Winston-Salem, NC Auto Insurance (2024)

North Carolina requires 30/60/25 for bodily injury and property coverage. The average rate of auto insurance in Winston-Salem is $248.08/mo. Save now and compare rates below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Summary Overview of Winston-Salem, NC | |

|---|---|

| Population | 244,605 |

| Density | 2,247 people per square mile |

| Average Cost of Insurance in Winston-Salem | $2,977.04 |

| Cheapest Car Insurance Company | Liberty Mutual |

| Road Conditions | Poor: 12% Mediocre: 25% Fair: 25% Good: 38% |

Winston-Salem is a mid-tier city in North Carolina known for its art and innovation. The city has several historic buildings dutifully restored to help you go back in time.

To get a feel of the rich history, you can stay at the historic Brookstown Mill that was established in 1837. The beautiful Graylyn Estate is another historic building that has been restored as a hotel.

In Winston, you can still see the life of 18th-century Moravian settlers through recreated events and restored buildings of the time.

The city is hosts an American icon – Camel Cigarettes. The iconic company has been in Winston for more than 100 years.

There is much to see and do in and around the city of Winston-Salem. You can drive down to the Great Smokey Mountains and the Atlantic Ocean all within a day.

This growing city is gaining in popularity, and you should expect to see a lot of vehicles, pedestrians, and taxis. You should be able to enjoy all this city has to offer without the worry of insurance coverage.

In this comprehensive guide on the Twin City, we will cover the local auto insurance market, including coverage type, coverage rates, factors that determine your auto insurance rates, and much more.

We hope that by reading this guide, we will help you in choosing the right auto insurance company, policy and so much more.

You can start your comparison shopping today using our FREE online tool. Enter your zip code above to get started!

The Cost of Car Insurance in Winston-Salem

To save on car insurance premiums, you must first understand how companies calculate your premium rate. After you know what factors are important for your auto insurance policy, you will be able to control the rate you are charged.

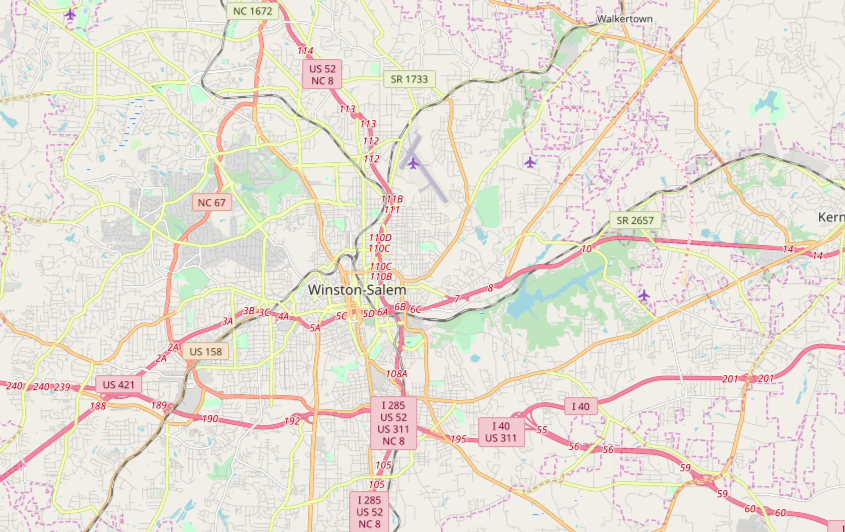

You might find yourself asking how does my Winston-Salem, NC stack up against other top metro auto insurance rates? We’ve got your answer below.

In this section, we will look at the relevant factors in Winston-Salem that might impact your car insurance rate.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

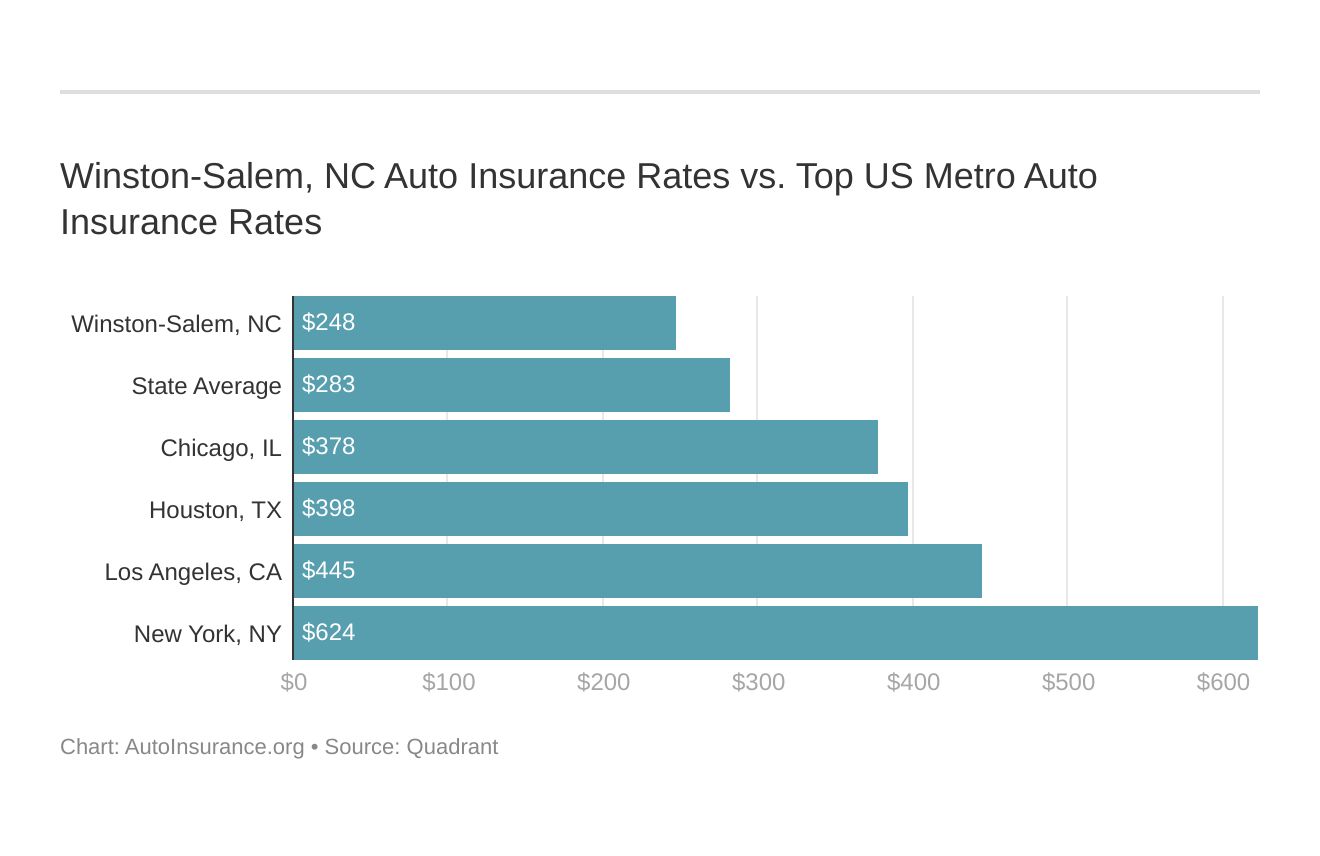

Male vs. Female vs. Age

Your age is a significant factor in helping auto insurance companies calculate your rate.

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. North Carolina does not use gender, so check out the average monthly auto insurance rates by age in Winston-Salem, NC.

Insurers consider young drivers susceptible to accidents, tickets, or reckless driving, and therefore at a higher risk of filing a claim.

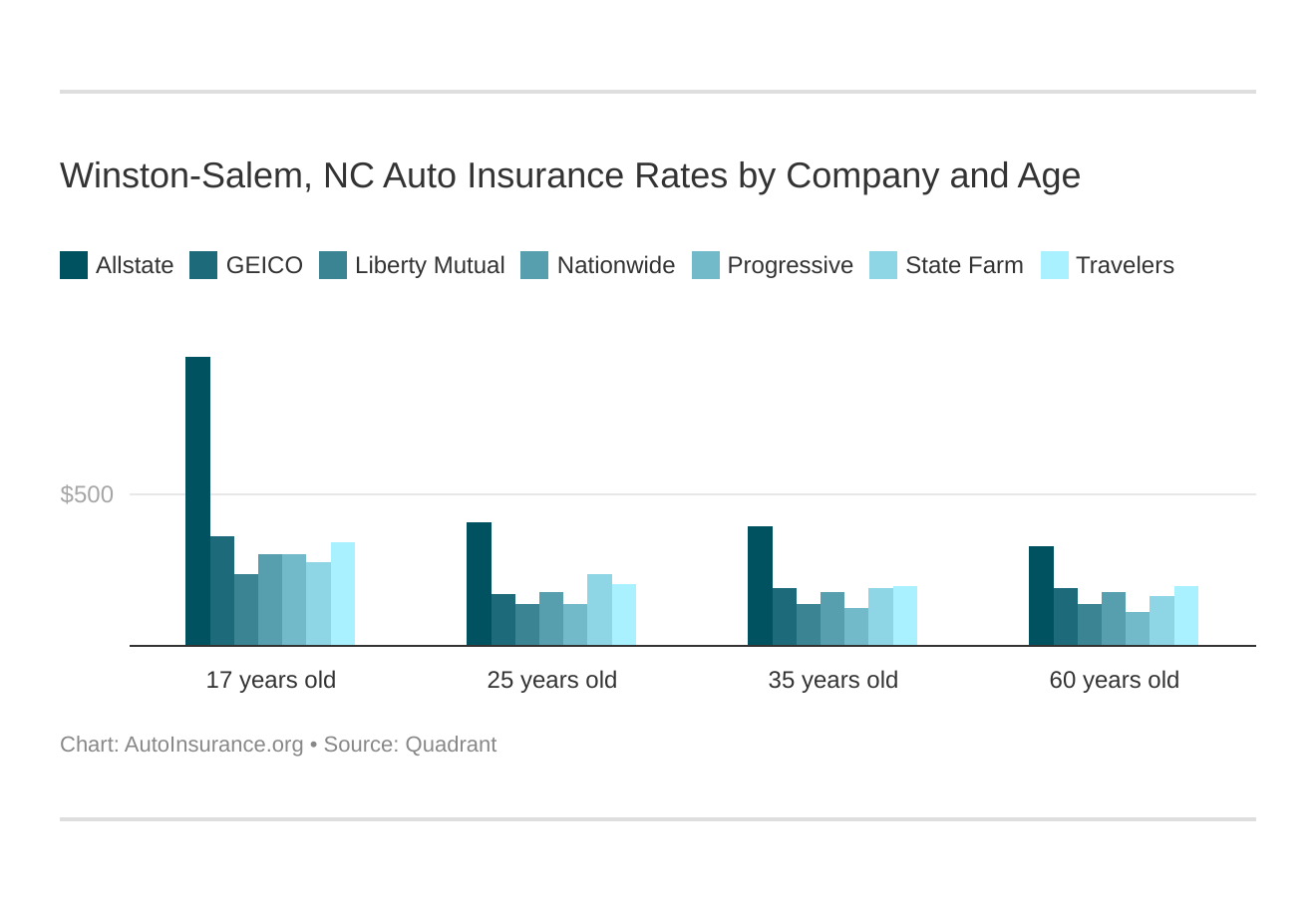

Winston-Salem, NC auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

As you gain experience as a driver, you tend to take fewer risks and make fewer mistakes. As you grow older, you gradually move into a lower risk bracket and get cheaper rates.

By the age of 35, your insurance rates tend toward the lower risk premium category. This is assuming you have all other factors in favor of your case, e.g., you have a clean driving record, strong credit, etc.

The median age in Winston-Salem is 35.3 years, and therefore, the majority of the population must have the insurance rate tending towards the citywide average.

Here are the average insurance rates for different age brackets in Winston-Salem:

| AGE | 17 | 25 | 35 | 60 | CHEAPEST AGE |

|---|---|---|---|---|---|

| Average Annual Rate | $4,754.03 | $2,502.22 | $2,417.29 | $2,234.63 | 60 |

As we discussed, the insurance rate is the highest for a teen, but it drops drastically as you gain experience. However, remember that these are average insurance rates and may not apply to you.

But what about gender?

The good news is that North Carolina does now allow insurers to use gender when calculating your insurance rates. North Carolina is among the seven states that do not allow gender-based pricing – the other six states are California, Hawaii, Massachusetts, Montana, Pennsylvania, and parts of Michigan.

However, your marital status can play a role in determining your auto insurance rates.

Here’s the summary of insurance rates organized by age and marital status:

| Demographic | Average Rate |

|---|---|

| Single 17-year old female | $4,756.83 |

| Single 17-year old male | $4,751.23 |

| Single 25-year old female | $2,503.10 |

| Single 25-year old male | $2,501.35 |

| Married 35-year old female | $2,420.49 |

| Married 35-year old male | $2,414.09 |

| Married 60-year old female | $2,237.70 |

| Married 60-year old male | $2,231.55 |

| Overall Average | $2,977.04 |

As you can see, on average, 17-year-old drivers pay nearly double the premium that a 35-year-old driver would have to pay. However, unlike other states, rates for male and female drivers are generally equal.

Your marital status may also impact your insurance rates. Insurance companies have observed that, on average, married people are less risky and therefore are less prone to file a claim. The lower the risk for insurance companies, the lower your premium rate.

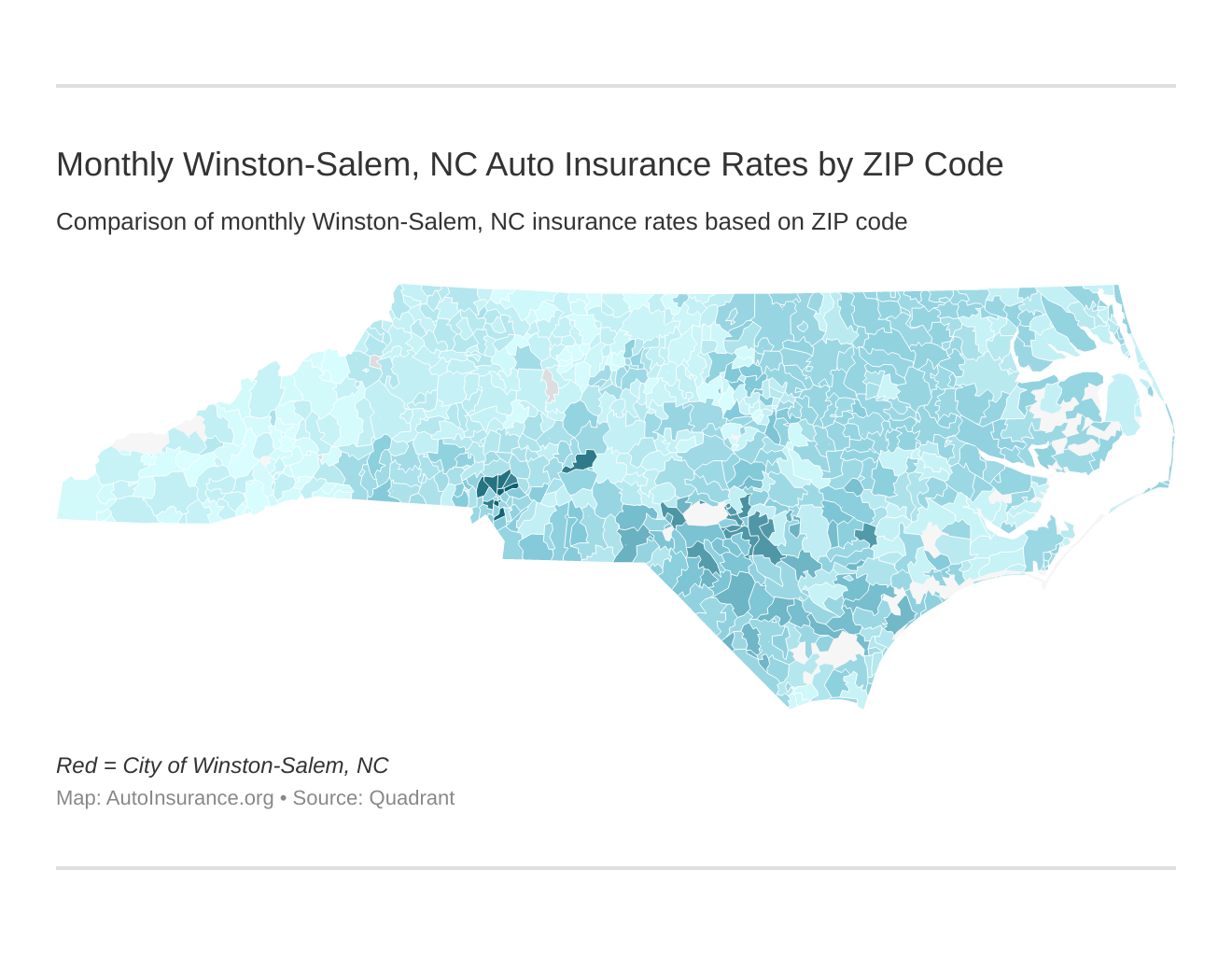

Cheapest Zip Codes in Winston-Salem

Where you live may also have an impact on your car insurance rate.

Check out the monthly Winston-Salem, NC auto insurance rates by ZIP Code below:

Your zip code may help insurance companies determine your risk profile. Your location can help insurers understand the following:

- number of accidents reported per year from your neighborhood or zip code

- numbers of claims made

- cost of living

- car thefts in your zip code

- crime rate

Let us check the average insurance rates across various zip codes in Winston-Salem:

| Zip Code | Average Rate |

|---|---|

| 27105 | $2,654.09 |

| 27103 | $2,654.84 |

| 27101 | $2,658.64 |

| 27109 | $2,664.81 |

| 27104 | $2,667.20 |

| 27106 | $2,673.69 |

| 27127 | $2,773.71 |

| 27110 | $2,777.40 |

| 27107 | $2,781.36 |

| 27157 | $2,823.48 |

However, it may also depend on the city where you are based. In the case of Winston-Salem, the difference in average insurance rates between the most expensive and cheapest neighborhood is only $200.

Therefore, where you live in the Dash may not impact your auto insurance rates.

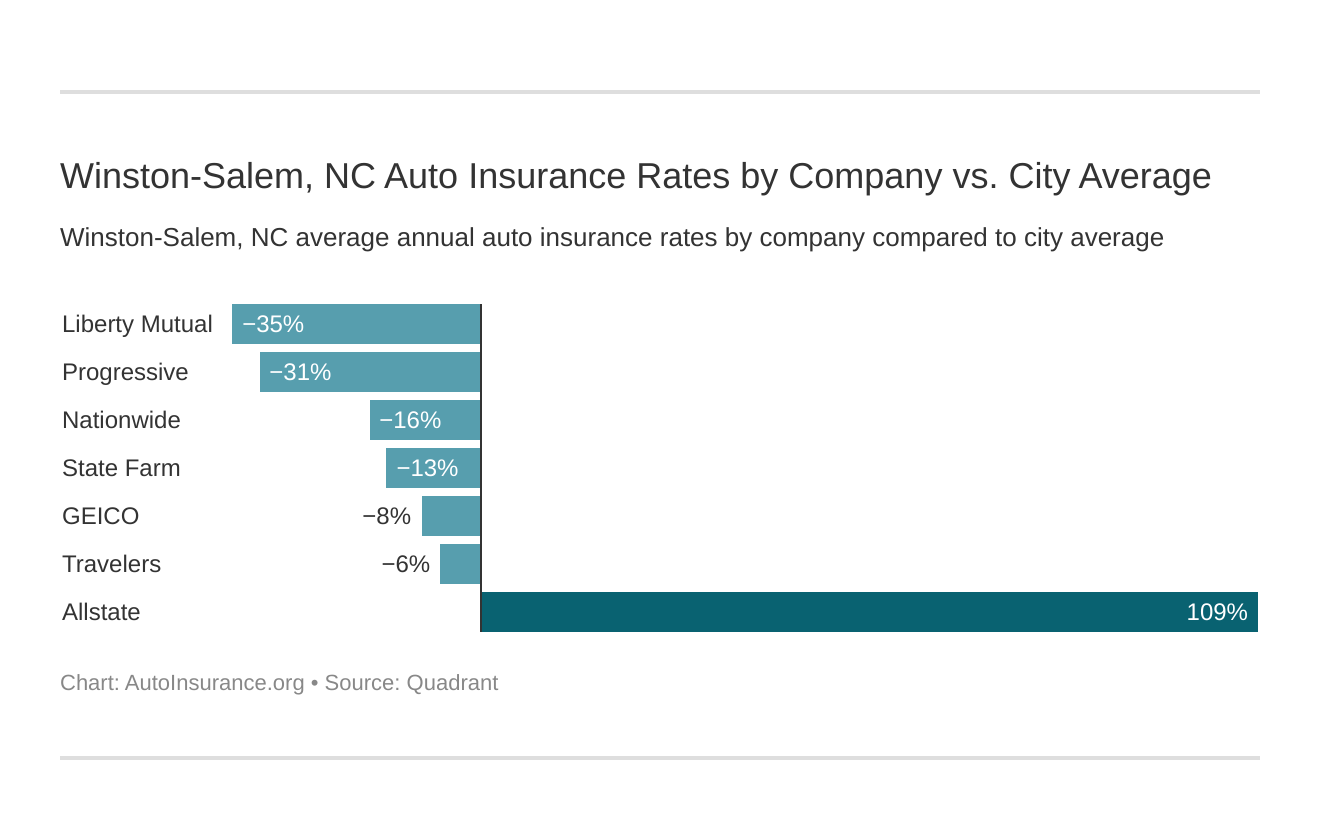

What’s the best car insurance company in Winston-Salem?

We understand that it is complicated to figure out the best car insurance company. However, what is best for someone may not be for you. It depends on several factors that are very specific to you.

Which Winston-Salem, NC auto insurance company has the cheapest rates? And how do those rates compare against the average North Carolina auto insurance company rates? We’ve got the answers below.

Insurance companies use different insurance models and may price factors differently. Depending on which factor is more important to you, different insurance companies may quote you different rates.

It is always advisable to shop around to check for the best insurance quotes.

In this section, we will help you figure out how to find the best car insurance companies based on your requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance Rates by Company

Winston-Salem offers a plethora of options for car insurance, as most of the top insurers are licensed in the city. With players competing for the business, you may have a chance to get some discounts.

Depending on your risk profile, different insurance companies may offer you varying quotes to provide coverage.

Each insurance company has a sophisticated model to price your risk and calculate your premium.

Here’s a table that shows average insurance rates, organized by company and broken down by age and marital status.

| Group | Married 35-year old | Married 60-year old | Single 17-year old | Single 25-year old | Average |

|---|---|---|---|---|---|

| Liberty Mutual | $1,611.02 | $1,667.40 | $2,861.16 | $1,611.02 | $1,937.65 |

| Progressive | $1,500.44 | $1,372.26 | $3,644.62 | $1,686.77 | $2,051.02 |

| Nationwide | $2,134.01 | $2,134.01 | $3,639.60 | $2,134.01 | $2,510.41 |

| State Farm | $2,257.18 | $1,952.72 | $3,330.67 | $2,788.44 | $2,582.25 |

| Geico | $2,314.83 | $2,283.15 | $4,360.41 | $2,019.01 | $2,726.95 |

| Travelers | $2,375.27 | $2,356.22 | $4,058.44 | $2,437.94 | $2,806.97 |

| Allstate | $4,750.66 | $3,898.14 | $11,402.88 | $4,844.49 | $6,224.04 |

Remember, Winston-Salem does not allow insurance companies to consider your gender for rate calculation.

However, your age and marital status can have an impact on your insurance rates.

A 17-year-old driver is expected to pay $4,756 for auto insurance coverage. However, different insurance companies may price policy coverage differently. On average, Allstate can price a teen policy at a whopping $11,400, whereas Liberty Mutual may charge only $2,800.

Therefore, it is advisable to shop around to get the cheapest rate.

An additional point to note is a teen can expect the insurance rate to drop, on average, by 47 percent by the age of 25. However, keep in mind that several other factors will be considered, including one’s driving record, when calculating the premium rate.

Nevertheless, you shouldn’t base your insurance purchase decision solely on the price factors. Instead, focus on getting appropriate coverage and try to get the best discount for that coverage.

The best coverage will depend on a variety of factors, and we will cover salient ones in this guide.

Best Car Insurance for Commute Rates

One of the factors that can influence your policy decision is your expected annual commute. Depending on how long your yearly commute is, insurance companies may price you differently. Check auto insurance for limited use.

As discussed, different companies have slightly different risk models. Some may quote you a higher price and some a lower price based on your commute.

Shop around to get the cheapest rate for auto insurance coverage.

According to the Federal Highway Administration, the average annual mileage for a driver in North Carolina is 15,375 miles. This is slightly more than the national average of 14,132 miles.

Insurance companies may use this data as a benchmark to compare your expected annual commute.

To understand the impact of commute on your insurance rate, we partnered with Quadrant Data Solutions. Here’s the average insurance rate organized by the insurer and broken down by annual mileage:

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| Liberty Mutual | $1,937.65 | $1,937.65 | $1,937.65 |

| Progressive | $2,051.02 | $2,051.02 | $2,051.02 |

| Nationwide | $2,510.40 | $2,510.40 | $2,510.40 |

| State Farm | $2,574.56 | $2,589.95 | $2,582.26 |

| Geico | $2,726.95 | $2,726.95 | $2,726.95 |

| Travelers | $2,806.97 | $2,806.97 | $2,806.97 |

| Allstate | $6,224.04 | $6,224.04 | $6,224.04 |

The good news is almost all major insurance companies in Winston-Salem do not penalize for the additional commute. Only State Farm adds $15 for clocking in the higher annual mileage.

However, these are average rates and only account for 12,000 miles per year, which is less than the state average. You should check with your insurance company if you expect to clock in additional miles.

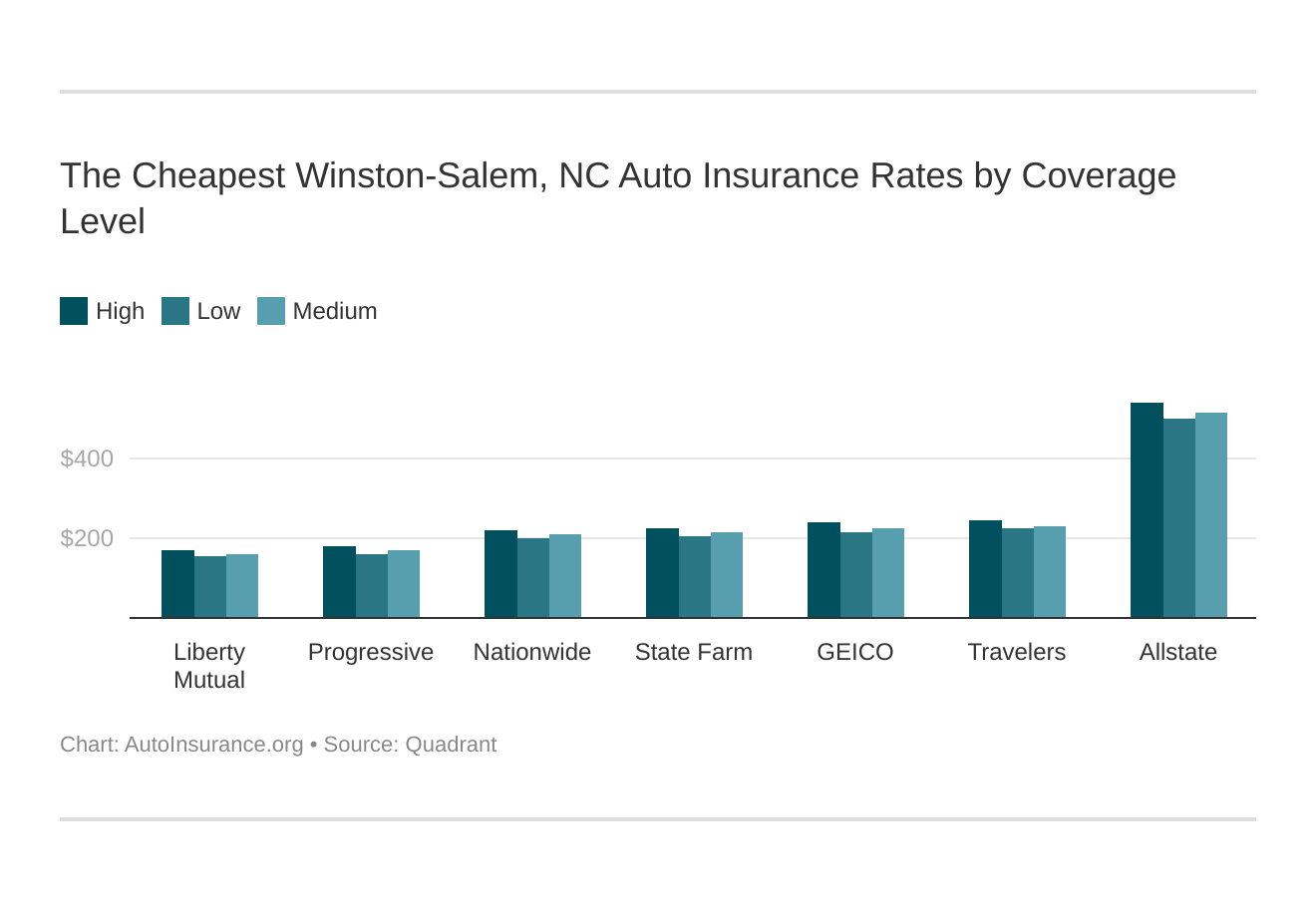

Best Car Insurance for Coverage Level Rates

Increasing coverage or supplementing your policy with add-ons increases the insurance cost.

Why?

Because any additional exposure the insurance company takes on your behalf increases their risk.

Your coverage level will play a major role in your Winston-Salem, NC auto insurance rates. Find the cheapest Winston-Salem, NC auto insurance rates by coverage level below:

However, the good news is that the difference between high and low is not considerable. Therefore, you can choose to have the best coverage to protect you and your family.

Here’s the table highlighting the rates for different coverage levels organized by insurers:

| GROUP | LOW | MEDIUM | HIGH | AVERAGE |

|---|---|---|---|---|

| Allstate | $5,980.89 | $6,197.96 | $6,493.28 | $6,224.04 |

| Travelers | $2,684.79 | $2,791.06 | $2,945.05 | $2,806.97 |

| Geico | $2,600.27 | $2,716.64 | $2,863.95 | $2,726.95 |

| State Farm | $2,472.49 | $2,568.07 | $2,706.20 | $2,582.25 |

| Nationwide | $2,404.28 | $2,496.86 | $2,630.07 | $2,510.40 |

| Progressive | $1,940.88 | $2,037.38 | $2,174.80 | $2,051.02 |

| Liberty Mutual | $1,841.97 | $1,924.80 | $2,046.19 | $1,937.65 |

As you can see, the average difference between a low and high coverage range is between $200-$500 per year. But before you make a decision, make sure you understand what low and high coverage is.

Any car insurance policy in Winston-Salem can consist of two parts:

- mandatory minimum liability insurance required to drive

- additional optional coverage that you may purchase

The minimum liability insurance that you must have to drive a car in Winston-Salem is:

- Bodily Injury Liability – $30,000 per person, $60,000 per accident

- Property Damage Liability – $25,000 per person

This can be called low coverage.

However, the minimum required coverage may not sufficient for your needs. You can buy additional liability insurance or additional optional coverage that may help you protect your investment better.

Some of the optional coverages that you can purchase are:

- Collision

- Comprehensive

- MedPay

- Uninsured/Underinsured Motorist

- Personal Injury Protection

If you add on liability coverage and opt for additional coverage, you may have bought yourself full or high coverage.

Remember, you should buy the coverage based on your requirements.

If you want to add optional coverages to your policy, shop around for the best discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

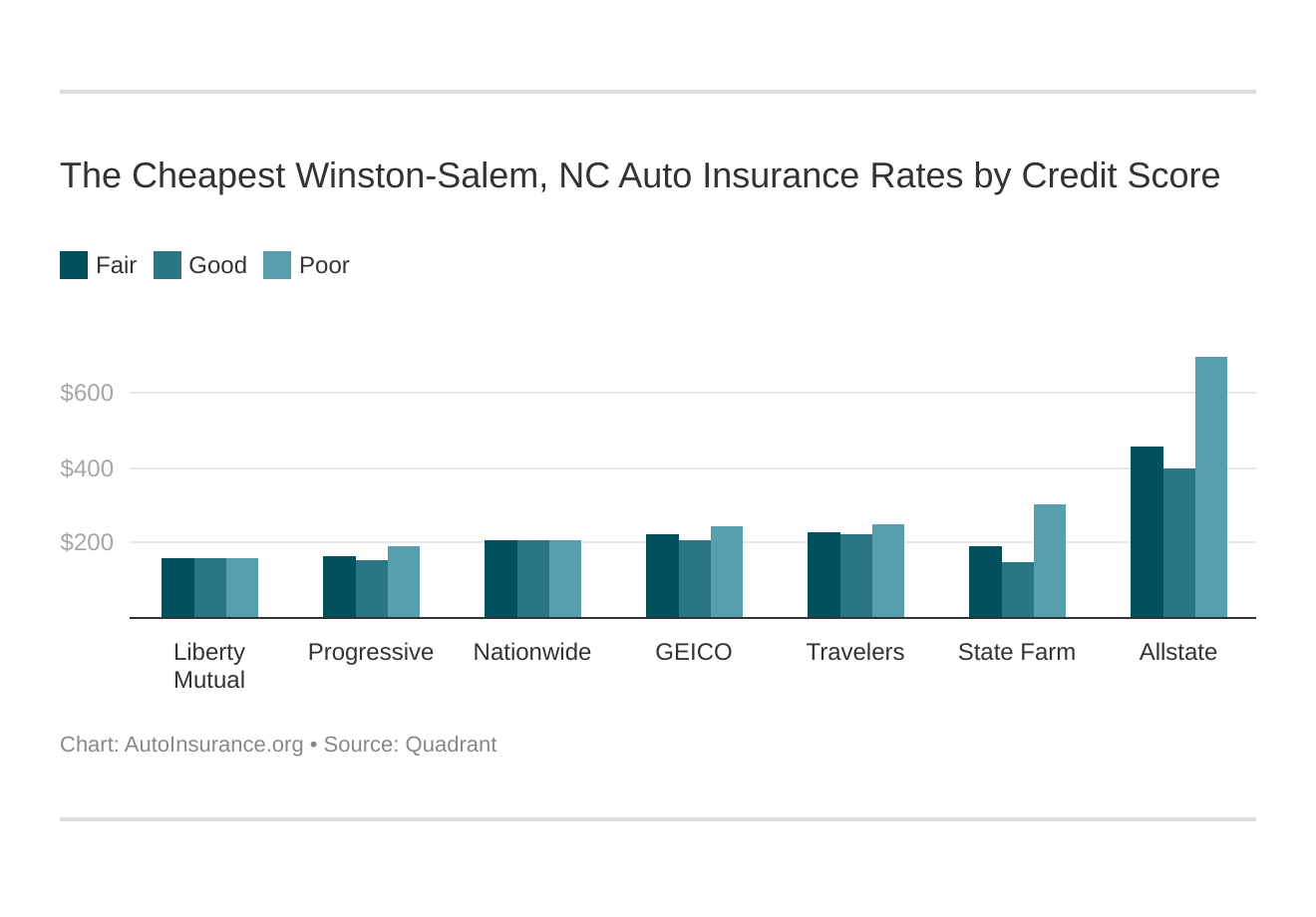

Best Car Insurance for Credit History Rates

Your credit score can have a significant impact on your auto insurance rates. Insurance companies use your credit score to understand your risk profile.

Your credit score will play a major role in your auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Winston-Salem, NC auto insurance rates by credit score below.

A high credit score indicates that you are less of a risk to the insurance companies.

The average credit score in the US is 675, while that of North Carolina is 666. If your credit score is below the average, you might attract a higher premium rate.

With the help of Quadrant Data Solutions, we analyzed the impact of your credit score on your auto insurance rate. Here’s the table indicating the average insurance rate organized by credit level and insurer:

| COMPANY | GOOD | FAIR | POOR | AVERAGE |

|---|---|---|---|---|

| Liberty Mutual | $1,937.65 | $1,937.65 | $1,937.65 | $1,937.65 |

| Progressive | $1,836.23 | $2,001.94 | $2,314.89 | $2,051.02 |

| Nationwide | $2,510.40 | $2,510.40 | $2,510.40 | $2,510.40 |

| State Farm | $1,802.42 | $2,319.02 | $3,625.33 | $2,582.26 |

| Geico | $2,510.32 | $2,713.62 | $2,956.91 | $2,726.95 |

| Travelers | $2,700.18 | $2,728.34 | $2,992.39 | $2,806.97 |

| Allstate | $4,806.26 | $5,474.35 | $8,391.51 | $6,224.04 |

Several factors impact your credit scores, and therefore, some companies do not penalize your auto insurance rates.

If you have a poor credit score, you can seek quotes from Liberty Mutual or Nationwide, as they do not seem to increase rates based on credit scores.

However, if you have poor credit, you may have to pay a steep increase if you have a policy with Allstate or State Farm, as they increase your premium by around $2,000.

Regardless, the best bet for getting a discount is to seek quotes from multiple providers and to review what they have to offer.

Our platform provides a convenient way of seeking quotes. You can start comparison shopping today using our FREE online tool. You just need your zip code below to get started!

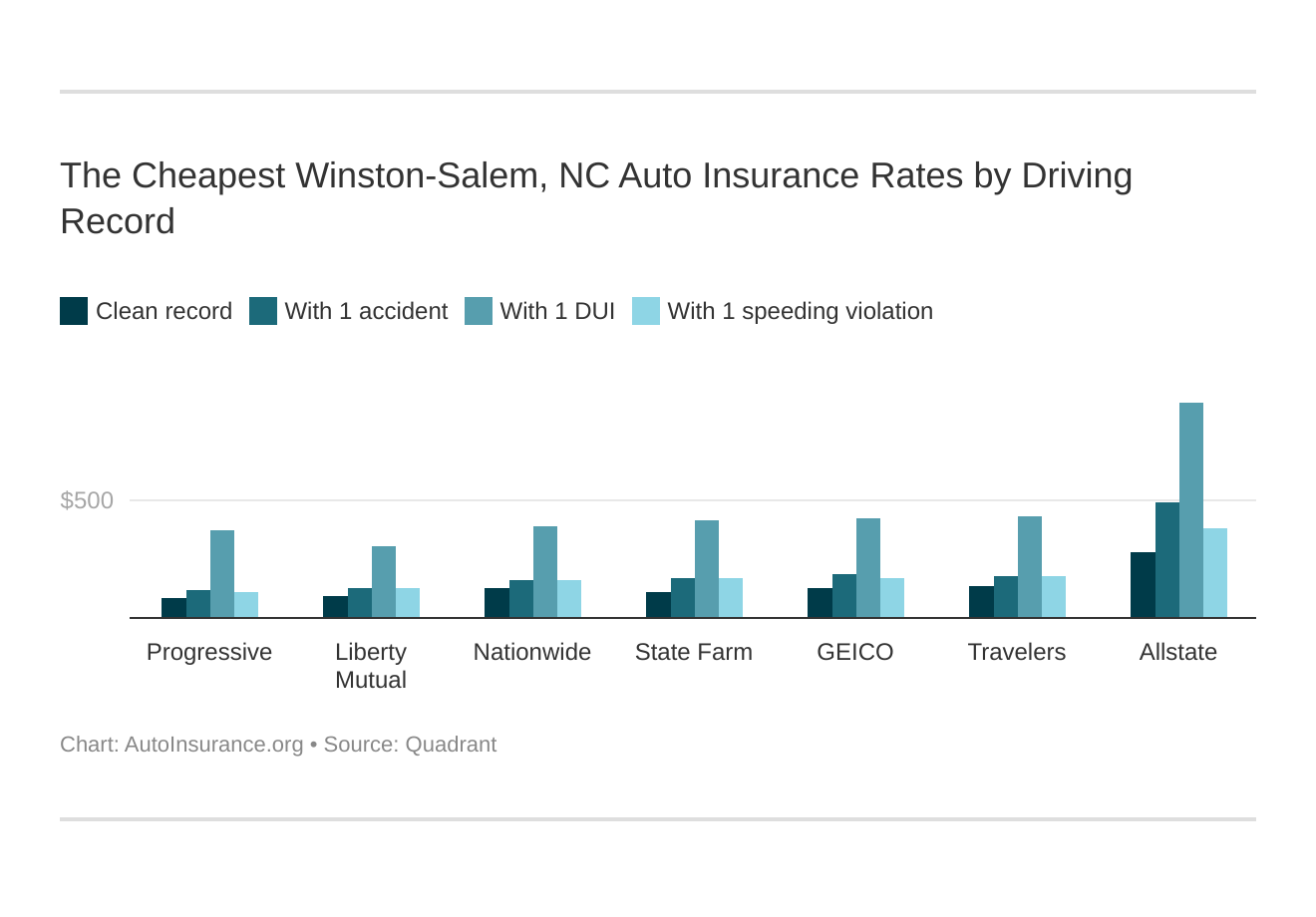

Best Car Insurance for Driving Record Rates

Your driving record is probably the biggest factor in deciding your car insurance rate.

Your driving record will play a major role in your Winston-Salem auto insurance rates. For example, other factors aside, a Winston-Salem, NC DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Winston-Salem, NC auto insurance rates by driving record.

Insurance companies will refer to your motor vehicle report (MVR) to get a summary of your driving record. An MVR will have the following information:

- Traffic tickets

- Convictions

- Accidents

- Even little things like parking tickets

Here’s the average premium rate in Winston-Salem organized by insurance providers and violations:

| COMPANY | CLEAN RECORD | WITH 1 SPEEDING VIOLATION | WITH 1 ACCIDENT | WITH 1 DUI | AVERAGE |

|---|---|---|---|---|---|

| Allstate | $3,370.40 | $4,553.78 | $5,952.80 | $11,019.20 | $6,780.80 |

| Travelers | $1,680.44 | $2,160.42 | $2,189.93 | $5,197.09 | $3,022.49 |

| Geico | $1,514.35 | $2,049.21 | $2,210.91 | $5,133.34 | $2,952.87 |

| State Farm | $1,374.01 | $1,990.38 | $1,990.38 | $4,974.24 | $2,779.54 |

| Nationwide | $1,481.81 | $1,912.13 | $1,912.13 | $4,735.55 | $2,709.83 |

| Progressive | $971.33 | $1,366.27 | $1,412.54 | $4,453.94 | $2,279.27 |

| Liberty Mutual | $1,158.17 | $1,483.92 | $1,483.92 | $3,624.58 | $2,088.89 |

If you are caught speeding, cause an accident, or drive under the influence, you will not only face fines, but your insurance rates might also shoot up.

Insurance companies penalize such actions because they indicate risky behavior that can lead to claims and losses for them.

Each insurance company may decide on the penalty differently. Therefore, if your insurance rate is increasing due to an at-fault accident, you should shop around to find the cheapest coverage.

For cases of accidents, insurance companies in Winston-Salem might increase the insurance rate by around $400-$500. Allstate is an exception, as on average, the insurer might increase the insurance rate by around $2,500.

However, if you are convicted of a DUI charge, you can expect your insurance premium to increase by around $4,000. Liberty Mutual might be the most lenient with an average increase of around $2,500.

We encourage you to drive safe not only for fines and rate hikes but for you and your family’s safety.

Car Insurance Factors in Winston-Salem

Many factors impact your car insurance rates. Some factors are directly in your control, such as driving record; however, there are external factors that are not in your control.

Factors affecting auto insurance rates in Winston-Salem, NC may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Winston-Salem, North Carolina auto insurance.

In this section, we will look at several factors relevant to Winston-Salem that might influence your auto insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Metro Report – Growth & Prosperity

According to the Bureau of Economic Analysis (BEA), the Winston-Salem metropolitan area is the 106th-largest metropolitan area by GDP.

The most prominent industries in Winston-Salem are healthcare, manufacturing, finance, hospitality, and retail.

Winston-Salem has a long and illustrious history in the economic story of our country. The city is the home of several large national brands including, BB&T Bank, HanesBrands, Krispy Kreme, Lowes Food, Reynolds American (owner of Camel cigarettes), and TW Garner Food Company.

However, the local economy has been witnessing weak economic activity in the last decade, evident by the decline in the number of jobs, the standard of living, productivity, and the gross metropolitan product.

According to the Brookings Institution, Winston-Salem ranked 87th in growth and 73rd in prosperity nationally between 2007-2017.

Prosperity (73rd)

Productivity: -0.4 percent (88th of 100)

Standard of living: -7.8 percent (90th of 100)

Average annual wage: +9.8 percent (15th of 100)

Growth (87th)

Jobs: -0.8 percent (88th of 100)

Gross metropolitan product (GMP): -1.2 percent (94th of 100)

Jobs at young firms: -23.4 percent (77th of 100)

According to the Metro Monitor Report by the Brookings Institution, while productivity and standard of living have declined at a faster rate than the national average, the average annual wage has increased in the last decade.

In the changing economic climate, you must optimize your auto insurance coverage so you get the best return for your investment.

Median Household Income

According to DataUSA, the median household income in Winston-Salem is $42,219, which is less than the national median household income of $60,336.

However, the median household income in Winston-Salem is increasing, as evident from the 2.3 percent rise in median household income between 2016 and 2017.

Nevertheless, the median household in Winston-Salem is considerably less than the median household income in North Carolina.

Consequently, the auto insurance rates in Winston-Salem are less than the average rates in North Carolina. However, given the low median household income, the residents of Winston-Salem pay a larger proportion of their income toward maintaining their auto insurance coverage.

| MEDIAN INCOME LEVEL | AVERAGE CAR INSURANCE PREMIUM | PREMIUM AS A PERCENTAGE OF INCOME | |

|---|---|---|---|

| Winston-Salem | $42,219 | $2,977.04 | 7.05% |

| North Carolina | $50,320 | $3,370.78 | 6.70% |

Homeownership in the Winston-Salem

Many of us dream of owning a home. But do you know that homeownership may have an impact on auto insurance rates?

Being a homeowner doesn’t directly impact your auto insurance rates or the ability to qualify for a plan, but it indicates financial stability and may help you get some discounts. You have to check with your insurance company to see if you are eligible for any additional discount.

According to DataUSA, the median property value in Winston-Salem is $142,200, which is considerably less than the national median property value of $193,500.

However, the lower median property value doesn’t translate into higher owner-occupied houses.

The owner-occupation of houses in Winston-Salem is 54.5 percent, which is less than the national ratio of 63.9 percent. This indicates that a lot of people in Winston-Salem live in rented accommodations.

However, homeownership is not the only way of showing financial stability. Anybody renting accommodation with steady rent payments and a high credit score may also be able to demonstrate financial stability.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Education in Winston-Salem

Winston-Salem has a long history of imparting education and continues to offer quality education opportunities.

Various universities in the city awarded 6,271 degrees in 2017, of which the most popular majors are registered nursing, business administration, and liberal arts and sciences.

The most prominent universities in Winston-Salem are Wake Forest University, Forsyth Technical Community College, and Winston-Salem State University.

Your education is an important factor in deciding your auto insurance rate. Insurance companies tend to equate higher education with a lower profile.

Wage by Race & Ethnicity in Common Jobs

In 2017, Asians were the highest-paid ethnicity in Winston-Salem, followed by White and people belonging to two or more races.

Here’s the table summarizing the average annual wage organized by ethnicity:

| RACE & ETHNICITY | AVERAGE SALARIES |

|---|---|

| Asian | $59,267 |

| White | $49,962 |

| Two or More Races | $36,539 |

Wage by Gender in Common Jobs

North Carolina is one of the seven U.S. states that do not allow insurance companies to use gender when calculating insurance rates.

However, gender still plays a role in deciding how much of your income goes toward auto insurance, because wage distribution is skewed in favor of males.

The average annual male salary in Winston-Salem is $59,982, whereas the average annual female salary is $44,729.

This means females have to pay a larger share of their income toward maintaining identical coverage in the city. Here’s the summary calculation of what an average individual has to pay for auto insurance:

| OCCUPATION | PREMIUM AS A % OF INCOME (MALE) | PREMIUM AS A % OF INCOME (FEMALE) |

|---|---|---|

| Miscellaneous managers | 2.9 | 4.0 |

| Elementary & middle school teachers | 6.2 | 9.0 |

| Retail salespersons | 6.7 | 7.3 |

As you can see, females have to pay a much larger share of their income toward maintaining auto insurance coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Poverty by Age & Gender

Around 23.3 percent of residents in the city of Winston-Salem live below the poverty line. This is considerably higher than the national poverty rate of 13.4 percent.

The three largest demographics living in poverty in the city are females aged 25-35, 18-24, and six to 11. Alarmingly, Winston-Salem has one of the worst child poverty rates in the country.

The auto insurance premium takes a larger share of the household income for living below the poverty line. Additionally, the premiums may be higher than average for people in poverty, as factors such as credit score, financial stability, etc. might increase their risk profile.

Poverty by Race & Ethnicity

Poverty in Winston-Salem is also prevalent across different ethnicities. However, people from Black, White, and Hispanic ethnicities constitute around 91 percent of the people living below the poverty line in Winston-Salem.

Here’s the summary of poverty among different ethnicities and races in Winston-Salem:

| Race or ethnicity | Share of Poverty in Winston-Salem (%) |

|---|---|

| Black | 34.5 |

| White | 33.8 |

| Hispanic | 22.6 |

| Other | 6.03 |

| Two or more | 1.74 |

| Asian | 0.84 |

| Native American | 0.29 |

| Pacific Islander | 0.18 |

Employment by Occupations

In 2017, there were 106,000 people employed in Winston-Salem across various occupations.

The top three occupations that employ Winston-Salem are office & administration support, sales, and management. Winston-Salem, being a retirement community, has an unusually high number of people employed in healthcare services.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Driving in Winston-Salem

We talked about factors specific to you and the city. Still another set of factors insurance companies take into consideration are about the car you drive, how much you drive, and the local road conditions.

In this section on driving in Winston-Salem, we will discuss the road conditions, speed traps, vehicle thefts, and much more.

Roads in Winston-Salem

There are always some roads that are better than others on account of the road condition or traffic. Want to know which roads to take in Winston-Salem?

In this section, we will discuss the main roads in the city and the respective road conditions.

Major Highways in Winston-Salem

The fifth-most populous city in North Carolina is connected through several major highways and interstates. It is well connected with major cities on the east coast through a network of interstates and highways.

Here’s the map of interstates and highways connecting the city:

The U.S. 52 passes north-south through the downtown of Winston-Salem, while U.S. 421 is the east-west freeway also passing through downtown. The I-40 is another major interstate that connects the city with Greensboro and Raleigh.

In 2014, the North Carolina Department of Transportation started constructing the Winston-Salem Northern Beltway, which is a multi-lane freeway that loops around the northern part of Winston-Salem. The $1.74 billion project is expected to reduce congestion and improve road safety.

The major highways and roads around Winston-Salem are Silas Creek Parkway & Reynolda Road (NC 67), Peters Creek Parkway( NC 150), Stratford Road (U.S. 158), University Parkway, Hanes Mall Boulevard, Martin Luther King Jr. Drive, North Point Boulevard, Country Club Road, Jonestown Road, Patterson Avenue, Fourth Street, Trade Street, Third Street, Liberty Street, and Main Street.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Popular Road Trips and Sites

Winston-Salem has a rich cultural and business history that you can explore in the city.

The city was a Moravian settlement in the 18th century, and you can find buildings and events that can take you back in time. You can explore the Historic Bethabara Park, a National Historic Landmark, to see the archaeological remains of a small Moravian community.

The city is also known for its art and theater. You can see many museums and art galleries in the city, including:

- Reynolda House Museum of American Art

- The Museum of Early Southern Decorative Arts (MESDA)

- The Southeastern Center for Contemporary Art

Here’s a quick video on some of the things that you can do while in Winston-Salem:

Road Conditions in Winston-Salem

According to TRIP, a national transportation research group, around 60 percent of the roads in Winston-Salem are either in poor or mediocre condition.

| ROAD CONDITION | POOR | MEDIOCRE | FAIR | GOOD |

|---|---|---|---|---|

| Winston-Salem, NC | 29% | 31% | 11% | 29% |

Due to the bad roads, residents of the city have to spend around $435 to maintain their vehicles.

Does Winston-Salem use speeding or red-light cameras?

The city of Winston-Salem doesn’t use red-light or speeding cameras.

Instead, the city uses wireless traffic signals that help optimize the traffic flow and reduce the time wasted waiting for the traffic lights to turn green. It saves fuel and time and reduces emissions for the residents of the city.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Vehicles in Winston-Salem

Residents of Winston-Salem use cars for their daily commute. More than 82 percent of people prefer to drive alone to work, whereas only 1.8 percent of people take public transit.

Since public transportation is probably inadequate, residents prefer to drive their cars.

In the following section, we will discuss how the car you drive can influence your car insurance rate.

Most Popular Vehicles Owned

While we could not find data for the most popular car in Winston-Salem, the Jeep Grand Cherokee is the most preferred car in Greenboro – the closest city in the Piedmont Triad area.

The choice of car is understandable, given that the focus is not on fuel efficiency but on reliability and ease of driving. Since the cities in the area are not as big as New York City or Los Angeles, you can afford to focus on cars that are bigger and less fuel-efficient, but reliable.

Which vehicle you drive has a significant impact on your car insurance rates. If you drive a Honda Civic, you’ll be measured by insurance companies differently than if you drive a Dodge Viper.

How Many Cars Per Household

Given the importance of cars in Winston-Salem, most of the households own two cars, which is in line with the national average for a household.

It is understandable since the city doesn’t have an extensive transportation network.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Households Without a Car

The lack of public transportation is why many residents of the city prefer to own a car. However, around 9 percent of the residents do not own a car.

Not owning a car doesn’t mean you shouldn’t purchase auto coverage. If you only drive occasionally, you can buy a non-owners coverage so you do not have to purchase the expensive waivers at the rental booths.

Speed Traps in Winston-Salem

If you are caught speeding, insurance companies may increase the rates on the insurance policy.

However, driving at a safe speed is not just about the rate hike but about the general wellbeing of yourself and your family. Always follow the posted speed limits.

The city of Winston-Salem wants the motorists in the city to drive safe and follow speed limits. This is why they have several speed traps around the city.

According to the website speedtrap.org, when it comes to speed traps, Winston-Salem ranks third among the cities in North Carolina.

Vehicle Theft in Winston-Salem

According to the neighborhoodscout.com crime index, Winston-Salem is safer than only 7 percent of U.S. cities.

The high crime rate is also related to vehicle thefts in the city. Therefore, it is important to consider vehicles that are low on the theft list. If the risk of theft is high, so will be your insurance premium.

In Winston-Salem, the chance of becoming a victim of violent crime is one in 164, whereas it is one in 275 for North Carolina. However, if you consider property crimes as well, your chance of becoming a victim increases to one in 23 in Winston-Salem.

Property crimes include burglary, larceny over $50, motor vehicle theft, and arson.

However, there are neighborhoods in the city that have a comparatively lower crime rate. The 10 safest neighborhoods in Winston-Salem are:

- Reynolda Rd / Transou Rd

- Robinhood Rd / Meadowlark Dr

- Mount Tabor

- Old Lexington Rd / Gumtree Rd

- Saponi Village Ct / Hogan Point Dr

- Fosterdale Ln / Blue Stone Ln

- Glenn High Rd / Union Cross Rd

- N Peace Haven Rd / Archer Rd

- N Peace Haven Rd / Commonwealth Dr

- Jonestown

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Traffic in Winston-Salem

Nobody likes getting stuck in traffic.

It is tiring and stressful when you can’t do something productive with your time.

Traffic Congestion

A good thing about living in Winston-Salem is that you don’t have to get stuck in traffic like you have to in New York or LA.

According to TomTom, Winston-Salem ranks 88th (out of 93 listed) in the country when it comes to traffic congestion. The congestion level in the Dash is only at 10 percent.

If you keep on the highway, you will have a better chance to avoid traffic, as the congestion level is only 4 percent. However, the congestion level for non-highway roads is slightly higher at 16 percent.

Due to peak hour traffic congestion, motorists in Winston-Salem stand to lose four minutes every 30 minutes in the morning and eight minutes in the evening.

Transportation

The lower congestion levels in Winston-Salem means people ideally spend less time in their daily commute.

According to DataUSA, commuters in Winston-Salem spend only 19.6 minutes in their daily commute. This is considerably less than the average commute time of 25.1 minutes that a typical US worker spends in their daily commute.

The majority of daily commuters spend only between 10-19 minutes getting to work. Because of the low traffic congestion, many commuters prefer to drive alone to work.

More than 82 percent of people prefer to drive alone to work in Winston-Salem.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Busiest Highways

University Parkway and North Point Boulevard are the busiest highways in Winston-Salem and see around 70,000 cars ply on them every day.

How safe are Winston-Salem streets & roads?

Winston-Salem is the county seat of Forsyth County. Unfortunately, Forsyth County is the sixth-worst county in North Carolina for traffic fatalities.

| North Carolina Counties by 2018 Ranking | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Mecklenburg County | 69 | 80 | 103 | 114 | 115 |

| Wake County | 63 | 65 | 81 | 53 | 66 |

| Guilford County | 57 | 57 | 59 | 66 | 60 |

| Robeson County | 32 | 53 | 38 | 53 | 49 |

| Cumberland County | 40 | 43 | 43 | 43 | 46 |

| Forsyth County | 34 | 40 | 42 | 42 | 45 |

| Harnett County | 23 | 23 | 22 | 34 | 37 |

| Buncombe County | 29 | 36 | 25 | 32 | 34 |

| Davidson County | 24 | 28 | 34 | 23 | 34 |

| Johnston County | 36 | 27 | 34 | 32 | 34 |

| Top Ten Counties | 418 | 474 | 496 | 500 | 520 |

| All Other Counties | 866 | 905 | 954 | 912 | 917 |

| All Counties | 1,284 | 1,379 | 1,450 | 1,412 | 1,437 |

According to the National Highway Traffic Safety Administration, between 2014 and 2018, Forsyth County saw an average of around 40 fatalities per year.

Here are the biggest causes of traffic-related fatalities in Forsyth County:

| 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|

| Fatalities (All Crashes) | 34 | 40 | 42 | 42 | 45 |

| Fatalities in Crashes Involving an Alcohol-Impaired Driver | 12 | 10 | 16 | 13 | 16 |

| Single Vehicle Crash Fatalities | 20 | 17 | 17 | 23 | 22 |

| Fatalities in Crashes Involving a Large Truck by County for 2017 | 4 | 6 | 6 | 3 | 6 |

| Fatalities in Crashes Involving Speeding | 12 | 10 | 14 | 11 | 14 |

| Fatalities in Crashes Involving an Intersection | 4 | 10 | 9 | 7 | 4 |

| Passenger Car Occupant Fatalities | 17 | 13 | 18 | 17 | 20 |

| Pedestrian Fatalities | 4 | 8 | 6 | 6 | 12 |

Single-vehicle crashes are one of the most fatal kinds of accidents in Forsyth County. Probably the reason that single-vehicle crashes are so high is because of the alcohol-impaired driving.

According to the National Highway Traffic Safety Administration, local roads are the most dangerous in Forsyth County.

| Roads | Fatalities |

|---|---|

| RURAL INTERSTATE | 0 |

| URBAN INTERSTATE | 2 |

| FREEWAY/EXPRESSWAY | 3 |

| OTHER | 10 |

| MINOR ARTERIAL | 1 |

| COLLECTOR ARTERIAL | 2 |

| LOCAL | 24 |

| UNKNOWN | 0 |

| TOTAL | 42 |

To understand how NHTSA classifies different types of roads, you can read the definition on their website.

Allstate America’s Best Drivers Report

To understand driver behavior, Allstate conducts a study that covers 200 cities in the country.

Here’s how Winston-Salem performed in the latest Allstate report:

| City | Winston-Salem |

|---|---|

| 2018 Best Drivers Report Ranking | 28th |

| Average Years Between Claims | 11.1 |

The good news is that driving behavior is among the best drivers in the country. According to the study, drivers in Winston-Salem rank 28th of 200 cities in the country.

The better driving behavior in Winston-Salem results in average driver spending 11.1 years between claims, whereas the national average is 10.6 years.

Less accidents mean lower premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ridesharing

Ridesharing is an excellent alternative to public transportation. It can not only lower congestion but also helps in reducing emissions.

Here’s the list of ridesharing companies available in Winston-Salem:

- Blacklane

- Lyft

- Traditional taxis

- Uber

E-star Repair Shops

Esurance has also put together a repair shop network called E-star, which is a list of reputable and top-quality repair shops near your location.

If your car breaks down, you can use the E-star to connect with a repair shop near your location.

Winston-Salem has one E-star Repair Shop: Carolinas Collision Center at North Point. They are reachable at (336) 759-2993 and located at 7600 Phoenix Drive, Winston-Salem, NC.

Weather in Winston-Salem

Winston-Salem has a humid subtropical climate characterized by moderately cold winters, and hot, humid summers. The temperature varies between a minimum of 28F to a maximum of 88F.

Here’s the quick summary of the Winston-Salem weather:

| WEATHER FACTS | DETAILS |

|---|---|

| Annual High Temperature | 69.7°F |

| Annual Low Temperature | 49.4°F |

| Average Temperature | 59.5°F |

| Average Annual Rainfall | 46.9 inches |

| Average Snowfall | 6 inches |

| Sunshine days | 216 days |

Forsyth County has witnessed natural disasters in-line with the national average. The main causes of natural disasters in Winston-Salem are Hurricanes (6), Droughts (2), Blizzard (1), Flood (1), Freeze (1), and Ice Storm (1).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Public Transit in Winston-Salem

Winston-Salem Transit Authority manages public transportation in the city of Winston-Salem and manages a little over 32 routes.

Here’s the quick snapshot of the WTSA fares:

| TAP VALIDITY | FARE |

|---|---|

| 1-Way | $1.00 |

| 30-Day Pass | $30 |

| 10 Ride Pass | $10 |

You can purchase a single-fare for $1 with free transfers. You can also purchase 10-ride or 30-day passes for $10 and $20 respectively. The elderly and differently-abled passengers can avail of a 50 percent discount on the fare with valid IDs and Medicare cards.

Cost of Alternate Transportation in Winston-Salem

Electric scooters and bicycles have thus far been not allowed in the city of Winston-Salem.

However, the city has recently allowed Zagster to put out 100 spin scooters for public use. Another company called VeoRide has applied to begin operations in the city.

Dockless scooters in the city can now be used by the public subject to the following restrictions:

- You can only use the scooters between 6:00 a.m. and 9:00 p.m.

- You must be 16 years or older

- You cannot use them on sidewalks, on greenways, in Old Salem, or public parks

- You must obey stoplights, stop signs, and all other traffic laws

- You must yield to pedestrians in the public right-of-way

- You must not leave the scooters where they will block sidewalks, driveways or curbside parking

- Although not legally required, you are encouraged to wear helmets

Parking in Winston-Salem

You can use the city-owned parking facilities in downtown Winston-Salem. You use one of the 800 parking meters in the city to pay the fee using cash or credit.

You can also use mobile applications to book parking ahead of time. Some of the apps you can use are:

- Park Mobile

- Parking.com

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Air Quality in Winston-Salem

It is a known fact that vehicle emissions contribute to pollution in our cities. With so many people using cars for transportation, the local pollution levels increase in large cities.

According to the Environmental Protection Agency, the good news is that residents of Winston-Salem enjoy year-long good quality air.

In the last three years, there have been no days where the air quality dropped to unhealthy or very unhealthy levels. Here’s the summary of the air quality in Winston-Salem:

| YEAR | GOOD | MODERATE | UNHEALTHY FOR SENSITIVE GROUPS | UNHEALTHY | VERY UNHEALTHY |

|---|---|---|---|---|---|

| 2018 | 233 | 130 | 2 | 0 | 0 |

Military/Veterans

Although there are no military bases in or near Winston-Salem, the city is home to several veterans. We are deeply thankful to all who have served!

The majority of the veterans living in Winston-Salem have seen action during Vietnam and the Second Gulf War.

Be sure to check with the following insurers, as these provide discounts for veterans and active military personnel:

- USAA

- Allstate

- Esurance

- Farmers Insurance

- Geico

- Liberty Mutual

- Metlife

- State Farm

- The General

USAA is generally the most cost-effective insurer for military personnel; however, in North Carolina, you can seek quotes from Liberty Mutual and Progressive for the maximum discount.

Here’s the summary of average insurance rates in North Carolina:

| AVERAGE ANNUAL PREMIUM ($3,393.11) | HIGHER/LOWER (%) | |

|---|---|---|

| Allstate | $7,190.43 | 111.91 |

| Nationwide | $2,848.03 | -16.06 |

| Geico | $2,936.69 | -13.45 |

| Liberty Mutual | $2,182.71 | -35.67 |

| StateFarm | $3,078.65 | -9.27 |

| Progressive | $2,382.61 | -29.78 |

| Travelers | $3,132.66 | -7.68 |

Liberty Mutual and Progressive may provide the most cost-effective auto insurance in North Carolina, followed by Nationwide and Geico.

However, remember these are average rates for North Carolina, and the average rates and discounts for your case in Winston-Salem might differ.

Unique City Laws

Every city in the states has some unique laws. If you are new to Winston-Salem, you will find this section illuminating.

Do you know that it is illegal for kids below seven to attend college in the Dash.

Here are some unique laws in Winston-Salem:

– Handheld Device Laws

North Carolina is one of the few states that still allow drivers over the age of 18 to use handheld phones or hands-free phones to talk and to use navigation systems.

However, texting while driving is illegal in North Carolina.

Remember, handheld devices are still banned for drivers under the age of 18.

It is a primary offense, which means that police can stop and give you a ticket for using your handheld devices illegally.

– Food Trucks

Food trucks and food-truck festivals are getting popular in the city. The city has several steady locations where locals and visitors can find many food trucks:

- Krankie’s Airstream on Reynolda Road

- Downtown Winston-Salem Food Truck Fridays from 6-9 p.m. at the corner of Fourth Street and Broad Street

- Bailey Park

- Burke Street Food Truck Festival

To know more about the specific permits or to start a food truck journey of your own, you can visit the City of Winston-Salem’s website.

– Tiny Homes

Tiny Homes are gaining popularity across various cities in the U.S. However, the City of Winston-Salem is yet to come out with rules to legalize the activity. Tiny homes are still tagged as RVs, and according to the law, living full-time in RV is not legal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Winston-Salem Car Insurance FAQs

Here are some routinely asked questions on car insurance in Winston-Salem.

Is North Carolina a no-fault or at-fault state?

North Carolina is an at-fault state that follows contributory negligence. This means that North Carolina follows a system of assigning a degree of fault to every driver involved in an accident.

What is the minimum amount of coverage required to drive in Winston-Salem?

According to the North Carolina Department of Transportation, the minimum liability coverage that you must have are:

- Bodily injury per person: $30,000

- Total bodily injury per accident: $60,000

- Property damage: $25,000

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Who has the most affordable auto insurance in Winston-Salem?

Each insurance company may offer a rate based on your unique factors. However, on average, Liberty Mutual and USAA are the cheapest providers in Winston-Salem.

How can I get insurance if insurance companies deny coverage?

First, you should shop around to see if some insurance company can provide you coverage in the voluntary market.

If you are unsuccessful, you can opt for the North Carolina High-Risk Auto Insurance, where you will be assigned to an insurance provider. You will receive the same coverage; however, your premiums will be higher than the average rates.

What happens if I don’t have auto insurance?

Driving without insurance (or letting your coverage lapse) while maintaining registration is illegal in North Carolina. You can attract civil penalties, license suspension, and jail time.

Now that you know about car insurance in Winston-Salem, you can start comparison shopping today using our FREE online tool. Enter your zip code below to get started.

Frequently Asked Questions

How safe are Winston-Salem streets and roads?

Road safety can vary, so it’s important to drive cautiously, follow traffic laws, and stay informed about local road conditions and advisories.

What are the popular vehicles in Winston-Salem?

Specific data may not be available, but popular vehicle brands and models in the US include Ford F-150, Chevrolet Silverado, Honda Accord, Toyota Camry, and Nissan Altima.

What are the penalties for driving without insurance in North Carolina?

Driving without insurance in North Carolina is illegal and can result in fines, license and vehicle registration suspension, and personal liability for damages in an accident.

How can I get insurance if I’m denied coverage?

If denied coverage, you may qualify for insurance through the North Carolina Reinsurance Facility (NCRF) or high-risk pool.

Who has the most affordable auto insurance in Winston-Salem?

The most affordable auto insurance company varies based on personal factors, so it’s best to compare quotes from multiple companies.

What is the minimum coverage required in Winston-Salem?

The minimum auto insurance in Winston-Salem is 30/60/25, which means $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage liability.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.