Cheap Buick Auto Insurance in 2025 (Cash Savings With These 10 Companies!)

Erie, Geico, and State Farm all offer cheap Buick auto insurance. Erie has the cheapest minimum rates for most drivers, with rates averaging just $32/mo. However, rates will vary by Buick model, as Buick Cascada insurance will cost more at the cheapest Buick companies than Buick Verano car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Buick

A.M. Best

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Buick

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Buick

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsYou can find cheap Buick auto insurance at Erie, Geico, or State Farm.

Buick auto insurance rates are around the national average, though rates vary based on several factors that affect auto insurance rates. For example, young drivers, people with a DUI on their record, or people with low credit scores tend to see much higher rates for their Buick car insurance.

Our Top 10 Company Picks: Cheap Buick Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A+ | Customer Service | Erie |

| #2 | $43 | A++ | Online Convenience | Geico | |

| #3 | $47 | A++ | Student Savings | State Farm | |

| #4 | $53 | A+ | Loyalty Discounts | Travelers | |

| #5 | $56 | A | Budgeting Tools | Progressive | |

| #6 | $62 | A+ | Accident Forgiveness | American Family | |

| #7 | $63 | A | Commercial Insurance | Nationwide |

| #8 | $76 | A | Safety Discounts | Farmers | |

| #9 | $87 | A+ | Infrequent Drivers | Allstate | |

| #10 | $96 | A | 24/7 Support | Liberty Mutual |

Finding affordable Buick auto insurance isn’t usually a challenge, whether you want to buy your state’s minimum insurance or a full coverage policy.

Read on to explore your Buick auto insurance options and how you can find the lowest rates. Then, compare rates with as many companies as possible to find the best policy for your Buick.

- Erie has the cheapest Buick auto insurance rates

- Buick LaCrosses and Veranos models have the cheapest quotes

- Buick Cascadas the highest Buick car insurance quotes

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Erie: Top Pick Overall

Pros

- Customer Service: Most customers are satisfied with the customer service at Erie and left good reviews.

- Customizable Coverage: Purchase a full or minimum coverage policy. Learn what Erie offers in our Erie review.

- Full Coverage Perks: Get perks like pet injury coverage when you purchase a full coverage policy.

Cons

- State Availability: Erie doesn’t cover all states.

- Claim Filing: Claim filing can be inconvenient for some customers, as Erie doesn’t have an online claim filing process.

#2 – Geico: Best for Online Convenience

Pros

- Online Convenience: File claims online or make policy changes online.

- Financial Stability: Your Buick’s claims will be backed by a financially responsible company. Find out more in our Geico review.

- Available Nationwide: You can keep Geico as your Buick insurer when you move.

Cons

- In-Person Assistance: You may not be able to find a local agent near you.

- Good Driver Discount Availability: You may have a reduced discount or no discount for good driving in your state.

#3 – State Farm: Best for Student Savings

Pros

- Student Savings: State Farm has discounts specially tailored to students. Read our State Farm review to learn about State Farm’s discounts.

- Rideshare Insurance: State Farm is one of the few insurers that offers rideshare insurance.

- Customer Service: State Farm has mostly positive customer satisfaction reviews.

Cons

- Poor Credit Rates: State Farm may increase your rates if you don’t have a good credit score.

- Accident Forgiveness Requirements: State Farm requires customers to have been accident-free for almost a decade to qualify.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Loyalty Discounts

Pros

- Loyalty Discounts: Keeping your Buick insured by Travelers will earn you a discount.

- Nationwide Availability: Travelers is sold in all 50 U.S. states. Read about the company in our Travelers review.

- Gap Coverage: Owners of new Buicks will want to purchase gap insurance.

Cons

- Customer Reviews: Customers have posted negative reviews about claims.

- IntelliDrive Program: This discount program may actually raise rates if drivers do poorly.

#5 – Progressive: Best for Budgeting Tools

Pros

- Budgeting Tools: Find what coverage you can buy on budget constraints at Progressive.

- Online Convenience: Perform simple tasks easily online. Read more about the company in our Progressive review.

- Rideshare Insurance: Progressive is one of the few companies that offers insurance for ridesharing.

Cons

- Teen Rates: Teens rates are high at Progressive.

- Snapshot Program: This discount program could raise rates if drivers do poorly.

#6 – American Family: Best for Accident Forgiveness

Pros

- Accident Forgiveness: If it’s been a while since you filed a claim, you could be forgiven an accident.

- Gap Coverage: This coverage is great for owners of new Buicks. Learn what else is offered in our American Family review.

- Customer Service: Customer reviews are mostly positive, which is a plus.

Cons

- Limited Availability: Coverage is not yet available in all states.

- Rate Competitivity: For some drivers, rates may not be as competitive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Commerical Insurance

Pros

- Commercial Insurance: You can get commercial insurance if your Buick is a business vehicle.

- Pay-Per-Mile Insurance: You can get limited-use insurance if you rarely drive.

- Agent Availability: Agents are in most areas. Read our review of Nationwide for more customer service details.

Cons

- No Rideshare Insurance: Nationwide does not offer insurance for ridesharing.

- Rate Competitivity: Nationwide’s rates are less competitive for high-risk drivers.

#8 – Farmers: Best for Safety Discounts

Pros

- Safety Discounts: Get cheaper rates if your Buick is equipped with the latest safety features.

- Convenient App: Manage your policy or file a claim from your phone.

- Family Plans: Farmers offers discounts and coverages for the whole family.

Cons

- Rate Competitivity: Rates can be pricy for high-risk drivers. Learn more in our Farmers insurance review.

- Claim Reviews: Not everyone has rated filing claims at Farmers as great.

#9 – Allstate: Best for Infrequent Drivers

Pros

- Infrequent Drivers: Drivers with low mileage can sign up for Allstate’s low-mileage insurance plan.

- Claim Satisfaction Guarantee: You may get a discounted rate if Allstate’s claim service is poor.

- Paperless Discount: Going paperless will earn you a small discount from Allstate.

Cons

- Customer Complaints: Allstate has more complaints than expected from customers. Learn more in our Allstate review.

- Teen Rates: Young drivers’ rates will be pricier.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Easily get help with your Buick policy or claim.

- Online Convenience: Most tasks can be done online. Learn more about the company in our Liberty Mutual insurance review.

- New Car Coverages: Get new car replacement or gap insurance for your new Buick.

Cons

- Poor Credit Rates: Rates can be pricy for drivers with poor credit scores.

- Discount Limitations: You may find that in your state, some discounts are reduced or missing.

Buick Auto Insurance Coverage Options

The type of auto insurance coverage you should buy depends on your needs. For example, most drivers who own their car and can afford to replace it can buy their state’s minimum insurance. If you have a car loan or lease, you’ll probably need full coverage auto insurance.

Even if you own your Buick outright, full coverage is the best Buick insurance for most owners. Without full coverage, Buick owners may be unable to afford to repair their car or purchase a new car if their Buick is totaled.Daniel Walker Licensed Insurance Producer

While there are many types of auto insurance, some of the most popular coverage options for Buick drivers include:

- Liability: Most states require a minimum amount of liability auto insurance before you can drive, which pays for damage and injuries you cause in an at-fault accident.

- Collision: Liability insurance doesn’t cover damages to your car. If you want help with your car, you’ll need collision auto insurance. Collision insurance also covers you if you hit a stationary object, like a tree.

- Comprehensive: Comprehensive auto insurance covers life’s unexpected events, including vandalism, theft, animal contact, fire, floods, and extreme weather.

- Uninsured/Underinsured Motorist: Although most states require insurance, not all drivers carry it. Uninsured motorist insurance pays for your car if a driver without enough coverage hits you.

- Personal Injury Protection/Medical Payments: Medical payments or personal injury protection auto insurance covers health care costs for you and your passengers after any collision.

These are the most popular auto insurance options, but many alternative options exist for Buick drivers. Some commonly purchased auto insurance add-ons for Buick drivers include roadside assistance, rental car reimbursement, and gap insurance.

Buick Auto Insurance Rates

The average driver pays about $39 a month to meet their state’s minimum auto insurance requirements and $142 for full coverage. While rates vary by several factors, Buick auto insurance rates are about the same as the national average.

Insurance companies consider your unique circumstances when they craft a personalized quote, but the Buick model you choose plays a crucial role. Before you decide where to buy your auto insurance, consider the following rates below.

Buick Auto Insurance Rates by Company

The cheapest company for Buick car insurance depends on your situation, meaning you’ll see vastly different rates based on where you get your Buick auto insurance quotes. Since Buick rates closely match the national average, you can get an idea of how much coverage might cost you below:

Auto Insurance Monthly Rates for Buick by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $32 | $83 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

There’s significant variation between companies, with some of the cheapest options being Geico auto insurance and State Farm auto insurance. On the other hand, Progressive auto insurance, Safeco auto insurance, and Liberty Mutual auto insurance are more expensive.

While these rates represent a company’s offerings fairly, you should always get quotes from multiple sources. For certain factors, some companies are more forgiving than others, so you can see very different rates.

OnStar Insurance for Your Buick

Tesla isn’t the only car manufacturer that offers insurance. General Motors has exclusive discounts and programs through its OnStar Insurance. It offers usage-based insurance for Buick models 2016 or newer, and traditional auto insurance for models before 2016. Read more in our GM auto insurance review.

Buick Auto Insurance Rates by Model

While Buick insurance usually matches the national average for coverage, you can still see some variation based on the model you buy. Some Buick models cost more to insure than others, and you can compare auto insurance rates by vehicle make and model below:

Buick Full Coverage Auto Insurance Monthly Rates by Model

| Model | Rates |

|---|---|

| 2024 Buick Cascada | $156 |

| 2024 Buick Enclave | $150 |

| 2024 Buick Encore | $144 |

| 2024 Buick Envision | $146 |

| 2024 Buick LaCrosse | $138 |

| 2024 Buick Regal | $142 |

| 2024 Buick Verano | $138 |

The Cascada is one of the most expensive Buicks to insure, primarily because it’s a convertible. Conversely, the Verano and LaCrosse are some of the cheapest models to insure. The LaCrosse and Verano are relatively inexpensive vehicles and have solid safety ratings.

Buick Auto Insurance Rates by Age

While many factors affect your Buick auto insurance rates, one of the most important is your age. Insurance companies charge young, inexperienced drivers more for their coverage because they’re more likely to file claims, get into accidents, and drive recklessly.

Check out the table below to compare average auto insurance rates by age:

Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $292 | $761 |

| 16-Year-Old Male | $323 | $808 |

| 30-Year-Old Female | $68 | $182 |

| 30-Year-Old Male | $71 | $191 |

| 45-Year-Old Female | $62 | $166 |

| 45-Year-Old Male | $61 | $165 |

| 55-Year-Old Female | $59 | $158 |

| 55-Year-Old Male | $58 | $157 |

| 65-Year-Old Female | $61 | $163 |

| 65-Year-Old Male | $61 | $161 |

While teens and young adults pay more for auto insurance, there’s some good news: if you keep your driving record clean, your Buick insurance cost will lower around age 25. You should also learn how to get a good student auto insurance discount if you have good grades. Read more about auto insurance for teens.

Buick Auto Insurance Rates by Model Year

The year of your Buick also affects your car insurance quotes. Check out the table below to see how your Buick model year impacts your rates:

Buick Encore Auto Insurance Monthly Rates by Coverage Level & Model Year

| Model Year | Minimum Coverage | Full Coverage |

|---|---|---|

| 2013 Buick Encore | $55 | $130 |

| 2014 Buick Encore | $58 | $135 |

| 2015 Buick Encore | $61 | $140 |

| 2016 Buick Encore | $64 | $145 |

| 2017 Buick Encore | $67 | $150 |

| 2018 Buick Encore | $70 | $155 |

| 2019 Buick Encore | $73 | $160 |

| 2020 Buick Encore | $76 | $165 |

| 2021 Buick Encore | $79 | $170 |

| 2022 Buick Encore | $82 | $175 |

| 2023 Buick Encore | $85 | $180 |

| 2024 Buick Encore | $88 | $185 |

Generally, auto insurance for older cars is cheaper than coverage for new vehicles. For example, 2013 Buick Encore car insurance cost is $35 less monthly than full coverage for a brand-new Buick. So, it’s vital to compare rates by model year to find affordable Buick auto insurance, whether you are shopping for Buick LaCrosse car insurance or Buick Enclave car insurance.

Compare the Auto Insurance Costs Across BMW’s Models

Explore auto insurance costs for Buick models – the Encore and Encore GX – in this concise table, providing quick insights for those considering insurance expenses for these specific vehicles.

| Cost of Auto Insurance for Buick's by Model |

|---|

| Buick Encore |

| Buick Encore GX |

If you own a more expensive model, get quotes from cheap Buick car insurance companies like Erie.

Read on to learn more about factors affecting how much you pay for Buick auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting Your Buick Auto Insurance Rates

Companies look at the same factors to determine your Buick car insurance rates, whether you’re buying a used vehicle or need auto insurance for a luxury car. The following factors will affect your rates when you’re shopping for Buick auto insurance coverage:

- Age and Gender: Age and gender significantly impact rates because companies carefully track who makes claims. Young, inexperienced drivers and men tend to file more claims, so they pay more for insurance. To find low Buick rates, compare average auto insurance rates by age.

- Location: Auto insurance rates by ZIP code vary. Since insurance companies track location, your Buick auto insurance rates can change drastically by moving even a single ZIP code over.

- Model of Your Buick: You saw above that Buick models come with different rates. The primary reasons behind the price differences are your car’s cost, safety ratings, and body style.

- Credit Score: It might be a surprise, but most states allow insurance companies to use your credit score as part of your rates. The lower your credit score, the higher your insurance rates will be. Learn more about auto insurance and credit scores.

- Marital Status: Married couples file fewer claims than single drivers, so they usually see slightly lower rates. Compare rates from the best auto insurance companies for married couples to find the lowest Buick insurance quotes.

- Driving History: Finding affordable Buick auto insurance coverage with a bad driving record can be difficult. Serious driving infractions like speeding tickets, at-fault accidents, and DUIs will dramatically affect your rates. You might need high-risk auto insurance if you have too many.

The amount of coverage you need also affects how much you’ll pay for auto insurance. Some drivers who own their car and can afford to replace it outright can probably get away with the minimum insurance required by your state. However, drivers with a loan or lease should get full coverage to fully protect their Buick.

How to Get Affordable Buick Auto Insurance Quotes

Buick auto insurance rates are relatively affordable, but it never hurts to get cheaper insurance. Most auto insurance companies offer auto insurance discounts to help you save. Consider how many discounts are available when looking for auto insurance.

Try the following tips to find even lower insurance quotes:

- Park in Safe Spots: Insurance companies are more comfortable insuring a car parked in a safe place every night. If you park in a covered garage or driveway, you’ll see lower rates.

- Enroll in a Telematics Program: Most companies offer usage-based auto insurance for lower rates. If you regularly practice safe driving habits, you can save up to 40% on your insurance.

- Keep a Clean Record: Since you pay more if you have driving infractions on your record, avoiding incidents will help you get cheap Buick insurance. Read more about how auto insurance companies check driving records.

- Add Security: Security systems like audible alarms and GPS tracking will keep your insurance rates low if you have comprehensive coverage. Speak with your insurance company if you’re wondering how to get an anti-theft auto insurance discount for your Buick.

Since companies use unique formulas to determine rates, you can see many different prices when you get personalized Buick auto insurance quotes.

In the market for auto insurance?🚘You don't want to skip the most important step: comparing rates!⚖️At https://t.co/27f1xf131D, we can help you compare rates to ensure you're getting the best deal!💲Learn more here👉: https://t.co/ax4M3DRVnp pic.twitter.com/51SVJ2XMXY

— AutoInsurance.org (@AutoInsurance) May 22, 2023

Some companies are more forgiving than others when it comes to auto insurance for Buicks. For example, Geico has some of the lowest rates for people with low credit scores, while State Farm auto insurance has some of the highest.

Find the Best Buick Auto Insurance Today

No matter which model you buy, most Buicks come with affordable auto insurance rates that match the national average. While rates are usually affordable, drivers can save by looking for the best Buick auto insurance discounts, installing security systems, and signing up for a usage-based program.

One of the easiest ways to find affordable Buick auto insurance rates is to compare rates with as many companies as possible. You’ll likely overpay for auto insurance if you don’t get multiple Buick auto insurance quotes. Enter your ZIP code into our free tool to find cheap Buick car insurance rates today.

Frequently Asked Questions

Are Buicks expensive to insure?

While Buick auto insurance rates vary by several factors, Buicks are usually affordable cars to insure. Buick auto insurance costs $142 monthly for full coverage and $39 for liability. However, some Buick models cost more to insure than others.

What is the cheapest auto insurance to go through?

The cheapest auto insurance company for you depends on your unique situation. However, Erie, State Farm, and Geico are usually the most affordable options.

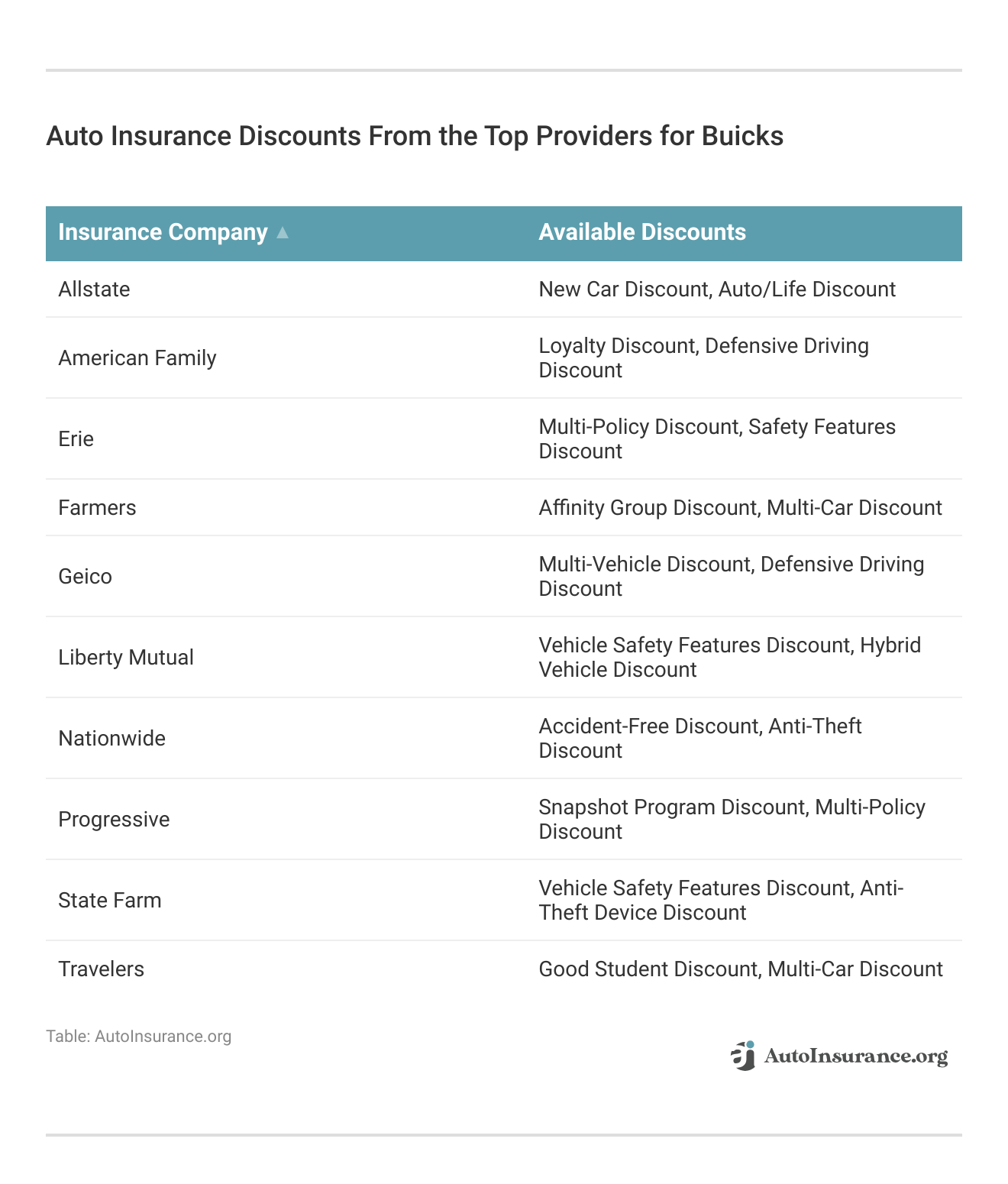

Are there specific auto insurance discounts available for Buick owners?

Yes, Buick auto insurance could be eligible for Buick-specific discounts. Some companies offer Buick car insurance discounts based on safety features, anti-theft devices, or driver assistance systems (read more: How to Get an Anti-Theft Auto Insurance Discount).

How much are Buick Enclave auto insurance rates?

You’ll pay $147 per month for Buick Enclave insurance rates, though they’ll vary. You won’t know exactly what your coverage costs until you get a Buick auto insurance quote.

Is Buick auto insurance any different from insurance for other car brands?

Buick auto insurance is similar to insurance for other car brands. However, factors such as the model of the Buick, its value, safety features, and the driver’s profile can influence insurance rates. Insurance providers consider these factors along with the usual criteria when determining premiums for Buick vehicles.

What types of coverage are available for Buick auto insurance?

Buick auto insurance typically offers the same coverage options as insurance for other vehicles. These options include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and optional coverages such as roadside assistance and rental reimbursement.

The specific coverage options available may vary depending on the insurance provider and policy (learn more: How much car insurance do I need?).

Are there any specific Buick models that may have higher or lower insurance rates?

Insurance rates for specific Buick models can vary based on factors such as the model’s safety features, repair costs, and theft rates. Buick models are generally known for their safety features and low theft rates. However, it’s important to obtain quotes for the Buick model you own. Get free quotes now with our comparison tool.

Can I use any insurance provider for my Buick, or are there recommended companies?

You can choose any insurance provider for your Buick vehicle. However, it’s recommended to research and compare quotes from different insurance companies to find the best coverage and rates for your specific needs. Consider factors such as the company’s reputation, customer service, coverage options, and financial stability when selecting an insurance provider for your Buick.

What is the cheapest Buick model to insure?

The Buick LaCrosse and Buick Verano are both cheaper models to insure.

What is the most expensive Buick model to buy?

The Buick Enclave is one of the most expensive models to purchase, with the average cost being almost $60,000 for a new model (read more: Does the price of a car affect auto insurance rates?).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.