Cheapest Full Coverage Auto Insurance in 2025 (9 Most Affordable Companies)

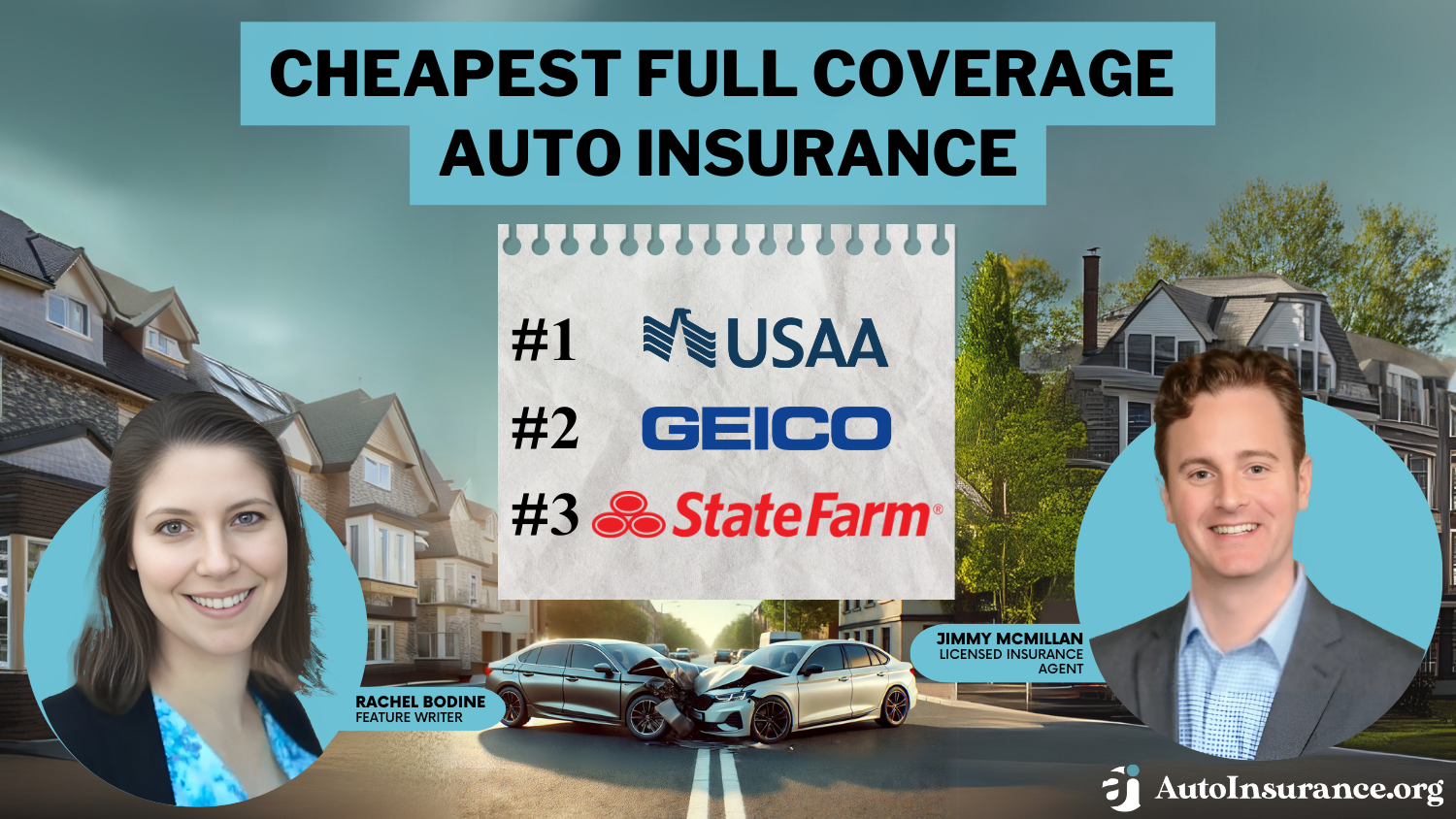

USAA has the lowest rates for cheap full coverage auto insurance, followed by Geico and State Farm. At USAA, the average price of full coverage auto insurance is $84 a month. However, because USAA is for military and veterans only, other drivers will find the cheapest full coverage rates at Geico and State Farm.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA, Geico, and State Farm offer cheap full coverage auto insurance, starting at $84 a month. While the average monthly cost for car insurance is higher when you opt for full coverage, it is a very wise investment that pays off in the long run.

We’ve done the work for you by collecting data on the best companies that offer the lowest full coverage rates so you can start saving. Take a look at other cheap auto insurance companies below. Keep reading to learn more.

Our Top 9 Company Picks: Cheapest Full Coverage Auto Insurance

| Company | Rank | Monthly Rates | Good Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $84 | 30% | Military Members | USAA | |

| #2 | $114 | 26% | Online Convenience | Geico | |

| #3 | $123 | 25% | Local Agents | State Farm | |

| #4 | $150 | 30% | Roadside Assistance | Progressive | |

| #5 | $164 | 40% | SmartRide Program | Nationwide |

| #6 | $166 | 25% | Loyalty Rewards | American Family | |

| #7 | $198 | 30% | Great Add-Ons | Farmers | |

| #8 | $228 | 25% | Pay-Per-Mile Rates | Allstate | |

| #9 | $248 | 10% | Bundling Policies | Travelers |

Shopping around with the top affordable full-coverage companies will help drivers find the lowest rates.

- USAA has the cheapest average full coverage auto insurance

- Full coverage car insurance costs an average of $119 per month

- Affordable full coverage insurance rates will vary based on the driver

When it comes to auto insurance, cheap full coverage is possible. As a savvy shopper, your first step should be to enter your ZIP code into our free quote tool to find the most affordable rates for the coverage you need today.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Pick Overall

Pros

- Great Customer Service: Customers are highly satisfied with USAA’s customer service (learn more in our USAA review).

- Good Coverage Options: USAA offers a good selection of coverage that can be added to full coverage at an affordable price.

- Policy Perks: USAA offers discounts on shopping, travel, and more for policyholders.

Cons

- Exclusively for Veterans/Military: USAA is only for veterans, military members, and their families.

- In-Person Agents Limited: Most of USAA’s communication with clients is virtual.

#2 – Geico: Best for Online Convenience

Pros

- Online Convenience: Geico’s app is highly rated, and its website also provides easy policy management.

- Add-On Coverages: Geico offers add-ons like roadside assistance to round out a policy in addition to full coverage. You can learn more about it in our Geico review.

- UBI Program: Geico offers DriveEasy, which gives discounts to safe drivers. Read more in our Geico DriveEasy review.

Cons

- Average Claims Satisfaction Reviews: J.D. Power gave Geico an average rating for customer satisfaction with claims.

- Communication is Mostly Virtual: Geico primarily relies on virtual communication rather than in-person agents.

#3 – State Farm: Best for Local Agents

Pros

- Local Agents: State Farm has a wide network of local agents. Learn more about the company in our State Farm review.

- Strong Financial Stability: State Farm’s high ratings for financial stability mean it is better able to keep rates stable for customers.

- Multiple Discounts Available: State Farm offers a number of discounts that can help customers save on full coverage.

Cons

- No Online Purchase: After getting quotes from State Farm, you will have to complete your purchase through a State Farm agent.

- Some Demographics May Have Higher Rates: Drivers with poor credit scores or bad driving records may have higher than average rates at State Farm.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Roadside Assistance

Pros

- Roadside Car Assistance: Progressive offers roadside assistance coverage that can be added to a full coverage policy.

- User-Friendly App and Website: Progressive makes checking policy details and making changes easy.

- Snapshot Program: Safe drivers can save on full coverage with Progressive’s Snapshot program (read more in our review of Progressive Snapshot).

Cons

- Reviews Can be Mixed: Progressive only has average ratings from J.D. Power for customer satisfaction (read more in our Progressive review).

- Higher Rates for Some Drivers: Young drivers should shop elsewhere, as Progressive tends to be pricy for younger drivers.

#5 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Safe drivers can save on full coverage with SmartRide (learn more in our Nationwide SmartRide review).

- Vanishing Deductibles: Nationwide reduces deductibles over time for safe drivers.

- Range of Coverages: Nationwide has a good selection of coverages (learn more in our review of Nationwide).

Cons

- Not in Every State: Nationwide isn’t available in a few states.

- Mixed Customer Reviews: Nationwide has a few negative customer service reviews.

#6 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family offers a loyalty discount to drivers who stay with American Family.

- Multiple Coverage Options: American Family offers full coverage and multiple add-ons. You can read more about American Family’s coverages in our review of American Family.

- Local Agents: American Family has local agents to assist with in-person purchases.

Cons

- Limited Availability: American Family isn’t available in every U.S. state.

- Some Demographics may not Have Competitive Rates: American Family may not have the cheapest rates for high-risk drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Great Add-Ons

Pros

- Great Add-Ons: Farmers has a number of add-on coverages beyond full coverage. Learn more about coverage options in our Farmers review.

- Local Agents: Farmers have a good network of local agents for those who want in-person assistance.

- Multiple Discounts: Farmers’ discounts can help drivers save on full coverage policies.

Cons

- Customer Reviews Mixed: There are some negative reviews from customers about Farmers’ customer service.

- Some Demographics Have Higher Rates: High-risk drivers may not find the cheapest rates at Farmers.

#8 – Allstate: Best for Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: Allstate offers pay-per-mile insurance with Milewise, which can offer huge savings on full coverage for infrequent drivers (read more in our Allstate Milewise review).

- Multiple Discounts: Allstate offers plenty of discounts to help drivers save on full coverage (learn more in our Allstate review).

- Add-On Coverages: There are plenty of coverages to add on to full coverage policies.

Cons

- Mixed Reviews: Allstate has some negative customer service reviews.

- Some Demographics may Have Higher Rates: High-risk drivers may not find the cheapest rates at Allstate.

#9 – Travelers: Best for Bundling Policies

Pros

- Bundling Policies: Travelers offers discounts for customers who bundle policies (learn more in our Travelers car insurance review).

- Strong Financial Stability: Travelers’ high financial ratings mean they can keep rates stable for customers.

- Good Coverage Options: Travelers offer add-ons in addition to full coverage.

Cons

- Not in Every State: Travelers auto insurance isn’t available in a handful of states.

- Customer Service is Mixed: Travelers have some negative customer service reviews.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Full Coverage Auto Insurance

If you’re looking for low-cost full coverage auto insurance, it will be more expensive than liability-only. However, full coverage offers more protection on the road and saves you from paying out of pocket for auto repairs after an accident or collision.

My recommendation on where you can get the cheapest full coverage policy is to start with USAA and compare them with Geico and State Farm.Jeff Root Licensed Insurance Agent

How much does full coverage car insurance cost? The average price for full coverage car insurance is $84 per month. This is more than double the average liability-only rate of $45 per month.

Take a look at this table to compare average auto insurance rates for full coverage vs. liability-only:

Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$87 $228

$62 $166

$76 $198

$43 $114

$63 $164

$56 $150

$47 $123

$53 $141

$32 $84

The average monthly car insurance payment in the U.S. is $45 for minimum coverage and $84 for full coverage.

Read More: How to Insure a Car for 1 Month

Despite having higher rates than liability insurance, full coverage auto plans are still very competitive when you know where to shop. Start by comparing quotes from these top three companies that offer the cheapest full coverage insurance.

Affordable Full Coverage Car Insurance

State Farm, Erie, and USAA may provide the best full coverage auto insurance, but limitations do apply. For example, coverage with Erie isn’t available in every state, and USAA only offers policies to military members.

So, which companies offer low-cost full coverage insurance in your area?

Fortunately, there are several options, including four with rates under $100 a month: Geico, State Farm, Travelers, and USAA.

How much does full coverage auto insurance cost? Let’s look at the average monthly car insurance cost for full coverage with the top U.S. auto insurance companies.

State Farm offers consistently cheap rates and is available in all 50 states. However, a local insurer in your city could offer cheaper full coverage auto insurance to drivers like you. That’s why it’s important to compare multiple insurance quotes from the companies in your area to find the best possible rates. You should also look into auto insurance discounts to find savings.

Top 9 Auto Insurance Companies Biggest Discounts by Amount

Insurance Company Bundling Multi-Vehicle UBI Safe Driver Anti-Theft

25% 25% 30% 18% 10%

25% 20% 30% 18% 25%

20% 20% 30% 20% 10%

25% 25% 25% 15% 25%

20% 20% 40% 12% 5%

10% 12% $231/yr 10% 25%

17% 20% 30% 20% 15%

13% 8% 30% 17% 15%

10% 10% 30% 10% 15%

Start comparing now with the full coverage car insurance quotes below for drivers by state, driving record, and age.

Cheapest Full Coverage Auto Insurance by State

Why does auto insurance vary from state to state? The population density in your state and city impacts local traffic accidents and auto theft rates. All of these variables increase your risk to the insurance company, along with your age, gender, and the kind of car you drive.

Read More: Minimum Auto Insurance Requirements by State

State laws also determine the minimum car insurance every driver must carry. So, for example, your full coverage policy will extend beyond the liability-only limits. Still, your rates will be higher if you are in some states like California or Florida, so you will have to shop around when looking for the cheapest full coverage car insurance in Florida or the cheapest full coverage car insurance in California.

Here are the cheapest states for full coverage auto insurance:

Here are the five states with the most expensive monthly full coverage rates, where it will be hard to find full coverage car insurance.

If you live in Idaho, Iowa, Maine, Virginia, or Washington State, you pay the lowest rates for full coverage auto insurance. Take a look at this table below to see the average full coverage car insurance costs in your state:

Auto Insurance Full Coverage Monthly Rates by State & Provider

| State |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $143 | $139 | $177 | $118 | $215 | $128 | $149 | $144 | $104 | $74 |

| Alaska | $192 | $150 | $181 | $109 | $234 | $155 | $138 | $93 | $133 | $85 |

| Arkansas | $226 | $191 | $231 | $126 | $138 | $178 | $183 | $112 | $154 | $76 |

| Arizona | $250 | $158 | $187 | $91 | $247 | $161 | $117 | $112 | $145 | $88 |

| California | $312 | $216 | $261 | $157 | $338 | $223 | $207 | $169 | $192 | $116 |

| Colorado | $245 | $174 | $240 | $139 | $135 | $158 | $178 | $140 | $169 | $115 |

| Connecticut | $269 | $172 | $207 | $85 | $276 | $153 | $182 | $125 | $114 | $106 |

| District of Columbia | $358 | $171 | $206 | $103 | $267 | $255 | $171 | $165 | $151 | $71 |

| Delaware | $242 | $153 | $184 | $118 | $579 | $168 | $105 | $135 | $96 | $50 |

| Florida | $245 | $252 | $304 | $119 | $216 | $138 | $205 | $132 | $223 | $63 |

| Georgia | $224 | $168 | $203 | $83 | $359 | $207 | $156 | $146 | $149 | $97 |

| Hawaii | $142 | $99 | $119 | $72 | $154 | $102 | $94 | $77 | $87 | $53 |

| Iowa | $152 | $114 | $99 | $98 | $140 | $88 | $91 | $79 | $112 | $66 |

| Idaho | $176 | $127 | $126 | $79 | $108 | $113 | $125 | $72 | $78 | $55 |

| Illinois | $285 | $184 | $190 | $77 | $123 | $150 | $145 | $104 | $141 | $101 |

| Indiana | $217 | $167 | $123 | $99 | $285 | $151 | $107 | $110 | $108 | $67 |

| Kansas | $195 | $139 | $176 | $91 | $212 | $113 | $155 | $99 | $106 | $69 |

| Kentucky | $287 | $199 | $240 | $97 | $204 | $224 | $135 | $119 | $169 | $87 |

| Louisiana | $239 | $204 | $247 | $163 | $319 | $211 | $187 | $144 | $181 | $114 |

| Massachusetts | $205 | $142 | $171 | $103 | $222 | $146 | $136 | $111 | $126 | $76 |

| Maryland | $368 | $213 | $257 | $248 | $333 | $195 | $222 | $196 | $189 | $147 |

| Maine | $154 | $120 | $167 | $52 | $171 | $124 | $134 | $83 | $88 | $52 |

| Michigan | $579 | $292 | $478 | $141 | $606 | $367 | $217 | $298 | $262 | $152 |

| Minnesota | $283 | $165 | $191 | $160 | $664 | $153 | $180 | $118 | $664 | $120 |

| Missouri | $226 | $162 | $207 | $137 | $197 | $101 | $150 | $130 | $173 | $76 |

| Mississippi | $200 | $163 | $197 | $97 | $162 | $130 | $163 | $111 | $120 | $74 |

| Montana | $220 | $178 | $234 | $118 | $84 | $126 | $243 | $100 | $158 | $71 |

| North Carolina | $257 | $124 | $150 | $104 | $125 | $168 | $48 | $116 | $151 | $66 |

| North Dakota | $194 | $207 | $153 | $86 | $567 | $109 | $157 | $109 | $126 | $63 |

| Nebraska | $178 | $159 | $185 | $131 | $255 | $110 | $136 | $98 | $145 | $79 |

| New Hampshire | $183 | $110 | $133 | $72 | $283 | $110 | $91 | $84 | $98 | $59 |

| New Jersey | $225 | $164 | $330 | $106 | $397 | $169 | $133 | $162 | $194 | $88 |

| New Mexico | $214 | $139 | $177 | $123 | $218 | $130 | $117 | $94 | $123 | $88 |

| Nevada | $210 | $178 | $196 | $139 | $141 | $142 | $104 | $130 | $115 | $87 |

| New York | $185 | $172 | $208 | $98 | $252 | $206 | $121 | $172 | $220 | $107 |

| Ohio | $168 | $86 | $135 | $82 | $148 | $159 | $119 | $98 | $89 | $57 |

| Oklahoma | $183 | $160 | $185 | $148 | $250 | $165 | $149 | $123 | $142 | $92 |

| Oregon | $220 | $153 | $160 | $134 | $202 | $160 | $111 | $108 | $139 | $84 |

| Pennsylvania | $237 | $174 | $210 | $109 | $351 | $138 | $238 | $122 | $121 | $91 |

| Rhode Island | $189 | $151 | $183 | $125 | $235 | $190 | $116 | $76 | $103 | $65 |

| South Carolina | $219 | $194 | $273 | $130 | $303 | $193 | $171 | $144 | $172 | $113 |

| South Dakota | $158 | $176 | $131 | $66 | $268 | $89 | $122 | $78 | $113 | $68 |

| Tennessee | $183 | $130 | $110 | $100 | $235 | $151 | $118 | $92 | $112 | $74 |

| Texas | $313 | $274 | $214 | $164 | $277 | $240 | $188 | $140 | $157 | $97 |

| Utah | $180 | $162 | $177 | $113 | $183 | $144 | $146 | $158 | $136 | $77 |

| Virginia | $168 | $135 | $163 | $113 | $211 | $140 | $99 | $103 | $120 | $71 |

| Vermont | $203 | $121 | $147 | $54 | $143 | $110 | $258 | $125 | $108 | $60 |

| Washington | $149 | $119 | $132 | $97 | $120 | $91 | $78 | $90 | $106 | $59 |

| Wisconsin | $174 | $89 | $154 | $88 | $119 | $321 | $133 | $83 | $103 | $66 |

| West Virginia | $198 | $141 | $170 | $102 | $239 | $127 | $135 | $97 | $124 | $82 |

| Wyoming | $157 | $112 | $131 | $112 | $76 | $116 | $107 | $83 | $99 | $58 |

| U.S. Average | $223 | $162 | $192 | $111 | $247 | $159 | $146 | $120 | $147 | $82 |

Not every insurance company writes policies in every state. So, you may be unable to find local agents or buy policies from the regional insurers on our list. Only Geico, Farm Bureau, USAA, Allstate, and State Farm offer cheap insurance for full coverage on policies that are available in all 50 states and Washington, D.C.

Read More:

- Delaware Auto Insurance

- Louisiana Auto Insurance

- Michigan Auto Insurance

- New Jersey Auto Insurance

- Rhode Island Auto Insurance

Cheapest Full Coverage Auto Insurance by Driving Record

Auto insurance rates can jump 25% or more after a speeding ticket, and reckless driving violations can increase your rates even more. If you were recently ticketed, compare quotes from the best auto insurance companies for drivers with speeding tickets to see which insurer can offer you the best rates.

These are the average full coverage car insurance rates for the top insurance companies after getting a ticket, DUI, or accident:

USAA offers the cheapest rates for speedy drivers, but coverage is limited to active military members, veterans, and their immediate families.

If you have multiple speeding tickets, it will raise your risk with insurance companies. You may be limited to only high-risk companies.

Cheapest Full Coverage Auto Insurance Rates for Teens

Teens and young drivers often pay the most for auto insurance coverage. This is because insurance companies consider their inexperience behind the wheel as high-risk and charge higher rates.

Buying liability-only can reduce teen car insurance rates, but young drivers are better protected with a full coverage policy. This table compares rates from the cheapest full coverage auto insurance companies for teens and young drivers under 25 with a clean record:

Teen Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

Insurance Company Age: 16 Female Age: 16 Male Age: 18 Female Age: 18 Male

$868 $910 $640 $740

$452 $456 $333 $371

$1,156 $1,103 $853 $897

$425 $445 $313 $362

$1,031 $1,121 $745 $893

$586 $679 $432 $552

$1,144 $1,161 $843 $944

$444 $498 $327 $405

$1,026 $1,298 $757 $1,056

Geico and State Farm offer cheaper rates to teen drivers, followed closely by American Family and Nationwide. However, if you live in one of the 12 states where Erie Insurance is available, you will find the most competitive rates on car insurance for under-25-year-olds.

Erie offers cheap full coverage insurance quotes to young drivers in Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, Wisconsin, and Washington, D.C.

Full Coverage Car Insurance Explained

What does fully comprehensive car insurance cover? Coverage includes three different types of accident damages:

- Liability Auto Insurance: Covers damages you cause to others in an at-fault accident.

- Collision Auto Insurance: Covers damages you sustain in a collision with another vehicle or stationary object.

- Comprehensive Auto Insurance: Covers damages caused by natural disasters or unforeseen events, such as hail storms, fire, or vandalism.

The difference between full coverage insurance and liability-only coverage is that full coverage policies extend protection for damage or loss to your vehicle. The policy is considered “full” because it includes all liability coverage required by law while offering additional protections for you and your passengers in the event of an accident.

The collision and comprehensive policies make full coverage unique. Combined, the policies provide drivers with more than enough coverage. However, you can adjust your coverage to accommodate new cars and drivers on your policy or reduce your monthly rates and save money.

Is full coverage really full?🚗Looks can be deceiving – it doesn’t cover everything.🚫 Have you wondered what additional coverage you may need? 👉 https://t.co/ZzJApDfK36 Use our FREE💸search to price compare insurance rates near you: https://t.co/27f1xf131D pic.twitter.com/9QnH5Wjsv8

— AutoInsurance.org (@AutoInsurance) February 22, 2023

There are additional coverage options that you might want to consider adding to your full coverage policy. You should also review your auto insurance contract every six months to make sure you aren’t paying for coverage you don’t need.

Add-On Coverages for Full Coverage Policies

As we discussed earlier, state laws determine how much auto insurance you must carry. In addition, some states require the following additional coverage that can be included in a full coverage policy:

- Personal Injury Protection (PIP) Auto Insurance: It covers medical costs and lost wages if you or your passengers are injured in an accident or collision.

- Medical Payments Coverage (MedPay): It covers medical costs for injuries sustained by you and your passengers.

- Uninsured Motorist (UM) Coverage: It covers damages and injuries caused by a hit-and-run or uninsured/underinsured driver.

- Guaranteed Auto Protection (Gap) Insurance: Although not required by law, you may want to buy gap insurance if you’re financing your vehicle.

Most companies also offer auto insurance add-ons that boost a policy with additional coverage, including roadside assistance or new car replacement.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Find Cheap Full Coverage Auto Insurance

Full coverage car insurance is a type of policy that extends your coverage beyond liability-only insurance. It includes coverage for collision and comprehensive damages, but policy rates are higher. However, drivers pay less out of pocket after an accident with full coverage insurance.

USAA, Geico, and State Farm lead in cheap full coverage auto insurance with the lowest monthly rates starting at $84 a month while offering unique advantages for military members, online users, and those preferring local agents.

You can get secure lower monthly rates on your full coverage car insurance if you raise your deductibles and lower your coverage limits.

If you drive an older car or can afford repairs, raising your deductible lowers rates but increases out-of-pocket costs. Full coverage costs more upfront, so compare quotes to find the best rate for your age and driving record.

GM owners may save with OnStar Insurance—read our GM auto insurance review. Use our free tool to compare rates.

If you want cheap full coverage auto insurance quotes, compare auto insurance quotes with our free quote tool. Comparing rates from multiple companies side by side is the fastest way to find one with the cheapest full coverage car insurance.

Frequently Asked Questions

What does full coverage car insurance cover?

Full coverage auto insurance covers liability, collision, and comprehensive auto insurance claims. The policy is considered “full” because it includes all liability coverage required by law while offering additional protections for you and your passengers in the event of an accident, collision, natural disaster, theft, or vandalism.

Do I need full coverage on a financed car?

If you’re financing your car, check your loan before you buy auto insurance. Most lenders require drivers to carry full coverage until the vehicle loan is paid off.

Once you pay off the vehicle, you can drop any coverages you don’t want as long as you continue to carry your state’s liability minimums.

What is the cost of the average auto insurance per month?

The average car insurance cost monthly in the United States is $100 to $200 for a single vehicle and driver.

Your actual monthly premium will vary based on your individual circumstances. To get a more accurate estimate of what you’ll have to pay for auto insurance, get quotes from multiple insurance companies – it’s easy; just enter your ZIP code!

Does full coverage car insurance replace your vehicle?

Full coverage auto insurance covers your car’s actual cash value if totaled, not the replacement cost. For new car replacements, choose insurers with that add-on. Compare quotes for classic or supercar insurance for coverage that protects appreciating vehicle values.

Read More: Replacement Cost vs. Actual Cash Value

What’s the average cost of full coverage car insurance?

The average cost of auto insurance per month when you invest in full coverage is $119 per month. However, your exact car insurance rates will vary based on your age, ZIP code, driving record, and more.

Compare quotes to find cheap full coverage car insurance near you and secure the best rate for your needs.

Is full coverage car insurance mandatory?

State insurance laws don’t require full coverage insurance. However, your lender might have insurance minimums listed in the terms of your auto loan.

Compare options to find cheap car insurance with full coverage that meets both legal requirements and lender terms while keeping costs manageable.

Who has the cheapest full coverage car insurance?

USAA has the cheapest rates for low-cost full coverage car insurance at just $84 per month, but it’s only available to military members and their families.

If you don’t qualify for USAA, compare providers to find auto insurance with cheap full coverage that fits your budget and coverage needs.

Get quotes from several providers to easily compare shops using our free quote generator today.

How can I find cheap full-coverage auto insurance?

To find affordable full coverage auto insurance, consider raising your auto insurance deductibles and lowering your coverage limits. It’s also important to compare quotes from multiple insurance companies to find cheap full coverage car insurance.

What other coverages could be included in a full coverage policy?

A full coverage policy may include additional coverages such as liability, collision, and comprehensive coverage, as well as uninsured/underinsured motorist coverage, personal injury protection, and medical payment coverage.

What is the average family car insurance cost?

The average cost of car insurance for a family with two cars and multiple drivers in the U.S. is $1,200 to $1,800 a year. Rates vary by location, coverage, drivers, vehicle types, and insurer. Compare options to find low-cost full coverage auto insurance that fits your needs and budget.

Get a more accurate rate based on your driver profile by using our free quote tool today!

Do states require full coverage auto insurance?

States do not require drivers to carry full coverage auto insurance. However, lenders drivers use to finance leased vehicles do usually require full coverage car insurance.

What companies offer full coverage auto insurance?

All auto insurance companies in the United States offer consumers the option of full coverage auto insurance.

Finding affordable American insurance is possible (even full coverage!) when you shop around and compare quotes.

What is the average full coverage car insurance cost in Colorado?

The average cost for full-coverage auto insurance in Colorado is $124 a month or $1,488 annually. But those who make a full annual payment will usually get a discount to bring that cost down.

Use our free quote comparison tool to find the lowest rates where you live today!

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.