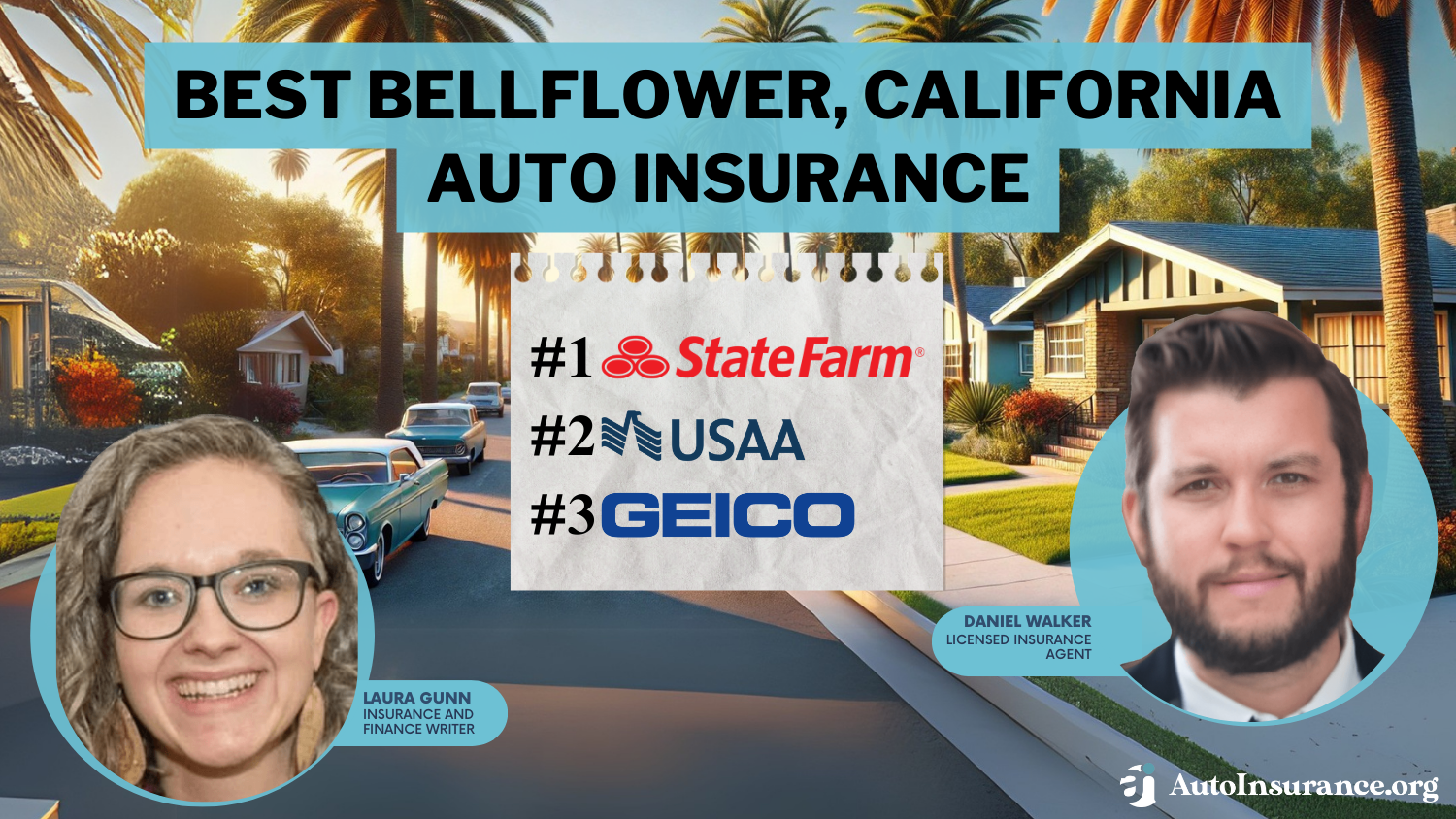

Best Bellflower, California Auto Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, USAA, and Geico are the best Bellflower, California auto insurance providers. Personalized coverage options are available with State Farm, with rates starting from $70/month. Affordable plans from USAA and Geico help Bellflower drivers easily find insurance that fits their needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Nov 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Bellflower California

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Bellflower California

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Bellflower California

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best Bellflower, California auto insurance providers are State Farm, USAA, and Geico. State Farm is a wise choice for most drivers, offering flexible coverage.

USAA provides outstanding customer service and support, offering the best auto insurance for military families and veterans.

Geico will likely appeal to budget-conscious drivers because of its reasonable pricing and attractive offers. These companies offer low-cost insurance with dependable coverage that caters to drivers across Bellflower.

Our Top 10 Company Picks: Best Bellflower, California Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | B | Reliable Service | State Farm | |

| #2 | 30% | A++ | Military Benefits | USAA | |

| #3 | 25% | A++ | Affordable Options | Geico | |

| #4 | 30% | A+ | Innovative Coverage | Progressive | |

| #5 | 40% | A+ | Comprehensive Protection | Allstate | |

| #6 | 30% | A | Flexible Policies | Liberty Mutual |

| #7 | 15% | A | Personalized Service | Farmers | |

| #8 | 40% | A+ | Nationwide Network | Nationwide |

| #9 | 20% | A++ | Trusted Experience | Travelers | |

| #10 | 20% | A | Customer Focused | American Family |

Use our free comparison tool above to see what auto insurance quotes look like in your area.

- State Farm ranks as the best auto insurance provider in Bellflower

- Customized coverage options help meet the unique needs of California drivers

- Affordable auto insurance is essential for Bellflower drivers seeking value

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Strong Local Presence: Bellflower residents benefit from the expertise of local agents who provide personalized attention and guidance throughout the insurance process.

- Flexible Policy Options: Explore our State Farm auto insurance review for auto insurance options that fit perfectly with what Bellflower drivers are looking for.

- Reliable Claims Support: The company promises swift and efficient claims processing so drivers in Bellflower can feel confident that help will arrive when needed.

Cons

- Elevated Premiums: Rates are higher than most insurance companies charge for unavoidable expenses for some drivers in Bellflower.

- Digital Platform Challenges: Some customers from Bellflower need help using the service provider’s online interface, which leads to dissatisfaction.

#2 – USAA: Best for Military Benefits

Pros

- Discounts for Service Members: Military families in Bellflower, CA, can take advantage of exclusive discounts through USAA, making it an excellent option for the best car insurance in Bellflower.

- Highly Rated Member Service: USAA has earned the respect of the members of Bellflower and their families by assisting them at all times.

- Competitive Premium Rates: Discover our USAA auto insurance review, highlighting affordable coverage that helps families in Bellflower.

Cons

- Eligibility Limitations: Options are limited to Bellflower military members and their families only.

- Limited Physical Locations: The lack of car insurance agents in Bellflower makes service less accessible for those unfamiliar with the online processes.

#3 – Geico: Best for Affordable Options

Pros

- Lower Premiums: See our Geico auto insurance review, which emphasizes the affordable rates and makes them an excellent choice for Bellflower drivers.

- User-Friendly Mobile App: The Geico app provides Bellflower drivers quick access to their policies and claim services.

- Extensive Discounts Available: With savings for good driving habits and more, Bellflower residents have plenty of ways to lower their premiums.

Cons

- Varying Customer Service Experiences: Some report inconsistent service quality, which may affect the best Bellflower, California auto insurance.

- Limited Coverage Customization: Some drivers within Bellflower’s viewpoint may perceive specific policy options as inflexible, highlighting the need for enhanced meeting scopes as an alternative.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Innovative Coverage

Pros

- Advanced Online Tools: The Name Your Price feature allows drivers to lock in a plan that best suits their budget and coverage needs.

- Flexible Coverage Choices: Check out our Progressive auto insurance review to see how they cater to the unique needs of Bellflower residents.

- Numerous Discounts Offered: Driving in Bellflower can mean savings with Progressive car insurance, which offers discounts for safe driving and bundling policies.

Cons

- Inconsistent Claims Processing: Clients from Bellflower complain about taking time to wait for claims to be processed.

- Online Support Challenges: Online support is convenient for some, but it has only sometimes worked for all Bellflower drivers, who sometimes prefer assistance directly.

#5 – Allstate: Best for Comprehensive Protection

Pros

- Extensive Agent Network: Allstate makes it easy for Bellflower drivers to find the right coverage with personalized service from its broad network of local agents.

- Diverse Coverage Options: Bellflower residents can customize their policies according to their needs with the wide range of coverage options Allstate offers.

- Comprehensive Discount Programs: With our Allstate auto insurance review, learn about multiple discount opportunities that help Bellflower residents save on insurance.

Cons

- Higher Average Premiums: Customers in Bellflower may encounter higher costs than with some competitors.

- Variable Claims Experience: Some Bellflower drivers have shared different views on the claims process, with satisfaction changing from case to case, which might lower trust in the service.

#6 – Liberty Mutual: Best for Flexible Policy

Pros

- Customizable Coverage Options: In our Liberty Mutual auto insurance review, please find out how drivers in Bellflower tailored their insurance plans to diverse needs

- Accident Forgiveness Feature: With this applicable policy, drivers in Bellflower don’t have to worry about premium hikes even after an accident.

- Special Discounts Offered: Liberty Mutual Insurance Company provides a range of discounts that help make insurance more affordable for people in Bellflower.

Cons

- Higher Rates for Flexible Policies: More customization in auto insurance often results in higher premiums, which may not suit Bellflower budget-conscious drivers.

- Mixed Customer Service Feedback: Some Bellflower drivers have reported frustration with inconsistent customer support, especially when they need quick help with their policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Personalized Service

Pros

- Dedicated Local Agents: A committed car insurance agent in Bellflower provides ongoing support to help drivers find the right insurance policy that meets their needs.

- Multiple Coverage Plans: Offers a variety of insurance plans personalized for drivers and guarantees that they will achieve the best car insurance rates in Bellflower.

- Discount Programs: According to our Farmers auto insurance review, multiple discounts help Bellflower residents save effectively.

Cons

- Higher Overall Costs: Premiums can be more expensive for drivers in Bellflower, other than some competitors.

- Claims Processing Delays: Some Bellflower customers have reported longer wait times for claims resolution.

#8 – Nationwide: Best for Nationwide Network

Pros

- Wide Range of Coverage Options: Nationwide allows customizing policies according to the choices of many Bellflower drivers.

- Competitive Pricing: Known for great pricing, Nationwide helps Bellflower residents protect their cars without overspending.

- Positive Customer Feedback: View our Nationwide auto insurance review, showcasing a solid reputation for customer service and giving Bellflower drivers confidence in their coverage.

Cons

- Limited Local Presence: Local agents’ availability may be fewer than competitors, impacting service for the best Bellflower, California auto insurance.

- Online Claims Issues: Some Bellflower customers have mentioned having trouble with Geico’s online claims system, saying the platform isn’t as easy to use.

#9 –Travelers: Best for Trusted Experience

Pros

- Extensive Coverage Choices: Offering a range of insurance plans tailored to Bellflower, California drivers, some options suit their lifestyle perfectly.

- Strong Claims Support Reputation: Our Travelers auto insurance review highlights how it resolves claims quickly, getting Bellflower drivers back on the road without unnecessary delays.

- Competitive Rates: Travelers provides some of the most affordable auto insurance options in Bellflower, California, while providing helpful services for local drivers.

Cons

- Complex Online Tools: A few Bellflower residents faced challenges with Travelers’ online tools, making it more difficult than anticipated.

- Inconsistent Claims Processing Times: Bellflower customers may experience variability in quick assistance when processing their claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Customer Focused

Pros

- Highly Customizable Policies: Enables the drivers to develop workable insurance coverage schemes while pursuing the best Bellflower, California auto insurance.

- Attractive Discounts for Safe Driving: Safe driver discounts boost cost-effectiveness for the best car insurance rates in Bellflower.

- Excellent Digital Tools: See our American Family auto insurance review, highlighting user-friendly mobile tools that help Bellflower drivers efficiently manage their policies.

Cons

- Limited Availability: Availability in Regional may restrict some drivers in Bellflower compared to national insurers.

- Higher Costs for Added Coverage: Customizing policies towards specific needs causes an increase in costs, which also affects the competitive auto insurance cost in Bellflower, California.

Rates and Minimum Coverage Requirements in Bellflower, CA

When evaluating the best Bellflower, California auto insurance, it’s essential to look at premiums, coverage options, and the customer service reputation of each provider.

The table below offers a quick reference for Bellflower residents, showing monthly rates for minimum and full coverage from several insurance companies.

Bellflower, California Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $85 | $170 | |

| $79 | $160 | |

| $82 | $164 | |

| $76 | $148 | |

| $87 | $177 |

| $78 | $155 |

| $84 | $158 | |

| $70 | $161 | |

| $83 | $167 | |

| $77 | $152 |

Top companies with significant value include Geico, State Farm, American Family, Nationwide, and Progressive. Geico is known for affordable premiums and excellent customer service.

State Farm offers a low price with a high service level through a network of agents. American families are more favorable in terms of coverage than cost. Competitive yet effective are the breaching attributes of the coverage provided by Nationwide.

The table below summarizes the minimum auto insurance coverage requirements, including the fundamental liability limits for bodily injury and property damage.

California Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

| Property Damage Liability | $5,000 per accident |

In Bellflower, California, drivers must understand the state’s minimum auto insurance requirements to ensure legal compliance and financial responsibility.

The law mandates liability insurance, including bodily injury and property damage coverage, with bodily injury liability protecting against medical expenses and damages to others.

While minimum limits are necessary, many drivers should consider higher coverage choices to safeguard their assets better. Knowledge of the insurance offerings of each provider enables drivers to find the most suitable auto insurance coverage in the market.

Save More: Auto Insurance Discounts for Bellflower Residents

Finding the right auto insurance in Bellflower, California, means looking at factors like coverage, pricing, and discounts. Many providers in Bellflower adjust their rates to offer savings for safe drivers.

Below is a table highlighting deals from some of the top insurance providers in Bellflower, California.

Auto Insurance Discounts From the Top Providers in Bellflower, California

| Insurance Company | Available Discounts |

|---|---|

| Multi-policy, Safe Driver, Good Student, Anti-theft, Responsible Payer, New Car | |

| Multi-policy, Safe Driver, Good Student, Low Mileage, Loyalty, Early Bird | |

| Multi-policy, Safe Driver, Good Student, Pay-in-Full, Signal App, Homeowner | |

| Multi-policy, Good Driver, Good Student, Military, Emergency Deployment, Anti-theft | |

| Multi-policy, Safe Driver, Homeowner, Online Purchase, New Vehicle, Military |

| Multi-policy, Safe Driver, Good Student, Anti-theft, Paperless, SmartRide |

| Multi-policy, Safe Driver, Multi-car, Homeowner, Online Quote, Pay-in-Full | |

| Multi-policy, Safe Driver, Good Student, Anti-theft, Vehicle Safety, Accident-Free | |

| Multi-policy, Safe Driver, Good Student, Homeowner, New Car, Pay-in-Full | |

| Multi-policy, Safe Driver, Good Student, New Vehicle, Military, Annual Mileage |

Allstate is a company that rewards responsible people who own several policies by providing a discount for drivers. In the same way, Geico offers discounts to individuals who maintain good driving records to encourage better driving practices.

Kristen Gryglik Licensed Insurance Agent

Additionally, Progressive offers multi-vehicle auto insurance discounts, encouraging families to consolidate their coverage—Liberty Mutual rewards safe drivers with easy savings. If you maintain a clean driving record, you can qualify for discounts that lower your insurance costs.

By taking advantage of these savings from different auto insurance providers, Bellflower drivers can significantly reduce expenses while finding coverage that fits their unique needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Options for All Age Groups in Bellflower, California

Finding the best Bellflower, California auto insurance involves carefully analyzing how premiums vary by age and gender rates and the provider options available; some providers are more dominant than others.

Geico is one of the paramount players in the teen auto insurance market, especially for younger ages, particularly below the age of seventeen. This provider has one of the lowest insurance quotes, and it is a perfect option for coverage of teenage drivers in the household.

Bellflower, California Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $741 | $931 | $337 | $368 | $264 | $217 | $167 | $167 | |

| $782 | $1,277 | $291 | $368 | $284 | $257 | $172 | $178 | |

| $452 | $459 | $260 | $249 | $200 | $182 | $167 | $167 | |

| $648 | $603 | $218 | $280 | $151 | $218 | $172 | $201 |

| $859 | $731 | $586 | $295 | $360 | $315 | $282 | $223 |

| $476 | $488 | $305 | $259 | $238 | $208 | $190 | $160 | |

| $652 | $747 | $476 | $462 | $361 | $336 | $258 | $236 | |

| $638 | $784 | $321 | $236 | $299 | $218 | $210 | $240 | |

| $469 | $649 | $393 | $461 | $298 | $218 | $187 | $169 |

State Farm offers an excellent option in terms of good coverage at competitive rates, but generally, Farmers charge higher premiums for younger drivers; thus, comparing quality options and shopping around and looking for a better price is essential.

As drivers hit their mid-20s, insurance costs tend to drop, with Geico and Liberty Mutual offering some of the most affordable rates for this age group.

In choosing any of these top-rated service providers, the residents of Bellflower can find the most appropriate auto insurance while also benefiting from the age-based pricing offered.

Top Auto Insurance Picks for Teen and Senior Drivers in Bellflower

Finding the best Bellflower, California auto insurance involves understanding the unique challenges different demographics face; teen drivers often pay significantly higher premiums than the general population due to their lack of experience.

Regarding providers, State Farm is the best option for parents with teenage drivers as they provide tailored services and broad family-oriented coverage plans, particularly insuring young drivers.

The following table outlines the monthly auto insurance rates for 17-year-old drivers in Bellflower, segmented by provider and gender:

Bellflower, California Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| $741 | $931 | |

| $782 | $1,275 | |

| $452 | $459 | |

| $456 | $489 |

| $812 | $898 |

| $569 | $573 | |

| $611 | $758 | |

| $495 | $562 | |

| $390 | $391 |

USAA provides better deals and more significant savings, especially for military families, while Geico earns praise for its low rates and discounts for safe drivers.

In contrast to teen drivers, seniors generally benefit from lower auto insurance rates due to their experience and usually lower risk profiles. The following table illustrates the monthly auto insurance rates for 60-year-old drivers in Bellflower:

Bellflower, California Senior Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| $193 | $194 | |

| $222 | $222 | |

| $140 | $140 | |

| $197 | $190 |

| $279 | $263 |

| $152 | $180 | |

| $296 | $296 | |

| $208 | $206 | |

| $167 | $167 |

Geico is a perfect choice for senior drivers due to its low rates and good customer service, and it is ideal for all price-oriented drivers. USAA also has attractive offers, particularly to those who belong to military families.

Despite offering higher-than-average rates, State Farm provides customized service and specializes in offering high-quality coverage tailored to older drivers. Teen and senior drivers in Bellflower can avail of suitable options for auto insurance by looking into other credible companies.

Teens undoubtedly have access to very favorable rates, while seniors enjoy lower rates but, at the same time, have reliable coverage. Drivers can obtain the best Bellflower, California auto insurance by assessing different insurance providers’ offers.

Auto Insurance Rates in Bellflower: The Role of Driving Records

Your driving record will broadly impact your auto insurance premiums in Bellflower, California. Drivers with clean records typically receive more favorable rates than those with tickets, accidents, or DUIs.

For instance, insurance providers such as USAA and Geico tend to offer reasonable prices for individuals with a clean record, which attracts safe drivers in the Bellflower area. State Farm provides exceptional service regarding all-inclusive protection and efficient client assistance.

Bellflower, California Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $248 | $323 | $650 | $658 | |

| $333 | $367 | $457 | $607 | |

| $167 | $208 | $259 | $324 | |

| $241 | $255 | $322 | $255 |

| $316 | $570 | $665 | $663 |

| $186 | $268 | $317 | $268 | |

| $301 | $553 | $676 | $593 | |

| $210 | $312 | $347 | $312 | |

| $158 | $173 | $236 | $219 |

Furthermore, outstanding customer service and several incentives make it easy for families and people seeking cost-effective, high-quality services.

Insurance providers often adjust their rates significantly after adding a ticket or accident to a driving record.

DUIs result in some of the highest premium increases, highlighting the need for responsible driving. Keeping a clean driving record becomes very important for getting the best auto insurance in Bellflower, California, and saving a lot. To gain further insights, consult our comprehensive guide, “How Auto Insurance Companies Check Driving Records.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Navigating DUI Auto Insurance: Top Picks for Bellflower Drivers

After getting a DUI, it is one of the most challenging jobs for most drivers to find cheapest car insurance in Bellflower. A DUI often results in higher premiums, making exploring options and finding the best coverage for your situation even more critical.

The following table highlights the annual auto insurance rates for various companies after a DUI; this will help you know what to look for to get the best Bellflower, California, auto insurance.

Bellflower, California DUI Auto Insurance Rates

| Insurance Company | Monthly Cost |

|---|---|

| $656 | |

| $565 | |

| $324 | |

| $291 |

| $686 |

| $367 | |

| $677 | |

| $402 | |

| $386 |

State Farm is well-known for its ability to meet the unique needs of every client and the variety of insurance plans available, which is why many drivers wanting the best auto insurance in Bellflower consider it one of the best options.

Another reasonable option is Geico, which is relatively cheap and offers several discounts that help lower the rates. USAA tailors its fantastic coverage for active-duty military members and their families and consistently earns a reputation for providing the best customer support.

For drivers facing DUI in Bellflower and trying to mitigate the effects of the charge, it is pivotal to shop around and request quotes from the most recommended providers to obtain the best Bellflower, California, auto insurance coverage available. To delve deeper, refer to our in-depth report titled “DUI Definition and Implications.”

Best Auto Insurance Choice for Bellflower Drivers by Commute Mileage

When looking for an auto insurance quote in Bellflower, California, it’s essential to factor in how annual mileage affects your premiums. Basic liability coverage may cost less than intentional damages, but with drivers consistently maintaining an annual mileage of 12,000 miles or more, the insurance rates usually go up for all.

The table below shows every provider’s mileage premiums and how the rates would vary based on mileage.

Bellflower, California Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $371 | $452 | |

| $409 | $493 | |

| $218 | $262 | |

| $254 | $300 |

| $400 | $506 |

| $309 | $311 | |

| $406 | $437 | |

| $286 | $350 | |

| $220 | $256 |

State Farm offers flexible coverage tailored to various mileage needs, including low-mileage auto insurance discounts, which are perfect for commuters. They focus on customer satisfaction and reliable service above all else.

Geico is the leading affordable yet user-friendly online car insurance. USAA makes even more significant progress in keeping its focus on providing its best services to military members and their families. USAA shines above all competitors in terms of customer satisfaction and coverage options.

Michelle Robbins Licensed Insurance Agent

Comparing different rates and coverage levels allows drivers to find the insurance that best suits their driving habits and financial goals by enabling them to assess distinct rates and coverage levels.

Auto Insurance Rates By Coverage Level in Bellflower

When selecting the best Bellflower, California auto insurance, drivers have plenty of options to consider. With a range of providers competing for attention, it can take time to determine which insurer truly offers the best value.

State Farm consistently stands out as a top contender. Due to its remarkable customer service and wide range of coverage options, this provider is still favorable among many regional drivers.

The table presents the monthly price of auto insurance for different insurance companies while showing various levels of coverage: low, medium, and high.

Bellflower, California Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| $388 | $415 | $431 | |

| $418 | $455 | $480 | |

| $216 | $243 | $260 | |

| $257 | $280 | $295 |

| $403 | $461 | $495 |

| $251 | $294 | $308 | |

| $379 | $428 | $456 | |

| $273 | $327 | $353 | |

| $215 | $243 | $256 |

Allstate offers discounts for safe drivers and students, while Farmers insurance in Bellflower is best for flexible coverage. Geico attracts young, tech-savvy users with its low rates and simple online quoting.

For the residents of Bellflower, the combination of quotes and evaluation of the strengths of different insurers will enable them to settle for a policy that suits them so that they can be well covered and not worry while driving. To expand your knowledge, refer to our comprehensive handbook titled “Auto Insurance for Different Types of Drivers.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tailored Coverage: Best Auto Insurance for Bellflower Drivers

Every driver is unique; thus, the volatility of any rates or coverages for some drivers will not be the same for others. When it comes to reviewing the best Bellflower, California auto insurance companies, there is a need for a policy tailoring strategy as these components tend to vary significantly.

USAA has good coverage options for teenagers and has low prices for persons with clean records or minor traffic offenses. Senior citizens can take advantage of Geico’s senior-friendly rates and services.

The comparison table below highlights top-rated insurance companies in every category, making it easy for residents to choose according to their needs.

Best by Category: Cheapest Auto Insurance in Bellflower, California

| Driver Profile | Insurance Company |

|---|---|

| Teenager | |

| Senior | |

| Clean Record | |

| One Accident | |

| One DUI |  |

| One Ticket |

Liberty Mutual is appealing in that it has lower rates for persons with a DUI, thereby reducing the impact of financial burden. Also, for drivers with one accident on their record, there is continued good value from USAA.

Evaluating one’s situation and exploring options will enable the residents of Bellflower to find the most suitable insurance cover that fits their pocket. For additional details, explore our comprehensive resource titled “How long does an accident affect your auto insurance rate?”

Factors Affect Auto Insurance Rates in Bellflower, California

When searching for the ideal auto insurance policy in Bellflower, California, you must consider certain local variables that can influence your rates. Several factors determine the coverage cost for the people living in the area, including crime rates and the average commute distance to work.

Auto Theft Rates

Auto theft contributes significantly to insurance rates charged by various firms as they revise their rate according to the policyholders’ claim history. As per FBI statistics, there were 394 incidences of theft reported in Bellflower, California.

Bellflower, California Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Uninsured Motorist Coverage | A | Essential due to a higher percentage of uninsured drivers in the area |

| Collision Coverage | B+ | Strong protection against damages from accidents |

| Liability Coverage | B | Meets state minimum; higher limits recommended for added protection |

| Comprehensive Coverage | B | Good for theft and non-collision incidents |

| Personal Injury Protection | B- | Covers medical expenses; varies by provider |

The higher the risks of theft, the higher the premiums may increase among residents because of the higher the chances of claims. Considering these factors, drivers in Bellflower can choose from the many cheap options for auto insurance. To learn more, explore our comprehensive insurance resource titled “Does auto insurance cover vehicle theft?”

Commute Times

Another essential factor to consider is the length of your commute. The time spent traveling is equally important, as longer trips increase the chances of accidents and, consequently, insurance losses.

As highlighted in City Data, the average travel time for those residing in Bellflower is slightly over half an hour, approximately thirty-one minutes.

Bellflower, California Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Year | 2,100 |

| Claims per Year | 1,800 |

| Average Claim Cost | $3,700 |

| Percentage of Uninsured Drivers | 15% |

| Vehicle Theft Rate | 250 per 100,000 vehicles |

| Traffic Density | Moderate to High |

| Weather-Related Incidents | 5% of total accidents |

The more time you spend on the road, the higher the chances of meeting an accident, which can result in the rise of your premiums by your insurers. When opting for the best Bellflower, California auto insurance, paying attention to local factors is essential.

Understanding each of the crime rates and the commuter average affects the pricing of insurance premiums, and they can, therefore, make decisions that are ideal for them and their pockets. For a comprehensive analysis, refer to our detailed guide titled “Pleasure-Use vs. Commuter Auto Insurance.”

Best Auto Insurance Options in Bellflower

There are several considerations that every resident must review as they look for the best Bellflower, California, auto insurance for their needs. State Farm is an excellent choice for families, offering personalized service and comprehensive coverage.

USAA uniquely provides the best rates and packages to suit military families. Geico features cheap auto insurance and the most impressive assortment of discounts for cost-sensitive motorists, especially for younger drivers.

Factors like age, driving history, and ZIP code can influence your rates, so gathering quotes from different providers is a good idea. Comparing these auto insurance quotes in bellflower and available discounts will help you find the coverage that meets your needs and fits your budget.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

What happens if you have no insurance but the other driver was at fault in California?

Driving without insurance may lead to fines in California with legal penalties, even if the other driver is at fault. If the at-fault driver’s insurer disputes coverage, it can complicate your recovery of damages.

Who is the most trusted car insurance company in Bellflower, CA?

Most residents trust car insurance companies in Bellflower, such as State Farm, Geico, Progressive, and Allstate, because they are known for their excellent customer service, dependability, and wide range of coverage options.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

How much is full coverage auto insurance in Bellflower, California?

Full coverage auto insurance in Bellflower, California, typically costs $70 per month with State Farm. Other providers, such as USAA and Geico, offer similar coverage, which includes bodily injury, property damage liability, collision, and comprehensive coverage.

What is the minimum auto insurance coverage in Bellflower?

In Bellflower, California, drivers must carry a minimum of $15,000 in bodily injury coverage per person, $30,000 per accident, and $5,000 for property damage to meet the state’s liability requirements.

How much is auto insurance for a new driver in Bellflower, California?

Auto insurance rates for new drivers in Bellflower, California, vary widely based on age, driving experience, and the vehicle they insure. Because new drivers often lack a driving history, they typically face higher premiums.

How much auto insurance should I carry in Bellflower?

Drivers need at least the state minimum auto insurance with liability coverage. Considering higher limits or full coverage is advisable, and comparing car insurance quotes in Bellflower can help find the best options.

How much is car insurance in Bellflower, CA, for a 22-year-old?

Car insurance rates for a 22-year-old in Bellflower, CA, can vary significantly depending on the provider and personal circumstances. However, premiums are generally higher than average because younger drivers are considered riskier.

Is car insurance taxed in Bellflower?

Car insurance premiums are generally not taxed in Bellflower. However, some associated fees or surcharges may apply depending on the insurance company and policy.

What type of car insurance is the cheapest in Bellflower?

The best cheap car insurance in Bellflower is liability-only coverage, which meets state requirements but provides minimal protection.

Where is the best place to buy a used car in Bellflower, CA?

Nearby dealerships, digital platforms, and second-hand car dealers are some of the best places to purchase a used vehicle in Bellflower, CA. Customer reviews and the types of cars available influence these recommendations.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.