Cheap Dodge Auto Insurance in 2025 (Compare the Top 10 Companies)

Geico, AAA, and State Farm are your top options for cheap Dodge auto insurance with Geico's monthly rates averaging $30 for minimum coverage. However, consider other Dodge insurance coverage options, such as gap insurance, for complete protection. Compare rates and coverage below to find the best option for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Dodge

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Dodge

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Dodge

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsYour top options for cheap Dodge auto insurance are Geico, AAA, and State Farm with Geico standing out for its cheap rates and extensive discounts.

If you need Dodge auto insurance, compare the best Dodge auto insurance companies to find cheap auto insurance and the coverage options you need.

Our Top 10 Company Picks: Cheap Dodge Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $30 | A++ | Cheap Rates | Geico | |

| #2 | $32 | A | Roadside Assistance | AAA |

| #3 | $33 | B | Coverage Options | State Farm | |

| #4 | $37 | A+ | Budgeting Tools | Travelers | |

| #5 | $39 | A | Loyalty Discounts | Progressive | |

| #6 | $43 | A+ | Accident Forgiveness | American Family | |

| #7 | $44 | A | Widespread Availability | Nationwide |

| #8 | $53 | A | Safe-Driving Discounts | Farmers | |

| #9 | $61 | A+ | Local Agents | Allstate | |

| #10 | $68 | A | 24/7 Support | Liberty Mutual |

Keep reading this Dodge auto insurance review to learn more about Dodge insurance coverage options and compare Dodge auto insurance rates. Then, enter your ZIP code above to get started on finding the best Dodge auto insurance.

- Geico has the cheapest Dodge auto insurance

- The Dodge Challenger and Viper are the most expensive Dodges to insure

- Save on your Dodge auto insurance by comparing quotes and coverage options

- Auto Insurance Rates by Vehicle

- Dodge Auto Insurance

- Best Dodge Durango Auto Insurance in 2025 (Find the Top 10 Companies Here)

- Best Dodge Challenger Auto Insurance in 2025 (Check Out These 10 Companies)

- Best Dodge Journey Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Dodge Grand Caravan Auto Insurance in 2025 (Top 10 Companies Ranked)

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Cheap Rates: Geico offers rates below the national average in many categories.

- Extensive Discounts: Geico provides numerous discounts, such as for good drivers, multi-policy holders, and military personnel. Learn more in our Geico auto insurance discounts guide.

- Convenient Online Tools: Geico’s digital tools, including a highly-rated mobile app, make managing policies, filing claims, and accessing support efficient and straightforward.

Cons

- Limited Local Agents: Geico has fewer local agencies.

- Higher Rates for Poor Credit: Geico tends to be less affordable for drivers with poor credit or recent accidents.

#2 – AAA: Best for Roadside Assistance

Pros

- Member Discounts: AAA members often receive discounts on auto insurance premiums.

- Multiple Insurance Products: AAA offers a variety of insurance options, making it easy for customers to get all their coverage needs from one provider. Learn more: AAA Auto Insurance Company Review.

- Bundle Savings: Policyholders can save by bundling auto insurance with other coverages, such as home or life insurance.

Cons

- Varied Insurance Offerings: AAA insurance products differ depending on your location.

- Membership Requirement: AAA auto insurance may require an AAA membership.

#3 – State Farm: Best for Coverage Options

Pros

- Student Discounts: State Farm offers good discount opportunities for students and teens.

- Rental and Travel Coverage: Generous rental car and travel expense coverage provides extra protection and convenience during trips.

- Strong Reputation: State Farm has a strong reputation in consumer studies. See the reviews and rankings in our full State Farm Auto Insurance Review.

Cons

- Higher Premiums: If you’re an adult driver, State Farm’s premiums may be higher compared to other companies.

- No Gap Insurance: State Farm doesn’t offer gap insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Budgeting Tools

Pros

- Strong Industry Ratings: Travelers has strong industry ratings, reflecting its reliability and customer satisfaction. Read more about Travelers’ ratings in our Travelers insurance review.

- Easy Claim Filing: Claim filing is available online and through the mobile app, offering convenience for policyholders.

- Bundling Options: Travelers allow bundling with homeowners insurance and other policies, which can lead to significant savings.

Cons

- Limited Rideshare Coverage: Travelers’ rideshare coverage is not available in all states, limiting options for rideshare drivers.

- Low BBB Rating: Travelers has received a low customer rating on the BBB, indicating potential dissatisfaction among policyholders.

#5 – Progressive: Best for Loyalty Discounts

Pros

- Coverage Options: Progressive offers a wide range of coverage options. Our complete Progressive review goes over this in more detail.

- Accident Forgiveness Programs: With three different accident forgiveness programs, including automatic enrollment, Progressive provides added peace of mind for drivers.

- Rideshare Coverage: For drivers who work for ridesharing businesses, Progressive provides specific insurance coverage.

Cons

- Average Customer Service: Progressive receives average ratings for customer service.

- Low Renewal Likelihood: In specific categories, Progressive ranks last in terms of the likelihood of policy renewal.

#6 – American Family: Best for Accident Forgiveness

Pros

- Affordable Rates: American Family Insurance offers competitive pricing for various driver profiles, including those with a clean driving record and those with incidents like accidents, DUIs, or speeding tickets.

- Usage-Based Insurance: Their KnowYourDrive program allows good drivers to potentially lower their insurance costs by monitoring and rewarding safe driving habits. Read more about this UBI in our American Family insurance KnowYourDrive review.

- Comprehensive Coverage Options: American Family Insurance provides non-owner and SR-22 insurance.

Cons

- Limited Availability: American Family auto insurance is only accessible in 19 states, limiting its reach for potential customers seeking coverage outside these areas.

- Average Collision Repair Ratings: Collision repair professionals gave American Family an average score of C+ for their repair process and customer service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Customizable Policies

Pros

- Competitive Rates: Nationwide offers great rates for drivers with speeding tickets and those with poor credit. Find out if Nationwide might have the lowest rates for you in our Nationwide auto insurance review.

- Senior and Teen Discounts: Nationwide provides the cheapest rates for senior drivers and parents, adding a 16-year-old to a policy.

- Extensive Coverage Options: Nationwide includes optional coverages like accident forgiveness, gap insurance, new car replacement, and a vanishing deductible.

Cons

- Limited Discount Options: Nationwide did not score well for discounts, meaning customers might find fewer opportunities to lower their premiums than other insurers.

- High Costs for DUI Drivers: Nationwide has the fourth-highest sample costs for drivers with a DUI on their record.

#8 – Farmers: Best for Safe-Driving Discounts

Pros

- High Customer Satisfaction: Farmers Insurance is rated above average in customer satisfaction for both auto insurance shopping and claims, indicating a positive overall customer experience.

- Numerous Discounts: Farmers offers a wide variety of discounts, providing opportunities for policyholders to save on their premiums. Take a look at our Farmers insurance company review to learn more.

- Positive Claims Resolution: Most survey respondents reported being satisfied with how their claims were resolved, highlighting the company’s effective claims-handling process.

Cons

- Higher Premiums: Sample premiums from Farmers are above the national average across various driver categories.

- Higher Rates for Teens: Teen drivers can expect to see higher rates with Farmers compared to other insurance companies.

#9 – Allstate: Best for Local Agents

Pros

- Diverse Coverage Options: Allstate offers a wide range of coverage options, including accident forgiveness, new car replacement, and a safe-driving bonus every six months.

- Plug-In Device: Allstate’s plug-in device for tracking safe driving is simple to use and install.

- Comprehensive Policy Features: Allstate provides the same comprehensive coverage options as standard policies. Find more information about Allstate’s rates in our review of Allstate insurance.

Cons

- Limited Availability: Allstate insurance is only available in 21 states and Washington, D.C.

- High Cost: Allstate tends to be more expensive for drivers who accumulate high mileage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- Excellent Ratings: Liberty Mutual has strong ratings from AM Best and the Better Business Bureau (BBB), indicating reliability and customer satisfaction.

- Extensive Coverage Options: Liberty Mutual offers various coverage options and discounts, allowing customers to tailor policies to their needs.

- You can learn more about Liberty Mutual’s insurance options in our complete guide: Liberty Mutual Auto Insurance Review.

- Competitive Pricing: In many categories, Liberty Mutual provides more affordable rates than rivals.

Cons

- Limited Agent Availability: Liberty Mutual does not have agents in some states.

- Lengthy Claims Process: Some customers reported longer wait times for claims to be processed.

Dodge Auto Insurance Coverage Options

All Dodge drivers must carry state-required auto insurance, such as bodily injury and property damage liability insurance. Some states also require coverages like personal injury protection auto insurance, medical payments, and uninsured/underinsured motorist insurance.

If you have a lease or loan on your car, your lender will also require you to carry collision and comprehensive auto insurance:

- Collision: Collision auto insurance pays for your car repairs if you crash into another vehicle or object.

- Comprehensive: Comprehensive auto insurance pays for your car repairs if you crash into an animal or your car gets damaged by vandalism or weather.

Besides your state’s required coverages, you don’t need specific auto insurance coverage for your Dodge. However, depending on your coverage needs, consider some of the other following auto insurance coverages:

- Modified Car Insurance: This covers the higher repair cost of any modifications to your Dodge, such as a custom paint job. You may want to shop with the best auto insurance companies that insure modified cars.

- Rental Car Insurance: Rental car insurance helps cover the cost of a rental car if your car is in the repair shop for a long time after a covered claim.

- Rideshare Insurance: Rideshare insurance protects rideshare drivers when waiting for a rider and transporting passengers.

- Umbrella Insurance: Umbrella insurance provides extra liability car insurance, which can be helpful if you get sued.

For the best protection, we recommend a full coverage auto insurance policy with comprehensive and collision insurance unless you have an older Dodge vehicle with a low market value. In those cases, you can probably just carry the state minimum auto insurance without a huge financial risk. Learn more about Dodge Ram 1500 auto insurance here.

Get The Best Dodge Auto Insurance Rates

The best way to get cheaper Dodge car insurance is to shop around to find the best Dodge car insurance companies or ones offering the lowest rates.

Geico and State Farm have some of the best Dodge auto insurance rates on the market for most drivers, so if you want to save on coverage, start with Dodge auto insurance quotes from these companies.

If you’re a military member or veteran, USAA auto insurance is another company offering cheaper than average car insurance rates. Often, auto insurance for veterans is more affordable than standard rates.

Dodge Auto Insurance Rates by Model

The cost of Dodge car insurance will partly depend on what model you own.

Models that are more expensive or have fewer safety features will cost more to insure than older or cheaper models.Scott W. Johnson Licensed Insurance Agent

Take a look at the table below to compare auto insurance rates by vehicle make and model for your Dodge:

Dodge Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| American Family | $43 | $117 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

Some of the more expensive Dodge models to insure include the Viper and Challenger. The Dodge Viper and the Dodge Challenger are more expensive sports car models, so you’ll need to compare sports car auto insurance from multiple companies to get fair rates.

Blink and you’ll miss it.#ThatsMyDodge

📸: Joseph G. & Willis W. pic.twitter.com/4o51p6rde7— Dodge (@Dodge) May 22, 2024

On the cheaper side are the Dodge Grand Caravan and Dodge Journey, a minivan, and an SUV, respectively. These Dodge models come with higher safety ratings, which leads to lower insurance rates. Learn more about Dodge Challenger auto insurance here.

Dodge vs. Chevrolet Auto Insurance Comparison

Comparing auto insurance rates for these pickup trucks can guide your decision-making process based on your budget and needs. Choose the one that best fits your requirements and financial situation.

| Dodge Auto Insurance Comparison |

|---|

| Dodge Ram 1500 vs. Chevrolet Silverado Auto Insurance (#current_year) |

Both the Dodge Ram 1500 and Chevrolet Silverado are popular full-size pickup trucks with strong capabilities and features. Compare the auto insurance rates for these vehicles to see which one offers better coverage and protection.

Cost of Auto Insurance for Dodge’s by Model

Embark on a journey through the realm of auto insurance expenses tailored to different Dodge models to make informed decisions about your coverage.

| Dodge Auto Insurance Cost by Model |

|---|

| Dodge Challenger |

| Dodge Durango |

| Dodge Grand Caravan |

| Dodge Journey |

| Dodge Ram 1500 |

Selecting the appropriate insurance for your Dodge model guarantees optimal protection tailored to your vehicle’s unique requirements

Dodge Auto Insurance Rates by Age and Driving Record

In addition to which model of Dodge you own, your driving record and age will also impact how much you pay for an auto insurance policy. So, always compare average auto insurance rates by age to get the best Dodge auto insurance.

Younger drivers will pay more for Dodge auto insurance due to their inexperience behind the wheel. The good news is young drivers will see lower rates if they maintain a driving record free of traffic tickets, at-fault accidents, and DUIs. However, if you get a ticket, you can always find affordable auto insurance for drivers with a bad driving record.

At-fault accidents, traffic tickets, and DUIs, OH MY!!!😱 These will raise drivers’ auto insurance rates!👀 Shop around at https://t.co/27f1xf131D for quotes to find cheaper rates! Visit: https://t.co/tczSjuPzp4 for more info on buying car insurance with a bad driving record.🚗 pic.twitter.com/WTU64wckUP

— AutoInsurance.org (@AutoInsurance) March 21, 2023

Learn more about the reasons why auto insurance costs more for young drivers and compare quotes from the best auto insurance companies for high-risk drivers to get the best rates based on age and driving record.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Dodge Auto Insurance Coverage

Comparing auto insurance rates on Dodge models is just one way to save on car insurance. You can also utilize the following tips to get cheaper auto insurance for your Dodge:

- Bundle Insurance Policies at Your Company: Most insurance companies offer bundling discounts if you purchase more than one type of insurance from them, such as home and auto. Learn more about how to save money by bundling insurance policies.

- Drop Any Unnecessary Car Insurance Coverages: You can eliminate add-on coverages like rental car reimbursement or roadside assistance if you no longer need them.

- Raise Your Deductible if Possible: Don’t raise your auto insurance deductible beyond an amount you can pay out of pocket for an accident, but raising it slightly will significantly reduce your monthly auto insurance rates.

- Apply for As Many Discounts As Possible:: Some auto insurance discounts don’t automatically apply to your policy, like good student discounts or defensive driver discounts.

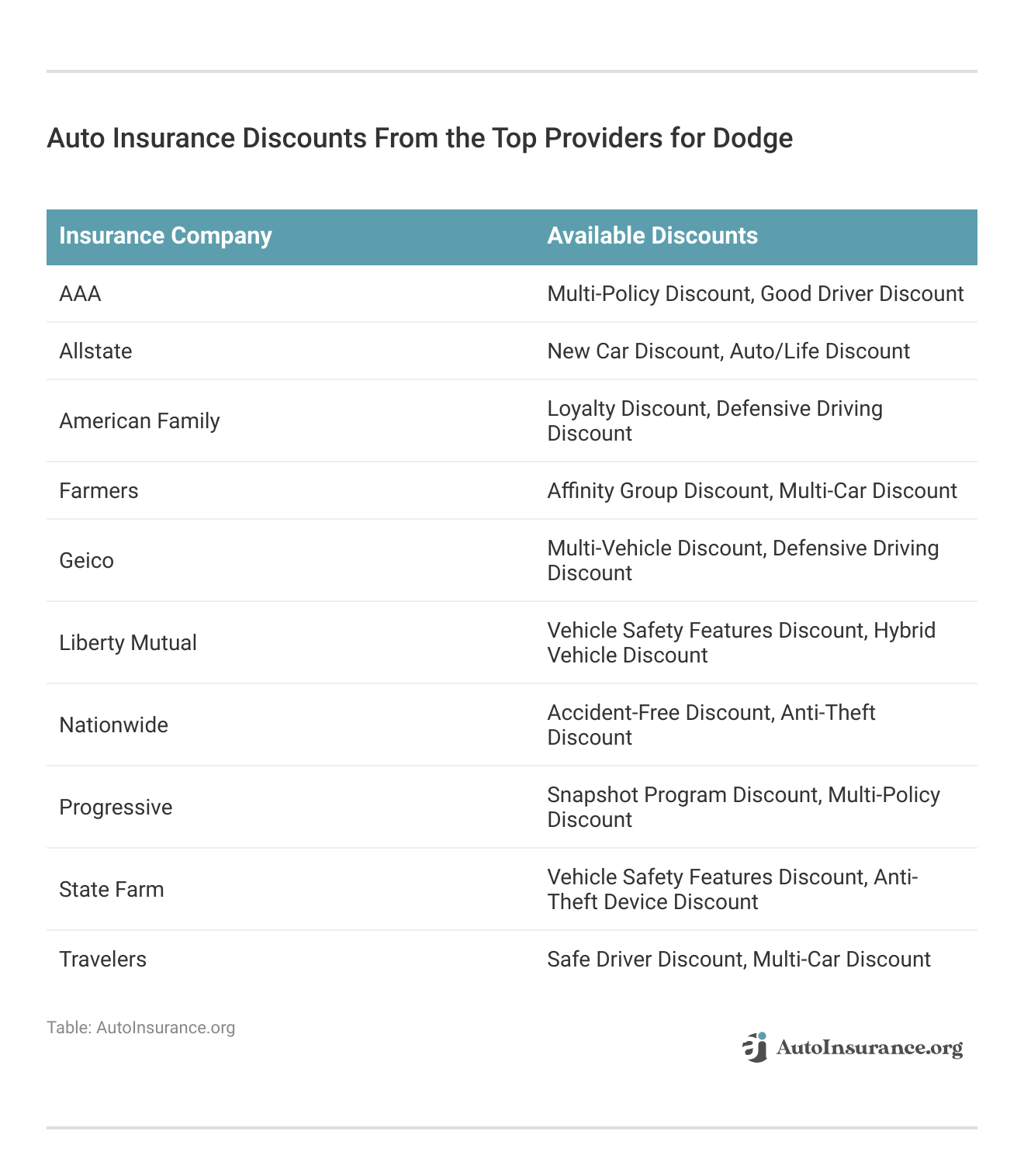

Explore the discount options from various companies below to help you find cheap insurance for your Dodge.

Following the tips above can help you save money on Dodge car insurance. Keeping a clean driving record will also help decrease your rates over time, as companies will reward safe drivers with discounts.

Buy the Best and Cheapest Dodge Auto Insurance Coverage

Your Dodge auto insurance rates will depend on your model, driving record, choice of insurance company, and more. Some models, such as the Dodge Viper sports car, will be much more expensive to insure than the Dodge Caravan or Dodge Journey.

However, the easiest way to buy cheap Dodge insurance is to compare rates from the best auto insurance companies. Get started on evaluating several Dodge car insurance quotes at once by entering your ZIP code below.

Frequently Asked Questions

Are Dodge cars expensive to insure?

On average, Dodge auto insurance costs $158 monthly for full coverage. However, your rates depend on what model you have, as a Dodge Viper or Challenger costs much more to insure than a Dodge Grand Caravan.

Rates also depend on your driving record, age, gender, and more, so shopping around for Dodge auto insurance quotes will ensure you find the best possible rates. Learn how to find auto insurance fast in our guide.

Is a Dodge Ram expensive to insure?

Auto insurance for your Dodge Ram costs about $152 monthly for full coverage.

Why is insurance so expensive on a Dodge Challenger?

On average, a full coverage auto insurance policy for a Dodge Challenger is around $169 per month. It’s one of the more expensive Dodge models to insure, though rates vary depending on factors such as driving profile, demographics, and location.

Dodge Challenger auto insurance is more expensive since it’s a sports car. Insurance companies charge sports cars higher rates because of purchase price and speed-related risks.

Is Dodge Charger insurance high?

Yes, Dodge Charge car insurance is higher than the overall Dodge average. Auto insurance for your Dodge Challenger costs around $167 a month for full coverage.

What is Dodge auto insurance?

Dodge auto insurance refers to insurance coverage specifically designed for vehicles manufactured by the Dodge brand, a popular American automobile manufacturer. It provides protection against financial losses in the event of accidents, theft, or other covered incidents involving Dodge vehicles.

Can I insure my Dodge vehicle with any insurance company?

Yes, you can insure your Dodge vehicle with any insurance company that offers auto insurance. There are numerous insurance providers that offer coverage for Dodge vehicles, allowing you to compare Dodge auto insurance quotes and choose the one that best suits your needs and budget.

Why is Hellcat insurance so expensive?

Insurance for a Dodge Challenger Hellcat is expensive because they’re more likely to get in an accident or be stolen.

What types of coverage are available for Dodge auto insurance?

The types of coverage available for Dodge auto insurance are similar to those available for any other vehicle. Some common types of coverage include:

- Liability Coverage: This covers damages and injuries you cause to others in an at-fault accident.

- Collision Coverage: This pays for repairs or replacement of your Dodge vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: This provides coverage for non-collision-related incidents, such as theft, vandalism, natural disasters, or hitting an animal.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

- Personal injury protection (PIP) or Medical Payments Coverage: This covers medical expenses for you and your passengers regardless of fault in an accident.

These coverages offer a comprehensive safety net, ensuring you and your Dodge are protected in various situations.

How are Dodge auto insurance rates determined?

Dodge auto insurance rates are determined by several factors, including:

- Vehicle-Specific Factors: Insurance companies consider the make, model, year, and trim level of the Dodge vehicle when determining rates. Factors such as the vehicle’s value, repair costs, safety features, and theft rates can impact insurance premiums.

- Driver-Related Factors: Dodge car insurance rates are also influenced by the driver’s age, driving record, location, and other personal factors, such as credit history. Younger and inexperienced drivers may face higher premiums.

- Coverage and Deductibles: The type and amount of coverage selected, as well as the deductibles chosen, can affect insurance rates. Higher coverage limits and lower deductibles typically result in higher premiums.

- Claims History: Your previous claims history can impact insurance rates. Drivers with a history of accidents or violations may face higher Dodge auto insurance quotes.

- Insurance Company’s Rating Factors: Each insurance company has its own proprietary rating factors and algorithms that are used to calculate premiums.

These factors can vary between companies, leading to different rates for the same Dodge vehicle.

Is Dodge Charger insurance expensive?

Yes, Dodge Charger insurance can be expensive. The Dodge Charger insurance cost tends to be higher due to the car’s performance capabilities and the higher risk associated with insuring sporty vehicles. The driver’s age, driving history, and location also impact the Dodge Charger insurance rates. Comparing quotes from multiple insurers can help find the best price.

Is a Dodge Charger a sports car on insurance?

While the Dodge Charger is a four-door sedan, its powerful engine and features can classify it as a sports or muscle car with some insurers. This classification can affect insurance for Dodge Charger rates, as sports cars generally have higher premiums.

Is a Dodge Challenger a sports car on insurance?

Popular models like the Dodge Challenger, Chevrolet Camaro, and Ford Mustang are often considered mid-level sports cars. Despite this classification, Dodge Challenger insurance typically doesn’t require additional coverage beyond standard requirements. Learn more by reading Chevrolet Camaro auto insurance.

How much is insurance for a Dodge Charger?

You might be wondering how much is car insurance for a dodge charger? Well on average, car insurance for a Dodge Charger costs $199 per year. Rates will vary depending on the model year and the vehicle’s value.

How much is insurance for a Dodge Challenger?

The average Dodge Challenger insurance cost is $2,014 per year, or about $168 monthly. Dodge Challenger insurance rates may vary based on model year and vehicle value. How much is car insurance for a Dodge Challenger? It typically averages around these amounts.

How much does Hellcat insurance cost per month?

The Hellcat insurance cost per month is approximately $189, given an average annual rate of $2,270. The Dodge Challenger SRT Hellcat’s high performance makes it expensive to insure.

How much does Dodge Durango insurance cost?

The Dodge Durango insurance cost averages around $139 per month. This rate can vary based on factors like the driver’s history and the specific model of the vehicle. Read more: What is the difference between car make and car model?

Where to find cheap car insurance for Dodge Charger?

For cheap car insurance for a Dodge Charger, Geico auto insurance offers the lowest rate at $30, followed by AAA at $32. These Dodge Charger insurance rates are among the most affordable options available.

How much is car insurance for Dodge Journey?

Car insurance for Dodge Journey varies from $18 to $87 per month. The Dodge Journey insurance rates fluctuate based on factors like the driver’s age, location, driving history, and coverage options chosen.

How much is Dodge Ram insurance?

Dodge Ram insurance costs vary widely based on the model year and driver’s profile. On average, expect to pay between $100 to $167 annually for Dodge Ram insurance. It’s essential to compare quotes from different insurance providers to find the best rates for your situation. Learn where to compare auto insurance rates in our detailed guide.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.