Best Toyota Tundra Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

For the best Toyota Tundra auto insurance, State Farm, Geico, and Progressive offer coverage starting at just $30 per month. These top providers deliver competitive rates and comprehensive protection. Explore your options to find the best value and understand the average insurance cost for Toyota Tundra.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jan 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Toyota Tundra

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Toyota Tundra

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Toyota Tundra

A.M. Best

Complaint Level

Pros & Cons

The best Toyota Tundra auto insurance providers are AAA, Farmers, and Geico, offering rates starting as low as $30 per month. These companies lead in delivering competitive insurance rates for Toyota Tundra, with AAA being the top pick for its exceptional coverage and value.

The article also explores auto insurance deductibles, highlighting how they impact your overall policy cost. Understanding the balance between higher deductibles for lower premiums and lower deductibles for higher premiums can help you make informed decisions about the best Toyota Tundra auto insurance for your needs.

Our Top 10 Company Picks: Best Toyota Tundra Auto Insurance

Company Rank Accident-Free Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A Accident-Free Drivers AAA

#2 18% A Roadside Assistance Farmers

#3 12% A++ Diminishing Deductible Geico

#4 10% A+ Online Tools The Hartford

#5 14% A Customer Service The General

#6 17% A++ Local Agents Auto-Owners

#7 16% B Student Savings State Farm

#8 13% A+ Personalized Policies Amica

#9 19% A+ Financial Strength Progressive

#10 11% A Personalized Service Liberty Mutual

Find your cheapest auto insurance quotes by entering your ZIP code above into our free comparison tool.

- AAA provides top Toyota Tundra insurance coverage

- Get comprehensive coverage to meet your Toyota Tundra’s unique needs

- Consider deductible options to optimize Toyota Tundra insurance rates

Toyota Tundra Insurance Cost

When it comes to insuring a Toyota Tundra, understanding the average insurance rates and how they compare across different providers can help you make informed decisions about your coverage. Here, we provide an overview of the average costs associated with insuring a Toyota Tundra and how various insurance companies’ rates differ based on coverage levels.

Toyota Tundra Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $46 | $86 |

| Amica Mutual | $46 | $151 |

| Auto-Owners | $33 | $87 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| The General | $54 | $232 |

| The Hartford | $43 | $113 |

Additionally, understanding the variations in rates among providers can help you identify potential savings opportunities. Shopping around and getting multiple quotes is essential to finding the most cost-effective insurance plan.

Toyota Tundra Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $122 |

| Discount Rate | $72 |

| High Deductibles | $105 |

| High Risk Driver | $261 |

| Low Deductibles | $154 |

| Teen Driver | $447 |

By comparing these rates, you can determine which insurance company offers the best value for your Toyota Tundra based on your desired coverage level. This knowledge will enable you to choose a policy that not only fits your budget but also provides the necessary protection for your vehicle.

Read More: Full coverage auto insurance

Are Toyota Tundras Expensive to Insure

The chart below details how Toyota Tundra insurance rates compare to other trucks like the Ford Ranger, Toyota Tacoma, and Chevrolet Colorado. This comparison provides insight into where the Tundra stands in terms of insurance costs among similar vehicles.

Toyota Tundra Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Colorado | $21 | $37 | $31 | $102 |

| Ford Ranger | $21 | $39 | $31 | $105 |

| GMC Canyon | $23 | $40 | $33 | $109 |

| GMC Sierra 2500HD | $28 | $55 | $35 | $133 |

| Honda Ridgeline | $26 | $45 | $38 | $123 |

| Toyota Tacoma | $25 | $40 | $33 | $110 |

| Toyota Tundra | $28 | $44 | $35 | $122 |

However, there are a few things you can do to find the cheapest Toyota insurance rates online. Comparing multiple quotes and considering different coverage options can significantly lower your insurance expenses. For a comprehensive analysis, refer to our detailed guide titled “Auto Insurance Discounts.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Toyota Tundra Insurance

The Toyota Tundra trim and model you choose will affect the total price you will pay for Toyota Tundra insurance coverage. Additionally, factors such as your driving history, location, and the amount of coverage you select play significant roles in determining your auto insurance premium.

Vehicles with more advanced safety features may qualify for discounts, helping to lower the overall cost. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Age of the Vehicle

Understanding how the age of your Toyota Tundra affects insurance costs can help you make more informed decisions. Older Toyota Tundra models generally cost less to insure.

Toyota Tundra Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Toyota Tundra | $30 | $46 | $36 | $124 |

| 2023 Toyota Tundra | $29 | $45 | $36 | $123 |

| 2022 Toyota Tundra | $29 | $45 | $36 | $123 |

| 2021 Toyota Tundra | $28 | $44 | $35 | $122 |

| 2020 Toyota Tundra | $28 | $44 | $35 | $122 |

| 2019 Toyota Tundra | $27 | $43 | $37 | $121 |

| 2018 Toyota Tundra | $26 | $42 | $38 | $120 |

| 2017 Toyota Tundra | $25 | $41 | $39 | $120 |

| 2016 Toyota Tundra | $24 | $40 | $41 | $119 |

| 2015 Toyota Tundra | $23 | $38 | $42 | $117 |

| 2014 Toyota Tundra | $22 | $35 | $43 | $115 |

| 2013 Toyota Tundra | $21 | $33 | $43 | $112 |

| 2012 Toyota Tundra | $20 | $30 | $43 | $108 |

| 2011 Toyota Tundra | $19 | $28 | $43 | $105 |

| 2010 Toyota Tundra | $18 | $26 | $44 | $103 |

By comparing these rates, you can see the significant savings that can be achieved with older models. This insight can help you decide whether to purchase a newer or older vehicle based on insurance costs.

Driver Age

Driver age can have a significant effect on Toyota Tundra auto insurance rates. Younger drivers often face higher premiums compared to older, more experienced drivers.

Toyota Tundra Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $447 |

| Age: 18 | $394 |

| Age: 20 | $277 |

| Age: 30 | $128 |

| Age: 40 | $122 |

| Age: 45 | $118 |

| Age: 50 | $112 |

| Age: 60 | $109 |

These figures highlight the importance of considering age when budgeting for insurance costs. Younger drivers should be aware of the potential higher premiums they may face.

Driver Location

Where you live can have a large impact on Toyota Tundra insurance rates. Geographic factors play a crucial role in determining premiums, with rates varying significantly by location.

Toyota Tundra Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $162 |

| Columbus, OH | $102 |

| Houston, TX | $192 |

| Indianapolis, IN | $104 |

| Jacksonville, FL | $177 |

| Los Angeles, CA | $209 |

| New York, NY | $193 |

| Philadelphia, PA | $164 |

| Phoenix, AZ | $142 |

| Seattle, WA | $119 |

By comparing rates in different cities, you can better understand how location affects your insurance costs. This can be especially useful if you are considering a move or if you live in an area with higher insurance premiums.

Your Driving Record

Your driving record can have an impact on your Toyota Tundra auto insurance rates. Teens and drivers in their 20’s see the highest jump in their Toyota Tundra auto insurance with violations on their driving record.

Toyota Tundra Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $447 | $491 | $555 | $723 |

| Age: 18 | $394 | $433 | $490 | $663 |

| Age: 20 | $277 | $302 | $359 | $511 |

| Age: 30 | $128 | $139 | $167 | $294 |

| Age: 40 | $122 | $133 | $160 | $280 |

| Age: 45 | $118 | $129 | $155 | $272 |

| Age: 50 | $112 | $121 | $145 | $258 |

| Age: 60 | $109 | $119 | $142 | $250 |

Accidents and violations can significantly increase your insurance costs. Maintaining a clean driving record is crucial for keeping your insurance premiums low.

Safety Ratings

Your Toyota Tundra auto insurance rates are influenced by the vehicle’s safety ratings. Higher safety ratings often lead to lower insurance premiums.

Toyota Tundra Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Acceptable |

| Small overlap front: passenger-side | Poor |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Good safety ratings can help lower your insurance premiums. Ensuring your vehicle has high safety ratings can contribute to overall savings.

Crash Test Ratings

Not only do good Toyota Tundra crash test ratings mean you are better protected in a crash, but good Toyota Tundra crash ratings also mean cheaper insurance rates.

Toyota Tundra Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Toyota Tundra PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2024 Toyota Tundra PU/EC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2024 Toyota Tundra PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2024 Toyota Tundra PU/CC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2023 Toyota Tundra PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Toyota Tundra PU/EC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2023 Toyota Tundra PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Toyota Tundra PU/CC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2022 Toyota Tundra PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Toyota Tundra PU/EC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2022 Toyota Tundra PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Toyota Tundra PU/CC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2021 Toyota Tundra PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Toyota Tundra PU/EC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2021 Toyota Tundra PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Toyota Tundra PU/CC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2020 Toyota Tundra PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Toyota Tundra PU/EC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2020 Toyota Tundra PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Toyota Tundra PU/CC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2019 Toyota Tundra PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Toyota Tundra PU/EC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2019 Toyota Tundra PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Toyota Tundra PU/CC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2018 Toyota Tundra PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Toyota Tundra PU/EC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2018 Toyota Tundra PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Toyota Tundra PU/CC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2017 Toyota Tundra PU/RC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Toyota Tundra PU/RC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2017 Toyota Tundra PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Toyota Tundra PU/EC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2017 Toyota Tundra PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Toyota Tundra PU/CC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2016 Toyota Tundra PU/RC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Toyota Tundra PU/RC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2016 Toyota Tundra PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Toyota Tundra PU/EC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2016 Toyota Tundra PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Toyota Tundra PU/CC 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

High crash test ratings can lead to lower insurance costs. It’s essential to consider these ratings when purchasing a vehicle to ensure both safety and cost-effectiveness.

Toyota Tundra Safety Features

The Toyota Tundra’s safety features can help lower insurance costs by providing added protection. Key safety features include:

- Driver and passenger air bags

- 4-wheel ABS and brake assist

- Electronic stability control and traction control

- Daytime running lights and lane departure warning

- Child safety locks

These features not only enhance vehicle safety but also contribute to potentially lower insurance premiums. Ensuring your Tundra is equipped with these technologies is beneficial for both safety and cost savings.

Loss Probability

The lower percentage means lower Toyota Tundra auto insurance rates; higher percentages mean higher Toyota Tundra auto insurance rates. Insurance loss probability on the Toyota Tundra fluctuates between each type of coverage.

Toyota Tundra Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Bodily Injury | -6% |

| Collision | -12% |

| Comprehensive | -4% |

| Medical Payment | -25% |

| Personal Injury | -37% |

| Property Damage | 5% |

Understanding loss probabilities can help you anticipate potential insurance costs. This knowledge can guide you in selecting the best insurance coverage for your needs.

If you are financing a Toyota Tundra, most lenders will require your carry higher Toyota Tundra coverage options including comprehensive coverage, so be sure to shop around and compare Toyota Tundra auto insurance quotes from the best auto insurance companies using our free tool below.

Ways to Save on Toyota Tundra Insurance

Although it may seem like your Toyota Tundra auto insurance rates are set, there are a few measures that you can take to secure the best Toyota Tundra auto insurance rates possible. Take a look at the following five ways to save on Toyota Tundra auto insurance.

- Remove young drivers from your Toyota Tundra auto insurance policy when they move out or go to school.

- Re-check Toyota Tundra insurance rates every 6 months.

- Ask for a Toyota Tundra discount if you have college degree or higher.

- Check the odometer on your toyota tundra.

- Audit your Toyota Tundra driving when you move to a new location or start a new job.

By implementing these strategies, you can potentially lower your Toyota Tundra insurance costs. Regularly reviewing and adjusting your policy can lead to significant savings over time. Explore our guide “How to Lower Your Auto Insurance Rates.”

AAA is the top choice for Toyota Tundra insurance, offering comprehensive coverage and affordable rates.Chris Abrams LICENSED INSURANCE AGENT

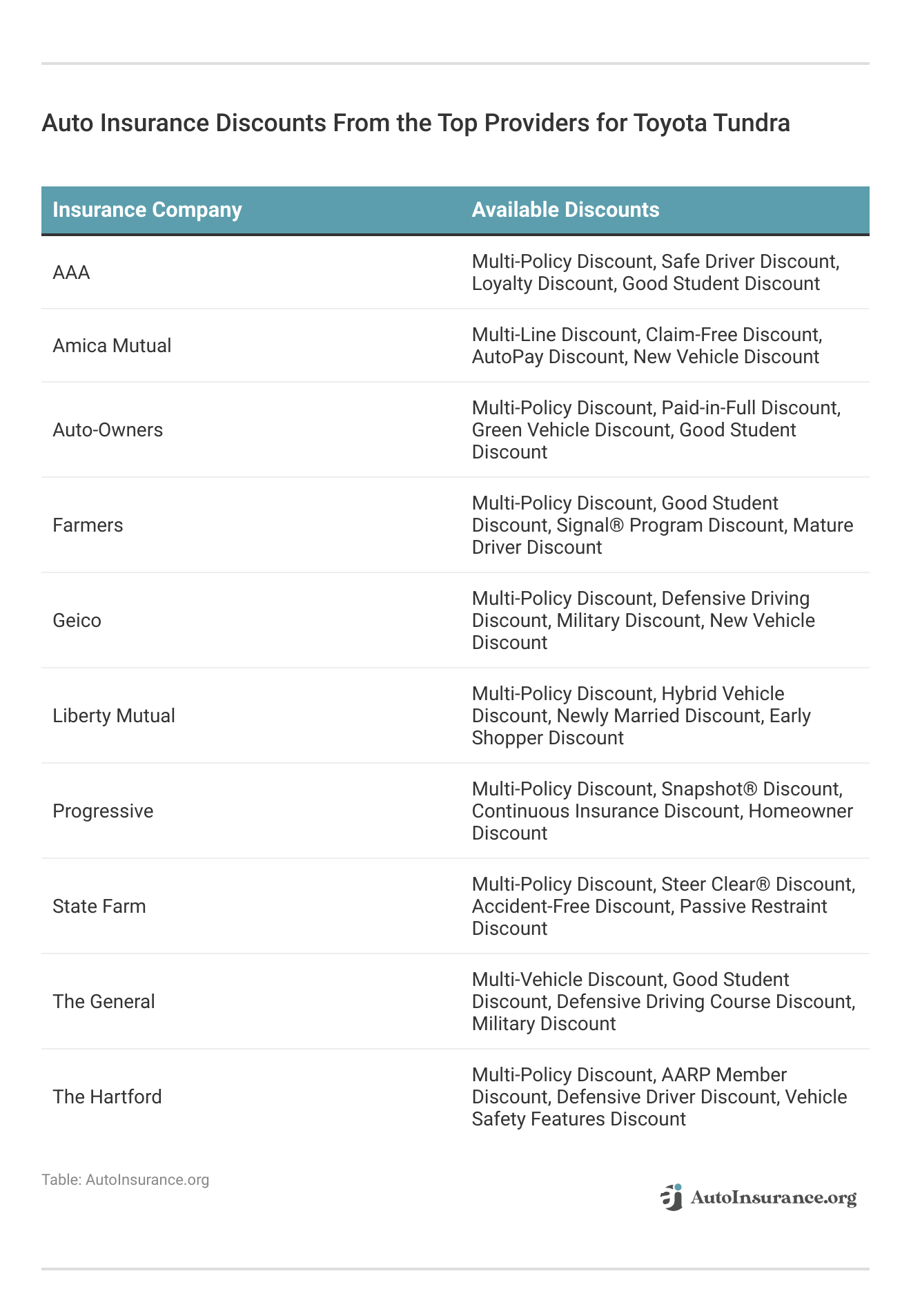

Knowing the available discounts from various insurance providers can significantly reduce your overall insurance costs for your Toyota Tundra. Many insurance companies offer multiple discount options that can help you save money.

By exploring these discounts, you can find opportunities to lower your Toyota Tundra insurance premiums. Regularly reviewing your policy and checking for new discounts can lead to significant savings over time.

Top Toyota Tundra Insurance Companies

The best auto insurance companies for Toyota Tundra auto insurance rates will offer competitive rates, discounts, and account for the Toyota Tundra’s safety features. The following list of auto insurance companies outlines which companies hold the highest market share.

Top 10 Toyota Tundra Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Liberty Mutual | $39.2 million | 5% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20.0 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

These companies hold the highest market share and are well-regarded for their comprehensive coverage options and customer service. Evaluating these top insurers can help you find the best coverage for your Toyota Tundra at a competitive price.

Start comparing Toyota Tundra auto insurance quotes for free by using our free online comparison tool.

Frequently Asked Questions

How much does Toyota Tundra insurance cost?

The cost of auto insurance for a Toyota Tundra can be influenced by various factors, including the driver’s age, location, driving history, coverage options, auto insurance deductible amount, and the specific model and year of the Toyota Tundra. Insurance providers also consider the cost of repairs and replacement parts for the Toyota Tundra when determining premiums.

How does the age of the vehicle affect Toyota Tundra insurance rates?

Generally, older Toyota Tundra models have lower insurance rates. For example, a 2020 Toyota Tundra may cost $146 to insure, while a 2010 model could cost $123. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

How do Toyota Tundra safety features affect insurance costs?

Toyota Tundra’s safety features, such as driver and passenger airbags, ABS, stability control, and more, can help lower insurance costs.

Which insurance companies offer coverage for Toyota Tundra?

Some of the top auto insurance companies that provide coverage for Toyota Tundra include State Farm, Geico, Progressive, Liberty Mutual, Allstate, Travelers, USAA, Chubb, Farmers, and Nationwide. Check out our guide “Where to Compare Auto Insurance Rates.“

Can I transfer my current insurance policy to a new Toyota Tundra?

Yes, if you already have an existing auto insurance policy, you can typically transfer it to your new Toyota Tundra. Contact your insurance provider to update the vehicle information and ensure continuous coverage.

How does my credit score affect my Toyota Tundra insurance rates?

In some states, insurance companies may consider your credit score when determining your insurance rates. A higher credit score is generally associated with lower insurance premiums, as it is seen as an indicator of responsible financial behavior.

What factors influence the cost of insuring a Toyota Tundra?

Several factors impact the cost of insuring a Toyota Tundra, including the driver’s age, driving record, location, and the specific trim and model of the vehicle. Additionally, safety features and the age of the Tundra can also affect insurance premiums.

Are there specific discounts available for Toyota Tundra insurance?

Yes, many insurance companies offer various discounts that can help lower your Toyota Tundra insurance costs. These may include multi-policy discounts, safe driver discounts, and discounts for having advanced safety features in your vehicle.

Does the Toyota Tundra’s safety rating impact insurance rates?

Yes, the Toyota Tundra’s safety rating significantly impacts insurance rates. Vehicles with higher safety ratings typically qualify for lower insurance premiums due to the reduced risk of injury in the event of an accident. Delve into our guide “At-Fault Accident.”

How do I find the best insurance rates for my Toyota Tundra?

To find the best insurance rates for your Toyota Tundra, it’s crucial to shop around and compare quotes from multiple insurance providers. Utilizing online comparison tools can make this process easier and help you find the most competitive rates.

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.