Best Newport News, Virginia Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Discover why Geico, USAA, and Erie have the best Newport News, Virginia auto insurance, offering minimum monthly rates starting at $100/mo. Geico stands out with tailored discounts for safe drivers, making it the ideal choice for Newport News, Virginia residents seeking reliable coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Newport News Virginia

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Newport News Virginia

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Newport News Virginia

A.M. Best

Complaint Level

Pros & Cons

The best Newport News, Virginia auto insurance providers are Geico, USAA, and Erie, offering top-notch coverage and significant discounts.

Geico stands out for its comprehensive coverage options, while USAA is ideal for military families, and Erie excels with its extensive discount programs.

Our Top 10 Company Picks: Best Newport News, Virginia Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Competitive Pricing Geico

#2 10% A++ Military Benefits USAA

#3 10% A+ Comprehensive Options Erie

#4 20% B Extensive Network State Farm

#5 25% A+ Personalized Service Allstate

#6 20% A+ Policy Flexibility Nationwide

#7 25% A Policy Flexibility Liberty Mutual

#8 12% A+ Innovative Tools Progressive

#9 8% A++ Broad Coverage Travelers

#10 25% A Discount Variety Farmers

These companies are the top picks for affordable and reliable insurance in Newport News, Virginia. Compare these top providers to find the best coverage for your needs.

Our guide explains how you can secure cheap auto insurance in Newport News, Virginia, for every age, credit history, and driving record. Start saving on auto insurance in Newport News, Virginia, by entering your ZIP code above and comparing quotes.

- Geico is the top pick for affordable auto insurance in Newport News, Virginia

- Tailored coverage options meet the specific needs of Newport News residents

- Newport News drivers benefit from discounts for safe driving and military service

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Low Rates: Geico offers some of the most affordable auto insurance rates in Newport News, Virginia. Deepen your understanding by reading our guide, “Geico Auto Insurance Review.”

- High Multi-Vehicle Discount: Newport News drivers can save up to 25% with Geico’s multi-vehicle discount.

- A++ Rating: Geico’s strong A.M. Best rating of A++ ensures financial stability for Newport News, Virginia policyholders.

Cons

- Limited Local Agents: Geico has fewer local agents available in Newport News, Virginia, compared to some competitors.

- Basic Coverage: Geico’s basic coverage options in Newport News, Virginia, might not meet the needs of drivers looking for more comprehensive plans.

#2 – USAA: Best for Military Benefits

Pros

- Military Discounts: USAA provides exclusive discounts for military families in Newport News, Virginia. Learn more by reading our USAA auto insurance review.

- Strong Financial Stability: With an A++ rating, USAA ensures robust financial security for Newport News, Virginia members.

- Customer Satisfaction: USAA consistently ranks high in customer satisfaction among Newport News, Virginia military members.

Cons

- Restricted Eligibility: USAA coverage is only available to military personnel and their families in Newport News, Virginia.

- Average Discounts: USAA’s 10% multi-vehicle discount in Newport News, Virginia, is lower than some competitors.

#3 – Erie: Best for Comprehensive Options

Pros

- Comprehensive Coverage: Erie offers extensive coverage options tailored to the unique needs of Newport News, Virginia drivers.

- Affordability: Erie provides competitive rates that are attractive for Newport News, Virginia residents. Uncover insights in our guide, “Erie Auto Insurance Review.”

- A+ Rating: Erie’s A.M. Best rating of A+ reflects strong financial reliability for Newport News, Virginia policyholders.

Cons

- Limited Availability: Erie’s coverage is not as widely available in Newport News, Virginia, compared to larger national insurers.

- Lower Multi-Vehicle Discount: Newport News, Virginia drivers receive only a 10% discount for multiple vehicles, which is less than some competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Extensive Network

Pros

- Wide Network: State Farm has a broad network of local agents in Newport News, Virginia, offering personalized service. Explore our review of State Farm auto insurance review.

- Customizable Coverage: Newport News, Virginia residents can tailor their policies with a variety of coverage options available through State Farm.

- 20% Multi-Vehicle Discount: State Farm offers a 20% discount for multiple vehicles, providing savings for Newport News, Virginia drivers with more than one car.

Cons

- B Rating: State Farm’s B rating with A.M. Best suggests less financial stability compared to other insurers in Newport News, Virginia.

- Higher Premiums: Despite discounts, State Farm’s premiums in Newport News, Virginia, may be higher than competitors for certain coverage levels.

#5 – Allstate: Best for Personalized Service

Pros

- Personalized Service: Allstate provides highly personalized service through local agents in Newport News, Virginia. Dive into our analysis of Allstate auto insurance review.

- High Multi-Vehicle Discount: Allstate offers a 25% discount on multi-vehicle policies, which is beneficial for Newport News, Virginia households with multiple cars.

- A+ Rating: Allstate’s A+ rating reflects strong financial security and reliability for policyholders in Newport News, Virginia.

Cons

- Premium Costs: Allstate’s premiums in Newport News, Virginia, can be higher than those of more budget-friendly options like Geico.

- Discount Limitations: Some discounts offered by Allstate in Newport News, Virginia, may have stricter eligibility requirements compared to competitors.

#6 – Nationwide: Best for Policy Flexibility

Pros

- Flexible Coverage: Nationwide offers customizable auto insurance policies in Newport News, Virginia, tailored to individual needs.

- Policy Discounts: Newport News, Virginia, residents can benefit from a 20% discount for bundling auto and home insurance. Get detailed insights in our guide, “Nationwide Auto Insurance Review.”

- Strong Financial Rating: Nationwide holds an A+ rating, ensuring reliable coverage for Newport News, Virginia, policyholders.

Cons

- Discount Limits: The 20% bundling discount in Newport News, Virginia, may be lower than some competitors.

- Premium Costs: Nationwide’s premiums in Newport News, Virginia, may be higher for full coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Policy Flexibility

Pros

- Flexible Policy Options: Liberty Mutual provides customizable auto insurance policies in Newport News, Virginia, to meet diverse needs.

- Bundling Discount: Newport News, Virginia, residents can access a 25% discount when bundling auto and other insurance products.

- Solid Financial Stability: Liberty Mutual has an A rating, ensuring dependable coverage in Newport News, Virginia. Access in-depth insights in our complete Liberty Mutual auto insurance review.

Cons

- Higher Premiums: Liberty Mutual’s premium rates in Newport News, Virginia, may be on the higher side compared to competitors.

- Limited Online Tools: Liberty Mutual offers fewer online resources for managing policies in Newport News, Virginia.

#8 – Progressive: Best for Innovative Tools

Pros

- Innovative Technology: Progressive offers cutting-edge tools for Newport News, Virginia, drivers, like the Snapshot program for tracking driving habits.

- Strong Discounts: Newport News, Virginia, residents can save up to 12% through Progressive’s various discount programs.

- High Financial Rating: Progressive holds an A+ rating, ensuring reliable coverage for Newport News, Virginia, drivers. Learn more about offerings in our complete Progressive auto insurance review.

Cons

- Limited Discounts: The maximum discount in Newport News, Virginia, is only 12%, which may be less competitive.

- Customer Service: Progressive’s customer service in Newport News, Virginia, might not be as robust as other providers.

#9 – Travelers: Best for Broad Coverage

Pros

- Comprehensive Coverage: Travelers offers extensive coverage options in Newport News, Virginia, catering to various insurance needs.

- Financial Strength: Travelers has an A++ rating, providing Newport News, Virginia, residents with exceptional financial reliability. Explore offerings further in our complete guide, “Travelers Auto Insurance Review.”

- Safe Driver Discounts: Newport News, Virginia, drivers can benefit from additional savings through Travelers’ safe driver programs.

Cons

- Higher Premiums: Travelers’ premium rates in Newport News, Virginia, may be higher than some competitors.

- Fewer Discounts: Travelers offers fewer discounts compared to other providers in Newport News, Virginia.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Discount Variety

Pros

- Variety of Discounts: Farmers provides Newport News, Virginia, residents with a wide range of discounts, including a 25% bundling discount. See how you can save on insurance in our Farmers auto insurance review.

- Customizable Policies: Farmers offers flexible policy options tailored to Newport News, Virginia, drivers’ unique needs.

- Solid Financial Standing: Farmers has an A rating, ensuring dependable coverage for Newport News, Virginia, policyholders.

Cons

- Higher Premiums: Farmers’ premiums in Newport News, Virginia, may be higher compared to other providers.

- Limited Online Resources: Farmers offers fewer online tools for managing policies in Newport News, Virginia.

Coverage Rate Comparison in Newport News, Virginia

When comparing auto insurance premiums in Newport News, Virginia, it’s important to consider both the minimum and full coverage options offered by various providers. The table below highlights the monthly rates for each level of coverage across different insurance companies, providing a clear view of how these options compare.

Newport News, Virginia Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $125 $300

Erie $115 $280

Farmers $150 $350

Geico $100 $250

Liberty Mutual $135 $320

Nationwide $130 $310

Progressive $140 $330

State Farm $120 $290

Travelers $145 $340

USAA $110 $270

In Newport News, Virginia, Geico offers the most affordable minimum coverage at $100 per month, while also providing the lowest full coverage rate at $250 per month. USAA and Erie follow closely behind, with USAA offering minimum coverage at $110 and full coverage at $270, and Erie offering $115 for minimum coverage and $280 for full coverage.

On the higher end, Farmers has the most expensive rates, charging $150 for minimum coverage and $350 for full coverage. Learn more about offerings in our complete guide, “Where to Compare Auto Insurance Rates.”

These rates reflect the varied pricing strategies of each provider, allowing Newport News drivers to choose the best option for their budget and coverage needs.

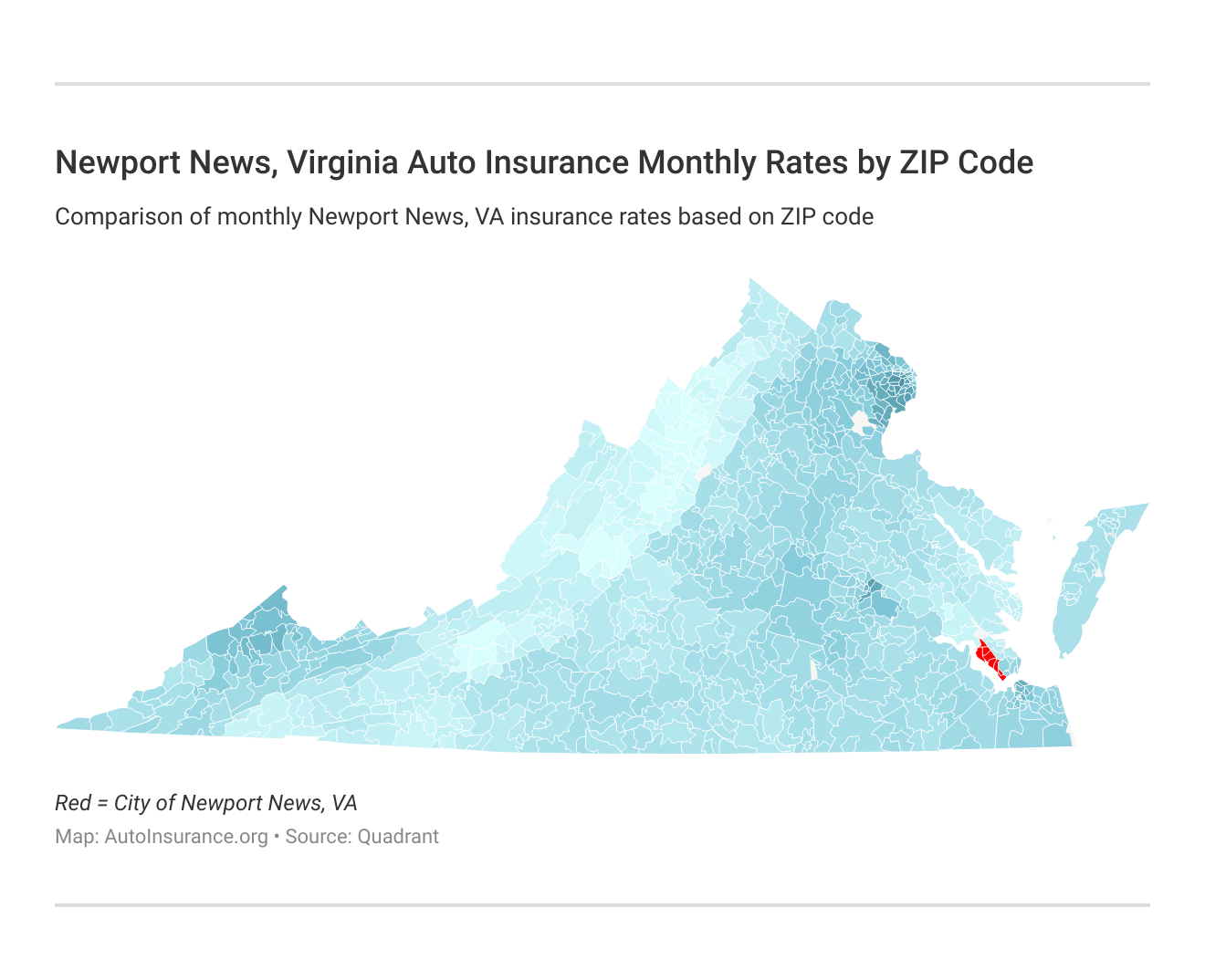

Monthly Newport News, VA Car Insurance Rates by ZIP Code

Explore the monthly auto insurance rates in Newport News, VA, by ZIP code to find the best coverage options for your area. Understanding how rates vary can help you make an informed decision on your auto insurance.

Reviewing car insurance rates by ZIP code in Newport News, VA, ensures you find the most affordable and suitable coverage for your specific location. Compare these rates to secure the best deal in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

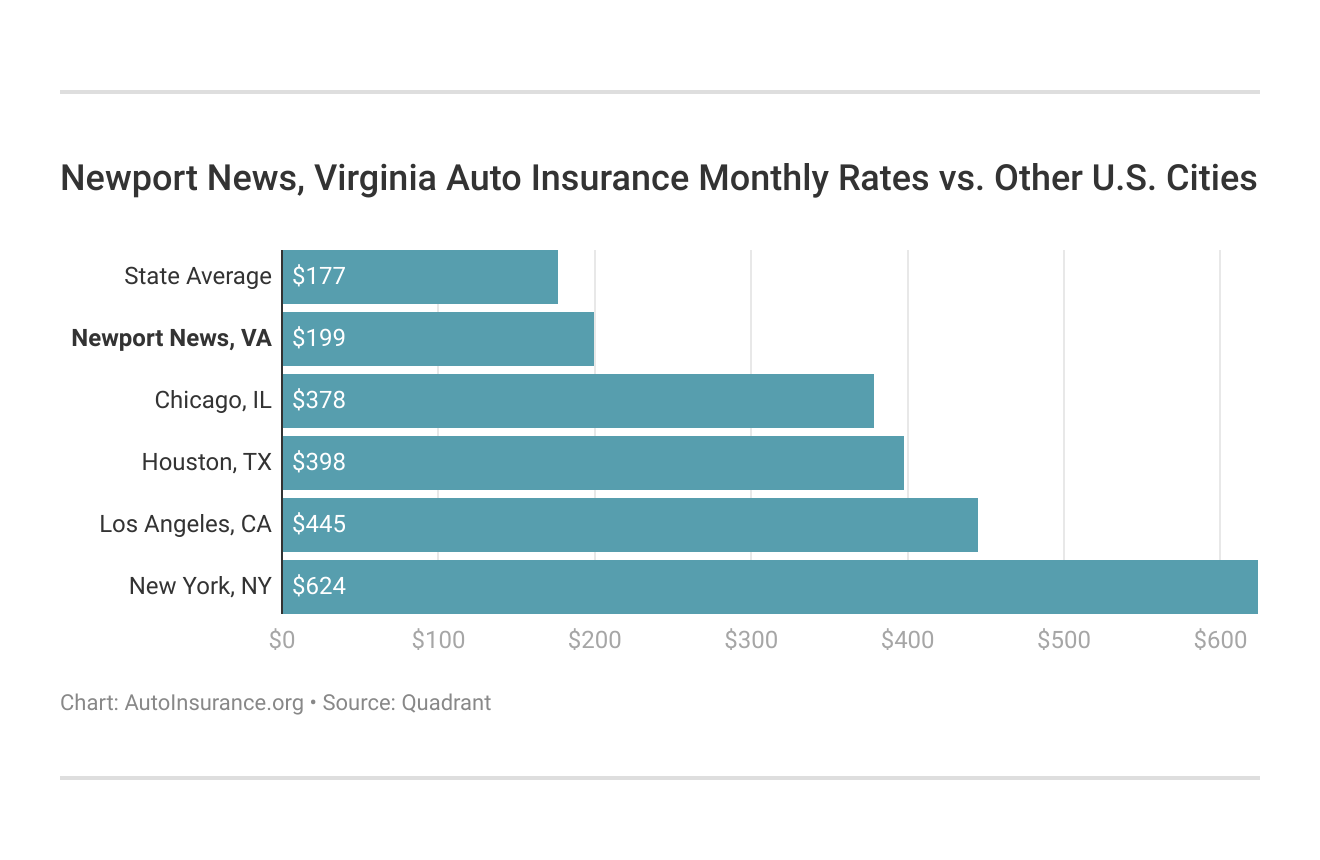

Newport News, VA Car Insurance Rates vs. Top US Metro Car Insurance Rates

Discover how Newport News, VA car insurance rates compare to other top US metro areas. Use our guide to see where your rates stand and find affordable coverage. See more details in our guide titled, “Best Auto Insurance Companies.”

Now that you know how Newport News, VA compares to other metro areas, it’s time to find the best local rates. Enter your ZIP code to start comparing affordable auto insurance options today.

Affordable Auto Insurance Options in Newport News, VA

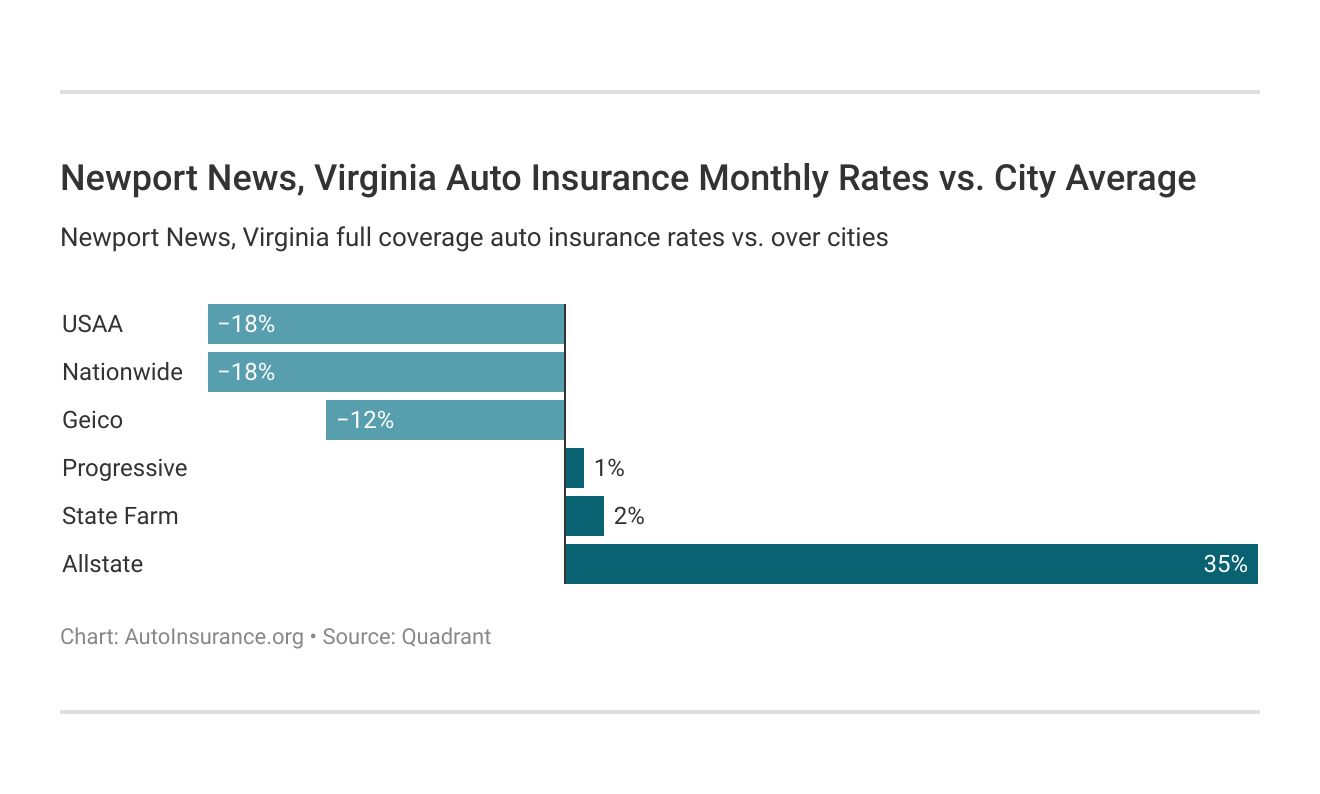

The cheapest car insurance company in Newport News, Virginia, is Nationwide. Which Newport News, VA auto insurance company has the cheapest rates? And how do those rates compare against the average Virginia auto insurance company rates? We’ve got the answers below.

Here are the best auto insurance companies in Newport News, VA, ranked from cheapest to most expensive monthly rates:

- Nationwide: $165

- USAA: $166

- Geico: $177

- Progressive: $201

- State Farm: $203

- Allstate: $282

Nationwide, Geico, and USAA are the only Newport News auto insurance providers that offer cheaper than average car insurance rates. With the right discounts, you can lower your annual costs. Remember, cost isn’t everything. Allstate in Newport News offers a variety of insurance products to meet your needs. From auto to home insurance, Allstate can provide you with the coverage you need to protect your investments.

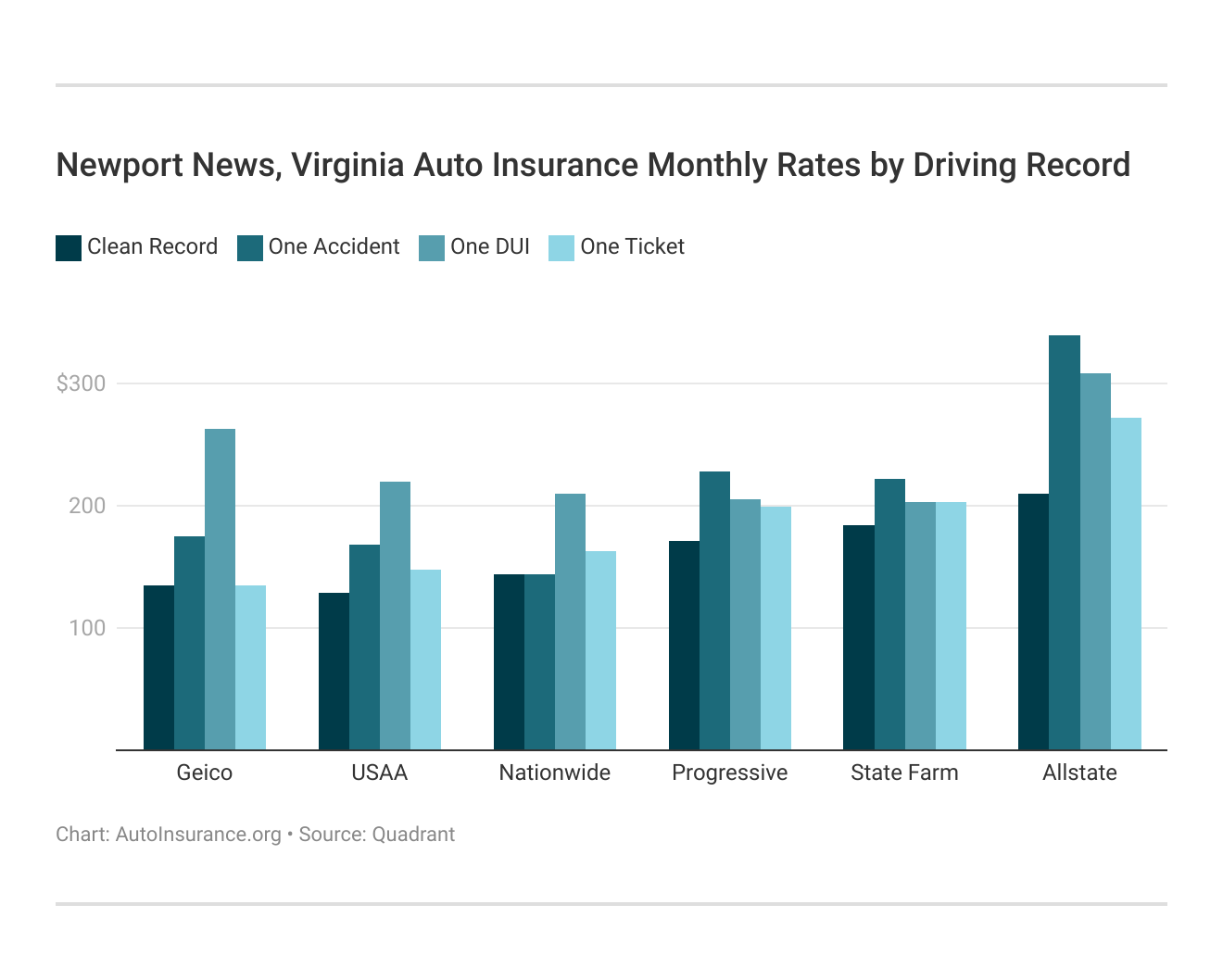

Car insurance companies look at many specific factors that determine your car insurance rates, such as age, gender, marital status, driving record, and credit history. One of the most significant of those determining factors is your driving record.

In fact, some auto insurance companies will reward you with up to 40% off for having a clean driving record.

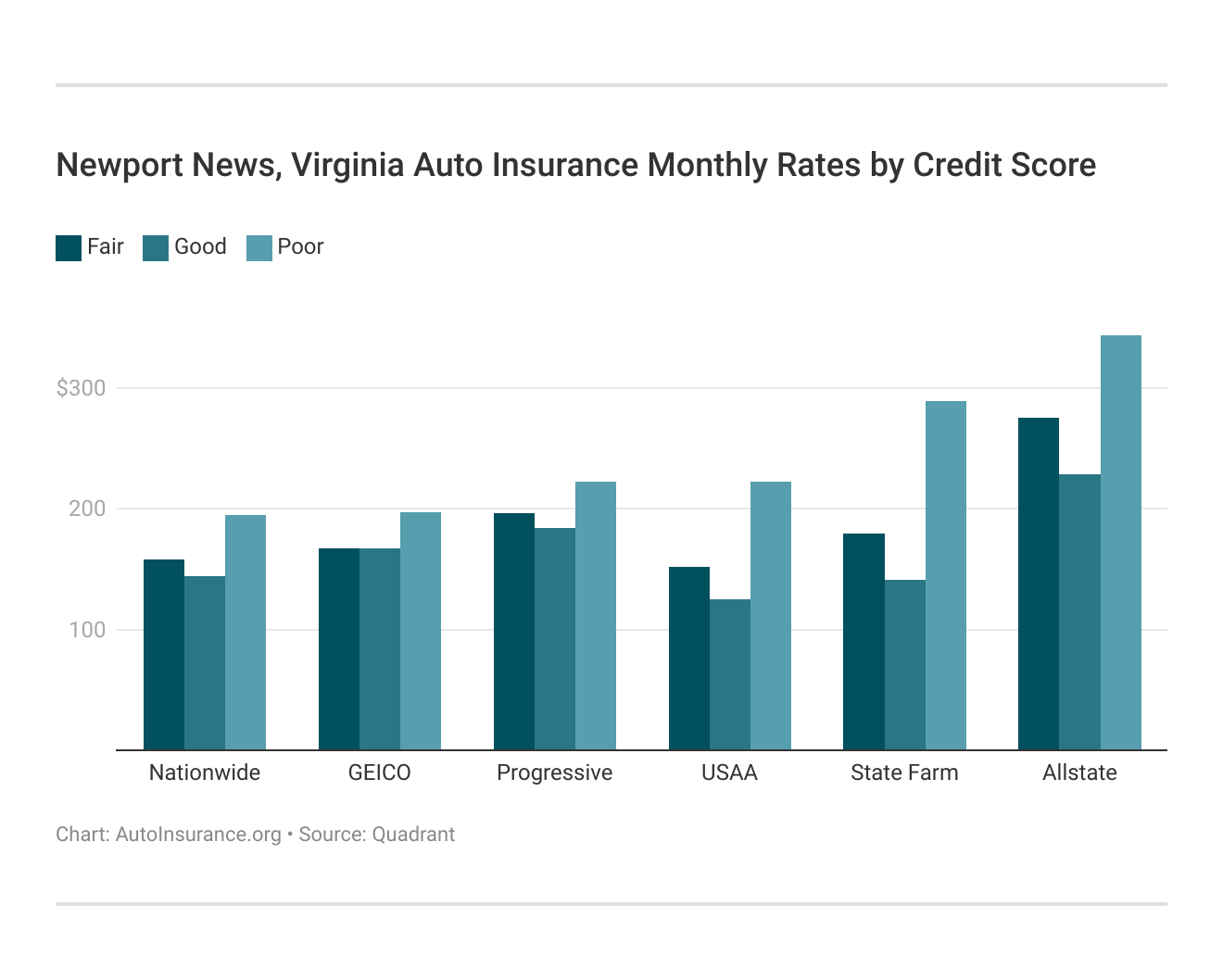

In addition to preventing traffic violations or accidents, a good credit score can lower your auto insurance rates even more. Your neighborhood ZIP code is also a factor that determines auto insurance. The cheapest ZIP code in Newport News, Virginia, is 23606, and its average car insurance cost is $170 per month.

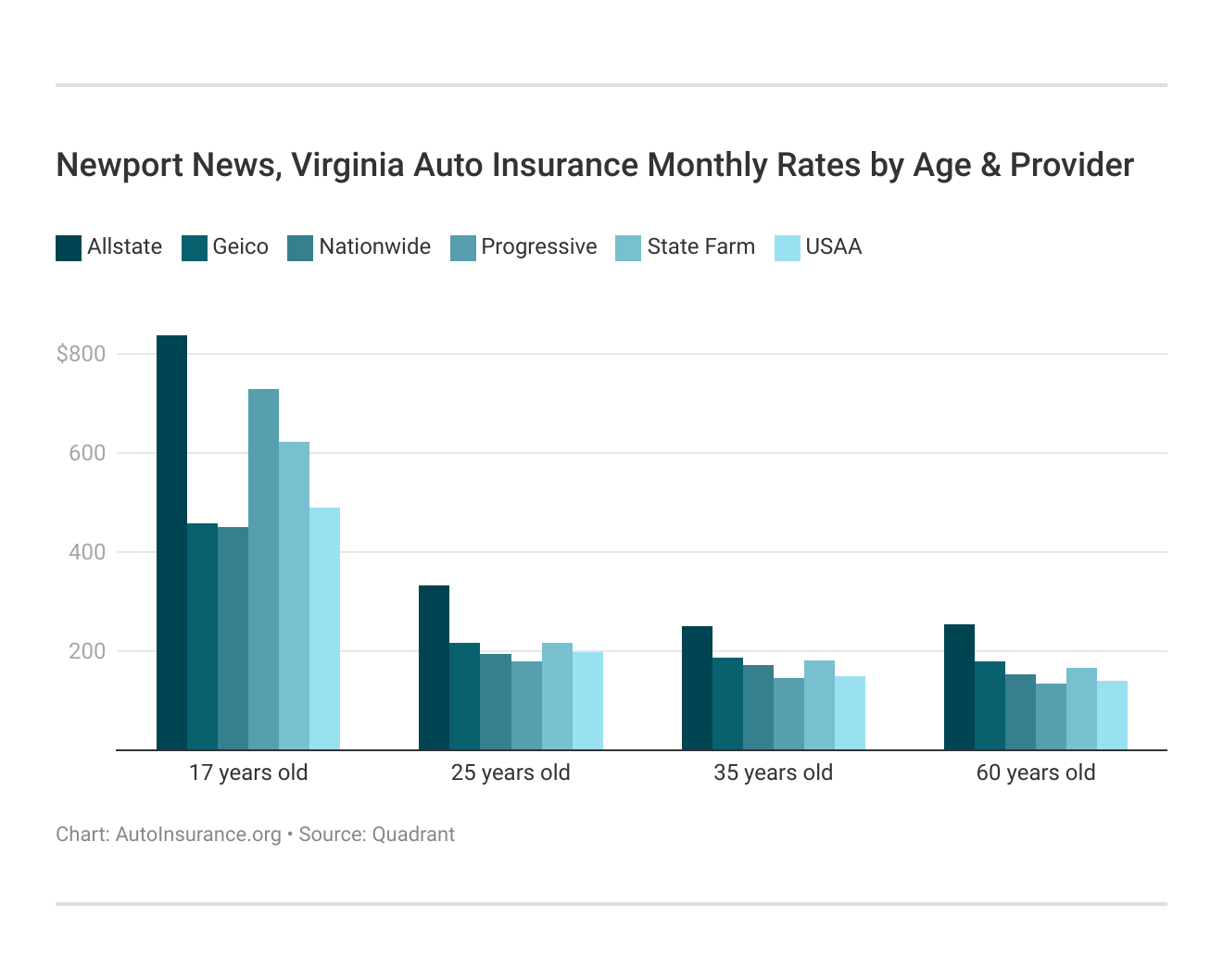

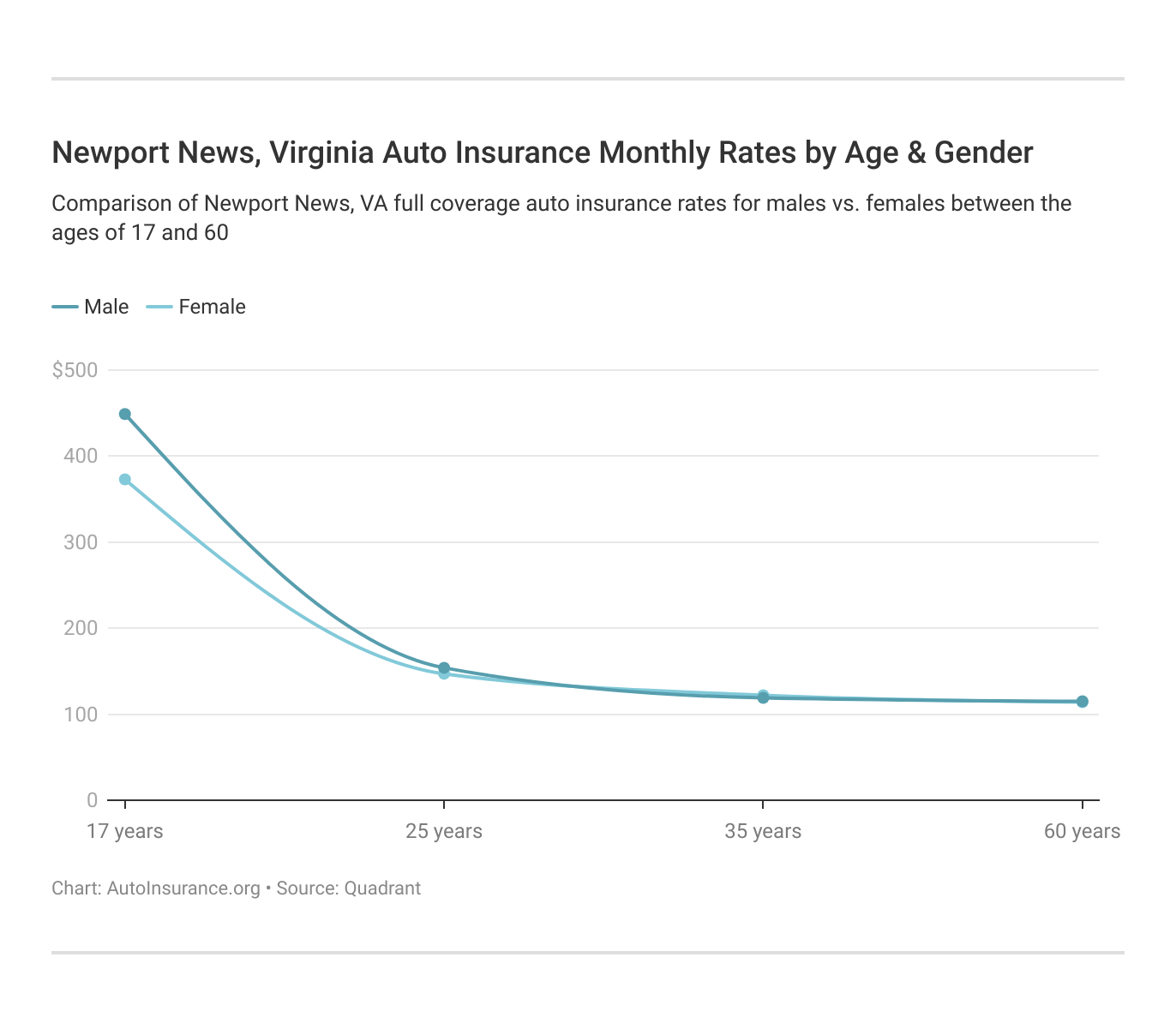

If you’re a driver under 25 years old, you could face car insurance quotes up to $449 per month. On the other hand, senior drivers may have car insurance rates of about $114 per month.

For budget-conscious drivers in Newport News, Geico provides unbeatable rates with comprehensive coverage.Dani Best Licensed Insurance Producer

Newport News, VA auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Your credit score will play a major role in your Newport News auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Newport News, VA, auto insurance rates by credit score below.

Your driving record will play a major role in your Newport News auto insurance rates. For example, other factors aside, a Newport News, VA DUI may increase your auto insurance rates by 40 to 50%. Find the cheapest Newport News, VA, auto insurance rates by driving record.

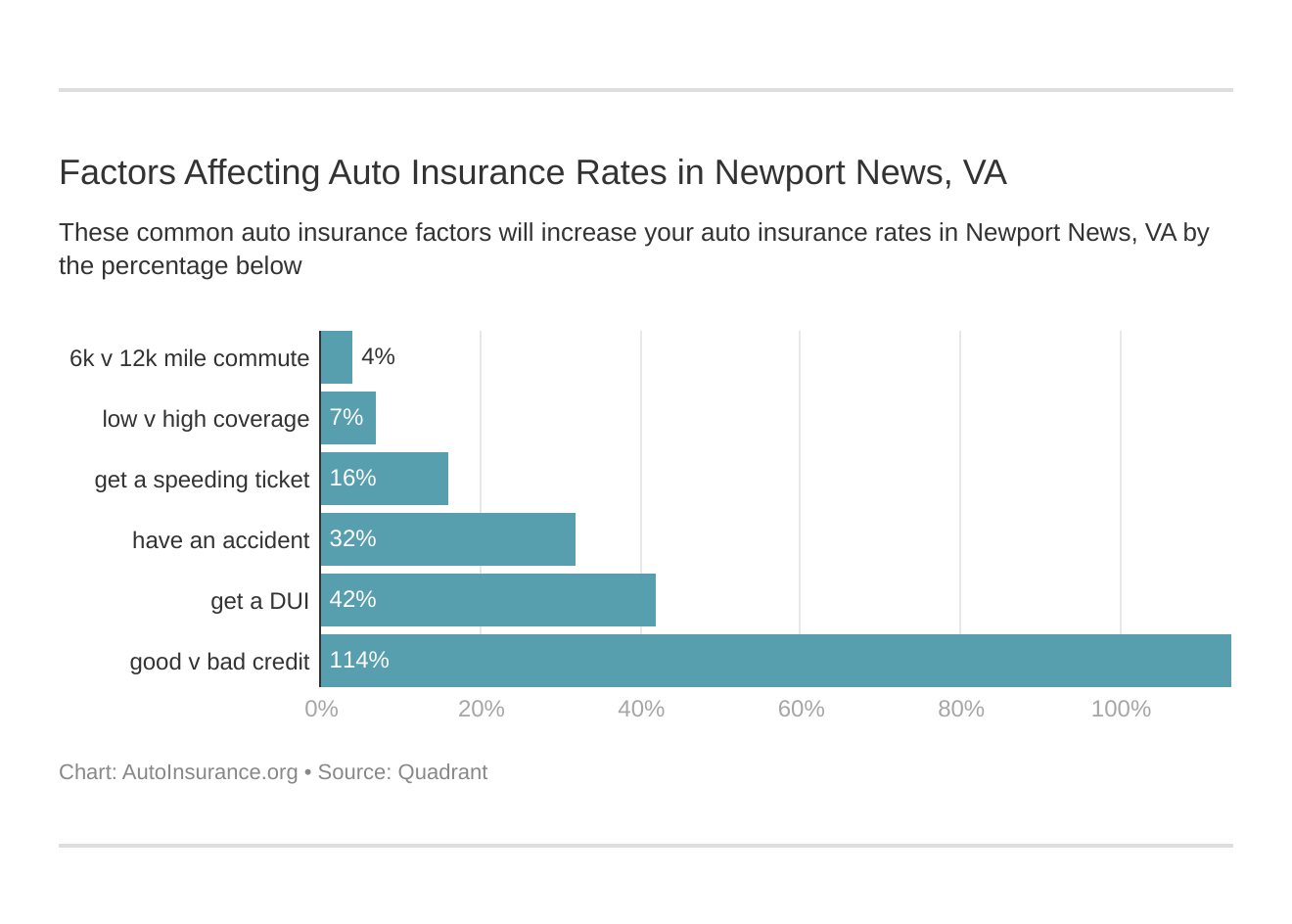

Factors affecting auto insurance rates in Newport News, VA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Newport News, Virginia, auto insurance.

These states no longer use gender to calculate your auto insurance rates; Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. However, age is still a significant factor because young drivers are often considered high-risk. Virginia does use gender, so check out the average monthly auto insurance rates by age and gender in Newport News, VA.

Understanding how age and gender impact auto insurance rates in Newport News, VA can help you make informed decisions. Use this comparison to find the best coverage options for your specific needs.

Minimum Auto Insurance Coverage Requirements in Newport News, VA

Understanding the minimum auto insurance coverage requirements in Newport News, VA is essential for all drivers. These mandatory limits help protect against liability in the event of an accident. All Newport News drivers must have the minimum Virginia auto insurance requirements, which are:

- $25,000 for bodily injury liability of one person per accident

- $50,000 for bodily injury liability of multiple people per accident

- $20,000 for property damage liability per accident

Some auto insurance agents may recommend coverage for uninsured/underinsured motorists to cover the gaps in insurance. Collision and comprehensive coverage can get additional car insurance coverage for property damage, regardless of fault.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting Auto Insurance Rates in Newport News, VA

Did you know auto insurance companies determine rates based on how much you drive? We see this factor as commute mileage, which measures the miles a motorist drives during an insurance policy. Most drivers in the United States travel around 14,000 miles per year. That’s about 25 minutes, on average. However, Newport News drivers have faster commutes.

According to Data USA, it takes the average Newport News driver 23 minutes to get to work. To save money on auto insurance, you can drive less during the policy. In Newport News, VA, weather has little effect on car insurance, but drivers should still be cautious during the winter and fall seasons, as storms tend to increase during those seasons.

The Impact of Vehicle Theft on Newport News Auto Insurance

The short answer is yes. However, vehicle theft only has a significant impact on comprehensive auto insurance. Higher rates of motor vehicle theft in any city can increase auto insurance costs. The FBI annual statistics reported that Newport News had 340 auto thefts in 2019, which is much lower than the biggest cities in Virginia. Therefore, your comprehensive insurance could be cheaper than average.

Finding the Right Auto Insurance in Newport News, Virginia

Newport News, VA car insurance rates may be cheaper than most cities in the United States, but it all depends on car insurance factors. The best way to get affordable auto insurance in Newport News is by comparing the best companies.

Teen and young adult drivers should consider going under a parent’s or legal guardian’s car insurance policy to avoid massive prices. You can even receive a discount for safety and anti-theft features on your vehicle. Before you buy auto insurance in Newport News, Virginia, be sure you’ve checked out rates from multiple companies. Enter your ZIP code below to get fast, free auto insurance quotes.

Frequently Asked Questions

What should I do to get affordable auto insurance in Newport News, VA?

To get affordable car insurance in Newport News, VA, compare quotes, maintain a clean driving record, improve your credit score, and inquire about available discounts. Find out more in our guide titled, “Auto Insurance Discounts to Ask.”

Do age and gender affect auto insurance rates in Newport News, VA?

Yes, age and gender can affect auto insurance rates in Newport News, VA, with young drivers often facing higher premiums.

Can I get discounts on auto insurance in Newport News, VA?

Yes, discounts such as safe driver discounts and multi-policy discounts are available in Newport News, VA. Get the best auto insurance rates possible in Newport News, VA by entering your ZIP code below into our free comparison tool today.

How does my credit score affect auto insurance rates in Newport News, VA?

In most states, including Virginia, a good credit score can lower auto insurance rates.

Are there any specific factors that affect auto insurance rates in Newport News, VA?

Specific factors influencing Newport News car insurance rates include commute mileage, traffic tickets or violations, and DUIs. Get further details in our comprehensive guide, “Factors That Affect Auto Insurance Rates.”

What are the options for car insurance in Newport News, VA?

Car insurance in Newport News, VA offers a variety of options, with companies like Geico, USAA, and Erie providing affordable insurance coverage.

Where can I find cheap auto insurance in Newport News?

To find cheap auto insurance in Newport News, consider providers like Geico and USAA, which offer competitive rates starting at $100 per month.

Which company offers the best car insurance in Newport News?

Geico is considered the best car insurance company in Newport News, offering low rates and comprehensive coverage.

How can I find cheap car insurance in VA?

You can find cheap car insurance in VA by comparing rates from providers like Geico, Progressive, and State Farm, focusing on monthly premiums. Additional information is available about this provider in our article, “Cheapest Auto Insurance Companies.”

How do I get direct auto insurance in Newport News?

Direct auto insurance in Newport News can be obtained by contacting companies like Geico directly for quotes and coverage options.

Where can I get auto insurance quotes in Petersburg, VA?

Auto insurance quotes in Petersburg, VA can be obtained online from providers like Geico, Progressive, and State Farm.

What options are available for direct auto in Newport News?

Direct auto in Newport News is available through companies like Geico, offering easy access to coverage and quotes online.

How can I find home insurance in Newport News?

Home insurance in Newport News is offered by providers like State Farm and Allstate, providing comprehensive coverage for homeowners. Find more information in our complete guide, “Where to Compare Auto Insurance Rates.”

What is SR22 insurance in Altavista?

SR22 insurance Altavista, VA is required for high-risk drivers and can be obtained through providers like Progressive and State Farm.

What is the cheapest car insurance in VA for young drivers?

The cheapest car insurance in VA for young drivers is often provided by Geico, offering competitive rates and discounts.

Where can I find a VA life insurance rate chart?

A VA life insurance rate chart can be obtained through providers like State Farm and USAA, detailing monthly premiums and coverage options.

How can I contact State Farm insurance in Newport News, VA?

State Farm insurance in Newport News, VA can be contacted through their local offices or online for quotes and services. Discover more by checking out our guide titled, “Best State Farm Auto Insurance Discounts.”

How do I get car shipping quotes in Newport News, VA?

Car shipping quotes in Newport News, VA can be requested from shipping companies online, offering competitive pricing for vehicle transport.

Where can I find an insurance agency in Newport News, VA?

An insurance agency in Newport News, VA can be located through a quick online search, with options like Geico and State Farm readily available.

What is the best insurance for people with a bad driving record?

The best insurance for people with a bad driving record often comes from providers like Progressive, which specializes in high-risk coverage. Protect your vehicle in Newport News, VA at the best price by entering your ZIP code into our free auto insurance quote comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.