Cheap Nissan Auto Insurance in 2025 (Save With These 10 Companies)

Erie, State Farm, and Progressive have the lowest rates for cheap Nissan auto insurance. Minimum coverage at Erie, for example, is an average of only $32/mo. However, average rates will vary by Nissan model, vehicle age, and coverage type. Newer Nissan vehicles will typically have the most expensive rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Nissans

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Nissans

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Nissans

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsErie, State Farm, and Progressive are the top providers of cheap Nissan auto insurance.

Nissan auto insurance costs as low as $32 monthly for minimum coverage with the cheapest companies. However, factors such as vehicle age, type, and mileage all impact Nissan insurance rates.

So, it’s always important to compare auto insurance rates by vehicle make and model to find the best Nissan car insurance.

Luckily, Nissan owners see fairly low rates from most top insurers.

Our Top 10 Company Picks: Cheap Nissan Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A+ | Filing Claims | Erie |

| #2 | $47 | A++ | Local Agents | State Farm | |

| #3 | $56 | A+ | Loyalty Rewards | Progressive | |

| #4 | $61 | A+ | Organization Discount | The Hartford |

| #5 | $62 | A | Customer Service | American Family | |

| #6 | $63 | A+ | Widespread Availability | Nationwide |

| #7 | $65 | A | Roadside Assistance | AAA |

| #8 | $76 | A | First-Responder Discount | Farmers |

| #9 | $87 | A+ | Usage-Based Discount | Allstate | |

| #10 | $96 | A | Business Vehicles | Liberty Mutual |

We’ll go over how much Nissan car insurance costs and how to find cheap Nissan auto insurance below. Then, you can start comparing free Nissan insurance quotes today by entering your ZIP code.

- Erie has the cheapest Nissan auto insurance on average

- Nissan car insurance costs as low as $32 per month

- You could also find cheaper car insurance for a Nissan by insuring an older model

#1 – Erie: Top Pick Overall

Pros

- Filing Claims: Erie has a simple claims process, which you can read more about in our Erie auto insurance review.

- Rate Lock: Customers who rarely make policy changes will benefit from Erie’s rate lock guarantee.

- Add-On Coverages: Erie offers coverages to help meet different driver needs, such as roadside assistance.

Cons

- UBI Discount: Erie offers gift cards through its UBI program instead of an auto insurance discount.

- Availability: Currently, Erie auto insurance is not offered in all states.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agents

Pros

- Local Agents: State Farm offers great customer service, in part due to its availability of local agents. Learn more in our State Farm auto insurance review.

- Multi-Policy Discount: State Farm customers can save by bundling policies.

- Financial Ratings: State Farm has great financial strength ratings.

Cons

- Agent-Only Purchases: You can’t purchase a policy online after getting a quote.

- UBI Discount Availability: Customers may not be able to get State Farm’s UBI discount in their state.

#3 – Progressive: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Customers who stick with Progressive may earn a loyalty discount. Learn about Progressive’s other saving opportunities in our Progressive auto insurance review.

- Budgeting Tool: Progressive’s free tool allows customers to calculate their coverage options on a budget.

- Add-On Coverages: Progressive’s selection of add-on coverages includes gap insurance for new Nissans.

Cons

- UBI Rate Increases: Poor driving performances while participating in Progressive’s UBI program can result in rate increases.

- Customer Satisfaction: Progressive has average and below-average ratings and reviews for its customer service.

#4 – The Hartford: Best for Organization Discount

Pros

- Organization Discount: AARP members qualify for a discount at The Hartford. Learn more in our review of The Hartford auto insurance.

- UBI Program: Customers can save by participating in The Hartford’s UBI program.

- Accident Forgiveness: The Hartford offers accident forgiveness to safe drivers.

Cons

- Rates Best for Older Drivers: The Hartford’s rates for younger drivers are often more expensive than the average.

- Customer Complaints: Some customers have negative reviews for The Hartford.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Best for Customer Service

Pros

- Customer Service: American Family has good reviews from customers. Learn more about the company in our American Family auto insurance review.

- Coverage Options: Customers can purchase extras like gap insurance for their Nissans.

- Discount Options: American Family has loyalty discounts, good driver discounts, and more.

Cons

- Availability: Currently, American Family is not available in every state.

- High-Risk Driver Rates: American Family’s rates often aren’t as competitive for high-risk drivers.

#6 – Nationwide: Best for Widespread Availability

Pros

- Widespread Availability: Nationwide is available across the U.S. Read more about the company in our Nationwide auto insurance review.

- Vanishing Deductibles: Claim-free customers can qualify for deductible deductions.

- Accident Forgiveness: Nissan owners with clean driving records may be forgiven their first at-fault accident.

Cons

- High-Risk Driver Rates: Nationwide’s rates for high-risk drivers tend to be above average.

- Customer Reviews: Some customers rated Nationwide’s customer service as below average.

#7 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA has one of the best roadside assistance programs, which you can read about in our review of AAA auto insurance.

- Membership Perks: AAA members qualify for discounts on shopping, traveling, and more.

- Coverage Choices: AAA has a selection of add-on coverages for customers.

Cons

- Membership Fee: Customers must pay an annual AAA membership fee to purchase auto insurance.

- Various Clubs Sell AAA Coverage: AAA auto insurance is sold by different clubs, so customer service and coverage can vary from state to state.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for First-Responder Discount

Pros

- First-Responder Discount: First responders can qualify for an affiliation discount at Farmers.

- Coverage Options: Farmers has add-ons like roadside assistance to round our policies. Learn more about Farmers’ coverage in our Farmers auto insurance review.

- Accident Forgiveness: Customers with clean driving records will benefit from Farmers’ accident forgiveness policy after their first at-fault accident.

Cons

- Lacks Gap Insurance: New Nissan owners won’t be able to purchase gap insurance from Farmers.

- UBI Discount Availability: Farmers’ UBI discount is unavailable in some states.

#9 – Allstate: Best for Usage-Based Discount

Pros

- Usage-Based Discount: Allstate offers a UBI discount for good drivers. Learn about the company’s other discounts in our review of Allstate auto insurance.

- Coverage Options: Allstate offers plenty of add-ons, like rideshare insurance, to meet customers’ needs.

- Availability: Allstate insurance is available in every state, so customers don’t need to switch providers before a move.

Cons

- UBI Discount Availability: Allstate doesn’t offer its UBI discount in a few states.

- High-Risk Driver Rates: Allstate’s rates are less competitive for some high-risk drivers, such as DUI drivers.

#10 – Liberty Mutual: Best for Business Vehicles

Pros

- Business Vehicles: If your Nissan is a work vehicle, Liberty Mutual has great insurance for business vehicles.

- 24/7 Support: Liberty Mutual offers 24/7 support. Learn more about the company in our Liberty Mutual auto insurance review.

- Discount Options: Customers can save with good driver discounts, bundling discounts, and more.

Cons

- UBI Discount Availability: Not all states offer Liberty Mutual’s UBI discount.

- Customer Ratings: Liberty Mutual scored average or below average ratings from customers for customer service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Nissan Auto Insurance Rates

Are Nissans expensive to insure? It costs around $83 monthly to get full coverage auto insurance for a Nissan. See the monthly rates from top providers below:

Nissan Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $62 | $166 | |

| $32 | $83 |

| $76 | $198 |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $61 | $161 |

However, every insurance company uses different formulas when calculating rates and considers factors unique to each driver, such as driving record, demographics, and vehicle type. We’ll go over Nissan car insurance rates by model below.

Average Cost of Nissan Altima Car Insurance

Nissan Altima auto insurance averages $145 monthly. If your Nissan insurance company doesn’t offer you the lowest rates for your Altima, consider switching to get cheap auto insurance from a different car insurance company. Get quotes from cheap companies like Erie or State Farm to find out which offers the best deal.

Every vehicle’s value reduces over time, resulting in the cost of insurance decreasing, especially if you have certain types of auto insurance. Here’s what to expect to pay for insurance for a Nissan Altima based on the model year.

Nissan Altima Auto Insurance Monthly Rates by Model Year

Model Rates

2023 Nissan Altima

$144

2020 Nissan Altima $120

2019 Nissan Altima $118

2018 Nissan Altima $118

2017 Nissan Altima $117

2016 Nissan Altima $116

2015 Nissan Altima $114

Newer Nissan Altimas cost more to insure compared to older models, largely due to an older model costing less to repair, so insurance companies will charge more for coverage when you have a newer model.

Auto insurance for young adults is also more expensive than for older adults. Check out the average cost to insure an Altima by age below:

Nissan Altima Auto Insurance Monthly Rates by Driver's Age

Age Rates

16-Year-Old $461

17-Year-Old $408

18-Year-Old $359

19-Year-Old $257

20-Year-Old $230

21-Year-Old $182

22-Year-Old $167

23-Year-Old $153

24-Year-Old $144

25-Year-Old $130

40-Year-Old $110

Once drivers turn 25 years old, they will likely see a decrease in their insurance rates because they have gained more experience behind the wheel.

Average Cost of Nissan Versa Car Insurance

You’ll pay around $137 monthly for Nissan Versa car insurance coverage. However, you could find cheaper rates by insuring an older model:

Nissan Versa Auto Insurance Monthly Rates by Model Year

Model Rates

2020 Nissan Versa $114

2019 Nissan Versa $113

2018 Nissan Versa $112

2017 Nissan Versa $112

2016 Nissan Versa $111

2015 Nissan Versa $109

2014 Nissan Versa $107

2013 Nissan Versa $104

2012 Nissan Versa $100

2011 Nissan Versa $96

2010 Nissan Versa $94

As you can see, you could insure a 2011 Nissan Versa for around $96 monthly. Read more about auto insurance for older cars and how they can help you save on Nissan insurance.

Average Cost of Nissan Leaf Car Insurance

Nissan Leaf auto insurance costs $153 monthly for full coverage. As an electric vehicle, it has more expensive repair costs, so you’ll pay higher rates for car insurance for Nissan Leafs. Check out the table below to compare Nissan Leaf coverage costs by age:

Nissan Leaf Auto Insurance Monthly Rates by Age

Age Rates

16-Year-Old $560

20-Year-Old $348

30-Year-Old $160

40-Year-Old $153

50-Year-Old $140

60-Year-Old $137

As you can see, you’ll pay a lower Nissan Leaf insurance cost the older you are since you have more driving experience. Your Leaf could also qualify for electric vehicle auto insurance discounts, including a $7,500 tax credit.

Discover Nissan Vehicle Comparison

This table compares the safety ratings of small SUVs from Nissan and Chevy, focusing on whether Nissan’s ratings surpass those of Chevy.

Nissan Vehicle Comparison

The table also contrasts Nissan with Toyota and offers a starting point for Nissan auto insurance rates comparison.

Nissan Car Insurance Rates Across Models

Gain insights into the dynamic range of car insurance prices for various Nissan models, empowering consumers with comprehensive data to make well-informed decisions about their automotive insurance needs.

Cost of Car Insurance for Nissan's by Model

You will see price differences when comparing models, as Nissan Sentra insurance rates will be slightly different than Nissan Xterra insurance rates.

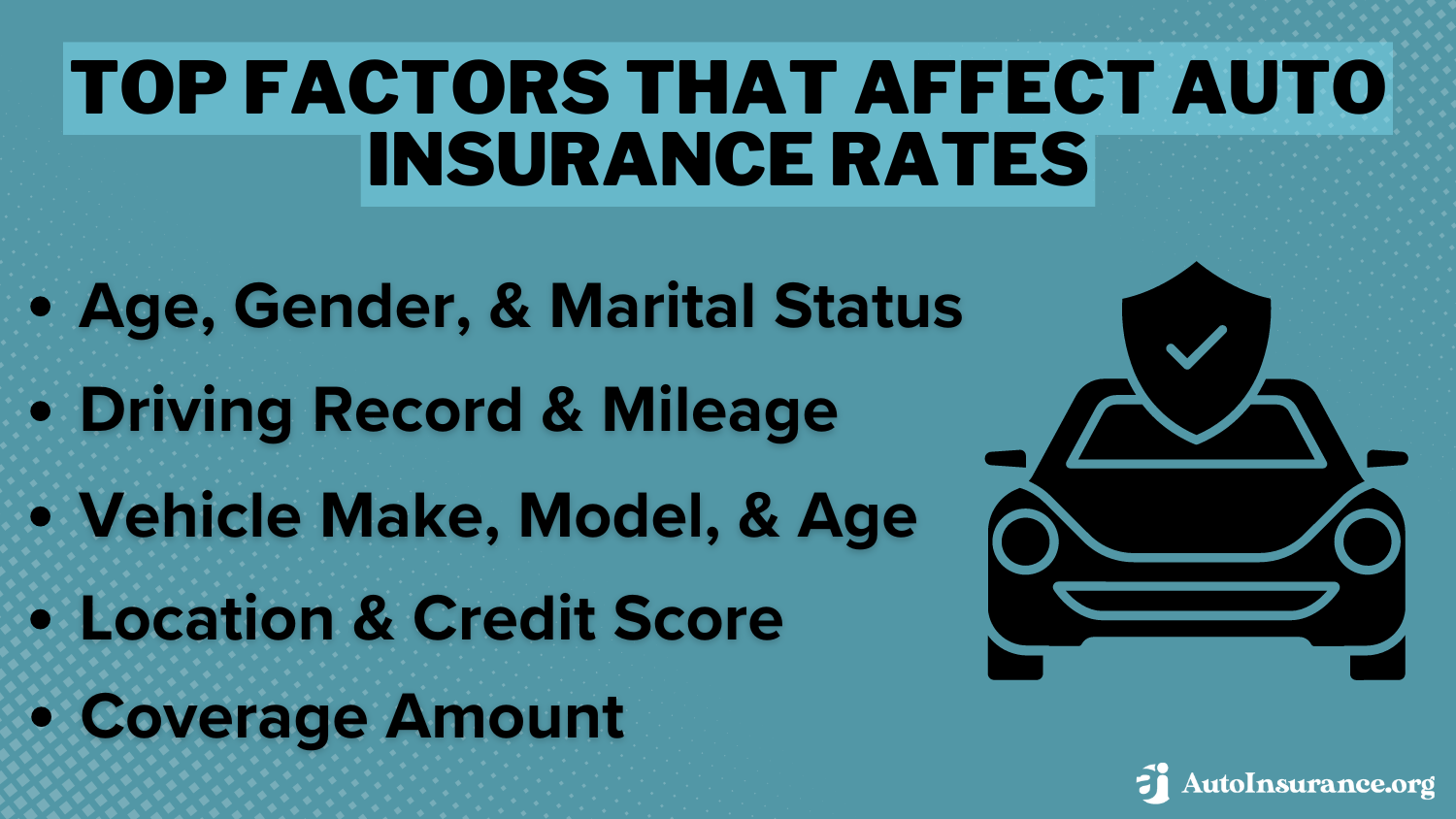

How Auto Insurance Rates for Nissans Get Calculated

There are various factors that affect auto insurance rates for Nissans, and each insurance company weighs factors differently. Check out our list of common factors that affect car insurance rates for Nissans:

Of course, you should always compare Nissan car insurance quotes from the best auto insurance companies for the cheapest premiums.

How to Save Money on Nissan Car Insurance Quotes

Many drivers wonder why is Nissan Altima insurance so high compared to other sedans. This is typically due to several factors including higher theft rates for certain Nissan models and more expensive replacement parts.

Even Nissan Armada insurance and Nissan Xterra car insurance rates are a bit pricier due to their higher vehicle value.

Do you like doing the same thing over and over🥱? Wouldn't it be nice to get several auto insurance quotes at once instead of entering the same information📊 a hundred times? https://t.co/27f1xf1ARb has what you need to stop wasting your time. Check out👉: https://t.co/wKUJsuX6su pic.twitter.com/i5zKxesbop

— AutoInsurance.org (@AutoInsurance) August 8, 2023

Nissan auto insurance costs around 24% higher than the national average, but discounts can help you save. Whether you’re looking for insurance on a Nissan, knowing how to reduce your premiums is essential.

Nissan Auto Insurance Discounts

| Insurance Company | Bundling | Safe Driver | Good Student | Anti-Theft Device | Loyalty |

|---|---|---|---|---|---|

| 15% | 10% | 14% | 8% | 12% |

| 25% | 18% | 22% | 10% | 15% | |

| 25% | 18% | 20% | 25% | 18% | |

| 25% | 15% | 15% | 10% | 12% |

| 20% | 20% | 15% | 10% | 10% | |

| 25% | 20% | 12% | 35% | 10% |

| 20% | 12% | 18% | 5% | 8% |

| 10% | 10% | 10% | 25% | 13% | |

| 17% | 20% | 35% | 15% | 10% | |

| 12% | 8% | 10% | 10% | 7% |

Confirm which auto insurance discounts are offered by your insurance company and inquire about how to apply them to your policy. In most cases, making a few quick and easy changes can get you down to a more acceptable number if you’re not satisfied with your current Nissan auto insurance rates.

Insurers consider not only Nissan’s make, model, and year, but also look at the car's engine size, repair cost, and safety record.Michelle Robbins Licensed Insurance Agent

By implementing these strategies, most Nissan owners can reduce their insurance costs by 15-40%. Even if your initial car insurance for the Nissan Altima seems high, these approaches can help bring your premium down to a more reasonable level.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Buy a Cheap Nissan Auto Insurance Policy

Erie, State Farm, and Progressive offer cheap Nissan auto insurance thanks to their low monthly rates, starting at just $32; searching for affordable Nissan insurance is easy if you know how to lower your auto insurance rates. Of course, the cost of auto insurance will vary based on several factors.

When you seek affordable insurance for your Nissan, keep in mind that the costs differ greatly from one model to another. The Armada and Pathfinder often come at a lower price, while the 370Z, with its performance, tends to be more expensive to insure.

So, get started on comparing cheap Nissan insurance quotes today by entering your ZIP code.

Frequently Asked Questions

What is Nissan auto insurance?

Nissan auto insurance refers to the insurance coverage specifically designed for Nissan vehicles. It provides financial protection in the event of accidents, damage to the vehicle, or injuries to individuals involved in a car accident while driving a Nissan.

Are Nissan cars expensive to insure?

Nissan auto insurance costs around $83 monthly for full coverage, though rates vary by company. Erie offers the cheapest rates, starting at just $32 monthly for minimum coverage.

How do I get quotes for a Nissan Altima?

To get quotes for a Nissan Altima, you select multiple car insurance companies and provide each with the requested personal and vehicle information. Learn more: How to Get Multiple Auto Insurance Quotes

How much is insurance for a 2023 Nissan Altima?

Nissan Altima insurance costs around $145 monthly, close to the overall Nissan average.

Why is Nissan Altima insurance so high?

Nissan auto insurance shouldn’t be too expensive. If your Nissan Altima insurance cost are high, you can reduce them by shopping around, improving your credit score, taking advantage of discounts, bundling policies, optimizing coverage, and maintaining a clean driving record.

Which Nissan is cheapest to insure?

The Nissan Pathfinder and Nissan Armada car insurance are the cheapest Nissans to insure. Read more about Nissan Pathfinder auto insurance.

How does the vehicle’s model year impact the cost of insurance?

The vehicle’s model year can drive up the cost of insurance because the newer the vehicle, the higher the cost of repairs.

Why is a Nissan Maxima so expensive to insure?

Nissan Maxima auto insurance averages $158 monthly, more than 7% higher than the overall Nissan average. Nissan Maxima insurance rates are high partly due to their high theft rate.

Do I need specific insurance for my Nissan vehicle?

Yes, all vehicles, including Nissan vehicles, require auto insurance coverage to comply with legal requirements and protect against potential financial losses. Insurance for Nissan owners provides coverage tailored fit to their specific needs.

Why is Nissan insurance so expensive?

Nissan insurance can be more expensive because of poor crash safety ratings and expensive repair costs. Nissan Rogue insurance cost and Nissan Sentra car insurance may be higher in areas with elevated theft rates. To find cheap car insurance for Nissan vehicles, compare rates with our free tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.