Best Omaha, Nebraska Auto Insurance in 2025 (Compare the Top 10 Companies Here)

State Farm, Geico, and Farmers deliver the best Omaha, Nebraska auto insurance, with rates starting at $43 per month. These companies excel with competitive rates, local agents, and good discounts, making them the best choices for affordable and reliable auto insurance in Omaha, Nebraska.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Omaha NE

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Omaha NE

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Omaha NE

A.M. Best

Complaint Level

Pros & Cons

The best Omaha, Nebraska auto insurance comes from State Farm, Geico, and Farmers. These companies stand out due to their competitive rates, excellent customer service, and a variety of discounts that cater to diverse needs in different types of auto insurance.

Factors like driving record, credit history, and coverage level significantly influence the rates, with monthly premiums starting at just $43.

Our Top 10 Company Picks: Best Omaha, Nebraska Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Local Agent | State Farm | |

| #2 | 18% | A++ | Competitive Rates | Geico | |

| #3 | 12% | A+ | Good Discounts | Farmers | |

| #4 | 16% | A+ | Comprehensive Coverage | Allstate | |

| #5 | 14% | A+ | Good Driver | Progressive | |

| #6 | 22% | A++ | Military Personnel | USAA | |

| #7 | 21% | A+ | Financial Stability | Nationwide |

| #8 | 16% | A | Flexible Coverage | Liberty Mutual |

| #9 | 10% | A++ | Accident Forgiveness | Travelers | |

| #10 | 20% | A | Rental Reimbursement | American Family |

Whether you’re a teen driver, senior, or have a varied commute, comparing quotes from these top companies ensures you get the best coverage for your situation.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

- State Farm is the top pick for Omaha auto insurance, starting at $43/mo

- Options for various driving records and coverage needs

- Compare Omaha auto insurance quotes to find the best deals

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Strong Local Presence: State Farm offers personalized service through its local agents specifically for Omaha, Nebraska auto insurance, ensuring tailored customer interaction.

- Customizable Coverage Options: Provides a range of coverage options that can be personalized to meet the specific needs of drivers looking for Omaha, Nebraska auto insurance.

- Community Involvement: See our State Farm auto insurance review to learn how the company’s strong community presence in Omaha, Nebraska enhances trust and reliability among local insurance customers.

Cons

- Higher Cost: For Omaha, Nebraska auto insurance, State Farm’s premiums may be higher than competitors, particularly for those not qualifying for discounts.

- Digital Services Limitation: The digital tools for managing Omaha, Nebraska auto insurance may not be as advanced, affecting tech-savvy customers.

#2 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: With our Geico auto insurance review, learn how Geico offers competitive rates that make Omaha, Nebraska auto insurance more accessible to a broader range of drivers.

- Efficient Claims Process: Known in Omaha for a quick and user-friendly claims process, appealing to those seeking efficient insurance services.

- Extensive Discounts: Provides numerous discounts that can significantly lower Omaha, Nebraska auto insurance premiums for eligible drivers.

Cons

- Impersonal Service: The emphasis on online and phone services limits personal interaction, which might deter Omaha residents who prefer face-to-face service.

- Coverage Limitations: Some Omaha, Nebraska auto insurance customers might find Geico’s coverage options less flexible compared to other local providers.

#3 – Farmers: Best for Good Discounts

Pros

- Wide Range of Discounts: Farmers offers extensive discounts, significantly lowering Omaha, Nebraska auto insurance costs for qualifying drivers.

- Customized Insurance Packages: Highly customized insurance packages are available to meet the unique needs of residents in Omaha, Nebraska.

- Local Agent Network: In our Farmers auto insurance review, read about how Farmers provides knowledgeable local agents in Omaha to assist with insurance claims and policy management.

Cons

- Premium Costs Without Discounts: Without discounts, Farmers’ rates for Omaha, Nebraska auto insurance can be relatively high.

- Customer Service Variability: The customer service experience can vary based on the local agent, leading to potential inconsistencies in Omaha.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Broad Coverage Options: Explore our Allstate auto insurance review to understand how Allstate offers extensive coverage choices, protecting drivers comprehensively in Omaha, Nebraska.

- Rewards for Safe Drivers: Provides incentives like safe driving bonuses and deductible rewards, beneficial for Omaha, Nebraska auto insurance customers.

- Robust Mobile App: Enhances the Omaha, Nebraska auto insurance management experience through a comprehensive mobile app.

Cons

- Higher Price Point: Allstate’s premiums can be expensive, potentially deterring budget-conscious drivers in Omaha, Nebraska.

- Complex Policy Options: For some customers, the variety of options in an auto insurance policy in Omaha, NE can be daunting without proper guidance.

#5 – Progressive: Best for Good Driver

Pros

- Snapshot Program: Progressive’s Snapshot program rewards safe driving, offering discounts beneficial to careful drivers in Omaha, Nebraska.

- Competitive Pricing: Offers competitive pricing that can be lowered through discounts, appealing to Omaha, Nebraska auto insurance customers.

- Strong Online Presence: See our Progressive auto insurance review to find out how Progressive provides excellent online tools and apps, catering well to the digitally inclined in Omaha, Nebraska.

Cons

- Customer Service Inconsistencies: Variability in customer service quality reported by some Omaha, Nebraska auto insurance customers.

- Claims Process Issues: Occasional slower claims processing reported, which could concern drivers in Omaha, Nebraska.

#6 – USAA: Best for Military Personnel

Pros

- Exclusive Services for Military: Tailored services for military members and their families, offering significant benefits for Omaha, Nebraska auto insurance.

- Competitive Rates: View our USAA auto insurance review to see how USAA offers competitive rates and comprehensive coverage, providing great value for Omaha, Nebraska auto insurance.

- High Customer Satisfaction: Consistently high customer service and claims satisfaction rates among the military community in Omaha, Nebraska.

Cons

- Limited Eligibility: Restricted to military personnel and their families, limiting access for the general public in Omaha, Nebraska.

- Less Local Agents: Fewer local agents available, potentially impacting service for those preferring in-person interactions in Omaha, Nebraska.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Financial Stability

Pros

- Financial Strength: Delve into our Nationwide auto insurance review to learn how Nationwide’s robust financial stability reassures customers about its ability to handle claims in Omaha, Nebraska.

- Wide Range of Products: Offers a comprehensive array of insurance products, fulfilling diverse needs for Omaha, Nebraska auto insurance.

- Accident Forgiveness: Includes policies that prevent rate increases after an accident, an appealing feature for drivers in Omaha, Nebraska.

Cons

- Costlier Premiums: Nationwide can be more expensive than some competitors for Omaha, Nebraska auto insurance.

- Customer Service Complaints: Some Omaha, Nebraska auto insurance customers report responsiveness issues with claims and customer service.

#8 – Liberty Mutual: Best for Flexible Coverage

Pros

- Customizable Policies: Offers highly flexible policies that can be tailored extensively to meet the specific needs of drivers in Omaha, Nebraska.

- Accident Forgiveness: Our Liberty Mutual auto insurance review shows the company offers accident forgiveness to prevent premium increases after the first at-fault accident in Omaha, Nebraska.

- Online Tools and Resources: Strong suite of online tools enhances the insurance management experience for Omaha, Nebraska auto insurance.

Cons

- Variable Customer Service: Customer service quality varies, which can affect overall satisfaction for Omaha, Nebraska auto insurance.

- Higher Rates Without Discounts: Premiums may be high unless Omaha, Nebraska auto insurance customers qualify for various discounts.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Programs: Offers programs that prevent rate increases after the first accident, a significant benefit for Omaha, Nebraska drivers.

- Competitive Policy Options: Provides a range of competitive options catering to different insurance needs in Omaha, Nebraska.

- Risk Management Tools: Within our Travelers auto insurance review, discover how the company offers tools that help Omaha, Nebraska drivers manage and reduce their insurance risks effectively.

Cons

- Pricing Above Average: Generally, rates are higher compared to local competitors in Omaha, Nebraska.

- Complexity in Policy Management: Some customers find the policy management and adjustment process complex and time-consuming in Omaha, Nebraska.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Rental Reimbursement

Pros

- Excellent Rental Reimbursement Options: Offers comprehensive rental reimbursement coverage, highly beneficial for drivers in Omaha, Nebraska needing temporary vehicles.

- Customer-Focused Services: Our American Family auto insurance review shows the company’s customer-centric services enhance the insurance experience in Omaha, Nebraska.

- Diverse Discount Opportunities: Provides various discounts that can significantly reduce insurance costs for eligible Omaha, Nebraska drivers.

Cons

- Limited Coverage Scope: Coverage options might be less extensive than those offered by competitors in Omaha, Nebraska.

- Inconsistent Agent Experiences: Variability in agent quality can affect the level of service and satisfaction for Omaha, Nebraska auto insurance customers.

Monthly Auto Insurance Rates and Discounts in Omaha, Nebraska

Discover the best rates and discounts for both full and minimum coverage auto insurance in Omaha, Nebraska, from leading providers like State Farm and Geico. Take advantage of options such as multi-policy and safe driver rewards to ensure you get the best deal for your insurance needs.

Omaha, Nebraska Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $52 | $130 |

| American Family | $46 | $118 |

| Farmers | $50 | $125 |

| Geico | $45 | $115 |

| Liberty Mutual | $54 | $132 |

| Nationwide | $49 | $123 |

| Progressive | $48 | $118 |

| State Farm | $47 | $120 |

| Travelers | $47 | $120 |

| USAA | $43 | $110 |

Compare monthly auto insurance rates in Omaha, Nebraska, by coverage level and provider, and learn where to compare auto insurance rates effectively. Rates range from $43 for minimum coverage with USAA to $132 for full coverage with Liberty Mutual. Evaluate rates from Allstate, American Family, Farmers, and others to find the perfect fit for your budget and coverage requirements.

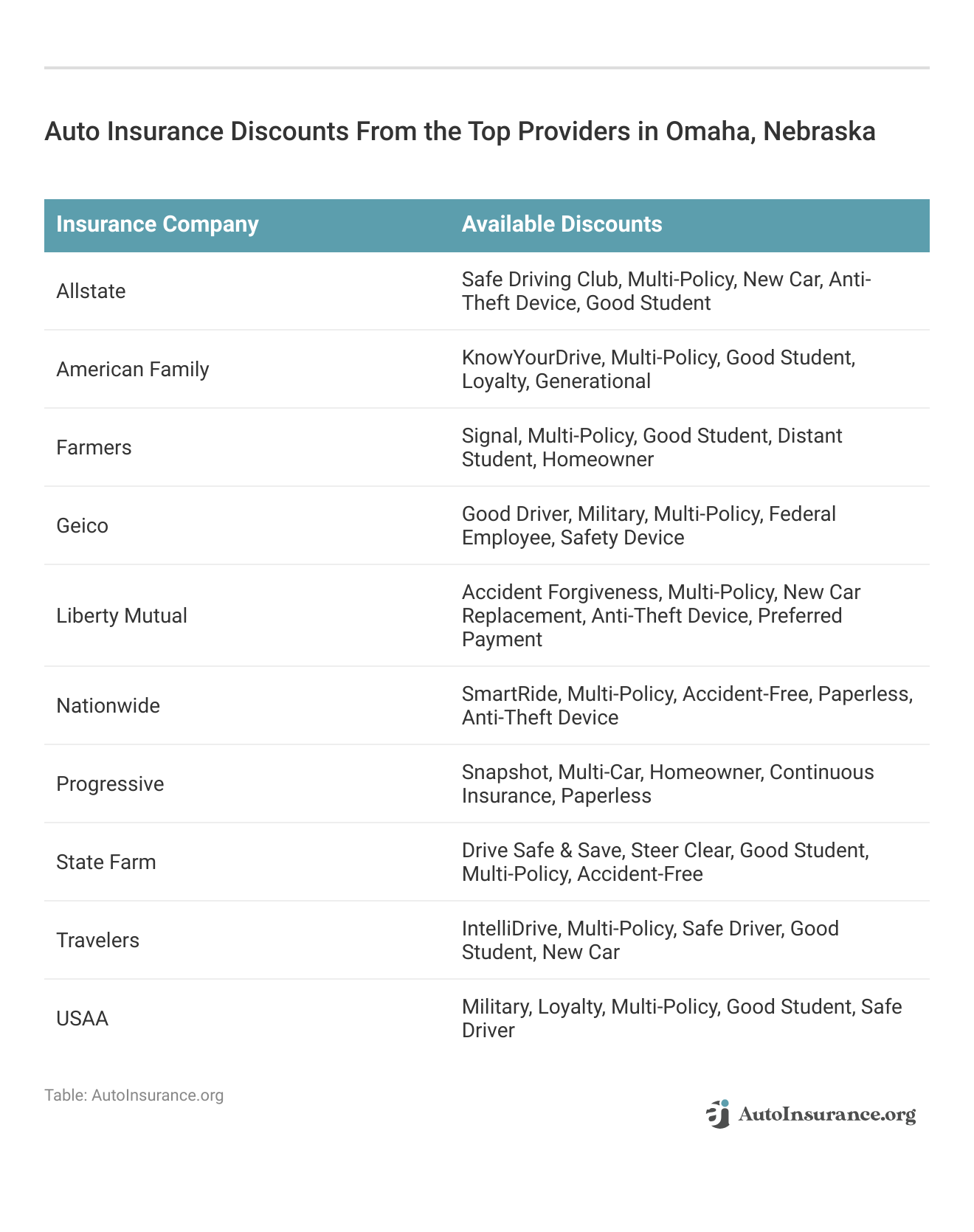

Explore a variety of auto insurance discounts from top providers in Omaha, Nebraska. Our table highlights various discounts such as multi-policy, safe driver, and good student discounts offered by renowned companies like State Farm, Geico, and Progressive. Assess these benefits to secure the best savings on your auto insurance.

By evaluating auto insurance rates and discounts, you can make a well-informed decision and optimize your savings in Omaha, Nebraska. Use the detailed information provided to select the best insurance provider and coverage level that meets your specific needs and budget.

Minimum Auto Insurance Requirements in Omaha, Nebraska

In Omaha, Nebraska, auto insurance laws require drivers to have at least the state’s minimum auto insurance coverage to ensure financial responsibility in the event of an accident.

State Farm is the best pick for auto insurance in Omaha, Nebraska, thanks to its competitive rates and outstanding customer service.Laura Berry Former Licensed Insurance Producer

This minimum coverage includes liability insurance with specific limits of $25,000 per person, $50,000 per accident for bodily injury liability, and $25,000 for property damage liability. These requirements provide essential protection for drivers and others involved in accidents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Omaha, Nebraska Auto Insurance by Age, Gender, and Marital Status

Auto insurance rates in Omaha, Nebraska, vary based on demographics and provider choices, which is crucial for effective budgeting. This table displays the monthly auto insurance premiums from various providers, categorized by age, gender, and the insurance company. It offers a thorough overview, assisting Omaha consumers in making informed decisions tailored to their specific demographic needs.

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $193 | $182 | $174 | $175 | $591 | $623 | $212 | $214 |

| Farmers | $157 | $157 | $145 | $145 | $275 | $419 | $154 | $169 |

| Geico | $216 | $215 | $193 | $205 | $895 | $924 | $245 | $254 |

| Liberty Mutual | $224 | $219 | $220 | $212 | $498 | $646 | $203 | $195 |

| Nationwide | $298 | $323 | $236 | $288 | $1,367 | $1,537 | $310 | $341 |

| Progressive | $191 | $196 | $171 | $183 | $477 | $589 | $224 | $242 |

| State Farm | $184 | $175 | $152 | $158 | $763 | $858 | $219 | $235 |

| Travelers | $453 | $572 | $167 | $189 | $150 | $150 | $135 | $135 |

| USAA | $387 | $457 | $147 | $162 | $115 | $114 | $107 | $108 |

This analysis of auto insurance rates in Omaha shows the importance of comparing options to manage costs effectively, with varying rates for young drivers and seniors impacting monthly expenses; residents can utilize this data to optimize their insurance strategy, ensuring they select a provider that aligns with their financial and coverage needs. For more, see our report “Auto Insurance rates by Age.”

Omaha, Nebraska Auto Insurance for Teen Drivers

Navigating teen auto insurance options for teen drivers in Omaha, Nebraska requires an understanding of how premiums vary across different providers and gender. The data provided here offers a snapshot of monthly auto insurance rates for 17-year-old male and female drivers, highlighting the disparities and helping families make well-informed decisions about their insurance choices.

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $193 | $182 |

| American Family | $157 | $157 |

| Farmers | $216 | $215 |

| Geico | $224 | $219 |

| Liberty Mutual | $298 | $323 |

| Nationwide | $191 | $196 |

| Progressive | $184 | $175 |

| State Farm | $453 | $572 |

| USAA | $387 | $457 |

This summary of monthly rates for teen drivers emphasizes the need to explore options for cheap car insurance in Omaha, NE, that is both affordable and appropriate. The choice of insurance provider and the teen’s gender greatly affect the cost. Parents and guardians can utilize this data to select the most suitable insurance policies offering extensive coverage and economic viability for their young drivers in Omaha.

Omaha, Nebraska Auto Insurance for Seniors

Choosing the right auto insurance is crucial for senior drivers in Omaha, Nebraska. This detailed table presents the monthly auto insurance rates for senior drivers aged 60, broken down by gender and insurance provider. By understanding these rates, senior drivers can better evaluate their options and select insurance that offers both affordability and comprehensive coverage.

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $212 | $214 |

| American Family | $154 | $169 |

| Farmers | $245 | $254 |

| Geico | $203 | $195 |

| Liberty Mutual | $310 | $341 |

| Nationwide | $224 | $242 |

| Progressive | $219 | $235 |

| State Farm | $135 | $135 |

| USAA | $107 | $108 |

This comparative analysis highlights the need for seniors in Omaha to shop around for auto insurance for seniors. The differences in premiums between providers suggest that comparing rates could lead to significant savings. Seniors can utilize this information to find an insurance plan that balances cost and coverage, tailored to their individual needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Omaha, Nebraska Auto Insurance by Driving Record

Auto insurance costs in Omaha, Nebraska, can differ greatly depending on a driver’s history. This table offers an in-depth view of how monthly rates from Omaha auto insurance companies change according to various driving records, including those with a clean record, one accident, one DUI, and one ticket.

This information aids Omaha drivers in comprehending the financial impact of driving incidents on their insurance premiums, illustrating what high-risk auto insurance defined entails.

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $252 | $288 | $355 | $286 |

| American Family | $199 | $214 | $199 | $199 |

| Farmers | $332 | $428 | $418 | $395 |

| Geico | $197 | $280 | $416 | $315 |

| Liberty Mutual | $502 | $596 | $643 | $609 |

| Nationwide | $203 | $292 | $412 | $229 |

| Progressive | $290 | $432 | $325 | $324 |

| State Farm | $223 | $265 | $244 | $244 |

| USAA | $151 | $192 | $286 | $171 |

This data underscores the importance of maintaining a clean driving record to secure lower auto insurance rates in Omaha. For drivers with marks on their records, it shows how much more they might expect to pay, encouraging safer driving habits. Drivers should use this information to assess potential insurance costs post-incident and possibly shop around for better rates if their driving history changes.

Omaha, Nebraska Auto Insurance Rates After a DUI

For drivers in Omaha, Nebraska, grasping how a DUI defined can influence auto insurance premiums is essential. This table offers a detailed comparison of monthly rates from different companies for drivers who have experienced a DUI incident, providing a crucial resource for those reevaluating their insurance choices post-event.

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $355 |

| American Family | $199 |

| Farmers | $418 |

| Geico | $416 |

| Liberty Mutual | $643 |

| Nationwide | $412 |

| Progressive | $325 |

| State Farm | $244 |

| USAA | $286 |

The information shows significant differences in how insurance providers adjust their rates post-DUI. Omaha drivers should compare these rates and consider which company offers the most forgiving terms or the best coverage at a reasonable cost. This comparison helps individuals make informed decisions about their auto insurance, ensuring protection while managing the financial implications of a DUI on their insurance rates.

Omaha, Nebraska Auto Insurance by Credit History

In Omaha, Nebraska, your credit history can significantly impact your auto insurance premiums. This table details how different insurance companies adjust their monthly rates based on whether a customer has bad, fair, or good credit. Understanding these variances can help Omaha residents choose an insurance provider that aligns with their financial background and offers the most favorable rates according to their credit score.

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $367 | $280 | $240 |

| American Family | $273 | $184 | $150 |

| Farmers | $448 | $375 | $357 |

| Geico | $345 | $300 | $262 |

| Liberty Mutual | $844 | $514 | $403 |

| Nationwide | $340 | $273 | $239 |

| Progressive | $389 | $332 | $308 |

| State Farm | $354 | $212 | $165 |

| USAA | $264 | $181 | $154 |

The table demonstrates a clear link between credit history and how credit scores affect auto insurance rates in Omaha. Residents looking to reduce insurance costs should focus on improving their credit scores. It’s advisable for consumers to regularly assess their insurance costs related to credit and consider changing providers if their credit situation improves or if they discover more competitive rates that match their current credit status.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Omaha, Nebraska Auto Insurance Rates by Commute

Exploring the impact of annual mileage on auto insurance premiums is crucial for Omaha drivers. This detailed table breaks down the monthly rates offered by various insurance companies based on two distinct mileage thresholds: 6,000 miles and 12,000 miles.

The information provided enables drivers to evaluate how their driving habits, including those related to the most expensive commutes in America, might impact their insurance costs, facilitating better-informed financial choices.

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $296 | $296 |

| American Family | $201 | $204 |

| Farmers | $393 | $393 |

| Geico | $298 | $307 |

| Liberty Mutual | $587 | $587 |

| Nationwide | $284 | $284 |

| Progressive | $343 | $343 |

| State Farm | $238 | $250 |

| USAA | $197 | $202 |

The table showcases that while some insurers adjust their rates with increased mileage, others maintain consistent pricing. This indicates the importance of understanding each insurer’s policy on mileage when choosing your auto insurance.

For Omaha drivers, actively updating your mileage status with your insurer can ensure you’re not overpaying for your insurance based on your actual vehicle use.

Factors Affecting Auto Insurance Rates in Omaha, Nebraska

Auto insurance rates in Omaha, Nebraska, can fluctuate based on several factors that affect auto insurance rates, including traffic conditions and vehicle theft rates. Additionally, longer average commute times, such as Omaha’s 19.2-minute average, are likely to raise insurance costs.

data-media-max-width=”560″>

Because bumper-to-bumper traffic can turn into a fender bender, we’ll be here to help. Let’s talk auto insurance. pic.twitter.com/BIr86GNHhV

— Vinson State Farm (@TVStateFarm) July 14, 2018

Omaha ranks as the 824th most congested city worldwide, contributing to higher insurance premiums. Understanding these local factors can help you better navigate and compare auto insurance quotes in Bellevue to find the best rates.

Compare Omaha, Nebraska Auto Insurance Quotes

In Omaha, Nebraska, leading auto insurance providers such as State Farm, Geico, and Farmers offer competitive rates starting at $47 per month. These companies stand out due to their competitive pricing, excellent customer service, and various discounts, showcasing how to compare auto insurance quotes effectively.

State Farm leads as Omaha's top auto insurance choice with an impressive 95% customer satisfaction rating, ensuring reliable and cost-effective coverage for a diverse range of drivers.Daniel Walker Licensed Auto Insurance Agent

To secure the best auto insurance for your requirements, compare auto insurance quotes in Omaha from various providers, taking into account elements like driving record, credit history, and coverage level. Leveraging discounts such as multi-policy and safe driver rewards can lead to additional savings.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Frequently Asked Questions

How much is car insurance in Omaha, Nebraska?

The cost of car insurance in Omaha varies based on factors such as your driving record, credit score, vehicle, and the level of coverage you choose. On average, you might expect to pay around $47 per month for basic coverage.

To learn more, explore our comprehensive resource on insurance titled “What is an auto insurance score?” for a quick overview.

What happens if you don’t have car insurance in Omaha, Nebraska?

Driving without insurance in Nebraska is illegal and can result in severe penalties including fines, suspension of your driver’s license and registration, and potential impoundment of your vehicle.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

What type of auto insurance are you required to have by Nebraska law?

Nebraska law requires drivers to have minimum liability coverage known as 25/50/25: $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage.

To delve deeper, refer to our in-depth report titled “Types of Auto Insurance” for detailed insights.

How long do you have to get insurance after buying a used car in Omaha, Nebraska?

Nebraska requires you to have insurance before you drive any vehicle, including just after buying a used car. It’s essential to arrange for insurance coverage to be effective from the date of purchase or transfer of the vehicle.

What is the minimum car insurance required in Omaha, Nebraska?

The minimum required insurance is liability coverage of $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage (25/50/25).

Is car insurance cheaper in Nebraska compared to other states?

Generally, Nebraska’s car insurance rates are considered to be cheaper compared to national averages, mainly due to lower population density and a lower frequency of claims.

For a thorough understanding, refer to our detailed analysis titled “Cheap Full Coverage Auto Insurance” for more information.

Is it illegal to not have car insurance in Omaha, Nebraska?

Yes, it is illegal. Driving without the minimum required insurance in Nebraska can lead to significant penalties, including fines and suspension of driving privileges.

Does Nebraska allow electronic proof of insurance in Omaha?

Yes, Nebraska allows drivers to show electronic proof of insurance during traffic stops or when registering a vehicle.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Can you insure a car without a license in Omaha, Nebraska?

Yes, you can insure a car without a license in Nebraska, but you may need to specify a primary driver who is licensed. Insurers might also view you as a higher risk, potentially increasing premiums.

To expand your knowledge, refer to our comprehensive handbook titled “How to Get Auto Insurance Without a License” for further details.

Do you need insurance to register a car in Omaha, Nebraska?

Yes, proof of insurance is required to register a vehicle in Omaha, Nebraska. You need to show evidence of the minimum required liability insurance to complete the registration process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.