Best Auto Insurance for Exotic Cars in 2024 (Compare the Top 10 Companies)

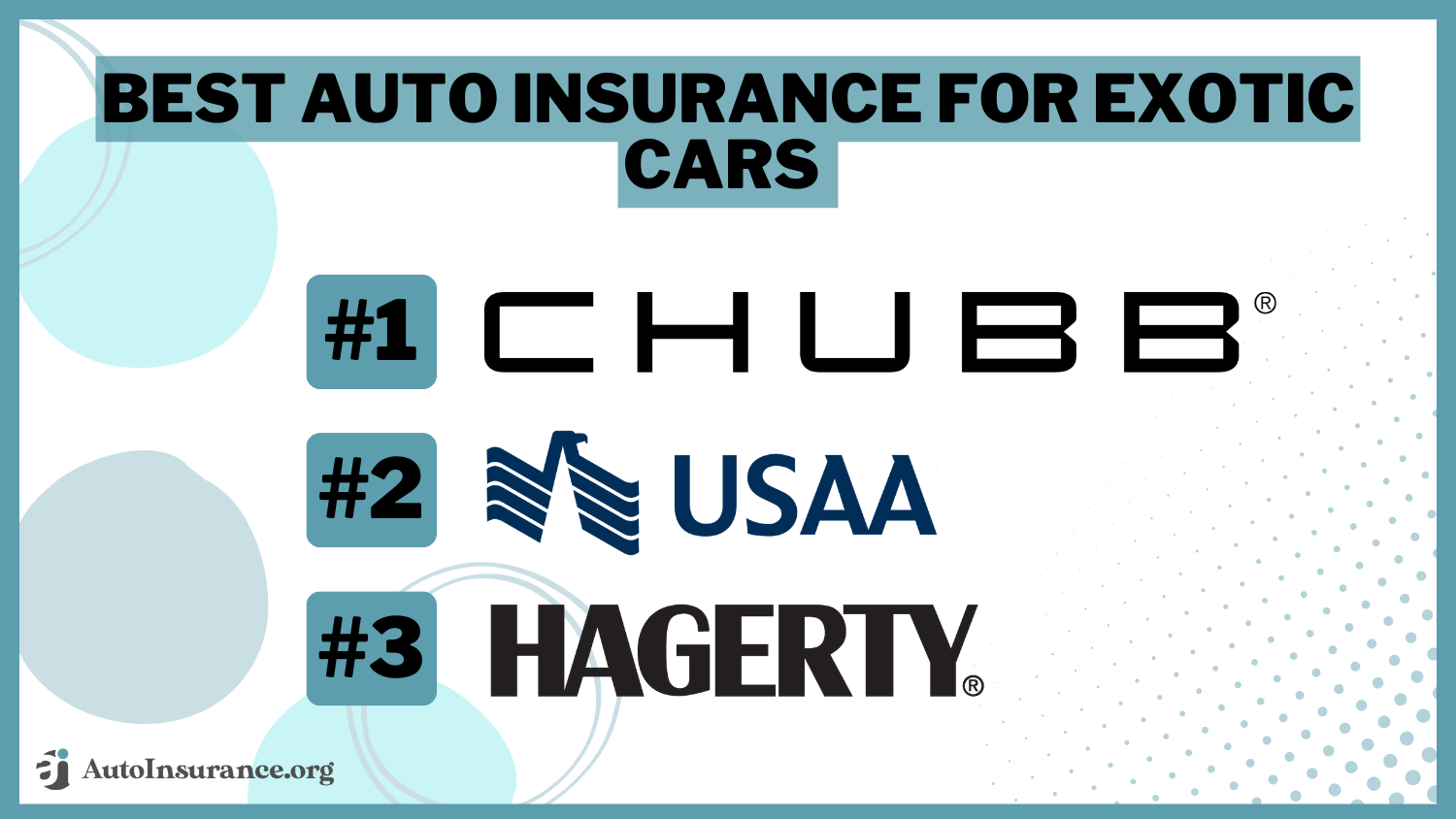

Chubb, USAA, and Hagerty have the best auto insurance for exotic cars. At Chubb, the minimum exotic car insurance is an average of $75/mo. While exotic car insurance policies are expensive, the best companies offer full protection plans and some discount opportunities to exotic car customers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

69 reviews

69 reviewsCompany Facts

Full Coverage for Exotic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

69 reviews

69 reviews 6,435 reviews

6,435 reviewsCompany Facts

Full Coverage for Exotic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

6,435 reviews

6,435 reviews 17 reviews

17 reviewsCompany Facts

Full Coverage for Exotic Cars

A.M. Best Rating

Complaint Level

Pros & Cons

17 reviews

17 reviewsChubb, USAA, and Hagerty have the best auto insurance for exotic cars.

Even if you only plan to drive your exotic car on limited occasions, you should still plan to get the minimum car insurance required by states for it so that you are sure you are following the state law.

Our Top 10 Company Picks: Best Auto Insurance for Exotic Cars

| Company | Rank | Safe Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A++ | Agreed Value | Chubb | |

| #2 | 10% | A++ | Military Benefits | USAA | |

| #3 | 5% | A- | Classic Expertise | Hagerty | |

| #4 | 20% | B | Reliable Claims | State Farm | |

| #5 | 31% | A+ | Unique Discounts | Progressive | |

| #6 | 45% | A+ | Safe Driving | Allstate | |

| #7 | 30% | A | Customizable Policies | Liberty Mutual |

| #8 | 10% | A+ | Vanishing Deductible | Nationwide |

| #9 | 10% | A+ | AARP Benefits | The Hartford |

| #10 | 23% | A++ | Discount Options | Travelers |

It is true that coverage for an exotic vehicle generally costs more than for a regular car or truck, but there are specific things you can do to make sure that you do not pay more than you have to for your insurance policy. Compare car insurance quotes today to find the best deal for the coverage you need.

- Chubb has the best insurance for exotic cars

- Exotic car insurance often costs more than regular car insurance

- Exotic cars cost more to repair because the parts are more expensive

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Chubb: Top Pick Overall

Pros

- Agreed Value: Chubb has agreed value coverage if the exotic car is totaled. Learn more in our Chubb review.

- International Coverage: Your vehicle will be covered if you take it to an international show.

- Rental Reimbursement Limit: Chubb doesn’t have a per-day limit on rental reimbursement coverage.

Cons

- Higher Premiums: Chubb is more expensive compared to other companies.

- Limited Discounts: Chubb doesn’t offer many discounts to policyholders.

#2 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers various benefits to its customers, such as shopping discounts.

- Customer Service: Positively rated by most customers, which you can learn about in our USAA review.

- Flexible Payment Options: Choose your payment method and frequency of payments.

Cons

- Eligibility Restrictions: Only military members and their families can get USAA insurance.

- Less Exotic Experience: USAA is less experienced than companies specializing in exotic cars.

#3 – Hagerty: Best for Classic Expertise

Pros

- Classic Expertise: Hagerty specializes in classic cars, which is perfect for older exotic cars. Read our Hagerty review to learn more.

- Agreed Value: Claims won’t have deductions for depreciation.

- Flexible Usage: Exotic classic cars can be used for pleasure driving or driving to events.

Cons

- Mileage Restrictions: Some classic car coverages will include mileage limits.

- Higher Premiums for Frequent Use: More frequent use will result in higher exotic car insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Reliable Claims

Pros

- Reliable Claims: State Farm is rated well for claim reliability. Find out more in our review of State Farm.

- Large Network: State Farm has multiple local agents and a repair shop network.

- Multi-Policy Discounts: Purchase other types of insurance to save on exotic coverage.

Cons

- Coverage Options: Fewer specialized coverages for exotic cars.

- Financial Stability: State Farm’s rating recently went down.

#5 – Progressive: Best for Unique Discounts

Pros

- Unique Discounts: Progressive has unique disciuonts, like its Snapshot discount program. Read more in our Progressive Snapshot review.

- Custom Parts Coverage: This coverage protects aftermarket parts and customizations to your exotic car.

- 24/7 Service: Customer support is accessible at any time for Progressive exotic car insurance.

Cons

- Snapshot Rate Increases: If Snapshot scores customers driving poorly, rates may increase.

- Customer Service Ratings: Responsiveness and claims processing have some poor reviews.

#6 – Allstate: Best for Safe Driving

Pros

- Safe Driving: Allstate rewards safe driving with discounts and other perks. Learn more in our Allstate review.

- Customizable Coverage: Tailor your policy to your specific needs by adding coverages or adjusting deductibles.

- Online Convenience: Allstate’s app helps customers make changes to exotic car policies.

Cons

- Customer Complaints: A higher-than-average number of complaints are filed against Allstate.

- Less Specialized in Exotic: Allstate isn’t a niche insurer for exotic cars.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Customize exotic policies easily. Learn more in our Liberty Mutual review.

- New Car Replacement: Useful if your exotic car is brand-new.

- Custom Parts Coverage: This is useful if you have aftermarket parts or modifications done to your exotic car.

Cons

- Higher Rates: Liberty Mutual is usually more expensive, especially for exotic vehicles.

- Average Service: The quality of customer service may be inconsistent.

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide may lower exotic deductibles if drivers don’t file claims.

- Accident Forgiveness: For some drivers, there will be no rate increases after an accident.

- Bundling Discount: Purchase other insurance with your auto coverage. Find out more in our Nationwide review.

Cons

- Limited Exotic Expertise: Nationwide isn’t a niche exotic car insurance company.

- Mileage Limits: Classic car coverage includes mileage restrictions.

#9 – The Hartford: Best for AARP Benefits

Pros

- AARP Benefits: AARP members get benefits from The Hartford, such as discounts. Learn more in our review of The Hartford.

- New Car Replacement: A useful add-on for brand-new exotic vehicles.

- Customer Service: Most customers seem satisfied.

Cons

- Higher Rates for Younger Drivers: The Hartford’s rates are the most affordable for seniors.

- Coverage Options: There are less specialized options for exotic vehicles.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Discount Options

Pros

- Discount Options: Travelers has multiple savings opportunities, such as its IntelliDrive discount program.

- Financial Stability: Travelers has strong financial backing ratings.

- 24/7 Support: Representatives can be reached 24/7. Learn more in our Travelers review.

Cons

- IntelliDrive Rate Increases: IntelliDrive customers with poor scores may pay more.

- Average Customer Service: Experiences with customer service aren’t usually rated highly.

Types of Exotic Vehicle Insurance Coverages

If you drive an exotic car, there are some optional insurance coverages that you should consider to make sure that you are not paying for an expensive repair on your own after an auto accident. While you are required to have at least a basic auto liability policy, you should also consider getting comprehensive and collision insurance for a full coverage policy.

Auto Insurance for Exotic Cars: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $70 | $210 |

| Chubb | $75 | $225 |

| Hagerty | $70 | $200 |

| Liberty Mutual | $75 | $220 |

| Nationwide | $65 | $200 |

| Progressive | $65 | $190 |

| State Farm | $60 | $180 |

| The Hartford | $60 | $190 |

| Travelers | $70 | $210 |

| USAA | $50 | $175 |

When you are the cause of an accident, your auto liability coverage will pay for the damage that you cause to another car, but it will not help to pay for any repairs to your own car or truck that were your fault.

On the other hand, when you damage your car and have comprehensive and collision insurance, you will be covered for the cost of the repairs up to the limit of your policy.

Learn more: Collision vs. Comprehensive: What is the difference?

The difference between comprehensive and collision insurance is that collision insurance is specifically used when your exotic car is damaged because you collided with another object. Comprehensive insurance is for other types of incidents, such as damage to your exotic car from a severe weather event.

With both comprehensive and collision insurance, you will have to pay a deductible out of your own pocket when you go to file a claim. This means you will have a set amount that you are responsible for chipping in before the car insurance company is required to pay the balance of your repair.

Deductible amounts are usually adjustable on your coverages. If you have a $500 deductible, you would have to pay the first $500 of your repair bill before you get any reimbursement or coverage for the rest.

Setting the Appropriate Coverage Limits for Your Car Insurance Policy

Given that an exotic car is more of a liability than a regular car, you will want to make sure that your policy limits reflect the increased risk. If your policy limits are set too low, then you could end up having to pay more out of your own pocket than you can afford.

You might also want to consider gap coverage if you are financing your exotic car. This type of coverage helps you out in the event that you still owe payments on your car that was damaged beyond repair in an accident.Brandon Frady Licensed Insurance Agent

With gap coverage, you will not have to worry about making payments on a car that you can no longer drive. You can also add on extras like exotic car rental insurance for when your car is in the shop, and you need a rental car.

Ways to Keep the Cost Down for Car Insurance for an Exotic Car

If you are looking for ways to keep your car insurance premium affordable on insurance for expensive cars, here are some suggestions:

- You should look into car insurance companies that specifically provide auto insurance coverage for exotic cars.

- Shop around and compare prices.

- Drive the car for limited purposes.

- Park in a secure location.

Specialty insurers are typically more familiar with the risks involved in insuring these types of vehicles and can offer specific discounts to exotic car owners. For example, if you are able to show that you only drive your car on certain occasions, then you may be able to lower the cost of your coverage further with a mileage discount. Below are some discounts to look for at popular companies.

In addition, you should make sure to check into more than one car insurance company before getting a policy for your exotic car. You can reduce the rate that you have to pay for car insurance coverage on an exotic car by shopping around for different rates.

View this post on Instagram

Without shopping around for different auto insurance rates, you cannot be sure that you are paying a reasonable exotic car insurance cost in your area. Even if you live in one of the best cities for custom and exotic cars, you should always shop around for quotes from companies like USAA or Hagerty.

There are free tools that you can use to compare rates online, which means that you can have an auto insurance quote set before you even step into the dealership to purchase an exotic vehicle.

Another way that you can keep your car insurance premium in check is to let the car insurance company know if you only plan to drive your car for limited purposes.

For example, if you are not commuting to work daily in your exotic car, you may be able to pay a lower rate for auto insurance coverage than if you used it like a regular car every day.

A car insurance company will also be pleased to see if you are keeping your car in a safe area when you are not driving it. You will often be able to get a lower rate on your car insurance policy by showing that you have your exotic car or truck stored in an enclosed private garage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Last Word on Exotic Auto Insurance

If you are going to buy an exotic car, you should be prepared to pay a little more for insurance on exotic cars than what you would be able to get for a regular car, even with car insurance discounts. You can take precautions to get your car insurance premium as low as possible for your exotic car, such as making sure the auto insurance company knows that you store it in a safe place and only drive it on special occasions.

The best way to know that you are not paying too much for exotic car insurance coverage is to look into more than one car insurance provider and compare exotic cars’ insurance rates. Compare rates for exotic cars today using our free rate tool.

Frequently Asked Questions

What is considered an exotic vehicle?

Exotic vehicles typically refer to high-value, rare, or luxury cars. These may include brands such as Ferrari, Lamborghini, Bugatti, Aston Martin, and others.

Is it necessary to have auto insurance for an exotic vehicle?

Yes, it is necessary to have auto insurance for an exotic vehicle, just like any other vehicle. In fact, due to their high value and unique characteristics, it is even more crucial to have adequate insurance coverage for exotic vehicles.

What are the advantages of specialized insurance for exotic vehicles?

There are certain auto insurance companies that specialize in offering auto insurance coverage for exotic cars. Some of the benefits of going with one of these companies are:

- Higher Coverage Limits: Specialized policies can offer higher coverage limits to account for the higher value of exotic vehicles.

- Agreed Value Coverage: These policies often provide agreed-value car insurance coverage, where the insurer and the policyholder agree on the vehicle’s value upfront. This ensures fair compensation in case of a total loss.

- Customized Coverage: Exotic vehicle insurance can offer coverage tailored to the unique needs of these vehicles, including coverage for rare parts, collectible value, and specialized repairs.

- Access to Specialized Repair Shops: These policies may provide access to repair shops that specialize in exotic vehicles, ensuring proper maintenance and repairs by experienced professionals.

- Enhanced Roadside Assistance: Specialized policies often include enhanced roadside assistance services specifically designed for exotic vehicles.

Going with a specialized company will cost more, but your exotic car will be in the best hands possible.

Are there any downsides to specialized insurance for exotic vehicles?

Some of the downsides of exotic insurance are:

- Higher Premiums: Specialized insurance for exotic vehicles typically comes with higher premiums compared to standard auto insurance policies due to the higher value and unique risks associated with these vehicles.

- Limited Availability: Finding specialized insurance coverage for exotic vehicles can sometimes be challenging, as not all insurance companies offer these policies.

- Stringent Requirements: Insurance companies may have specific requirements for exotic vehicle owners, such as secure storage, limited mileage, and driver qualifications, which may be more restrictive than standard policies.

Ready to shop for affordable car insurance for exotic cars? Enter your ZIP in our free tool to find the best exotic auto insurance quotes.

Can I insure an exotic vehicle with a standard auto insurance policy?

While it is possible to insure an exotic vehicle with a standard auto insurance policy, it may not provide sufficient coverage for the unique needs of these vehicles. Specialized insurance policies designed for exotic vehicles are generally recommended.

How can I find specialized insurance for my exotic vehicle?

To find specialized insurance for your exotic vehicle, it is recommended to work with an insurance broker or agent who specializes in high-value or exotic vehicles. They can help you navigate the insurance market and find the best coverage options for your specific needs (learn more: Should I buy car insurance through a broker or direct from the company?).

What factors affect the cost of insurance for exotic vehicles?

The cost of insurance for exotic vehicles can be influenced by various factors, including the vehicle’s make and model, age, value, driving record, location, storage arrangements, usage, and desired coverage limits.

What should I consider when selecting an insurance policy for my exotic vehicle?

When selecting an insurance policy for your exotic vehicle, consider the coverage limits, deductibles, policy exclusions, roadside assistance services, repair shop options, and the financial stability and reputation of the insurance company (read more: Understanding Your Car Insurance Policy).

How much is exotic car insurance?

The best exotic car insurance is expensive, with rates varying based on what model you own and your choice of insurance company. The only way to know exactly what you’ll pay for exotic vehicle insurance is to get exotic car insurance quotes.

Who has the best exotic car insurance?

Top providers of exotic insurance include Chubb, USAA, and Hagerty.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.