Best Toyota Tacoma Auto Insurance in 2025 (Top 10 Companies Ranked)

The best Toyota Tacoma auto insurance providers include Safeco, Farmers, and Erie, offering rates as low as $22 per month. These top choices excel in affordability and comprehensive coverage. With average insurance costs for Toyota Tacoma often higher, these providers ensure you get the best value for your money.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Toyota Tacoma

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Toyota Tacoma

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Toyota Tacoma

A.M. Best

Complaint Level

Pros & Cons

Safeco, Farmers, and Erie offer the best Toyota Tacoma auto insurance, with rates starting at just $22 per month. If you’re wondering why Toyota Tacoma insurance is so expensive, these top providers offer the most competitive prices and comprehensive coverage. Safeco stands out as the top pick overall for its exceptional value.

The article also explores how changing your address affects auto insurance, including its impact on insurance for Toyota Tacoma. By understanding this factor, you can better assess how moving might influence your premiums and find ways to adjust your policy for optimal savings and coverage.

Our Top 10 Company Picks: Best Toyota Tacoma Auto Insurance

Company Rank Low Mileage Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A Low Rates Safeco

#2 18% A Vanishing Deductible Farmers

#3 12% A+ Multi-Policy Savings Erie

#4 10% B Accident Forgiveness State Farm

#5 14% A+ Competitive Rates Nationwide

#6 17% A+ Coverage Options Progressive

#7 16% A+ Roadside Assistance Amica

#8 13% A Customer Service American Family

#9 19% A++ Online Management Travelers

#10 11% A Loyalty Rewards Liberty Mutual

Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

- Safeco provides the best rates for Toyota Tacoma insurance

- Toyota Tacoma insurance costs vary by location and driving record

- Discover the auto insurance discounts available for Toyota Tacoma

#1 – Safeco: Top Overall Pick

Pros

- Affordable Rates for Toyota Tacoma: Safeco offers Toyota Tacoma insurance for just $71 per month, making it one of the most affordable options available. This is significantly lower than the average cost of $112 per month.

- Good Driver Discounts: Safeco provides discounts for good drivers, which can further reduce the cost of Toyota Tacoma insurance. This is beneficial for mature drivers with a clean driving record.

- Comprehensive Coverage Options: As outlined in Safeco auto insurance review, Safeco offers a variety of comprehensive coverage options for Toyota Tacoma owners, ensuring that all aspects of your vehicle’s protection needs are met.

Cons

- Limited Availability: Safeco’s insurance options may not be available in all areas, which could limit accessibility for some Toyota Tacoma owners.

- Customer Service Concerns: Some customers have reported issues with Safeco’s customer service, which could be a drawback when handling claims or inquiries about Toyota Tacoma insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Farmers: Best for Vanishing Deductible

Pros

- Extensive Coverage Options: Farmers offers a wide range of coverage options for Toyota Tacoma owners, including comprehensive, collision, and liability coverage, ensuring full protection.

- Strong Financial Stability: Farmers is a well-established insurance provider with strong financial ratings, offering peace of mind for Toyota Tacoma owners knowing their claims will be paid.

- Discounts for Safety Features: Farmers provides discounts for Toyota Tacoma owners who have advanced safety features installed in their vehicles, helping to lower the overall insurance cost. Check their rates in our Farmers auto insurance review.

Cons

- Higher Premiums: At $139 per month, Farmers’ insurance rates for Toyota Tacoma are higher than the average, which might not be the best option for budget-conscious drivers.

- Complex Policy Terms: Some Toyota Tacoma owners might find Farmers’ policy terms and conditions complex and difficult to understand, which could lead to confusion when filing claims.

#3 – Erie: Best for Multi-Policy Savings

Pros

- Lowest Rates Available: As outlined in our Erie auto insurance review, Erie offers the most affordable insurance rates for Toyota Tacoma at just $58 per month, significantly lower than the average cost.

- High Customer Satisfaction: Erie is known for its high customer satisfaction ratings, indicating a positive experience for Toyota Tacoma owners when dealing with the company.

- Comprehensive Coverage: Despite the low cost, Erie provides comprehensive coverage options for Toyota Tacoma, ensuring all essential protection needs are met.

Cons

- Limited Coverage Area: Erie’s insurance is not available nationwide, which can limit access for Toyota Tacoma owners depending on their location.

- Fewer Discount Opportunities: Compared to other insurers, Erie might offer fewer discounts, which could affect overall savings for Toyota Tacoma owners.

#4 – State Farm: Best for Accident Forgiveness

Pros

- Competitive Rates: State Farm offers Toyota Tacoma insurance at $86 per month, which is below the average cost, making it an affordable choice for many drivers.

- User-Friendly Online Platform: State Farm provides an intuitive and easy-to-navigate online platform, making it simple for Toyota Tacoma owners to manage their policies and file claims.

- Multiple Discount Options: As mentioned in our State Farm auto insurance review, State Farm provides various discounts, including those for good drivers and multi-policy holders, which can help reduce the cost of Toyota Tacoma insurance.

Cons

- Potential Rate Increases: Some Toyota Tacoma owners have reported unexpected rate increases with State Farm, which could affect long-term affordability.

- Limited Coverage Customization: While State Farm offers comprehensive coverage, there may be fewer options for customizing policies to fit specific needs of Toyota Tacoma owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Competitive Rates

Pros

- Wide Range of Coverage Options: Nationwide offers extensive coverage options for Toyota Tacoma owners, including comprehensive, collision, and liability insurance.

- Vanishing Deductible: Nationwide’s vanishing deductible program can help Toyota Tacoma owners save money over time by reducing their deductible for each year of safe driving.

- Strong Financial Ratings: Nationwide has strong financial stability, ensuring that Toyota Tacoma owners can trust their claims will be paid promptly and efficiently. For more information, read our Nationwide auto insurance review.

Cons

- Higher Than Average Rates: At $115 per month, Nationwide’s rates for Toyota Tacoma are higher than some competitors, which might not be ideal for those looking for the cheapest option.

- Mixed Customer Reviews: Nationwide has received mixed reviews regarding customer service, which could impact the overall experience for Toyota Tacoma owners.

#6 – Progressive: Best for Coverage Options

Pros

- Usage-Based Discounts: Progressive offers usage-based discounts through its Snapshot program, which can help Toyota Tacoma owners save based on their actual driving habits.

- Competitive Rates: With rates at $105 per month, Progressive provides competitive pricing for Toyota Tacoma insurance, making it an attractive option.

- Extensive Online Tools: As mentioned in Progressive auto insurance review, Progressive offers a range of online tools and resources to help Toyota Tacoma owners manage their policies and claims efficiently.

Cons

- Higher Rates for High-Risk Drivers: Toyota Tacoma owners with a poor driving record may face higher premiums with Progressive compared to other insurers.

- Potential for Rate Increases: Some Toyota Tacoma owners have reported rate increases after the initial policy period, which could affect long-term cost predictability.

#7 – Amica: Best for Roadside Assistance

Pros

- Exceptional Customer Service: Amica Mutual is known for its top-tier customer service, providing a highly supportive experience for Toyota Tacoma owners.

- Dividend Policies: Amica offers dividend policies that can return a portion of the premium to Toyota Tacoma owners, providing potential savings.

- Comprehensive Coverage Options: As mentioned in our Amica auto insurance review, Amica provides a wide range of comprehensive coverage options for Toyota Tacoma, ensuring full protection.

Cons

- High Premiums: At $151 per month, Amica’s insurance rates for Toyota Tacoma are among the highest, which might not be suitable for budget-conscious drivers.

- Limited Availability: Amica’s insurance policies are not available in all states, which could restrict access for some Toyota Tacoma owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Customer Service

Pros

- Good Driver Discounts: American Family offers substantial discounts for Toyota Tacoma owners with good driving records, helping to lower the overall insurance cost.

- Comprehensive Coverage: As outlined in our American Family auto insurance review, American Family provides a wide range of coverage options, ensuring that Toyota Tacoma owners have all their insurance needs met.

- Strong Financial Stability: With strong financial ratings, American Family offers peace of mind to Toyota Tacoma owners knowing their claims will be handled reliably.

Cons

- Higher Rates: At $117 per month, American Family’s rates are higher than the average cost of Toyota Tacoma insurance, which might not be ideal for all drivers.

- Mixed Customer Service Reviews: Some Toyota Tacoma owners have reported mixed experiences with American Family’s customer service, which could impact overall satisfaction.

#9 – Travelers: Best for Online Management

Pros

- Competitive Pricing: Travelers offers Toyota Tacoma insurance at $99 per month, which is below the average cost, providing a good balance of cost and coverage.

- Strong Financial Ratings: As mentioned in our Travelers Auto insurance review, Travelers has strong financial stability, ensuring reliable claims processing for Toyota Tacoma owners.

- Discounts for Safe Drivers: Travelers offers discounts for safe drivers, which can help Toyota Tacoma owners save on their insurance premiums.

Cons

- Limited Online Resources: Compared to other insurers, Travelers may offer fewer online tools and resources, which could affect policy management for Toyota Tacoma owners.

- Potential Rate Increases: Some Toyota Tacoma owners have reported rate increases after the initial policy period, which could impact long-term affordability.

#10 – Liberty Mutual: Best for Loyalty Rewards

Pros

- Extensive Coverage Options: Liberty Mutual offers a wide range of coverage options for Toyota Tacoma, including comprehensive and collision insurance, ensuring full protection.

- Accident Forgiveness: Liberty Mutual provides accident forgiveness, which can help prevent rates from increasing after the first accident for Toyota Tacoma owners.

- Strong Financial Ratings: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual has strong financial stability, providing peace of mind for Toyota Tacoma owners knowing their claims will be paid.

Cons

- High Premiums: At $174 per month, Liberty Mutual’s insurance rates for Toyota Tacoma are significantly higher than the average, which may not be affordable for all drivers.

- Mixed Customer Service Reviews: Some Toyota Tacoma owners have reported mixed experiences with Liberty Mutual’s customer service, which could impact overall satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Toyota Tacoma Insurance Cost

The table below provides a comparison of monthly car insurance rates for a Toyota Tacoma, featuring both minimum and full coverage options from various providers. Access comprehensive insights into our guide titled “What are the recommended auto insurance coverage levels?“

Toyota Tacoma Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $44 | $117 |

| Amica Mutual | $46 | $151 |

| Erie | $22 | $58 |

| Farmers | $53 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| Safeco | $27 | $71 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

Additionally, the second table showcases how different factors such as high deductibles, low deductibles, high-risk drivers, and teen drivers can influence the average insurance rates for the Toyota Tacoma.

Toyota Tacoma Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $112 |

| Discount Rate | $66 |

| High Deductibles | $96 |

| High Risk Driver | $238 |

| Low Deductibles | $140 |

| Teen Driver | $408 |

Understanding these rates and how different factors affect them can help Toyota Tacoma owners make informed decisions when selecting the most cost-effective insurance coverage for their needs.

Are Toyota Tacomas Expensive to Insure

The chart below details how Toyota Tacoma insurance rates compare to other trucks like the Nissan Frontier, Chevrolet Colorado, and GMC Sierra 3500HD. Discover insights in our article titled “How much car insurance do I need?”

Toyota Tacoma Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Colorado | $21 | $37 | $31 | $102 |

| Ford F-150 | $27 | $39 | $31 | $110 |

| Ford Ranger | $21 | $39 | $31 | $105 |

| GMC Sierra | $28 | $50 | $31 | $122 |

| GMC Sierra 3500HD | $31 | $55 | $35 | $136 |

| Nissan Frontier | $25 | $42 | $35 | $116 |

| Toyota Tacoma | $26 | $42 | $31 | $112 |

Comparing insurance rates across different trucks and understanding the impact of various factors can help Toyota Tacoma owners secure the best insurance deals and manage their insurance expenses effectively.

What Impacts the Cost of Toyota Tacoma Insurance

Your policy can be higher or lower depending on your unique profile. Factors that influence your insurance costs include your age, home address, driving history, and the model year of your Toyota Tacoma.

Safeco stands out with its comprehensive coverage and value.Chris Abrams LICENSED INSURANCE AGENT

Additionally, aspects such as your credit score, the level of coverage you choose, and any applicable discounts can further affect your insurance premiums. Understanding these factors can help you find the most cost-effective policy tailored to your needs. Discover more about offerings in our article titled “Best Auto Insurance by Age.”

Age of the Vehicle

The average Toyota Tacoma auto insurance rates are higher for newer models. For example, auto insurance rates for a 2020 Toyota Tacoma are significantly higher than those for a 2010 model.

Toyota Tacoma Auto Insurance Monthly Rates by Model Year

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Toyota Tacoma | $28 | $45 | $32 | $114 |

| 2023 Toyota Tacoma | $27 | $44 | $32 | $113 |

| 2022 Toyota Tacoma | $27 | $43 | $32 | $113 |

| 2021 Toyota Tacoma | $26 | $42 | $31 | $112 |

| 2020 Toyota Tacoma | $26 | $42 | $31 | $112 |

| 2019 Toyota Tacoma | $25 | $40 | $33 | $110 |

| 2018 Toyota Tacoma | $24 | $40 | $33 | $110 |

| 2017 Toyota Tacoma | $23 | $39 | $35 | $109 |

| 2016 Toyota Tacoma | $22 | $37 | $36 | $108 |

| 2015 Toyota Tacoma | $21 | $36 | $37 | $107 |

| 2014 Toyota Tacoma | $20 | $33 | $38 | $104 |

| 2013 Toyota Tacoma | $19 | $31 | $38 | $102 |

| 2012 Toyota Tacoma | $18 | $28 | $38 | $98 |

| 2011 Toyota Tacoma | $17 | $26 | $38 | $95 |

| 2010 Toyota Tacoma | $17 | $24 | $39 | $93 |

Newer Toyota Tacoma models tend to have higher insurance rates due to their higher value and cost of repairs. Understanding how the model year affects insurance can help you make more cost-effective choices.

Driver Age

Driver age can have a significant effect on Toyota Tacoma auto insurance rates. Younger drivers tend to pay much higher rates compared to older, more experienced drivers.

Toyota Tacoma Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $408 |

| Age: 18 | $372 |

| Age: 20 | $253 |

| Age: 30 | $116 |

| Age: 40 | $112 |

| Age: 45 | $108 |

| Age: 50 | $102 |

| Age: 60 | $100 |

Age is a crucial factor in determining insurance costs, with younger drivers facing higher premiums. It’s beneficial for younger drivers to look for discounts and safe driving incentives to reduce costs.

Driver Location

Where you live can have a large impact on Toyota Tacoma insurance rates. For example, drivers in New York may pay more than drivers in Seattle.

Toyota Tacoma Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $147 |

| Houston, TX | $175 |

| Indianapolis, IN | $95 |

| Jacksonville, FL | $162 |

| Los Angeles, CA | $191 |

| New York, NY | $176 |

| Philadelphia, PA | $149 |

| Phoenix, AZ | $129 |

| Seattle, WA | $108 |

Your location significantly affects your insurance rates, with higher premiums in densely populated areas. Knowing this can help you anticipate and plan for your insurance expenses.

Your Driving Record

Your driving record can have an impact on the cost of Toyota Tacoma auto insurance. Teens and drivers in their 20’s see the highest jump in their Toyota Tacoma auto insurance with violations on their driving record.

Toyota Tacoma Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $408 | $448 | $507 | $661 |

| Age: 18 | $372 | $409 | $464 | $611 |

| Age: 20 | $253 | $275 | $329 | $469 |

| Age: 30 | $116 | $127 | $151 | $280 |

| Age: 40 | $112 | $121 | $145 | $268 |

| Age: 45 | $108 | $117 | $140 | $260 |

| Age: 50 | $102 | $111 | $133 | $250 |

| Age: 60 | $100 | $108 | $130 | $244 |

In conclusion, maintaining a clean driving record is crucial for keeping insurance rates low. Avoiding violations and accidents can significantly reduce your premiums.

Safety Ratings

The Toyota Tacoma’s safety ratings will affect your Toyota Tacoma auto insurance rates. Good ratings can help reduce premiums, while lower ratings may increase them.

Toyota Tacoma Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Acceptable |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Toyota Tacoma’s strong safety ratings help lower insurance rates. Investing in a vehicle with high safety standards can be financially beneficial in the long run.

Crash Test Ratings

Poor Toyota Tacoma crash test ratings could mean higher Toyota Tacoma auto insurance rates. Higher safety ratings contribute to lower premiums.

Toyota Tacoma Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Toyota Tacoma PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2024 Toyota Tacoma PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2024 Toyota Tacoma PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2024 Toyota Tacoma PU/CC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Toyota Tacoma PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Toyota Tacoma PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Toyota Tacoma PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Toyota Tacoma PU/CC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Toyota Tacoma PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Toyota Tacoma PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Toyota Tacoma PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Toyota Tacoma PU/CC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Toyota Tacoma PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Toyota Tacoma PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Toyota Tacoma PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Toyota Tacoma PU/CC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Toyota Tacoma PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Toyota Tacoma PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Toyota Tacoma PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Toyota Tacoma PU/CC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Toyota Tacoma PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Toyota Tacoma PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Toyota Tacoma PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Toyota Tacoma PU/CC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Toyota Tacoma PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Toyota Tacoma PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Toyota Tacoma PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Toyota Tacoma PU/CC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Toyota Tacoma PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Toyota Tacoma PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Toyota Tacoma PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2017 Toyota Tacoma PU/CC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Toyota Tacoma PU/EC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Toyota Tacoma PU/EC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Toyota Tacoma PU/CC 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2016 Toyota Tacoma PU/CC 2WD | 4 stars | 4 stars | 5 stars | 4 stars |

The Toyota Tacoma’s solid crash test ratings help maintain reasonable insurance rates. Vehicles with good crash test performance are typically less expensive to insure.

Toyota Tacoma Safety Features

The numerous safety features of the Toyota Tacoma help contribute to lower insurance rates. The 2020 Toyota Tacoma has the following safety features:

- Driver and passenger air bags with on/off switch

- 4-wheel ABS, brake assist, and front disc/rear drum brakes

- Electronic stability control and traction control

- Lane departure warning and daytime running lights

- Front tow hooks and front/rear head air bags

These advanced safety features enhance the Toyota Tacoma’s protection, helping to lower insurance rates. Ensuring your vehicle is well-equipped can lead to more affordable coverage.

Loss Probability

The lower percentage means lower Toyota Tacoma auto insurance costs; higher percentages mean higher Toyota Tacoma auto insurance costs. Compare the following Toyota Tacoma auto insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury.

Toyota Tacoma Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Bodily Injury | -8% |

| Collision | -21% |

| Comprehensive | -30% |

| Medical Payment | -24% |

| Personal Injury | -23% |

| Property Damage | 9% |

The Toyota Tacoma’s favorable insurance loss probabilities can help keep your premiums low. Understanding these rates can aid in choosing a cost-effective insurance policy.

If you are financing a Toyota Tacoma, most lenders will require your carry higher Toyota Tacoma coverage options including comprehensive coverage, so be sure to shop around and compare Toyota Tacoma auto insurance rates from the best companies using our free tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Toyota Tacoma Insurance

There are many ways that you can save on Toyota Tacoma auto insurance to get the best value possible. Below are five scenarios you can explore to help keep your Toyota Tacoma auto insurance rates low.

- Start searching for new Toyota Tacoma insurance rates a month before your renewal.

- Don’t skimp on Toyota Tacoma liability insurance coverage.

- If you’re a young driver living at home, add yourself to your parents’ plan.

- Wait six years for accidents to disappear from your record.

- Bundle your Toyota Tacoma auto insurance with home insurance.

To maximize savings on your Toyota Tacoma insurance, start shopping for rates early and consider bundling with other policies. Explore these strategies to ensure you get the best value and keep your premiums low.

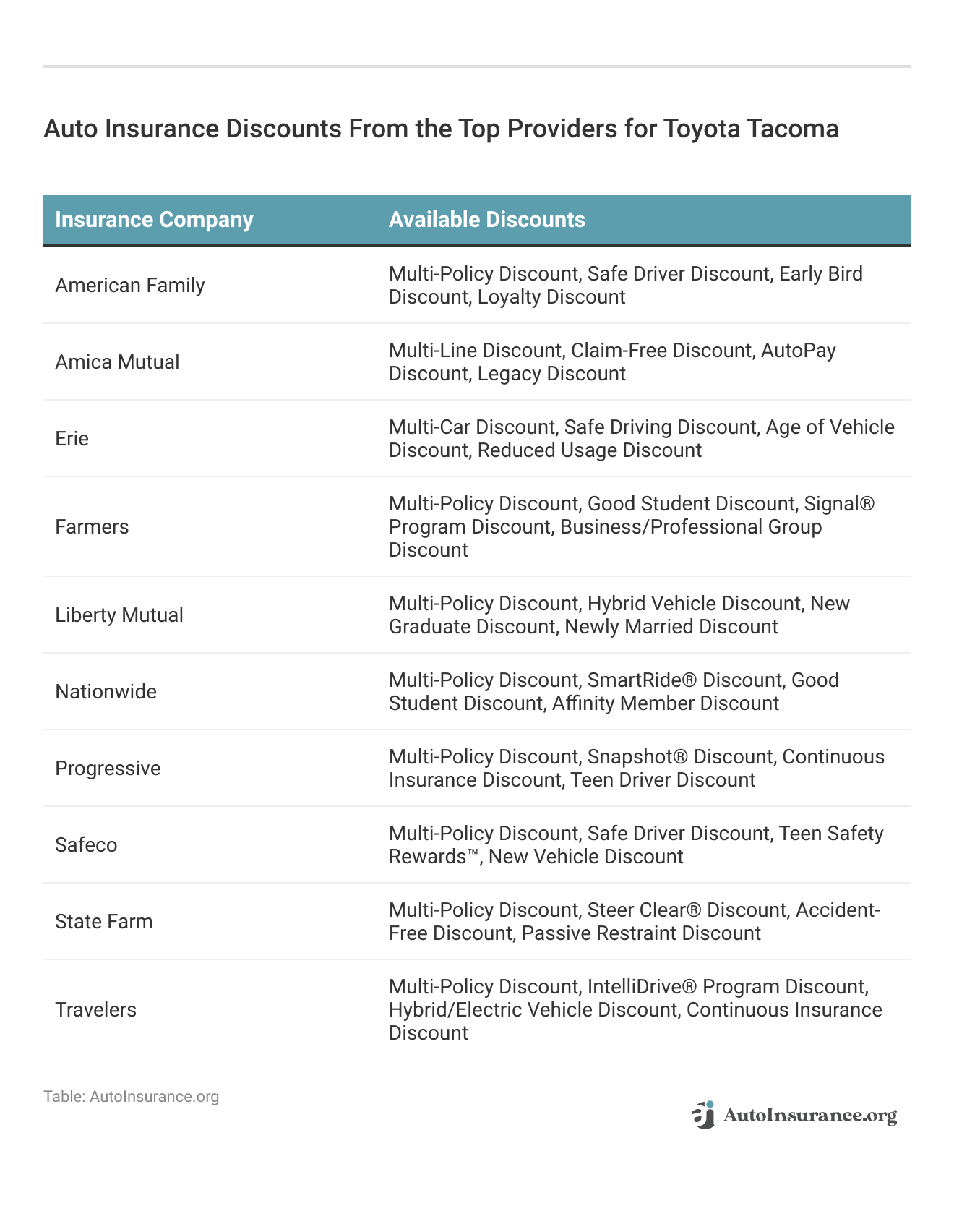

Discover the variety of car insurance discounts offered by top providers for Toyota Tacoma to help you save on your premiums.

These discounts from top insurance providers for Toyota Tacoma offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Toyota Tacoma Insurance Companies

Several insurance companies offer competitive rates for the Toyota Tacoma based on factors like discounts for safety features. Take a look at the best auto insurance companies that are popular with Toyota Tacoma drivers organized by market share.

Top 10 Toyota Tacoma Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

Choosing from these top insurers can provide Toyota Tacoma drivers with various options for competitive rates and comprehensive coverage. It’s beneficial to compare these companies to find the best fit for your insurance needs.

You can start comparing quotes for Toyota Tacoma auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

What is the average cost of Toyota Tacoma auto insurance?

On average, Toyota Tacoma insurance rates cost $112 per month or $1,338 per year.

How do I find the best insurance rates for my Toyota Tacoma?

To find the best insurance rates for your Toyota Tacoma, compare quotes from multiple insurance providers. Use online comparison tools, consider bundling policies, and look for discounts based on your driving history, vehicle safety features, and membership in certain organizations. (Read more: How to Compare Auto Insurance Quotes).

Can I find cheap Toyota Tacoma insurance rates?

Yes, if you are a good driver with a mature driving record, you may find rates as low as $78 per month. Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

How does the age of the vehicle affect insurance rates?

Newer models of Toyota Tacoma typically have higher insurance rates compared to older models. For example, a 2020 Toyota Tacoma may have insurance rates of $112 per month, while a 2010 Toyota Tacoma may have rates of $80 per month.

How can I save on Toyota Tacoma insurance?

To save on Toyota Tacoma insurance, start searching for new insurance rates a month before your renewal. Avoid skimping on liability coverage, as it can leave you financially vulnerable. If you’re a young driver living at home, consider adding yourself to your parents’ plan to take advantage of potentially lower rates.

Wait for accidents to disappear from your record after six years, which can help reduce premiums. Additionally, bundling your Toyota Tacoma auto insurance with home insurance can lead to significant savings.

Do safety ratings affect Toyota Tacoma insurance rates?

Yes, the safety ratings of the Toyota Tacoma can influence insurance rates. Good safety ratings may lead to lower insurance costs.

Are Toyota Tacoma insurance rates higher for younger drivers?

Yes, younger drivers, especially those under 25, often face higher insurance rates for a Toyota Tacoma due to their lack of driving experience and higher risk of accidents. It’s advisable for young drivers to look for discounts and safe driving programs to help lower their premiums. Check out our guide “Why You Should Take a Defensive Driving Class.”

Are Toyota Tacoma insurance rates affected by the vehicle’s trim level or engine size?

Yes, the trim level and engine size of your Toyota Tacoma can impact insurance rates. Higher-end trims or more powerful engines may result in slightly higher insurance premiums.

Does installing additional safety features on my Toyota Tacoma reduce insurance rates?

Yes, installing additional safety features such as anti-theft devices, advanced driver assistance systems (ADAS), and enhanced braking systems can help reduce your Toyota Tacoma insurance rates. Insurance companies often offer discounts for vehicles equipped with these features. Check out our guide “How to Get an Anti-Theft Auto Insurance Discount.”

Can my Toyota Tacoma insurance rates change if I move to a different state?

Yes, moving to a different state can affect your Toyota Tacoma insurance rates. Factors such as state regulations, local accident rates, and the cost of living in the new area can influence your premiums. Always inform your insurance provider of any address changes to ensure you have the appropriate coverage.

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.