Best Nissan Sentra Auto Insurance in 2025 (Find the Top 10 Companies Here)

When looking for the best Nissan Sentra auto insurance, Geico, State Farm, and Progressive stand out with rates as low as $32 per month. These top providers offer the best combination of affordability and comprehensive coverage for your Nissan Sentra car insurance. Compare quotes to find the best value.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Nissan Sentra

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Nissan Sentra

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Nissan Sentra

A.M. Best

Complaint Level

Pros & Cons

The best Nissan Sentra auto insurance providers are Geico, State Farm, and Progressive, with rates starting at $32 per month. The average insurance cost for Nissan Sentra varies, but these companies offer the most competitive rates. Geico stands out as the top pick overall for its affordability and coverage options.

The article also explores auto insurance rates by state, detailing how regional factors influence premiums for Nissan Sentra owners. Understanding these variations helps in choosing the best insurance provider based on your location. This information is crucial for finding the most cost-effective coverage tailored to your area.

Our Top 10 Company Picks: Best Nissan Sentra Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Extensive Discount Geico

#2 20% B Local Agent State Farm

#3 10% A+ Innovative Programs Progressive

#4 10% A+ Drivewise Program Allstate

#5 15% A++ Military Families USAA

#6 10% A Accident Forgiveness Liberty Mutual

#7 10% A+ Vanishing Deductible Nationwide

#8 8% A++ IntelliDrive Discounts Travelers

#9 10% A+ Customer Satisfaction Amica

#10 10% A+ Customizable Policies Farmers

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- Compare rates to find the best insurance on Nissan Sentra for your area

- Learn how different states impact the average insurance cost for Nissan Sentra

- Geico provides excellent coverage tailored for the Nissan Sentra.

#1 – Geico: Top Overall Pick

Pros

- Affordable Premiums: As mentioned in our Geico auto insurance review, the company offers a competitive rate of $145 per month for Nissan Sentra insurance. This budget-friendly pricing helps drivers save money while still obtaining quality coverage for their vehicle.

- Discount Opportunities: Geico provides various discounts, such as safe driver and multi-policy discounts. These discounts can further lower the cost of insuring a Nissan Sentra, making it an economical choice for many drivers.

- Strong Customer Service: Geico is renowned for its excellent customer service and user-friendly online tools. Their mobile app and website facilitate easy management of policies and filing of claims, ensuring a hassle-free experience for Nissan Sentra owners.

Cons

- Limited Coverage Options: Geico’s coverage options might be more limited compared to other providers. Nissan Sentra drivers seeking specialized or additional coverage options may find Geico’s offerings insufficient.

- Higher Rates for New Drivers: New or inexperienced drivers may face higher rates with Geico. While their overall rates are competitive, young or novice Nissan Sentra drivers might not benefit as much from the available discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agent

Pros

- Broad Coverage Options: State Farm offers extensive coverage options for Nissan Sentra owners, including comprehensive and collision coverage. This variety allows drivers to customize their policy according to their specific needs.

- Numerous Discounts: As mentioned in our State Farm auto insurance review, State Farm provides several discount opportunities, such as the good student discount and the drive safe & save program. These discounts help reduce the overall cost of insurance for Nissan Sentra drivers.

- Local Agent Network: State Farm’s extensive network of local agents provides personalized service and support. Nissan Sentra owners can benefit from face-to-face consultations and tailored advice from local representatives, enhancing their overall insurance experience.

Cons

- Higher Premiums for High-Risk Drivers: State Farm may charge higher premiums for drivers with a history of traffic violations or accidents. Nissan Sentra owners with less-than-perfect driving records might face increased rates.

- Limited Availability in Some Areas: State Farm’s coverage options and discounts may not be available in all regions. Some Nissan Sentra owners might find that State Farm’s offerings are not accessible or competitive in their location.

#3 – Progressive: Best for Innovative Programs

Pros

- Competitive Rates: As mention in Progressive auto insurance review, Progressive offers competitive rates at an average of $155 per month for Nissan Sentra insurance. This pricing provides a good balance of cost and coverage, making it a solid choice for many drivers.

- Customizable Policies: Progressive allows Nissan Sentra owners to tailor their insurance policies with various add-ons and coverage options. This flexibility helps meet specific needs, such as roadside assistance or rental car coverage.

- Snapshot Program: Progressive’s Snapshot program offers discounts based on driving behavior. Safe driving practices can lead to additional savings on insurance premiums for Nissan Sentra owners, rewarding good driving habits.

Cons

- Higher Rates for Younger Drivers: Younger drivers may experience higher rates with Progressive. Nissan Sentra owners in this age group might find their premiums higher compared to older, more experienced drivers.

- Complex Policy Terms: Progressive’s policy options can be complex, potentially confusing for Nissan Sentra owners. Understanding all available coverage choices and policy details may require extra effort.

#4 – Allstate: Best for Drivewise Program

Pros

- Comprehensive Coverage Options: Allstate provides a wide range of coverage options for Nissan Sentra drivers, including accident forgiveness and new car replacement. These options enhance protection and add value to the insurance policy.

- Excellent Discounts: Allstate offers significant discounts for safe driving, bundling policies, and participating in the Drivewise program. These discounts help reduce the cost of insuring a Nissan Sentra, making it more affordable. Learn more about their discounts in our Allstate auto insurance review.

- Strong Claims Service: Allstate has a reputation for reliable claims service, ensuring that Nissan Sentra owners receive prompt and effective assistance when filing a claim.

Cons

- Higher Average Premiums: Allstate’s premiums are higher, averaging $160 per month. This cost may be less attractive to budget-conscious Nissan Sentra drivers compared to other insurance providers.

- Varied Customer Service Quality: While Allstate generally offers good service, customer experiences can vary. Some Nissan Sentra owners might encounter inconsistent service quality or delays in claims processing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Lowest Average Premiums: As outlined in USAA auto insurance review, the company offers the lowest average premiums at $140 per month for Nissan Sentra insurance. This affordability is particularly advantageous for drivers looking for budget-friendly insurance options.

- Excellent Military Discounts: USAA provides substantial discounts for military members and their families. Nissan Sentra owners with military affiliations can benefit from lower rates and additional savings on their insurance.

- Top-Rated Customer Service: USAA is highly rated for its customer service, offering exceptional support and a smooth insurance experience for Nissan Sentra owners. Their commitment to service quality is well-regarded.

Cons

- Eligibility Restrictions: USAA’s services are restricted to military members and their families. Nissan Sentra owners without military connections cannot access USAA’s insurance options, limiting availability.

- Limited Coverage Options: USAA may offer fewer customization options compared to other insurers. Nissan Sentra drivers seeking extensive or specialized coverage might find USAA’s offerings somewhat limited.

#6 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Extensive Coverage Options: Liberty Mutual provides a variety of coverage options for Nissan Sentra drivers, including unique add-ons like better car replacement. This allows for tailored insurance plans that meet specific needs.

- Generous Discounts: As mentioned in our Liberty Mutual auto insurance review, the company offers numerous discounts, including for safe driving and bundling multiple policies. These discounts can significantly lower the cost of insuring a Nissan Sentra.

- Strong Financial Stability: Liberty Mutual’s financial strength ensures they can handle claims and provide reliable coverage for Nissan Sentra owners, offering confidence in policy stability and claims support.

Cons

- Higher Premiums: Liberty Mutual’s average premiums are among the highest at $165. This higher cost might be a disadvantage for Nissan Sentra drivers seeking more affordable insurance options.

- Customer Service Variability: Customer service experiences with Liberty Mutual can be inconsistent. Some Nissan Sentra owners might encounter issues with service quality or delays in handling claims.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Comprehensive Coverage Plans: Nationwide offers extensive coverage options for Nissan Sentra owners, including accident forgiveness and vanishing deductibles. These plans provide valuable protection and benefits.

- Discount Opportunities: Nationwide provides various discounts, such as for good students and safe drivers. Nissan Sentra owners can take advantage of these discounts to reduce their insurance premiums. For more information, read our Nationwide auto insurance review.

- Strong Customer Support: Nationwide is known for its reliable customer support, offering assistance and guidance throughout the insurance process. This ensures a positive experience for Nissan Sentra drivers.

Cons

- Moderate Premiums: Nationwide’s premiums average $158 per month, which is moderate compared to other providers. This might not be the most cost-effective option for all Nissan Sentra drivers.

- Limited Regional Availability: Nationwide’s coverage and discounts may not be available in all regions. Some Nissan Sentra owners might find fewer options or less competitive rates depending on their location.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for IntelliDrive Discounts

Pros

- Competitive Insurance Rates: As outlined in our Travelers auto insurance review, Travelers offers competitive rates at $152 per month for Nissan Sentra insurance. This pricing provides a good balance of cost and coverage for many drivers.

- Variety of Coverage Options: Travelers provides a range of coverage options for Nissan Sentra owners, including collision and comprehensive coverage. This variety allows drivers to customize their insurance according to their needs.

- Attractive Discounts: Travelers offers several discounts, such as for safe driving and multi-policy holders. These discounts help reduce the overall cost of insuring a Nissan Sentra, making it more affordable.

Cons

- Higher Rates for Certain Drivers: Travelers may charge higher premiums for drivers with a history of accidents or traffic violations. Nissan Sentra owners with less-than-ideal driving records might face increased insurance costs.

- Complex Policy Options: Travelers’ policy options can be complex and potentially confusing for some Nissan Sentra owners. Understanding all available coverage choices might require additional effort.

#9 – Amica: Best for Customer Satisfaction

Pros

- Affordable Premiums: Amica offers competitive rates at $148 per month for Nissan Sentra insurance. This affordability helps drivers manage their insurance costs while maintaining good coverage.

- Strong Customer Service: As outlined in our Amica auto insurance review, Amica is known for its excellent customer service, providing attentive support to Nissan Sentra owners. This high level of service contributes to a positive insurance experience.

- Discount Programs: Amica offers various discount programs, such as for safe driving and bundling policies. These discounts help lower the cost of insuring a Nissan Sentra, making it more budget-friendly.

Cons

- Limited Coverage Customization: Amica’s coverage options may be less extensive compared to some competitors. Nissan Sentra drivers seeking more specialized or additional coverage options might find Amica’s choices limited.

- Regional Variability: Availability and rates with Amica may vary by region. Some Nissan Sentra owners might experience different coverage options or pricing depending on their location.

#10 – Farmers: Best for Customizable Policies

Pros

- Wide Coverage Options: Farmers offers a range of coverage options for Nissan Sentra drivers, including customizable plans tailored to individual needs. This flexibility ensures comprehensive protection for your vehicle.

- Numerous Discounts: Farmers provides various discounts, such as for safe driving and bundling multiple policies. These discounts help reduce insurance premiums for Nissan Sentra owners, making it more affordable. Check out this page Farmers auto insurance review to know more details.

- Reputable Customer Service: Farmers is known for its reliable customer service, providing strong support and assistance to Nissan Sentra owners. Their commitment to service enhances the overall insurance experience.

Cons

- Higher Average Premiums: Farmers’ premiums average $157, which might be higher compared to some other insurers. This cost may be a drawback for budget-conscious Nissan Sentra drivers.

- Inconsistent Customer Service: Customer service experiences with Farmers can be inconsistent. Some Nissan Sentra owners may encounter issues with service quality or delays in claims processing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Nissan Sentra Insurance Cost

When insuring a Nissan Sentra, it’s important to consider various factors that can influence the premiums. Here is a detailed breakdown of the monthly insurance rates for a Nissan Sentra, segmented by coverage level and provider:

Nissan Sentra Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$87 $228

$65 $215

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$53 $248

$32 $84

Comparing these rates helps in choosing the right insurance provider and coverage level for your needs. Learn more in our article titled “Comprehensive Auto Insurance Defined.”

Nissan Sentra Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $116 |

| Discount Rate | $68 |

| High Deductibles | $100 |

| High Risk Driver | $247 |

| Low Deductibles | $146 |

| Teen Driver | $423 |

By comparing quotes, Nissan Sentra owners can select a policy that offers the right balance of cost and coverage for their specific needs. The cost of insurance can vary significantly based on the coverage level and the provider chosen.

Are Nissan Sentras Expensive to Insure

When determining whether Nissan Sentras are expensive to insure, it’s helpful to compare their insurance rates to those of similar sedans. The chart below provides a detailed comparison of insurance costs for the Nissan Sentra and other sedans, including the Subaru Impreza, Chevrolet Sonic, and Chevrolet Impala.

Nissan Versa Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Buick Regal | $26 | $45 | $33 | $117 |

| Cadillac ATS | $25 | $47 | $33 | $118 |

| Cadillac CTS | $27 | $52 | $33 | $125 |

| Chevrolet Impala | $23 | $44 | $31 | $112 |

| Chevrolet Sonic | $23 | $45 | $33 | $114 |

| Nissan Sentra | $22 | $50 | $31 | $116 |

| Subaru Impreza | $27 | $45 | $33 | $118 |

Comparing the insurance rates of the Nissan Sentra with other sedans reveals that its costs are relatively competitive. For a comprehensive analysis, refer to our detailed guide titled “Auto Insurance Discounts.”

What Impacts the Cost of Nissan Sentra Insurance

When selecting a Nissan Sentra, considering the implications of the trim and model on insurance costs is essential. Understanding how these factors affect insurance rates can help you choose a trim and model that fits both your budget and insurance considerations.

With Geico, Nissan Sentra owners can enjoy comprehensive coverage tailored to their specific driving needs.Daniel Walker Licensed Insurance Agent

For a deeper dive into how various elements impact auto insurance rates, refer to our detailed evaluation in the article titled “Factors That Affect Auto Insurance Rates.”

Age of the Vehicle

The age of a Nissan Sentra significantly impacts its insurance rates. Generally, newer models have higher insurance costs. For example, insurance for a 2020 Nissan Sentra costs more compared to a 2010 model.

Nissan Sentra Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Nissan Sentra | $24 | $53 | $32 | $118 |

| 2023 Nissan Sentra | $23 | $52 | $32 | $117 |

| 2022 Nissan Sentra | $23 | $51 | $32 | $117 |

| 2021 Nissan Sentra | $22 | $50 | $31 | $116 |

| 2020 Nissan Sentra | $22 | $50 | $31 | $116 |

| 2019 Nissan Sentra | $21 | $48 | $33 | $114 |

| 2018 Nissan Sentra | $20 | $47 | $33 | $114 |

| 2017 Nissan Sentra | $20 | $46 | $35 | $114 |

| 2016 Nissan Sentra | $19 | $44 | $36 | $112 |

| 2015 Nissan Sentra | $18 | $43 | $37 | $111 |

| 2014 Nissan Sentra | $17 | $40 | $38 | $108 |

| 2013 Nissan Sentra | $17 | $37 | $38 | $105 |

| 2012 Nissan Sentra | $16 | $33 | $38 | $101 |

| 2011 Nissan Sentra | $15 | $31 | $38 | $97 |

| 2010 Nissan Sentra | $14 | $29 | $39 | $95 |

Understanding the insurance cost variations based on the vehicle’s age can help you make an informed decision when purchasing a Nissan Sentra.

Driver Age

The age of the driver is another critical factor affecting Nissan Sentra insurance costs. Younger drivers, especially teenagers, tend to pay significantly more for insurance compared to older, more experienced drivers.

Nissan Sentra Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $206 |

| Age: 30 | $191 |

| Age: 40 | $116 |

| Age: 45 | $169 |

| Age: 50 | $157 |

| Age: 60 | $152 |

For instance, a 20-year-old driver may pay more each month than a 30-year-old driver. Being aware of how age influences insurance rates can help young drivers find ways to reduce their premiums.

Driver Location

Where you live plays a significant role in determining Nissan Sentra insurance rates. For example, drivers in Los Angeles typically pay more than those in Houston.

Nissan Sentra Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $153 |

| Columbus, OH | $96 |

| Houston, TX | $182 |

| Indianapolis, IN | $99 |

| Jacksonville, FL | $168 |

| Los Angeles, CA | $198 |

| New York, NY | $183 |

| Philadelphia, PA | $155 |

| Phoenix, AZ | $134 |

| Seattle, WA | $112 |

Understanding how location affects insurance costs for your Nissan Sentra can help you budget more effectively.

Your Driving Record

Your driving record can have an impact on the cost of Nissan Sentra auto insurance. Maintaining a clean driving record is crucial for keeping insurance costs low.

Nissan Sentra Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $423 | $465 | $528 | $687 |

| Age: 18 | $378 | $416 | $472 | $631 |

| Age: 20 | $263 | $286 | $341 | $490 |

| Age: 30 | $121 | $132 | $156 | $285 |

| Age: 40 | $116 | $126 | $150 | $275 |

| Age: 45 | $112 | $122 | $145 | $267 |

| Age: 50 | $106 | $115 | $137 | $256 |

| Age: 60 | $103 | $113 | $133 | $250 |

Teens and drivers in their 20’s see the highest jump in their Nissan Sentra auto insurance rates with violations on their driving record.

Safety Ratings

Vehicles with higher safety ratings typically enjoy lower insurance costs due to their reduced risk of injuries and accidents. The Nissan Sentra has been evaluated by the Insurance Institute for Highway Safety (IIHS), which provides the following ratings:

Nissan Sentra Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Not Tested |

| Head restraints and seats | Not Tested |

These high safety ratings indicate that the Nissan Sentra is well-equipped to protect its occupants in various crash scenarios, potentially leading to lower insurance premiums.

Crash Test Ratings

These ratings, provided by safety organizations, assess the vehicle’s performance in various crash scenarios, helping insurers determine the level of risk associated with the vehicle. Here are the crash test ratings for different Nissan Sentra models:

Nissan Sentra Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Nissan Sentra 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Nissan Sentra 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Nissan Sentra 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Nissan Sentra 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Nissan Sentra 4 DR FWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2019 Nissan Sentra SR Turbo 4 DR FWD | Not Rated | Not Rated | 5 stars | 4 stars |

| 2019 Nissan Sentra NISMO 4 DR FWD | Not Rated | Not Rated | Not Rated | 4 stars |

| 2019 Nissan Sentra 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Nissan Sentra Turbo 4 DR FWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2018 Nissan Sentra NISMO 4 DR FWD | Not Rated | Not Rated | Not Rated | 4 stars |

| 2018 Nissan Sentra 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Nissan Sentra NISMO 4 DR FWD | Not Rated | Not Rated | Not Rated | 4 stars |

| 2017 Nissan Sentra 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Nissan Sentra 4 DR FWD | 4 stars | 4 stars | 5 stars | 4 stars |

These crash test ratings provide a comprehensive view of the Nissan Sentra’s safety performance, reflecting its ability to protect occupants in different types of collisions.

Nissan Sentra Safety Features

The Nissan Sentra is equipped with several advanced safety features that can significantly reduce insurance costs by enhancing the vehicle’s safety profile. Key safety features include:

- Stability Control and ABS: Enhances vehicle stability and control.

- Comprehensive Air Bags: Provides front, side, and curtain air bags.

- Blind Spot and Lane Warnings: Alerts the driver to potential hazards.

- Collision Warning With AEB: Helps prevent collisions with warnings and automatic braking.

- Back-Up Camera and Child Locks: Improves reversing visibility and child safety.

These features not only enhance the safety of the Nissan Sentra but also contribute to potential insurance discounts.

Loss Probability

The lower percentage means lower Nissan Sentra auto insurance costs; higher percentages mean higher Nissan Sentra auto insurance costs.

Nissan Sentra Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Bodily Injury | 41% |

| Collision | 20% |

| Comprehensive | -19% |

| Medical Payment | 79% |

| Personal Injury | 58% |

| Property Damage | 7% |

Compare the following Nissan Sentra auto insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury. Check out our guide “Do you need medical payment coverage on auto insurance?”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Nissan Sentra Insurance

Save more on your Nissan Sentra auto insurance rates. Take a look at the following five strategies that will get you the best Nissan Sentra auto insurance rates possible.

- Drive your Nissan Sentra safely.

- Re-check Nissan Sentra quotes every 6 months.

- Ask about retiree discounts.

- Apply for your full, unrestricted license as soon as you’re eligible.

- Move to the countryside.

By driving safely, regularly checking for new quotes, taking advantage of available discounts, obtaining your full license promptly, and considering your location, you can reduce your insurance premiums and enjoy significant savings. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

By understanding and leveraging these discounts, you can significantly lower your premiums and enjoy more affordable coverage.

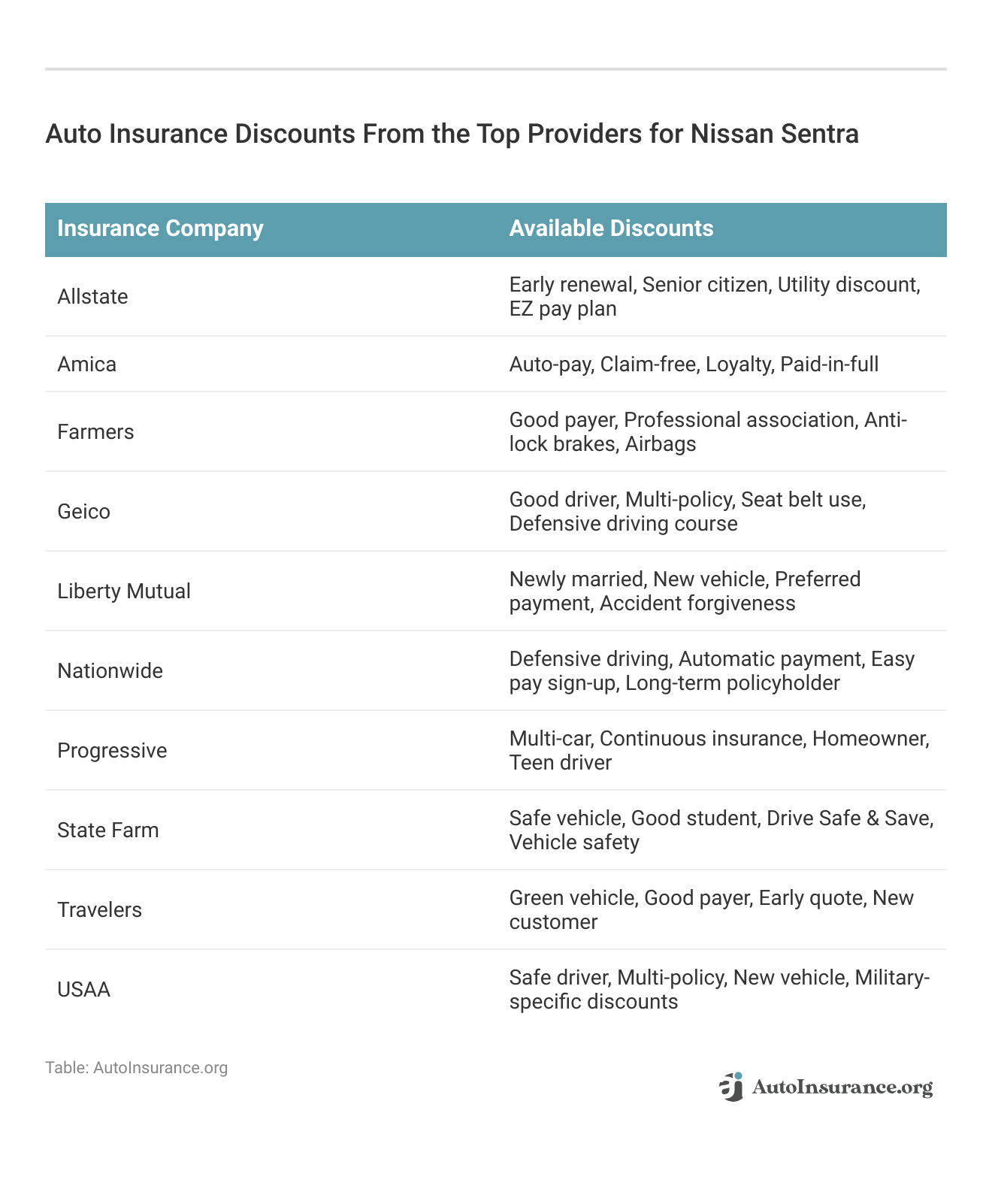

Discounts such as a multi-car auto insurance discount can save you money if you insure multiple vehicles with the same provider. Additionally, safe driving, bundling policies, and participating in loyalty programs further reduce your costs. These strategies make it easier to manage and minimize your insurance expenses while maintaining comprehensive protection.

Top Nissan Sentra Insurance Companies

Several top auto insurance companies offer competitive rates for the Nissan Sentra rates based on factors like discounts for safety features. Take a look at this list of top auto insurance companies that are popular with Nissan Sentra drivers organized by market share.

Top 10 Nissan Sentra Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 6% |

| #3 | Progressive | $39.2 milllion | 5% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 2% |

| #10 | Nationwide | $18.4 milllion | 2% |

You can start comparing quotes for Nissan Sentra auto insurance rates from some of the best auto insurance companies by using our free online tool now. If you’re looking for a small and affordable car that’s good on gas, then the Nissan Sentra might be the right choice for you.

If you don’t take the necessary steps to get good auto insurance for it, however, buying a Sentra may not be so cheap after all.

Whether you’re thinking about buying a Nissan Sentra, or already have one, then knowing how to find cheap car insurance will reduce your ownership costs dramatically.

Frequently Asked Questions

What factors can affect the cost of auto insurance for a Nissan Sentra?

Several factors can influence the cost of auto insurance for a Nissan Sentra. These factors include your driving history, age, location, the model and year of your Sentra, your insurance deductible, coverage limits, and any optional add-ons you choose, such as comprehensive or collision coverage.

Is Nissan Sentra considered an expensive vehicle to insure?

The cost of insuring a Nissan Sentra is generally affordable compared to some higher-end or luxury vehicles. However, insurance rates can vary depending on various factors, such as the specific model, your location, and your personal driving profile. To learn more, explore our comprehensive resource on “Where to Compare Auto Insurance Rates.”

Are there any specific safety features of the Nissan Sentra that could lower insurance costs?

Yes, the safety features of the Nissan Sentra can potentially help lower your insurance costs. The Sentra typically comes equipped with safety features such as anti-lock brakes, stability control, traction control, airbags, and possibly advanced driver assistance systems. These safety features may make you eligible for discounts with certain insurance companies.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Should I consider purchasing additional coverage for my Nissan Sentra?

The decision to purchase additional coverage for your Nissan Sentra depends on your individual circumstances and preferences. While liability insurance is typically required by law, you may want to consider optional coverages such as comprehensive and collision coverage to provide extra protection for your vehicle. To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

Can I get discounts on insurance for my Nissan Sentra?

Yes, you may be eligible for various discounts on your Nissan Sentra auto insurance. Insurance companies often offer discounts for factors such as bundling multiple policies, having a good driving record, being a safe driver, completing defensive driving courses, having certain safety features installed in your vehicle, and being a member of certain professional organizations or alumni associations.

Is it possible to transfer my current insurance policy to a new Nissan Sentra?

Yes, it is typically possible to transfer your current insurance policy to a new Nissan Sentra. However, it’s important to inform your insurance provider about the change in your vehicle to ensure that you have the appropriate coverage for your new Sentra. The insurance premiums may also change based on the new vehicle’s specifications and other factors.

Can I choose any insurance provider for my Nissan Sentra?

Yes, you have the freedom to choose any insurance provider for your Nissan Sentra. It’s recommended to research and compare quotes from multiple insurance companies to find the best coverage options and rates for your specific needs. Consider factors such as the company’s reputation, customer service, coverage options, and discounts available to make an informed decision.

How does the trim level of my Nissan Sentra affect insurance rates?

The trim level of your Nissan Sentra can significantly impact insurance rates. Higher trim levels, which often come with more advanced features and higher market values, may result in higher premiums compared to base models. It’s essential to consider this when choosing a trim level to balance your desired features with insurance costs.

What impact does my credit score have on Nissan Sentra insurance premiums?

Your credit score can affect your Nissan Sentra insurance premiums. Insurers often use credit scores as a factor in determining risk, with higher credit scores typically leading to lower premiums. Maintaining a good credit score can help you secure more affordable insurance rates.

Can installing additional safety features on my Nissan Sentra reduce my insurance costs?

Yes, installing additional safety features on your Nissan Sentra can potentially reduce your insurance costs. Features such as anti-theft devices, dash cams, and advanced driver assistance systems can lower the risk of accidents and theft, leading to discounts from some insurance providers.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.