Best Toyota Camry Auto Insurance in 2025 (Check Out These 10 Companies)

The best Toyota Camry auto insurance includes top providers Geico, Progressive, and State Farm, offering rates as low as $75 per month. These companies offer competitive Toyota Camry car insurance rates, reliable coverage, and excellent service, making them the top choices for affordable and dependable protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Toyota Camry

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Toyota Camry

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Toyota Camry

A.M. Best

Complaint Level

Pros & Cons

Geico, State Farm, and Progressive offer the best Toyota Camry auto insurance rates, starting at $75 per month. For the most affordable coverage, Geico excels with its competitive pricing and comprehensive policies. If you’re asking “how much is car insurance for a Toyota Camry,” Geico provides the best balance of cost and coverage. Explore these top providers to find the ideal insurance solution for your needs.

The article covers how factors like the car a teen drives affect auto insurance rates and compares Toyota Camry Hybrid car insurance options. It also explores cost-saving tips and coverage details.

Our Top 10 Company Picks: Best Toyota Camry Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Numerous Discount Geico

#2 12% A+ Snapshot Program Progressive

#3 20% B Reliable Coverage State Farm

#4 10% A Good Driver Liberty Mutual

#5 10% A+ Vanishing Deductible Nationwide

#6 8% A++ Broad Coverage Travelers

#7 10% A+ Local Agent Farmers

#8 10% A+ New Cars Allstate

#9 10% A Loyalty Discounts American Family

#10 11% A+ Customer Satisfaction Amica

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

Toyota Camry Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $76 $160

American Family $73 $152

Amica $71 $148

Farmers $79 $162

Geico $75 $155

Liberty Mutual $80 $165

Nationwide $77 $158

Progressive $72 $150

State Farm $78 $160

Travelers $74 $155

Are Toyotas expensive to insure? No. As mentioned above, the average Toyota Camry insurance cost per month is $120, saving you around $300 on car insurance every year if you drive one.

In a side-by-side comparison with other popular sedans, Toyotas are among the cheapest cars to insure. This table shows how the Camry’s rates compare to Chevrolet Cruze insurance rates and more:

Toyota Camry Auto Insurance Monthly Rates vs. Other Vehicles

Vehicle Rates

Chevrolet Cruze $131

Ford Fusion $147

Honda Accord $136

Hyundai Sonata $146

Nissan Altima $145

Toyota Camry $120

Insurance for some of the other sedans costs over $300 more per year than the Camry. This may not seem like much, but if you’re a young driver or have an accident on your record, these costs start to add up.

What Impacts the cost of Toyota Camry Insurance

Your driving record will have the biggest impact on your Toyota Camry insurance costs. Accidents, speeding tickets, and DUI charges make you a higher risk to insure, and insurance companies will raise your rates.

Age and gender have the next most significant effect on your rates. This table shows how much rates vary for younger drivers and between males and females:

Full Coverage Auto Insurance Cost by Age & Gender

Age & Gender Monthly Rates

Age: 17 Female $582

Age: 17 Male $694

Age: 25 Female $254

Age: 25 Male $270

Age: 35 Female $208

Age: 35 Male $214

Age: 60 Female $194

Age: 60 Male $204

As you can see, teen drivers pay much higher rates based on the risk associated with their age and inexperience on the road. Fortunately, there are things you can do to lower your Toyota Camry insurance rates.

You may not be able to age any faster, you can choose a Camry trim with more affordable rates.Jeff Root LICENSED INSURANCE AGENT

The year and trim you choose can impact your total price for Toyota Camry auto insurance coverage. Keep in mind that Toyota Camry auto insurance rates are higher for newer models.

For example, annual auto insurance for a 2020 Toyota Camry costs $1,645, while rates for a 2011 Toyota Camry can be as low as $800 per year. So, save money where you can by buying an older model. Additionally, considering your auto insurance deductible can also help manage costs effectively.

How to Save Money on Toyota Camry Insurance

Toyota Camrys are not expensive to insure. The average Toyota Camry insurance cost per month is $120, but you may see higher-than-average auto quotes if you’re a teen driver or have an accident on your driving record. You can keep your rates as low as possible by buying an older model.

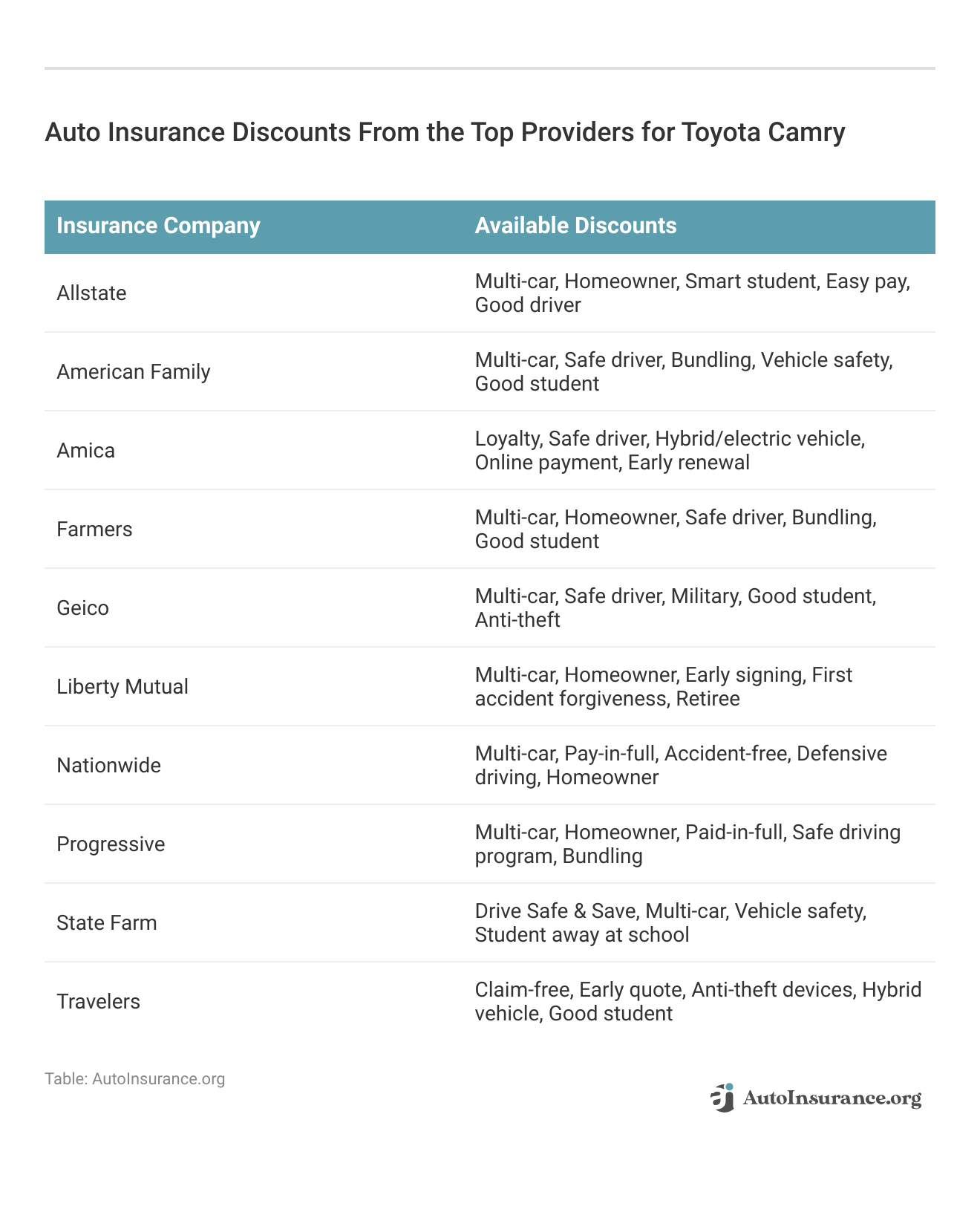

Discover the variety of car insurance discounts offered by top providers for Toyota Camry to help you save on your premiums.

You can also compare Camry insurance costs to other Toyota models. For example, researching Toyota Corolla insurance and the best car insurance companies for a Toyota 4Runner might help you make a more informed purchasing decision regarding the Camry.

Another way to reduce your Toyota insurance rates is by asking about auto insurance discounts. Since the Camry has some of the highest safety ratings, you might be able to earn a percentage off your rates for safety features and additional anti-theft devices.

Finally, always compare auto insurance quotes from at least three companies before you buy a policy. Each insurer rates your risk differently, and you may find more affordable Toyota Camry insurance with a local company over national insurers.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

How much does it cost to insure a Toyota Camry?

On average, the cost of insuring a Toyota Camry is around $120 per month or $1,448 per year. The actual rates may vary depending on factors such as age, ZIP code, and driving record.

Are there any specific discounts available for Toyota Camry insurance?

Many insurers offer discounts for Toyota Camry owners, such as multi-car, safe driver, or low-mileage discounts. It’s best to inquire with your insurer about all available auto insurance discounts to maximize savings.

Are Toyotas expensive to insure?

No, Toyotas, including the Camry, are generally not expensive to insure. In fact, the average monthly insurance cost for a Toyota Camry is $120, which can result in annual savings of about $300 compared to other cars.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

What factors impact the cost of Toyota Camry insurance?

The cost of Toyota Camry insurance is influenced by several factors. The most significant factor is your driving record, including accidents, speeding tickets, and DUI charges. Age and gender also play a role, with younger drivers and males generally paying higher rates.

What are the best auto insurance companies for a Toyota Camry?

To find the best auto insurance rates for a Toyota Camry, it’s recommended to compare quotes from multiple companies. Based on average rates, USAA and Geico offer some of the cheapest insurance options for Camry drivers.

How does having a Toyota Camry affect my car insurance premiums?

The Toyota Camry generally has moderate insurance premiums due to its safety features and reliability, but rates can vary based on factors like the model year and driver history.

How can I save money on Toyota Camry insurance?

There are several ways to save money on Toyota Camry insurance. Buying an older model can result in lower rates, as newer models tend to have higher insurance costs. Additionally, asking about discounts for safety features and anti-theft devices, and comparing quotes from different companies can help you find more affordable coverage.

How does the age of a Toyota Camry affect its auto insurance rates?

The age of a Toyota Camry can significantly impact insurance rates. Older models may have lower premiums due to reduced repair costs and lower replacement values, while newer models might cost more to insure due to higher repair and replacement costs.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Does the type of Toyota Camry model affect insurance rates?

Yes, different Toyota Camry models, such as the hybrid or high-performance versions, can impact insurance rates. Premium models may have higher rates due to increased repair costs or higher value.

Read More: Compare Auto Insurance Rates by Vehicle Make and Model

How does the Toyota Camry’s safety features impact insurance rates?

The Toyota Camry’s advanced safety features, such as automatic emergency braking and lane departure warning, can help reduce insurance rates by lowering the risk of accidents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.