Chattanooga, TN Auto Insurance (2024)

The cheapest auto insurance in Chattanooga, TN, is from State Farm. However, Chattanooga, TN auto insurance quotes vary for each person. Chattanooga drivers must meet the state minimum requirements with coverage levels of 25/50/15 for liability and 25/50,500 in uninsured/underinsured motorist coverage. Compare Chattanooga, TN car insurance rates online to get the best price for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joe...

Certified Financial Planner

UPDATED: Mar 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- On average, Chattanooga, TN auto insurance quotes are $3,527/yr

- The cheapest auto insurance company in Chattanooga, TN, is State Farm

- Driving your vehicle less in Chattanooga can save you money on auto insurance

- Auto thefts in your area can affect your auto insurance policy

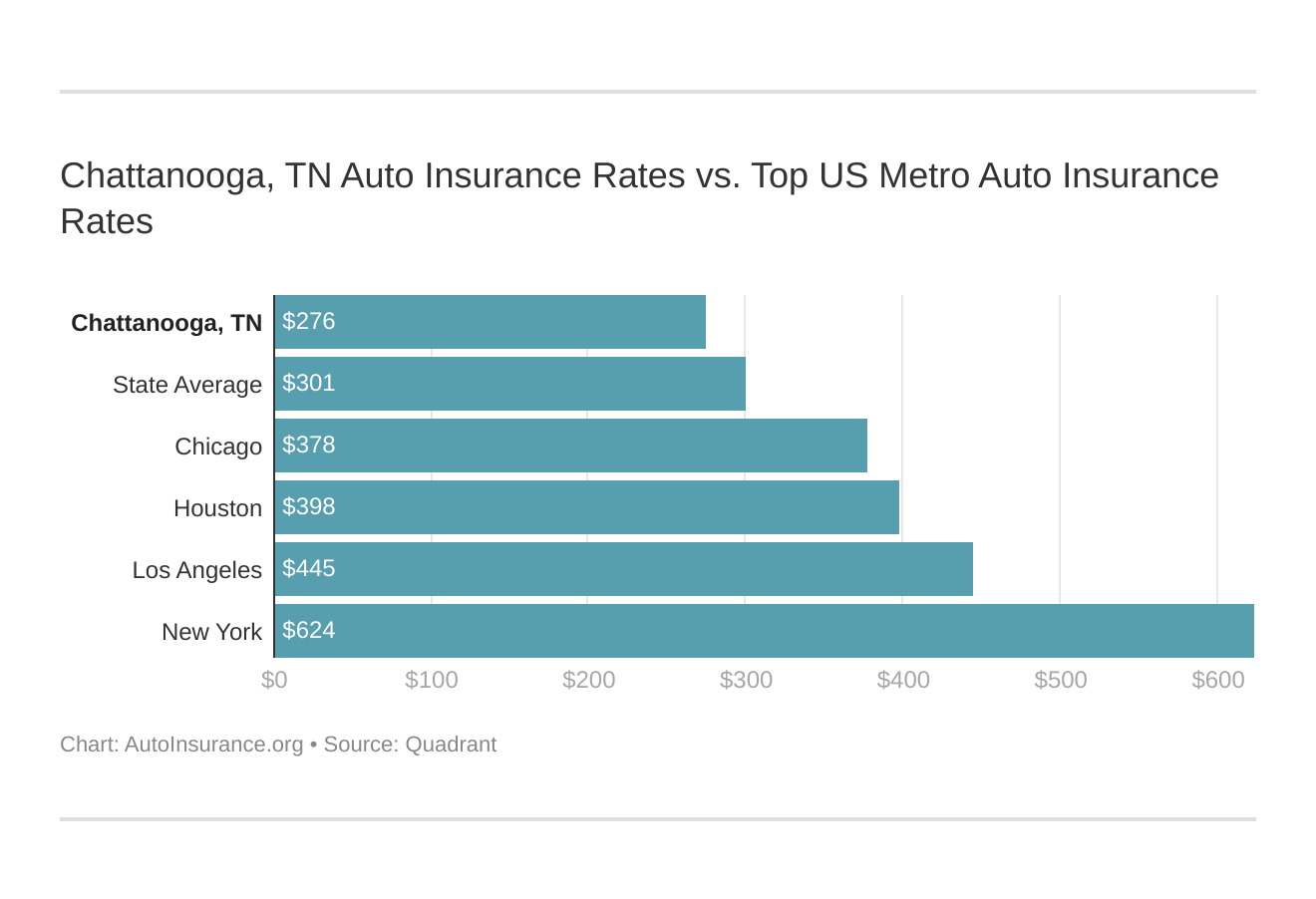

Chattanooga, TN auto insurance rates are $134 cheaper than the Tennessee average and $405 less expensive than the national average. But, your Chattanooga, Tennessee auto insurance rates will vary.

How come? Chattanooga, TN auto insurance quotes are determined by several factors, such as age, credit history, and driving record.

Read through this guide to learn how to find cheap auto insurance in Chattanooga, TN.

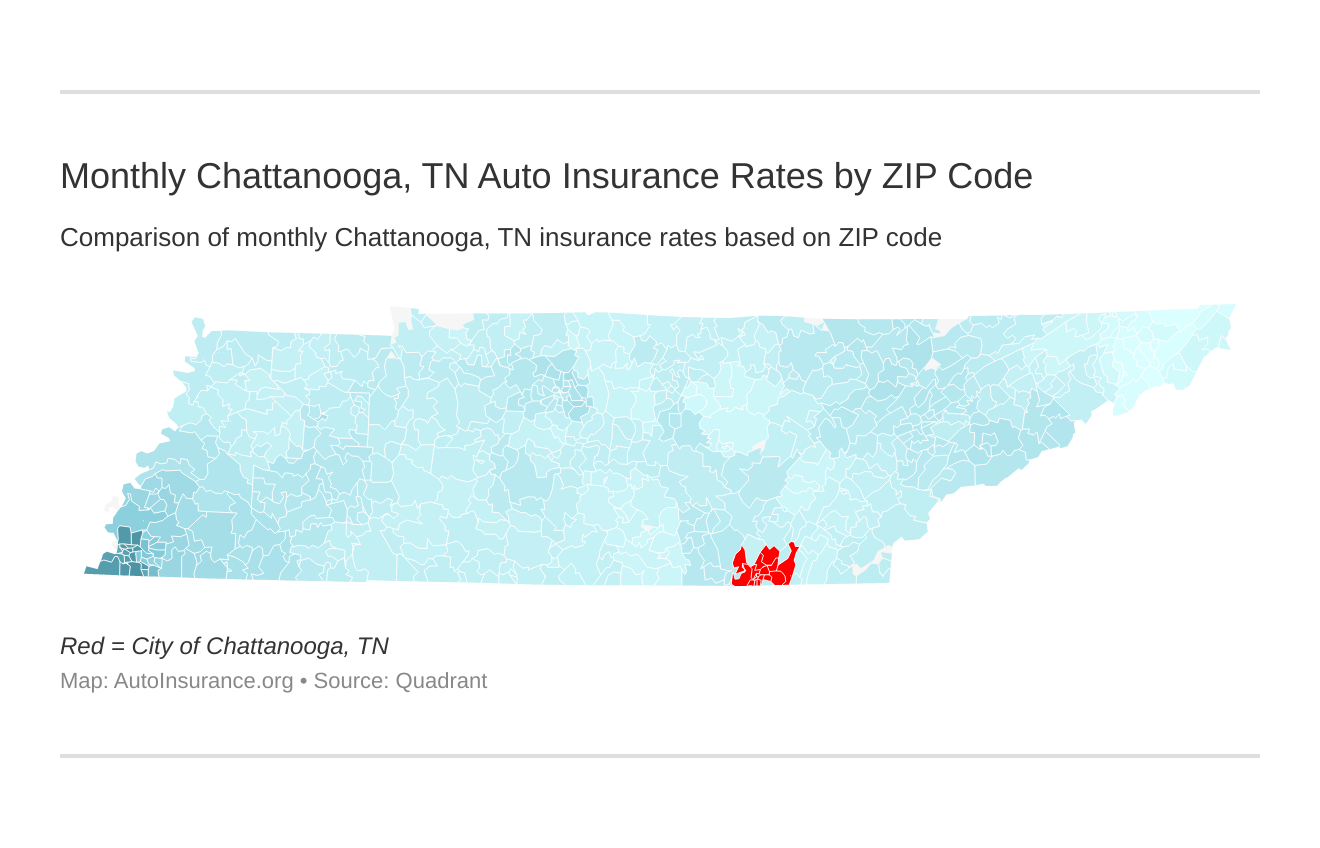

Monthly Chattanooga, TN Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Chattanooga, TN auto insurance rates by ZIP Code below:

For more details, see auto insurance rates by ZIP code: what you need to know.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chattanooga, TN Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Chattanooga, TN against other top US metro areas’ auto insurance costs.

If you’re ready to find affordable Chattanooga, TN auto insurance? Enter your ZIP code above to get started.

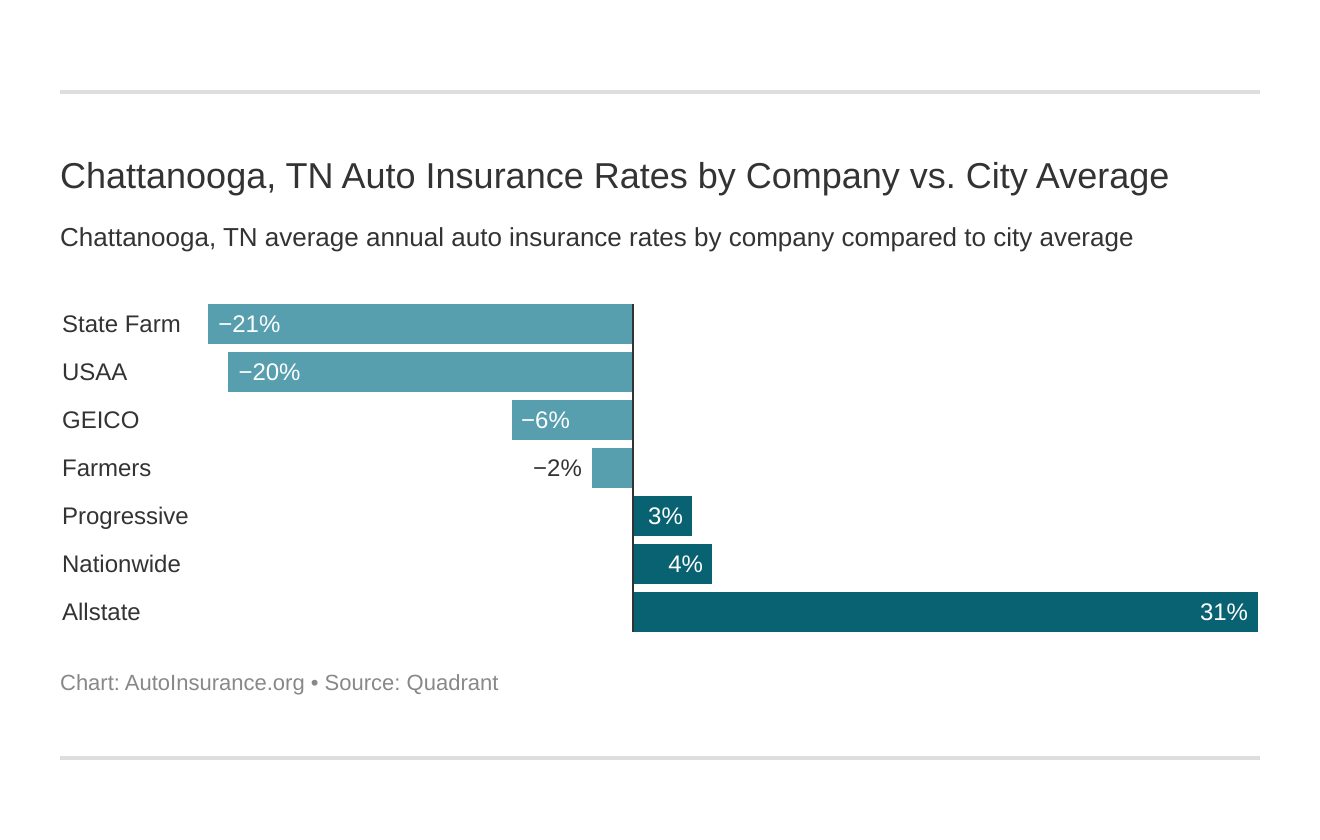

What is the cheapest auto insurance company in Chattanooga, TN?

The cheapest auto insurance company in Chattanooga, Tennessee, based on average rates, is State Farm.

https://youtu.be/lvpq2OjmJvg

The cheapest Chattanooga, TN car insurance providers can be found below. You also might be wondering, “How do those Chattanooga, TN rates compare against the average Tennessee car insurance company rates?” We uncover that too.

The best auto insurance companies in Chattanooga, ranked from cheapest to most expensive, are:

- State Farm auto insurance – $2,692

- USAA auto insurance – $2,718

- Travelers auto insurance – $2,748

- Geico auto insurance – $3,124

- Farmers auto insurance – $3,235

- Progressive auto insurance – $3,422

- Nationwide auto insurance – $3,439

- Allstate auto insurance – $4,544

- Liberty Mutual auto insurance – $5,901

Several factors determine your auto insurance rates. The cheapest company depends on personal factors.

One of the most significant factors is driving record. A clean driving history can save you at least 20 percent on auto insurance rates.

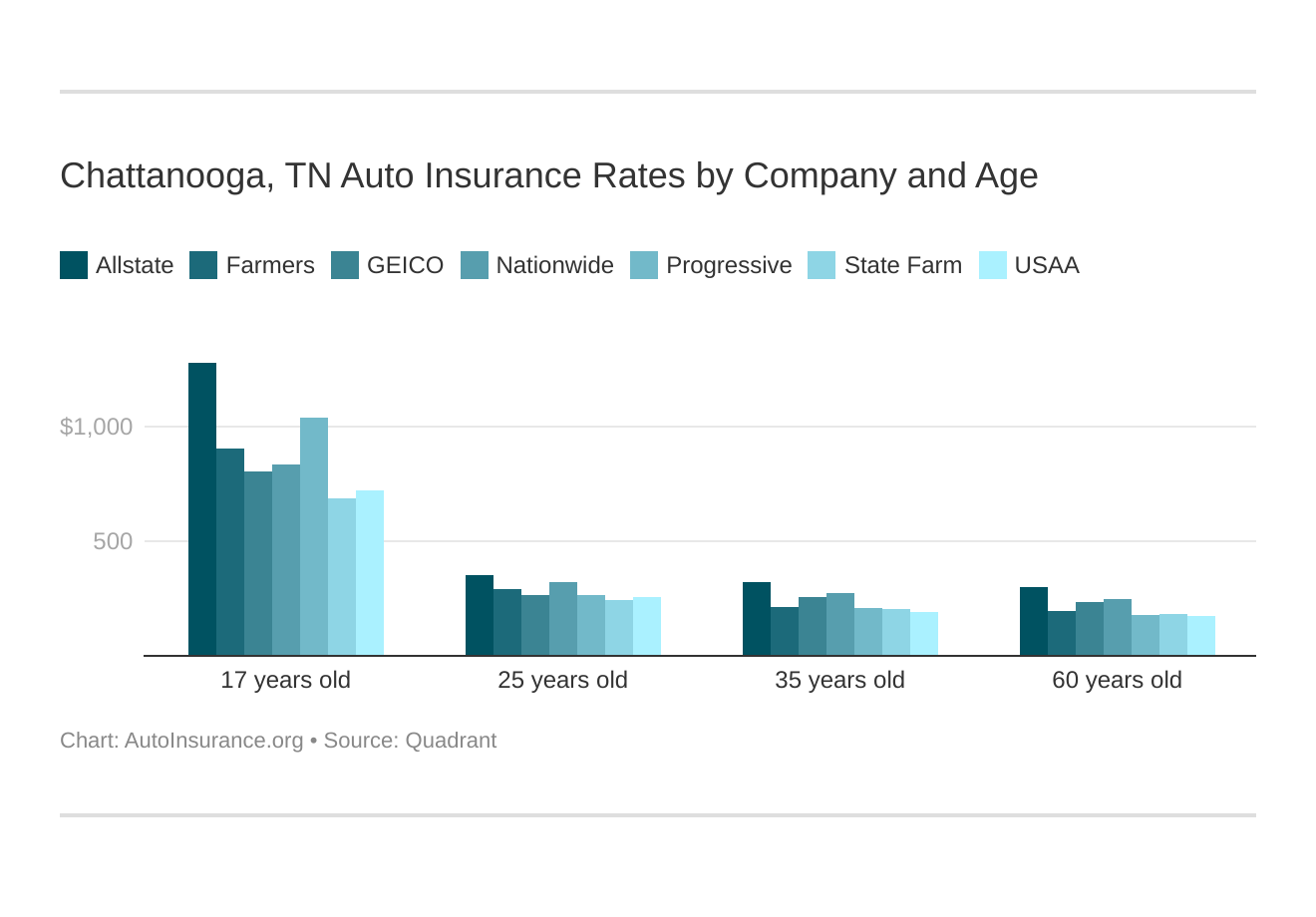

Even your age is a factor. Young and single drivers pay the most car insurance. So, a teen or young adult driver in Chattanooga, TN, may pay more for auto insurance.

Married drivers between 35 and 60 years old pay significantly less. However, you can qualify for cheaper rates when you have good credit.

Chattanooga, Tennessee car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

For more details, see auto insurance rates for married vs. single drivers.

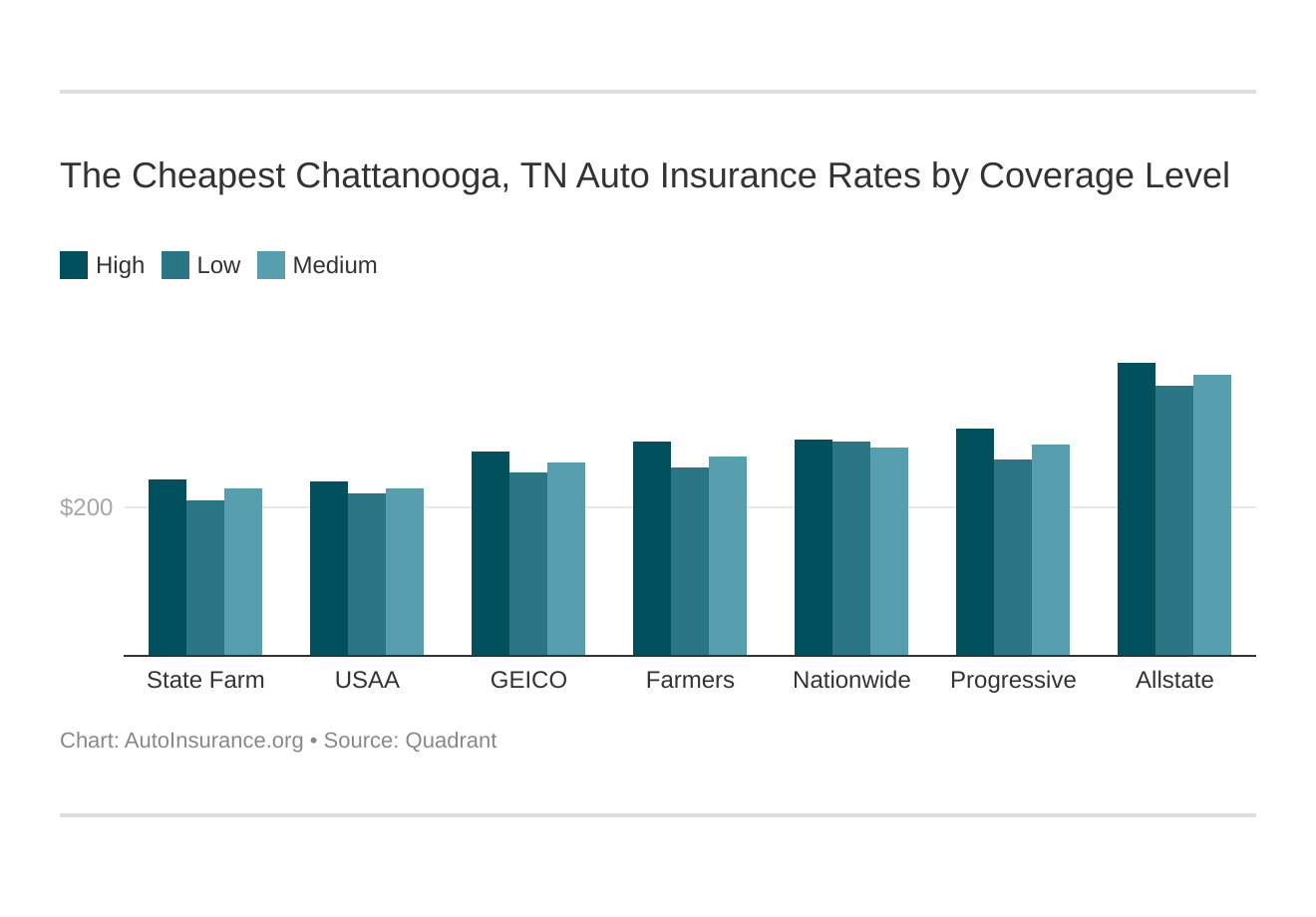

Your coverage level will play a major role in your Chattanooga, Tennessee car insurance costs. Find the cheapest Chattanooga, Tennessee car insurance costs by coverage level below:

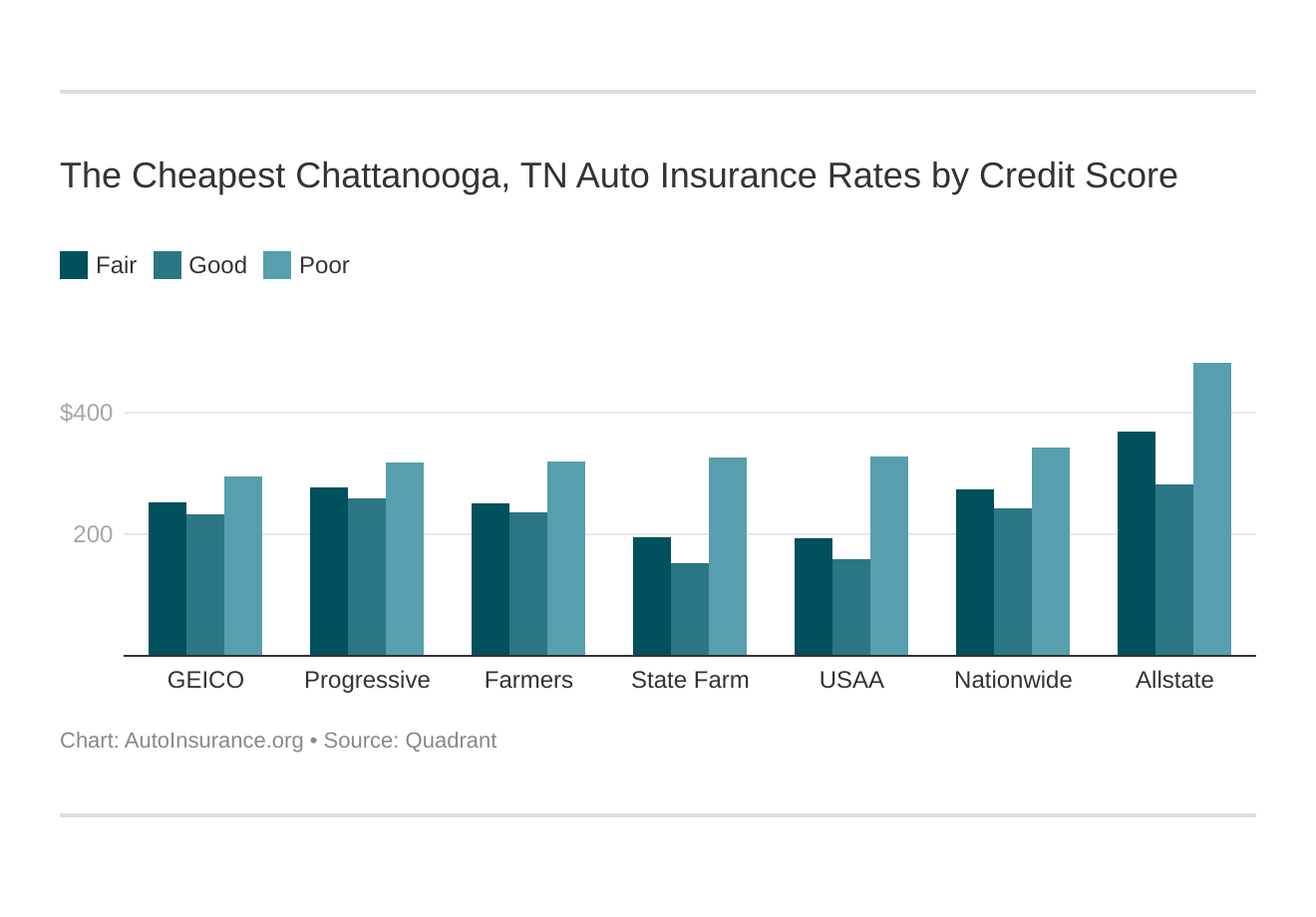

Your credit score will play a major role in your Chattanooga, TN car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. See details at auto insurance and your credit score.

Find the cheapest Chattanooga, Tennessee car insurance costs by credit score below.

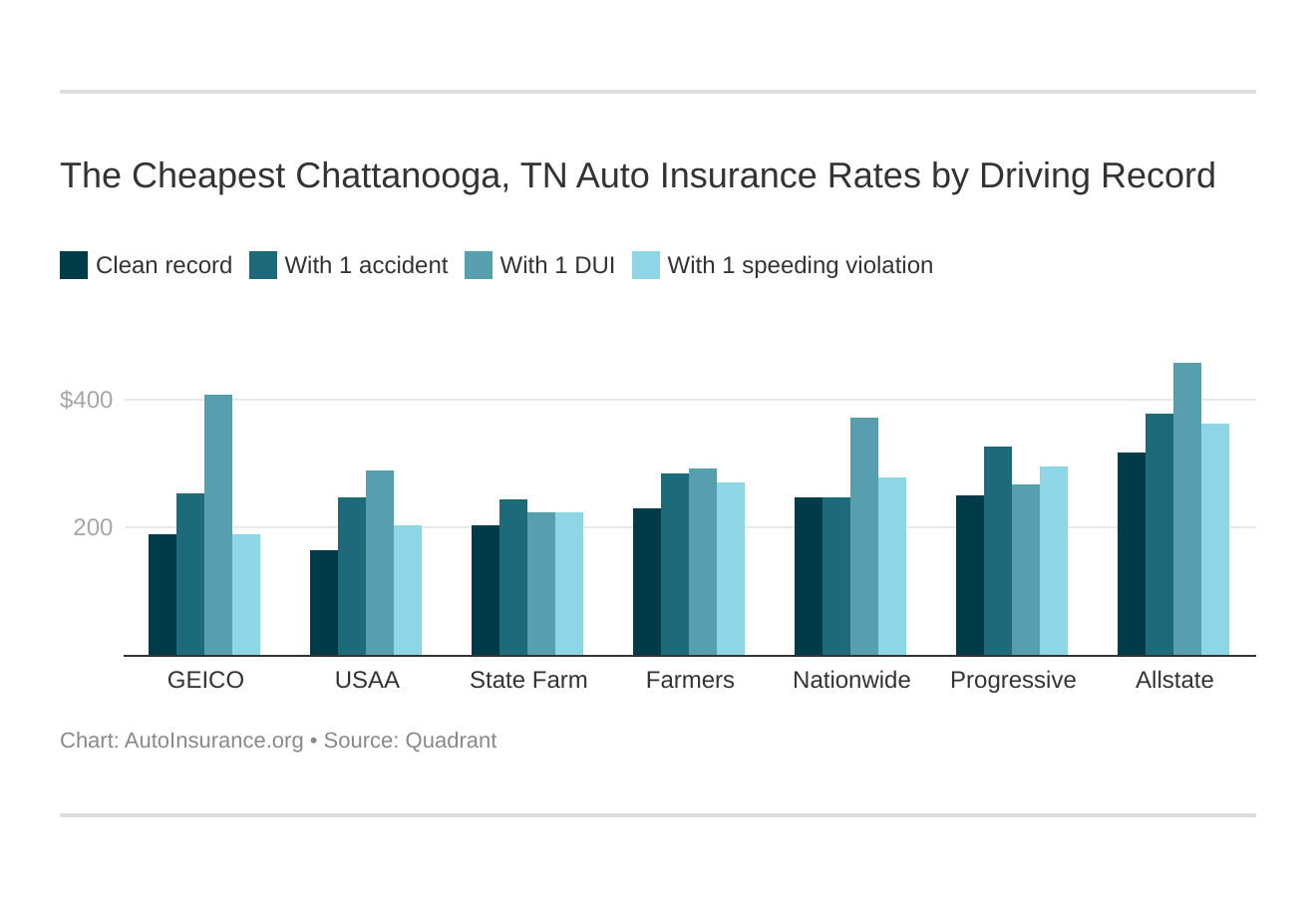

Your driving record will affect your Chattanooga, TN car insurance costs. For example, a Chattanooga, Tennessee DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Chattanooga, Tennessee car insurance costs by driving record.

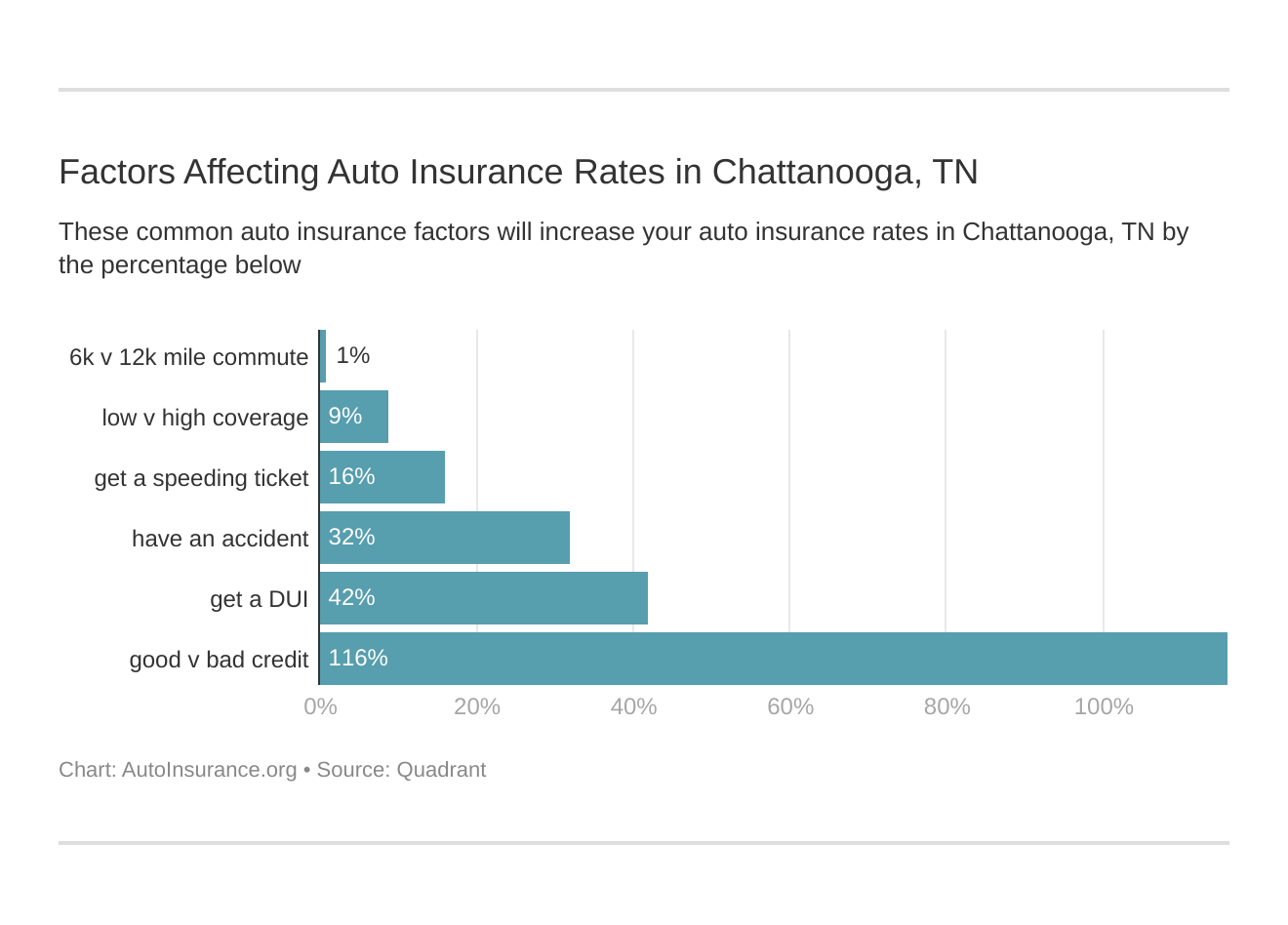

Controlling these risk factors will ensure you have the cheapest Chattanooga, Tennessee car insurance. Factors affecting car insurance rates in Chattanooga, TN may include your commute, coverage level, tickets, DUIs, and credit.

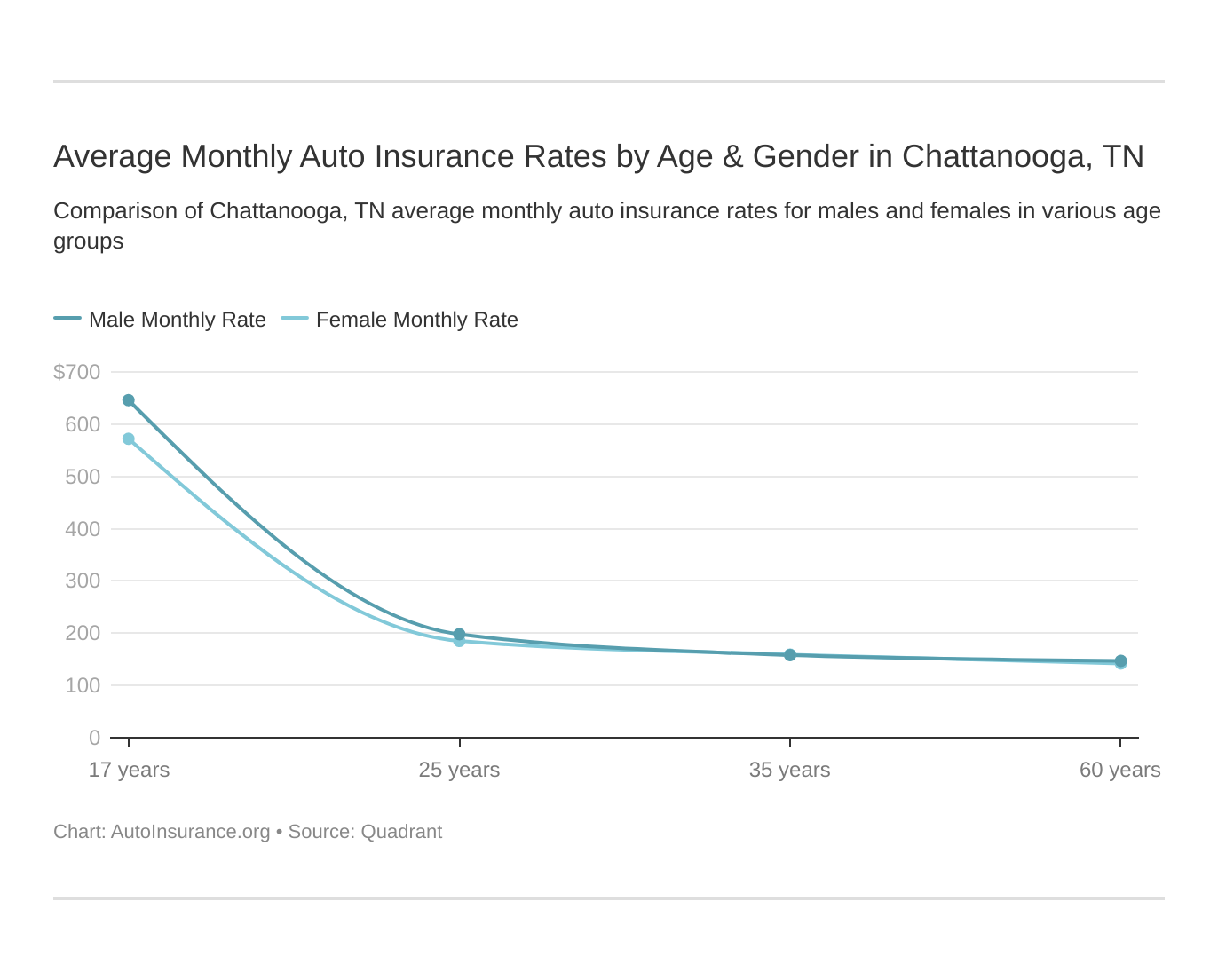

Age is a significant factor for Chattanooga, TN car insurance rates. Young drivers are often considered high-risk. This Chattanooga, Tennessee does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Chattanooga, TN.

What are the auto insurance requirements in Chattanooga, TN?

All Chattanooga drivers have to meet the minimum Tennessee auto insurance requirements.

In Tennessee, you have to carry at least:

- $25,000 per person and $50,000 per accident for bodily injury liability (BIL) insurance

- $15,000 per accident for property damage liability

- $25,000 per person and $50,000 per accident for uninsured motorist coverage (UIM) auto insurance

Tennessee is an at-fault state. It’s recommended that most drivers carry more than the state minimum.

Some car insurance companies recommended you carry higher coverage levels. However, increasing your coverage level drives up your auto insurance cost.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What affects auto insurance rates in Chattanooga, TN?

According to Data USA, the average commute time in Chattanooga is 19 minutes. That’s six minutes faster than the national average.

But driving less than the Chattanooga, TN commute average could mean big savings on your auto insurance policy.

Vehicle theft in Chattanooga, TN, also affects car insurance rates. The most recent annual statistics list 1,314 auto thefts in Chattanooga.

Auto thefts affect comprehensive auto insurance most. If you happen to have a vehicle on the low theft rate list, you may be able to save a few hundred dollars on car insurance.

What about Chattanooga, TN weather? According to City-Data, Chattanooga had ten floods and ten storms that caused natural disasters.

Chattanooga, TN Auto Insurance: What’s the bottom line?

Chattanooga drivers have more chances to buy affordable auto insurance in Tennessee than the average American motorist.

The best way to secure cheap car insurance in Chattanooga is to keep a clean driving record and maintain good credit. If your vehicle has any anti-theft or safety features, you can qualify for auto insurance discounts.

Before you buy Chattanooga, TN auto insurance, be sure you’ve checked out rates from multiple companies. Enter your ZIP code below to get fast, free auto insurance quotes.

Frequently Asked Questions

What type of auto insurance coverage is required in Chattanooga, TN?

In Chattanooga, TN, drivers are required to have liability insurance coverage. The minimum liability limits mandated by the state are 25/50/15, which means $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $15,000 for property damage per accident.

What are some additional coverage options I should consider for my auto insurance in Chattanooga, TN?

In addition to liability insurance, it’s advisable to consider additional coverage options for enhanced protection. These may include comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and medical payments coverage. These coverages can help protect you financially in case of accidents, theft, or damage to your vehicle.

Are there any factors that can impact my auto insurance rates in Chattanooga, TN?

Yes, several factors can influence your auto insurance rates in Chattanooga, TN. These factors may include your driving record, age, gender, marital status, credit history, the type of vehicle you drive, your location, and the coverage options you choose. Insurance companies assess these factors to determine the level of risk you present and calculate your premiums accordingly.

How can I find affordable auto insurance in Chattanooga, TN?

To find affordable auto insurance in Chattanooga, TN, it’s recommended to shop around and obtain quotes from multiple insurance companies. Comparing quotes will help you identify the best coverage options at competitive rates. Additionally, you can inquire about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for installing safety features in your vehicle.

What should I do if I have an accident or need to file an insurance claim in Chattanooga, TN?

In case of an accident or insurance claim in Chattanooga, TN, follow these steps:

- Ensure the safety of everyone involved and seek medical attention if necessary.

- Contact the police to report the accident, especially if there are injuries or significant property damage.

- Exchange information with the other party involved, including names, contact details, and insurance information.

- Notify your insurance company promptly and provide them with all the necessary details about the accident.

- Cooperate with your insurance company’s claims process, providing any requested documentation or evidence to support your claim.

Can I bundle my auto insurance with other policies?

Yes, many insurance companies offer the option to bundle your auto insurance with other policies such as homeowners insurance or renters insurance. Bundling your insurance policies can often lead to discounts and cost savings. Contact your insurance provider to inquire about available bundle options and potential discounts.

Are there any specific requirements for auto insurance coverage in Tennessee?

Yes, Tennessee law requires drivers to carry a minimum level of liability insurance coverage. The minimum liability limits mandated by the state are 25/50/15, which means $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $15,000 for property damage per accident.

Are there any discounts available that can help me save on auto insurance in Chattanooga, TN?

Yes, there are various discounts that insurance companies may offer to help you save on your auto insurance premiums. Some common discounts include safe driver discounts, multi-policy discounts (for bundling multiple insurance policies with the same provider), good student discounts, and discounts for installing safety features in your vehicle. It’s advisable to inquire about available discounts when obtaining quotes from insurance companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joe...

Certified Financial Planner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.