Best Massachusetts Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Amica, USAA, and Liberty Mutual provide the best Massachusetts auto insurance, with rates from $30 per month for minimum liability. These companies excel in customer satisfaction, military benefits, and customizable coverage options, respectively, making them the top choices for auto insurance in Massachusetts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in MA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in MA

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in MA

A.M. Best

Complaint Level

Pros & Cons

The best Massachusetts auto insurance providers are Amica, USAA, and Liberty Mutual, offering top-notch customer satisfaction, military benefits, and full coverage auto insurance options.

This guide dives into Massachusetts auto insurance requirements, explores affordable options, and provides insights on how factors like location, driving record, and credit score impact your rates.

Our Top 10 Company Picks: Best Massachusetts Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A+ | Customer Satisfaction | Amica | |

| #2 | 10% | A++ | Military Benefits | USAA | |

| #3 | 12% | A | Customizable Policies | Liberty Mutual |

| #4 | 8% | A++ | Affordable Rates | Geico | |

| #5 | 10% | A+ | Snapshot Program | Progressive | |

| #6 | 17% | B | Agent Network | State Farm | |

| #7 | 10% | A+ | Claim Satisfaction | Allstate | |

| #8 | 13% | A++ | Discount Options | Travelers | |

| #9 | 10% | A+ | Bundling Discounts | Nationwide |

| #10 | 15% | A+ | Local Presence | Mapfre |

Whether you’re a high-risk driver, a young driver, or someone with a DUI on record, this guide will help you make informed decisions and secure the best coverage.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Amica is the top pick for Massachusetts auto insurance

- Military benefits and customizable coverage meet unique needs

- Compare quotes to find the best Massachusetts auto insurance rates

#1 – Amica: Top Overall Pick

Pros

- Superior Customer Service: Amica is known for its exceptional customer service and claims satisfaction. Explore our Amica auto insurance review for more details.

- Competitive Rates for High-Risk Drivers: Offers affordable rates for drivers with DUIs and other high-risk factors.

- Extensive Coverage Options: Provides a variety of coverage options and discounts to meet different needs.

Cons

- Higher Premiums: Amica’s premiums can be higher compared to some competitors.

- Limited Local Agents: Fewer local agents available for personalized service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Exclusive Member Benefits: Offers unique benefits for military members and their families.

- Highly Rated Customer Service: Consistently receives high marks for customer service and claims handling.

- Competitive Rates: Provides competitive rates, especially for military families. See our USAA auto insurance review to learn more.

Cons

- Membership Restrictions: Only available to military members, veterans, and their families.

- Limited Physical Locations: Fewer physical branches for in-person assistance.

#3 – Liberty Mutual: Best for Customizable Coverage

Pros

- Wide Range of Coverage Options: Offers comprehensive and customizable insurance packages.

- Discount Opportunities: Provides various discounts, including for safe driving and bundling policies.

- Strong Online Tools: Robust online tools and mobile app for managing policies and claims. Discover our Liberty Mutual auto insurance review for comprehensive insights.

Cons

- Mixed Customer Reviews: Customer service experiences can be inconsistent.

- Higher Rates for Some Drivers: Rates can be higher for drivers with poor credit or high-risk profiles.

#4 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Known for offering some of the lowest rates in the industry. Take a look at our Geico auto insurance review for more information.

- User-Friendly Technology: Excellent mobile app and online services for easy policy management.

- Discounts: Numerous discounts available, including for good drivers and multiple vehicles.

Cons

- Limited Coverage Options: Fewer add-on coverage options compared to competitors.

- Average Customer Service: Customer service can be less personalized due to the company’s size.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for High-Risk Drivers

Pros

- Innovative Tools: Snapshot program helps monitor driving habits and potentially lower premiums.

- Competitive Rates: Generally offers competitive rates, especially for high-risk drivers.

- Comprehensive Coverage: Wide range of coverage options and add-ons. View our Progressive auto insurance review to explore the options.

Cons

- Customer Service Variability: Customer service experiences can vary widely.

- Higher Rates for Low-Risk Drivers: Sometimes higher premiums for low-risk drivers compared to other insurers.

#6 – State Farm: Best for Local Agent Support

Pros

- Comprehensive Coverage: Provides a wide range of coverage options, including comprehensive auto insurance, collision, and liability.

- Excellent Customer Service: Renowned for responsive and reliable customer support. Read our State Farm auto insurance review to understand their services.

- Local Agent Network: Extensive network of local agents offering personalized service and face-to-face support.

Cons

- Higher Premiums: Rates can be higher for high-risk drivers or those with poor credit scores.

- Limited Discounts: Offers fewer discounts compared to some competitors.

#7 – Allstate: Best for Financial Stability

Pros

- Wide Coverage Options: Offers a variety of insurance products and coverage options.

- Strong Financial Stability: Well-established company with solid financial backing.

- Local Agents: Numerous local agents provide personalized service. Delve into our Allstate auto insurance review for detailed analysis.

Cons

- Higher Premiums: Often has higher premiums than many other insurers.

- Mixed Customer Reviews: Customer service experiences and claim handling can be inconsistent.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Customizable Policies

Pros

- Customizable Policies: Provides highly customizable insurance policies to fit individual needs.

- Strong Discounts: Offers several discounts, including for hybrid vehicles and safe driving.

- Good Financial Ratings: Strong financial stability and reliability. Following our Travelers auto insurance review, you’ll find they are highly stable.

Cons

- High Premiums for Some Drivers: Premiums can be higher for high-risk drivers.

- Average Customer Service: Customer service ratings are average compared to top competitors.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Strong Financial Ratings: Excellent financial stability and reliable claim payouts.

- Variety of Coverage Options: Comprehensive and customizable coverage options.

- Vanishing Deductible: Offers a program that reduces your deductible over time. With regard to our Nationwide auto insurance review, discover their unique program.

Cons

- Higher Rates: Can have higher rates compared to other insurers.

- Limited Availability of Local Agents: Fewer local agents for personalized service.

#10 – Mapfre: Best for Massachusetts Residents

Pros

Pros

- Competitive Rates: Offers competitive rates, especially for standard coverage. In our Mapfre auto insurance review, see how they compare.

- Strong Presence in Massachusetts: Well-established in Massachusetts with good local support.

- Comprehensive Coverage Options: Provides a variety of coverage options and discounts.

Cons

- Mixed Customer Reviews: Customer service and claims handling experiences can be inconsistent.

- Limited Nationwide Presence: Primarily operates in specific regions, limiting availability outside those areas.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Massachusetts Auto Insurance Insights

Massachusetts drivers must meet specific auto insurance requirements, including liability, uninsured motorist, and PIP coverage. The state’s minimum liability insurance is relatively affordable, while full coverage is more expensive but offers extensive protection. MA car insurance boasts rates that are lower than the national average.

Amica is the best overall auto insurance provider in Massachusetts, offering exceptional customer satisfaction and affordable rates.Laura Berry Former Licensed Insurance Producer

Factors like location, credit score, and driving record significantly influence rates. For teens and high-risk drivers, shopping around for quotes can yield significant savings. Regularly comparing quotes is essential to avoid overpaying for coverage.

Massachusetts Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$80 $205

$48 $129

$40 $103

$86 $222

$56 $148

$57 $146

$53 $136

$43 $111

$49 $126

$30 $76

The table compares monthly auto insurance rates for minimum and full coverage from various providers in Massachusetts. Allstate offers $56 for minimum and $143 for full coverage. Amica’s rates are $48 for minimum and $129 for full coverage. Geico charges $28 for minimum and $72 for full coverage. Liberty Mutual’s rates are $61 for minimum and $155 for full coverage. Mapfre offers $56 for minimum and $148 for full coverage.

Nationwide’s rates are $40 for minimum and $103 for full coverage. Progressive charges $37 for minimum and $95 for full coverage. State Farm offers $30 for minimum and $78 for full coverage. Travelers’ rates are $34 for minimum and $88 for full coverage. USAA provides the lowest rates at $21 for minimum and $53 for full coverage. Comparing these rates helps you find the best coverage at competitive prices.

Credit Score and Massachusetts Auto Insurance

A person’s credit score can impact car insurance rates in many states. Studies have shown a correlation between poor credit scores and an influx in car insurance claims. So, many companies charge higher rates when people have bad credit. This is an important consideration when evaluating MA auto insurance options.

Massachusetts Full Coverage Auto Insurance Monthly Rates & Provider by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

Fortunately, Massachusetts doesn’t allow companies to charge higher rates if people have poor credit scores. So, if you live in Massachusetts and have poor credit, don’t worry about your credit score impacting your car insurance rates.

Why is State Farm not in Massachusetts? The absence of State Farm in Massachusetts can be attributed to various regulatory and market factors that influence the company’s presence and competitiveness in this state.

Improving your credit score can significantly impact your life, including your car insurance rates outside Massachusetts. It’s important to understand how credit scores affect rates since insurers use them to assess risk and set premiums. Also, be aware of the Massachusetts car insurance increase.

At-Fault Accidents and Massachusetts Auto Insurance

Massachusetts Full Coverage Auto Insurance Monthly Rates & Provider: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $80 | $205 | |

| $55 | $142 | |

| $67 | $171 | |

| $40 | $103 | |

| $86 | $222 |

| $57 | $146 |

| $53 | $136 | |

| $43 | $111 | |

| $49 | $126 | |

| $30 | $76 | |

| U.S. Average | $56 | $144 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Young Drivers and Massachusetts Auto Insurance

Insurance companies charge teens and young adults the highest car insurance rates, with Massachusetts rates nearly four times the national average at $4,475 annually or $373 monthly. State Farm is the cheapest at $1,590 annually or $133 monthly, followed by Geico at $3,009 annually or $251 monthly.

Massachusetts Teen Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Female (Age 16) | Male (Age 16) | Female (Age 18) | Male (Age 18) |

|---|---|---|---|---|

| $817 | $572 | $574 | $664 | |

| $620 | $434 | $371 | $504 | |

| $956 | $670 | $739 | $777 | |

| $402 | $282 | $283 | $327 | |

| $1,002 | $702 | $680 | $815 |

| $608 | $426 | $386 | $494 |

| $1,051 | $737 | $763 | $855 | |

| $450 | $315 | $295 | $365 | |

| $1,157 | $811 | $674 | $940 | |

| $322 | $226 | $233 | $262 | |

| U.S. Average | $785 | $550 | $500 | $600 |

Travelers charges $3,631 annually or $303 monthly, Amica Mutual $5,530 annually or $461 monthly, Progressive $6,883 annually or $574 monthly, and Allstate $7,010 annually or $584 monthly. Adding a car insurance for teens to a guardian’s policy can save money. As teens age, their rates decrease, so compare car insurance quotes in Massachusetts annually to avoid overpaying.

Massachusetts Auto Insurance Rates: The Impact of Your Residence

Auto insurance companies consider your residence in Massachusetts, where rural areas typically have lower rates, while larger cities incur higher costs due to increased traffic, vandalism, theft, and crime. Massachusetts auto insurance rate increase is a factor to consider, as Northfield residents often have the cheapest rates, whereas Roxbury residents pay the most.

In Cambridge, expect to pay around $130 per month, while Lowell residents pay about $140 per month. Boston residents face rates of approximately $152 per month, Worcester residents $157 per month, and Springfield residents $169 per month. The average car insurance cost in Boston reflects these rates.

Even in larger cities, competitive rates can be found by comparing quotes. It’s crucial to compare car insurance in MA quotes online and review them annually to ensure you’re not overpaying, considering the factors that affect auto insurance rates.

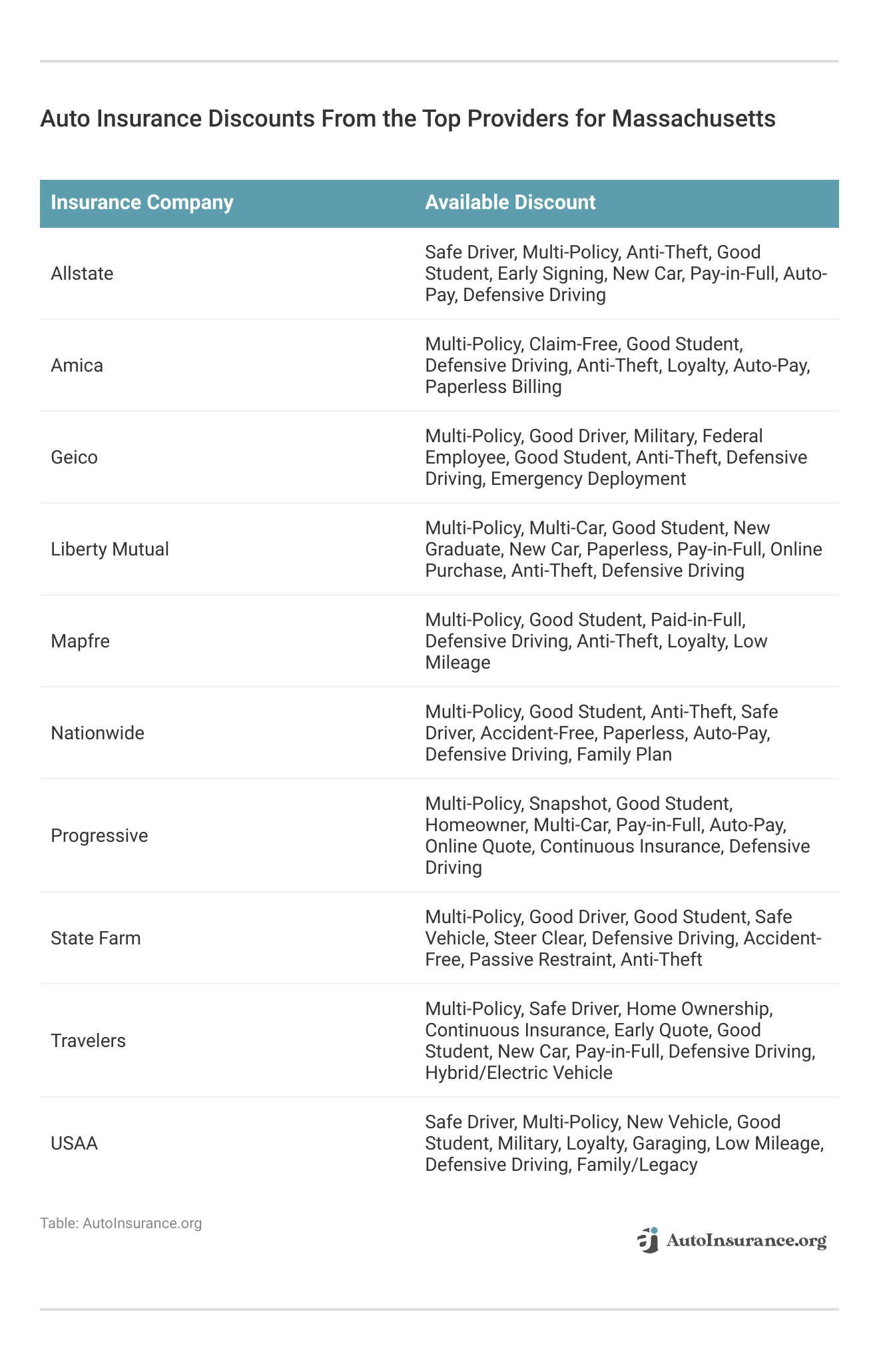

The table below highlights the various discounts available from top auto insurance providers in Massachusetts. These discounts can significantly reduce your monthly premiums and offer substantial savings. Reviewing these discounts can help you choose the best provider and maximize your savings on auto insurance in Massachusetts.

Massachusetts DUI Laws

If you get a DUI in Massachusetts, it’s no small offense. A DUI on your driving record can increase your car insurance premiums by up to 100%. While you may be able to find an insurer willing to cover you after a DUI, it won’t be easy to find cheap car insurance with a DUI.

Auto insurance companies take DUIs very seriously, so expect to pay higher-than-average rates for up to 10 years after your conviction. Anyone having difficulty getting coverage after a DUI should shop online and search for coverage with multiple companies. You can contact your nearest in Massachusetts if you can’t find a company willing to cover you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

DUI Insurance Rates in Massachusetts

Your car insurance rates will significantly increase if you get a DUI in Massachusetts. Unfortunately, there’s no way to know exactly how much you’ll pay for coverage until you shop online and get quotes from several companies.

Massachusetts Full Coverage Auto Insurance Monthly Rates & Provider by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $205 | $288 | $345 | $241 | |

| $142 | $214 | $236 | $166 | |

| $171 | $244 | $238 | $214 | |

| $103 | $171 | $279 | $136 | |

| $222 | $299 | $400 | $270 |

| $146 | $206 | $302 | $175 |

| $136 | $240 | $181 | $181 | |

| $111 | $132 | $144 | $124 | |

| $126 | $177 | $262 | $171 | |

| $76 | $101 | $139 | $87 | |

| U.S. Average | $144 | $219 | $265 | $186 |

State Farm offers the cheapest rates for DUI or DWI drivers in Massachusetts, with average rates of $1,017 annually or $85 monthly. Geico charges $1,749 annually or $146 monthly, Progressive costs $1,880 annually or $157 monthly, and Travelers charges $2,858 annually or $238 monthly.

Amica’s rates are $3,204 annually or $267 monthly, and Allstate charges nearly $4,100 annually or $342 monthly. A DUI can remain on your driving record for up to 10 years, so it’s crucial to find a company that offers suitable coverage at a reasonable price. Regularly compare rates to avoid overpaying for coverage.

Massachusetts Auto Insurance Requirements

Massachusetts drivers must carry auto insurance with minimum auto insurance coverage of $20,000 in bodily injury liability per person, $40,000 per accident, $5,000 in property damage per accident, $20,000 in bodily injury liability per person for uninsured motorists, $40,000 per accident for uninsured motorists, and $8,000 in personal injury protection per person.

Drivers can opt for extra coverage like comprehensive auto insurance for non-accident damages, collision auto insurance for accident repairs, GAP coverage, Medical Payments (MedPay) for medical expenses, roadside assistance, uninsured/underinsured motorist coverage, and rental car reimbursement.

While a minimum coverage policy might seem cost-effective, it’s crucial to assess your specific needs and consider additional coverage for better protection, especially if you drive frequently or have concerns about potential out-of-pocket expenses.

Massachusetts SR-22 Auto Insurance

SR-22 auto insurance is a form submitted to the Department of Motor Vehicles to prove financial responsibility as a driver, which most drivers will never need. However, you may need to file an SR-22 if you have a DUI conviction, multiple traffic tickets, at-fault accidents, were caught driving without insurance or with a suspended/revoked license, or are behind on child support payments.

In Massachusetts, an insurance company must help you file the SR-22. If you already have insurance, contact your provider to file the form, which typically costs $20 to $30. If you don’t have insurance, you’ll need to find a company to file the SR-22 on your behalf by shopping online and comparing quotes.

If you don’t own a car but need SR-22 coverage, purchase a non-owner car insurance policy and inform the insurance company of your situation, which may result in lower rates if you don’t drive often.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Massachusetts Auto Insurance Providers

These case studies, based on real-world scenarios, demonstrate the benefits of choosing top auto insurance companies in Massachusetts for diverse needs.

- Case Study #1 – DUI Conviction: John, a Massachusetts driver with a DUI conviction, found Amica offered competitive rates and excellent customer service, providing coverage at $3,204 annually or $267 monthly. Amica’s tailored approach and reliable claims process ensured John had the support he needed.

- Case Study #2 – Young Driver: Sarah, a new driver in Boston, chose USAA for its exceptional service and affordable rate of $1,590 annually or $133 monthly. USAA’s comprehensive auto insurance coverage and discounts for safe driving and good grades provided excellent protection at a reasonable cost.

- Case Study #3 – At-Fault Accident: Michael, a driver from Worcester, needed insurance after an at-fault accident. Liberty Mutual provided him with the best rate, offering coverage at $2,456 annually or $205 monthly. Liberty Mutual’s accident forgiveness program and personalized customer service helped Michael manage his higher premiums while maintaining essential coverage.

These case studies highlight the advantages of choosing the right auto insurance provider in Massachusetts, from competitive rates and specialized coverage to excellent customer service.

Amica excels with a 96% customer satisfaction rating, making it the top choice for auto insurance in Massachusetts.Daniel Walker Licensed Auto Insurance Agent

By understanding these scenarios, you can make informed decisions and find the best insurance solution for your needs.

Find Your Best Auto Insurance Option in Massachusetts

Top auto insurance providers in Massachusetts excel in customer satisfaction, military benefits, and customizable coverage options. By comparing quotes from these leading companies, you can find the best coverage at competitive rates.

It’s essential to compare auto insurance quotes to ensure you’re getting the most value for your money. Regularly reviewing your options ensures you avoid overpaying and maintain the best protection for your needs. This approach helps you secure affordable and comprehensive insurance.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

What are the best auto insurance companies in Massachusetts?

The best auto insurance companies in Massachusetts include Amica, USAA, and Liberty Mutual. These companies are known for their excellent customer satisfaction, military benefits, and customizable coverage options.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Best Auto Insurance Companies” for more insights.

Is Allstate a good choice for auto insurance in Massachusetts?

Yes, Allstate auto insurance Massachusetts is known for its financial stability and comprehensive coverage options. However, it’s essential to compare quotes from different providers to ensure you’re getting the best rate for your needs.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

How much does auto insurance cost in Massachusetts?

The cost of auto insurance in Massachusetts varies based on factors like location, driving record, and coverage levels. On average, Massachusetts auto insurance costs around $112 monthly, but you can compare rates to find cheaper options.

For detailed information, refer to our comprehensive report titled “Compare Auto Insurance Rates by Vehicle Make and Model” for further insights.

How can I find the cheapest car insurance in Massachusetts?

To find the cheapest car insurance in Massachusetts, compare quotes from multiple providers. Companies like Geico and State Farm often offer competitive rates. Using online tools to get auto insurance Massachusetts quotes can help you find the most affordable options.

For a comprehensive analysis, refer to our detailed guide titled “Cheap Full Coverage Auto Insurance” for more information.

What factors can cause an increase in Massachusetts car insurance rates?

Factors that can cause an increase in Massachusetts car insurance rates include having an at-fault accident, getting a DUI, or having a poor credit score. Additionally, living in areas with higher traffic or crime rates can also lead to higher premiums.

To enhance your understanding, explore our comprehensive resource on insurance titled “Top 7 Factors That Affect Auto Insurance Rates” for more details.

What does Amica offer for auto insurance in Massachusetts?

Amica auto insurance Massachusetts is highly rated for customer service and offers various coverage options, including Amica gap insurance. They provide competitive rates and customizable policies to suit different drivers’ needs.

How can I apply for car insurance in Massachusetts?

To apply for car insurance in Massachusetts, you can visit the websites of various auto insurance companies in Massachusetts or use comparison tools to get quotes. You’ll need to provide personal information, driving history, and vehicle details.

What are the minimum auto insurance requirements in Massachusetts?

Massachusetts auto insurance laws require drivers to have minimum coverage, including $20,000 in bodily injury liability per person, $40,000 per accident, and $5,000 in property damage per accident. Additionally, uninsured motorist and personal injury protection (PIP) coverage are also mandatory.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Are there any discounts available for auto insurance in Massachusetts?

Yes, many Massachusetts auto insurance companies offer discounts for various factors such as safe driving, bundling policies, and having anti-theft devices. It’s beneficial to ask your provider about available discounts to reduce your auto insurance costs in Massachusetts.

To gain profound insights, consult our extensive guide titled “Auto Insurance Discounts” for more information.

How can I compare auto insurance rates in Massachusetts?

To compare auto insurance rates in Massachusetts, use online comparison tools that allow you to enter your information and receive quotes from multiple providers. This will help you find the most affordable car insurance in Massachusetts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros