Fayetteville, NC Auto Insurance (2024)

The cheapest auto insurance in Fayetteville, NC is Liberty Mutual, although rates will vary based on factors such as age, driving record, and credit score. Drivers in Fayetteville, NC must meet the minimum required liability insurance of 30/60/25, although more coverage is recommended. Compare online quotes to find the best Fayetteville, NC auto insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Jun 22, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 22, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The cheapest Fayetteville, NC auto insurance company is Liberty Mutual

- Fayetteville has short commute times and is not very congested

- Average auto insurance in Fayetteville is higher than the state average but lower than the national average

Fayetteville, NC auto insurance can be higher than the North Carolina average, partly due to Fort Bragg. There are a large number of young male drivers in the area, which tends to raise rates.

There are many ways to save on your Fayetteville, North Carolina auto insurance, including shopping around, asking for discounts, and comparing rates. Keep reading to learn how to find cheap auto insurance in Fayetteville regardless of age, driving record, or credit history.

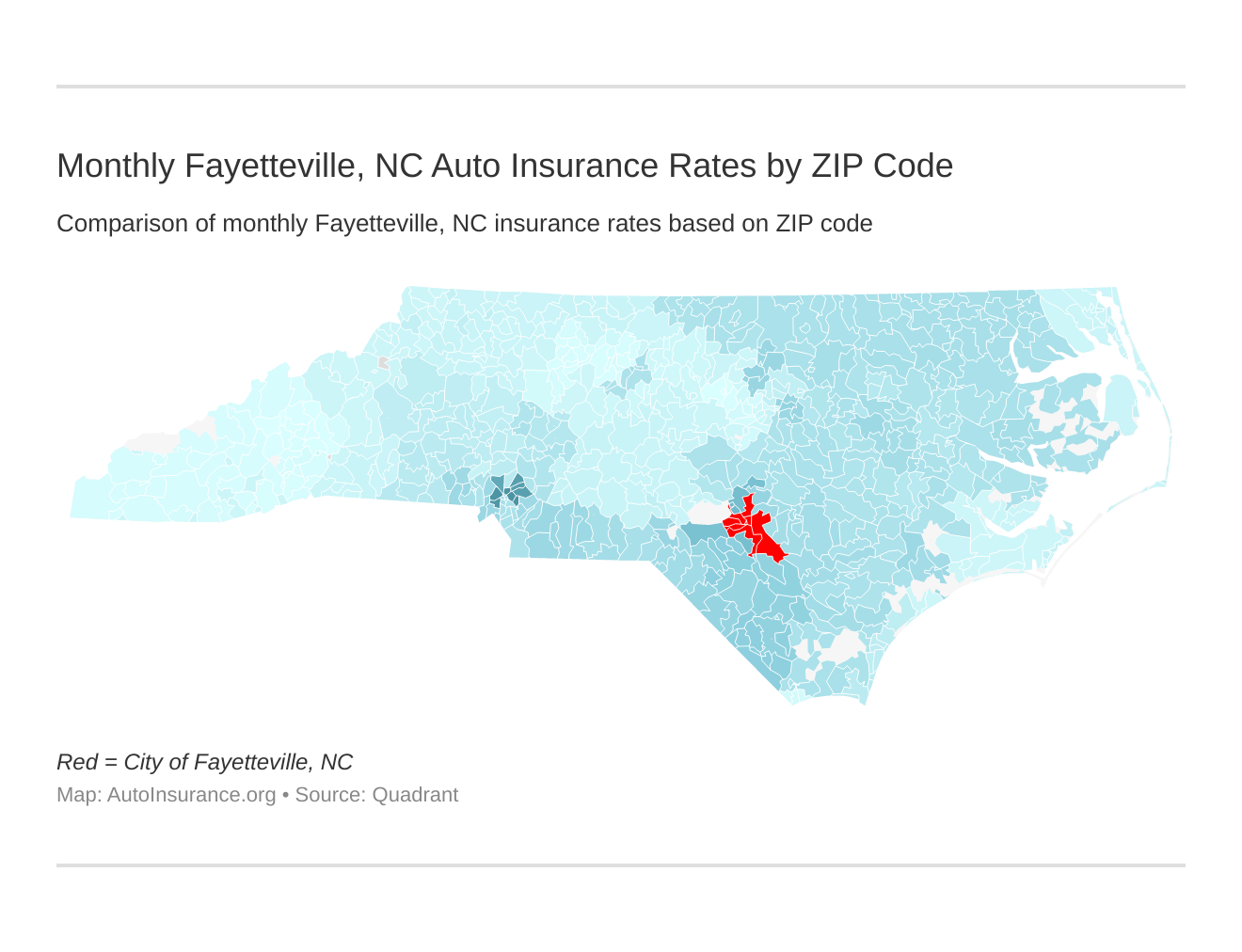

Monthly Fayetteville, NC Car Insurance Rates by ZIP Code

Find more info about the monthly Fayetteville, NC car insurance rates by ZIP Code below:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

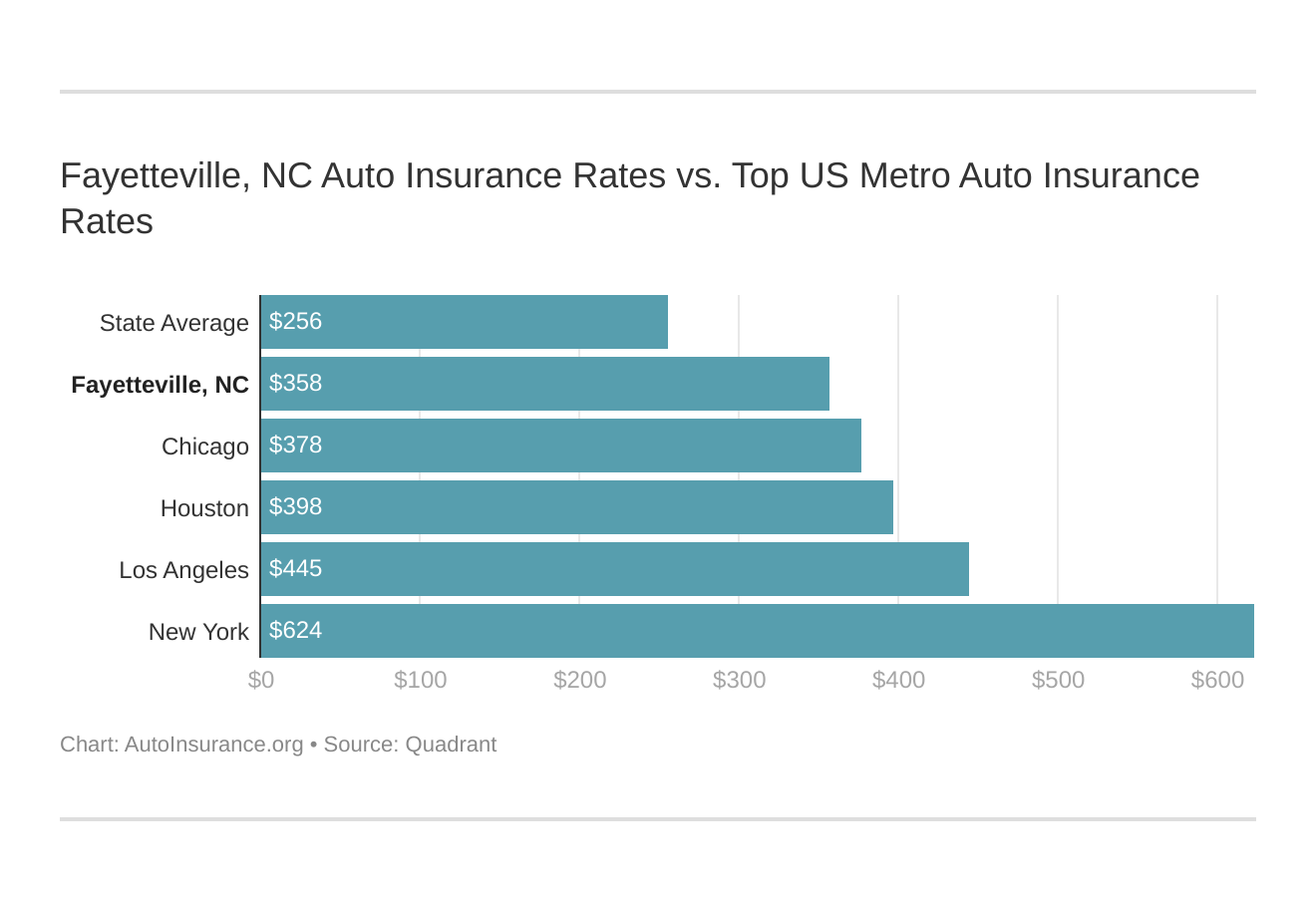

Fayetteville, NC Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare Fayetteville, NC against other top US metro areas’ auto insurance rates.

Enter your ZIP code now to compare Fayetteville, NC auto insurance quotes.

What is the cheapest auto insurance company in Fayetteville, NC?

Liberty Mutual has the lowest auto insurance in Fayetteville, NC based on average rates.

The cheapest Fayetteville, NC auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average North Carolina auto insurance company rates?” We cover that as well.

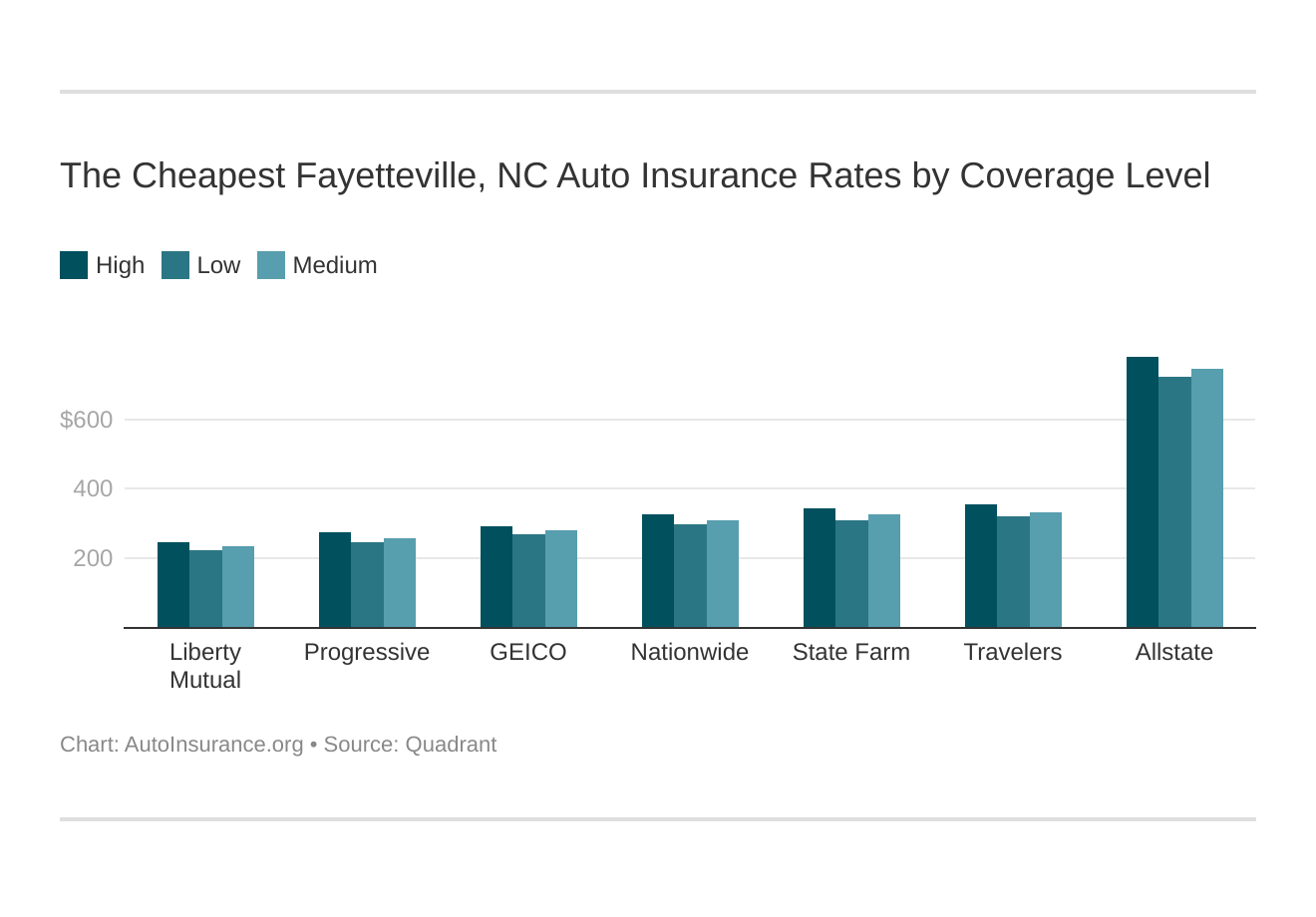

These are the top Fayetteville, NC auto insurance companies ranked from cheapest to most expensive:

- Liberty Mutual – $2,815.72

- Progressive – $3,122.13

- Geico – $3,364.58

- Nationwide – $3,754.57

- State Farm – $3,926.88

- Travelers – $4,040.19

- Allstate – $9,007.01

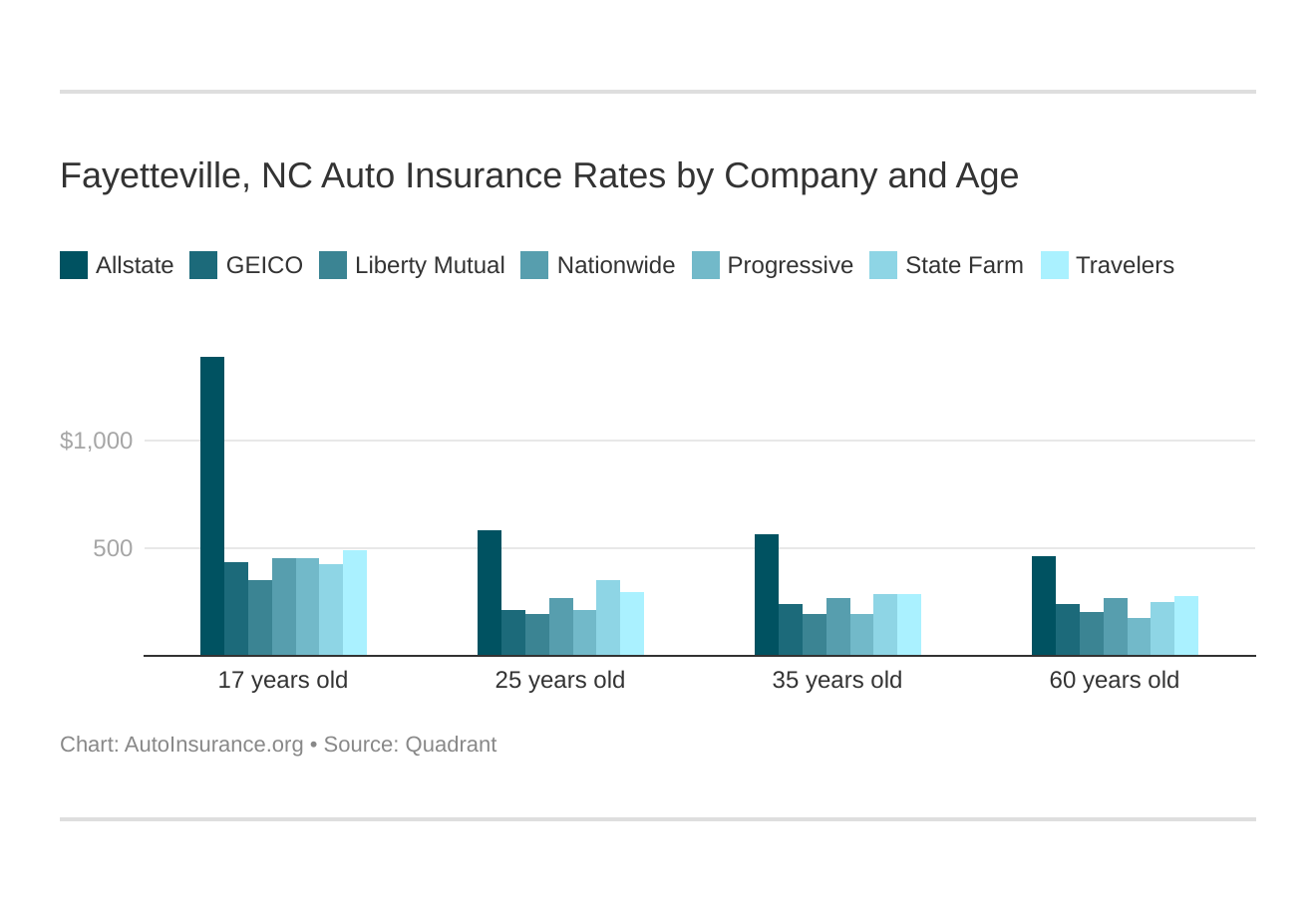

There are many different factors that affect your auto insurance rates. Your age, gender, marital status, credit score, where you live, and driving history can all be used to determine how much you pay.

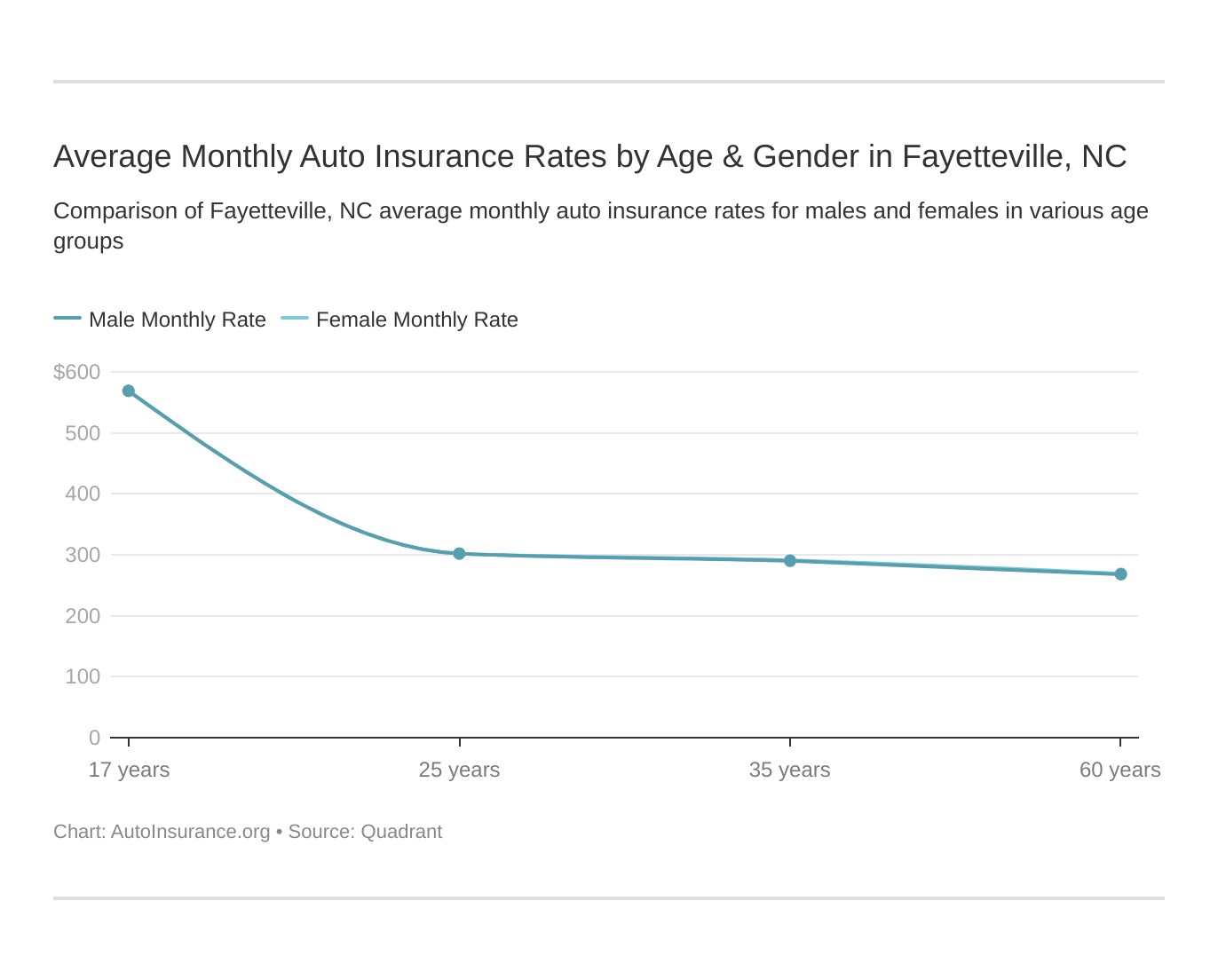

Young male drivers tend to pay the most in auto insurance, which contributes to the high rates in Fayetteville.

Each company will offer different prices, so compare multiple companies to find affordable Fayetteville, NC auto insurance.

Fayetteville, North Carolina auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Your coverage level will play a significant role in your Fayetteville, NC auto insurance rates. Find the cheapest Fayetteville, NC auto insurance rates by coverage level below:

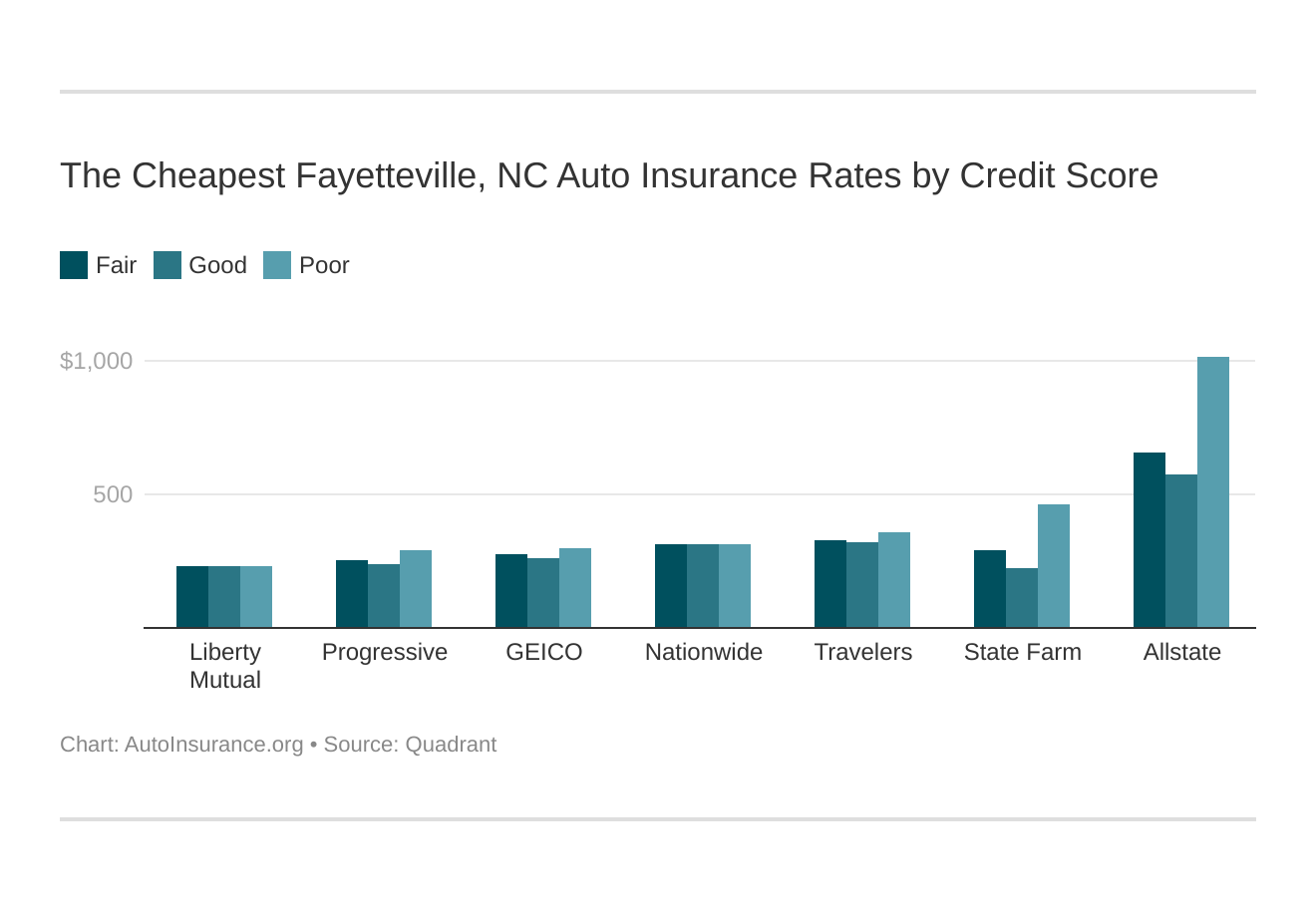

Your credit score will play a major role in your Fayetteville, NC auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Fayetteville, North Carolina auto insurance rates by credit score below.

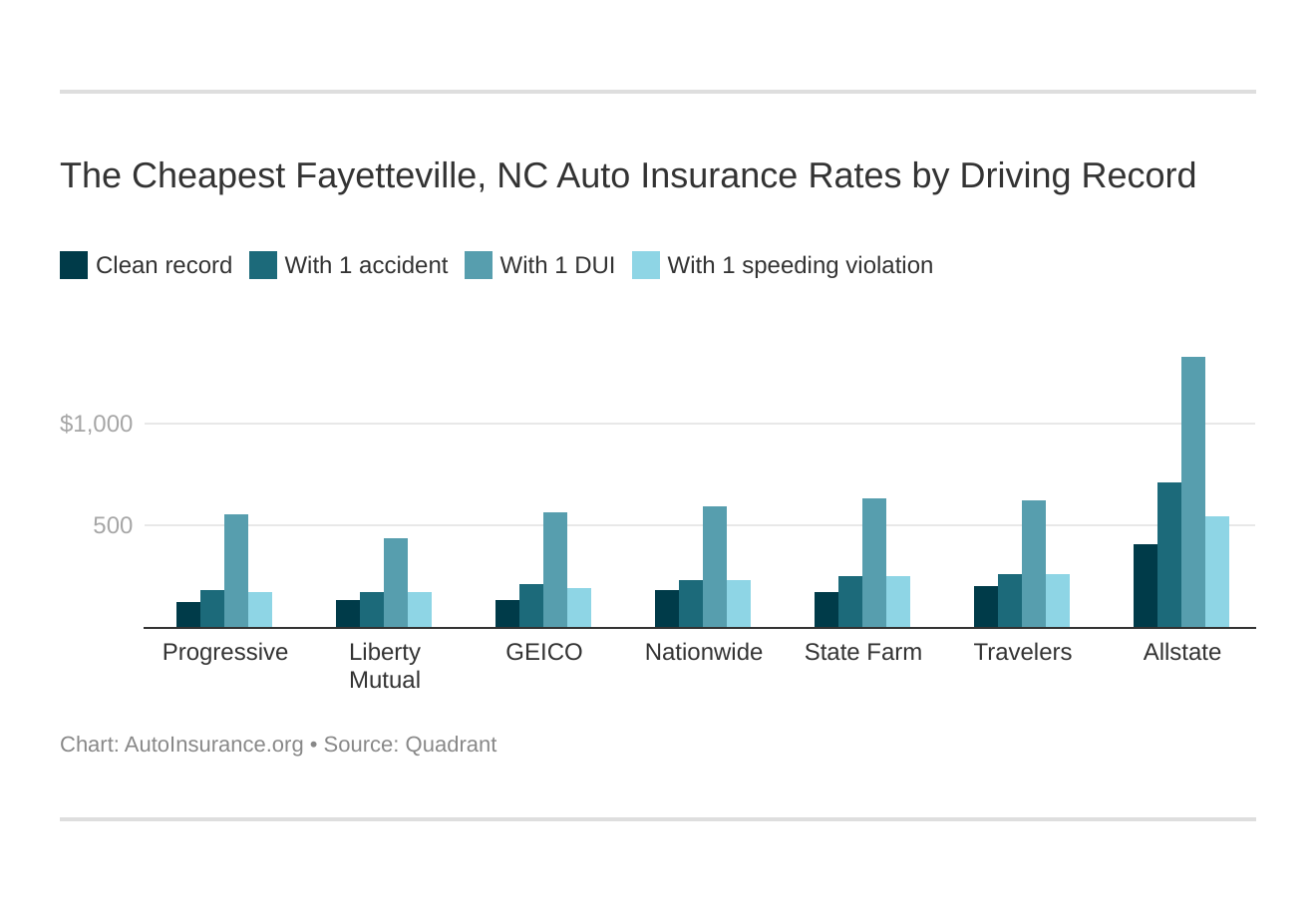

Your driving record will affect your Fayetteville auto insurance rates. For example, a Fayetteville, NC DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Fayetteville, North Carolina auto insurance rates by driving record.

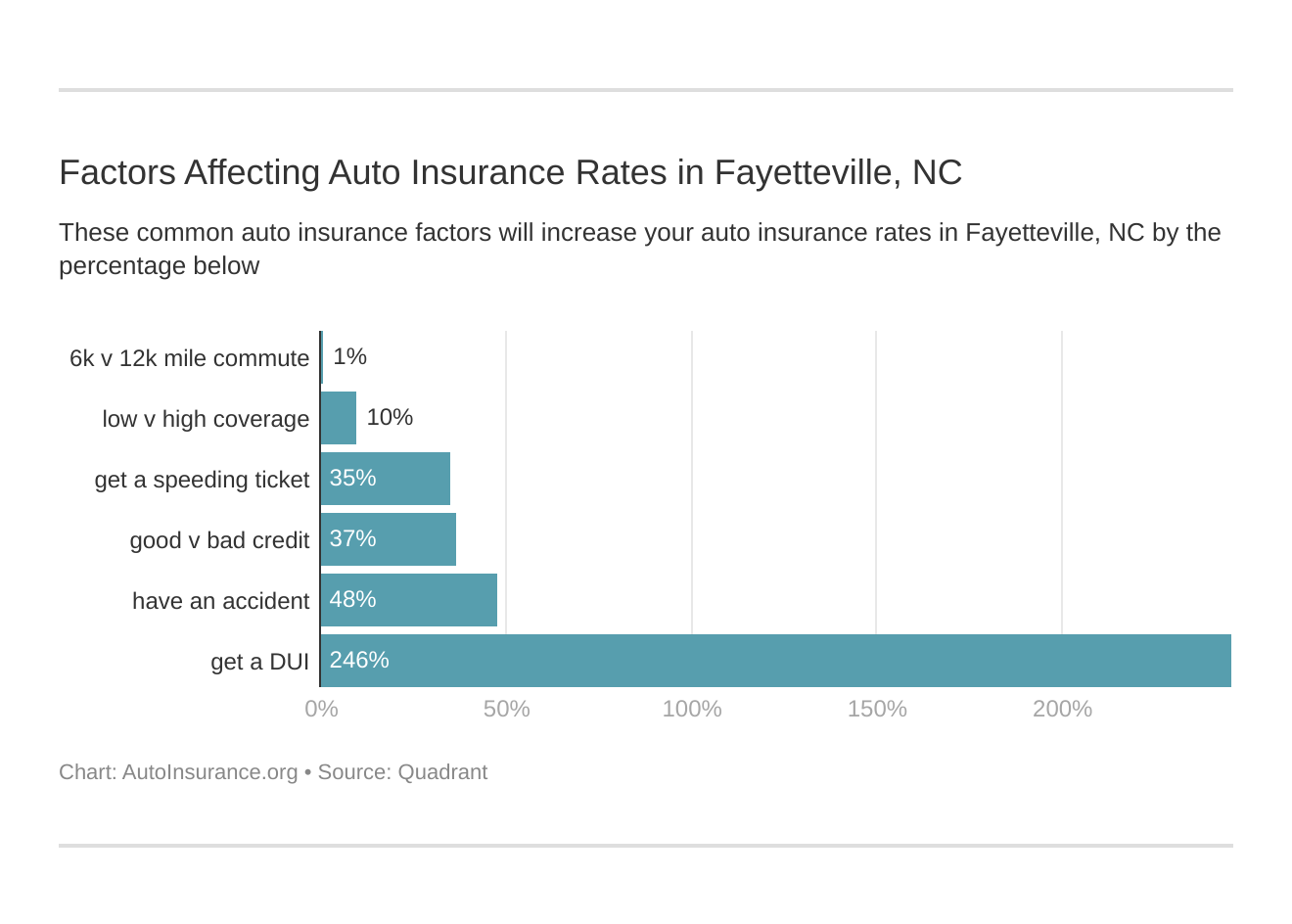

Factors affecting auto insurance rates in Fayetteville, NC may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Fayetteville, North Carolina auto insurance.

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Fayetteville. North Carolina does not use gender, so check out the average monthly auto insurance rates by age and gender in Fayetteville, NC.

What auto insurance coverage is required in Fayetteville, NC?

In order to drive in North Carolina, drivers have to carry a minimum level of auto insurance.

The minimum amount of car insurance NC drivers have to carry is:

- $30,000 per person and $60,000 per incident for bodily injury liability

- $25,000 per incident for property damage

Although carrying these amounts of coverage will allow you to drive legally, you can see that you would exhaust those limits fairly quickly in a serious accident.

It’s recommended that you carry more than the bare minimum auto insurance to keep accident costs as low as possible.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What affects auto insurance rates in Fayetteville, NC?

Traffic in Fayetteville isn’t that bad. Drivers don’t have long wait times on a daily basis.

INRIX ranks Fayetteville as the 191st most congested city in the country, which is great news for drivers.

According to City-Data, the average commute time for Fayetteville drivers is under 20 minutes.

There is public transportation available in Fayetteville, but most people drive their own cars.

Auto theft can also affect your car insurance rates. Auto insurance companies will charge more in cities that experience a large number of thefts. According to the FBI, there were 415 vehicle thefts in 2017, the last year data is available.

Fayetteville, NC Auto Insurance: The Bottom Line

Although Fayetteville, NC auto insurance rates are higher than the state average, they are still much lower than normally seen across the country.

Before you buy Fayetteville, NC auto insurance, enter your ZIP code to compare quotes from top companies.

Frequently Asked Questions

What does bodily injury liability coverage mean?

Bodily injury liability coverage is a type of auto insurance that pays for medical expenses, lost wages, and legal fees resulting from injuries or death caused to other people in an accident you are responsible for. It helps protect your assets if you are sued for damages.

What does property damage liability coverage mean?

Property damage liability coverage is a type of auto insurance that pays for damages to another person’s property, such as their vehicle or any other property, caused by an accident you are responsible for. It helps cover the cost of repairs or replacement.

Are the minimum insurance requirements enough?

While the minimum insurance requirements in Fayetteville, NC, satisfy the legal obligation, they may not provide sufficient coverage in all situations. It is generally recommended to consider higher coverage limits and additional types of coverage to protect yourself financially in case of a severe accident.

How are auto insurance premiums determined?

Auto insurance premiums are determined based on various factors, including your age, gender, driving record, the type of vehicle you drive, where you live, your credit score, and the coverage options you choose. Insurers also consider local factors, such as the accident and theft rates in Fayetteville, NC.

How can I lower my auto insurance premiums?

Here are some ways to potentially lower your auto insurance premiums:

- Maintain a clean driving record.

- Choose a higher deductible.

- Take advantage of discounts offered by insurance companies, such as multi-policy discounts or safe driver discounts.

- Drive a vehicle with safety features and anti-theft devices.

- Bundle your auto insurance with other types of insurance, such as homeowners insurance.

What should I do after an auto accident in Fayetteville, NC?

After an auto accident in Fayetteville, NC, it is important to:

- Ensure everyone’s safety and seek medical attention if necessary.

- Exchange information with the other parties involved, including names, contact details, and insurance information.

- Document the accident scene by taking photos and gathering witness information.

- Notify your insurance company and provide them with the necessary details about the accident.

- Cooperate with law enforcement and follow their instructions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.