Cheap Toyota Auto Insurance in 2025 (Unlock Big Savings From These 10 Companies!)

When it comes to cheap Toyota auto insurance, Erie, AAA, and Geico have the lowest rates. Insurance for Toyotas starts at just $22 per month from Erie, but drivers looking for roadside assistance will save more at AAA. Other savings options include enrolling in a UBI program, like Erie’s YourTurn.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Jan 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Toyota

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Toyota

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Toyota

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsDrivers looking for cheap Toyota auto insurance will find the best rates and coverage options from Erie, Geico, and AAA.

Drivers looking for the cheapest coverage should consider meeting the minimum car insurance requirements in their state. Erie offers affordable Toyota car insurance, with prices starting at just $22 per month for minimum coverage insurance. Toyota drivers can also take advantage of Erie’s generous discounts, UBI program, ample coverage options, and superb customer serivce.

Our Top 10 Company Picks: Cheap Toyota Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | A+ | Youth Discounts | Erie |

| #2 | $30 | A++ | Cheap Rates | Geico | |

| #3 | $32 | A | Roadside Assistance | AAA |

| #4 | $33 | B | Customer Service | State Farm | |

| #5 | $39 | A+ | Qualifying Coverage | Progressive | |

| #6 | $44 | A+ | Usage-Based Coverage | Nationwide |

| #7 | $44 | A | Costco Members | American Family | |

| #8 | $53 | A | Safe-Driving Discounts | Farmers | |

| #9 | $61 | A+ | Infrequent Drivers | Allstate | |

| #10 | $68 | A | Add-on Coverages | Liberty Mutual |

Read on to find the cheapest car insurance for Toyota Corollas, Camries, and other models. Then, enter your ZIP code into our free comparison tool to find the cheapest rates for you.

- As safe, reliable vehicles, Toytota car insurance rates are usually low

- Drivers can save on their insurance by finding discounts and comparing quotes

- Erie and AAA have the cheapest auto insurance for Toyotas

- Toyota Auto Insurance

- Best Toyota Corolla Auto Insurance in 2025 (Compare the Top 10 Companies)

- Best Toyota Prius Auto Insurance in 2025 (Top 10 Companies Ranked)

- Best Toyota Highlander Hybrid Auto Insurance in 2025 (Find the Top 10 Companies Here)

- Best Toyota Sequoia Auto Insurance in 2025 (Check Out the Top 10 Companies)

- Best Toyota Tacoma Auto Insurance in 2025 (Top 10 Companies Ranked)

- Best Toyota Camry Auto Insurance in 2025 (Check Out These 10 Companies)

- Best Toyota Venza Auto Insurance in 2025 (Find the Top 10 Companies Here)

- Best Toyota Tundra Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Toyota 4Runner Auto Insurance in 2025 (Find the Top 10 Companies Here)

#1 – Erie: Top Pick Overall

Pros

- Affordable Rates: No matter where you live or what type of driver you are, Erie tends to have affordable Toyota vehicle insurance rates.

- YourTurn: An excellent way to keep your insurance rates low is to sign up for a usage-based insurance (UBI) program. You can save up to 30% on your insurance with Erie’s YourTurn.

- Superior Customer Service: Erie consistently earns high marks for its customer service. See what customers have to say in our Erie auto insurance review.

Cons

- Limited Availability: Erie only sells insurance in just 12 states and hasn’t announced plans to expand.

- Fewer Discounts: As a smaller provider, Erie lacks the discount options some of its larger competitors have. However, Erie still offers low rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Great Discounts: There are 16 Geico discounts to help you save, including special savings for government workers. Learn more about your opportunities to save in our Geico auto insurance review.

- Affordability: Geico is well-known for its affordable rates, especially for high-risk drivers.

- Online Tools: With a focus on digital policy management, Geico is an excellent option for drivers who don’t want to speak with a representative to purchase coverage.

Cons

- Limited Add-ons: Many customers report disappointment Geico doesn’t offer as many coverage options as other similarly-sized companies.

- Mixed Customer Reviews: Geico may offer affordable car insurance for Toyotas, but that doesn’t mean everyone is happy. Customer reviews for Geico’s policies are negative as often as they are positive.

#3 – AAA: Best Roadside Assistance Options

Pros

- Roadside Assistance Plans: AAA is famous for its roadside assistance plans. Toyota auto insurance reviews usually agree that roadside assistance is an excellent add-on.

- Membership Perks: AAA membership comes with a variety of perks, like special travel savings. Explore membership perks in our AAA auto insurance review.

- Excellent customer service: If access to good customer service is an important part of your Toyota insurance policy, AAA has you covered.

Cons

- Regional availability varies: AAA sells insurance through clubs, which are managed regionally. This means coverage and discount availability can vary.

- Membership fees: AAA members have to pay an annual membership fee, which increases the overall price of Toyota insurance coverage.

#4 – State Farm: Best for Excellent Customer Service

Pros

- Coverage Options: State Farm offers a variety of coverage options to fit almost every need. Whether you need Toyota Yaris insurance or coverage for a Prius, State Farm has just about everything you want.

- Drive Safe & Save: You can save up to 30% on your insurance by enrolling in State Farm’s UBI program, Drive Safe & Save. See if this is a good savings opportunity for you in our State Farm auto insurance review.

- Extensive Network of Agents: Toyota insurance reviews usually agree that State Farm’s network of insurance representatives makes finding personalized help simple.

Cons

- Rates can be high. While often an affordable Toyota insurance company, State Farm has higher rates for drivers with bad credit scores.

- Reviews are mixed. Many State Farm customers are happy with their coverage, but the company received complaints about the speed of its claims resolution process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Loyalty Discounts

Pros

- Loyalty Discounts: Progressive offers customer loyalty discounts after the first year, which are automatically applied to your account. See other Progressive discounts in our Progressive auto insurance review.

- Snapshot: Snapshot offers savings of up to 30% to drivers who enroll and regularly drive safely.

- Name Your Price Tool: Progressive makes it easy to stick to a budget with the Name Your Price tool. If you need Toyota new car insurance or coverage for a used vehicle, Name Your Price will give you a list of coverage options to meet your budget.

Cons

- Low Customer Satisfaction: Despite having solid loyalty discounts, Progressive struggles to keep drivers satisfied in the long run.

- Unexpected Rate Increases: Many customer report that their rates went up unexpectedly, even though nothing about their situation had changed.

#6 – Nationwide: Best UBI Savings

Pros

- SmartRide: Nationwide is one of the few companies that offer UBI savings of up to 40% with its SmartRide program.

- Coverage Options: Nationwide offers a variety of Toyota car insurance policy options, including its Vanishing Deductible. See all your insurance options in our Nationwide auto insurance review.

- Affordable Rates for Bad Credit: Keep your Toyota insurance costs low no matter how bad your credit is with Nationwide.

Cons

- High Rates for High-Risk Drivers: Drivers with bad credit scores can find affordable, but that’s not the case if you have a DUI. Drivers with a DUI will see higher Nationwide rates, even if you drive the cheapest Toyota to insure.

- Limited Local Agents: If you prefer face-to-face help, you might need to consider a different company. Nationwide lacks local agents in some areas.

#7 – American Family: Best for Costco Members

Pros

- Writes Costco Policies: Costco offers its members affordable car insurance. These policies are written by American Family through its subsidiary, CONNECT.

- Plenty of Discounts: American Family offers 18 discounts to help drivers save, including several discounts for young drivers.

- KnowYourDrive: Save up to 30% on your policy by signing up for KnowYourDrive. This can help keep costs down, even if you need expensive Toyota Land Cruiser insurance.

Cons

- Average Rates: American Family isn’t the most expensive Toyota auto insurance option, but it’s also not the cheapest.

- Availability Lacking: Currently, American Family sells coverage in only 19 states. However, it extends Costco members coverage in 44 states through CONNECT. See if you can purchase American Family coverage in our American Family auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best Discount Selection

Pros

- Discount Selection: Farmers has a whopping 23 discounts to help drivers save. See how many discounts you qualify for in our Farmers auto insurance review.

- Excellent Customer Reviews: Many drivers feel that Farmers has the best car insurance for Toyotas because its representatives strive to provide exceptional customer experiences.

- Signal app: Save up to 15% on your Toyota insurance by downloading the Signal app and participating in the safe driving program.

Cons

- Limited Online Management Tools: You can make payments and start Toyota auto insurance claims online, but you’ll need to speak with a Farmers representative for other actions.

- No New Florida Policies: Famers is one of several auto insurance companies pulling out of Florida.

#9 – Allstate: Best for Low-Mileage Drivers

Pros

- Milewise: Milewise is one of two Allstate UBI programs that track your daily mileage to help you save.

- Excellent Coverage Options: Get the best Toyota comprehensive car insurance with Allstate’s ample coverage options. Read our Allstate auto insurance review to see all your coverage options.

- Drivewise: Save up to 40% on your insurance by maintaining safe driving habits and signing up for Drivewise.

Cons

- Occasional Rate Increases: Seeing rate increases in your insurance is normal, but many customers report feeling blindsided by their Allstate rates going up.

- Higher Rates: Allstate receives high marks in most areas in Toyota car insurance reviews. One area it lacks in is affordability – Allstate is usually one of the most expensive options.

#10 – Liberty Mutual: Best Add-on Options

Pros

- Diverse Policy Options: Liberty Mutual has a great list of car insurance add-ons to choose from, including original parts replacement insurance. These options are great when you need excellent coverage, like for Toyota Sequoia car insurance.

- Solid Discounts: Like most major insurance companies, Liberty Mutual offers a good selection of discounts to help drivers save. Learn more about Liberty Mutual’s discount options in our Liberty Mutual auto insurance review.

- Digital Tools: Between the Liberty Mutual website and app, there are plenty of ways to manage your Toyota car insurance policy online.

Cons

- Expensive After a DUI: If you have a DUI or other traffic violations in your driving record, Liberty Mutual is not likely to be your cheapest option.

- Inconsistent Customer Service: Toyota car insurance reviews from Liberty Mutual are mixed. Some drivers plan to stay for a long time because they love Liberty Mutual, while others warn drivers to stay away.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Toyota Auto Insurance Coverage Types

Statistically, any given Toyota is incredibly likely to outlive its loan. Whether you finance for two years or six, chances are that when you pay off your vehicle, it’s just getting started. If you’re still making payments, you must carry full coverage Toyota auto insurance.

Full coverage auto insurance is a combination of three types of auto insurance:

- Liability: You must carry liability auto insurance coverage for Toyotas. When you cause an accident, this covers injury and property damage for the other party.

- Collision: Collision auto insurance pays for your damages if you get in an accident. If you’re making loan or lease payments, this is required. Otherwise, it’s optional.

- Comprehensive: Comprehensive auto insurance covers damage from non-collision-related events, like animal or weather damage. If you have a car loan or lease for your Toyota, you must carry this Toyota auto insurance coverage.

If you own a Toyota and don’t have a car payment, you should still consider carrying comprehensive and collision coverage. In today’s auto market, used Toyotas are scarce, and that’s been driving those prices higher and higher. Nobody plans to be marked at fault, so they call them car accidents. Be prepared for any outcome as best you can.

Beyond these two, other coverage selections are available worth considering. Below, we’ll show a few you should consider, even if you opt out.

Roadside Assistance

The best roadside assistance plans might do more for your Toyota than you think. Roadside assistance can help in emergency situations for things like:

- Flat tire changes

- Fuel delivery

- Emergency repairs

- Key lockouts

- Dead batteries

- Towing and winching

Companies like AAA, Allstate, and Nationwide are excellent options for emergency roadside assistance coverage. Just make sure to read the fine print — insurance companies offer different services. You don’t want to be stranded and find out that your plan doesn’t cover what you need.

Uninsured/Underinsured Motorist Coverage

If you ride around in a new Avalon or 4Runner, you may find that most states don’t mandate other drivers to carry enough property damage liability auto insurance to replace your vehicle. In fact, sometimes the car can cost over double the state minimum, with little hope of recourse.

About 14% - or one in seven - American drivers are uninsured. Purchasing uninsured motorist coverage can save you thousands if one of those millions of drivers hits you.Eric Stauffer Licensed Insurance Agent

Uninsured/underinsured motorist coverage steps in under these types of occurrences. If you’re driving a $50,000 vehicle in a state which only requires $25,000 in property damage liability, then underinsured coverage is worth the extra cost. Find the best underinsured motorist (UIM) coverage auto insurance companies with a little extra research.

Rental Car Reimbursement

Rental car reimbursement coverage has become more helpful in recent times. Repairs nowadays are booked several weeks out and take much longer than usual once underway. Having an insurer help you secure a rental can feel like a lifesaver. If the other party is at fault, but you’re filing the Toyota auto insurance claim through your insurer, you’ll still need this coverage to secure your rental.

If you’ve paid off your vehicle and all you’re looking for is the cheapest coverage available, you can ignore the list above, minus the liability. It’s OK if you understand the risk you’re taking on and you’re comfortable with it.

Toyota Auto Insurance Rates

Toyota coverage is usually affordable, but there are many factors that affect car insurance rates. These include your age, location, driving record, and what type of Toyota you drive.

However, you can get an idea of which insurance companies offer the lowest rates by looking at average prices. Check the rates from our top Toyota auto insurance companies to see how much you might pay for coverage.

Toyota Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $32 | $86 |

| $61 | $160 | |

| $44 | $117 | |

| $22 | $58 |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 |

Remember, though, that as helpful as knowing those averages is, none of us actually represent the average. As said, the vehicle you drive is only one measure — the rest follows you. Age, location, driving habits, credit score, and driving record all impact your Toyota auto insurance rates.

Luckily, requesting quotes from individual companies is easy — if not time-consuming — as you can see below.

Even still, every company sees you a little differently because they all have their own parameters, statistics, and algorithms. If you shop around for several Toyota auto insurance quotes, you’ll find different figures. While this can be frustrating, it can help you save.

Learn how to compare auto insurance quotes.

Ways to Save on Toyota Auto Insurance Rates

What are some of the ways you can save on auto insurance for a Toyota? The most common types of auto insurance discounts you can get are for:

- Bundle your insurance policies. If you own a home, you can bundle your insurance policies to save on Toyota auto insurance rates. If you own multiple cars, quote them with the same carrier. The same goes for life insurance, renters, and plenty more.

- Get usage-based auto insurance. Consider the cheapest usage-based auto insurance companies for lower Toyota insurance rates. Most insurance carriers these days offer the chance at hefty discounts for monitoring driving habits.

- Lower your coverage. If you need the cheapest possible car insurance, you should consider minimum coverage. However, your vehicle won’t have the protection that full coverage offers.

- Raise your deductible. Your deductible is the portion you pay when you need to file a claim. Choosing a larger deductible will save you money each month, but you’ll have to pay more if you need to file a claim.

As you can see, there are many ways to find cheap auto insurance for your Toyota.

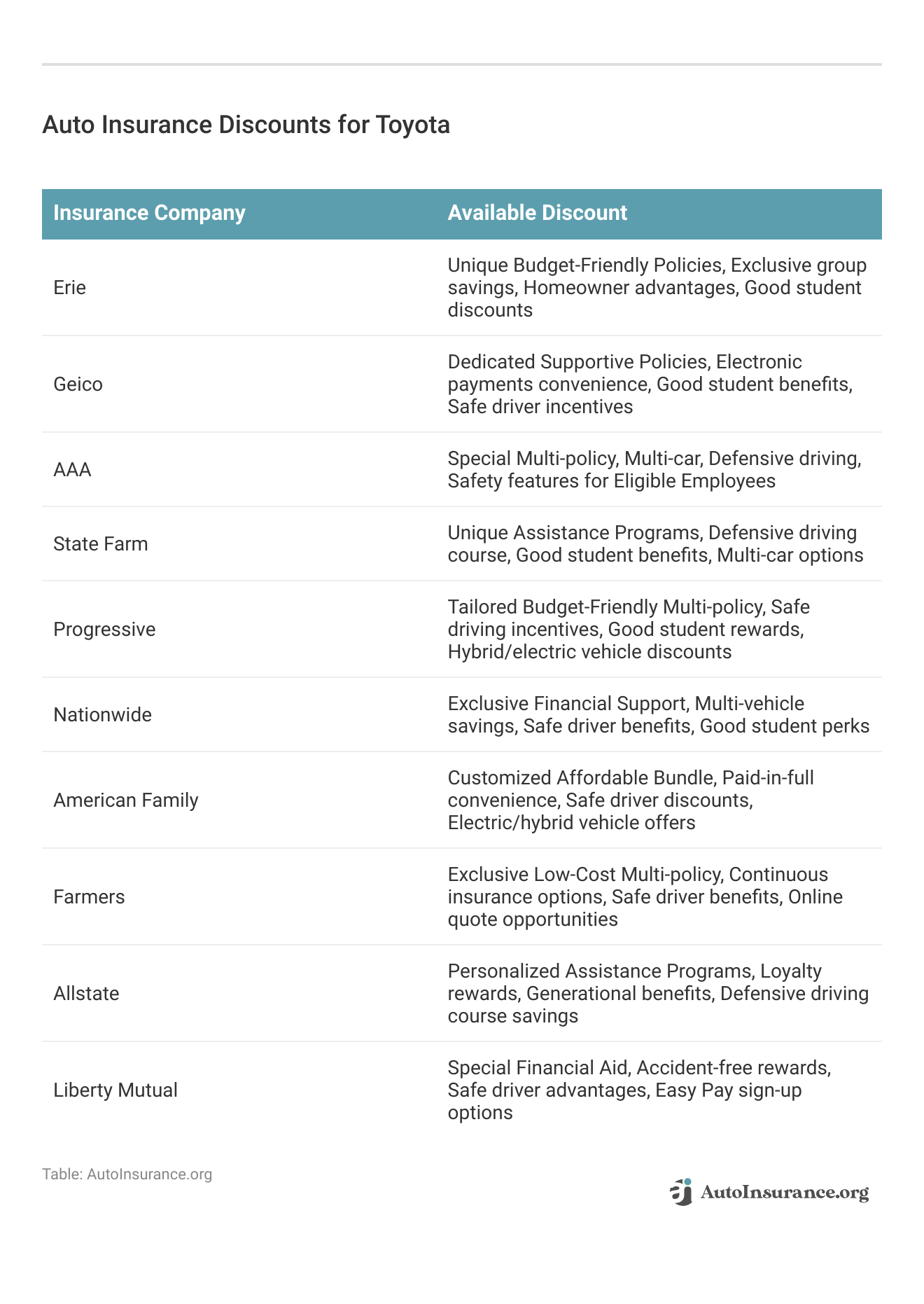

Auto Insurance Discounts for Toyotas

One of the easiest ways to save on your insurance is to take advantage of car insurance discounts. Most companies offer a variety of discounts for things ranging from your driving behaviors to how you pay for your coverage.

Check below to see what discounts are available from each company.

As you can see, there are plenty of discount options from our top companies. Some discounts are applied automatically, like customer loyalty auto insurance discounts. Others require proof, like a good student auto insurance discount, which requires drivers to submit their grades.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Toyota Auto Insurance Rates

You should shop around with different companies to find the best auto insurance for Toyotas. However, your state sets Toyota auto insurance requirements, so rates vary by location.

Further, most companies offer the same coverage, auto insurance discounts — by a different name — and fairly similar pricing. To see how much each insurance company might charge you, enter your ZIP code into our free comparison tool today.

Frequently Asked Questions

Which companies have the cheapest Toyota car insurance?

While you’ll need to learn how to evaluate car insurance quotes to see exact prices, our research finds that Erie, AAA, and Geico have the cheapest Toyota car insurance rates.

Do insurance companies consider Toyota vehicles to be luxury cars in terms of insurance pricing?

Thankfully, no. With Toyota’s reputation, you’d imagine they were a luxury line, but Lexus represents Toyota’s line of luxury vehicles. Toyotas, by comparison with other models, boast fantastic rates.

Is Toyota expensive to insure?

Toyotas tend to be an affordable brand to insure because they have a reputation for safety and reliability. However, the actual amount you pay for insurance depends on a variety of factors. To enure you get the lowest rates, enter your ZIP code into our free comparison tool.

Which Toyota is the cheapest to insure?

The cheapest car insurance for Toyotas will always be older models, especially if they’re paid off. State minimum auto insurance requirements on a 20-year-old Toyota Corolla will always feel like the lightest hit your budget can take.

What types of auto insurance coverage should I consider for my Toyota?

For financed vehicles, full coverage auto insurance is usually required, which includes liability, comprehensive, and collision coverage. Even for paid-off Toyotas, comprehensive and collision auto insurance are worth considering, along with other options like roadside assistance and uninsured/underinsured motorist coverage.

How can I save on auto insurance for my Toyota?

You can save on auto insurance for your Toyota by taking advantage of common discounts offered by insurance companies, such as safe driver discounts, multi-policy discounts, and good student discounts. It’s also essential to compare quotes from multiple insurers to find the best rates.

What factors can affect the cost of Toyota auto insurance?

The cost of Toyota auto insurance can vary based on factors such as the vehicle model, your age, location, and driving history.

What are some common auto insurance discounts available for Toyota owners?

Some common auto insurance discounts for Toyota owners include safe driver discounts, multi-vehicle discounts, bundled insurance discounts, and loyalty discounts. Qualifying for a good driver auto insurance discount is one of the best ways to save.

How much is insurance for a 2023 Toyota Tundra?

Toyota Tundra auto insurance costs $147 monthly for full coverage. However, you should always compare Toyota insurance quotes by model to find a good rate for you.

How do I cancel Toyota gap insurance?

Contact the insurance company providing you coverage to cancel your Toyota gap insurance coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.