Chevrolet?

Chevrolet auto insurance costs $144 monthly on average for full coverage, though other you might find more affordable Chevrolet car insurance with certain models.

Is insurance for a Chevrolet Silverado expensive?

Yes, auto insurance for a Chevrolet Silverado can be expensive depending on the payload capacity. For example, average auto insurance rates for a standard Chevrolet Silverado are $148 monthly, whereas a Chevrolet Silverado 3500HD is $166.

What factors affect the cost of Chevrolet auto insurance?

The best Chevrolet auto insurance companies consider several factors when setting rates, like Chevrolet model, driver age, driving history, coverage options, and discounts. So, comparing Chevrolet insurance quotes from various auto insurance companies is vital to find affordable coverage for you.

Are there any specific auto insurance requirements for a Chevrolet?

Each state has its own minimum requirements for liability coverage. Auto insurance requirements for a Chevrolet vehicle vary by location, so you should compare Chevrolet auto insurance rates by ZIP code.

What Chevrolet auto insurance discounts are available?

Chevrolet auto insurance discounts vary depending on the company, but you could qualify for various discounts to get affordable Chevrolet car insurance. Common auto insurance discounts include safe driver discounts, safety features discount, and multi-car discounts.

What is the best Chevrolet auto insurance?

For most drivers, the best Chevrolet car insurance will be full coverage insurance (learn more: What is full coverage auto insurance?).

Who has the cheapest auto insurance for Chevrolets?

Geico has the cheapest average rates for Chevy owners, whether you are shopping for Chevrolet Silverado 3500hd car insurance or Chevrolet Spark car insurance.

Who is cheaper, Geico or Progressive?

Geico’s average rates are cheaper than Progressive’s.

Is Chevy Malibu insurance expensive?

Chevy Malibu insurance rates are an average of $138/mo for full coverage. You can enter your ZIP code into our free tool to make sure you are getting the best Chevrolet insurance quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.