Richmond, VA Auto Insurance (2024)

The cheapest auto insurance in Richmond, VA is from Geico, but factors like your age, where you live, and your driving record will determine your rates. Richmond, VA auto insurance must meet the state coverage requirements of 25/50/20, or drivers can choose to pay a $500 fee each year to be uninsured. Compare Richmond, VA auto insurance quotes to get the cheapest coverage for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Commercial Lines Coverage Specialist

UPDATED: Mar 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Auto insurance in Richmond, VA is lower than the national average

- The cheapest Richmond, VA auto insurance company is Geico

- Auto insurance rates in Richmond are higher than the state average

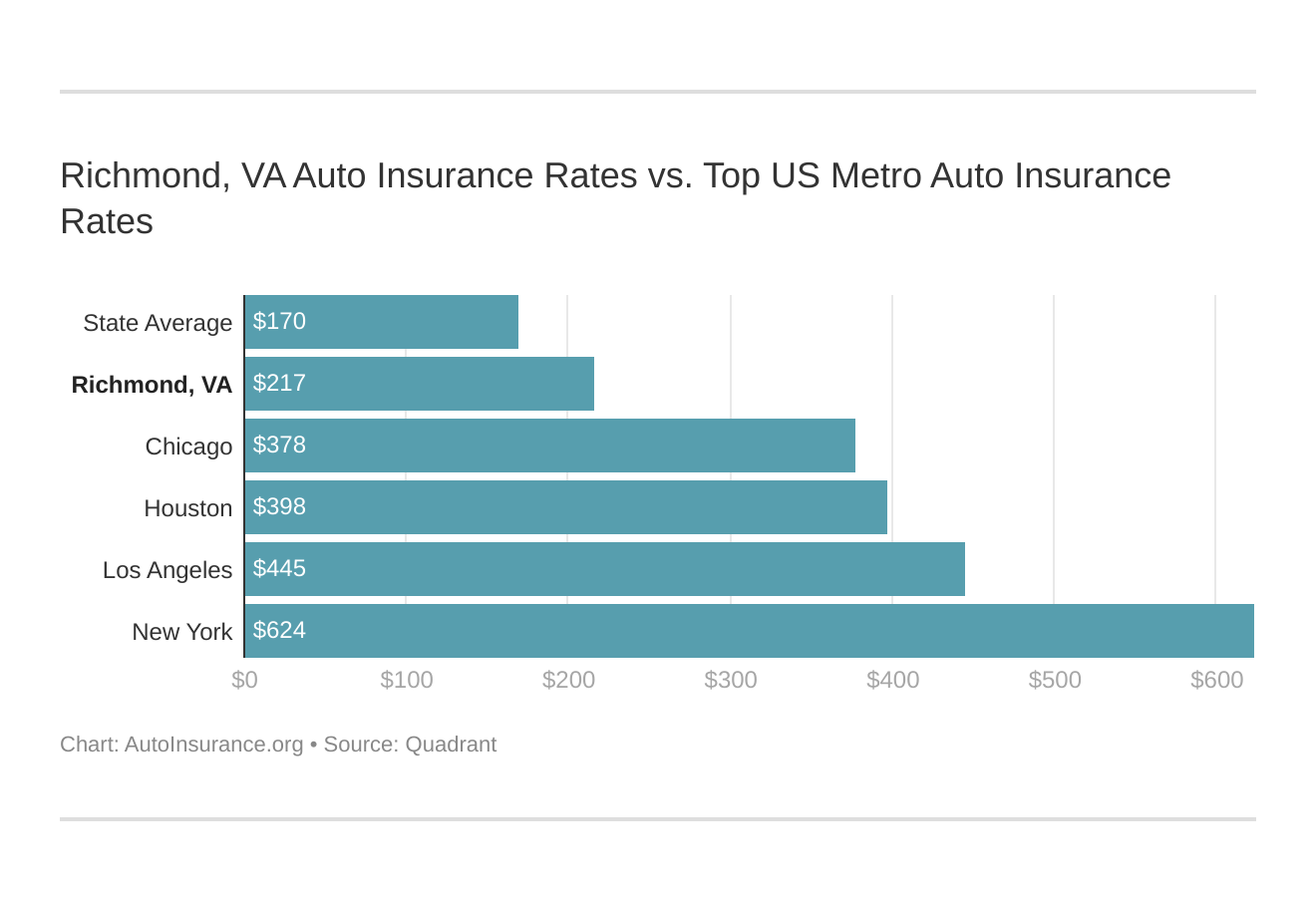

Richmond, VA auto insurance rates are lower than the U.S. average. However, they are still high compared to the Virginia auto insurance state average. Richmond, Virginia auto insurance is high due in part to the fact that it is the fourth largest city in Virginia, meaning more traffic and a higher chance for an accident.

It is still possible to find affordable Richmond, VA auto insurance. Shop around, compare quotes, and ask for discounts for cheap auto insurance.

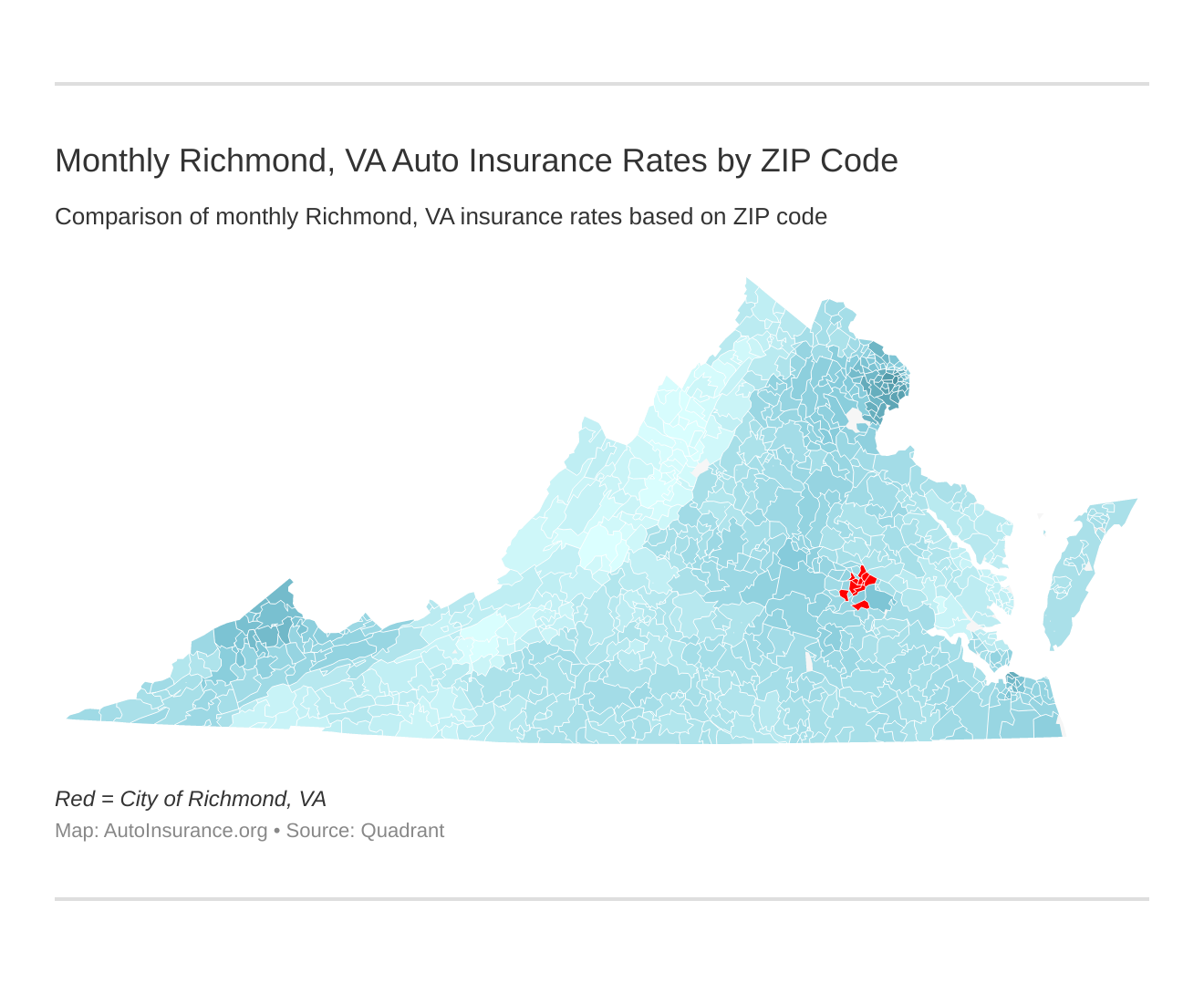

Monthly Richmond, VA Car Insurance Rates by ZIP Code

Find more info about the monthly Richmond, VA auto insurance rates by ZIP Code below:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Richmond, VA Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare Richmond, VA against other top US metro areas’ auto insurance rates.

Enter your ZIP code now to compare Richmond, VA auto insurance quotes.

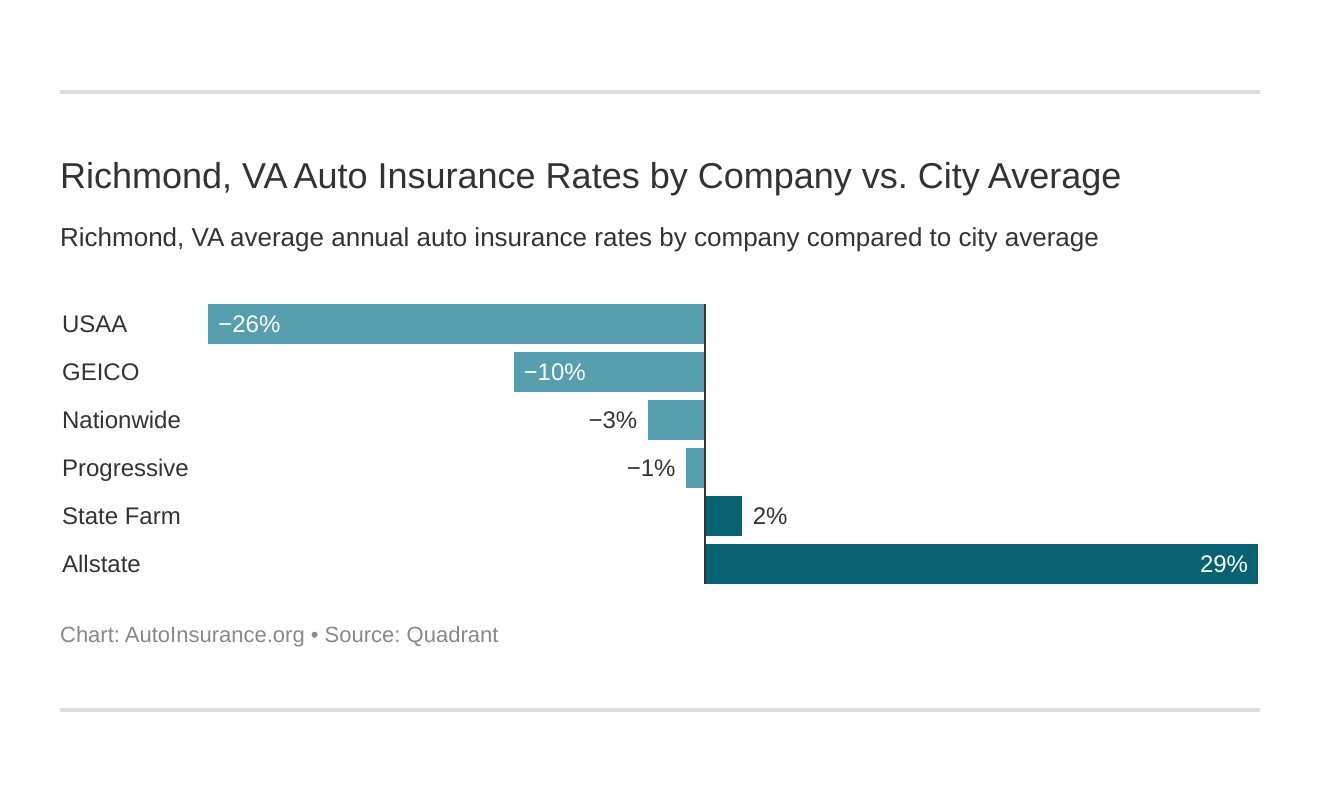

What is the cheapest auto insurance company in Richmond, VA?

Although USAA actually has the lowest auto insurance in Richmond, it is only available to the military, veterans, and their families. If you’re looking for auto insurance for military members or veterans, it is probably your best choice. The company with the lowest auto insurance rates offered to everyone in Richmond, VA is Geico.

The cheapest Richmond, VA car insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Virginia car insurance company rates?” We cover that as well.

These are the top auto insurance companies in Richmond, ranked from least to most expensive:

- USAA auto insurance – $2,009.79

- Geico auto insurance – $2,364.79

- Nationwide auto insurance – $2,534.56

- Progressive auto insurance – $2,567.60

- State Farm auto insurance – $2,647.99

- Allstate auto insurance – $3,494.64

There are many different factors that determine your auto insurance rates. Age, gender, marital status, where you live, driving history, and credit score can all be used to calculate your auto insurance rates.

Each company will charge different rates so comparing quotes from multiple companies will help you find the best policy for you.

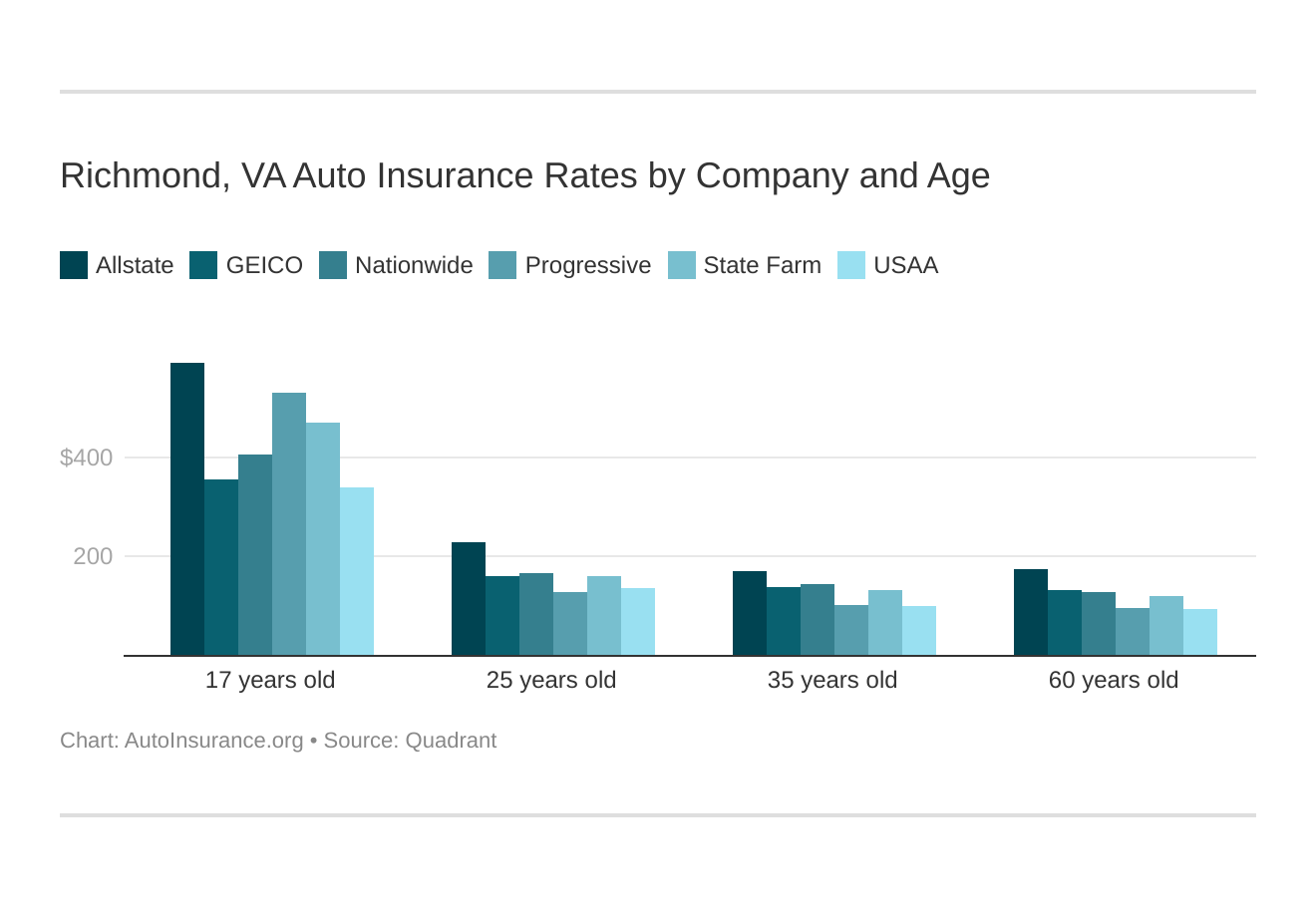

Richmond, VA car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group. Auto insurance for teens and young drivers is usually the most expensive.

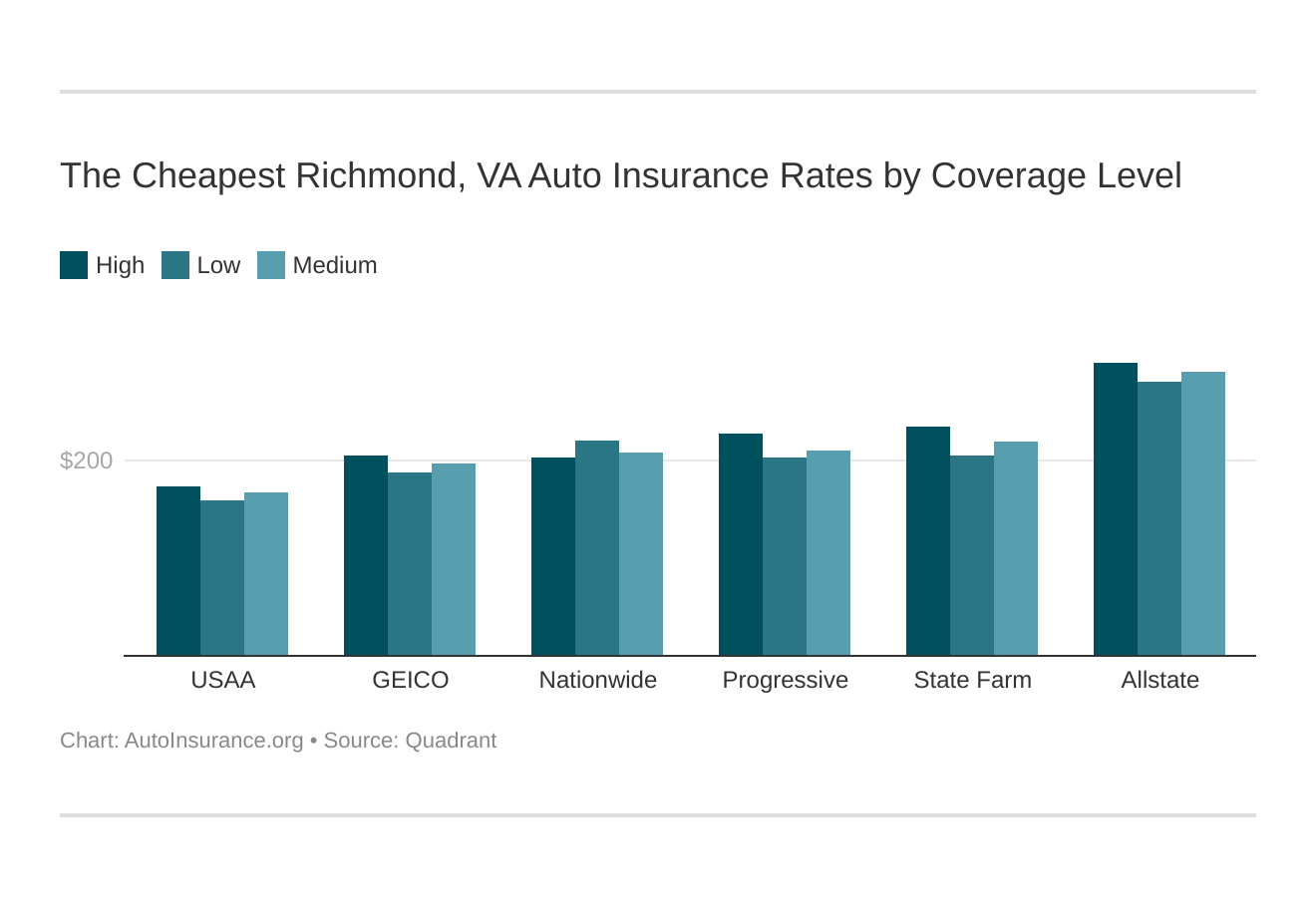

Your coverage level will play a major role in your Richmond, VA car insurance rates. The types of car insurance you choose will impact your rates. Find the cheapest Richmond, Virginia car insurance rates by coverage level below:

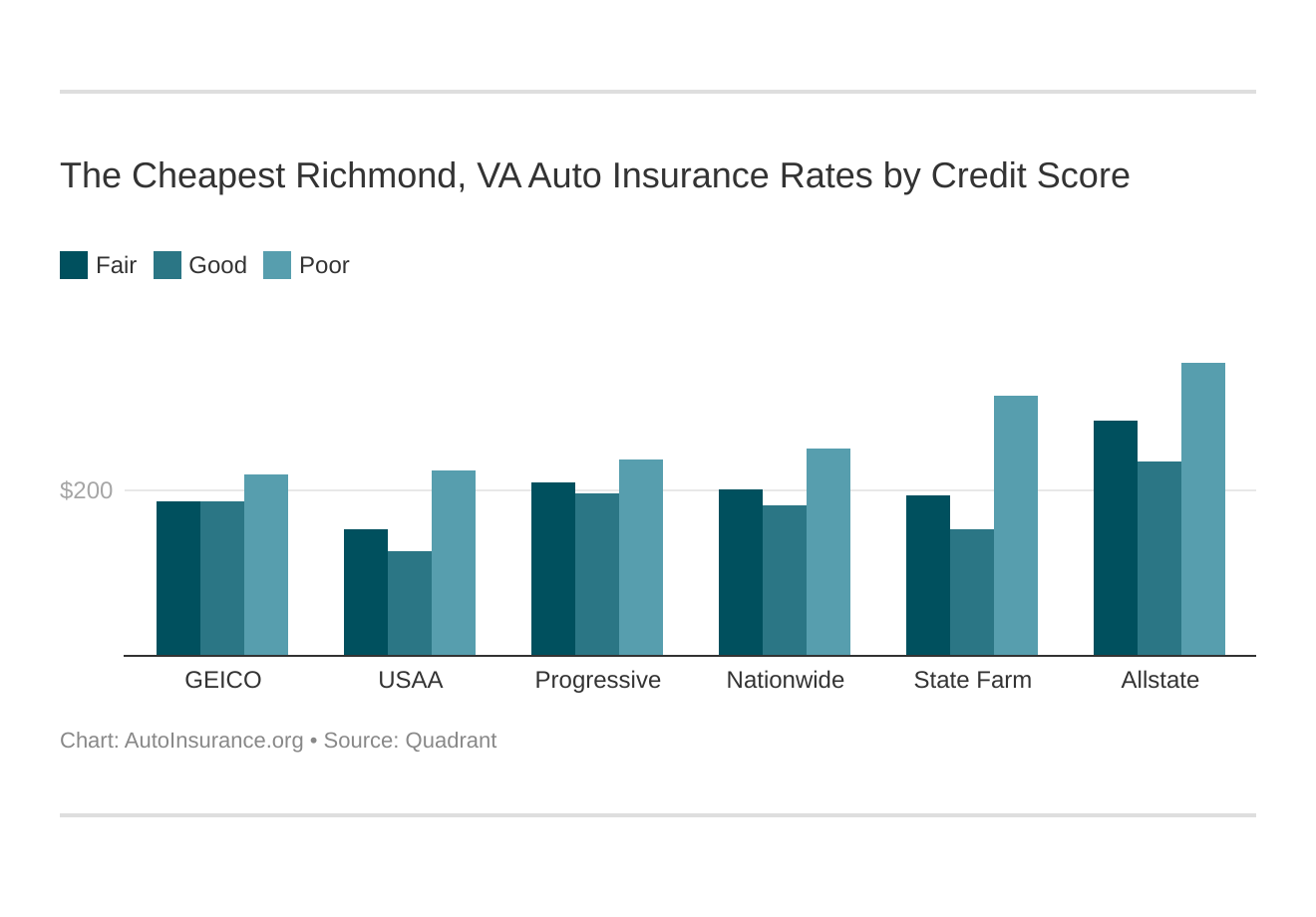

Your credit score will play a major role in your Richmond, VA car insurance rates since auto insurance companies use credit scores to determine rates. Find the cheapest Richmond, Virginia car insurance rates by credit score below.

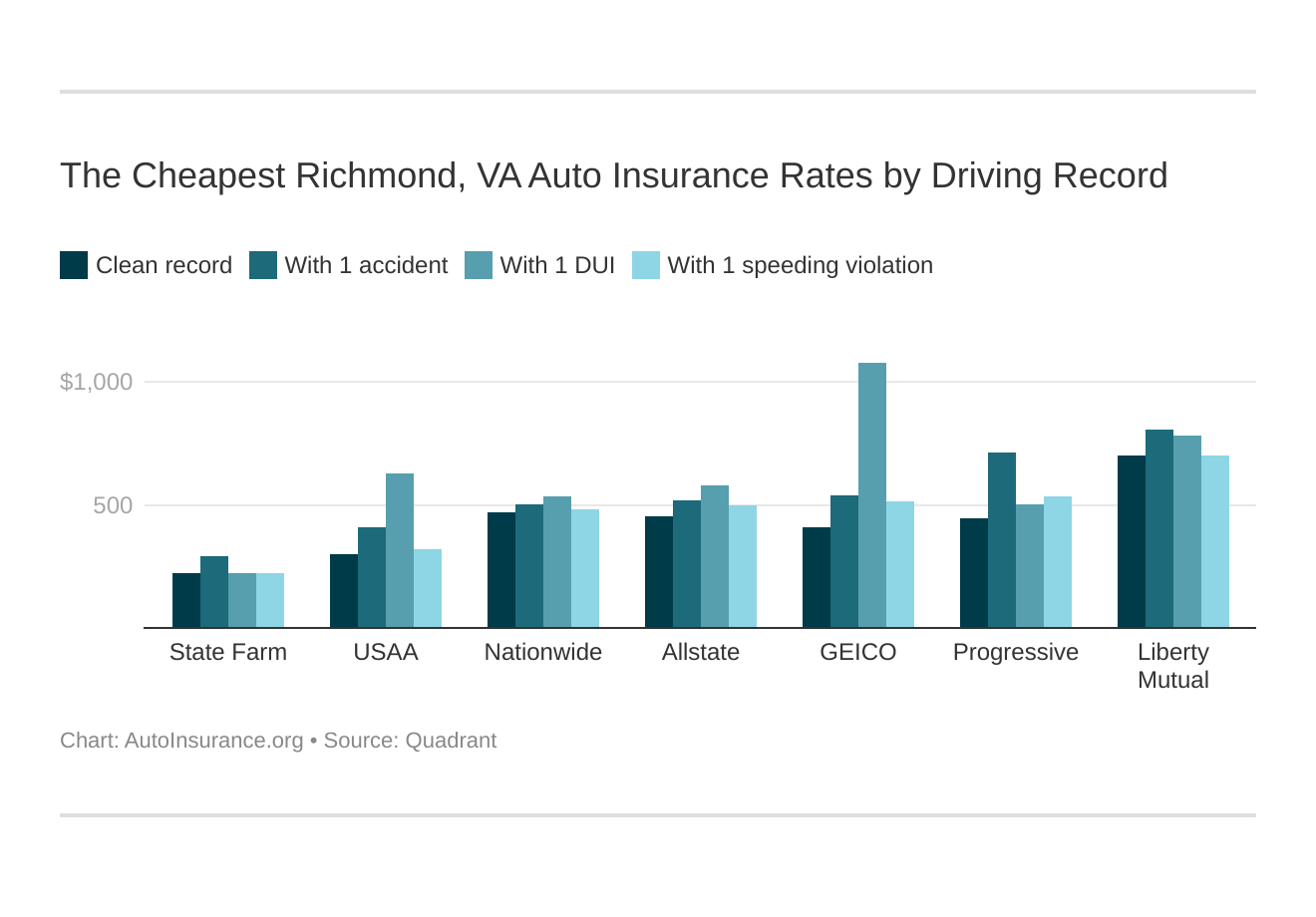

Your driving record will affect your Richmond car insurance rates. For example, a Richmond, Virginia DUI may increase your car insurance rates 40% to 50%. Cheap auto insurance for drivers with a DUI is not easy to find. Find the cheapest Richmond, VA car insurance rates by driving record.

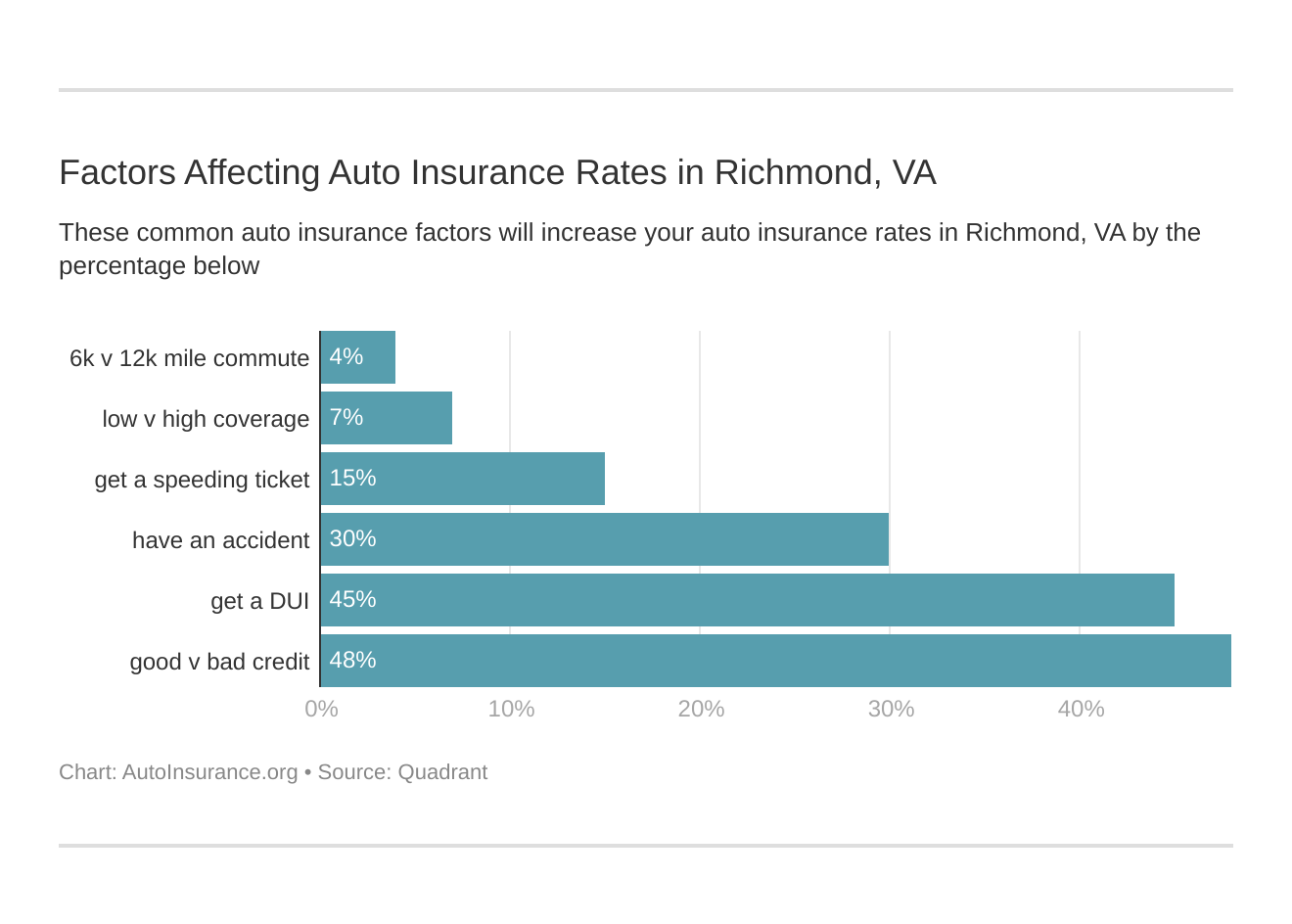

Factors affecting car insurance rates in Richmond, VA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Richmond, Virginia car insurance.

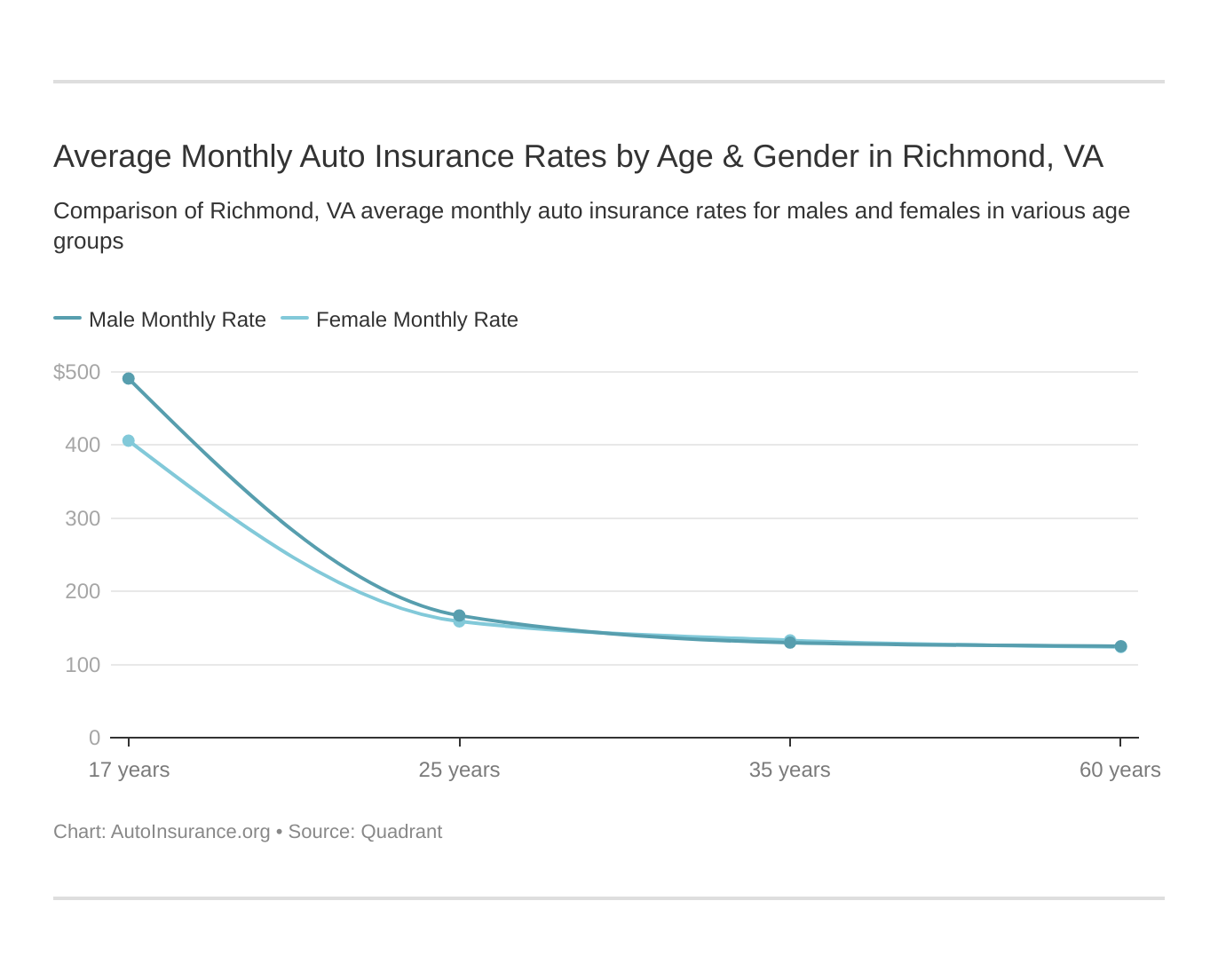

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in Richmond, VA. Richmond, VA does use gender, so check out the average monthly car insurance rates by age and gender in Richmond, VA. Car insurance rates are more for males on average.

What auto insurance coverage is required in Richmond, VA?

Virginia has a minimum level of auto insurance drivers much carry in order to drive legally. The minimum requirements for car insurance in Virginia are:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $20,000 per incident for property damage

Virginia also requires you to carry uninsured and underinsured motorist coverage. If you choose not to carry auto insurance, you can pay a $500 Uninsured Motor Vehicle Fee each year. However, you will still be personally liable for any damages and injuries you cause in an accident.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What affects auto insurance rates in Richmond, VA?

Two more factors that are used to determine auto insurance rates are traffic and thefts where you live.

INRIX ranks Richmond, VA as the 48th most congested city in the U.S. This is important because accidents are more likely to happen when more cars are on the road.

According to City-Data, most drivers have a commute time of 25 minutes.

The FBI does not list vehicle theft data for Richmond, but nearby Petersburg had 113 vehicle thefts.

Richmond, VA Auto Insurance: The Bottom Line

Richmond, VA does have higher than the state average auto insurance rates, but they are still lower than the national average. Drivers can take advantage of low rates by keeping a clean driving record and asking for discounts.

Before you buy Richmond, VA auto insurance, shop around to get the best deal. Just enter your ZIP code now to compare Richmond, VA auto insurance quotes.

Frequently Asked Questions

What factors determine auto insurance rates in Richmond, VA?

Auto insurance rates in Richmond, VA are determined by factors such as age, location, driving record, and credit score.

Which company offers the cheapest auto insurance rates in Richmond, VA?

Geico provides the lowest auto insurance rates for most drivers in Richmond, VA, but USAA offers the lowest rates for military members, veterans, and their families.

What is the minimum required auto insurance coverage in Richmond, VA?

In Richmond, VA, the minimum required auto insurance coverage is 25/50/20, which means $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, and $20,000 property damage liability per accident.

How does your credit score affect auto insurance rates in Richmond, VA?

Your credit score can impact your auto insurance rates in Richmond, VA. A higher credit score is generally associated with lower insurance rates, while a lower credit score may result in higher rates.

How does traffic congestion affect auto insurance rates in Richmond, VA?

Traffic congestion can influence auto insurance rates in Richmond, VA. Higher levels of congestion increase the likelihood of accidents, which can lead to higher insurance premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences i...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.