Best Nissan Cube Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

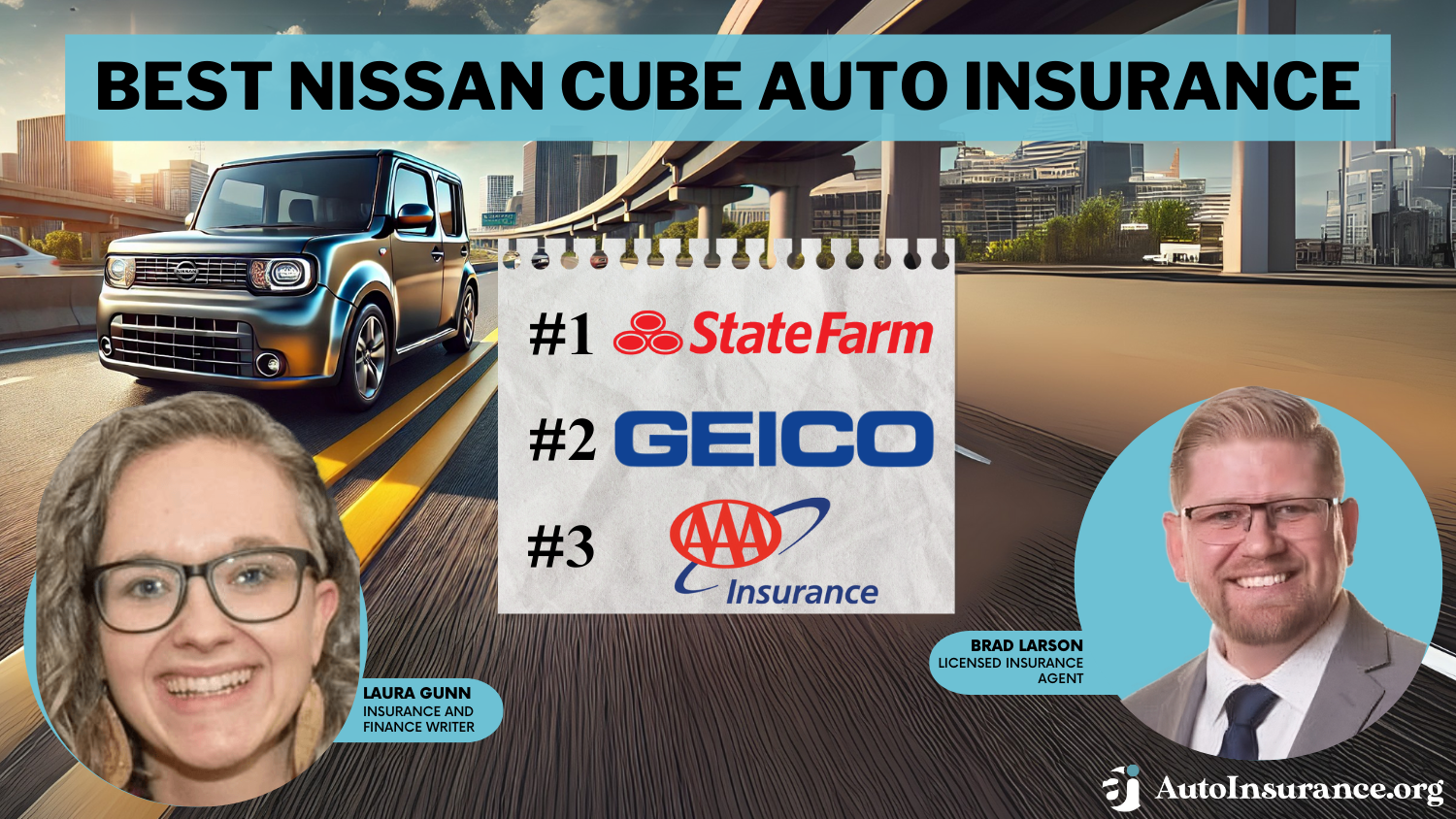

The top providers for the best Nissan Cube auto insurance are State Farm, Geico, and AAA, with rates starting at $40/month. State Farm offers excellent coverage, Geico provides competitive pricing, and AAA delivers top-notch customer service and roadside assistance, making them ideal for Nissan Cube owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Nissan Cube

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Nissan Cube

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Nissan Cube

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews

The top picks for the best Nissan Cube auto insurance are State Farm, Geico, and AAA, offering the most competitive rates and comprehensive coverage options with minimum data rate of $40/month.

This article delves into the key factors that make these providers stand out, including affordability, customer service, and policy flexibility. By comparing various aspects such as discounts, claims processing, and overall satisfaction, we reveal why these companies are the leading choices for Nissan Cube owners.

Our Top 10 Company Picks: Best Nissan Cube Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 13% B Many Discounts State Farm

#2 15% A++ Custom Plan Geico

#3 10% A Online App AAA

#4 18% A+ Online Convenience Progressive

#5 12% A+ Usage Discount Nationwide

#6 16% A+ Add-on Coverages Allstate

#7 9% A++ Accident Forgiveness Travelers

#8 14% A Local Agents Farmers

#9 17% A Customizable Polices Liberty Mutual

#10 11% A++ Military Savings USAA

Whether you prioritize low premiums or exceptional service, this guide will help you make an informed decision on the best Nissan Cube auto insurance.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- State Farm provides top coverage and competitive rates for Nissan Cube owners

- For the best Nissan Cube auto insurance, comprehensive coverage is essential

- Finding the best Nissan Cube auto insurance can lower costs to around $147/month

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm offers a variety of discounts that can help make the cost of the best Nissan Cube auto insurance more affordable, including multi-vehicle, safe driving, and bundling discounts. Learn more in our State Farm auto insurance review.

- Good Customer Service: Known for its reliable customer service, State Farm provides effective handling of claims, which is beneficial for those seeking the best Nissan Cube auto insurance experience.

- Wide Network of Agents: With an extensive network of local agents, State Farm offers personalized service and support, making it easier to manage your best Nissan Cube auto insurance policy.

Cons

- Average Ratings: AAA has an A.M. Best rating of B, which is considered average compared to competitors with higher ratings, potentially affecting the overall appeal for best Nissan Cube auto insurance.

- Limited Digital Tools: The online tools and app functionality offered by AAA may not be as advanced or user-friendly as those from some competitors, which could be a drawback for managing your best Nissan Cube auto insurance online.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Custom Plan

Pros

- Custom Plan Options: Geico offers flexible insurance plans tailored to the needs and preferences of Nissan Cube owners, ensuring you can find a plan that suits your specific requirements.

- High Financial Strength: With an A.M. Best rating of A++, Geico’s excellent financial stability provides peace of mind for Nissan Cube drivers, knowing that the insurer is financially reliable.

- Competitive Discounts: Based on our Geico auto insurance review, the company provides a variety of discounts, including a notable multi-vehicle discount, which can be advantageous for Nissan Cube owners with multiple cars.

Cons

- Customer Service Issues: Some Nissan Cube drivers have reported less satisfactory experiences with Geico’s customer service compared to other insurance providers, which could impact the overall satisfaction with their auto insurance.

- Limited Coverage Options: Geico may not offer as many add-on coverage options as some competitors, which could be a drawback for Nissan Cube owners seeking comprehensive or specialized coverage.

#3 – AAA: Best for Online App

Pros

- Online App: As outlined by our AAA auto insurance review, the company offers a user-friendly app that simplifies managing policies and filing claims, enhancing the experience for those seeking the best Nissan Cube auto insurance.

- Strong Membership Benefits: AAA members benefit from perks such as roadside assistance and travel discounts, which complement their best Nissan Cube auto insurance.

- Good Reputation: AAA is well-regarded for its reliability and customer satisfaction, which is valuable when managing the best Nissan Cube auto insurance claims.

Cons

- Lower Multi-Vehicle Discount: AAA provides a lower multi-vehicle discount compared to some competitors, which could affect the affordability of the best Nissan Cube auto insurance if you have multiple vehicles.

- Higher Premiums: Premiums with AAA might be higher than those from some other providers, potentially impacting the overall cost of the best Nissan Cube auto insurance depending on coverage and available discounts.

#4 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive offers easy-to-use online tools for quoting, purchasing, and managing your Nissan Cube auto insurance policy.

- High Multi-Vehicle Discount: The insurer provides a generous multi-vehicle discount, which can be beneficial if you have multiple vehicles to insure, including your Nissan Cube.

- Flexible Coverage Options: Progressive offers a range of coverage options tailored to suit different needs, ensuring you can find the best coverage for your Nissan Cube. Unlock details in our Progressive auto insurance review.

Cons

- Mixed Customer Service Reviews: Some customers report issues with customer service and claims handling, which might affect your experience with Progressive’s Nissan Cube auto insurance.

- Complex Policy Structure: The coverage options and add-ons can be complex and difficult to navigate, making it challenging to determine the best coverage for your Nissan Cube.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide offers usage-based discounts that could make it a top choice for those seeking the best Nissan Cube auto insurance, reflecting how driving habits impact your premium.

- Strong Financial Rating: With an A.M. Best rating of A+, Nationwide demonstrates strong financial stability, making it a reliable option for the best Nissan Cube auto insurance.

- Good Customer Service: As per our Nationwide auto insurance review, the company generally receives positive feedback for customer service and claims handling, which can be crucial when securing the best Nissan Cube auto insurance.

Cons

- Lower Multi-Vehicle Discount: Nationwide’s multi-vehicle discount may be less competitive compared to other insurers, which might impact the cost-effectiveness of the best Nissan Cube auto insurance if you have multiple vehicles.

- Limited Digital Tools: The online tools and mobile app functionality might not be as advanced as those of competitors, which could affect your experience when managing the best Nissan Cube auto insurance.

#6 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: Allstate offers a wide range of add-on coverages for the best Nissan Cube auto insurance, allowing you to customize your policy to fit specific needs.

- Strong Financial Strength: With an A.M. Best rating of A+, Allstate demonstrates strong financial stability, ensuring reliable coverage for the best Nissan Cube auto insurance. See more details on our Allstate auto insurance review.

- Numerous Discounts: Allstate provides various discounts, including multi-vehicle and safe driving discounts, which can make their coverage for the best Nissan Cube auto insurance more affordable.

Cons

- Higher Premiums: Premiums for the best Nissan Cube auto insurance with Allstate can be higher compared to some other insurance providers.

- Mixed Customer Service Experiences: Experiences with customer service can be mixed, with some customers reporting less satisfactory service when dealing with Allstate for the best Nissan Cube auto insurance.

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers includes accident forgiveness in its coverage options, which can benefit those seeking the best Nissan Cube auto insurance.

- High Financial Rating: With an A.M. Best rating of A++, Travelers demonstrates excellent financial stability, making it a reliable choice for the best Nissan Cube auto insurance.

- Competitive Discounts: According to our Travelers auto insurance review, the company offers competitive discounts such as multi-vehicle and bundling discounts, helping to make their best Nissan Cube auto insurance more affordable.

Cons

- Lower Multi-Vehicle Discount: The multi-vehicle discount provided by Travelers is lower than some competitors, which may impact the cost-effectiveness of the best Nissan Cube auto insurance.

- Complex Policy Options: The policy options and coverage details can be complex to navigate, which might be a drawback for those seeking straightforward best Nissan Cube auto insurance solutions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers offers an extensive network of local agents, providing personalized service and support for the best Nissan Cube auto insurance.

- High Multi-Vehicle Discount: For those insuring multiple vehicles, Farmers provides a substantial discount, which can benefit those seeking the best Nissan Cube auto insurance rates.

- Customizable Policies: Farmers allows for a range of customizable policy options, catering to various needs for the best Nissan Cube auto insurance coverage. Discover insights in our Farmers auto insurance review.

Cons

- Average Financial Strength: Farmers has an A.M. Best rating of A, indicating average financial stability compared to higher-rated competitors, which may affect the best Nissan Cube auto insurance offerings.

- Mixed Customer Service: Customer service experiences with Farmers can vary, with some policyholders reporting issues with claims handling, impacting their overall satisfaction with the best Nissan Cube auto insurance.

#9 – Liberty Mutual: Best for Customizable Polices

Pros

- Customizable Policies: Liberty Mutual offers a variety of customizable policy options for the best Nissan Cube auto insurance, allowing you to tailor coverage to your specific needs. Read up on the Liberty Mutual auto insurance review for more information.

- High Multi-Vehicle Discount: Liberty Mutual provides a generous multi-vehicle discount, which can be beneficial if you insure multiple vehicles, including the best Nissan Cube auto insurance.

- Strong Financial Stability: With an A.M. Best rating of A, Liberty Mutual demonstrates strong financial stability, which is reassuring when choosing the best Nissan Cube auto insurance.

Cons

- Higher Premiums: The premiums for the best Nissan Cube auto insurance with Liberty Mutual can be on the higher side compared to some competitors, potentially increasing your overall insurance costs.

- Mixed Customer Reviews: Liberty Mutual has mixed customer reviews, with some reporting less satisfactory experiences related to customer service and claims handling for the best Nissan Cube auto insurance.

#10 – USAA: Best for Military Savings

Pros

- Military Savings: In line with our USAA auto insurance review, the company offers special discounts and benefits for military members and their families, which can contribute to finding the best Nissan Cube auto insurance rates for those eligible.

- High Financial Rating: USAA’s A.M. Best rating of A++ reflects excellent financial stability, ensuring that they provide reliable coverage for the best Nissan Cube auto insurance.

- Excellent Customer Service: In line with our is renowned for its superior customer service and efficient handling of claims, making it a top choice for the best Nissan Cube auto insurance.

Cons

- Limited Eligibility: The best Nissan Cube auto insurance from USAA is only available to military members, veterans, and their families, limiting accessibility for non-eligible drivers.

- Higher Premiums: Depending on coverage and available discounts, the best Nissan Cube auto insurance premiums with USAA might be higher compared to some other providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Nissan Cube Auto Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Nissan Cube from various providers.

Nissan Cube Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $73 $221

Allstate $61 $178

Farmers $96 $305

Geico $59 $181

Liberty Mutual $73 $224

Nationwide $71 $203

Progressive $40 $129

State Farm $50 $147

Travelers $64 $197

USAA $59 $174

The table outlines Nissan Cube auto insurance premiums across different companies. Progressive offers the most affordable rates, with minimum coverage at $40 and full coverage at $129. In contrast, Farmers has the highest premiums, with minimum coverage at $96 and full coverage at $305. AAA and Liberty Mutual have comparable full coverage costs at $221 and $224, respectively.

State Farm offers the best Nissan Cube auto insurance with competitive rates and comprehensive coverage options.Brandon Frady Licensed Insurance Producer

Allstate, Nationwide, and Travelers fall in between, with varying mid-range rates. Geico and USAA also provide competitive pricing, with full coverage at $181 and $174, respectively. This comparison helps identify cost-effective options for Nissan Cube auto insurance.

Nissan Cube Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $101 |

| Discount Rate | $60 |

| High Deductibles | $215 |

| High Risk Driver | $215 |

| Low Deductibles | $127 |

| Teen Driver | $369 |

Understanding the insurance costs for the Nissan Cube is essential for budgeting and financial planning. By examining rates for different driver profiles and deductible levels, consumers can find the best Nissan Cube auto insurance. Discount rates indicate potential premium savings, while high deductibles can lower costs.

The average rate provides a comparison benchmark, and low deductibles typically mean higher premiums. High-risk driver rates offer insight into insuring under these conditions, and teen driver rates reflect higher costs due to inexperience. This information helps select the best Nissan Cube auto insurance policy.

Are Nissan Cubes Expensive to Insure

The chart below details how Nissan Cube insurance rates compare to other Nissan Cube alternative hatchbacks like the FIAT 500L, Kia Soul, and Toyota Yaris.

Nissan Cube Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| FIAT 500L | $21 | $40 | $38 | $114 |

| Kia Soul | $26 | $42 | $31 | $112 |

| Toyota Yaris | $21 | $40 | $33 | $108 |

| Nissan Cube | $24 | $45 | $33 | $115 |

Compared to other hatchbacks, the Toyota Yaris generally has lower insurance costs than the Kia Soul and FIAT 500L. For those looking for the best Nissan Cube auto insurance, the Yaris’s rates can provide a useful comparison. Evaluating your specific needs and vehicle details will help you find the best insurance rates for your Nissan Cube.

What Impacts the Cost of Nissan Cube Auto Insurance

The cost of insuring a Nissan Cube is influenced by several key factors. The trim level and model year significantly impact premiums, with higher trims and newer models generally costing more due to their higher value and repair costs.

Vehicle value, including replacement cost and depreciation, also affects rates. Newer and more expensive models tend to have higher premiums, while older vehicles might be cheaper but could have increased repair costs.

Safety features, repair costs, and the risk of theft are crucial considerations as well. Vehicles with advanced safety technologies and high safety ratings may qualify for discounts, while those with costly repairs or higher theft rates could see increased premiums. Your driving history, including annual mileage and past incidents, also plays a role in determining insurance costs.

Additionally, your location, the type of coverage you choose, and the insurance provider you select, including any available discounts, will further influence the overall premium.

This table showcases the best auto insurance discounts available for Nissan Cube owners from top insurance providers. It details the discount percentages and associated programs offered by each company, with discounts ranging from 9% to 18%. The table highlights the most competitive discounts for securing the best Nissan Cube auto insurance. Programs include OnBoard, Drivewise, Snapshot, and more.

Age of the Vehicle and Its Impact on Nissan Cube Auto Insurance Rates

The age of your Nissan Cube significantly affects auto insurance rates. Typically, newer models come with higher insurance premiums. For instance, the best Nissan Cube auto insurance rates for a 2014 model average $1,212 annually.

In contrast, insuring a 2010 Nissan Cube costs about $1,084 per year, reflecting a difference of $128. This variation highlights the importance of considering the vehicle’s age when seeking the best Nissan Cube auto insurance.

To better understand this impact, here are the average annual Nissan Cube auto insurance rates by model year:

Auto insurance is more expensive for newer cars simply because it costs more to repair or replace them.

Nissan Cube Auto Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Nissan Cube | $21 | $33 | $39 | $104 |

| 2023 Nissan Cube | $20 | $33 | $39 | $103 |

| 2022 Nissan Cube | $20 | $32 | $39 | $103 |

| 2021 Nissan Cube | $20 | $31 | $39 | $102 |

| 2020 Nissan Cube | $19 | $30 | $39 | $101 |

| 2019 Nissan Cube | $19 | $29 | $38 | $100 |

| 2018 Nissan Cube | $18 | $28 | $38 | $99 |

| 2017 Nissan Cube | $18 | $28 | $38 | $98 |

| 2016 Nissan Cube | $18 | $27 | $38 | $98 |

| 2015 Nissan Cube | $17 | $26 | $38 | $97 |

| 2014 Nissan Cube | $17 | $25 | $38 | $96 |

| 2013 Nissan Cube | $18 | $29 | $38 | $99 |

| 2012 Nissan Cube | $18 | $26 | $38 | $95 |

| 2011 Nissan Cube | $16 | $24 | $38 | $92 |

| 2010 Nissan Cube | $16 | $23 | $39 | $90 |

These rates demonstrate how the best Nissan Cube auto insurance can vary significantly based on the vehicle’s model year, with newer models generally incurring higher premiums.

Driver Age

Understanding how driver age affects Nissan Cube auto insurance rates can help you make informed decisions about your insurance needs. Insurance companies consider age a key factor due to its correlation with driving experience and risk levels.

Generally, younger drivers face higher premiums due to their inexperience, while older drivers benefit from lower rates. Below is a brief description of the table showing the monthly Nissan Cube auto insurance rates by age. Unlock details in our guide titled, “Auto Insurance Rates by Age.”

Nissan Cube Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $480 |

| Age: 18 | $369 |

| Age: 20 | $229 |

| Age: 30 | $105 |

| Age: 40 | $101 |

| Age: 45 | $98 |

| Age: 50 | $92 |

| Age: 60 | $90 |

The table demonstrates the variation in monthly Nissan Cube auto insurance rates across different age groups. Younger drivers, such as 16-year-olds, face the highest premiums at $480 per month. As drivers age and gain more experience, the rates decrease, with 30-year-olds paying $105 per month and 60-year-olds enjoying the lowest rate of $90 per month.

This trend highlights the correlation between increased driving experience and lower insurance costs.

Driver Location

Where you live can have a large impact on Nissan Cube insurance rates. For example, drivers in Los Angeles may pay $667 a year more than drivers in Phoenix.

Nissan Cube Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $167 |

| New York, NY | $160 |

| Houston, TX | $158 |

| Jacksonville, FL | $146 |

| Philadelphia, PA | $135 |

| Chicago, IL | $133 |

| Phoenix, AZ | $117 |

| Seattle, WA | $98 |

| Indianapolis, IN | $86 |

| Columbus, OH | $84 |

Your location can greatly influence the best Nissan Cube auto insurance rates, with some cities like Los Angeles having significantly higher premiums compared to others like Columbus. Comparing rates based on your city can help you find the most affordable coverage tailored to your specific area.

Your Driving Record

Your driving record can have an impact on the cost of Nissan Cube auto insurance. Teens and drivers in their 20s see the highest jump in their Nissan Cube auto insurance rates with violations on their driving record.

Nissan Cube Auto Insurance Monthly Rates by Model Year & Coverage Type

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $480 | $620 | $900 | $540 |

| Age: 18 | $369 | $495 | $730 | $435 |

| Age: 20 | $229 | $340 | $580 | $315 |

| Age: 30 | $105 | $160 | $310 | $140 |

| Age: 40 | $101 | $150 | $290 | $135 |

| Age: 45 | $98 | $145 | $280 | $130 |

| Age: 50 | $92 | $135 | $260 | $125 |

| Age: 60 | $90 | $130 | $250 | $120 |

Younger drivers face steep increases for violations, with a 16-year-old’s premium rising from $480 to $900 with a DUI. Rates decrease with age, with a 30-year-old’s premium ranging from $105 to $310 with a DUI. A clean driving record helps keep insurance costs lower.

Nissan Cube Safety Ratings

Your Nissan Cube auto insurance rates are tied to the safety ratings of the Nissan Cube. See the breakdown below:

Nissan Cube Safety Ratings

| Test Type | Rating |

|---|---|

| Head restraints and seats | Good |

| Moderate overlap front | Good |

| Roof strength | Good |

| Side | Good |

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

The Nissan Cube’s impressive safety ratings across all major test categories including head restraints, roof strength, and both small overlap fronts, contribute to its favorable insurance rates. Investing in a vehicle with such strong safety features can help lower your overall insurance costs.

This video from the IIHS shows a crash test for a 2009 Nissan Cube.

This moderate overlap crash test received a “Good” rating.

Nissan Cube Crash Test Ratings

The Nissan Cube consistently receives strong crash test ratings, making it a safe choice for drivers. These ratings, which span from 2017 to 2024, show an overall score of 5 stars, with 4 stars in frontal crash tests, 5 stars in side crash tests, and 4 stars in rollover tests.

Nissan Cube Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Nissan Cube | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Nissan Cube | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Nissan Cube | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Nissan Cube | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Nissan Cube | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Nissan Cube | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Nissan Cube | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Nissan Cube | 5 stars | 4 stars | 5 stars | 4 stars |

This impressive safety performance could translate to cheaper Nissan Cube auto insurance rates, as insurers often provide lower premiums for vehicles with high safety ratings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Nissan Cube Auto Insurance

Finding affordable auto insurance for your Nissan Cube can be a challenge, but there are several strategies you can employ to reduce your rates. Follow these tips to ensure you get the best possible deal:

- Move to a safe neighborhood.

- Use an accurate job title when requesting Nissan Cube auto insurance.

- Maintain a clean driving record.

- Work with a direct insurer instead of an insurance broker for your Nissan Cube auto insurance.

- Check reviews and state complaints before you choose an insurer.

By applying these tips, you can significantly reduce your Nissan Cube auto insurance expenses. Implementing these strategies not only helps you find the most cost-effective coverage but also ensures you get the best value for your money.

With these savings, you’ll have more financial flexibility and peace of mind, knowing that you’re well-protected without overpaying. Delve into our evaluation of “How do auto insurance payments work?“

Top Nissan Cube Auto Insurance Companies

The best auto insurance companies for Nissan Cube auto insurance rates will offer competitive rates and discounts that account for the Nissan Cube’s safety features. The following list of auto insurance companies features the insurers with the highest market shares in the industry.

Top 10 Nissan Cube Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9.1% |

| #2 | Geico | $46,358,896 | 6.4% |

| #3 | Progressive | $41,737,283 | 5.7% |

| #4 | Allstate | $39,210,020 | 5.4% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3.4% |

| #8 | Chubb | $24,199,582 | 3.3% |

| #9 | Farmers | $20,083,339 | 2.8% |

| #10 | Nationwide | $18,499,967 | 2.5% |

While the best Nissan Cube auto insurance rates depend on personal factors, knowing the top providers can guide your decision. State Farm leads with a 9.1% market share, followed by Geico, Progressive, Allstate, and Liberty Mutual. To get the best Nissan Cube auto insurance, explore discounts for safety features and security systems.

Understanding Various Types of Auto Insurance Coverage

Auto insurance isn’t just a legal requirement; it’s essential protection on the road. While minimum coverage is mandated, you can customize your plan based on your budget and needs, especially for your Nissan Cube.

Bodily Injury Liability (BIL) covers others’ medical bills and legal fees if you’re at fault in an accident, while Property Damage Liability (PDL) pays for damage you cause to other vehicles or property. Personal Injury Protection (PIP) handles your medical and funeral expenses after an accident, with a typical minimum of $10,000.

If your Nissan Cube is new or financed, Collision Coverage ensures repairs after an accident, regardless of fault. Comprehensive Coverage guards against non-collision events like theft or severe weather, though be aware of exclusions. For more personalized insurance, Pay-As-You-Go Coverage adjusts premiums based on your driving habits and mileage.

For high-value vehicles or extensive repair needs, specialized policies offer added protection. Choosing a reputable insurer is key to ensuring you get the best coverage for your needs and drive with peace of mind.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Smart Strategies to Lower Your Nissan Cube Auto Insurance Rates

To lower your auto insurance rates, start by understanding your coverage options, needs, and budget. Raising your deductible to $1,000 can reduce your premium, but ensure you can cover this amount if needed. Maintain a clean driving record to avoid higher rates and qualify for discounts like the safe driver discount.

Ask about available insurance discounts when speaking with insurance agents, such as safety discounts for vehicles with advanced features. Comparison shop using online tools and consult multiple agents to find the best deal. Negotiate with your current insurer for better rates if you have a good driving history.

State Farm stands out for providing the best Nissan Cube auto insurance, combining affordability with exceptional service.Kristen Gryglik Licensed Insurance Agent

Lastly, consider dropping comprehensive coverage if your vehicle is securely parked and you’re in a low-risk area, as this can further lower your costs.

Looking for affordable Nissan Cube car insurance? If you think scouring the internet for excellent insurance coverage is a painful exercise, just type your ZIP code into our free quote tool below for no-hassle Nissan Cube auto insurance quotes.

Compare Free Nissan Cube Auto Insurance Quotes Online

Begin comparing quotes for Nissan Cube insurance from top auto insurance providers using our free online tool today.

The Nissan Cube, with its unique design, spacious interior, and easy maneuverability, has garnered significant attention. Ideal for city living, this car maximizes seating and interior features.

If you’re looking for cheap Nissan Cube insurance, type your ZIP code into our free quote tool below today.

In today’s market, affordability is crucial. Insurance rates are soaring, making it challenging to find quality coverage. The unstable economy is also compelling many to drive without insurance or with minimal coverage.

Therefore, securing the best possible insurance at the lowest price for your stylish Cube is essential.

Frequently Asked Questions

What factors influence the best Nissan Cube auto insurance rates?

Several factors can affect finding the best Nissan Cube auto insurance rates, including your driving record, age, location, and the specific coverage options you choose. Additionally, the safety features and model year of your Nissan Cube play a significant role in determining the insurance premium.

Are there discounts to reduce the cost of the best Nissan Cube auto insurance?

Yes, discounts like safe driver, multi-policy, and those for safety features (anti-lock brakes, electronic stability control, anti-theft systems) can help lower the cost of the best Nissan Cube auto insurance. Access comprehensive insights into our guide titled, “Auto Insurance Discounts.”

How can I compare quotes to get the best Nissan Cube auto insurance?

To get the best Nissan Cube auto insurance, compare quotes from multiple providers using online tools. This helps you find the most affordable and comprehensive policy by evaluating coverage options, discounts, and rates.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Is Nissan Cube comfortable?

The interior is roomy and comfortable, though. The seats are wide with plenty of cushioning, and there are several cubbies for stashing gear.

What coverage options should I consider for the best Nissan Cube auto insurance?

When looking for the best Nissan Cube auto insurance, consider coverage options such as liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. Evaluating these options based on your needs and budget will help you select the best coverage for your Nissan Cube.

Access comprehensive insights into our guide titled, “Types of Auto Insurance.”

Are Nissan Cubes fast?

According to Car and Driver testing, a manual transmission Cube did get to 60 mph in 9.1 seconds, but a 2008 Scion xB sprinted there in 7.2 seconds.

How can I maintain the best Nissan Cube auto insurance rates?

To maintain the best Nissan Cube auto insurance rates, keep a clean driving record, regularly compare quotes, and utilize discounts for safe driving and safety features. Updating your insurer with any changes, such as reduced mileage, can also help retain favorable rates.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

What engine is in a Cube?

All Cubes come with a 1.8-liter four-cylinder engine that makes 122 horsepower.

How does the age of my vehicle impact the best Nissan Cube auto insurance rates?

The age of your vehicle significantly impacts the best Nissan Cube auto insurance rates. Newer models typically have higher insurance premiums due to their higher replacement costs and repair expenses. Conversely, older models may have lower premiums but could also come with increased repair costs.

To find out more, explore our guide titled, “How Vehicle Year Affects Auto Insurance Rates.”

Can my driving record influence the best Nissan Cube auto insurance rates?

Yes, your driving record is crucial for getting the best Nissan Cube auto insurance rates. A clean record usually means lower premiums, while violations like speeding tickets or DUIs can raise your costs. Keeping a good driving record is key to affordable rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.